202abb733b5db366b2cf7ac7718c7e86.ppt

- Количество слайдов: 23

The Sale of Great Lakes Strategies, LLC A Case Study Gary Gabel April 24, 2009

The Sale of Great Lakes Strategies, LLC A Case Study Gary Gabel April 24, 2009

Overview of presentation Positioning Your Firm with an Exit Strategy in Mind ¡ What are Buyers Willing to Pay For? ¡ Two Types of Buyers ¡ What Will Buyers Pay? ¡ Why Hire an Investment Bank? ¡ The Selling Process ¡

Overview of presentation Positioning Your Firm with an Exit Strategy in Mind ¡ What are Buyers Willing to Pay For? ¡ Two Types of Buyers ¡ What Will Buyers Pay? ¡ Why Hire an Investment Bank? ¡ The Selling Process ¡

Overview of Presentation ¡ ¡ ¡ ¡ Overview of Great Lakes Strategies, LLC Investment Company Proposals The Presentation Made to Potential Partners The Final Offers l Financial Buyer l Strategic Buyer The Transaction The Aftermath Conclusion

Overview of Presentation ¡ ¡ ¡ ¡ Overview of Great Lakes Strategies, LLC Investment Company Proposals The Presentation Made to Potential Partners The Final Offers l Financial Buyer l Strategic Buyer The Transaction The Aftermath Conclusion

Positioning Your Firm With an Exit Strategy in Mind ¡ Revenues l l ¡ Maximize annuity revenue Extend client contracts as long as possible Expenses l Eliminate extraneous expenses: ¡ Excessive compensation ¡ Company cars ¡ Club memberships ¡ Season tickets ¡ Planes, boats

Positioning Your Firm With an Exit Strategy in Mind ¡ Revenues l l ¡ Maximize annuity revenue Extend client contracts as long as possible Expenses l Eliminate extraneous expenses: ¡ Excessive compensation ¡ Company cars ¡ Club memberships ¡ Season tickets ¡ Planes, boats

Positioning Your Firm With an Exit Strategy in Mind ¡ People l ¡ Develop deep bench strength Results/Relationships l l Make sure quality of your service or product is exceptional Develop close relationships with customers—make sure they’re not just yours

Positioning Your Firm With an Exit Strategy in Mind ¡ People l ¡ Develop deep bench strength Results/Relationships l l Make sure quality of your service or product is exceptional Develop close relationships with customers—make sure they’re not just yours

What Are Buyers Willing to Pay More For? Eliminate competition ¡ Entry into a complementary market ¡ A book of attractive business ¡ Annuity/recurring revenue ¡ Companies with high earnings/sales ¡ Strong talent ¡

What Are Buyers Willing to Pay More For? Eliminate competition ¡ Entry into a complementary market ¡ A book of attractive business ¡ Annuity/recurring revenue ¡ Companies with high earnings/sales ¡ Strong talent ¡

Two Types of Buyers Strategic—They see you as a way to eliminate competition, enter a new market, buy a book of business, buy a talent base, gain new technology ¡ Financial—They see a vehicle that can generate revenue and increase wealth—because they will buy it at the lowest price possible ¡

Two Types of Buyers Strategic—They see you as a way to eliminate competition, enter a new market, buy a book of business, buy a talent base, gain new technology ¡ Financial—They see a vehicle that can generate revenue and increase wealth—because they will buy it at the lowest price possible ¡

What Will Buyers Pay? Most firms are sold for a multiple of EBITDA (Earnings before interest and taxes, depreciation and amortization)

What Will Buyers Pay? Most firms are sold for a multiple of EBITDA (Earnings before interest and taxes, depreciation and amortization)

Why Hire an Investment Bank or Business Broker? They know the business of M&A ¡ They know how to package what you have ¡ You are too emotionally involved ¡ They are experienced negotiators ¡

Why Hire an Investment Bank or Business Broker? They know the business of M&A ¡ They know how to package what you have ¡ You are too emotionally involved ¡ They are experienced negotiators ¡

Deal with your Emotional Expectations ¡ In a strategic sale: l Don’t expect to stick around ¡ l ¡ Tenure of most entrepreneurs who sell their companies is less than 1 year Don’t expect your people will be treated well In a financial sale: l Expect to be hounded regularly to increase earnings

Deal with your Emotional Expectations ¡ In a strategic sale: l Don’t expect to stick around ¡ l ¡ Tenure of most entrepreneurs who sell their companies is less than 1 year Don’t expect your people will be treated well In a financial sale: l Expect to be hounded regularly to increase earnings

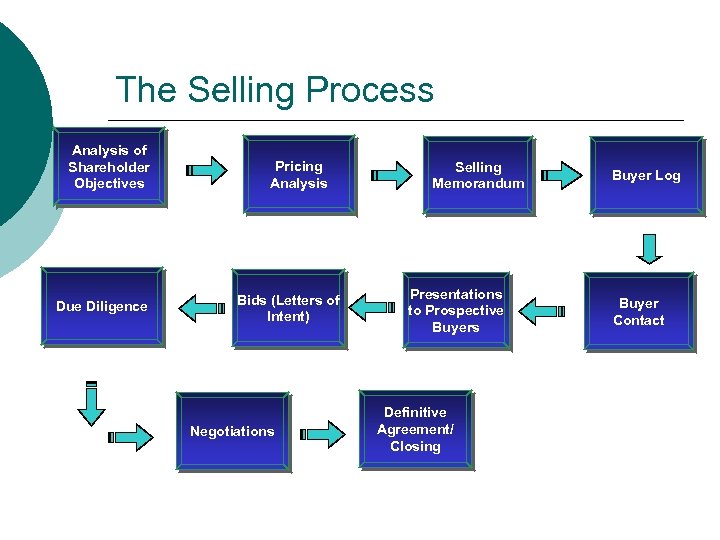

The Selling Process Analysis of Shareholder Objectives Due Diligence Pricing Analysis Bids (Letters of Intent) Negotiations Selling Memorandum Presentations to Prospective Buyers Definitive Agreement/ Closing Buyer Log Buyer Contact

The Selling Process Analysis of Shareholder Objectives Due Diligence Pricing Analysis Bids (Letters of Intent) Negotiations Selling Memorandum Presentations to Prospective Buyers Definitive Agreement/ Closing Buyer Log Buyer Contact

Great Lakes Strategies Provided outsourcing of benefits to clients ranging in size from 100 employees to 20, 000 employees ¡ At time of sale, sales exceeded $11 Million ¡ 115 Employees ¡

Great Lakes Strategies Provided outsourcing of benefits to clients ranging in size from 100 employees to 20, 000 employees ¡ At time of sale, sales exceeded $11 Million ¡ 115 Employees ¡

The Sale of Great Lakes Strategies Process Began: January 2002 Sale Consummated: December 2002

The Sale of Great Lakes Strategies Process Began: January 2002 Sale Consummated: December 2002

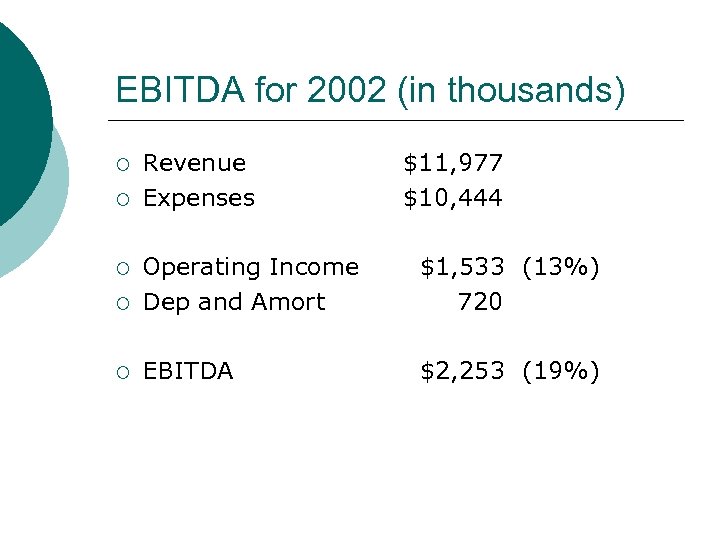

EBITDA for 2002 (in thousands) ¡ ¡ Revenue Expenses $11, 977 $10, 444 ¡ Operating Income Dep and Amort $1, 533 (13%) 720 ¡ EBITDA $2, 253 (19%) ¡

EBITDA for 2002 (in thousands) ¡ ¡ Revenue Expenses $11, 977 $10, 444 ¡ Operating Income Dep and Amort $1, 533 (13%) 720 ¡ EBITDA $2, 253 (19%) ¡

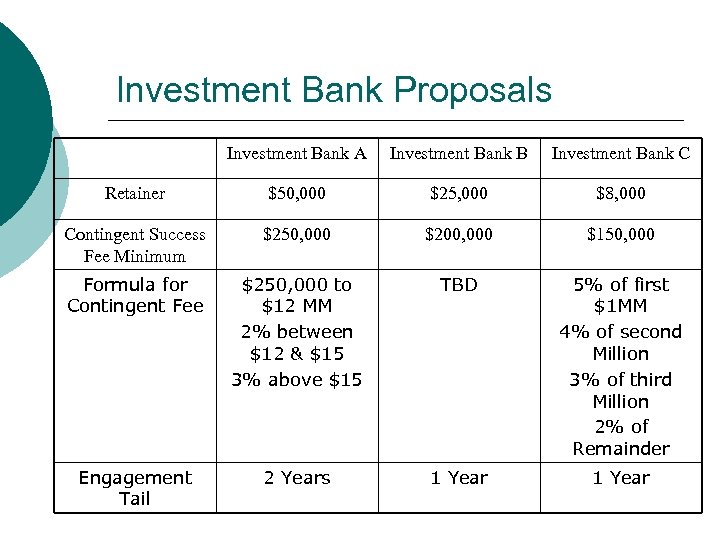

Investment Bank Proposals Investment Bank A Investment Bank B Investment Bank C Retainer $50, 000 $25, 000 $8, 000 Contingent Success Fee Minimum $250, 000 $200, 000 $150, 000 Formula for Contingent Fee $250, 000 to $12 MM 2% between $12 & $15 3% above $15 TBD 5% of first $1 MM 4% of second Million 3% of third Million 2% of Remainder Engagement Tail 2 Years 1 Year

Investment Bank Proposals Investment Bank A Investment Bank B Investment Bank C Retainer $50, 000 $25, 000 $8, 000 Contingent Success Fee Minimum $250, 000 $200, 000 $150, 000 Formula for Contingent Fee $250, 000 to $12 MM 2% between $12 & $15 3% above $15 TBD 5% of first $1 MM 4% of second Million 3% of third Million 2% of Remainder Engagement Tail 2 Years 1 Year

The Presentation to Prospects

The Presentation to Prospects

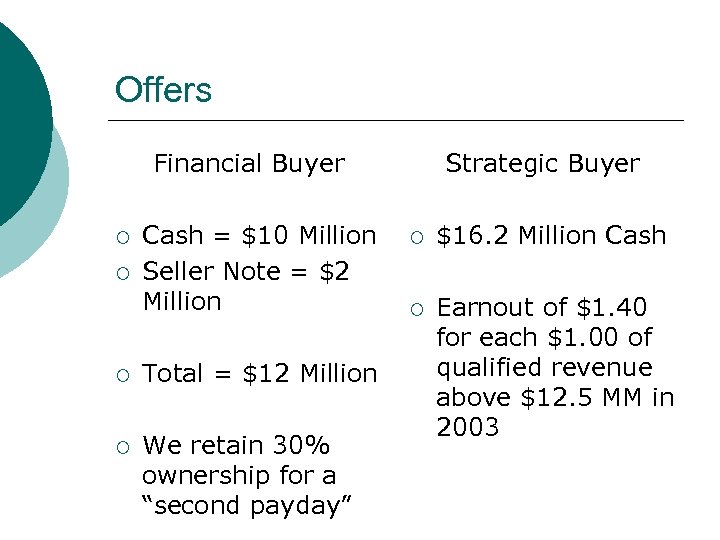

Offers Financial Buyer ¡ ¡ Cash = $10 Million Seller Note = $2 Million ¡ Total = $12 Million ¡ We retain 30% ownership for a “second payday” Strategic Buyer ¡ $16. 2 Million Cash ¡ Earnout of $1. 40 for each $1. 00 of qualified revenue above $12. 5 MM in 2003

Offers Financial Buyer ¡ ¡ Cash = $10 Million Seller Note = $2 Million ¡ Total = $12 Million ¡ We retain 30% ownership for a “second payday” Strategic Buyer ¡ $16. 2 Million Cash ¡ Earnout of $1. 40 for each $1. 00 of qualified revenue above $12. 5 MM in 2003

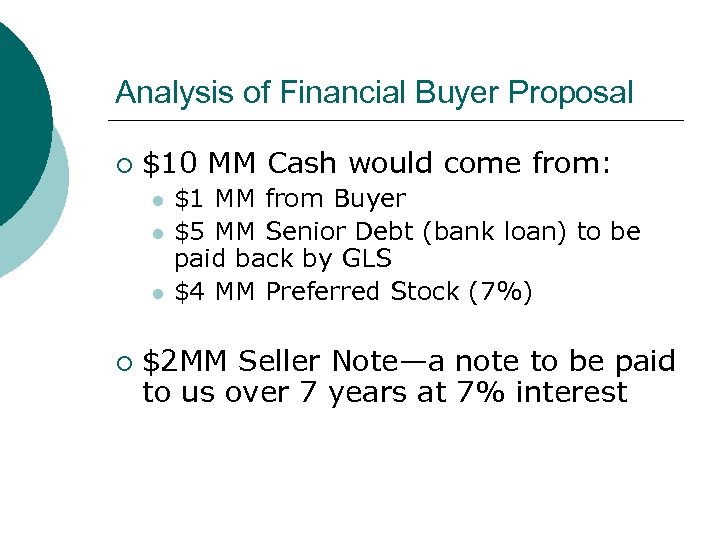

Analysis of Financial Buyer Proposal ¡ $10 MM Cash would come from: l l l ¡ $1 MM from Buyer $5 MM Senior Debt (bank loan) to be paid back by GLS $4 MM Preferred Stock (7%) $2 MM Seller Note—a note to be paid to us over 7 years at 7% interest

Analysis of Financial Buyer Proposal ¡ $10 MM Cash would come from: l l l ¡ $1 MM from Buyer $5 MM Senior Debt (bank loan) to be paid back by GLS $4 MM Preferred Stock (7%) $2 MM Seller Note—a note to be paid to us over 7 years at 7% interest

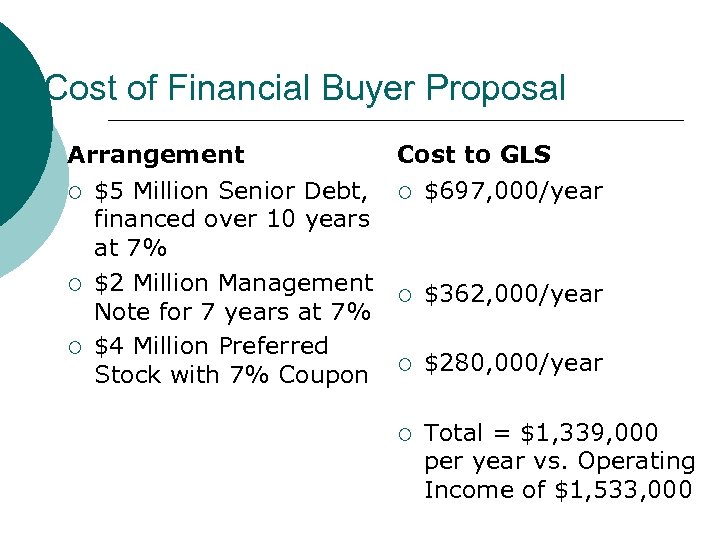

Cost of Financial Buyer Proposal Arrangement ¡ ¡ ¡ $5 Million Senior Debt, financed over 10 years at 7% $2 Million Management Note for 7 years at 7% $4 Million Preferred Stock with 7% Coupon Cost to GLS ¡ $697, 000/year ¡ $362, 000/year ¡ $280, 000/year ¡ Total = $1, 339, 000 per year vs. Operating Income of $1, 533, 000

Cost of Financial Buyer Proposal Arrangement ¡ ¡ ¡ $5 Million Senior Debt, financed over 10 years at 7% $2 Million Management Note for 7 years at 7% $4 Million Preferred Stock with 7% Coupon Cost to GLS ¡ $697, 000/year ¡ $362, 000/year ¡ $280, 000/year ¡ Total = $1, 339, 000 per year vs. Operating Income of $1, 533, 000

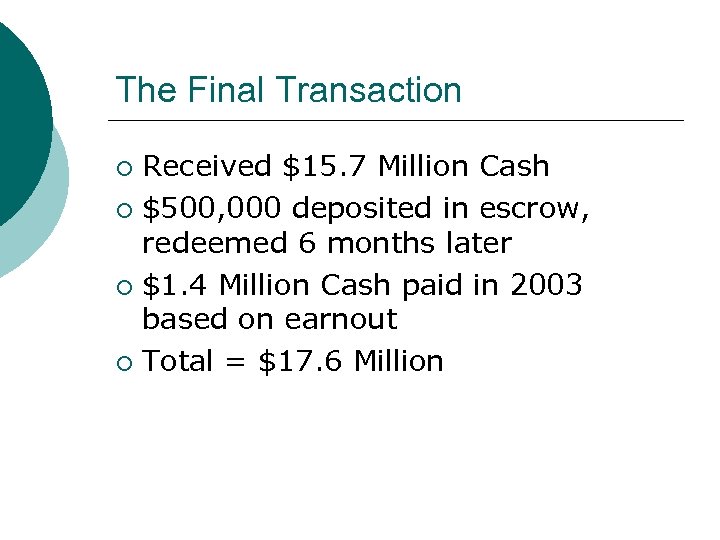

The Final Transaction Received $15. 7 Million Cash ¡ $500, 000 deposited in escrow, redeemed 6 months later ¡ $1. 4 Million Cash paid in 2003 based on earnout ¡ Total = $17. 6 Million ¡

The Final Transaction Received $15. 7 Million Cash ¡ $500, 000 deposited in escrow, redeemed 6 months later ¡ $1. 4 Million Cash paid in 2003 based on earnout ¡ Total = $17. 6 Million ¡

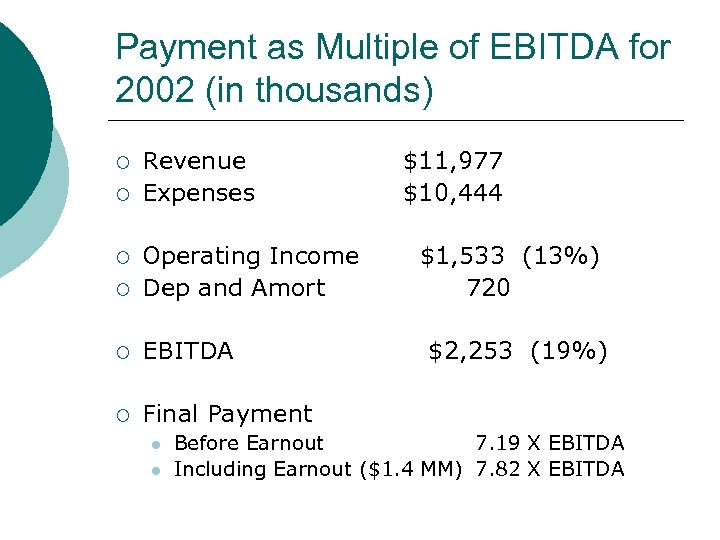

Payment as Multiple of EBITDA for 2002 (in thousands) ¡ ¡ Revenue Expenses ¡ Operating Income Dep and Amort ¡ EBITDA ¡ $11, 977 $10, 444 Final Payment ¡ l l $1, 533 (13%) 720 $2, 253 (19%) Before Earnout 7. 19 X EBITDA Including Earnout ($1. 4 MM) 7. 82 X EBITDA

Payment as Multiple of EBITDA for 2002 (in thousands) ¡ ¡ Revenue Expenses ¡ Operating Income Dep and Amort ¡ EBITDA ¡ $11, 977 $10, 444 Final Payment ¡ l l $1, 533 (13%) 720 $2, 253 (19%) Before Earnout 7. 19 X EBITDA Including Earnout ($1. 4 MM) 7. 82 X EBITDA

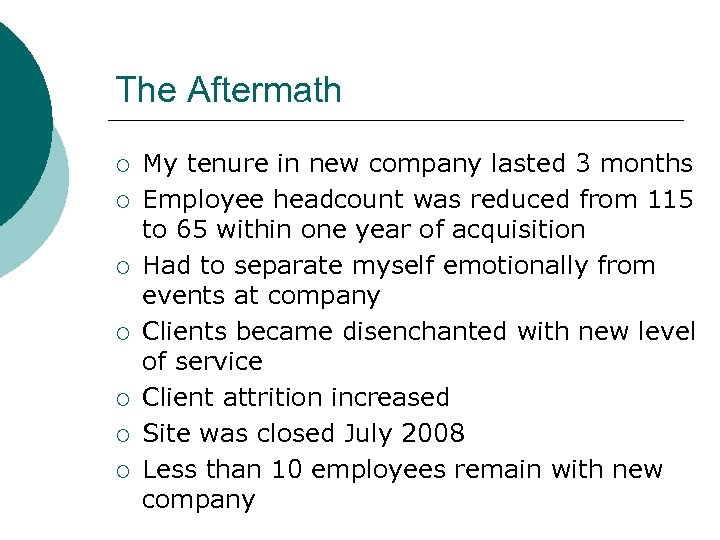

The Aftermath ¡ ¡ ¡ ¡ My tenure in new company lasted 3 months Employee headcount was reduced from 115 to 65 within one year of acquisition Had to separate myself emotionally from events at company Clients became disenchanted with new level of service Client attrition increased Site was closed July 2008 Less than 10 employees remain with new company

The Aftermath ¡ ¡ ¡ ¡ My tenure in new company lasted 3 months Employee headcount was reduced from 115 to 65 within one year of acquisition Had to separate myself emotionally from events at company Clients became disenchanted with new level of service Client attrition increased Site was closed July 2008 Less than 10 employees remain with new company

Conclusion

Conclusion