4faf3dd61ee28e3d75170983198a6744.ppt

- Количество слайдов: 27

The Sage Payroll Pay. Card Cost-effective. Secure. Smart

The Sage Payroll Pay. Card Cost-effective. Secure. Smart

Agenda • Positioning – What do we tell your customers • What’s in it for you – Benefits – Revenue example • • What you need to do The process Roadmap Q&A 2

Agenda • Positioning – What do we tell your customers • What’s in it for you – Benefits – Revenue example • • What you need to do The process Roadmap Q&A 2

What is the Sage Payroll Pay. Card? Pre-paid debit card 3

What is the Sage Payroll Pay. Card? Pre-paid debit card 3

Main benefits • Good for the company – Saving cost – Hassle free – Happy employees – great service • Good for the employees – – No checks to cash Direct access to funds Safe All the benefits of a Visa debit card, but without a bank account 4

Main benefits • Good for the company – Saving cost – Hassle free – Happy employees – great service • Good for the employees – – No checks to cash Direct access to funds Safe All the benefits of a Visa debit card, but without a bank account 4

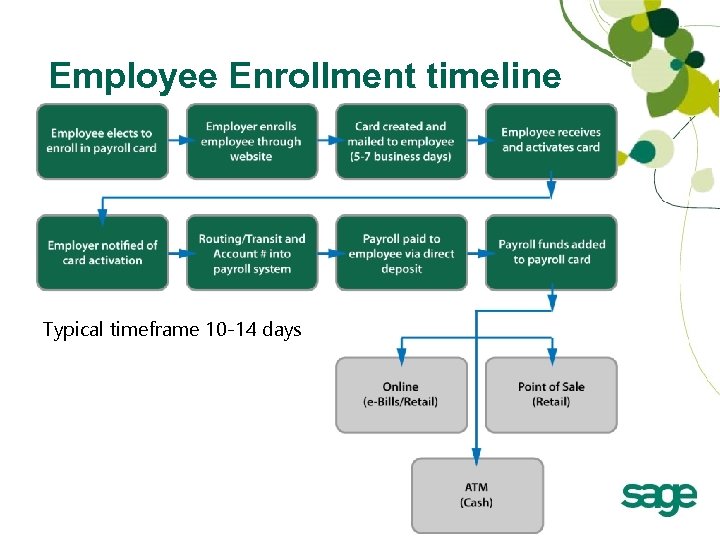

Employee Enrollment timeline Typical timeframe 10 -14 days 6

Employee Enrollment timeline Typical timeframe 10 -14 days 6

Employer website . com/ ycard rollpa ay ttp: // h p. sage www 7

Employer website . com/ ycard rollpa ay ttp: // h p. sage www 7

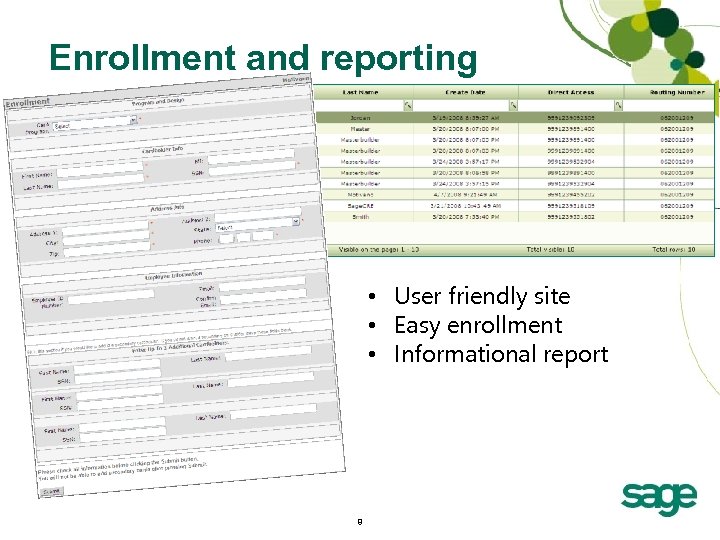

Enrollment and reporting • User friendly site • Easy enrollment • Informational report 8

Enrollment and reporting • User friendly site • Easy enrollment • Informational report 8

Benefits to Employers • Cost reduction • Paperless payroll – going “green” • No hassle – – – No lost or stolen checks Minimizes exposure to check fraud Eliminates check reconciliation process Eliminates check distribution costs Eliminates escheatment liability • Works with both Abra Payroll and Compupay • Not responsible for cardholder issues • No financial liability for cardholder activity 9

Benefits to Employers • Cost reduction • Paperless payroll – going “green” • No hassle – – – No lost or stolen checks Minimizes exposure to check fraud Eliminates check reconciliation process Eliminates check distribution costs Eliminates escheatment liability • Works with both Abra Payroll and Compupay • Not responsible for cardholder issues • No financial liability for cardholder activity 9

Costs of Issuing Payroll Checks What is it costing your company? • Costs to issue a stop payment and replace a lost check • Transportation costs • Cost to deliver checks • Decreased HR/payroll personnel productivity 10

Costs of Issuing Payroll Checks What is it costing your company? • Costs to issue a stop payment and replace a lost check • Transportation costs • Cost to deliver checks • Decreased HR/payroll personnel productivity 10

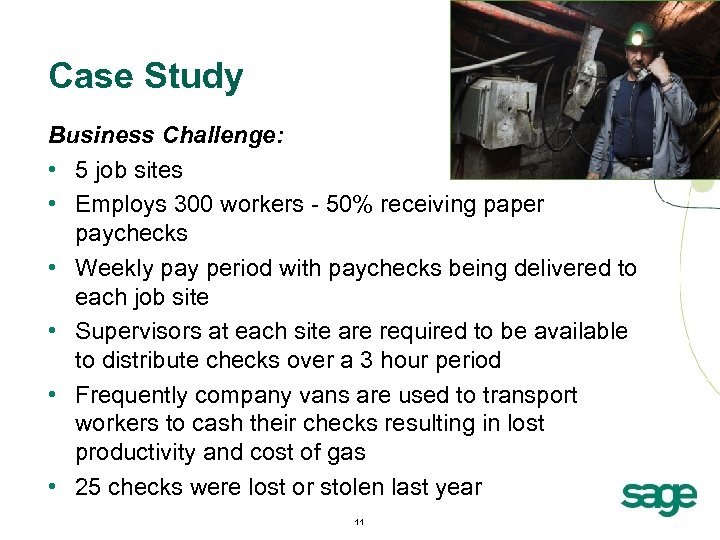

Case Study Business Challenge: • 5 job sites • Employs 300 workers - 50% receiving paper paychecks • Weekly pay period with paychecks being delivered to each job site • Supervisors at each site are required to be available to distribute checks over a 3 hour period • Frequently company vans are used to transport workers to cash their checks resulting in lost productivity and cost of gas • 25 checks were lost or stolen last year 11

Case Study Business Challenge: • 5 job sites • Employs 300 workers - 50% receiving paper paychecks • Weekly pay period with paychecks being delivered to each job site • Supervisors at each site are required to be available to distribute checks over a 3 hour period • Frequently company vans are used to transport workers to cash their checks resulting in lost productivity and cost of gas • 25 checks were lost or stolen last year 11

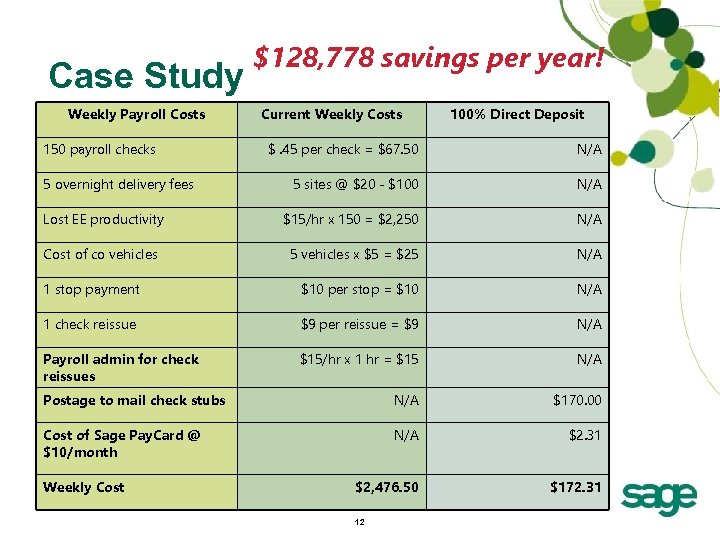

Case Study Weekly Payroll Costs 150 payroll checks $128, 778 savings per year! Current Weekly Costs 100% Direct Deposit $. 45 per check = $67. 50 N/A 5 sites @ $20 - $100 N/A Lost EE productivity $15/hr x 150 = $2, 250 N/A Cost of co vehicles 5 vehicles x $5 = $25 N/A 1 stop payment $10 per stop = $10 N/A 1 check reissue $9 per reissue = $9 N/A Payroll admin for check reissues $15/hr x 1 hr = $15 N/A Postage to mail check stubs N/A $170. 00 Cost of Sage Pay. Card @ $10/month N/A $2. 31 $2, 476. 50 $172. 31 5 overnight delivery fees Weekly Cost 12

Case Study Weekly Payroll Costs 150 payroll checks $128, 778 savings per year! Current Weekly Costs 100% Direct Deposit $. 45 per check = $67. 50 N/A 5 sites @ $20 - $100 N/A Lost EE productivity $15/hr x 150 = $2, 250 N/A Cost of co vehicles 5 vehicles x $5 = $25 N/A 1 stop payment $10 per stop = $10 N/A 1 check reissue $9 per reissue = $9 N/A Payroll admin for check reissues $15/hr x 1 hr = $15 N/A Postage to mail check stubs N/A $170. 00 Cost of Sage Pay. Card @ $10/month N/A $2. 31 $2, 476. 50 $172. 31 5 overnight delivery fees Weekly Cost 12

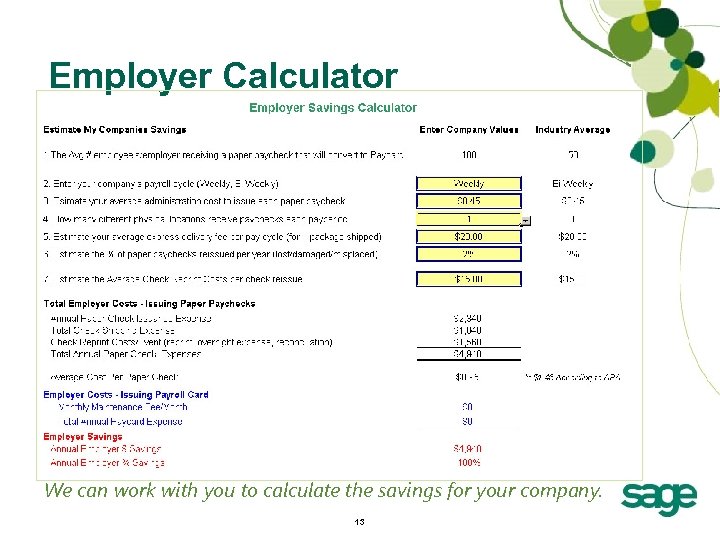

Employer Calculator We can work with you to calculate the savings for your company. 13

Employer Calculator We can work with you to calculate the savings for your company. 13

Benefits to Employees • • No check cashing No bank account or credit check required Immediate access on payday Safer than carrying cash Convenient Employee owns the card Allpoint ATM Network – over 37, 000 surchargefree ATM locations worldwide at www. allpointnetwork. com • Up to 3 secondary cards available 14

Benefits to Employees • • No check cashing No bank account or credit check required Immediate access on payday Safer than carrying cash Convenient Employee owns the card Allpoint ATM Network – over 37, 000 surchargefree ATM locations worldwide at www. allpointnetwork. com • Up to 3 secondary cards available 14

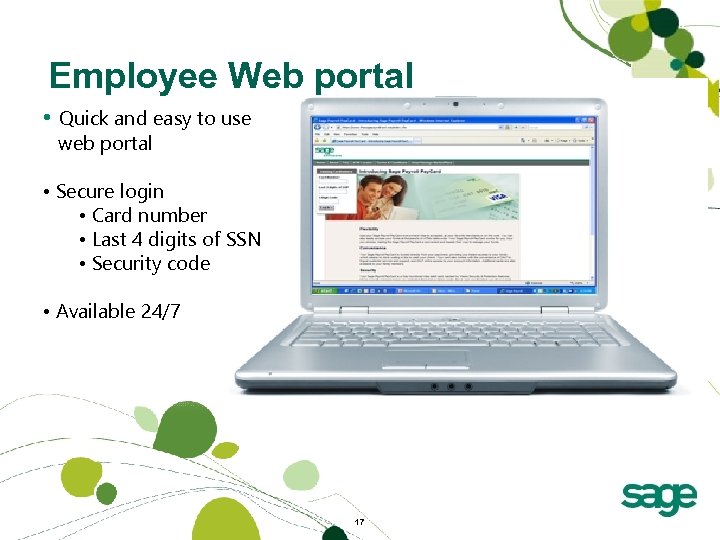

Employee Web portal • Quick and easy to use web portal • Secure login • Card number • Last 4 digits of SSN • Security code • Available 24/7 17

Employee Web portal • Quick and easy to use web portal • Secure login • Card number • Last 4 digits of SSN • Security code • Available 24/7 17

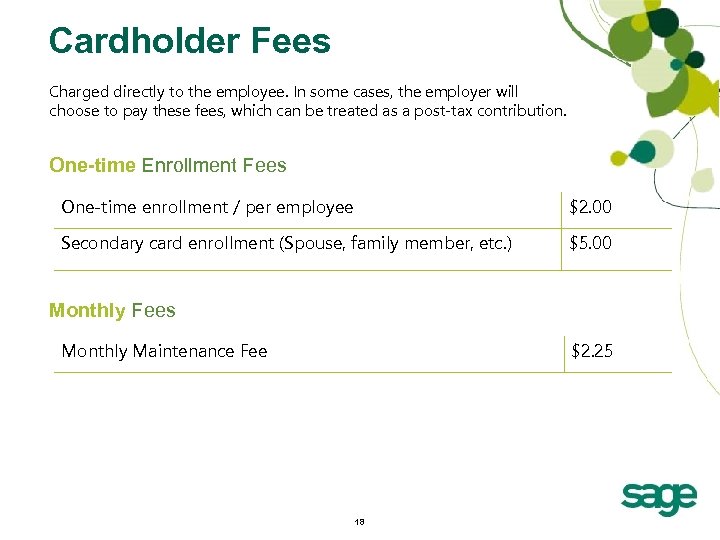

Cardholder Fees Charged directly to the employee. In some cases, the employer will choose to pay these fees, which can be treated as a post-tax contribution. One-time Enrollment Fees One-time enrollment / per employee $2. 00 Secondary card enrollment (Spouse, family member, etc. ) $5. 00 Monthly Fees Monthly Maintenance Fee $2. 25 18

Cardholder Fees Charged directly to the employee. In some cases, the employer will choose to pay these fees, which can be treated as a post-tax contribution. One-time Enrollment Fees One-time enrollment / per employee $2. 00 Secondary card enrollment (Spouse, family member, etc. ) $5. 00 Monthly Fees Monthly Maintenance Fee $2. 25 18

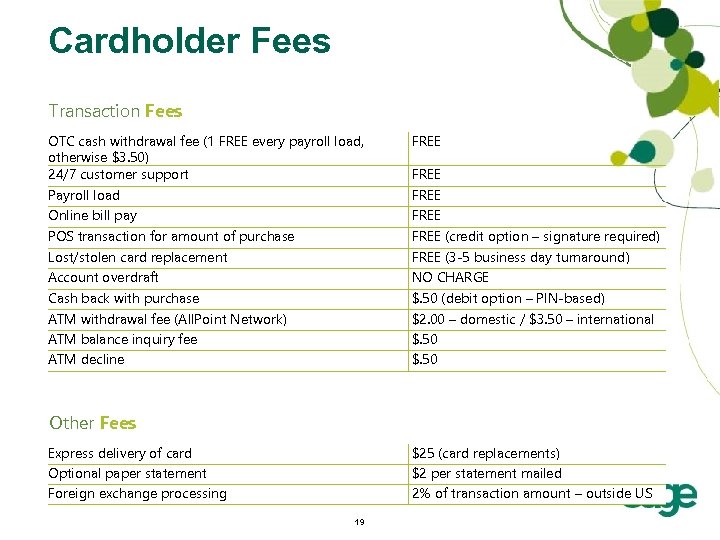

Cardholder Fees Transaction Fees OTC cash withdrawal fee (1 FREE every payroll load, otherwise $3. 50) 24/7 customer support Payroll load Online bill pay POS transaction for amount of purchase Lost/stolen card replacement Account overdraft Cash back with purchase ATM withdrawal fee (All. Point Network) ATM balance inquiry fee ATM decline FREE FREE (credit option – signature required) FREE (3 -5 business day turnaround) NO CHARGE $. 50 (debit option – PIN-based) $2. 00 – domestic / $3. 50 – international $. 50 Other Fees Express delivery of card Optional paper statement Foreign exchange processing $25 (card replacements) $2 per statement mailed 2% of transaction amount – outside US 19

Cardholder Fees Transaction Fees OTC cash withdrawal fee (1 FREE every payroll load, otherwise $3. 50) 24/7 customer support Payroll load Online bill pay POS transaction for amount of purchase Lost/stolen card replacement Account overdraft Cash back with purchase ATM withdrawal fee (All. Point Network) ATM balance inquiry fee ATM decline FREE FREE (credit option – signature required) FREE (3 -5 business day turnaround) NO CHARGE $. 50 (debit option – PIN-based) $2. 00 – domestic / $3. 50 – international $. 50 Other Fees Express delivery of card Optional paper statement Foreign exchange processing $25 (card replacements) $2 per statement mailed 2% of transaction amount – outside US 19

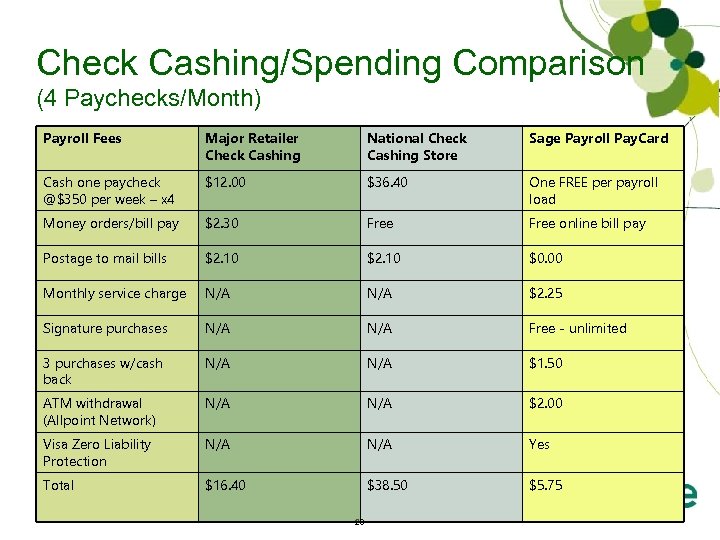

Check Cashing/Spending Comparison (4 Paychecks/Month) Payroll Fees Major Retailer Check Cashing National Check Cashing Store Sage Payroll Pay. Card Cash one paycheck @$350 per week – x 4 $12. 00 $36. 40 One FREE per payroll load Money orders/bill pay $2. 30 Free online bill pay Postage to mail bills $2. 10 $0. 00 Monthly service charge N/A $2. 25 Signature purchases N/A Free - unlimited 3 purchases w/cash back N/A $1. 50 ATM withdrawal (Allpoint Network) N/A $2. 00 Visa Zero Liability Protection N/A Yes Total $16. 40 $38. 50 $5. 75 20

Check Cashing/Spending Comparison (4 Paychecks/Month) Payroll Fees Major Retailer Check Cashing National Check Cashing Store Sage Payroll Pay. Card Cash one paycheck @$350 per week – x 4 $12. 00 $36. 40 One FREE per payroll load Money orders/bill pay $2. 30 Free online bill pay Postage to mail bills $2. 10 $0. 00 Monthly service charge N/A $2. 25 Signature purchases N/A Free - unlimited 3 purchases w/cash back N/A $1. 50 ATM withdrawal (Allpoint Network) N/A $2. 00 Visa Zero Liability Protection N/A Yes Total $16. 40 $38. 50 $5. 75 20

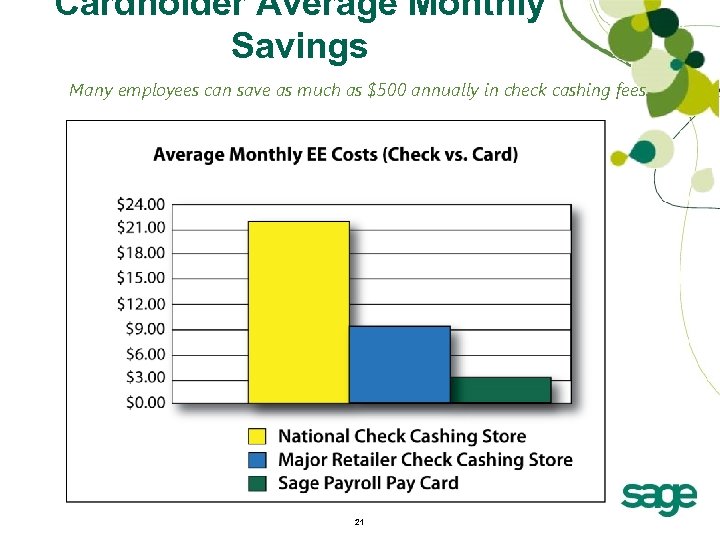

Cardholder Average Monthly Savings Many employees can save as much as $500 annually in check cashing fees. 21

Cardholder Average Monthly Savings Many employees can save as much as $500 annually in check cashing fees. 21

Positioning the Payroll Card Program – Make It Mandatory • Direct deposit is a condition of employment • Offer employees choice of direct deposit or payroll debit card – Voluntary - Direct Deposit is “Preferred by the Company” • Offer the Sage Payroll Pay. Card as “a new and better way to get your pay” • Include paper paychecks as a discouraged option 22

Positioning the Payroll Card Program – Make It Mandatory • Direct deposit is a condition of employment • Offer employees choice of direct deposit or payroll debit card – Voluntary - Direct Deposit is “Preferred by the Company” • Offer the Sage Payroll Pay. Card as “a new and better way to get your pay” • Include paper paychecks as a discouraged option 22

Employer Support • Dedicated Account Manager • Communication materials for employees – – – Promotional introductory letters Setup forms Posters Email content Paycheck stuffers FAQs • Employer Materials – – – Online training Website guide Quick reference guides Implementation guide Easy-to-use website portal 23

Employer Support • Dedicated Account Manager • Communication materials for employees – – – Promotional introductory letters Setup forms Posters Email content Paycheck stuffers FAQs • Employer Materials – – – Online training Website guide Quick reference guides Implementation guide Easy-to-use website portal 23

Marketing materials 24

Marketing materials 24

Sage Payroll Paycard fees • Employer Fees – One Time Set Up Fee $50. 00 – – Monthly Employer Maintenance Fee $10. 00 – One-time employee card enrollment $2. 00 • Fall 2010 PROMOTION: Fees above are WAIVED IF ENROLLED BY …. 25

Sage Payroll Paycard fees • Employer Fees – One Time Set Up Fee $50. 00 – – Monthly Employer Maintenance Fee $10. 00 – One-time employee card enrollment $2. 00 • Fall 2010 PROMOTION: Fees above are WAIVED IF ENROLLED BY …. 25

What’s in it for you • • Recurring revenue $1. 00/card/month Happy customers Increased ‘stickiness’ 26

What’s in it for you • • Recurring revenue $1. 00/card/month Happy customers Increased ‘stickiness’ 26

What you need to do • • Almost nothing Inform your customer Answer some questions Start collecting money 27

What you need to do • • Almost nothing Inform your customer Answer some questions Start collecting money 27

The Process • Leads – New & Existing Clients – Webcasts • Opportunity Management – Resources • Sage & Motivano • Placing Orders – Order Form – Underwriting Guidelines 28

The Process • Leads – New & Existing Clients – Webcasts • Opportunity Management – Resources • Sage & Motivano • Placing Orders – Order Form – Underwriting Guidelines 28

Roadmap: more good stuff to come • “Instacards”: one time instant usage • In-product connected service – Batch processing – ROI calculator 29

Roadmap: more good stuff to come • “Instacards”: one time instant usage • In-product connected service – Batch processing – ROI calculator 29

Questions? 30

Questions? 30