57457c2e1fd94a10be5d00438f819bc7.ppt

- Количество слайдов: 41

The SA Economy 2012: Managing Crises or Unlocking Golden Opportunities Presentation for: Cape Town Press Club 21 February 2012 By Dr Iraj Abedian Pan-African Investment & Research Services (Pty) Ltd.

The SA Economy 2012: Managing Crises or Unlocking Golden Opportunities Presentation for: Cape Town Press Club 21 February 2012 By Dr Iraj Abedian Pan-African Investment & Research Services (Pty) Ltd.

Outline 1. Stylized Facts of the SA Political Economy 2. Assessing the Fiscal Framework 3. Conditions for Unlocking the Golden Opportunities 4. Concluding Remarks Slide # 2

Outline 1. Stylized Facts of the SA Political Economy 2. Assessing the Fiscal Framework 3. Conditions for Unlocking the Golden Opportunities 4. Concluding Remarks Slide # 2

SA Political Economy Stylized Facts of

SA Political Economy Stylized Facts of

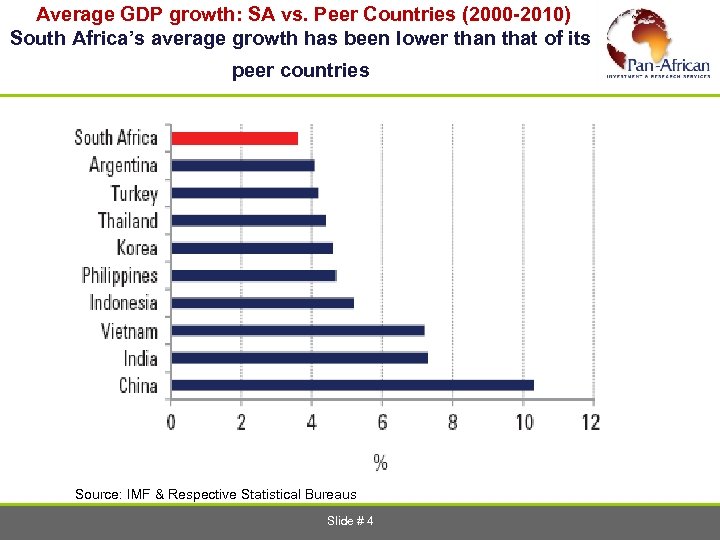

Average GDP growth: SA vs. Peer Countries (2000 -2010) South Africa’s average growth has been lower than that of its peer countries Source: IMF & Respective Statistical Bureaus Slide # 4

Average GDP growth: SA vs. Peer Countries (2000 -2010) South Africa’s average growth has been lower than that of its peer countries Source: IMF & Respective Statistical Bureaus Slide # 4

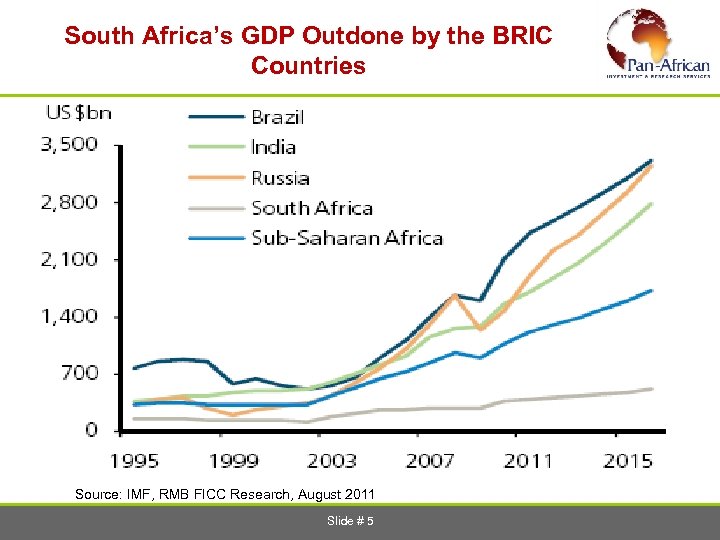

South Africa’s GDP Outdone by the BRIC Countries Source: IMF, RMB FICC Research, August 2011 Slide # 5

South Africa’s GDP Outdone by the BRIC Countries Source: IMF, RMB FICC Research, August 2011 Slide # 5

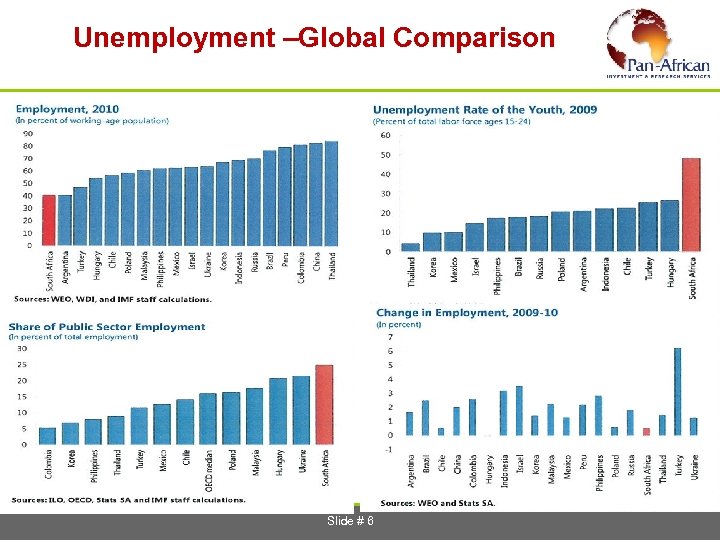

Unemployment –Global Comparison Slide # 6

Unemployment –Global Comparison Slide # 6

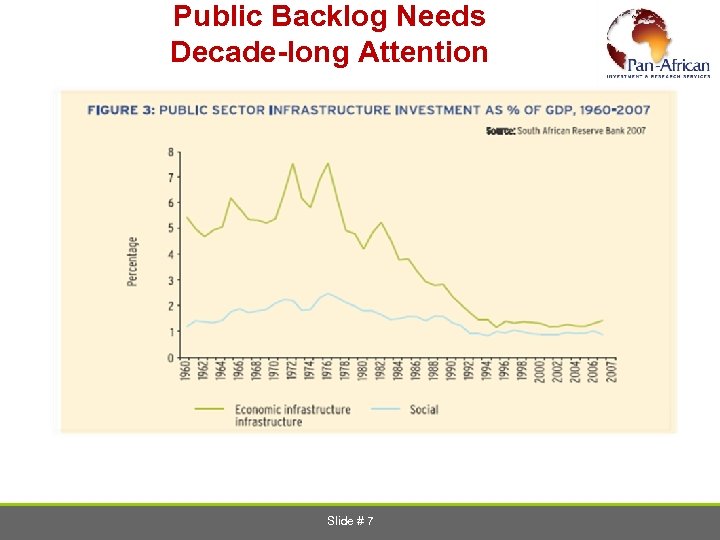

Public Backlog Needs Decade-long Attention Source: DBSA Barometer, 2008 Slide # 7

Public Backlog Needs Decade-long Attention Source: DBSA Barometer, 2008 Slide # 7

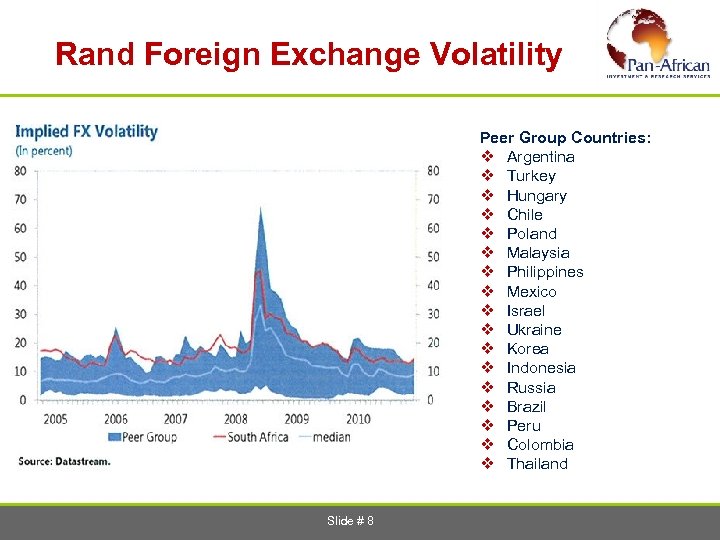

Rand Foreign Exchange Volatility Peer Group Countries: v Argentina v Turkey v Hungary v Chile v Poland v Malaysia v Philippines v Mexico v Israel v Ukraine v Korea v Indonesia v Russia v Brazil v Peru v Colombia v Thailand Slide # 8

Rand Foreign Exchange Volatility Peer Group Countries: v Argentina v Turkey v Hungary v Chile v Poland v Malaysia v Philippines v Mexico v Israel v Ukraine v Korea v Indonesia v Russia v Brazil v Peru v Colombia v Thailand Slide # 8

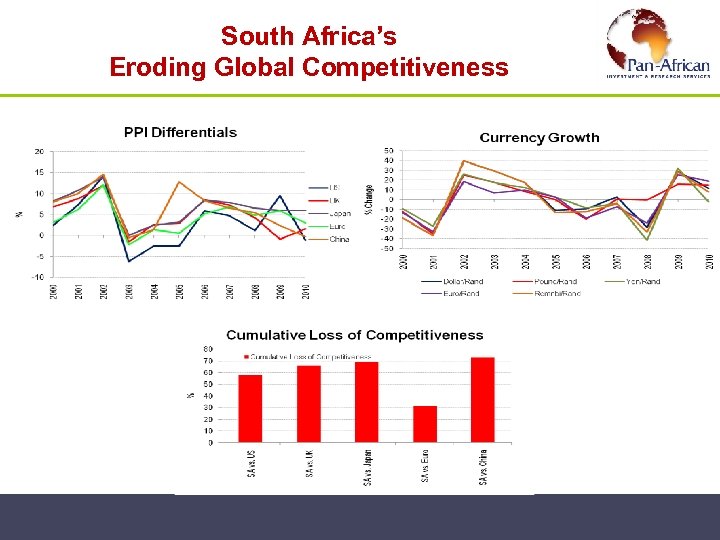

South Africa’s Eroding Global Competitiveness

South Africa’s Eroding Global Competitiveness

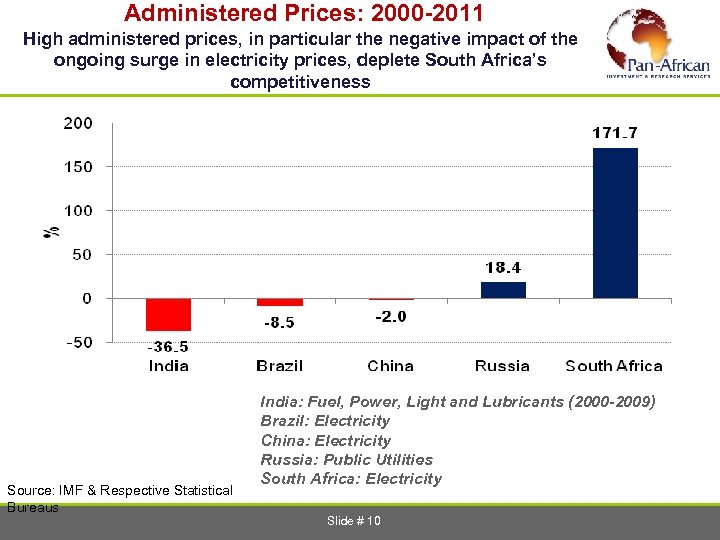

Administered Prices: 2000 -2011 High administered prices, in particular the negative impact of the ongoing surge in electricity prices, deplete South Africa’s competitiveness Source: IMF & Respective Statistical Bureaus India: Fuel, Power, Light and Lubricants (2000 -2009) Brazil: Electricity China: Electricity Russia: Public Utilities South Africa: Electricity Slide # 10

Administered Prices: 2000 -2011 High administered prices, in particular the negative impact of the ongoing surge in electricity prices, deplete South Africa’s competitiveness Source: IMF & Respective Statistical Bureaus India: Fuel, Power, Light and Lubricants (2000 -2009) Brazil: Electricity China: Electricity Russia: Public Utilities South Africa: Electricity Slide # 10

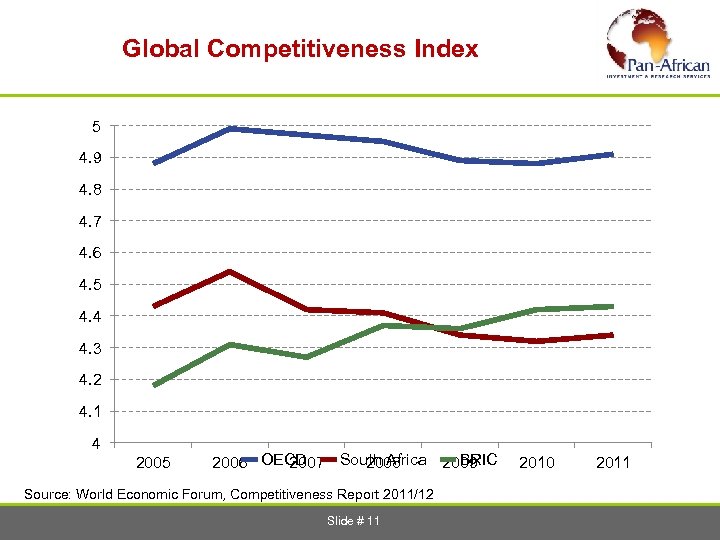

Global Competitiveness Index 5 4. 9 4. 8 4. 7 4. 6 4. 5 4. 4 4. 3 4. 2 4. 1 4 2005 BRIC 2006 OECD 2007 South Africa 2009 2008 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 11 2010 2011

Global Competitiveness Index 5 4. 9 4. 8 4. 7 4. 6 4. 5 4. 4 4. 3 4. 2 4. 1 4 2005 BRIC 2006 OECD 2007 South Africa 2009 2008 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 11 2010 2011

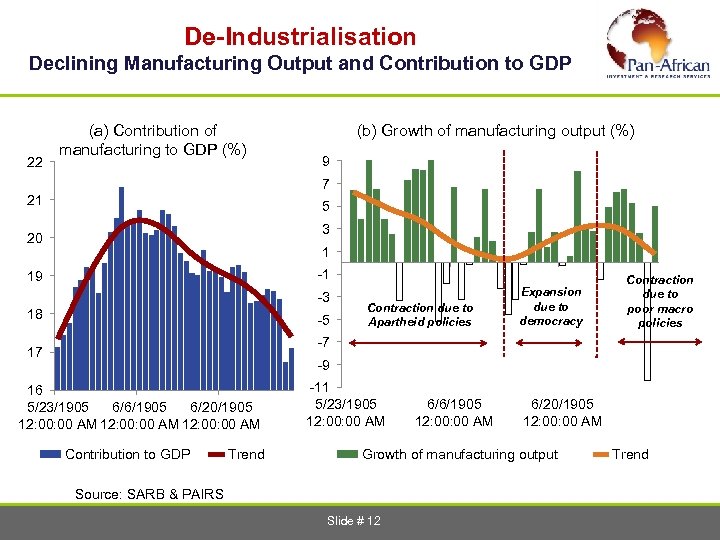

De-Industrialisation Declining Manufacturing Output and Contribution to GDP 22 (a) Contribution of manufacturing to GDP (%) (b) Growth of manufacturing output (%) 9 7 21 5 3 20 1 -1 19 -3 18 -5 Contraction due to Apartheid policies Expansion due to democracy Contraction due to poor macro policies -7 17 -9 16 5/23/1905 6/6/1905 6/20/1905 12: 00: 00 AM 12: 00 AM Contribution to GDP Trend -11 5/23/1905 12: 00 AM 6/6/1905 12: 00 AM 6/20/1905 12: 00 AM Growth of manufacturing output Source: SARB & PAIRS Slide # 12 Trend

De-Industrialisation Declining Manufacturing Output and Contribution to GDP 22 (a) Contribution of manufacturing to GDP (%) (b) Growth of manufacturing output (%) 9 7 21 5 3 20 1 -1 19 -3 18 -5 Contraction due to Apartheid policies Expansion due to democracy Contraction due to poor macro policies -7 17 -9 16 5/23/1905 6/6/1905 6/20/1905 12: 00: 00 AM 12: 00 AM Contribution to GDP Trend -11 5/23/1905 12: 00 AM 6/6/1905 12: 00 AM 6/20/1905 12: 00 AM Growth of manufacturing output Source: SARB & PAIRS Slide # 12 Trend

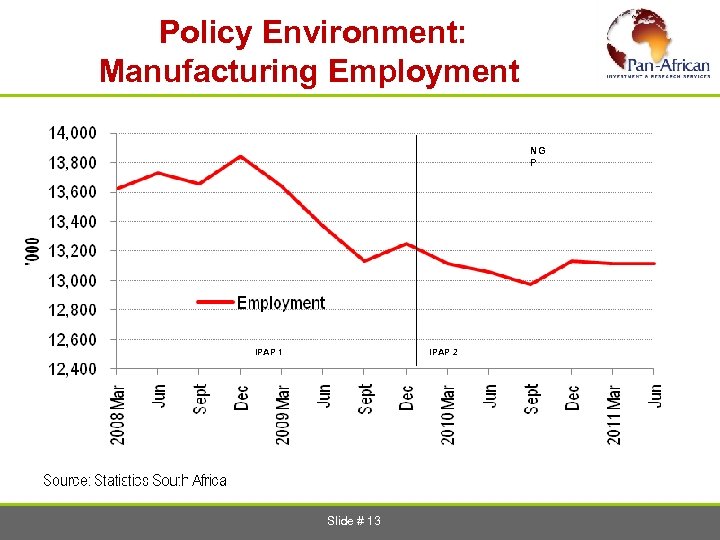

Policy Environment: Manufacturing Employment NG P IPAP 1 IPAP 2 Slide # 13

Policy Environment: Manufacturing Employment NG P IPAP 1 IPAP 2 Slide # 13

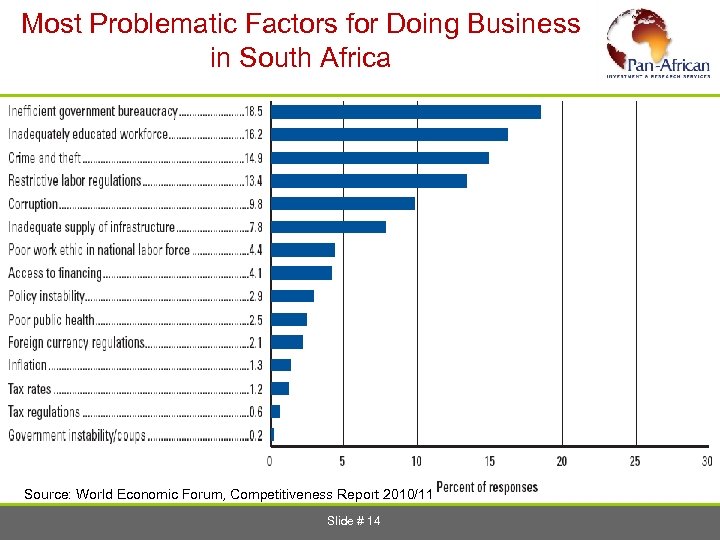

Most Problematic Factors for Doing Business in South Africa Source: World Economic Forum, Competitiveness Report 2010/11 Slide # 14

Most Problematic Factors for Doing Business in South Africa Source: World Economic Forum, Competitiveness Report 2010/11 Slide # 14

Fiscal Framework Assessing SA’s

Fiscal Framework Assessing SA’s

Financial , Economic and Effectiveness Assessment of the Fiscal Framework 1. Financial Criteria: Deficit/GDP Ratio, Debt/GDP Ratio Financial Sustainability Condition: Rate of Debt Service Changes <= Rate of GDP Growth (Tax Revenue) 2. Economic Criteria: a) Financial Sustainability Condition b) State of Economic Infrastructure Needed for Sustainable Growth. 3. Effectiveness Criteria Slide # 16

Financial , Economic and Effectiveness Assessment of the Fiscal Framework 1. Financial Criteria: Deficit/GDP Ratio, Debt/GDP Ratio Financial Sustainability Condition: Rate of Debt Service Changes <= Rate of GDP Growth (Tax Revenue) 2. Economic Criteria: a) Financial Sustainability Condition b) State of Economic Infrastructure Needed for Sustainable Growth. 3. Effectiveness Criteria Slide # 16

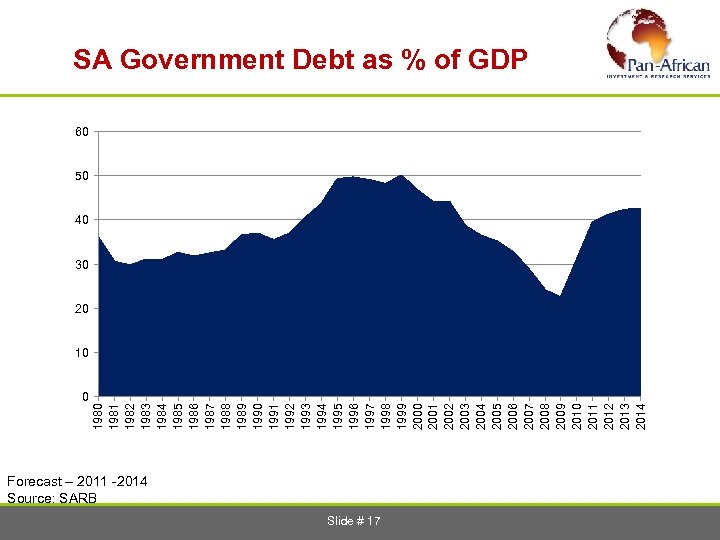

SA Government Debt as % of GDP 60 50 40 30 20 0 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 10 Forecast – 2011 -2014 Source: SARB Slide # 17

SA Government Debt as % of GDP 60 50 40 30 20 0 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 10 Forecast – 2011 -2014 Source: SARB Slide # 17

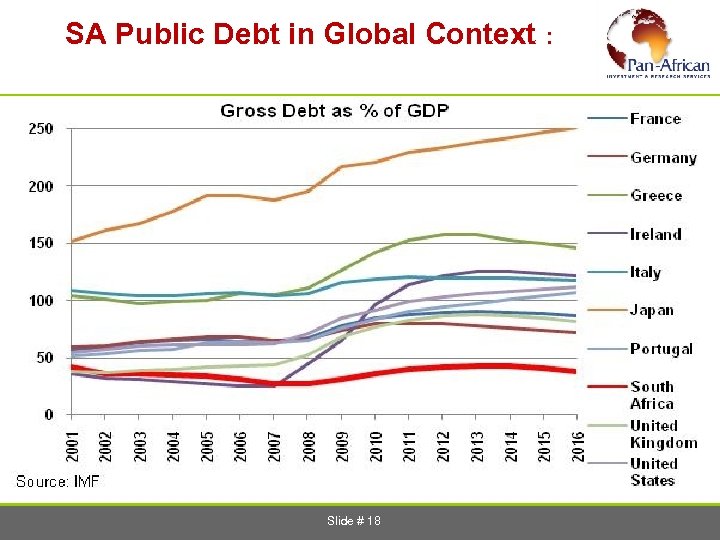

SA Public Debt in Global Context : Slide # 18

SA Public Debt in Global Context : Slide # 18

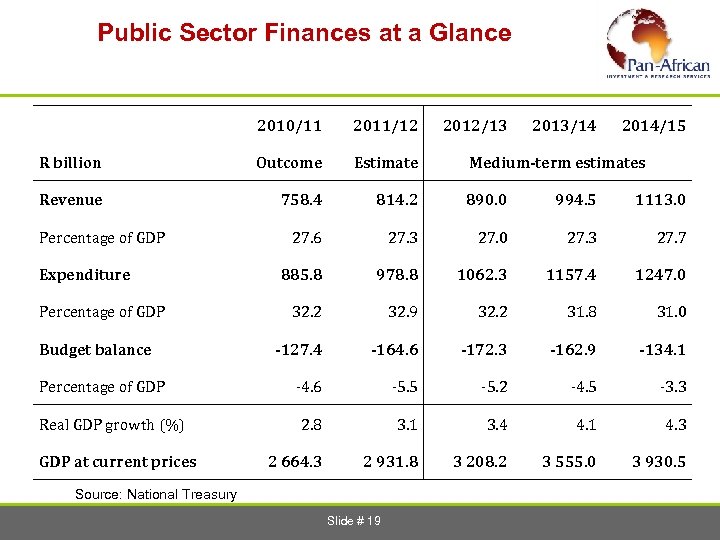

Public Sector Finances at a Glance 2010/11 2011/12 R billion Outcome Estimate Revenue 758. 4 814. 2 890. 0 994. 5 1113. 0 27. 6 27. 3 27. 0 27. 3 27. 7 885. 8 978. 8 1062. 3 1157. 4 1247. 0 32. 2 32. 9 32. 2 31. 8 31. 0 -127. 4 -164. 6 -172. 3 -162. 9 -134. 1 -4. 6 -5. 5 -5. 2 -4. 5 -3. 3 2. 8 3. 1 3. 4 4. 1 4. 3 2 664. 3 2 931. 8 3 208. 2 3 555. 0 3 930. 5 Percentage of GDP Expenditure Percentage of GDP Budget balance Percentage of GDP Real GDP growth (%) GDP at current prices Source: National Treasury Slide # 19 2012/13 2013/14 2014/15 Medium-term estimates

Public Sector Finances at a Glance 2010/11 2011/12 R billion Outcome Estimate Revenue 758. 4 814. 2 890. 0 994. 5 1113. 0 27. 6 27. 3 27. 0 27. 3 27. 7 885. 8 978. 8 1062. 3 1157. 4 1247. 0 32. 2 32. 9 32. 2 31. 8 31. 0 -127. 4 -164. 6 -172. 3 -162. 9 -134. 1 -4. 6 -5. 5 -5. 2 -4. 5 -3. 3 2. 8 3. 1 3. 4 4. 1 4. 3 2 664. 3 2 931. 8 3 208. 2 3 555. 0 3 930. 5 Percentage of GDP Expenditure Percentage of GDP Budget balance Percentage of GDP Real GDP growth (%) GDP at current prices Source: National Treasury Slide # 19 2012/13 2013/14 2014/15 Medium-term estimates

Effectiveness Assessment of the Fiscal Framework 1. Overall effectiveness of fiscal expenditure is poor- at best. 2. The level of abuse and corruption is way too high. a) Over R 5 billion is under formal investigation! b) Chronic annual audit qualification is the norm! c) Four Provinces are subject to Section C 100 d) The majority of municipalities are dysfunctional and financially stressed due to abuse and incompetence. 3. The spirit and the skills needed for managing for effectiveness are lacking. Note: Fixing this is a pre-condition for poverty alleviation and social development. Slide # 20

Effectiveness Assessment of the Fiscal Framework 1. Overall effectiveness of fiscal expenditure is poor- at best. 2. The level of abuse and corruption is way too high. a) Over R 5 billion is under formal investigation! b) Chronic annual audit qualification is the norm! c) Four Provinces are subject to Section C 100 d) The majority of municipalities are dysfunctional and financially stressed due to abuse and incompetence. 3. The spirit and the skills needed for managing for effectiveness are lacking. Note: Fixing this is a pre-condition for poverty alleviation and social development. Slide # 20

The upshot……………. . 1. Financial Criteria: SA is doing fine subject to cyclical changes 2. Economic Criteria: SA has a considerable and unsustainable deficit, unfunded and largely neglected. 3. Effectiveness Criteria: SA is facing a dangerous deficit! This is a real challenge, if not a crisis, of fiscal efficacy! For social development this is a pre-requisite. Slide # 21

The upshot……………. . 1. Financial Criteria: SA is doing fine subject to cyclical changes 2. Economic Criteria: SA has a considerable and unsustainable deficit, unfunded and largely neglected. 3. Effectiveness Criteria: SA is facing a dangerous deficit! This is a real challenge, if not a crisis, of fiscal efficacy! For social development this is a pre-requisite. Slide # 21

The Economy’s Unlocking Golden Opportunities :

The Economy’s Unlocking Golden Opportunities :

Unlocking SA’s Economic Potential Key Sources of SA’s Growth and Job Creation Potential: 1. An integrated mineral beneficiation strategy; 2. A re-industrialisation policy; 3. An effective regional integration strategy. Slide # 23

Unlocking SA’s Economic Potential Key Sources of SA’s Growth and Job Creation Potential: 1. An integrated mineral beneficiation strategy; 2. A re-industrialisation policy; 3. An effective regional integration strategy. Slide # 23

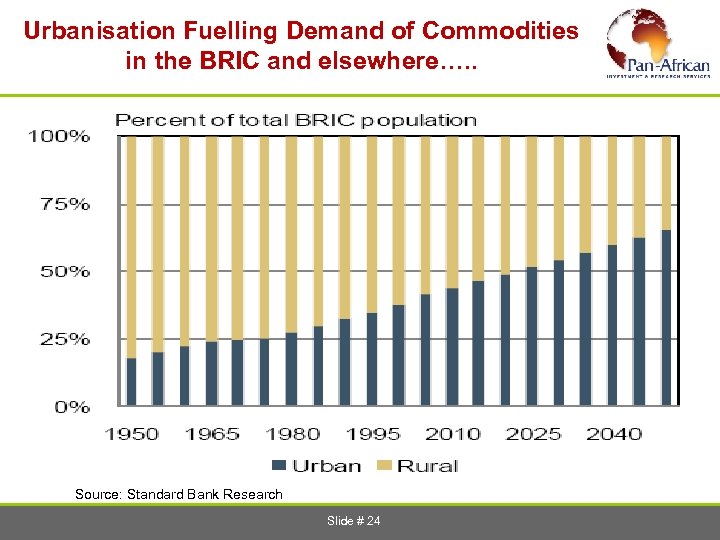

Urbanisation Fuelling Demand of Commodities in the BRIC and elsewhere…. . Source: Standard Bank Research Slide # 24

Urbanisation Fuelling Demand of Commodities in the BRIC and elsewhere…. . Source: Standard Bank Research Slide # 24

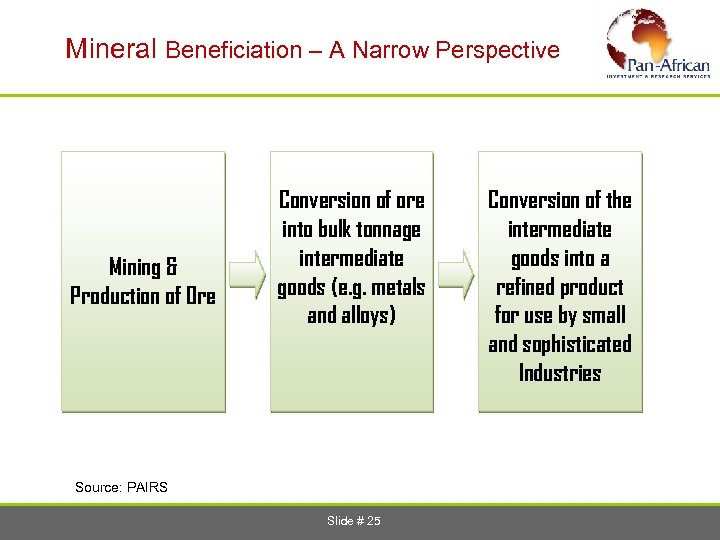

Mineral Beneficiation – A Narrow Perspective Mining & Production of Ore Conversion of ore into bulk tonnage intermediate goods (e. g. metals and alloys) Source: PAIRS Slide # 25 Conversion of the intermediate goods into a refined product for use by small and sophisticated Industries

Mineral Beneficiation – A Narrow Perspective Mining & Production of Ore Conversion of ore into bulk tonnage intermediate goods (e. g. metals and alloys) Source: PAIRS Slide # 25 Conversion of the intermediate goods into a refined product for use by small and sophisticated Industries

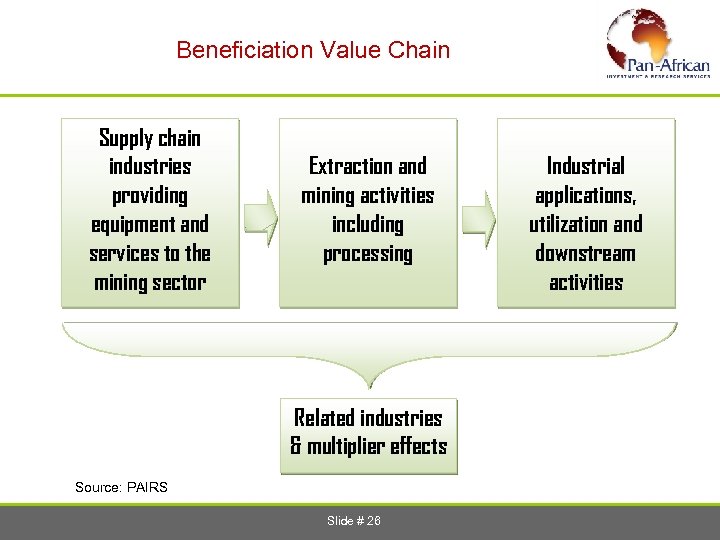

Beneficiation Value Chain Supply chain industries providing equipment and services to the mining sector Extraction and mining activities including processing Related industries & multiplier effects Source: PAIRS Slide # 26 Industrial applications, utilization and downstream activities

Beneficiation Value Chain Supply chain industries providing equipment and services to the mining sector Extraction and mining activities including processing Related industries & multiplier effects Source: PAIRS Slide # 26 Industrial applications, utilization and downstream activities

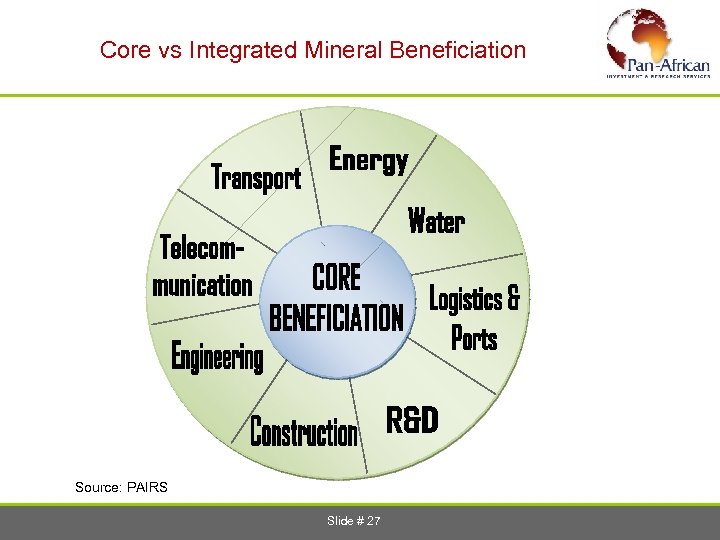

Core vs Integrated Mineral Beneficiation Source: PAIRS Slide # 27

Core vs Integrated Mineral Beneficiation Source: PAIRS Slide # 27

A significant business reality: Mineral beneficiation & Re-industrialisation are inseparable. .

A significant business reality: Mineral beneficiation & Re-industrialisation are inseparable. .

At present, SA enjoys a golden opportunity for the second wave of reindustrialisation with significant and meaningful political economy benefits. . An Econometric Illustration…

At present, SA enjoys a golden opportunity for the second wave of reindustrialisation with significant and meaningful political economy benefits. . An Econometric Illustration…

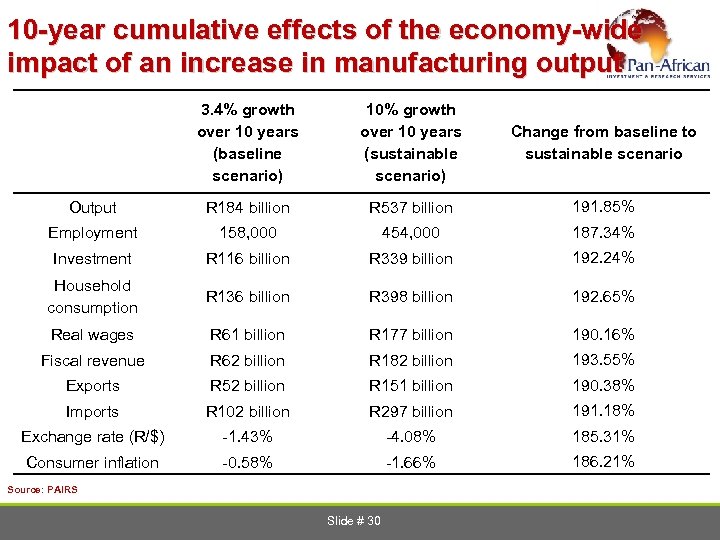

10 -year cumulative effects of the economy-wide impact of an increase in manufacturing output 3. 4% growth over 10 years (baseline scenario) 10% growth over 10 years (sustainable scenario) Change from baseline to sustainable scenario Output R 184 billion R 537 billion 191. 85% Employment 158, 000 454, 000 187. 34% Investment R 116 billion R 339 billion 192. 24% Household consumption R 136 billion R 398 billion 192. 65% Real wages R 61 billion R 177 billion 190. 16% Fiscal revenue R 62 billion R 182 billion 193. 55% Exports R 52 billion R 151 billion 190. 38% Imports R 102 billion R 297 billion 191. 18% Exchange rate (R/$) -1. 43% -4. 08% 185. 31% Consumer inflation -0. 58% -1. 66% 186. 21% Source: PAIRS Slide # 30

10 -year cumulative effects of the economy-wide impact of an increase in manufacturing output 3. 4% growth over 10 years (baseline scenario) 10% growth over 10 years (sustainable scenario) Change from baseline to sustainable scenario Output R 184 billion R 537 billion 191. 85% Employment 158, 000 454, 000 187. 34% Investment R 116 billion R 339 billion 192. 24% Household consumption R 136 billion R 398 billion 192. 65% Real wages R 61 billion R 177 billion 190. 16% Fiscal revenue R 62 billion R 182 billion 193. 55% Exports R 52 billion R 151 billion 190. 38% Imports R 102 billion R 297 billion 191. 18% Exchange rate (R/$) -1. 43% -4. 08% 185. 31% Consumer inflation -0. 58% -1. 66% 186. 21% Source: PAIRS Slide # 30

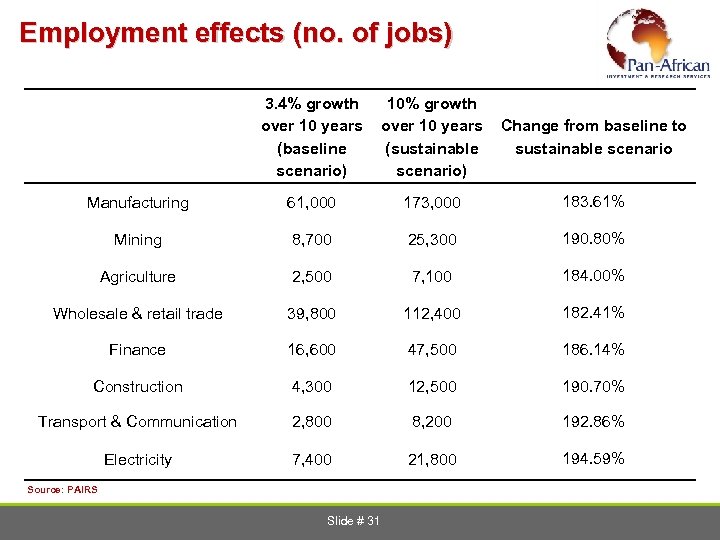

Employment effects (no. of jobs) 3. 4% growth over 10 years (baseline scenario) 10% growth over 10 years (sustainable scenario) Change from baseline to sustainable scenario Manufacturing 61, 000 173, 000 183. 61% Mining 8, 700 25, 300 190. 80% Agriculture 2, 500 7, 100 184. 00% Wholesale & retail trade 39, 800 112, 400 182. 41% Finance 16, 600 47, 500 186. 14% Construction 4, 300 12, 500 190. 70% Transport & Communication 2, 800 8, 200 192. 86% Electricity 7, 400 21, 800 194. 59% Source: PAIRS Slide # 31

Employment effects (no. of jobs) 3. 4% growth over 10 years (baseline scenario) 10% growth over 10 years (sustainable scenario) Change from baseline to sustainable scenario Manufacturing 61, 000 173, 000 183. 61% Mining 8, 700 25, 300 190. 80% Agriculture 2, 500 7, 100 184. 00% Wholesale & retail trade 39, 800 112, 400 182. 41% Finance 16, 600 47, 500 186. 14% Construction 4, 300 12, 500 190. 70% Transport & Communication 2, 800 8, 200 192. 86% Electricity 7, 400 21, 800 194. 59% Source: PAIRS Slide # 31

First things First: some necessary urgent steps. . . To unlock the potential: a. Professionalization/De-politicization of the key technocratic layer of the pubic sector and its SOEs as well as state agencies. b. A radical reform of the education and human resources development paradigm, even if this entails a ‘terminal tax compact’ c. Re-industrialisation policy based on an integrated mineral beneficiation strategy. d. An active African integration policy, especially for Sub-Saharan Africa. Slide # 32

First things First: some necessary urgent steps. . . To unlock the potential: a. Professionalization/De-politicization of the key technocratic layer of the pubic sector and its SOEs as well as state agencies. b. A radical reform of the education and human resources development paradigm, even if this entails a ‘terminal tax compact’ c. Re-industrialisation policy based on an integrated mineral beneficiation strategy. d. An active African integration policy, especially for Sub-Saharan Africa. Slide # 32

Concluding Remarks v. In 2012, South Africa finds itself at a cross-road again; v. Key capabilities are built over the past 15 years, v. Major fault-lines remain and need urgent attention; v. The solutions require a heavy mix of political and technical inputs. v. The speed with which we respond to the urgent issues will define the trajectory and the pace of the country’s democratization process and global standing over the next decade. Slide # 33

Concluding Remarks v. In 2012, South Africa finds itself at a cross-road again; v. Key capabilities are built over the past 15 years, v. Major fault-lines remain and need urgent attention; v. The solutions require a heavy mix of political and technical inputs. v. The speed with which we respond to the urgent issues will define the trajectory and the pace of the country’s democratization process and global standing over the next decade. Slide # 33

Concluding Remarks Slide # 34

Concluding Remarks Slide # 34

Thank you for your attention abedian@pan-african. co. za Tel: 011 883 8036/7 Fax: 011 883 8038 Slide # 35

Thank you for your attention abedian@pan-african. co. za Tel: 011 883 8036/7 Fax: 011 883 8038 Slide # 35

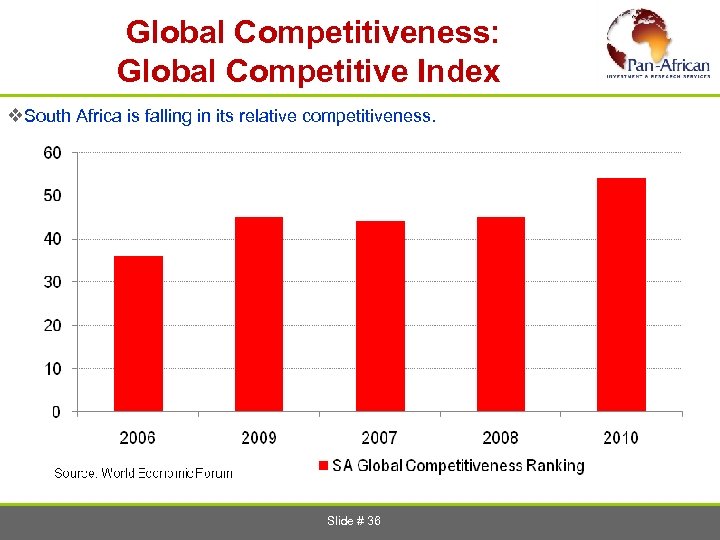

Global Competitiveness: Global Competitive Index v. South Africa is falling in its relative competitiveness. Slide # 36

Global Competitiveness: Global Competitive Index v. South Africa is falling in its relative competitiveness. Slide # 36

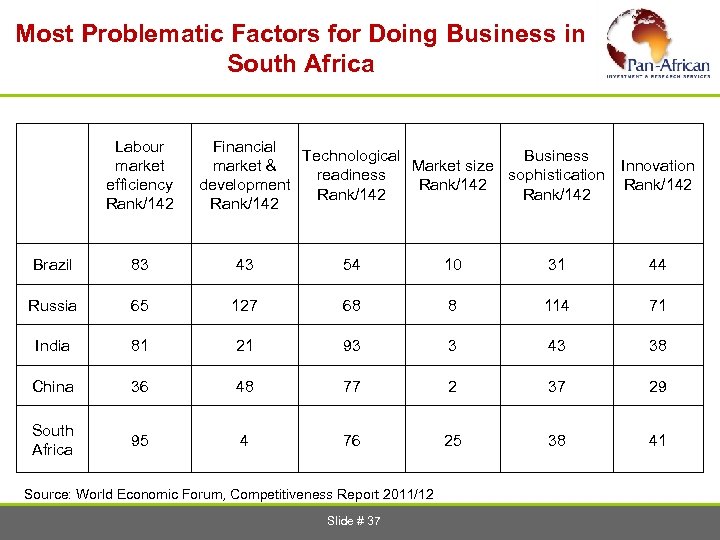

Most Problematic Factors for Doing Business in South Africa Labour market efficiency Rank/142 Financial Technological Business market & Market size Innovation readiness sophistication development Rank/142 Rank/142 Brazil 83 43 54 10 31 44 Russia 65 127 68 8 114 71 India 81 21 93 3 43 38 China 36 48 77 2 37 29 South Africa 95 4 76 25 38 41 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 37

Most Problematic Factors for Doing Business in South Africa Labour market efficiency Rank/142 Financial Technological Business market & Market size Innovation readiness sophistication development Rank/142 Rank/142 Brazil 83 43 54 10 31 44 Russia 65 127 68 8 114 71 India 81 21 93 3 43 38 China 36 48 77 2 37 29 South Africa 95 4 76 25 38 41 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 37

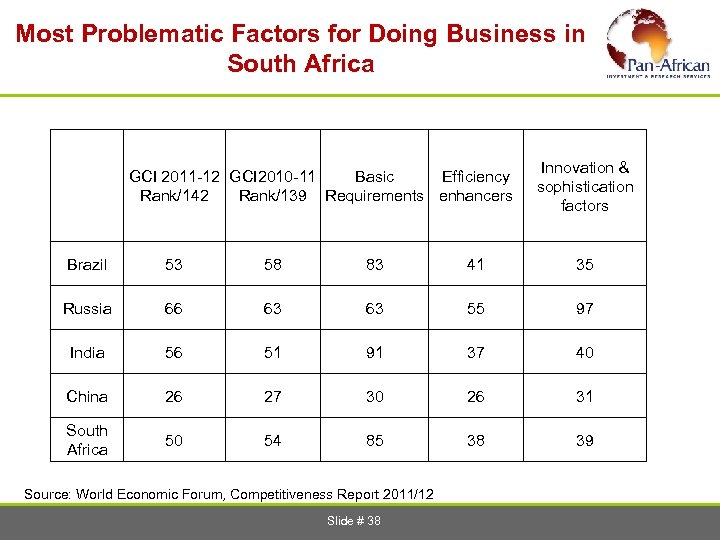

Most Problematic Factors for Doing Business in South Africa GCI 2011 -12 GCI 2010 -11 Basic Efficiency Rank/142 Rank/139 Requirements enhancers Innovation & sophistication factors Brazil 53 58 83 41 35 Russia 66 63 63 55 97 India 56 51 91 37 40 China 26 27 30 26 31 South Africa 50 54 85 38 39 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 38

Most Problematic Factors for Doing Business in South Africa GCI 2011 -12 GCI 2010 -11 Basic Efficiency Rank/142 Rank/139 Requirements enhancers Innovation & sophistication factors Brazil 53 58 83 41 35 Russia 66 63 63 55 97 India 56 51 91 37 40 China 26 27 30 26 31 South Africa 50 54 85 38 39 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 38

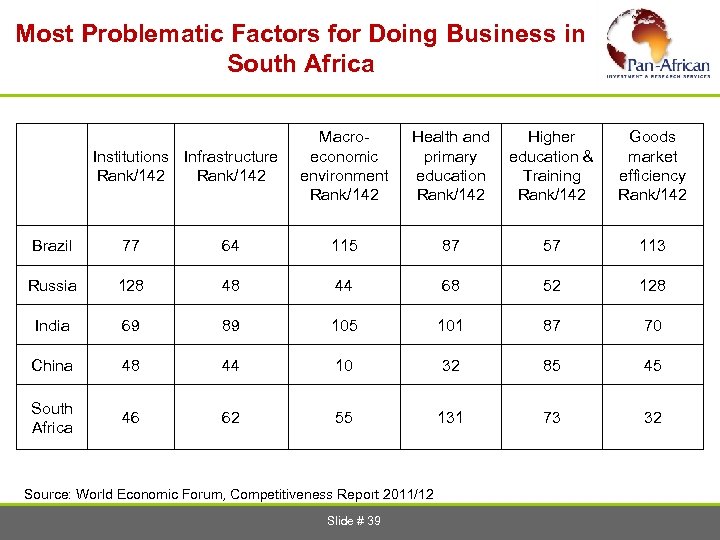

Most Problematic Factors for Doing Business in South Africa Institutions Infrastructure Rank/142 Macroeconomic environment Rank/142 Health and Higher primary education & education Training Rank/142 Goods market efficiency Rank/142 Brazil 77 64 115 87 57 113 Russia 128 48 44 68 52 128 India 69 89 105 101 87 70 China 48 44 10 32 85 45 South Africa 46 62 55 131 73 32 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 39

Most Problematic Factors for Doing Business in South Africa Institutions Infrastructure Rank/142 Macroeconomic environment Rank/142 Health and Higher primary education & education Training Rank/142 Goods market efficiency Rank/142 Brazil 77 64 115 87 57 113 Russia 128 48 44 68 52 128 India 69 89 105 101 87 70 China 48 44 10 32 85 45 South Africa 46 62 55 131 73 32 Source: World Economic Forum, Competitiveness Report 2011/12 Slide # 39

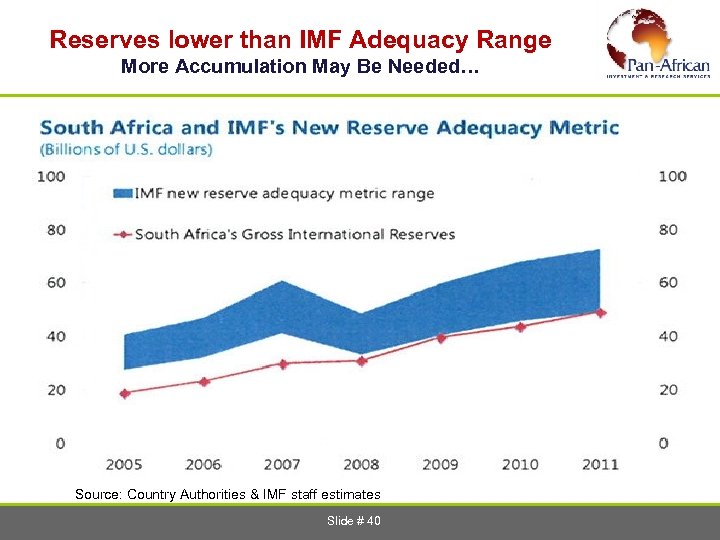

Reserves lower than IMF Adequacy Range More Accumulation May Be Needed… Source: Country Authorities & IMF staff estimates Slide # 40

Reserves lower than IMF Adequacy Range More Accumulation May Be Needed… Source: Country Authorities & IMF staff estimates Slide # 40

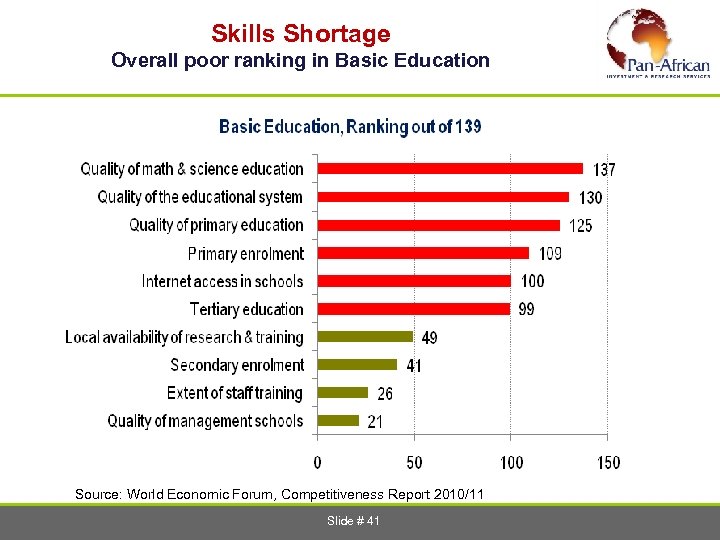

Skills Shortage Overall poor ranking in Basic Education Source: World Economic Forum, Competitiveness Report 2010/11 Slide # 41

Skills Shortage Overall poor ranking in Basic Education Source: World Economic Forum, Competitiveness Report 2010/11 Slide # 41