34ea6ef6fd4781624802adf95ecce077.ppt

- Количество слайдов: 38

The role of viability in plan making Anthony Lee 1 1

Introduction § § § § Why viability has become so important Viability basics Additional requirements resulting from the NPPF Finding your way through the guidance Use of consultants and being an informed client What can planners do themselves Questions/discussion 2

Why viability has become so important § Pre-2008 – assumption that values would keep going up § Developers and banks were getting lazy – taking a view on viability § Viability and deliverability of schemes is under pressure § § § Sales values have fallen Selling houses has become more difficult (choice; mortgages) Potential planning obligations pot has got smaller Development finance more difficult to secure Grant funding for affordable housing drastically reduced Landowners have not yet adjusted to new market reality § Moving away from negotiated S 106 to fixed CIL – viability impact 3

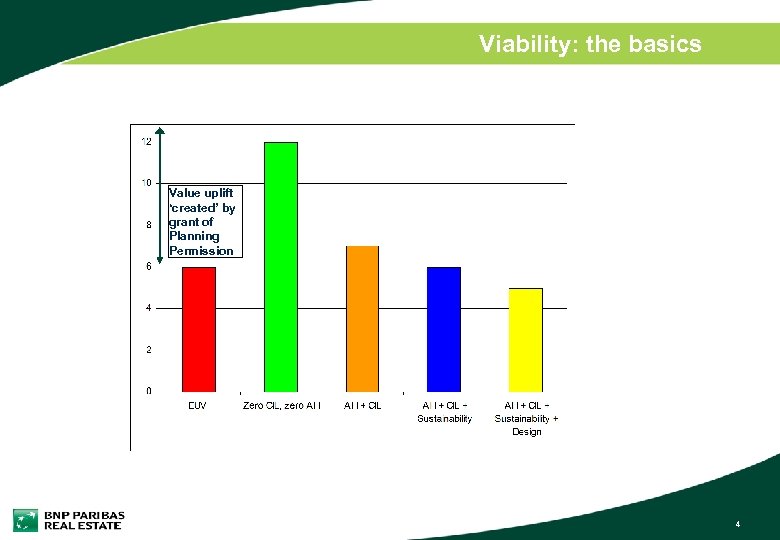

Viability: the basics Value uplift ‘created’ by grant of Planning Permission 4

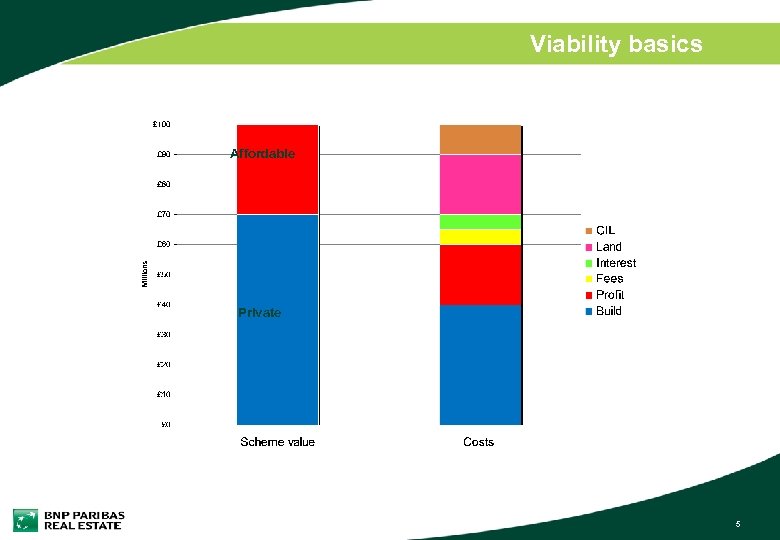

Viability basics Affordable Private 5

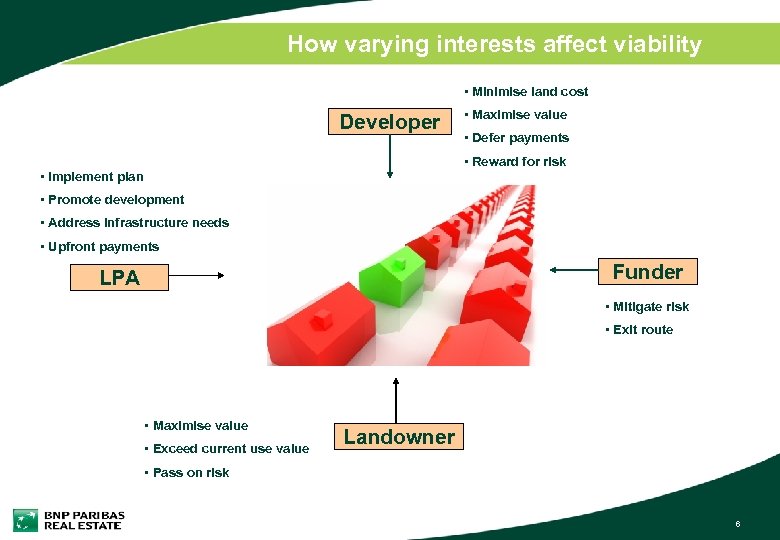

How varying interests affect viability • Minimise land cost Developer • Maximise value • Defer payments • Reward for risk • Implement plan • Promote development • Address infrastructure needs • Upfront payments Funder LPA • Mitigate risk • Exit route • Maximise value • Exceed current use value Landowner • Pass on risk 6

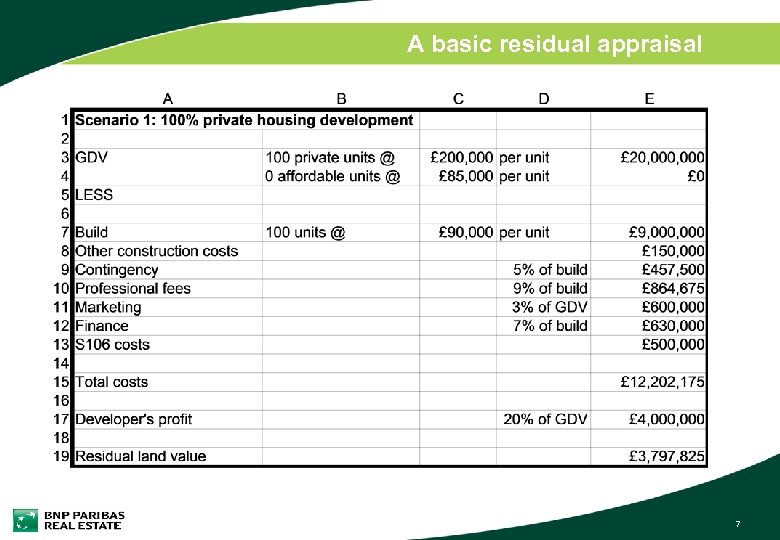

A basic residual appraisal 7

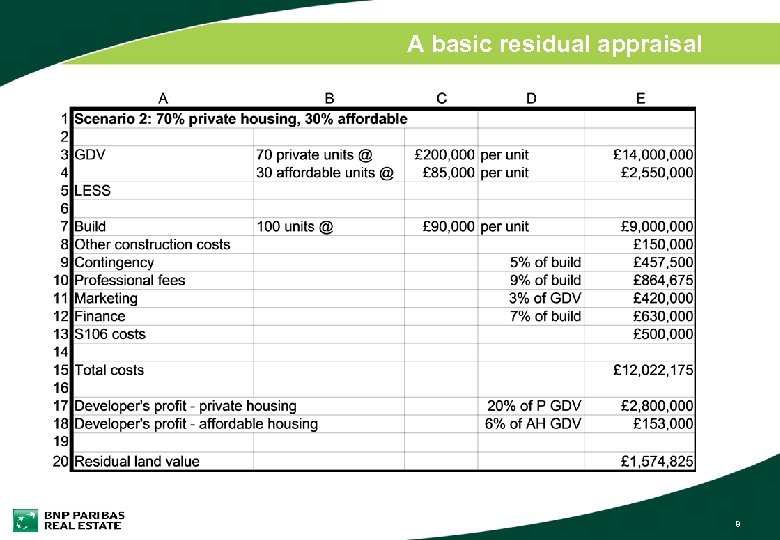

A basic residual appraisal 8

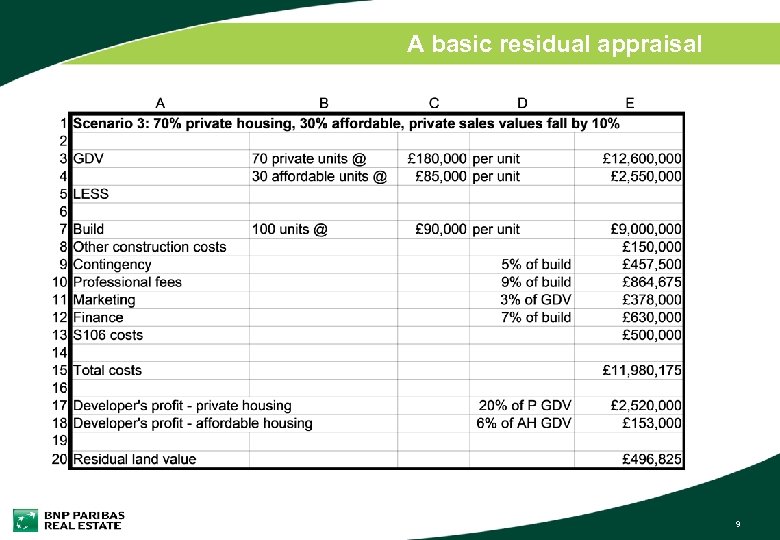

A basic residual appraisal 9

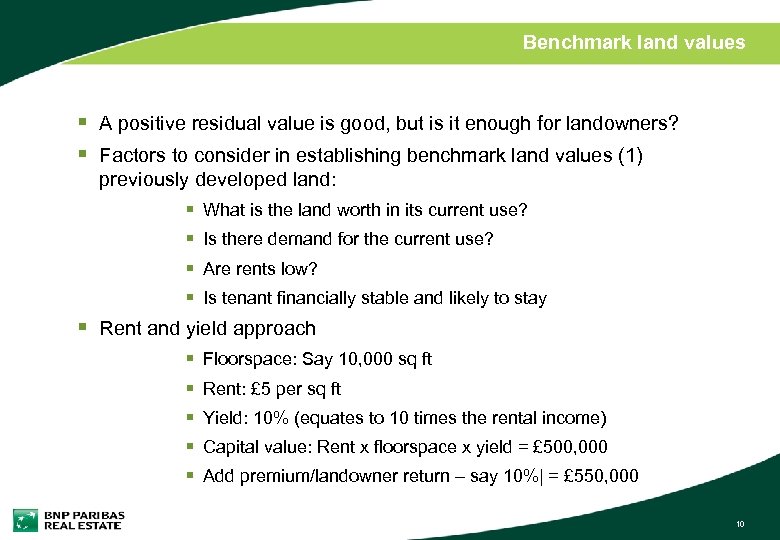

Benchmark land values § A positive residual value is good, but is it enough for landowners? § Factors to consider in establishing benchmark land values (1) previously developed land: § What is the land worth in its current use? § Is there demand for the current use? § Are rents low? § Is tenant financially stable and likely to stay § Rent and yield approach § § § Floorspace: Say 10, 000 sq ft Rent: £ 5 per sq ft Yield: 10% (equates to 10 times the rental income) Capital value: Rent x floorspace x yield = £ 500, 000 Add premium/landowner return – say 10%| = £ 550, 000 10

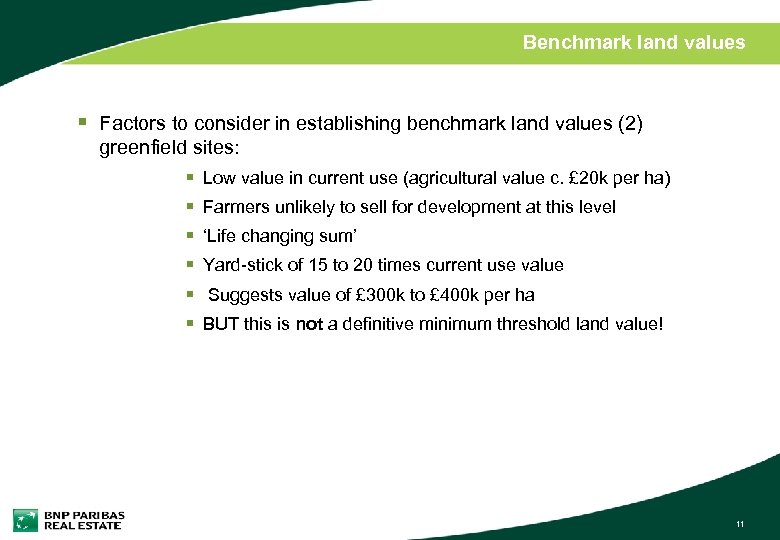

Benchmark land values § Factors to consider in establishing benchmark land values (2) greenfield sites: § Low value in current use (agricultural value c. £ 20 k per ha) § Farmers unlikely to sell for development at this level § ‘Life changing sum’ § Yard-stick of 15 to 20 times current use value § Suggests value of £ 300 k to £ 400 k per ha § BUT this is not a definitive minimum threshold land value! 11

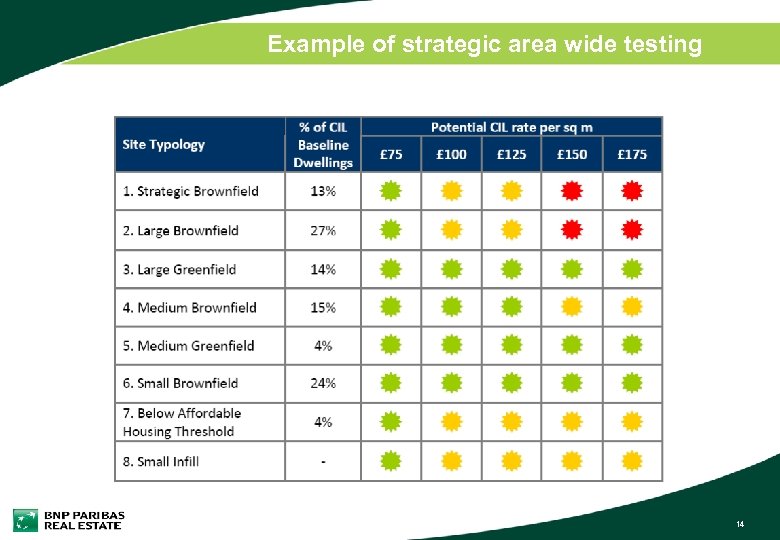

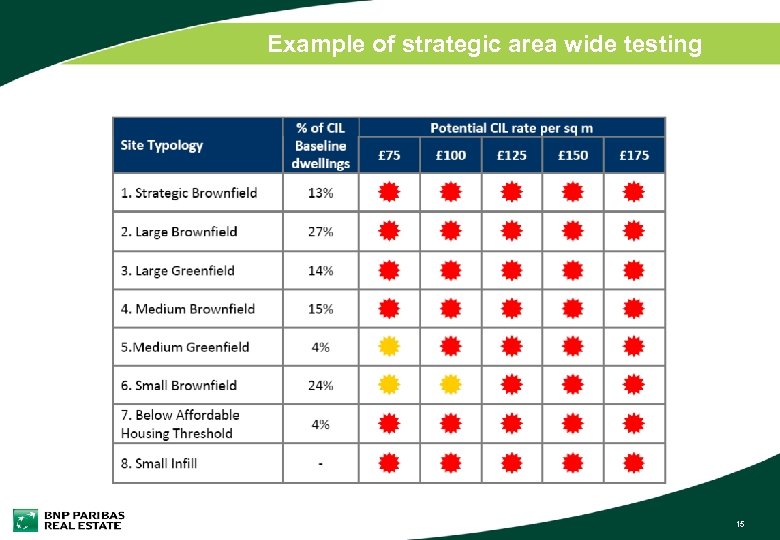

Viability and plan making – what might it look like? § § Strategic exercise Testing every site in SHLAA would be too onerous Generic or representative developments (e. g. notional hectares) Factors to test: § A range of densities of development § A range of sales values (low to high) § Varying affordable housing percentages and tenures § Profit levels § Sustainability requirements (code levels 3, 4, 5 and 6) § A range of benchmark land values 12

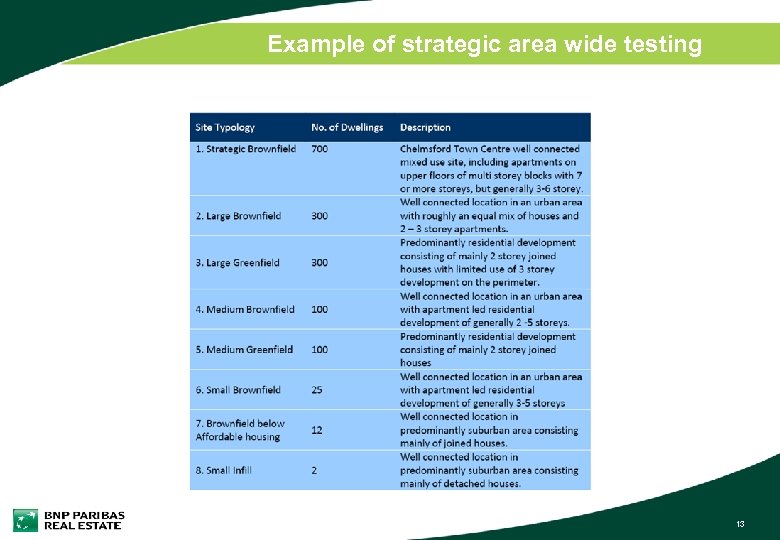

Example of strategic area wide testing 13

Example of strategic area wide testing 14

Example of strategic area wide testing 15

Implications of the NPPF Viability and planning policy – what has changed? 1. Pre NPPF requirements 16

Pre NPPF requirements § PPS 3 para 29: “Set an overall (ie plan-wide) target for the amount of affordable housing to be provided… reflect[ing] an assessment of the likely economic viability of land for housing within the area, taking account of risks to delivery and … the likely levels of finance available for affordable housing, including public subsidy and the level of developer contribution that can reasonably be secured” § PPS 12 para 4. 27: “Local authorities should undertake timely, effective and conclusive discussion with key stakeholders on what option(s) for a core strategy are deliverable”. § Blyth Valley and Wakefield decisions § LPAs must test affordable housing policies in line with PPS 3 § LPAs can adopt target based/aspirational affordable housing policies 17

Implications of the NPPF Viability and planning policy – what has changed? 2. Post NPPF requirements 18

Implications of the NPPF Para 173: “Pursuing sustainable development requires careful attention to viability and costs in plan-making and decision-taking. Plans should be deliverable. Therefore, the sites and the scale of development identified in the plan should not be subject to such a scale of obligations and policy burdens that their ability to be developed viably is threatened. To ensure viability, the costs of any requirements likely to be applied to development, such as requirements for affordable housing, standards, infrastructure contributions or other requirements should, when taking account of the normal cost of development and mitigation, provide competitive returns to a willing land owner and willing developer to enable the development to be deliverable. ” 19

Implications of the Draft NPPF § Can we continue with target based ‘Wakefield’ type approaches? § NPPF is more prescriptive on viability (para 39): “To ensure viability, the costs of [LPA requirements] should, when taking account of the normal cost of development and on-site mitigation, provide competitive returns [1] to a willing land owner and willing developer to enable the development to be deliverable” [1] ‘Acceptable returns’ in draft NPPF 20

Key changes from the draft to the final NPPF § Does the NPPF put an end to target based policies? Para 47: “LPAs should…identify and update annually a supply of specific deliverable sites sufficient to provide five years worth of housing…” Footnote 11 (Draft NPPF): “To be considered deliverable, sites should… be available now…and in particular that development of the site is viable… based on current values…” Footnote 11 (Final NPPF) “To be considered deliverable, sites should be available now… and be achievable with a realistic prospect that housing will be delivered on the site within five years and in particular that development of the site is viable. § Draft implied that Aff Hsg targets may need to have been reduced § In northern districts – no affordable housing delivery at all in first 5 years § Concerns addessed? Only in part – still emphasis on planning, not land value 21

Reactions to the Draft NPPF § Select Committee report focuses on viability issue: LGA: “the final NPPF needs to make clear that sustainability must always trump the need to reduce costs to ensure viability not the other way round” § A danger that LPAs might have to approve schemes that are unacceptable in planning terms to make them viable POS: “The worst-case scenario for the local community is that they get the development but there is not enough value coming forward from the development to mitigate it in terms of roads and all the other facilities that are required” § Impact on affordable housing delivery: Shelter: NPPF offers an “effective exemption for developers” putting LPAs in a weak position when trying to secure AH 22

Finding your way through guidance Filling the viability void in government policy Still no position on land value ‘benchmarks’ 23

Finding your way through guidance Two sets of guidance (neither from CLG): RICS Guidance Note ‘Exposure Draft’ HCA sponsored Guidance on viability and plan making (release date 21 June) 24

The draft RICS Guidance Note on viability § § § § RICS GNs not mandatory for RICS members Working Group hopes document will be widely adopted Will not be adopted planning guidance Informal consultation only – no formal examination process Neither a “how to do it guide” nor an account of principles No guidance on ranges of inputs – LPA to rely on experts It is aimed at Development Control, but strays into plan viability 25

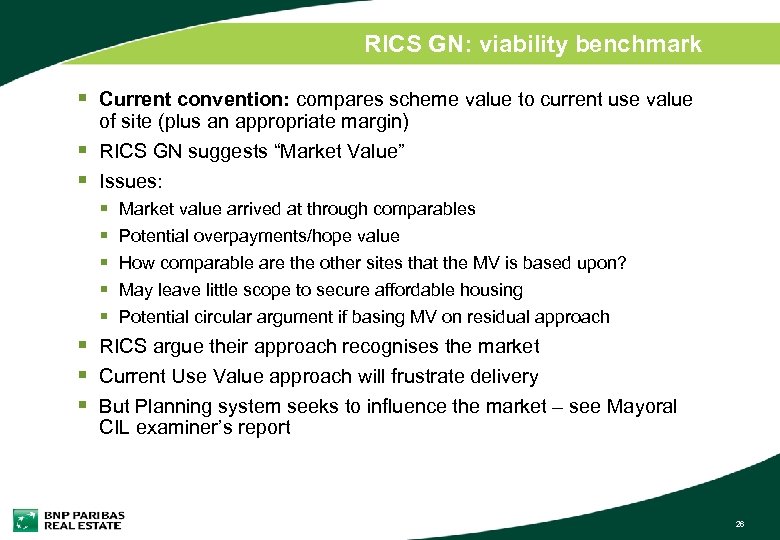

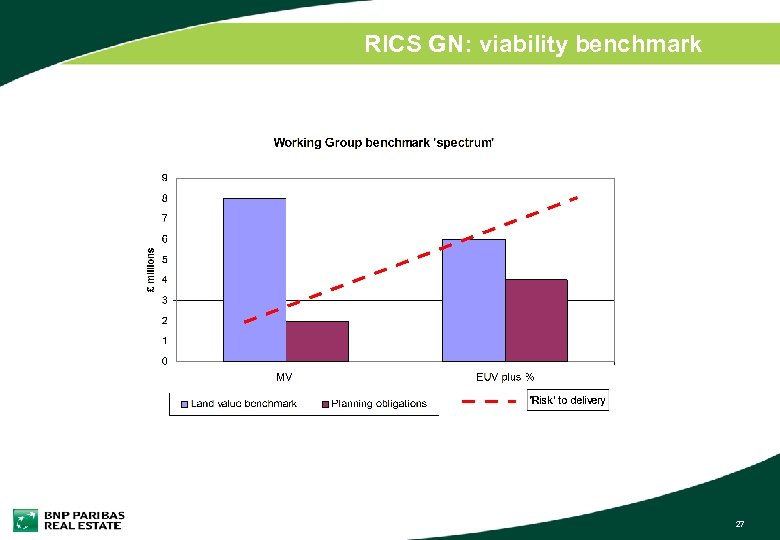

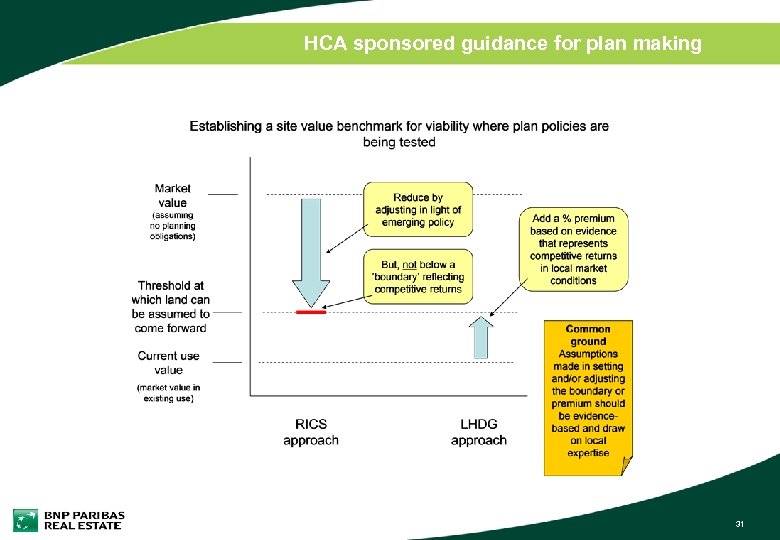

RICS GN: viability benchmark § Current convention: compares scheme value to current use value § § § of site (plus an appropriate margin) RICS GN suggests “Market Value” Issues: § Market value arrived at through comparables § Potential overpayments/hope value § How comparable are the other sites that the MV is based upon? § May leave little scope to secure affordable housing § Potential circular argument if basing MV on residual approach RICS argue their approach recognises the market Current Use Value approach will frustrate delivery But Planning system seeks to influence the market – see Mayoral CIL examiner’s report 26

RICS GN: viability benchmark 27

RICS Guidance Note on viability § § So is it helpful in its current form? Yes – for developers – Market Value benchmark Yes – for valuers – hours of debate on “Market Value” No – for LPAs – fails as a practical manual – muddled and fails to appreciate the ‘planning’ perspective § No – for Inspectors – no ranges of guidance on inputs § § § Does it enhance deliverability of schemes? No – lower planning obligations but higher land payments Departs from conventional approach to viability testing Mitigation only - resistance to housing schemes from communities Less local approvals and more appeals 28

HCA sponsored guidance for plan making There is an alternative! § HCA-led guidance for testing viability of plans § More balanced and nuanced approach “…viability of a plan should not be an overriding factor in the setting of plan policy [but] plans that do not take account of this are at risk of failing to be found sound when examined” “the economic viability of development is only one part of the wider balance that planning authorities will need to achieve” 29

HCA sponsored guidance for plan making On benchmark land value: “Whilst no alternative to a market value approach is perfect, it is recommended that the threshold land value is based on a premium over current use values. This approach is in common use, allows realistic scope to provide for policy requirements and is capable of adjusting to local circumstances by altering the percentage of premium used in the model. ” 30

HCA sponsored guidance for plan making Market value (assuming no planning obligations) Threshold at which land can be assumed to come forward Current use value (market value in existing use) RICS approach LHDG approach 31

Viability appraisals in plan making Who should undertake viability testing? DIY? Employing external advisors? 32

Commissioning consultants § § Do you have to employ external advisors to do viability tests? If you do, chose carefully – what are their primary interests? Getting the brief right is vital – check what other LPAs did Test their position on appropriate benchmark land value: § Market value-led approach – will result in minimal AH/CIL/S 106 § Current use value approach – likely to maximise AH/CIL/S 106 § Specify your preferred approach in the brief? § How do you know what you are being told is correct/appropriate? § § Check methodologies used by other LPAs Check appraisal inputs used by other authorities/advisors Transparent approach - ask that all assumptions be backed by evidence Be prepared to challenge inputs – valuers expect and are used to this! 33

DIY viability: appraisal models § Three Dragons Toolkit § § Static model with fixed development period Simple to use Contains ‘benchmark’ values Free to LPAs (everyone else pays £ 150 per annum) § HCA ‘Economic Appraisal Tool’ and ‘Development Appraisal Tool’ § § User can define development period and timings Cashflow backed No benchmarks – relies wholly on user inputs Free to download from HCA website § See also ‘Area Wide Viability Model’ § Circle Developer § § § ‘Gold standard’ valuation model Used by valuers for secured lending valuations Full cashflow No benchmarks Not user friendly – lots of training required Expensive licence-based access 3434

DIY viability § § Viability appraisals for CIL being heavily scrutinised Savills – HBF commission Running own appraisals is therefore risky Mitigating the risk of challenge: § § Procure advice on some inputs (eg land values) But discuss what you need before drafting brief ‘Critical friend’ review of approach and results Avoid setting requirements at the margins of viability 3535

DIY viability: data sources § Completing the appraisals § Key appraisal variables: sales values, costs, infrastructure, fees, profit § Sales values: § Comparable evidence in the immediate and wider area § Land Registry; Hometrack § Sales rate is also a vital consideration; it will vary between scheme types § Housing construction costs § BCIS provides costings based on other tender prices § Consider appropriate uplifts for external works/landscaping § Code for Sustainable Homes – CLG published studies § Infrastructure on greenfield sites § Publicly available evidence (other authorities viability assessments) § Quantity Surveyor § Fees, profit etc § Benchmarking data from scheme specific appraisals 36

Concluding thoughts § Vital components to getting viability right § § § § consult with key stakeholders to secure buy-in If considering external advisors, discuss brief before tendering Focus advisors efforts on gaps (information or skills) Don’t get led down RICS approach – applies to DC viability only Sensitivity analysis essential to test robustness of results Transparency to enable decision makers to take informed decisions Keep it simple! 37

The role of viability in plan making anthony. lee@bnpparibas. com 020 7338 4061 3838

34ea6ef6fd4781624802adf95ecce077.ppt