The rest of the semester: There are 4 weeks of lecture left, plus the final exam week. I will not lecture the final exam week, so that means just 4 more lectures.

The rest of the semester: There are 4 weeks of lecture left, plus the final exam week. I will not lecture the final exam week, so that means just 4 more lectures.

The rest of the semester: We will have just one more test…the final exam. It is not comprehensive. It will cover the remainder of the material that we go over…

The rest of the semester: We will have just one more test…the final exam. It is not comprehensive. It will cover the remainder of the material that we go over…

The rest of the semester: Remaining Chapters: 13 – Fiscal Policy 15 – Money and Banking 16 – Monetary Policy 5 – Public Spending

The rest of the semester: Remaining Chapters: 13 – Fiscal Policy 15 – Money and Banking 16 – Monetary Policy 5 – Public Spending

The rest of the semester: I will also try to have: § 4 more homework assignments § 4 more online discussion boards § 1 more extra credit assignment

The rest of the semester: I will also try to have: § 4 more homework assignments § 4 more online discussion boards § 1 more extra credit assignment

Fiscal Policy In response to the economic downturn of 2008 -2009, Congress passed the American Recovery and Reinvestment Act as an attempt to stimulate total planned expenditures through additional government spending.

Fiscal Policy In response to the economic downturn of 2008 -2009, Congress passed the American Recovery and Reinvestment Act as an attempt to stimulate total planned expenditures through additional government spending.

Fiscal Policy Although large portions of the federal funds authorized by ARRA were allocated to states, states spent no more than 5% of the total ARRA funds they received. Why is this?

Fiscal Policy Although large portions of the federal funds authorized by ARRA were allocated to states, states spent no more than 5% of the total ARRA funds they received. Why is this?

Fiscal Policy There are two methods that the government uses to achieve economic goals (like lower unemployment, lower inflation, higher GDP, etc…): 1. Fiscal Policy 2. Monetary Policy

Fiscal Policy There are two methods that the government uses to achieve economic goals (like lower unemployment, lower inflation, higher GDP, etc…): 1. Fiscal Policy 2. Monetary Policy

Fiscal Policy: The discretionary changing of government expenditures or taxes in order to achieve national economic goals.

Fiscal Policy: The discretionary changing of government expenditures or taxes in order to achieve national economic goals.

Fiscal Policy: The discretionary changing of government expenditures or taxes in order to achieve national economic goals. Note the key words: 1. Government Expenditures 2. Taxes

Fiscal Policy: The discretionary changing of government expenditures or taxes in order to achieve national economic goals. Note the key words: 1. Government Expenditures 2. Taxes

Fiscal Policy: So in other words, to achieve economic goals like low unemployment, price stability, and economic growth, the government could: -Spend more or spend less -Charge higher taxes or charge lower taxes

Fiscal Policy: So in other words, to achieve economic goals like low unemployment, price stability, and economic growth, the government could: -Spend more or spend less -Charge higher taxes or charge lower taxes

Fiscal Policy Changes in Government spending will either stimulate the economy or slow the economy…for example more military spending, less education spending, larger budgets for government agencies

Fiscal Policy Changes in Government spending will either stimulate the economy or slow the economy…for example more military spending, less education spending, larger budgets for government agencies

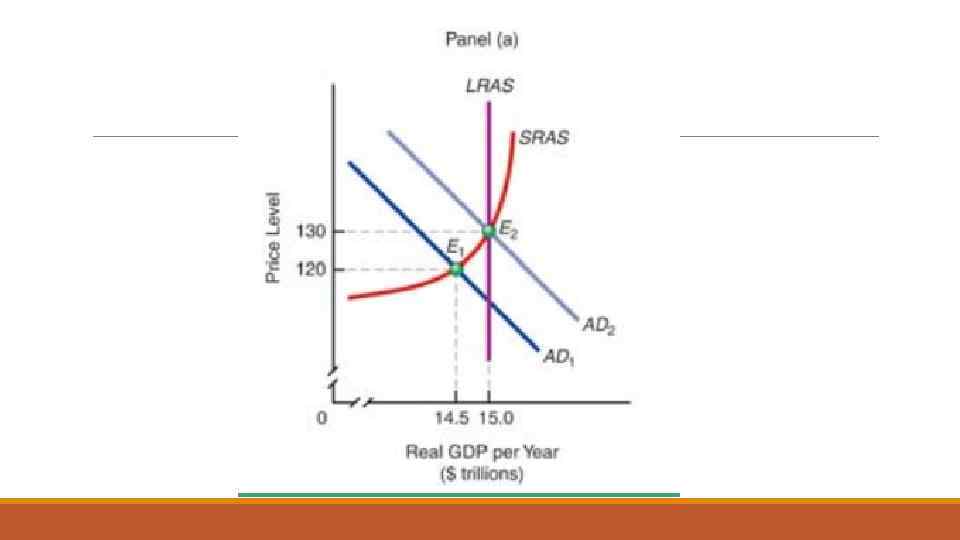

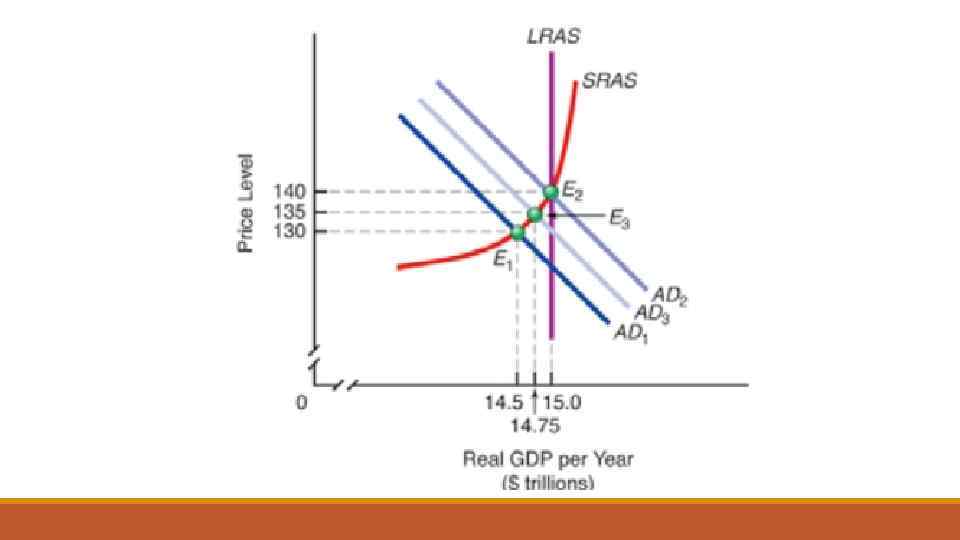

Fiscal Policy To see why this is the case, consider the diagram of Aggregate Demand, Long Run Aggregate Supply, and Short Run Aggregate Supply

Fiscal Policy To see why this is the case, consider the diagram of Aggregate Demand, Long Run Aggregate Supply, and Short Run Aggregate Supply

Fiscal Policy So what is happening…when government spending goes up, demand for goods and services goes up (i. e. the rightward shift of the AD curve)…. and the objective is to align aggregate demand, short run supply, and long run supply. This creates a sustainable level of prices and real GDP

Fiscal Policy So what is happening…when government spending goes up, demand for goods and services goes up (i. e. the rightward shift of the AD curve)…. and the objective is to align aggregate demand, short run supply, and long run supply. This creates a sustainable level of prices and real GDP

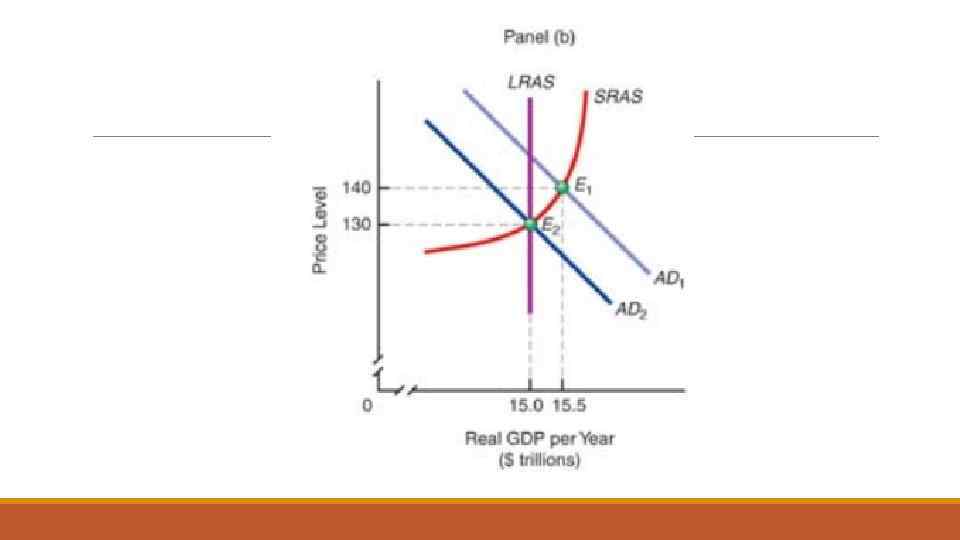

Fiscal Policy What would happen if the country were producing too many goods and services, and the government wanted to slow growth and deflate prices a little…

Fiscal Policy What would happen if the country were producing too many goods and services, and the government wanted to slow growth and deflate prices a little…

Fiscal Policy Notice that this time we see a leftward shift in the aggregate demand curve…because the government is demanding less goods and services by spending less. Notice the decrease in prices and real GDP

Fiscal Policy Notice that this time we see a leftward shift in the aggregate demand curve…because the government is demanding less goods and services by spending less. Notice the decrease in prices and real GDP

Fiscal Policy Taxes will work in much the same way…. Higher taxes will mean less discretionary income so lower aggregate demand Lower taxes will mean more discretionary income so higher aggregate demand (in theory of course)

Fiscal Policy Taxes will work in much the same way…. Higher taxes will mean less discretionary income so lower aggregate demand Lower taxes will mean more discretionary income so higher aggregate demand (in theory of course)

Fiscal Policy Real World Fiscal Policy: -In 2009 the US gov’t offered to pay between $3, 500 and $4, 500 to people who surrendered used cars and bought new vehicles -The program aimed to remove highpollution vehicles from the road and increase private spending on new cars and trucks

Fiscal Policy Real World Fiscal Policy: -In 2009 the US gov’t offered to pay between $3, 500 and $4, 500 to people who surrendered used cars and bought new vehicles -The program aimed to remove highpollution vehicles from the road and increase private spending on new cars and trucks

Fiscal Policy Real World Fiscal Policy: -Economic research suggest that the Cash-for -Clunkers program shifted the timing of vehicle purchases, but that it did not increase the total expenditures on cars and trucks. Consequently, it was not a very effective fiscal stimulus.

Fiscal Policy Real World Fiscal Policy: -Economic research suggest that the Cash-for -Clunkers program shifted the timing of vehicle purchases, but that it did not increase the total expenditures on cars and trucks. Consequently, it was not a very effective fiscal stimulus.

Fiscal Policy Possible Offsets to Fiscal Policy -Fiscal policy does not operate in a vacuum and important questions must be answered: ◦How are expenditures financed and by whom? ◦If taxes are increased, what does government do with the taxes? ◦What will happen if people worry about increases in future taxes?

Fiscal Policy Possible Offsets to Fiscal Policy -Fiscal policy does not operate in a vacuum and important questions must be answered: ◦How are expenditures financed and by whom? ◦If taxes are increased, what does government do with the taxes? ◦What will happen if people worry about increases in future taxes?

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦The tendency of expansionary fiscal policy to cause a decrease in planned investment or planned consumption in the private sector ◦This decrease normally results from the rise of interest rates (i. e. borrowing rates)

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦The tendency of expansionary fiscal policy to cause a decrease in planned investment or planned consumption in the private sector ◦This decrease normally results from the rise of interest rates (i. e. borrowing rates)

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦The rise in interest rates happens because if the government wants to finance its expenditure without raising taxes, it has to borrow the money ◦And in order to borrow money, it must offer appealing interest rates

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦The rise in interest rates happens because if the government wants to finance its expenditure without raising taxes, it has to borrow the money ◦And in order to borrow money, it must offer appealing interest rates

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦These interest rates are sometimes higher than prevailing market interest rates ◦So, if the government raises its interest rates, other private lenders follow and thus interest rates overall experience an increase

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: ◦These interest rates are sometimes higher than prevailing market interest rates ◦So, if the government raises its interest rates, other private lenders follow and thus interest rates overall experience an increase

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: So notice that people/businesses invest and borrow less money because of higher interest rates, which means less spending/investing which means lower aggregate demand…which offsets the increased gov’t spending

Fiscal Policy Possible Offsets to Fiscal Policy The crowding out effect: So notice that people/businesses invest and borrow less money because of higher interest rates, which means less spending/investing which means lower aggregate demand…which offsets the increased gov’t spending

Fiscal Policy Possible Offsets to Fiscal Policy The Ricardian Equivalence Theorem: -The proposition that an increase in the government budget deficit has no effect on aggregate demand -Reason: people anticipate that a larger budget deficit today will mean higher taxes in the future and they adjust their spending

Fiscal Policy Possible Offsets to Fiscal Policy The Ricardian Equivalence Theorem: -The proposition that an increase in the government budget deficit has no effect on aggregate demand -Reason: people anticipate that a larger budget deficit today will mean higher taxes in the future and they adjust their spending

Fiscal Policy Possible Offsets to Fiscal Policy Permanent Income Hypothesis: -An individual’s current consumption depends on anticipated lifetime income. -Therefore, a temporary tax cut will have a restrained effect on aggregate consumption

Fiscal Policy Possible Offsets to Fiscal Policy Permanent Income Hypothesis: -An individual’s current consumption depends on anticipated lifetime income. -Therefore, a temporary tax cut will have a restrained effect on aggregate consumption

Fiscal Policy Possible Offsets to Fiscal Policy Direct Expenditures Offsets -Actions on the part of the private sector in spending income that offset government fiscal policy actions -Any increase in government spending in an area that competes with the private sector will have some direct expenditure offset

Fiscal Policy Possible Offsets to Fiscal Policy Direct Expenditures Offsets -Actions on the part of the private sector in spending income that offset government fiscal policy actions -Any increase in government spending in an area that competes with the private sector will have some direct expenditure offset

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare What if the federal government seeks to boost real GDP by funding health care spending that people had already planned to do on their own?

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare What if the federal government seeks to boost real GDP by funding health care spending that people had already planned to do on their own?

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare In recent years, the US gov’t has shifted a larger share of discretionary spending toward construction of more public hospitals and clinics

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare In recent years, the US gov’t has shifted a larger share of discretionary spending toward construction of more public hospitals and clinics

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare Although some private health care companies had originally planned to expand their facilities, the federally-funded projects caused the plans for private facilities to be cancelled -RESULT: Direct Fiscal Off-set

Fiscal Policy Possible Offsets to Fiscal Policy Example: Healthcare Although some private health care companies had originally planned to expand their facilities, the federally-funded projects caused the plans for private facilities to be cancelled -RESULT: Direct Fiscal Off-set

Fiscal Policy Possible Offsets to Fiscal Policy Supply-side effect of tax changes: -Expansionary fiscal policy could involve reducing marginal tax rates -Some argue this would increase productivity since individuals will work harder and longer, save more, and invest more

Fiscal Policy Possible Offsets to Fiscal Policy Supply-side effect of tax changes: -Expansionary fiscal policy could involve reducing marginal tax rates -Some argue this would increase productivity since individuals will work harder and longer, save more, and invest more

Fiscal Policy Possible Offsets to Fiscal Policy Supply-side effect of tax changes: -This increased productivity will lead to more economic growth -Results: Lower marginal tax rates will not necessarily reduce tax revenues due to a larger tax base

Fiscal Policy Possible Offsets to Fiscal Policy Supply-side effect of tax changes: -This increased productivity will lead to more economic growth -Results: Lower marginal tax rates will not necessarily reduce tax revenues due to a larger tax base

Fiscal Policy So, is the conduct of fiscal policy as precise as it appears? Answer: The difficulty is that the conduct of fiscal policy involves a variety of lags

Fiscal Policy So, is the conduct of fiscal policy as precise as it appears? Answer: The difficulty is that the conduct of fiscal policy involves a variety of lags

Fiscal Policy The Time Lag: -Recognition Time Lag ◦The time required to gather information about the current state of the economy -Action Time Lag -The time required between recognizing an economic problem and putting policy into effect

Fiscal Policy The Time Lag: -Recognition Time Lag ◦The time required to gather information about the current state of the economy -Action Time Lag -The time required between recognizing an economic problem and putting policy into effect

Fiscal Policy The Time Lag: -Effect Time Lag ◦The time it takes for fiscal policy to affect the economy

Fiscal Policy The Time Lag: -Effect Time Lag ◦The time it takes for fiscal policy to affect the economy

Fiscal Policy The Time Lag: Fiscal Policy time lags are: -Long: a policy designed to correct a recession may not produce results until the economy is experiencing inflation -Variable in length: can be 1 -3 years…and timing of desired affect is hard to predict

Fiscal Policy The Time Lag: Fiscal Policy time lags are: -Long: a policy designed to correct a recession may not produce results until the economy is experiencing inflation -Variable in length: can be 1 -3 years…and timing of desired affect is hard to predict

Fiscal Policy The Time Lag: To combat this, there automatic or builtin stabilizing mechanisms: -Changes in government spending and taxation that occur automatically without deliberate action of congress (tax system, unemployment comp, welfare spending)

Fiscal Policy The Time Lag: To combat this, there automatic or builtin stabilizing mechanisms: -Changes in government spending and taxation that occur automatically without deliberate action of congress (tax system, unemployment comp, welfare spending)

Fiscal Policy The Time Lag: To combat this, there automatic or builtin stabilizing mechanisms: -Changes in government spending and taxation that occur automatically without deliberate action of congress (tax system, unemployment comp, welfare spending)

Fiscal Policy The Time Lag: To combat this, there automatic or builtin stabilizing mechanisms: -Changes in government spending and taxation that occur automatically without deliberate action of congress (tax system, unemployment comp, welfare spending)

Fiscal Policy So, why a federal stimulus project too time to provide stimulus: -A portion of ARRA funds were devoted to paying for insulation of private homes -After an initial attempt to get the insulation project underway, the Detroit agency facilitating this process realized it hadn’t complied with all federal requirements for hiring firms to do the work

Fiscal Policy So, why a federal stimulus project too time to provide stimulus: -A portion of ARRA funds were devoted to paying for insulation of private homes -After an initial attempt to get the insulation project underway, the Detroit agency facilitating this process realized it hadn’t complied with all federal requirements for hiring firms to do the work

Fiscal Policy So, why a federal stimulus project too time to provide stimulus: In other states, the funds transferred were largely used to pay off debts that had been incurred in earlier years -So there was a 95 percent direct fiscal offset

Fiscal Policy So, why a federal stimulus project too time to provide stimulus: In other states, the funds transferred were largely used to pay off debts that had been incurred in earlier years -So there was a 95 percent direct fiscal offset