5be901ea5f3449c372ace8734a29e6ff.ppt

- Количество слайдов: 36

THE REALITIES OF REAL ESTATE DURING THE GREAT RECESSION Julie Lang ABR, CRS The Julie Lang Team First Weber Group Realtors Racine, WI

THE REALITIES OF REAL ESTATE DURING THE GREAT RECESSION Julie Lang ABR, CRS The Julie Lang Team First Weber Group Realtors Racine, WI

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. ” -Franklin D. Roosevelt “Owning a home is a keystone of wealth. . both financial affluence and emotional security”. –Suze Orman “It’s tangible, it’s solid, it’s beautiful. It’s artistic, from my standpoint, and I just love real estate. ” – Donald Trump “The best investment on Earth is earth. ” -Louis Glickman, American business executive

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. ” -Franklin D. Roosevelt “Owning a home is a keystone of wealth. . both financial affluence and emotional security”. –Suze Orman “It’s tangible, it’s solid, it’s beautiful. It’s artistic, from my standpoint, and I just love real estate. ” – Donald Trump “The best investment on Earth is earth. ” -Louis Glickman, American business executive

PERCEPTIONS OF REAL ESTATE & HOMEOWNERSHIP It’s the American Dream It’s a good investment It’s safe It is a status symbol It is an entitlement It’s scary It’s a risk A Responsibility It’s now OK to walk away It’s a terrible investment Too much work What are your perceptions?

PERCEPTIONS OF REAL ESTATE & HOMEOWNERSHIP It’s the American Dream It’s a good investment It’s safe It is a status symbol It is an entitlement It’s scary It’s a risk A Responsibility It’s now OK to walk away It’s a terrible investment Too much work What are your perceptions?

WHY DO PEOPLE WANT TO OWN A HOME Not throw money away Build a nest egg Decorate the way they want Have a good place to raise a family Fulfill a dream Stability Budget Feel Grounded…Emotionally Satisfying

WHY DO PEOPLE WANT TO OWN A HOME Not throw money away Build a nest egg Decorate the way they want Have a good place to raise a family Fulfill a dream Stability Budget Feel Grounded…Emotionally Satisfying

SOME QUICK DEFINITIONS DOM – (Days on Market) the period of time a property is listed for sale prior to being sold or removed from market. LP/SP – (list price to sale price ratio) Assessed Value – the value placed on a home by a government tax assessor in order to calculate a tax base.

SOME QUICK DEFINITIONS DOM – (Days on Market) the period of time a property is listed for sale prior to being sold or removed from market. LP/SP – (list price to sale price ratio) Assessed Value – the value placed on a home by a government tax assessor in order to calculate a tax base.

SOME QUICK DEFINITIONS REO – (Real Estate Owned) property acquired by a lender, through foreclosure, which is held as inventory. Short Sale - a sales transaction in which the seller's mortgage lender agrees to accept a payoff of less than the balance due on the loan.

SOME QUICK DEFINITIONS REO – (Real Estate Owned) property acquired by a lender, through foreclosure, which is held as inventory. Short Sale - a sales transaction in which the seller's mortgage lender agrees to accept a payoff of less than the balance due on the loan.

SOME QUICK DEFINITIONS Sellers market – a very strong real estate market where sellers have the advantage because there are more buyers than properties for sale. Generally when there is less than a 5 month supply of inventory. Balanced market - occurs when the relative supply of homes reach a 5 or 6 month level. Buyer’s market – a real estate market in which the buyers have the advantage over the seller due to slow sales. Generally this is when there is more than a 7 month supply of inventory.

SOME QUICK DEFINITIONS Sellers market – a very strong real estate market where sellers have the advantage because there are more buyers than properties for sale. Generally when there is less than a 5 month supply of inventory. Balanced market - occurs when the relative supply of homes reach a 5 or 6 month level. Buyer’s market – a real estate market in which the buyers have the advantage over the seller due to slow sales. Generally this is when there is more than a 7 month supply of inventory.

SOME QUICK DEFINITIONS Sales Concession – an instance where the seller will pay a cost that is normally paid by the buyer. Usually done to ensure the sale will go through. Price appreciation – an increase in the value of real estate. The price may increase because of a number of factors, such as shortage of supply, improved economy, favorable political environment, tax incentives, or increased profitability. Expired listings – when the time frame of a contract to list a property for sale passes and the home is no longer for sale. No purchase was made.

SOME QUICK DEFINITIONS Sales Concession – an instance where the seller will pay a cost that is normally paid by the buyer. Usually done to ensure the sale will go through. Price appreciation – an increase in the value of real estate. The price may increase because of a number of factors, such as shortage of supply, improved economy, favorable political environment, tax incentives, or increased profitability. Expired listings – when the time frame of a contract to list a property for sale passes and the home is no longer for sale. No purchase was made.

SOME QUICK DEFINITIONS Sale Price – the amount of money that is paid by a purchaser to a seller for property that is bought. Absorption Rate - this is the measurement of current housing supply divided by the current rate of sales, expressed in months of supply. Multiple offers - more than one offer to purchase a property, which usually occurs in a seller’s market. This is most likely a competitive bidding situation.

SOME QUICK DEFINITIONS Sale Price – the amount of money that is paid by a purchaser to a seller for property that is bought. Absorption Rate - this is the measurement of current housing supply divided by the current rate of sales, expressed in months of supply. Multiple offers - more than one offer to purchase a property, which usually occurs in a seller’s market. This is most likely a competitive bidding situation.

WHAT WAS IT LIKE IN 2005 -2007 People looked at few homes…they might lose out on the one they want Confidence was up ~ Positive feelings were up Lending was easy…… easy underwriting, minimal qualifications No down payments , interest only loans, etc…

WHAT WAS IT LIKE IN 2005 -2007 People looked at few homes…they might lose out on the one they want Confidence was up ~ Positive feelings were up Lending was easy…… easy underwriting, minimal qualifications No down payments , interest only loans, etc…

WHAT WAS IT LIKE IN 2005 -2007 List/sale ratios…… very high 97 -98% Average days on market…. . 52 in 2005 72 in 2006 86 in 2007 Average sale price in eastern Racine County 2007=$174, 132 Average appreciation over 5 years in city of Racine 30%

WHAT WAS IT LIKE IN 2005 -2007 List/sale ratios…… very high 97 -98% Average days on market…. . 52 in 2005 72 in 2006 86 in 2007 Average sale price in eastern Racine County 2007=$174, 132 Average appreciation over 5 years in city of Racine 30%

WHAT WAS IT LIKE IN 2005 -2007 Multiple offers – common Inspections – repairs often not negotiated Flippers present in the market Homes ALWAYS appraised Sense of Urgency…. to list, to write an offer, to see a house…everything was urgent!!!!

WHAT WAS IT LIKE IN 2005 -2007 Multiple offers – common Inspections – repairs often not negotiated Flippers present in the market Homes ALWAYS appraised Sense of Urgency…. to list, to write an offer, to see a house…everything was urgent!!!!

THE NUMBERS DURING THE BOOM Homes sold in eastern Racine County: 2005 - 1721 2006 - 1524 2007 – 1364 How many houses expired …. . 815 in 2005 DOM - 52 in 2005

THE NUMBERS DURING THE BOOM Homes sold in eastern Racine County: 2005 - 1721 2006 - 1524 2007 – 1364 How many houses expired …. . 815 in 2005 DOM - 52 in 2005

OTHER FACTS DURING THE BOOM…… Mortgage rates …approx. 6% People financing 100% plus Most homes are selling well above the assessed value Many Realtors flooded the industry

OTHER FACTS DURING THE BOOM…… Mortgage rates …approx. 6% People financing 100% plus Most homes are selling well above the assessed value Many Realtors flooded the industry

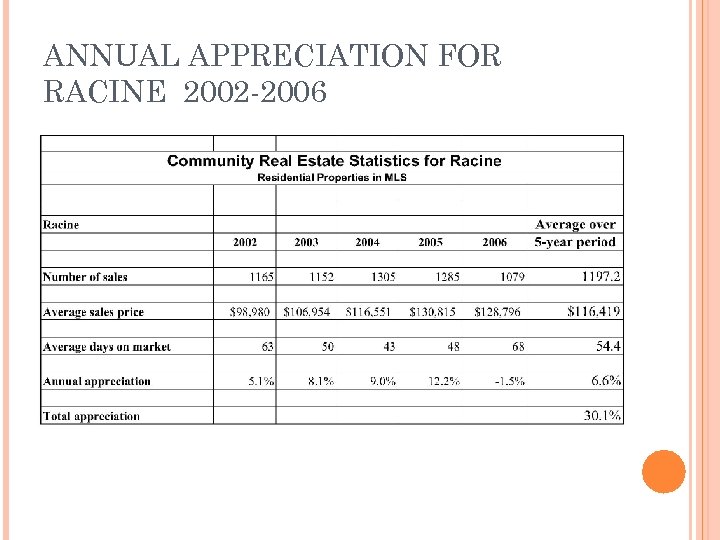

ANNUAL APPRECIATION FOR RACINE 2002 -2006

ANNUAL APPRECIATION FOR RACINE 2002 -2006

A HOUSE FOR SALE DURING THE BOOM 1330 Erie St. ~ Racine 4 BR, 1. 5 BA ~ 2017 sq. ft. Sold March 2007 for $140, 900

A HOUSE FOR SALE DURING THE BOOM 1330 Erie St. ~ Racine 4 BR, 1. 5 BA ~ 2017 sq. ft. Sold March 2007 for $140, 900

National Statistics Show The height of the market…. The absolute peak Q 1 2007

National Statistics Show The height of the market…. The absolute peak Q 1 2007

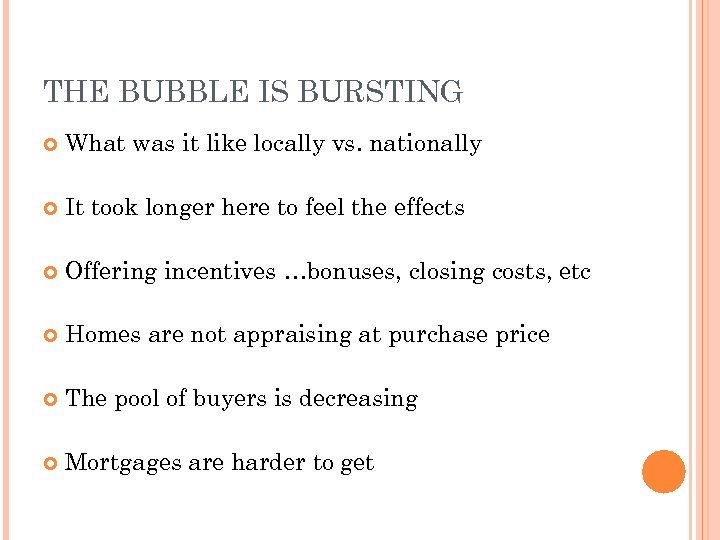

THE BUBBLE IS BURSTING What was it like locally vs. nationally It took longer here to feel the effects Offering incentives …bonuses, closing costs, etc Homes are not appraising at purchase price The pool of buyers is decreasing Mortgages are harder to get

THE BUBBLE IS BURSTING What was it like locally vs. nationally It took longer here to feel the effects Offering incentives …bonuses, closing costs, etc Homes are not appraising at purchase price The pool of buyers is decreasing Mortgages are harder to get

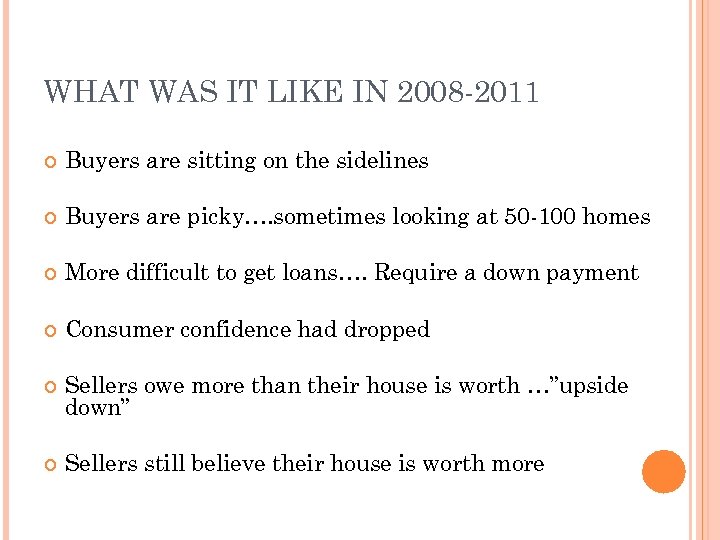

WHAT WAS IT LIKE IN 2008 -2011 Buyers are sitting on the sidelines Buyers are picky…. sometimes looking at 50 -100 homes More difficult to get loans…. Require a down payment Consumer confidence had dropped Sellers owe more than their house is worth …”upside down” Sellers still believe their house is worth more

WHAT WAS IT LIKE IN 2008 -2011 Buyers are sitting on the sidelines Buyers are picky…. sometimes looking at 50 -100 homes More difficult to get loans…. Require a down payment Consumer confidence had dropped Sellers owe more than their house is worth …”upside down” Sellers still believe their house is worth more

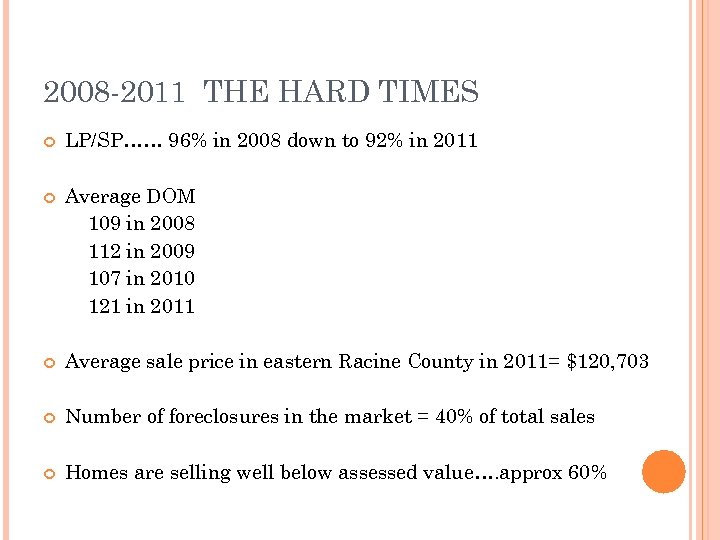

2008 -2011 THE HARD TIMES LP/SP…… 96% in 2008 down to 92% in 2011 Average DOM 109 in 2008 112 in 2009 107 in 2010 121 in 2011 Average sale price in eastern Racine County in 2011= $120, 703 Number of foreclosures in the market = 40% of total sales Homes are selling well below assessed value…. approx 60%

2008 -2011 THE HARD TIMES LP/SP…… 96% in 2008 down to 92% in 2011 Average DOM 109 in 2008 112 in 2009 107 in 2010 121 in 2011 Average sale price in eastern Racine County in 2011= $120, 703 Number of foreclosures in the market = 40% of total sales Homes are selling well below assessed value…. approx 60%

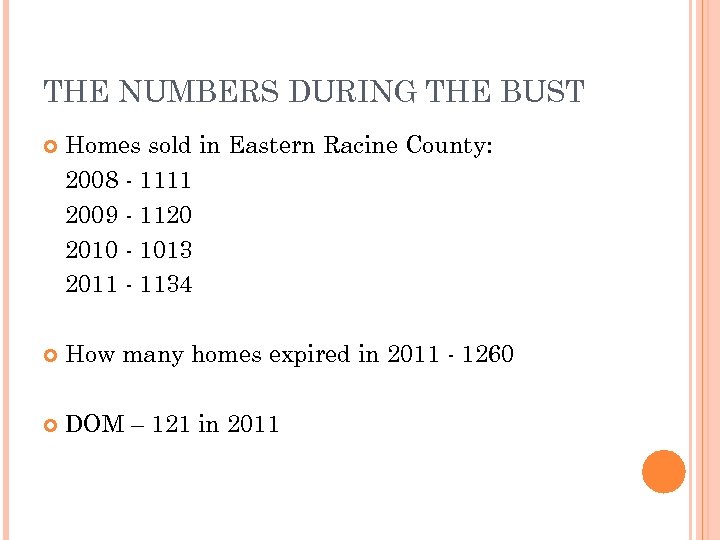

THE NUMBERS DURING THE BUST Homes sold in Eastern Racine County: 2008 - 1111 2009 - 1120 2010 - 1013 2011 - 1134 How many homes expired in 2011 - 1260 DOM – 121 in 2011

THE NUMBERS DURING THE BUST Homes sold in Eastern Racine County: 2008 - 1111 2009 - 1120 2010 - 1013 2011 - 1134 How many homes expired in 2011 - 1260 DOM – 121 in 2011

OTHER FACTS DURING THE BUST…. Multiple price reductions are common Short sales are common Foreclosures are everywhere. . in every price bracket The shiny penny story… you only sell if you are the shiny penny… or really CHEAP! Rentals are busy Mortgage rates – under 4% Good comparable properties are sometimes hard to find Realtors are leaving the industry for other jobs

OTHER FACTS DURING THE BUST…. Multiple price reductions are common Short sales are common Foreclosures are everywhere. . in every price bracket The shiny penny story… you only sell if you are the shiny penny… or really CHEAP! Rentals are busy Mortgage rates – under 4% Good comparable properties are sometimes hard to find Realtors are leaving the industry for other jobs

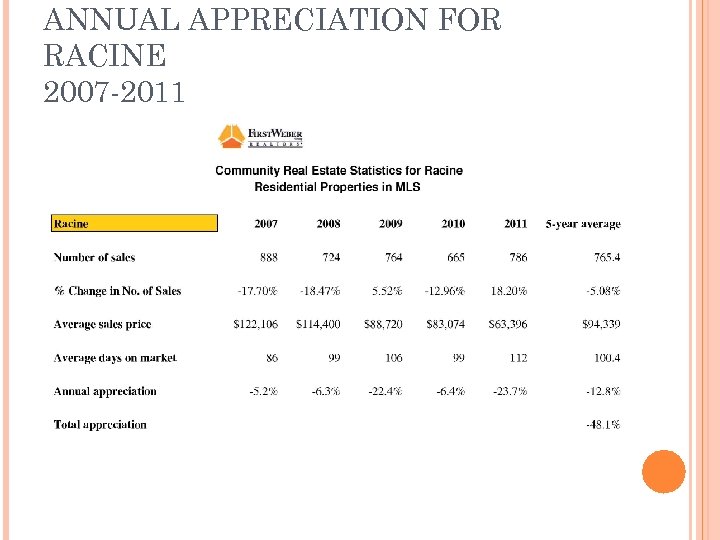

ANNUAL APPRECIATION FOR RACINE 2007 -2011

ANNUAL APPRECIATION FOR RACINE 2007 -2011

THE SAME HOUSE NOW FOR SALE 1330 Erie St. ~ Racine 4 BR, 1. 5 BA ~ 2017 sq. ft. Sold October 2011 for $32, 000

THE SAME HOUSE NOW FOR SALE 1330 Erie St. ~ Racine 4 BR, 1. 5 BA ~ 2017 sq. ft. Sold October 2011 for $32, 000

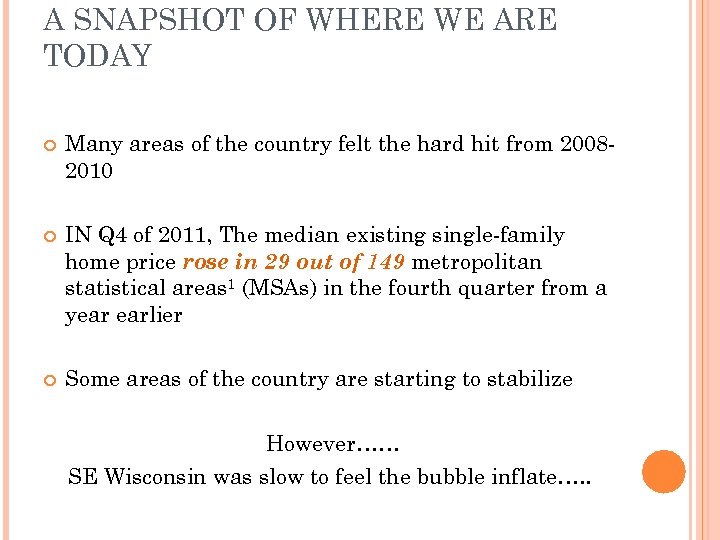

A SNAPSHOT OF WHERE WE ARE TODAY Many areas of the country felt the hard hit from 20082010 IN Q 4 of 2011, The median existing single-family home price rose in 29 out of 149 metropolitan statistical areas 1 (MSAs) in the fourth quarter from a year earlier Some areas of the country are starting to stabilize However…… SE Wisconsin was slow to feel the bubble inflate…. .

A SNAPSHOT OF WHERE WE ARE TODAY Many areas of the country felt the hard hit from 20082010 IN Q 4 of 2011, The median existing single-family home price rose in 29 out of 149 metropolitan statistical areas 1 (MSAs) in the fourth quarter from a year earlier Some areas of the country are starting to stabilize However…… SE Wisconsin was slow to feel the bubble inflate…. .

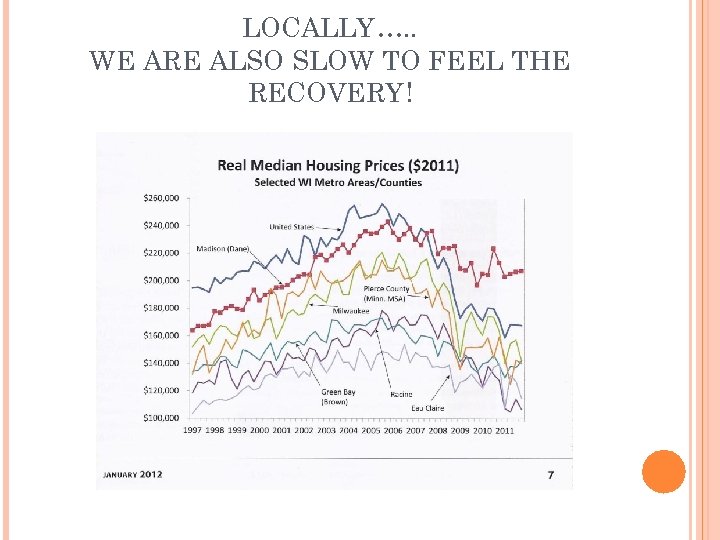

LOCALLY…. . WE ARE ALSO SLOW TO FEEL THE RECOVERY!

LOCALLY…. . WE ARE ALSO SLOW TO FEEL THE RECOVERY!

THE MEDIAN SALES PRICE IS STILL DECLINING ACCORDING TO STATISTICS FROM JANUARY 2012 This is by far the BIGGEST hurdle for us to cross!!

THE MEDIAN SALES PRICE IS STILL DECLINING ACCORDING TO STATISTICS FROM JANUARY 2012 This is by far the BIGGEST hurdle for us to cross!!

AFFORDABILITY Homes are now more affordable than ever! The national affordability index Nov. 2011 – WRA 242 Nov. 2011 – Nationally just under 200 Definition: that the family with median income can afford to buy 242 percent of the median priced home in the state, given 30 yr. fixed rate mortgages and a 20% down payment. In some cases, homes might be starting to become undervalued

AFFORDABILITY Homes are now more affordable than ever! The national affordability index Nov. 2011 – WRA 242 Nov. 2011 – Nationally just under 200 Definition: that the family with median income can afford to buy 242 percent of the median priced home in the state, given 30 yr. fixed rate mortgages and a 20% down payment. In some cases, homes might be starting to become undervalued

THE TOUGH CONVERSATIONS. . SELLERS How to sell now What are your options…is selling the best option Perception vs. Reality No Equity Many Sellers have Multiple loans Perception of value…some sellers still wearing rose colored glasses Difficult to find comps

THE TOUGH CONVERSATIONS. . SELLERS How to sell now What are your options…is selling the best option Perception vs. Reality No Equity Many Sellers have Multiple loans Perception of value…some sellers still wearing rose colored glasses Difficult to find comps

WHAT DOES IT TAKE NOW TO SELL Competitive prices Updated & show well Negotiating mortgages in short sales Pulling other resources to move on if you don’t have enough equity Know the numbers……. . How do you stay ahead of the curve when selling – get the numbers right the first time! No Defects…. pre-home inspections, make necessary repairs, and upgrades Each transaction presents unique and new challenges…. . Enlist professionals for help!

WHAT DOES IT TAKE NOW TO SELL Competitive prices Updated & show well Negotiating mortgages in short sales Pulling other resources to move on if you don’t have enough equity Know the numbers……. . How do you stay ahead of the curve when selling – get the numbers right the first time! No Defects…. pre-home inspections, make necessary repairs, and upgrades Each transaction presents unique and new challenges…. . Enlist professionals for help!

THE TOUGH CONVERSATIONS … BUYERS Hard to get financing…good credit is a must Condition of foreclosures. . can you afford repairs What loans are available Loan limits How long do you plan to stay in this house What is your lifestyle…buying within your means

THE TOUGH CONVERSATIONS … BUYERS Hard to get financing…good credit is a must Condition of foreclosures. . can you afford repairs What loans are available Loan limits How long do you plan to stay in this house What is your lifestyle…buying within your means

THE TRICKY PART Finding a home…or finding a buyer - NO Marketing a home – NO Looking at properties – NO Negotiating initial terms of offer - NO Dealing with contingencies & getting to the closing YES

THE TRICKY PART Finding a home…or finding a buyer - NO Marketing a home – NO Looking at properties – NO Negotiating initial terms of offer - NO Dealing with contingencies & getting to the closing YES

WHAT’S IT LIKE TODAY For Buyers Money is available …. . Good news! Prices are at an all time low…… Good news! Interest Rates are at an all time low…. . Good News! Affordability is better than ever…. . Good News! There is a lot of inventory …. Good News!

WHAT’S IT LIKE TODAY For Buyers Money is available …. . Good news! Prices are at an all time low…… Good news! Interest Rates are at an all time low…. . Good News! Affordability is better than ever…. . Good News! There is a lot of inventory …. Good News!

WHAT’S IT LIKE TODAY For Sellers Houses are selling, # of SOLD homes is up…Good News! Buyers are ready to buy…. Good News! Interest Rates are low…. . Good News! If homes are priced well and show well…. they sell fast!

WHAT’S IT LIKE TODAY For Sellers Houses are selling, # of SOLD homes is up…Good News! Buyers are ready to buy…. Good News! Interest Rates are low…. . Good News! If homes are priced well and show well…. they sell fast!

LOOKING FORWARD Fannie Mae: “The housing sector will likely take incremental steps forward in 2012 …according to economists at Fannie Mae. USA Today: “Housing Outlook is More Upbeat” The Wall Street Journal: “From Bottom Up, Signs of Housing Recovery”

LOOKING FORWARD Fannie Mae: “The housing sector will likely take incremental steps forward in 2012 …according to economists at Fannie Mae. USA Today: “Housing Outlook is More Upbeat” The Wall Street Journal: “From Bottom Up, Signs of Housing Recovery”

LOOKING FORWARD RIS Media – Feb. 22, 2012

LOOKING FORWARD RIS Media – Feb. 22, 2012