5ac64335f4a50b102762b41b54bdb9d5.ppt

- Количество слайдов: 33

The Profit and Loss Account

The Profit and Loss Account

What is Profit & Loss all about? The profit and loss account is actually 3 different things all rolled into one! The names of these 3 sections are: 1. Trading Account 2. Profit and Loss Account 3. Appropriation Account

What is Profit & Loss all about? The profit and loss account is actually 3 different things all rolled into one! The names of these 3 sections are: 1. Trading Account 2. Profit and Loss Account 3. Appropriation Account

To keep things simple, the Profit & Loss Account looks at all of the things that you have bought and sold across a year and takes away all of the costs you had to pay during that year.

To keep things simple, the Profit & Loss Account looks at all of the things that you have bought and sold across a year and takes away all of the costs you had to pay during that year.

If you make more money than you have to pay out you are in profit if you pay out more than you make then you are in loss.

If you make more money than you have to pay out you are in profit if you pay out more than you make then you are in loss.

Ok so what is a Trading Account? The Trading Account is used to calculate the amount of GROSS PROFIT that a business makes.

Ok so what is a Trading Account? The Trading Account is used to calculate the amount of GROSS PROFIT that a business makes.

let’s show you what this actually means using Sidney the Dodgy Salesman to help us out. I have made £ 35, 000 in sales during this year. Sidney has enjoyed a good year but we now need to work out how much these items cost him to buy to help us calculate his profit.

let’s show you what this actually means using Sidney the Dodgy Salesman to help us out. I have made £ 35, 000 in sales during this year. Sidney has enjoyed a good year but we now need to work out how much these items cost him to buy to help us calculate his profit.

Remember that this is Sidney’s Sales Revenue and it is NOT his profit!

Remember that this is Sidney’s Sales Revenue and it is NOT his profit!

OPENING STOCK At the start of the year, Sidney’s warehouse was almost empty. He only had £ 1, 000 worth of goods left.

OPENING STOCK At the start of the year, Sidney’s warehouse was almost empty. He only had £ 1, 000 worth of goods left.

Blimey I need to buy more stock and quickly! Sidney bought £ 12, 000 worth of new goods during the year which he intended to sell to the general public.

Blimey I need to buy more stock and quickly! Sidney bought £ 12, 000 worth of new goods during the year which he intended to sell to the general public.

FULL WAREHOUSE!

FULL WAREHOUSE!

CLOSING STOCK At the end of the year I have got only £ 2, 000 worth of stock left in my warehouse. Closing stock is the value of the stock left in the business at the end of the year. It is the amount of stock that is UNSOLD!

CLOSING STOCK At the end of the year I have got only £ 2, 000 worth of stock left in my warehouse. Closing stock is the value of the stock left in the business at the end of the year. It is the amount of stock that is UNSOLD!

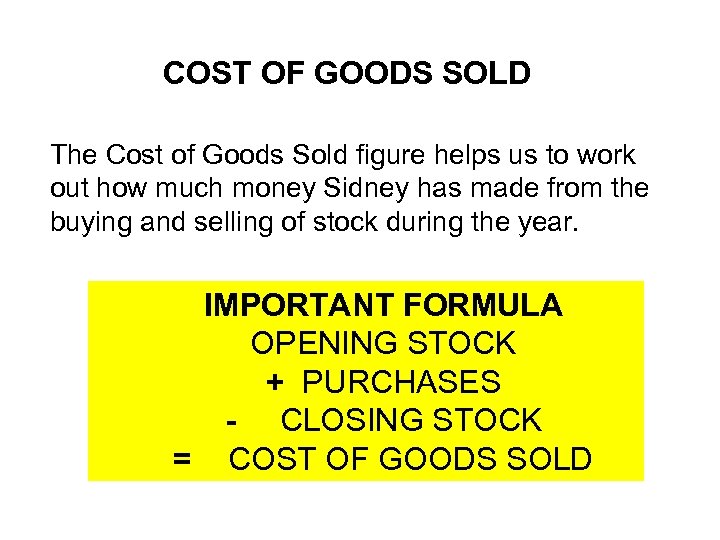

COST OF GOODS SOLD The Cost of Goods Sold figure helps us to work out how much money Sidney has made from the buying and selling of stock during the year. IMPORTANT FORMULA OPENING STOCK + PURCHASES - CLOSING STOCK = COST OF GOODS SOLD

COST OF GOODS SOLD The Cost of Goods Sold figure helps us to work out how much money Sidney has made from the buying and selling of stock during the year. IMPORTANT FORMULA OPENING STOCK + PURCHASES - CLOSING STOCK = COST OF GOODS SOLD

Do you think that I made a profit this year? Well we can help Sidney to find out by taking away the Cost of Goods Sold from Sales Revenue. This tells us how much Gross Profit (or loss) was made.

Do you think that I made a profit this year? Well we can help Sidney to find out by taking away the Cost of Goods Sold from Sales Revenue. This tells us how much Gross Profit (or loss) was made.

Bob the Blob’s Question Time Can you work out Sidney’s Cost of Goods Sold? What was Sidney’s Gross Profit figure for this year?

Bob the Blob’s Question Time Can you work out Sidney’s Cost of Goods Sold? What was Sidney’s Gross Profit figure for this year?

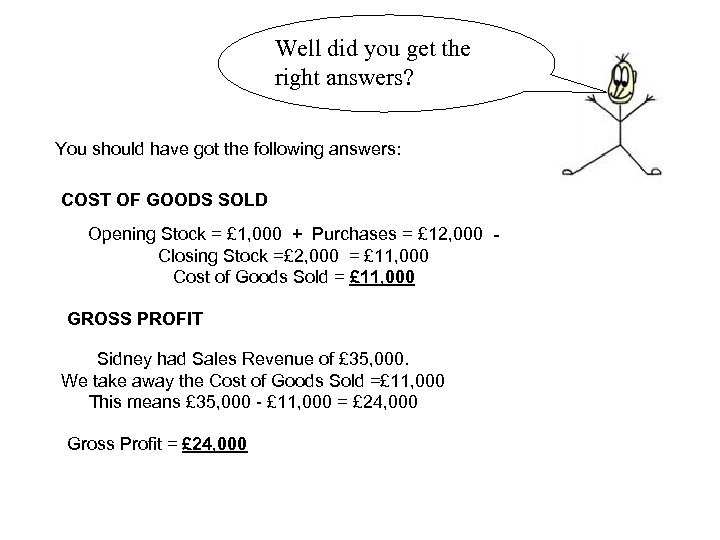

Well did you get the right answers? You should have got the following answers: COST OF GOODS SOLD Opening Stock = £ 1, 000 + Purchases = £ 12, 000 Closing Stock =£ 2, 000 = £ 11, 000 Cost of Goods Sold = £ 11, 000 GROSS PROFIT Sidney had Sales Revenue of £ 35, 000. We take away the Cost of Goods Sold =£ 11, 000 This means £ 35, 000 - £ 11, 000 = £ 24, 000 Gross Profit = £ 24, 000

Well did you get the right answers? You should have got the following answers: COST OF GOODS SOLD Opening Stock = £ 1, 000 + Purchases = £ 12, 000 Closing Stock =£ 2, 000 = £ 11, 000 Cost of Goods Sold = £ 11, 000 GROSS PROFIT Sidney had Sales Revenue of £ 35, 000. We take away the Cost of Goods Sold =£ 11, 000 This means £ 35, 000 - £ 11, 000 = £ 24, 000 Gross Profit = £ 24, 000

Bob the Blob’s Question Time Explain TWO ways in which Sidney could have increased his levels of Gross Profit? (Hint. Think about changing his suppliers and maybe changing the prices he charges his customers!) Write down the correct formula for calculating Gross Profit Sales revenue – cost of goods sold Write down the correct formula for calculating Cost of Goods Sold Opening stock + purchases – closing stock = cost of goods sold

Bob the Blob’s Question Time Explain TWO ways in which Sidney could have increased his levels of Gross Profit? (Hint. Think about changing his suppliers and maybe changing the prices he charges his customers!) Write down the correct formula for calculating Gross Profit Sales revenue – cost of goods sold Write down the correct formula for calculating Cost of Goods Sold Opening stock + purchases – closing stock = cost of goods sold

Ok so what is the Profit and Loss Account all about? THE PROFIT & LOSS ACCOUNT

Ok so what is the Profit and Loss Account all about? THE PROFIT & LOSS ACCOUNT

Cool I’m rich I’ve got £ 24, 000 of profit to spend! Ahh actually sorry Sidney but you do not have £ 24, 000 to spend. This figure is only your GROSS PROFIT figure. . we still need to take away all of Sidney’s expenses.

Cool I’m rich I’ve got £ 24, 000 of profit to spend! Ahh actually sorry Sidney but you do not have £ 24, 000 to spend. This figure is only your GROSS PROFIT figure. . we still need to take away all of Sidney’s expenses.

Can you think of what some of these expenses might be?

Can you think of what some of these expenses might be?

Hmm what exactly are expenses? EXPENSES Well expenses are extra costs that you have to pay for things that help you to operate as a business.

Hmm what exactly are expenses? EXPENSES Well expenses are extra costs that you have to pay for things that help you to operate as a business.

I had to pay my electric and gas bills, staff wages, rent for the warehouse and van hire. So you see when we add all of these extra expenses together they suddenly bring down the amount of profit that Sidney earned.

I had to pay my electric and gas bills, staff wages, rent for the warehouse and van hire. So you see when we add all of these extra expenses together they suddenly bring down the amount of profit that Sidney earned.

We take away all of the expenses from his Gross Profit to work out his OPERATING PROFIT = GROSS PROFIT – TOTAL EXPENSES

We take away all of the expenses from his Gross Profit to work out his OPERATING PROFIT = GROSS PROFIT – TOTAL EXPENSES

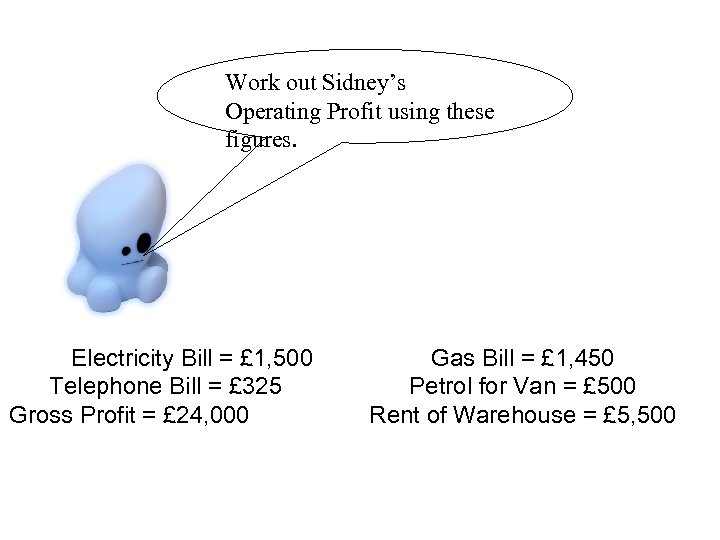

Work out Sidney’s Operating Profit using these figures. Electricity Bill = £ 1, 500 Telephone Bill = £ 325 Gross Profit = £ 24, 000 Gas Bill = £ 1, 450 Petrol for Van = £ 500 Rent of Warehouse = £ 5, 500

Work out Sidney’s Operating Profit using these figures. Electricity Bill = £ 1, 500 Telephone Bill = £ 325 Gross Profit = £ 24, 000 Gas Bill = £ 1, 450 Petrol for Van = £ 500 Rent of Warehouse = £ 5, 500

OPERATING PROFIT = £ 14, 725 Did you remember to show ALL of your working out!

OPERATING PROFIT = £ 14, 725 Did you remember to show ALL of your working out!

Right so I’ve made £ 14, 725. Can I spend all of this? NET PROFIT Unfortunately not Sidney. . . you still owe money to the bank and the Government in the form of Taxes!

Right so I’ve made £ 14, 725. Can I spend all of this? NET PROFIT Unfortunately not Sidney. . . you still owe money to the bank and the Government in the form of Taxes!

You owe the bank £ 2, 500 in interest payments on your loan. You always pay the Banks back first!

You owe the bank £ 2, 500 in interest payments on your loan. You always pay the Banks back first!

And you owe the Government £ 3, 000 in tax please! Sole Traders & Partnerships pay Income Tax Companies pay Corporation Tax

And you owe the Government £ 3, 000 in tax please! Sole Traders & Partnerships pay Income Tax Companies pay Corporation Tax

Can you work out Sidney’s Net Profit using these figures? Operating Profit = £ 14725 Interest Charges = £ 2, 500 Tax Bill = £ 3, 000 NET PROFIT =£ 9, 225

Can you work out Sidney’s Net Profit using these figures? Operating Profit = £ 14725 Interest Charges = £ 2, 500 Tax Bill = £ 3, 000 NET PROFIT =£ 9, 225

What is the name of the tax that Sole Traders and Partnerships must pay upon their profits? Answer: Income tax What is taken away from Operating Profit first: Interest or Taxes? Answer: interest

What is the name of the tax that Sole Traders and Partnerships must pay upon their profits? Answer: Income tax What is taken away from Operating Profit first: Interest or Taxes? Answer: interest

Ok I’ve made £ 9, 225 Net Profit can I spend this now? YES!!!! Once you have taken away interest and tax payments, what is left as Net Profit is entirely your own money to spend as you want to.

Ok I’ve made £ 9, 225 Net Profit can I spend this now? YES!!!! Once you have taken away interest and tax payments, what is left as Net Profit is entirely your own money to spend as you want to.

I’m going to save £ 2, 000, and take out £ 7, 225 as my wages (called DRAWINGS). When a business saves some money this is called RETAINED PROFIT. This can be used for future investment and means that they will need to borrow LESS from a bank! If Sidney was a company he might have to pay DIVIDENDS

I’m going to save £ 2, 000, and take out £ 7, 225 as my wages (called DRAWINGS). When a business saves some money this is called RETAINED PROFIT. This can be used for future investment and means that they will need to borrow LESS from a bank! If Sidney was a company he might have to pay DIVIDENDS

APPROPRIATION ACCOUNT The Appropriation Account is the final section that we need to learn. This shows us what Sidney decided to do with his £ 9, 225 of Net Profit.

APPROPRIATION ACCOUNT The Appropriation Account is the final section that we need to learn. This shows us what Sidney decided to do with his £ 9, 225 of Net Profit.

What does a proper Trading, Profit & Loss Account look like?

What does a proper Trading, Profit & Loss Account look like?