2baeeefdc60cf1718ab9e28f61c31609.ppt

- Количество слайдов: 30

The Price System 4. 1 The market system, also called the price system, performs two important and closely related functions: • Price Rationing • Resource Allocation Price rationing is the process by which the market system allocates goods and services to consumers when quantity demanded exceeds quantity supplied.

The Price System 4. 1 The market system, also called the price system, performs two important and closely related functions: • Price Rationing • Resource Allocation Price rationing is the process by which the market system allocates goods and services to consumers when quantity demanded exceeds quantity supplied.

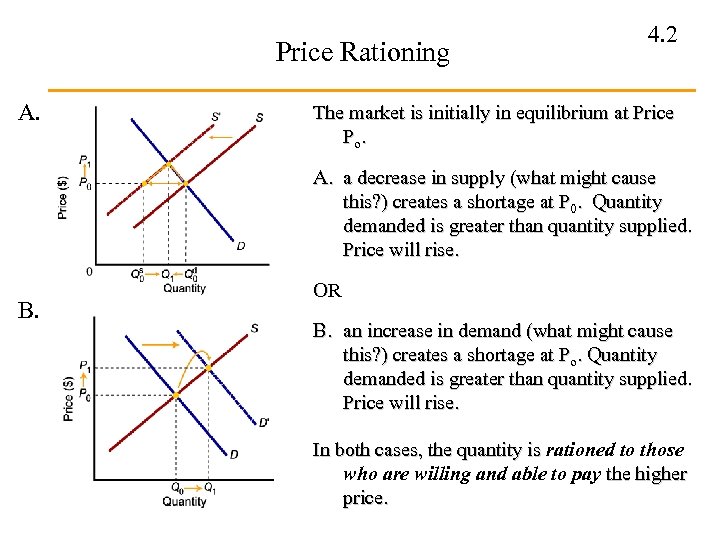

Price Rationing A. 4. 2 The market is initially in equilibrium at Price Po. A. a decrease in supply (what might cause this? ) creates a shortage at P 0. Quantity demanded is greater than quantity supplied. Price will rise. B. OR B. an increase in demand (what might cause this? ) creates a shortage at Po. Quantity demanded is greater than quantity supplied. Price will rise. In both cases, the quantity is rationed to those who are willing and able to pay the higher price.

Price Rationing A. 4. 2 The market is initially in equilibrium at Price Po. A. a decrease in supply (what might cause this? ) creates a shortage at P 0. Quantity demanded is greater than quantity supplied. Price will rise. B. OR B. an increase in demand (what might cause this? ) creates a shortage at Po. Quantity demanded is greater than quantity supplied. Price will rise. In both cases, the quantity is rationed to those who are willing and able to pay the higher price.

Price Ceilings 4. 3 • When a maximum price for a product or service is set (generally this is done by the government) • Why? Because the equilibrium price appears to be “unfair” • Consequences for the market? • An alternative to price rationing is needed to allocate the available quantity:

Price Ceilings 4. 3 • When a maximum price for a product or service is set (generally this is done by the government) • Why? Because the equilibrium price appears to be “unfair” • Consequences for the market? • An alternative to price rationing is needed to allocate the available quantity:

Alternative Rationing Mechanisms • Queuing is a nonprice rationing system that uses waiting in line as a means of distributing goods and services. • Favored customers are those who receive special treatment from dealers during situations when there is excess demand. • Ration coupons are tickets or coupons that entitle individuals to purchase a certain amount of a given product per month. The problem with these alternatives are the hidden costs that increase the effective price above the maximum price allowed. 4. 4

Alternative Rationing Mechanisms • Queuing is a nonprice rationing system that uses waiting in line as a means of distributing goods and services. • Favored customers are those who receive special treatment from dealers during situations when there is excess demand. • Ration coupons are tickets or coupons that entitle individuals to purchase a certain amount of a given product per month. The problem with these alternatives are the hidden costs that increase the effective price above the maximum price allowed. 4. 4

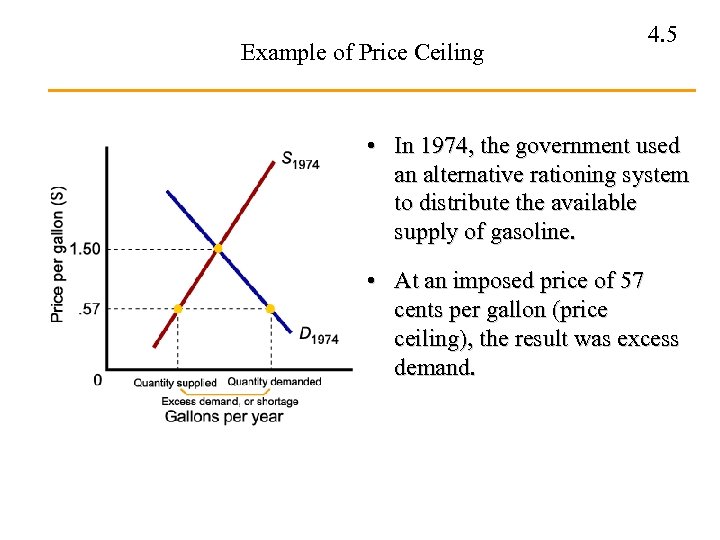

Example of Price Ceiling 4. 5 • In 1974, the government used an alternative rationing system to distribute the available supply of gasoline. • At an imposed price of 57 cents per gallon (price ceiling), the result was excess demand.

Example of Price Ceiling 4. 5 • In 1974, the government used an alternative rationing system to distribute the available supply of gasoline. • At an imposed price of 57 cents per gallon (price ceiling), the result was excess demand.

Alternative Rationing Mechanisms 4. 6 • No matter how good the intentions of private organizations and governments, it is very difficult to prevent the price system from operating and to stop the willingness to pay from asserting itself. • A black market is a market in which illegal trading takes place at market-determined prices. • With favored customers and black markets, the final distribution may be even more unfair than that which would result from simple price rationing.

Alternative Rationing Mechanisms 4. 6 • No matter how good the intentions of private organizations and governments, it is very difficult to prevent the price system from operating and to stop the willingness to pay from asserting itself. • A black market is a market in which illegal trading takes place at market-determined prices. • With favored customers and black markets, the final distribution may be even more unfair than that which would result from simple price rationing.

Price Floors 4. 7 • Some times it is believed that the equilibrium price of a good or service is too low. • The government steps in and imposes a minimum price in the market Examples and Consequences:

Price Floors 4. 7 • Some times it is believed that the equilibrium price of a good or service is too low. • The government steps in and imposes a minimum price in the market Examples and Consequences:

Prices and the Allocation of Resources 4. 8 When markets are allowed to work: • Changes in price resulting from shifts of demand supply in output markets cause profits to rise or fall. • Profits attract capital; losses lead to disinvestment. • Higher wages attract labor and encourage workers to acquire skills. • At the core of the system, supply, demand, and prices in input and output markets determine the allocation of resources and the ultimate combinations of things produced.

Prices and the Allocation of Resources 4. 8 When markets are allowed to work: • Changes in price resulting from shifts of demand supply in output markets cause profits to rise or fall. • Profits attract capital; losses lead to disinvestment. • Higher wages attract labor and encourage workers to acquire skills. • At the core of the system, supply, demand, and prices in input and output markets determine the allocation of resources and the ultimate combinations of things produced.

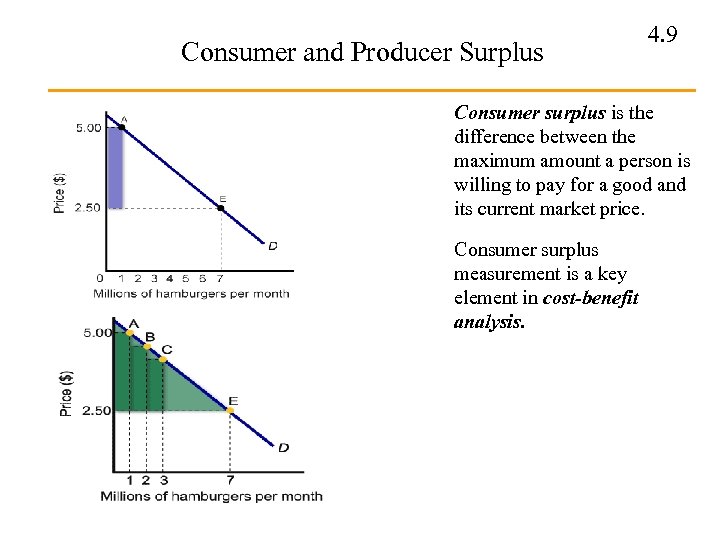

Consumer and Producer Surplus 4. 9 Consumer surplus is the difference between the maximum amount a person is willing to pay for a good and its current market price. Consumer surplus measurement is a key element in cost-benefit analysis.

Consumer and Producer Surplus 4. 9 Consumer surplus is the difference between the maximum amount a person is willing to pay for a good and its current market price. Consumer surplus measurement is a key element in cost-benefit analysis.

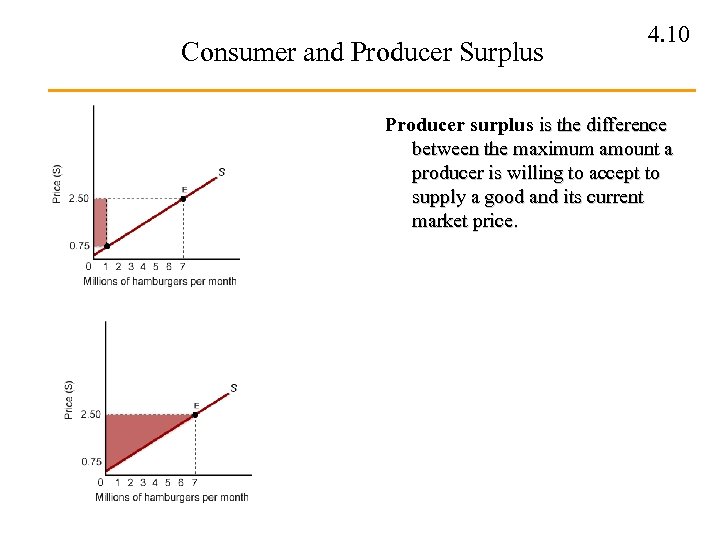

Consumer and Producer Surplus 4. 10 Producer surplus is the difference between the maximum amount a producer is willing to accept to supply a good and its current market price.

Consumer and Producer Surplus 4. 10 Producer surplus is the difference between the maximum amount a producer is willing to accept to supply a good and its current market price.

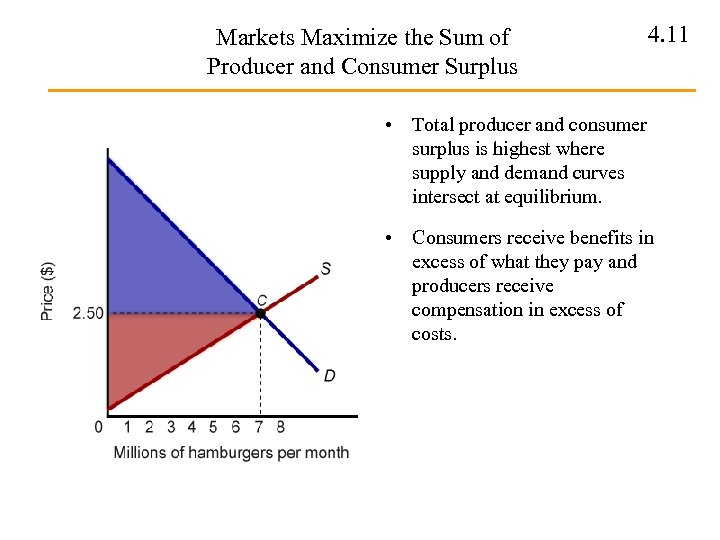

Markets Maximize the Sum of Producer and Consumer Surplus 4. 11 • Total producer and consumer surplus is highest where supply and demand curves intersect at equilibrium. • Consumers receive benefits in excess of what they pay and producers receive compensation in excess of costs.

Markets Maximize the Sum of Producer and Consumer Surplus 4. 11 • Total producer and consumer surplus is highest where supply and demand curves intersect at equilibrium. • Consumers receive benefits in excess of what they pay and producers receive compensation in excess of costs.

Deadweight Loss from Market Intervention: Price Ceiling 4. 12

Deadweight Loss from Market Intervention: Price Ceiling 4. 12

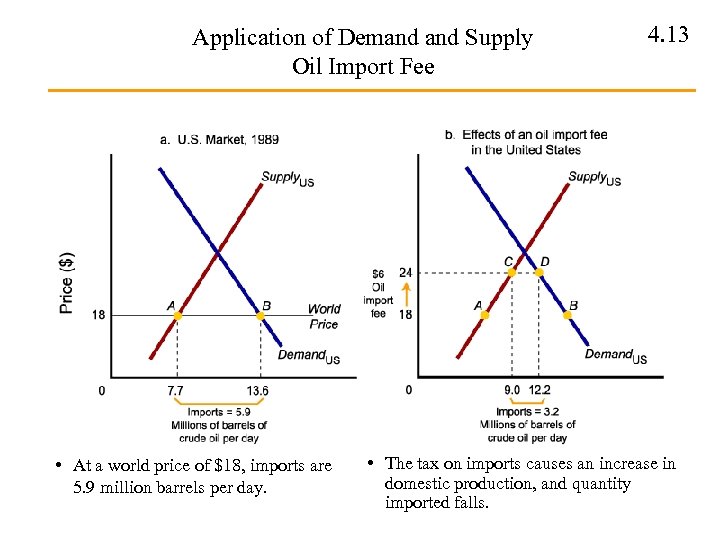

Application of Demand Supply Oil Import Fee • At a world price of $18, imports are 5. 9 million barrels per day. 4. 13 • The tax on imports causes an increase in domestic production, and quantity imported falls.

Application of Demand Supply Oil Import Fee • At a world price of $18, imports are 5. 9 million barrels per day. 4. 13 • The tax on imports causes an increase in domestic production, and quantity imported falls.

Elasticity 4. 14 Some questions: • If a firm wants to increase its total revenues (“sales”), should it raise price or lower price? • Why is a bumper crop often bad news for farmers? • How would a tax on cigarettes affect the number of teenage smokers compared to adult smokers? • Why do policies that limit the supply of illegal drugs often increase property crime?

Elasticity 4. 14 Some questions: • If a firm wants to increase its total revenues (“sales”), should it raise price or lower price? • Why is a bumper crop often bad news for farmers? • How would a tax on cigarettes affect the number of teenage smokers compared to adult smokers? • Why do policies that limit the supply of illegal drugs often increase property crime?

Elasticity is a general concept that can be used to quantify the response in one variable when another variable changes. Elasticity of A with respect to B We can measure the responsiveness of quantity demanded to changes in price, income, or prices of related goods. Price Elasticity of Demand: 4. 15

Elasticity is a general concept that can be used to quantify the response in one variable when another variable changes. Elasticity of A with respect to B We can measure the responsiveness of quantity demanded to changes in price, income, or prices of related goods. Price Elasticity of Demand: 4. 15

Elasticity Price Elasticity of Demand: • Measures the responsiveness of quantity demanded to changes in price. • It is the ratio of the percentage change in quantity demanded to the percentage change in price. • Its value is always negative, but stated in absolute terms. • The value of the line of the slope and the value of elasticity are not the same. 4. 16

Elasticity Price Elasticity of Demand: • Measures the responsiveness of quantity demanded to changes in price. • It is the ratio of the percentage change in quantity demanded to the percentage change in price. • Its value is always negative, but stated in absolute terms. • The value of the line of the slope and the value of elasticity are not the same. 4. 16

Why this formula? • Law of Demand tells us that if Price increases quantity demanded will decrease, but not by how much • Price elasticity of demand quantifies (in %) how quantity demanded changes will price changes. How much? Depends on the demand curve. • If it is steep small change in Qd • If it is flat large change in Qd • But, can’t use slope as a measure of elasticity: it is sensitive to the units of measurement. 4. 17

Why this formula? • Law of Demand tells us that if Price increases quantity demanded will decrease, but not by how much • Price elasticity of demand quantifies (in %) how quantity demanded changes will price changes. How much? Depends on the demand curve. • If it is steep small change in Qd • If it is flat large change in Qd • But, can’t use slope as a measure of elasticity: it is sensitive to the units of measurement. 4. 17

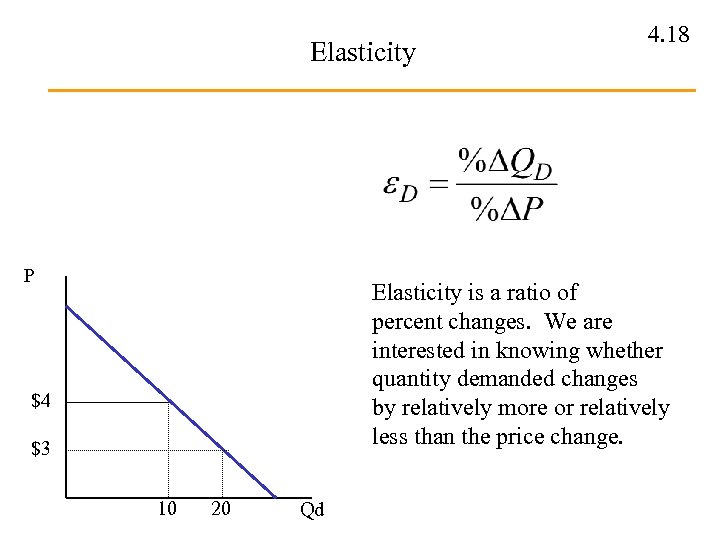

Elasticity P 4. 18 Elasticity is a ratio of percent changes. We are interested in knowing whether quantity demanded changes by relatively more or relatively less than the price change. $4 $3 10 20 Qd

Elasticity P 4. 18 Elasticity is a ratio of percent changes. We are interested in knowing whether quantity demanded changes by relatively more or relatively less than the price change. $4 $3 10 20 Qd

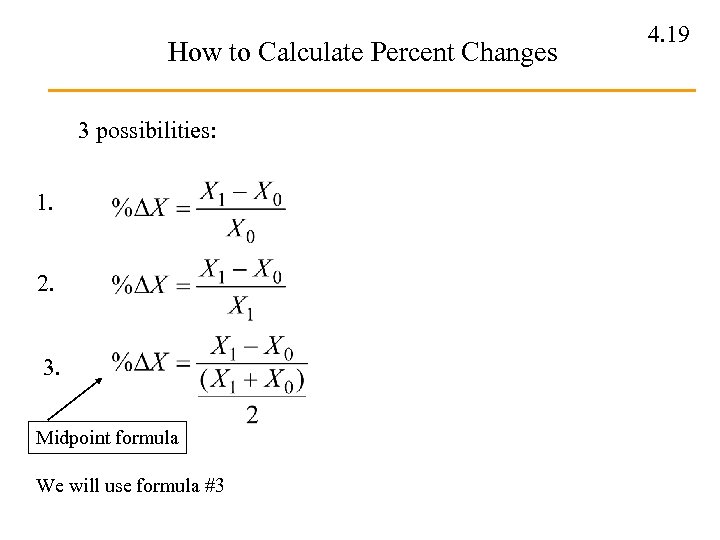

How to Calculate Percent Changes 3 possibilities: 1. 2. 3. Midpoint formula We will use formula #3 4. 19

How to Calculate Percent Changes 3 possibilities: 1. 2. 3. Midpoint formula We will use formula #3 4. 19

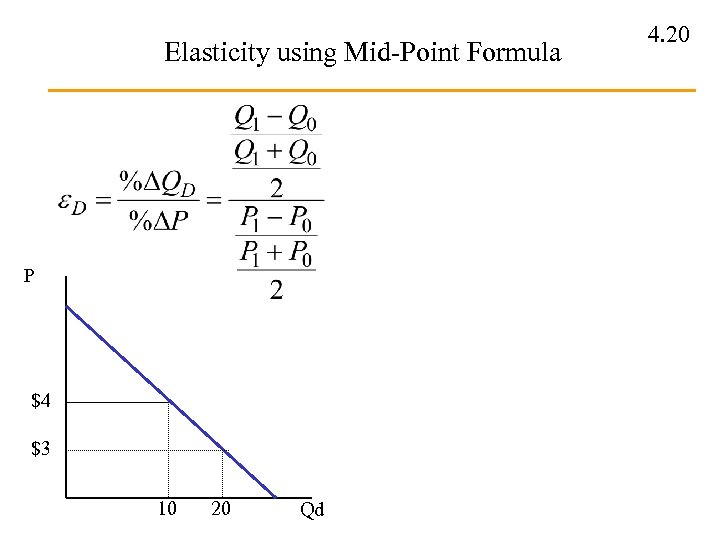

Elasticity using Mid-Point Formula P $4 $3 10 20 Qd 4. 20

Elasticity using Mid-Point Formula P $4 $3 10 20 Qd 4. 20

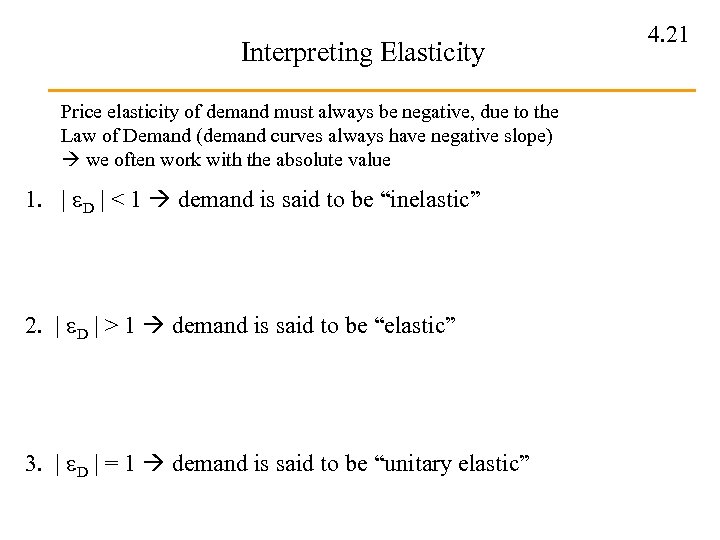

Interpreting Elasticity Price elasticity of demand must always be negative, due to the Law of Demand (demand curves always have negative slope) we often work with the absolute value 1. | D | < 1 demand is said to be “inelastic” 2. | D | > 1 demand is said to be “elastic” 3. | D | = 1 demand is said to be “unitary elastic” 4. 21

Interpreting Elasticity Price elasticity of demand must always be negative, due to the Law of Demand (demand curves always have negative slope) we often work with the absolute value 1. | D | < 1 demand is said to be “inelastic” 2. | D | > 1 demand is said to be “elastic” 3. | D | = 1 demand is said to be “unitary elastic” 4. 21

Interpreting Elasticity (con’t) 4. | D | = 0 demand is said to be “perfectly inelastic” 5. | D | = demand is said to be “perfectly elastic” 4. 22

Interpreting Elasticity (con’t) 4. | D | = 0 demand is said to be “perfectly inelastic” 5. | D | = demand is said to be “perfectly elastic” 4. 22

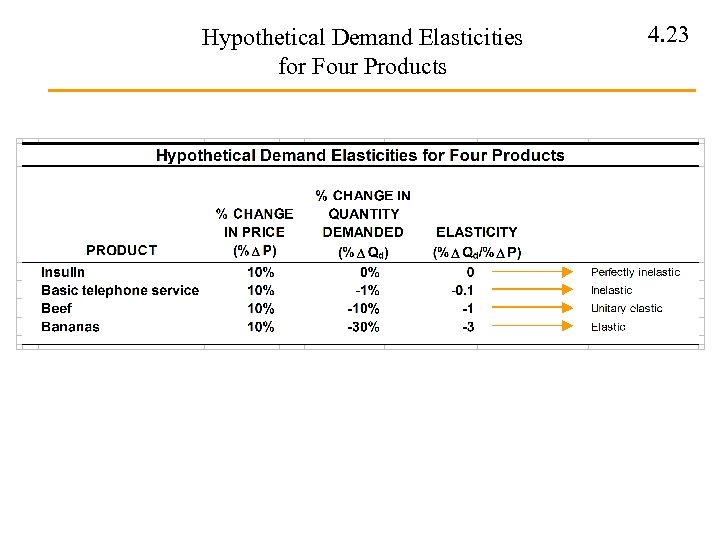

Hypothetical Demand Elasticities for Four Products 4. 23

Hypothetical Demand Elasticities for Four Products 4. 23

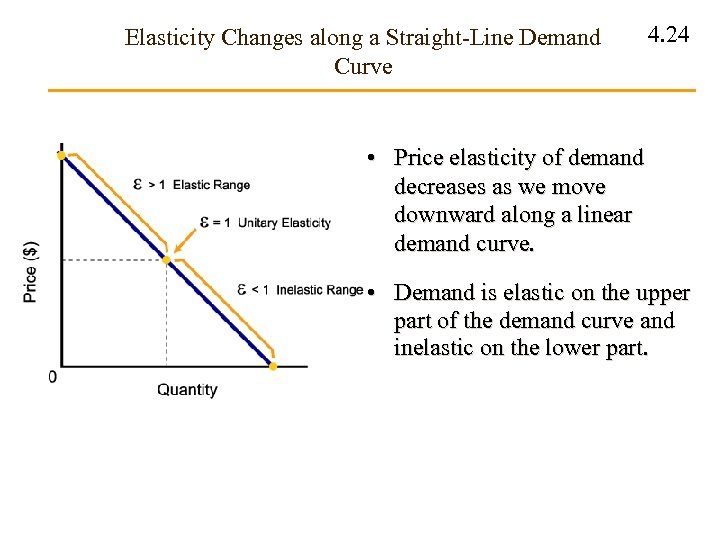

Elasticity Changes along a Straight-Line Demand Curve 4. 24 • Price elasticity of demand decreases as we move downward along a linear demand curve. • Demand is elastic on the upper part of the demand curve and inelastic on the lower part.

Elasticity Changes along a Straight-Line Demand Curve 4. 24 • Price elasticity of demand decreases as we move downward along a linear demand curve. • Demand is elastic on the upper part of the demand curve and inelastic on the lower part.

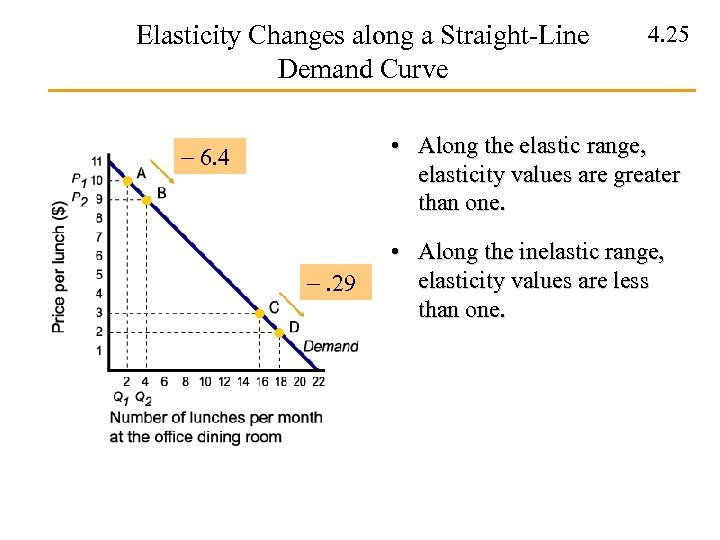

Elasticity Changes along a Straight-Line Demand Curve 4. 25 • Along the elastic range, elasticity values are greater than one. - 6. 4 -. 29 • Along the inelastic range, elasticity values are less than one.

Elasticity Changes along a Straight-Line Demand Curve 4. 25 • Along the elastic range, elasticity values are greater than one. - 6. 4 -. 29 • Along the inelastic range, elasticity values are less than one.

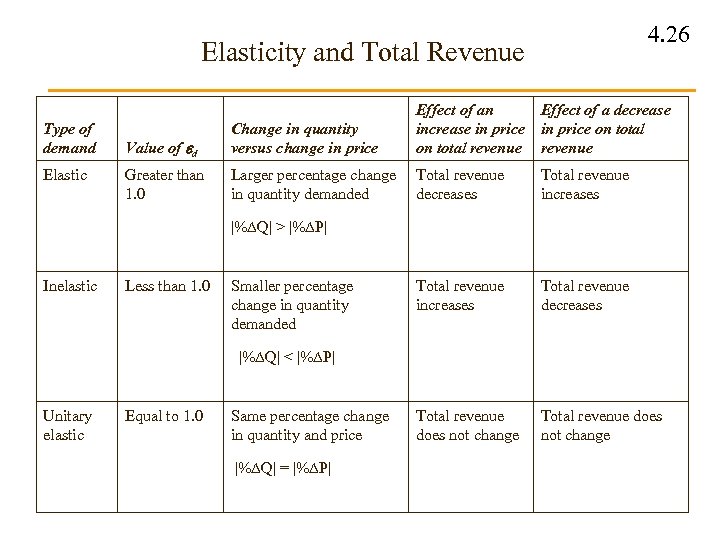

4. 26 Elasticity and Total Revenue Type of demand Elastic Value of d Change in quantity versus change in price Effect of an Effect of a decrease in price on total revenue Greater than 1. 0 Larger percentage change in quantity demanded Total revenue decreases Total revenue increases Total revenue decreases Total revenue does not change |% Q| > |% P| Inelastic Less than 1. 0 Smaller percentage change in quantity demanded |% Q| < |% P| Unitary elastic Equal to 1. 0 Same percentage change in quantity and price |% Q| = |% P|

4. 26 Elasticity and Total Revenue Type of demand Elastic Value of d Change in quantity versus change in price Effect of an Effect of a decrease in price on total revenue Greater than 1. 0 Larger percentage change in quantity demanded Total revenue decreases Total revenue increases Total revenue decreases Total revenue does not change |% Q| > |% P| Inelastic Less than 1. 0 Smaller percentage change in quantity demanded |% Q| < |% P| Unitary elastic Equal to 1. 0 Same percentage change in quantity and price |% Q| = |% P|

Elasticity and Total Revenue When demand is inelastic, price and total revenues are positively related. Price increases generate higher revenues. When demand is elastic, price and total revenues are negatively related. Price increases generate lower revenues. Some questions and Answers: • If a firm wants to increase its total revenues (“sales”), should it raise price or lower price? • Why is a bumper crop often bad news for farmers? • How would a tax on cigarettes affect the number of teenage smokers compared to adult smokers? • Why do policies that limit the supply of illegal drugs often increase property crime? 4. 27

Elasticity and Total Revenue When demand is inelastic, price and total revenues are positively related. Price increases generate higher revenues. When demand is elastic, price and total revenues are negatively related. Price increases generate lower revenues. Some questions and Answers: • If a firm wants to increase its total revenues (“sales”), should it raise price or lower price? • Why is a bumper crop often bad news for farmers? • How would a tax on cigarettes affect the number of teenage smokers compared to adult smokers? • Why do policies that limit the supply of illegal drugs often increase property crime? 4. 27

Determinants of Demand Elasticity • Availability of substitutes -- demand is more elastic when there are more substitutes for the product. • Importance of the item in the budget -- demand is more elastic when the item is a more significant portion of the consumer’s budget. • Time frame -- demand becomes more elastic over time. 4. 28

Determinants of Demand Elasticity • Availability of substitutes -- demand is more elastic when there are more substitutes for the product. • Importance of the item in the budget -- demand is more elastic when the item is a more significant portion of the consumer’s budget. • Time frame -- demand becomes more elastic over time. 4. 28

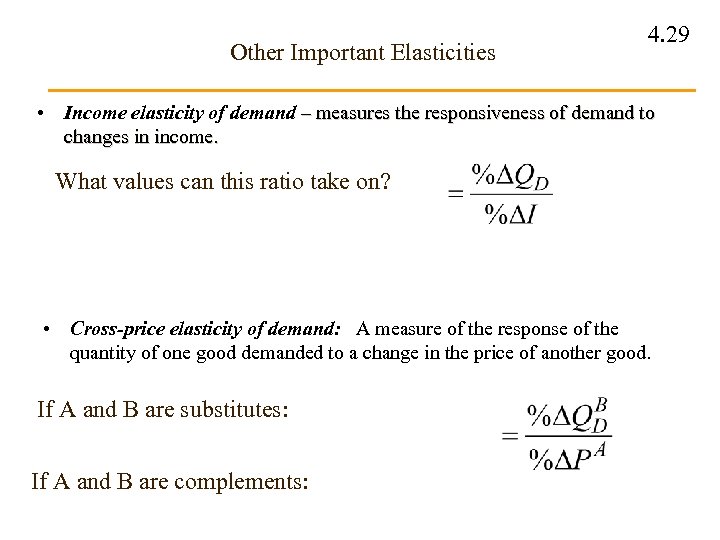

Other Important Elasticities • 4. 29 Income elasticity of demand – measures the responsiveness of demand to changes in income. What values can this ratio take on? • Cross-price elasticity of demand: A measure of the response of the quantity of one good demanded to a change in the price of another good. If A and B are substitutes: If A and B are complements:

Other Important Elasticities • 4. 29 Income elasticity of demand – measures the responsiveness of demand to changes in income. What values can this ratio take on? • Cross-price elasticity of demand: A measure of the response of the quantity of one good demanded to a change in the price of another good. If A and B are substitutes: If A and B are complements:

Other Important Elasticities 4. 30 • Elasticity of supply: A measure of the response of quantity of a good supplied to a change in price of that good. Likely to be positive in output markets. Price Elasticity of Supply:

Other Important Elasticities 4. 30 • Elasticity of supply: A measure of the response of quantity of a good supplied to a change in price of that good. Likely to be positive in output markets. Price Elasticity of Supply: