f957ebc949601a0a7318499d43678dba.ppt

- Количество слайдов: 34

The Pit and the Pendulum On Behalf of Virginia Association of Community Banks By: Anirban Basu Sage Policy Group, Inc. October 19 th, 2015

Dawn of the Dead

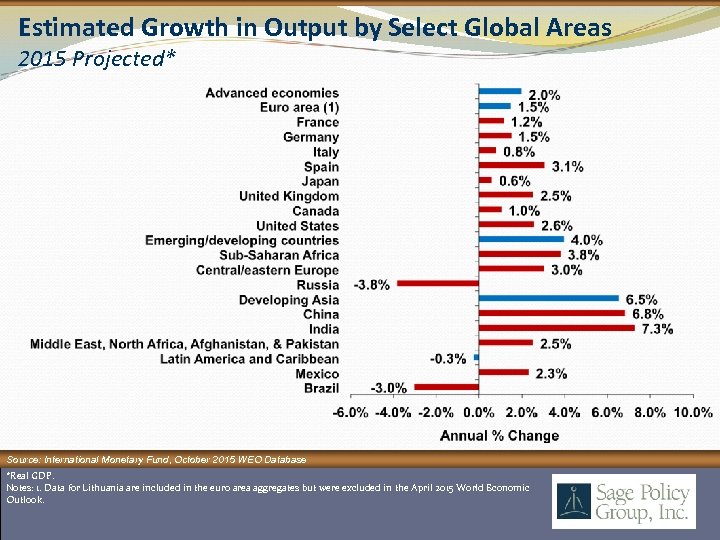

Estimated Growth in Output by Select Global Areas 2015 Projected* Source: International Monetary Fund, October 2015 WEO Database *Real GDP. Notes: 1. Data for Lithuania are included in the euro area aggregates but were excluded in the April 2015 World Economic Outlook.

What Lies Beneath Source: BEA, BLS, S&P Case-Shiller, Yahoo! Finance *Through July 2015

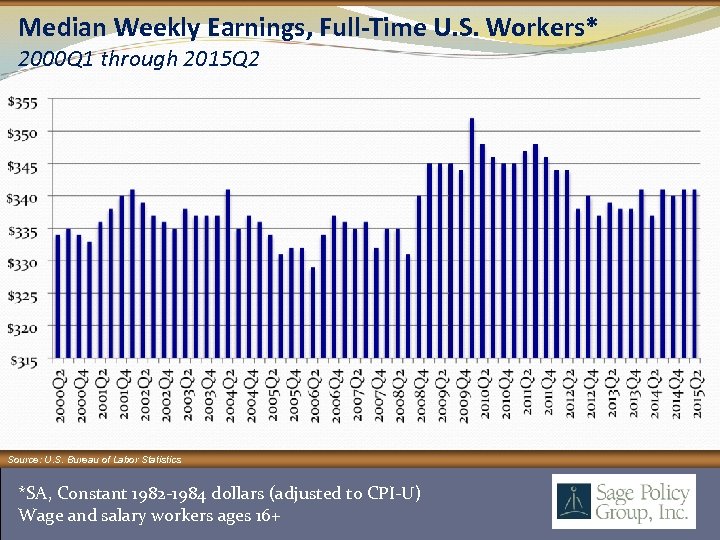

Median Weekly Earnings, Full-Time U. S. Workers* 2000 Q 1 through 2015 Q 2 Source: U. S. Bureau of Labor Statistics *SA, Constant 1982 -1984 dollars (adjusted to CPI-U) Wage and salary workers ages 16+

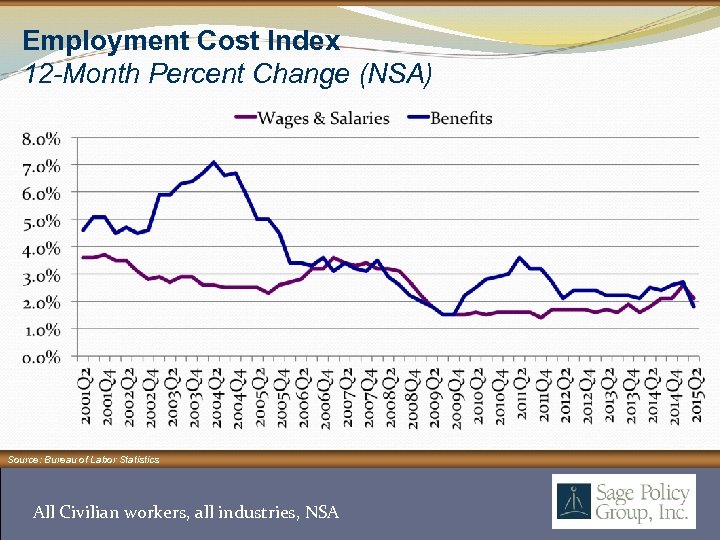

Employment Cost Index 12 -Month Percent Change (NSA) Source: Bureau of Labor Statistics All Civilian workers, all industries, NSA

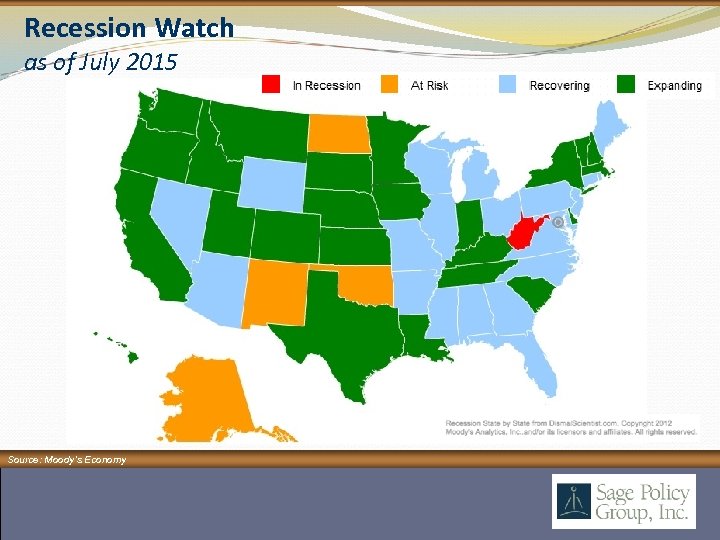

Recession Watch as of July 2015 Source: Moody’s Economy

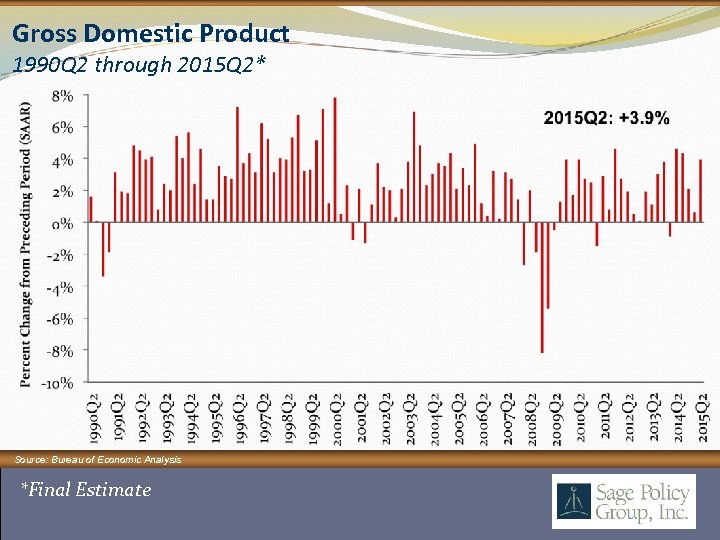

Gross Domestic Product 1990 Q 2 through 2015 Q 2* Source: Bureau of Economic Analysis *Final Estimate

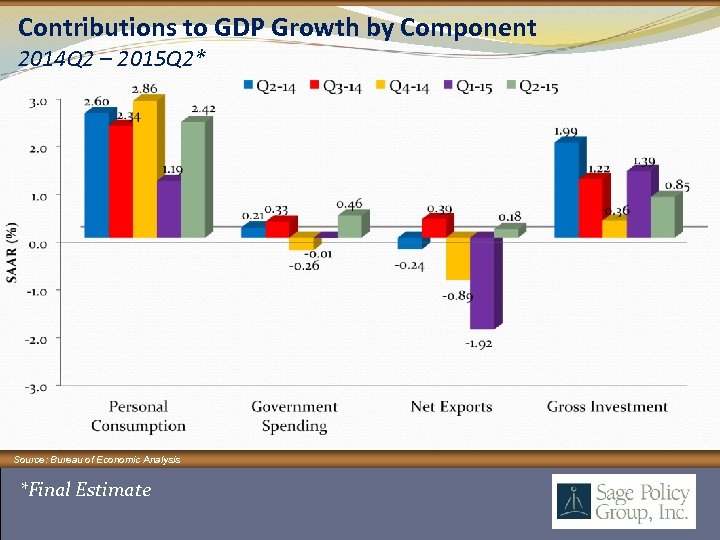

Contributions to GDP Growth by Component 2014 Q 2 – 2015 Q 2* Source: Bureau of Economic Analysis *Final Estimate

Invasion of the Body Snatchers

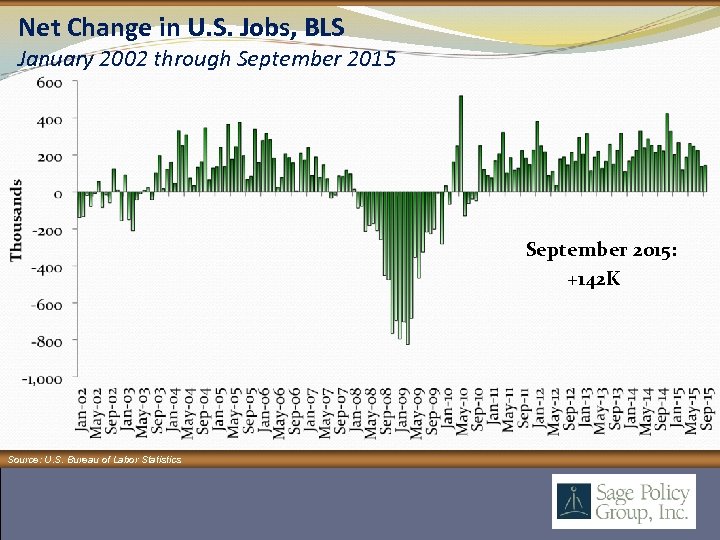

Net Change in U. S. Jobs, BLS January 2002 through September 2015: +142 K Source: U. S. Bureau of Labor Statistics

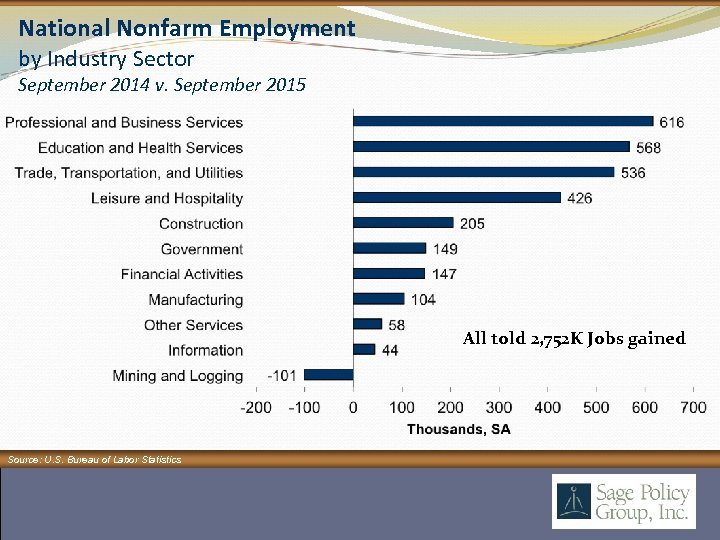

National Nonfarm Employment by Industry Sector September 2014 v. September 2015 All told 2, 752 K Jobs gained Source: U. S. Bureau of Labor Statistics

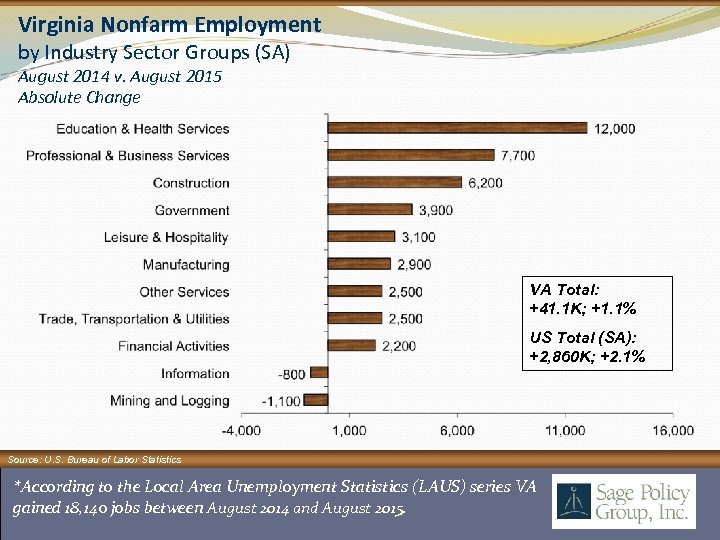

Virginia Nonfarm Employment by Industry Sector Groups (SA) August 2014 v. August 2015 Absolute Change VA Total: +41. 1 K; +1. 1% US Total (SA): +2, 860 K; +2. 1% Source: U. S. Bureau of Labor Statistics *According to the Local Area Unemployment Statistics (LAUS) series VA gained 18, 140 jobs between August 2014 and August 2015.

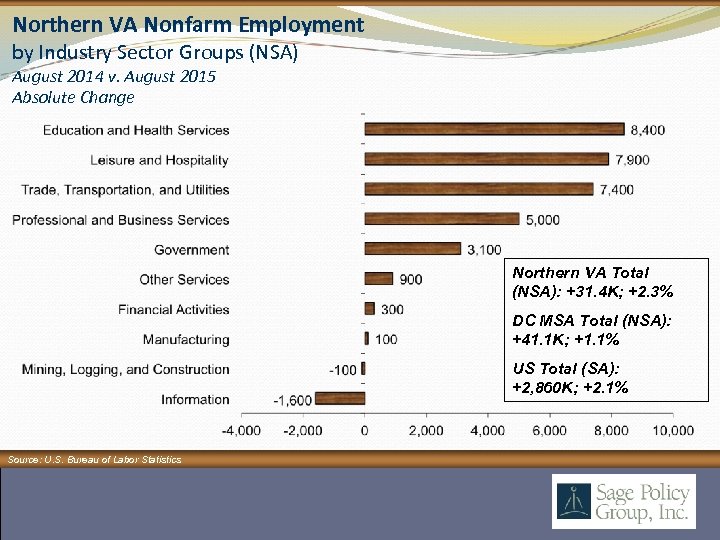

Northern VA Nonfarm Employment by Industry Sector Groups (NSA) August 2014 v. August 2015 Absolute Change Northern VA Total (NSA): +31. 4 K; +2. 3% DC MSA Total (NSA): +41. 1 K; +1. 1% US Total (SA): +2, 860 K; +2. 1% Source: U. S. Bureau of Labor Statistics

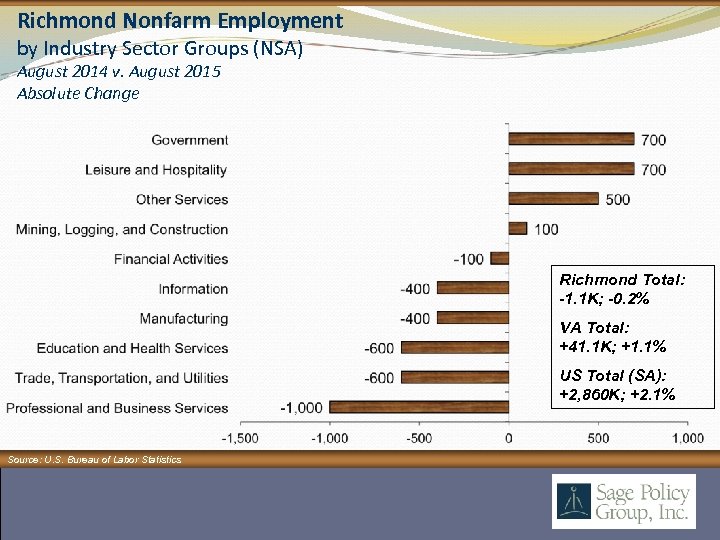

Richmond Nonfarm Employment by Industry Sector Groups (NSA) August 2014 v. August 2015 Absolute Change Richmond Total: -1. 1 K; -0. 2% VA Total: +41. 1 K; +1. 1% US Total (SA): +2, 860 K; +2. 1% Source: U. S. Bureau of Labor Statistics

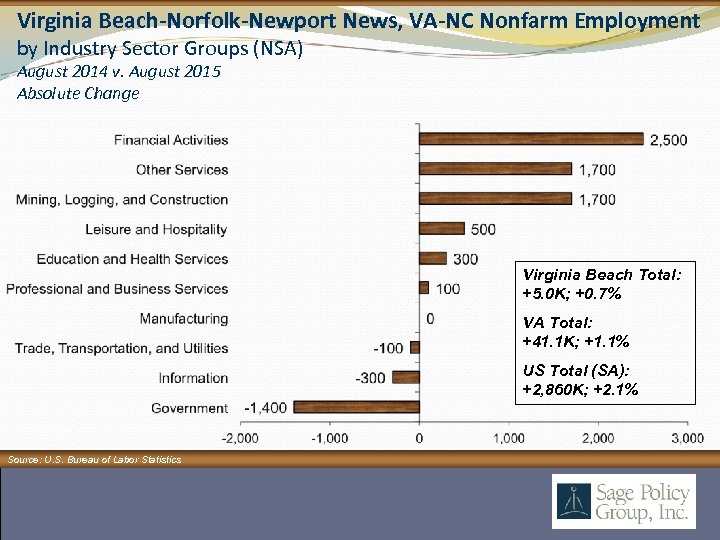

Virginia Beach-Norfolk-Newport News, VA-NC Nonfarm Employment by Industry Sector Groups (NSA) August 2014 v. August 2015 Absolute Change Virginia Beach Total: +5. 0 K; +0. 7% VA Total: +41. 1 K; +1. 1% US Total (SA): +2, 860 K; +2. 1% Source: U. S. Bureau of Labor Statistics

Employment Growth, U. S. States (SA) August 2014 v. August 2015 Percent Change RANK 1 2 3 3 5 6 6 8 9 9 11 12 13 14 14 STATE UTAH OREGON FLORIDA NEVADA WASHINGTON CALIFORNIA SOUTH CAROLINA IDAHO MASSACHUSETTS NORTH CAROLINA INDIANA ARKANSAS MICHIGAN ARIZONA CONNECTICUT GEORGIA HAWAII Source: U. S. Bureau of Labor Statistics % RANK STATE 4. 0 3. 5 3. 3 3. 2 3. 0 2. 9 2. 6 2. 5 2. 3 2. 2 2. 0 14 19 19 23 24 24 24 27 28 28 28 31 32 32 34 MARYLAND COLORADO DISTRICT OF COLUMBIA TENNESSEE TEXAS KENTUCKY IOWA NEW HAMPSHIRE WISCONSIN SOUTH DAKOTA ALABAMA NEW YORK VERMONT DELAWARE MINNESOTA RHODE ISLAND MAINE U. S. Year-over-year Percent Change: Aug: 2. 1% Sept: 2. 0% % RANK 2. 0 1. 9 1. 8 1. 7 1. 5 1. 4 1. 3 1. 2 1. 1 34 34 34 38 38 40 40 42 43 44 45 45 47 47 49 50 51 STATE MISSOURI OHIO VIRGINIA MISSISSIPPI PENNSYLVANIA NEBRASKA NEW JERSEY MONTANA ILLINOIS LOUISIANA NEW MEXICO OKLAHOMA KANSAS WYOMING ALASKA NORTH DAKOTA WEST VIRGINIA % 1. 1 1. 0 0. 9 0. 8 0. 7 0. 4 0. 3 0. 1 -0. 4 -0. 7 -2. 6

Unemployment Rates, U. S. States (SA) August 2015 RANK STATE 1 NEBRASKA 2 3 4 4 6 6 6 9 9 11 11 13 13 15 15 15 NORTH DAKOTA HAWAII NEW HAMPSHIRE VERMONT IOWA SOUTH DAKOTA UTAH MINNESOTA WYOMING MONTANA TEXAS COLORADO IDAHO MAINE VIRGINIA WISCONSIN % RANK STATE 2. 8 18 INDIANA % RANK STATE 4. 6 33 RHODE ISLAND % 5. 6 2. 9 3. 5 3. 6 3. 7 4. 0 4. 1 4. 2 4. 5 4. 6 4. 7 4. 9 5. 1 5. 2 5. 3 5. 4 5. 6 5. 7 5. 9 6. 0 6. 1 6. 2 6. 3 6. 6 6. 7 6. 8 7. 6 18 18 21 21 23 24 24 26 26 28 28 28 31 31 33 33 KANSAS OKLAHOMA MASSACHUSETTS OHIO DELAWARE MARYLAND MICHIGAN KENTUCKY NEW YORK CONNECTICUT FLORIDA WASHINGTON ARKANSAS PENNSYLVANIA ILLINOIS MISSOURI 36 36 38 38 40 40 42 42 44 45 45 47 48 49 49 51 Source: U. S. Bureau of Labor Statistics U. S. Unemployment Rate (Aug & Sept): 5. 1% NEW JERSEY TENNESSEE GEORGIA NORTH CAROLINA LOUISIANA SOUTH CAROLINA CALIFORNIA OREGON ALABAMA ARIZONA MISSISSIPPI ALASKA NEW MEXICO DISTRICT OF COLUMBIA NEVADA WEST VIRGINIA

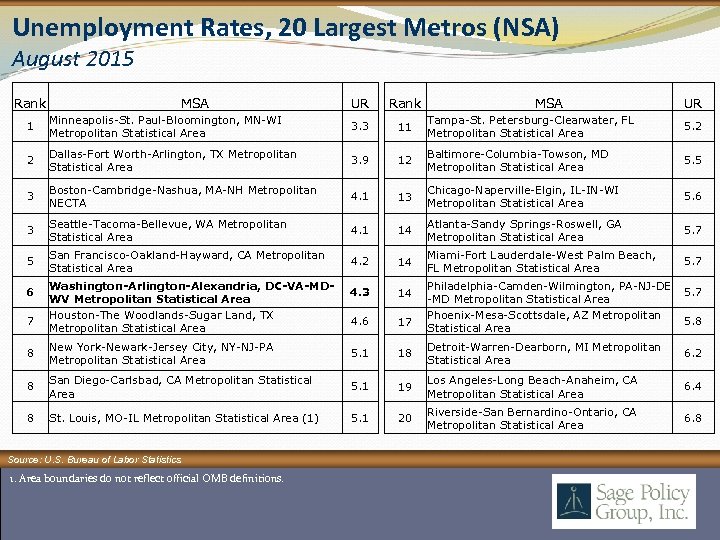

Unemployment Rates, 20 Largest Metros (NSA) August 2015 1 Minneapolis-St. Paul-Bloomington, MN-WI Metropolitan Statistical Area 3. 3 Rank 11 2 Dallas-Fort Worth-Arlington, TX Metropolitan Statistical Area 3. 9 12 Baltimore-Columbia-Towson, MD Metropolitan Statistical Area 5. 5 3 Boston-Cambridge-Nashua, MA-NH Metropolitan NECTA 4. 1 13 Chicago-Naperville-Elgin, IL-IN-WI Metropolitan Statistical Area 5. 6 3 Seattle-Tacoma-Bellevue, WA Metropolitan Statistical Area 4. 1 14 Atlanta-Sandy Springs-Roswell, GA Metropolitan Statistical Area 5. 7 5 San Francisco-Oakland-Hayward, CA Metropolitan Statistical Area 4. 2 14 Miami-Fort Lauderdale-West Palm Beach, FL Metropolitan Statistical Area 5. 7 4. 3 14 4. 6 17 Rank 6 7 MSA Washington-Arlington-Alexandria, DC-VA-MDWV Metropolitan Statistical Area Houston-The Woodlands-Sugar Land, TX Metropolitan Statistical Area UR MSA UR Tampa-St. Petersburg-Clearwater, FL Metropolitan Statistical Area 5. 2 Philadelphia-Camden-Wilmington, PA-NJ-DE -MD Metropolitan Statistical Area Phoenix-Mesa-Scottsdale, AZ Metropolitan Statistical Area 5. 7 5. 8 8 New York-Newark-Jersey City, NY-NJ-PA Metropolitan Statistical Area 5. 1 18 Detroit-Warren-Dearborn, MI Metropolitan Statistical Area 6. 2 8 San Diego-Carlsbad, CA Metropolitan Statistical Area 5. 1 19 Los Angeles-Long Beach-Anaheim, CA Metropolitan Statistical Area 6. 4 8 St. Louis, MO-IL Metropolitan Statistical Area (1) 5. 1 20 Riverside-San Bernardino-Ontario, CA Metropolitan Statistical Area 6. 8 Source: U. S. Bureau of Labor Statistics 1. Area boundaries do not reflect official OMB definitions.

Nightmare on Elm Street

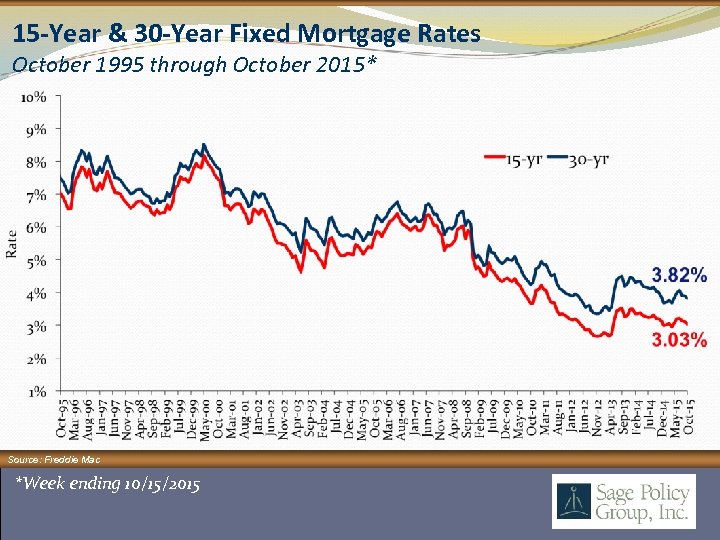

15 -Year & 30 -Year Fixed Mortgage Rates October 1995 through October 2015* Source: Freddie Mac *Week ending 10/15/2015

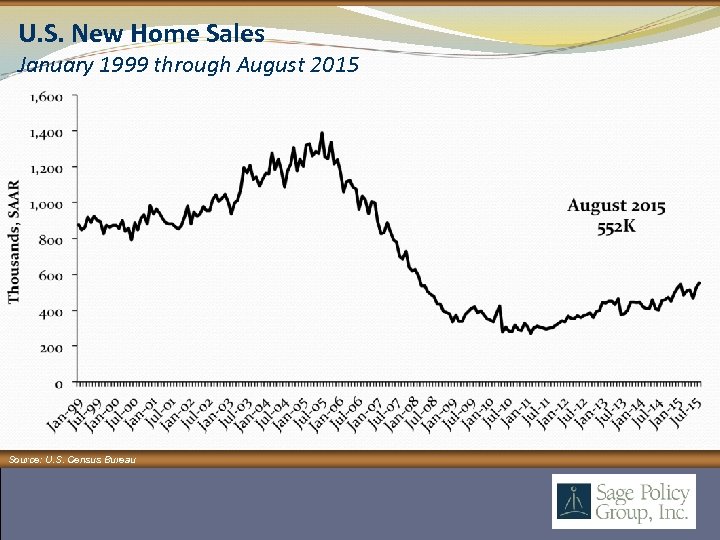

U. S. New Home Sales January 1999 through August 2015 Source: U. S. Census Bureau

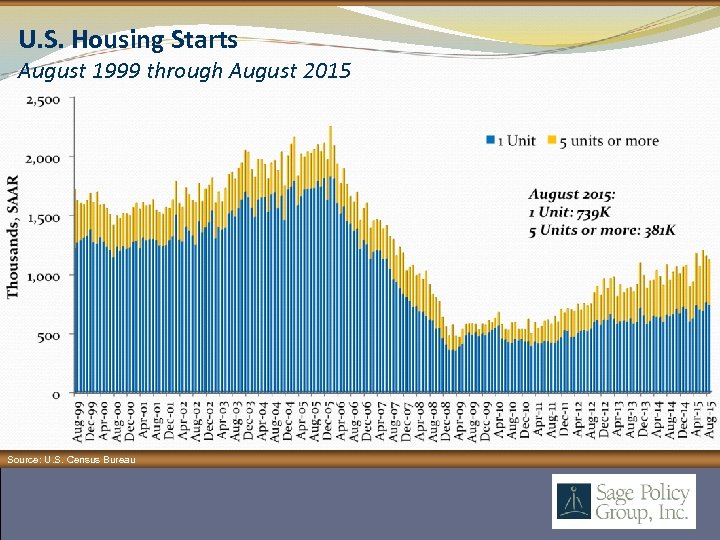

U. S. Housing Starts August 1999 through August 2015 Source: U. S. Census Bureau

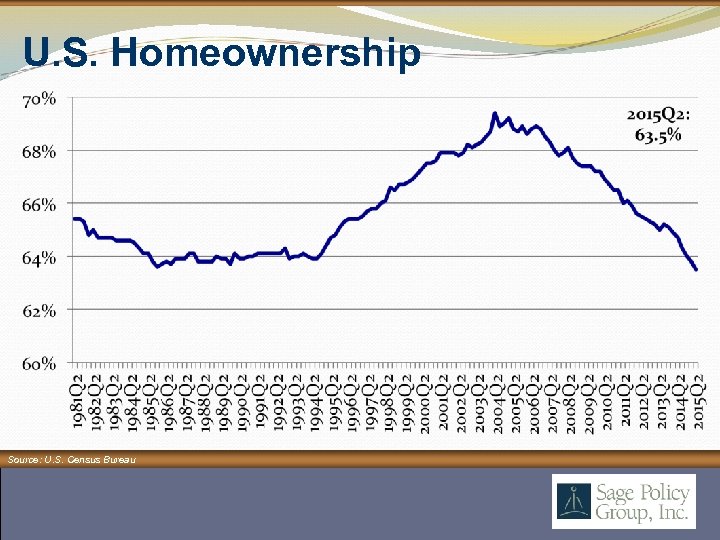

U. S. Homeownership Source: U. S. Census Bureau

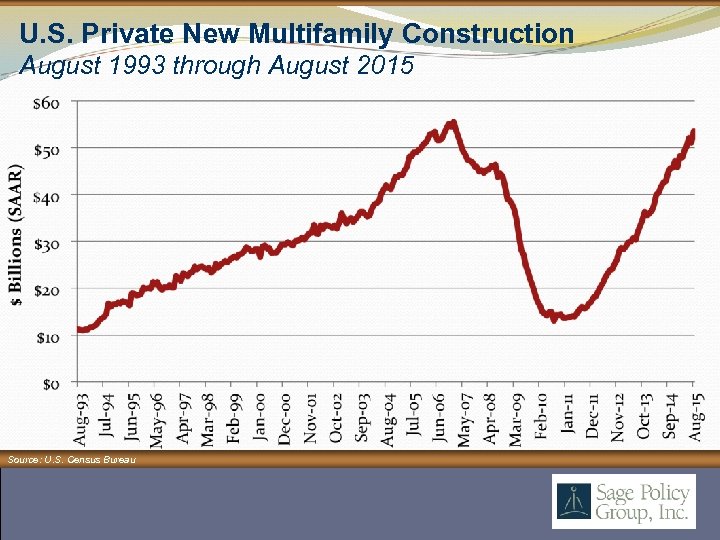

U. S. Private New Multifamily Construction August 1993 through August 2015 Source: U. S. Census Bureau

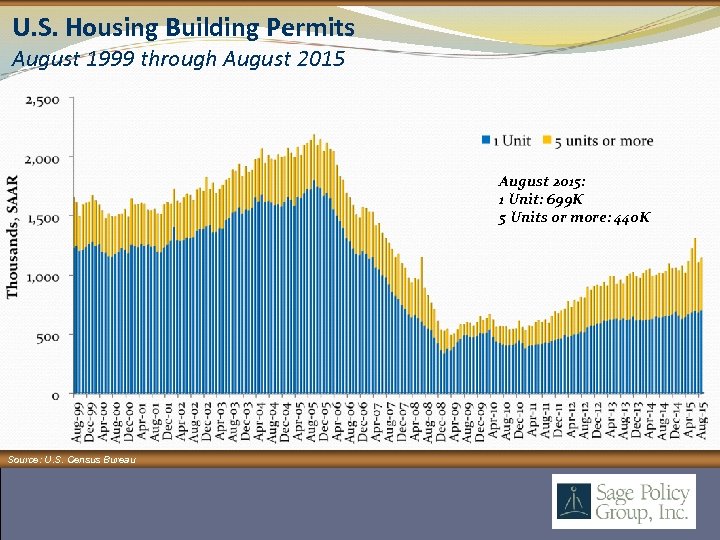

U. S. Housing Building Permits August 1999 through August 2015: 1 Unit: 699 K 5 Units or more: 440 K Source: U. S. Census Bureau

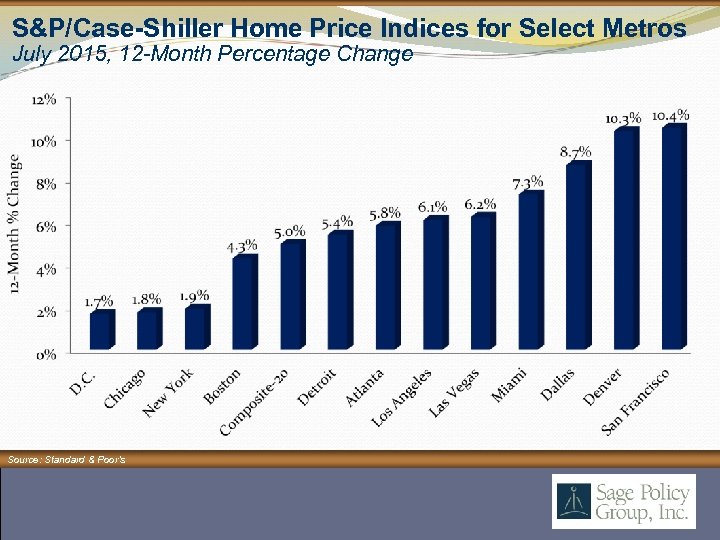

S&P/Case-Shiller Home Price Indices for Select Metros July 2015, 12 -Month Percentage Change Source: Standard & Poor’s

Psycho

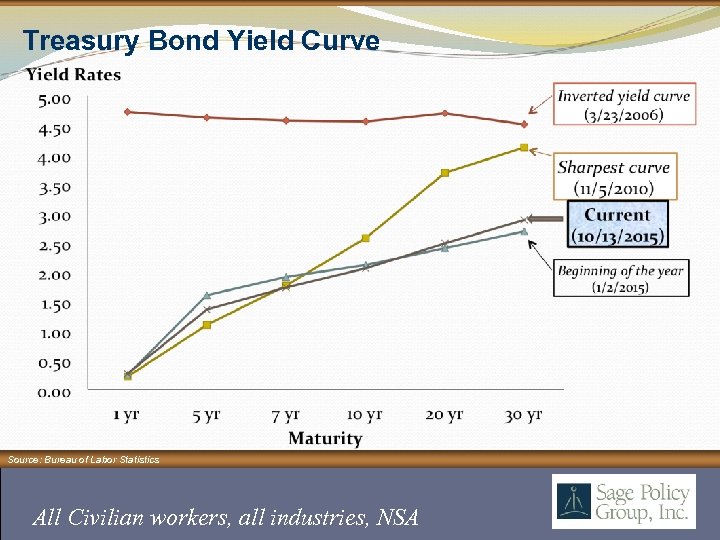

Treasury Bond Yield Curve Source: Bureau of Labor Statistics All Civilian workers, all industries, NSA

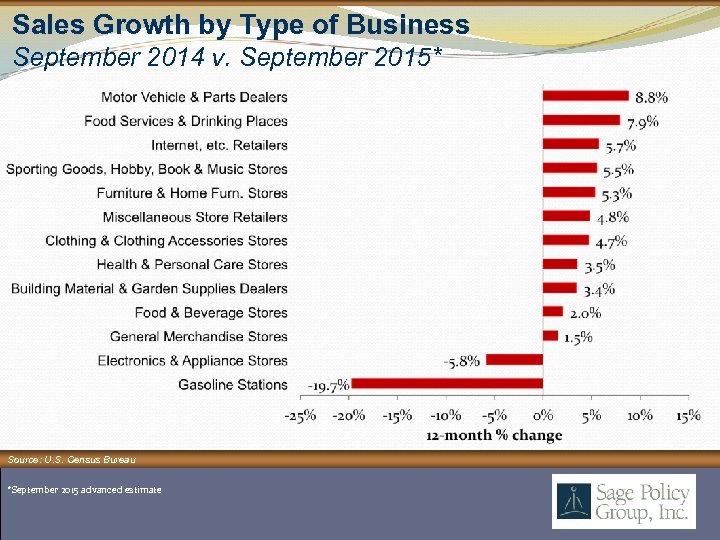

Sales Growth by Type of Business September 2014 v. September 2015* Source: U. S. Census Bureau *September 2015 advanced estimate

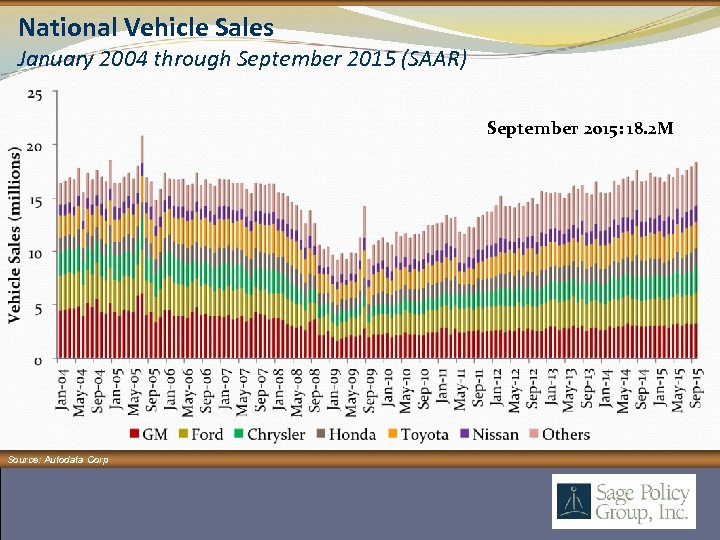

National Vehicle Sales January 2004 through September 2015 (SAAR) September 2015: 18. 2 M Source: Autodata Corp.

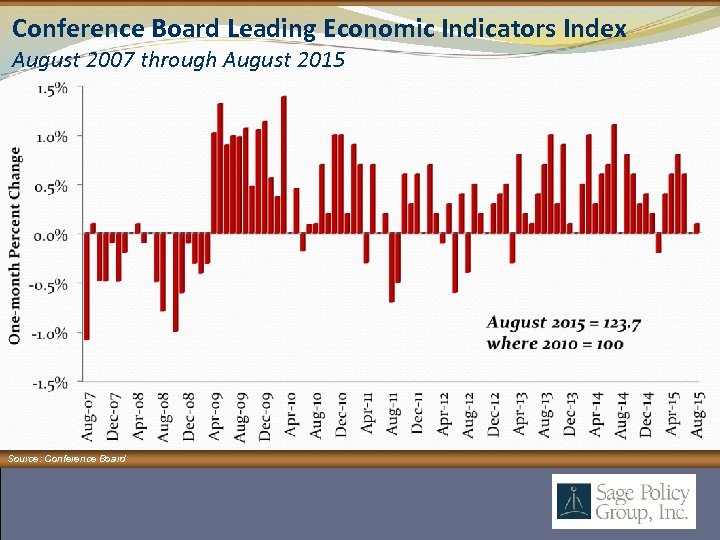

Conference Board Leading Economic Indicators Index August 2007 through August 2015 Source: Conference Board

Tell-Tale Heart • We are now in the mid-cycle stage of recovery – please enjoy it; • It’s all about interest rates – the four segments driving the U. S. economy presently are 1) consumer spending; 2) auto sales and production; 3) residential construction & 4) nonresidential construction – all are interest rate sensitive; • The Federal Reserve has successfully managed to put itself in a no win situation – only imperfect policies to choose from; • The world is not perfect - black swan threats remain: (1) Iran (2) Israel/Iran (3) Europe (4) contagion (5) cyber (6) EMP; • Market is nervous, but perhaps for the wrong reasons; and • More people benefit from lower oil prices than are hurt – more contractors and developers are helped than hurt – frankly, low oil prices just don’t make me that nervous (but something else does!)

Thank You Follow us on Twitter @Sage. Policy. Group You can always reach me at abasu@sagepolicy. com Please look for updates of information at www. sagepolicy. com. Also, if you need us in a hurry, we are at 410. 522. 7243 (410. 522. SAGE) Please contact us when you require economic research & policy analysis.

f957ebc949601a0a7318499d43678dba.ppt