f2b05eb7400dfb42172f6cf6fb3ddd40.ppt

- Количество слайдов: 21

The Pension Crisis in France Causes and Remedies Pension Reform in the European Union: Comparing the Different National Approaches Cicero Foundation Seminar 16 May 2008 > Ephraïm MARQUER > > Director Employee Savings and Retirement Schemes Private Equity and Venture Capital >

The Pension Crisis in France Causes and Remedies Pension Reform in the European Union: Comparing the Different National Approaches Cicero Foundation Seminar 16 May 2008 > Ephraïm MARQUER > > Director Employee Savings and Retirement Schemes Private Equity and Venture Capital >

Summary 1. Retirement system : Legal context Page 3 -8 2. Corporate Pensions Page 9 -16 3. Individual plans Page 17 -18 4. Companies and employees’ expectations Page 19 -20 2 2

Summary 1. Retirement system : Legal context Page 3 -8 2. Corporate Pensions Page 9 -16 3. Individual plans Page 17 -18 4. Companies and employees’ expectations Page 19 -20 2 2

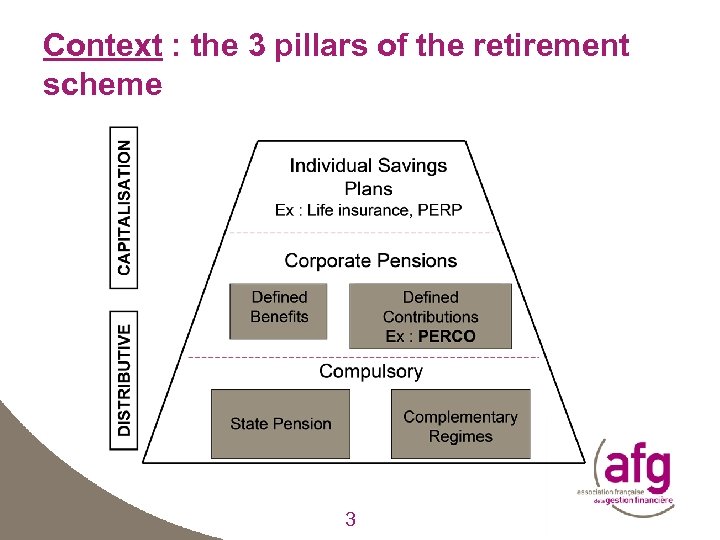

Context : the 3 pillars of the retirement scheme 3 3

Context : the 3 pillars of the retirement scheme 3 3

Context : compulsory regimes State Pension Ø Beneficiairies : private sector employees and independant workers Ø Common features : § Re-distributive regimes § Contributions and retirement revenues based on a legal « limit » - the PASS (and not on salaries) § Minimum pension equivalent to about 30 % average earnings § Target replacement rate of 50 % after 40 (and progressively 45) years Complementary (Mandatory occupational) Regimes Ø Beneficiairies : same as state regime Ø Common features : § Re-distributive regimes § Based en retirement « points » which depend on level and duration of contributions 4 4

Context : compulsory regimes State Pension Ø Beneficiairies : private sector employees and independant workers Ø Common features : § Re-distributive regimes § Contributions and retirement revenues based on a legal « limit » - the PASS (and not on salaries) § Minimum pension equivalent to about 30 % average earnings § Target replacement rate of 50 % after 40 (and progressively 45) years Complementary (Mandatory occupational) Regimes Ø Beneficiairies : same as state regime Ø Common features : § Re-distributive regimes § Based en retirement « points » which depend on level and duration of contributions 4 4

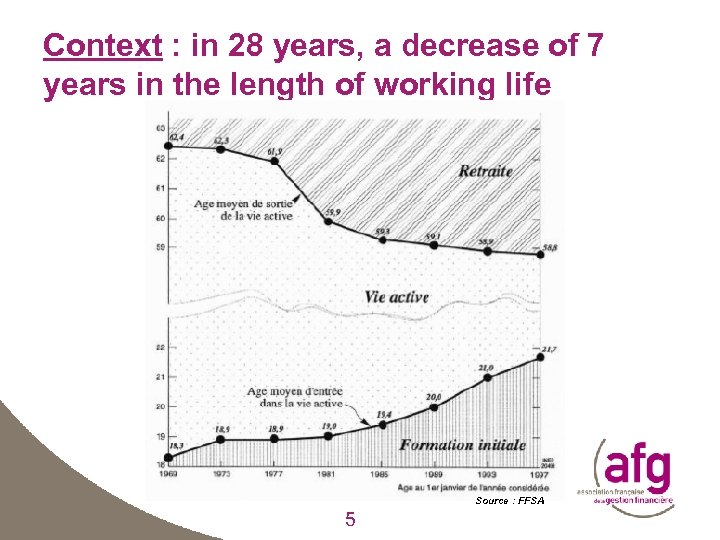

Context : in 28 years, a decrease of 7 years in the length of working life 5 Source : FFSA 5

Context : in 28 years, a decrease of 7 years in the length of working life 5 Source : FFSA 5

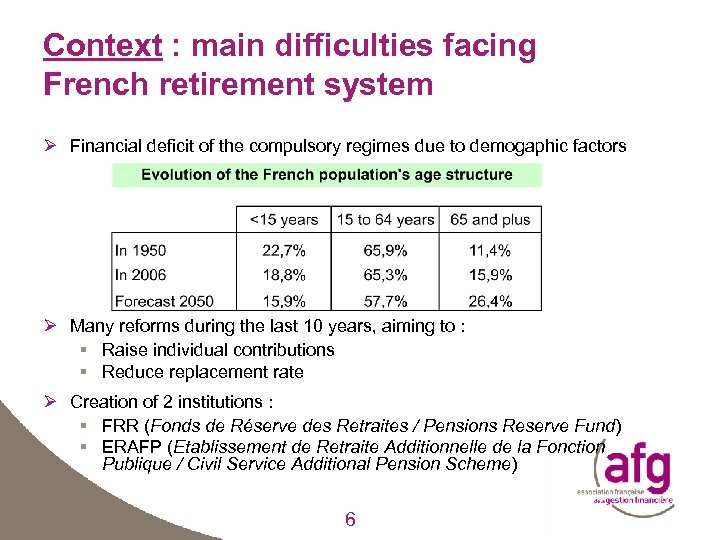

Context : main difficulties facing French retirement system Ø Financial deficit of the compulsory regimes due to demogaphic factors Ø Many reforms during the last 10 years, aiming to : § Raise individual contributions § Reduce replacement rate Ø Creation of 2 institutions : § FRR (Fonds de Réserve des Retraites / Pensions Reserve Fund) § ERAFP (Etablissement de Retraite Additionnelle de la Fonction Publique / Civil Service Additional Pension Scheme) 6 6

Context : main difficulties facing French retirement system Ø Financial deficit of the compulsory regimes due to demogaphic factors Ø Many reforms during the last 10 years, aiming to : § Raise individual contributions § Reduce replacement rate Ø Creation of 2 institutions : § FRR (Fonds de Réserve des Retraites / Pensions Reserve Fund) § ERAFP (Etablissement de Retraite Additionnelle de la Fonction Publique / Civil Service Additional Pension Scheme) 6 6

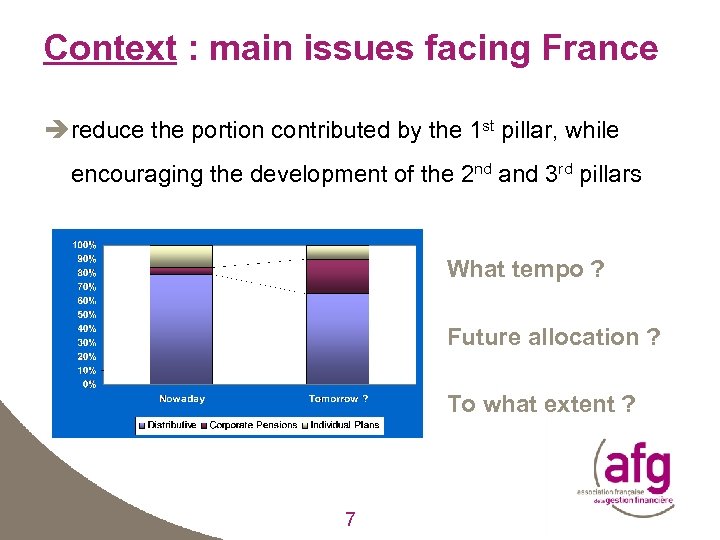

Context : main issues facing France reduce the portion contributed by the 1 st pillar, while encouraging the development of the 2 nd and 3 rd pillars What tempo ? Future allocation ? To what extent ? 7 7

Context : main issues facing France reduce the portion contributed by the 1 st pillar, while encouraging the development of the 2 nd and 3 rd pillars What tempo ? Future allocation ? To what extent ? 7 7

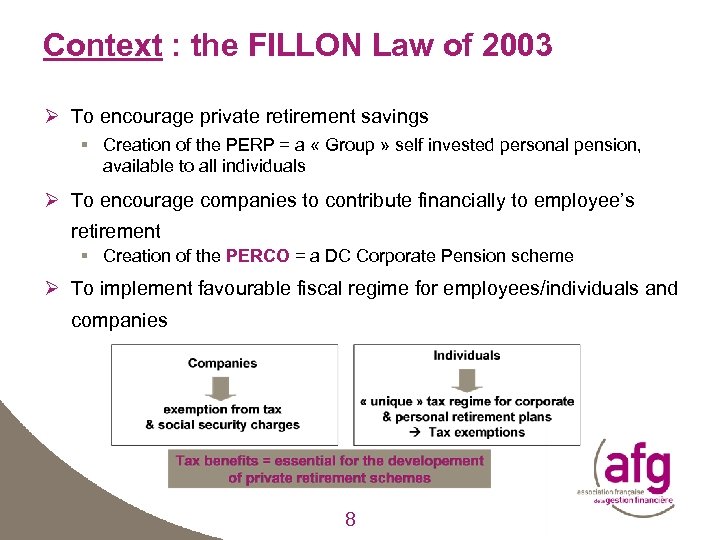

Context : the FILLON Law of 2003 Ø To encourage private retirement savings § Creation of the PERP = a « Group » self invested personal pension, available to all individuals Ø To encourage companies to contribute financially to employee’s retirement § Creation of the PERCO = a DC Corporate Pension scheme Ø To implement favourable fiscal regime for employees/individuals and companies 8 8

Context : the FILLON Law of 2003 Ø To encourage private retirement savings § Creation of the PERP = a « Group » self invested personal pension, available to all individuals Ø To encourage companies to contribute financially to employee’s retirement § Creation of the PERCO = a DC Corporate Pension scheme Ø To implement favourable fiscal regime for employees/individuals and companies 8 8

Corporate Pension : PERCO (1/6) Ø Implemented in a company or group of companies, after negociations with the union representatives Ø Beneficiaries : all employees on condition of meeting criteria related to the length of service (minimum 3 months) § Including directors of companies of 1 to 100 employees Ø Financing § Amounts paid to employees out of corporate profit sharing schemes § Voluntary contributions by employees, limited to 25 % of gross annual remuneration including performance-related bonus § Possibility of transfer of assets out of a PEE (short term corporate savings plan) § Days saved on a CET (time related savings plan) § Additional voluntary contributions by the company • A maximum of € 5, 324 not exceeding 300 % of employee contributions • May also be applied to assets transferred from the PEE 9 9

Corporate Pension : PERCO (1/6) Ø Implemented in a company or group of companies, after negociations with the union representatives Ø Beneficiaries : all employees on condition of meeting criteria related to the length of service (minimum 3 months) § Including directors of companies of 1 to 100 employees Ø Financing § Amounts paid to employees out of corporate profit sharing schemes § Voluntary contributions by employees, limited to 25 % of gross annual remuneration including performance-related bonus § Possibility of transfer of assets out of a PEE (short term corporate savings plan) § Days saved on a CET (time related savings plan) § Additional voluntary contributions by the company • A maximum of € 5, 324 not exceeding 300 % of employee contributions • May also be applied to assets transferred from the PEE 9 9

Corporate Pension : PERCO (2/6) Ø Investment supports = mutual funds (FCPE & SICAV) § At least 3 products with different risk/return profiles § Product must not hold more than 5 % of company stock § Obligation to propose a « solidarity » fund Ø Access to the savings fund § On retirement § But early redemption is possible under certain circumstances The purchase of main residence is an early avaibility case Ø Employees have a choice of 2 exit options (defined in the company’s agreement) § Life annuity, • subject to tax, level of taxation depending on the beneficiary’s age at the time annuity is liquidated • Subject to 11 % levy (reduced to 4, 4 % if annuity is liquidated between 60 and 70 years) § Capital withdrawal, subject to 11 % levy on capital gains 10 10

Corporate Pension : PERCO (2/6) Ø Investment supports = mutual funds (FCPE & SICAV) § At least 3 products with different risk/return profiles § Product must not hold more than 5 % of company stock § Obligation to propose a « solidarity » fund Ø Access to the savings fund § On retirement § But early redemption is possible under certain circumstances The purchase of main residence is an early avaibility case Ø Employees have a choice of 2 exit options (defined in the company’s agreement) § Life annuity, • subject to tax, level of taxation depending on the beneficiary’s age at the time annuity is liquidated • Subject to 11 % levy (reduced to 4, 4 % if annuity is liquidated between 60 and 70 years) § Capital withdrawal, subject to 11 % levy on capital gains 10 10

Corporate Pension : PERCO (3/6) Company’s policy of mark-ups is often more highly structured than that of the Employee Savings Plan (PEE) Ø Distinctions made based on contribution sources : § Some companies encourage employees to invest earnings from profit sharing scheme in the PERCO § On the other hand, some offer a higher contribution rate on voluntary contributions Ø Can sometimes offer more incentives for younger employees Ø Often offers more incentives for small contributions (decreasing rate per tranche) but an ultimate longer tranche to encourage larger contributions from executives Ø No distinctions made in terms of investment products 11 11

Corporate Pension : PERCO (3/6) Company’s policy of mark-ups is often more highly structured than that of the Employee Savings Plan (PEE) Ø Distinctions made based on contribution sources : § Some companies encourage employees to invest earnings from profit sharing scheme in the PERCO § On the other hand, some offer a higher contribution rate on voluntary contributions Ø Can sometimes offer more incentives for younger employees Ø Often offers more incentives for small contributions (decreasing rate per tranche) but an ultimate longer tranche to encourage larger contributions from executives Ø No distinctions made in terms of investment products 11 11

Corporate Pension : PERCO (4/6) KEY ADVANTAGES Ø No social liability in the employer balance sheet Ø Governance of funds : dual representation supervisory board Ø Security : § § Ø Safekeeping (segregation of assets, separation of functions) Diversification of assets Portability : § § Ø Assets marked to marked Seamless transfers from one plan to another Efficiency : § § Standardization and use of existing infrastructure for economies of scale § Ø No bond bias in asset allocation due to accounting rules or asset liability constraints Cost effectiveness : funds of funds, multi-company funds, standard UCITS Flexibility : § Ø Different investment options for different individual risk profiles Transparency on costs and other information 12 12

Corporate Pension : PERCO (4/6) KEY ADVANTAGES Ø No social liability in the employer balance sheet Ø Governance of funds : dual representation supervisory board Ø Security : § § Ø Safekeeping (segregation of assets, separation of functions) Diversification of assets Portability : § § Ø Assets marked to marked Seamless transfers from one plan to another Efficiency : § § Standardization and use of existing infrastructure for economies of scale § Ø No bond bias in asset allocation due to accounting rules or asset liability constraints Cost effectiveness : funds of funds, multi-company funds, standard UCITS Flexibility : § Ø Different investment options for different individual risk profiles Transparency on costs and other information 12 12

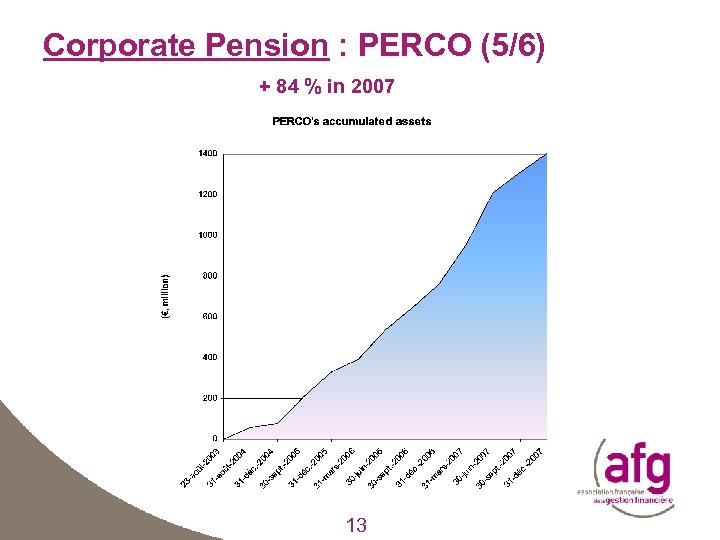

Corporate Pension : PERCO (5/6) + 84 % in 2007 13 13

Corporate Pension : PERCO (5/6) + 84 % in 2007 13 13

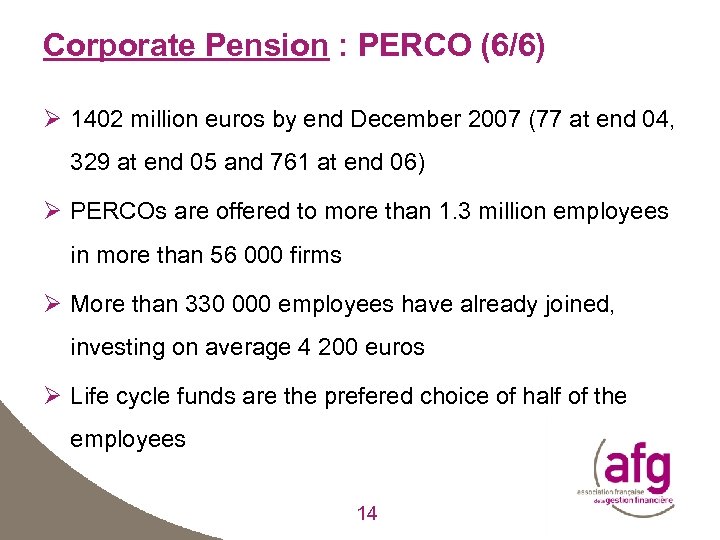

Corporate Pension : PERCO (6/6) Ø 1402 million euros by end December 2007 (77 at end 04, 329 at end 05 and 761 at end 06) Ø PERCOs are offered to more than 1. 3 million employees in more than 56 000 firms Ø More than 330 000 employees have already joined, investing on average 4 200 euros Ø Life cycle funds are the prefered choice of half of the employees 14 14

Corporate Pension : PERCO (6/6) Ø 1402 million euros by end December 2007 (77 at end 04, 329 at end 05 and 761 at end 06) Ø PERCOs are offered to more than 1. 3 million employees in more than 56 000 firms Ø More than 330 000 employees have already joined, investing on average 4 200 euros Ø Life cycle funds are the prefered choice of half of the employees 14 14

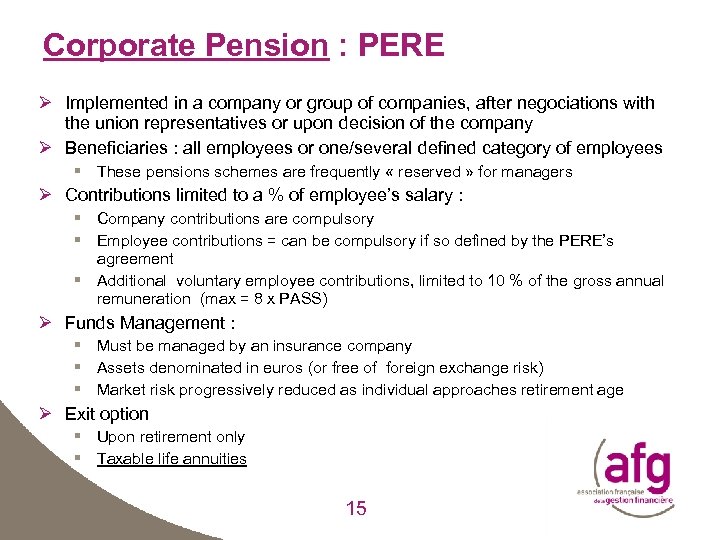

Corporate Pension : PERE Ø Implemented in a company or group of companies, after negociations with the union representatives or upon decision of the company Ø Beneficiaries : all employees or one/several defined category of employees § These pensions schemes are frequently « reserved » for managers Ø Contributions limited to a % of employee’s salary : § Company contributions are compulsory § Employee contributions = can be compulsory if so defined by the PERE’s agreement § Additional voluntary employee contributions, limited to 10 % of the gross annual remuneration (max = 8 x PASS) Ø Funds Management : § Must be managed by an insurance company § Assets denominated in euros (or free of foreign exchange risk) § Market risk progressively reduced as individual approaches retirement age Ø Exit option § Upon retirement only § Taxable life annuities 15 15

Corporate Pension : PERE Ø Implemented in a company or group of companies, after negociations with the union representatives or upon decision of the company Ø Beneficiaries : all employees or one/several defined category of employees § These pensions schemes are frequently « reserved » for managers Ø Contributions limited to a % of employee’s salary : § Company contributions are compulsory § Employee contributions = can be compulsory if so defined by the PERE’s agreement § Additional voluntary employee contributions, limited to 10 % of the gross annual remuneration (max = 8 x PASS) Ø Funds Management : § Must be managed by an insurance company § Assets denominated in euros (or free of foreign exchange risk) § Market risk progressively reduced as individual approaches retirement age Ø Exit option § Upon retirement only § Taxable life annuities 15 15

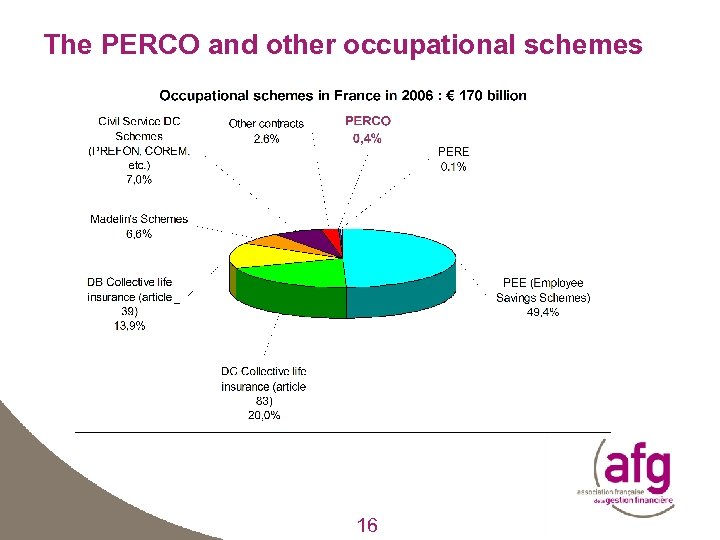

The PERCO and other occupational schemes 16 16

The PERCO and other occupational schemes 16 16

Individual plan : PERP Ø Individual retirement plan Ø Beneficiaries : all individuals Ø Financing : voluntary contributions, limited to 10 % of remuneration (max = 8 x PASS) Ø Funds Management : § Must be managed by an insurance company § Euro denominated assets ( or free of forex risk) § Market risk progresively reduced as individual approaches retirement age Ø Exit option § Upon retirement only § Taxable life annuities 17 17

Individual plan : PERP Ø Individual retirement plan Ø Beneficiaries : all individuals Ø Financing : voluntary contributions, limited to 10 % of remuneration (max = 8 x PASS) Ø Funds Management : § Must be managed by an insurance company § Euro denominated assets ( or free of forex risk) § Market risk progresively reduced as individual approaches retirement age Ø Exit option § Upon retirement only § Taxable life annuities 17 17

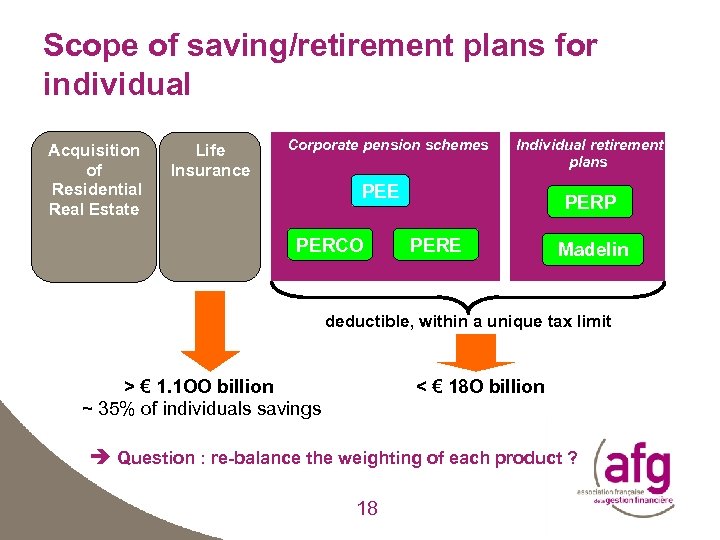

Scope of saving/retirement plans for individual Acquisition of Residential Real Estate Life Insurance Corporate pension schemes Individual retirement plans PEE PERCO PERP PERE Madelin deductible, within a unique tax limit > € 1. 1 OO billion ~ 35% of individuals savings < € 18 O billion Question : re-balance the weighting of each product ? 18 18

Scope of saving/retirement plans for individual Acquisition of Residential Real Estate Life Insurance Corporate pension schemes Individual retirement plans PEE PERCO PERP PERE Madelin deductible, within a unique tax limit > € 1. 1 OO billion ~ 35% of individuals savings < € 18 O billion Question : re-balance the weighting of each product ? 18 18

Companies’ expectations Ø Corporate Pensions are an essential item in the overall HR package and are increasingly seen as a solution to the following problems : § Building employees / executives loyalty § Attracting experienced executives, aware of the diminishing benefits of mandatory regimes Ø Companies require schemes that are : § Adapted to their goals in term of the scope of beneficiaries (executive directors, executives, non executives, etc …) § Most (tax. . ) efficient for the targeted group of beneficiaries Ø Furthermore, implementing a corporate pension scheme may : § Improve the social climate within the company § Help to forge an image of a cohesive group and strengthen corporate culture Ø The finacial impact of unfunded corporate pensions has become a major concern for listed companies (IAS standards) 19 19

Companies’ expectations Ø Corporate Pensions are an essential item in the overall HR package and are increasingly seen as a solution to the following problems : § Building employees / executives loyalty § Attracting experienced executives, aware of the diminishing benefits of mandatory regimes Ø Companies require schemes that are : § Adapted to their goals in term of the scope of beneficiaries (executive directors, executives, non executives, etc …) § Most (tax. . ) efficient for the targeted group of beneficiaries Ø Furthermore, implementing a corporate pension scheme may : § Improve the social climate within the company § Help to forge an image of a cohesive group and strengthen corporate culture Ø The finacial impact of unfunded corporate pensions has become a major concern for listed companies (IAS standards) 19 19

Employee expectations Ø To be given definitive and « transferable » rights (especially for younger employees) Ø To continue to benefit from company’s contributions, irrespective of the company’s performances Ø Acces to complementary income during retirement Ø Maximise the efficiency of their personnal savings plan, which implies that the following be taken into account : § Contributions of the company § Tax benefits on voluntary contributions § Tax and social levies on annuities (or capital withdrawals) Ø Right to transfer savings accumulated on death (as annuity or capital) 20 20

Employee expectations Ø To be given definitive and « transferable » rights (especially for younger employees) Ø To continue to benefit from company’s contributions, irrespective of the company’s performances Ø Acces to complementary income during retirement Ø Maximise the efficiency of their personnal savings plan, which implies that the following be taken into account : § Contributions of the company § Tax benefits on voluntary contributions § Tax and social levies on annuities (or capital withdrawals) Ø Right to transfer savings accumulated on death (as annuity or capital) 20 20

Thank you for your attention Ephraïm MARQUER Tel. : + (33) 1 44 94 94 39 e. marquer@afg. asso. fr 21 21

Thank you for your attention Ephraïm MARQUER Tel. : + (33) 1 44 94 94 39 e. marquer@afg. asso. fr 21 21