24c06edd45ac47e214fe59c33721026b.ppt

- Количество слайдов: 130

The PC Manufacturer Industry Business 417 Presentation: Ali Pourdad Claire Yan Jessica Vanden. Akker Benny Cheong

Agenda n Industry Analysis Industry Overview n Industry Profile n Industry Trends n n Company Analysis Gateway, Inc. n HP/Compaq Inc. n Dell, Inc. n

Industry Overview

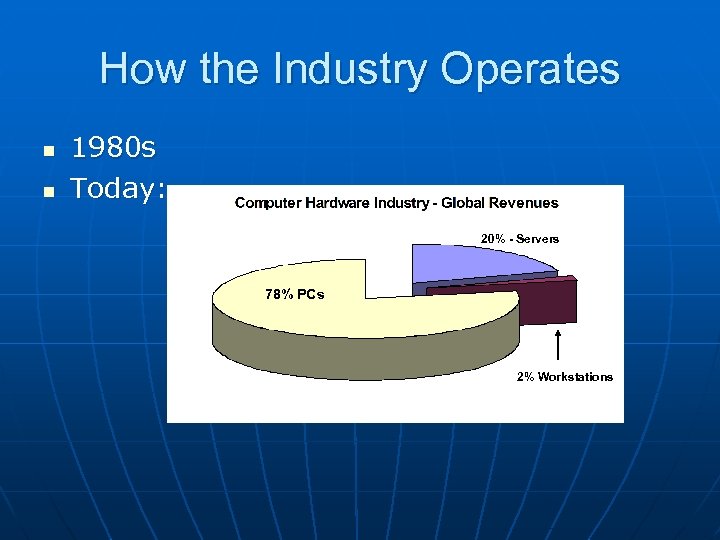

How the Industry Operates n n 1980 s Today: 20% Servers 78% PCs 2% Workstations

Assemblers, marketers, and manufacturers Power Source & Cables Floppy / CD Drive Hard Drive Motherboard Holds CPU Case Extra Peripherals

Computer Form Factors n n Every type of Computer comes in a variety of “form factors, ” or physical designs apart from the computer’s main electronics that play a large role in determining the computer’s potential uses and markets. The Most common form factor distinction in the PC market is between the desktop and notebook.

Worldwide PC Shipments Market Share (In percent, based on units shipped) Fujitsu – 4. 2% IBM – 5. 9% Toshiba – 3. 2% Dell – 15. 1% Toshiba – 3. 3% IBM – 5. 9% Dell – 16. 9% Others - 55. 6% HP/Compaq 16. 0% Total Units: 136. 9 Million Others – 53. 3% HP/Compaq 16. 4% Total Units: 152. 6 Million

Worldwide PC Shipment Growth (In percent, based on units shipped)

US PC Industry n Computer hardware mature in the latter half of the 90 s?

Business Models n Contract Manufacturing vs. J. I. T. delivery n n n Everyone vs. Dell Retail Store Model - MAC White Box Competition Tier 1 IBM Sun, Dell, HP/Compaq Tier 2 Gateway, Toshiba, Acer Fujitsu, etc. Tier 3 White Box Competition

White Box Competitors n n Highly fragmented Selling unbranded “white box” computers Accounts for over 50% of global market share in 2002, 2003, and 2004 to-date. In the United States: • Small and medium size businesses are primary purchasers of white box. • White box computers had the largest share of the small business market in the US, with almost 40% in 2002.

IT Trends n n White box have benefited from a niche market growing in the area of high performance PCs that are optimized for video game applications. The price gap between top-tier vendors’ machines and those manufactured by second/third tier vendors has narrowed. Third and fourth quarters are always the biggest in the PC manufacturer industry – Back-to-school and Holidays Standard & Poor’s believes that industry revenues may be up 3% to 4% in 2004, given the competitive pricing environment and the gradual upturn in IT investment expected.

PCs keep getting cheaper…

Dow Jones Computer Index 5 Years

Dow Jones Computer Index n n 142 securities in this index Some of the big names include: • Apple Computer, Inc. (AAPL) • HP/Compaq (HPQ) • Dell, Inc. (DELL) • Gateway, Inc. (GTW) • Others: Quantum Corp. , Seagate Technology, , Logitech, Lexmark, Synaptics Inc

Dow Jones Computer Index Last 3 Months – Beside NYSE Index

Dow Jones Industry Index INDUSTRY INDEX STATISTICS n n n n Price: 391. 76 Price Change: 5. 91 % Price Change: 1. 53% Market Cap: 262. 6 Billion Dividend Yield: n/a P/E Ratio: 53. 14 52 -Week Range: 324. 06 to 410. 35 1 -Yr % Change: 1. 32%

NASDAQ Computer Index

NASDAQ Computer Index n n 645 securities are on the Nasdaq Computer Index (IXCO) Some of the big names: Dell, Inc. (DELL) n Microsoft, Corporation (MSFT) n Intel Corporation (INTC) n Google, Inc. (GOOG) n Apple Computers (AAPL) n

NASDAQ Computer Index

NASDAQ Computer Index

Preliminary worldwide PC vendor unit shipments estimates for Q 2 2004 Company Shipments in Q 2 2004 (thousands of units) Q 2 2004 market share Shipments in Q 2 2003 (thousands of units) Q 2 2003 market share Year on Year Growth Dell 7080 16. 5% 5781 15. 3% 22. 5% HP/Compaq 6130 14. 3% 5306 14. 0% 15. 5% IBM 2535 5. 90% 2157 5. 70% 17. 5% Fujitsu 1506 3. 50% 1265 3. 30% 19. 0% Acer 1302 3. 00% 995 2. 60% 30. 9% Others 24449 56. 7% 22270 59. 0% 13. 3% In the United States, PC shipments totaled 14 million units in the second quarter of 2004, an 11. 4% increase from the second quarter of 2003.

Key Industry Ratios and Statistics n n n Index of leading economic indicators Business Capital Spending Consumer Confidence • Base year was 1985 (1985=100) • High Levels - Computer Sales Improve • Low Levels – Computer Sales Decline n Real growth in GDP

GATEWAY INC.

Company Overview n Founded in 1985 n Started by a $10, 000 loan n Previously called Gateway 2000 n In 1993, it went public, traded on NASDAQ n In 1997, added to NYSE n In March 2004, acquired e. Machines ($235 million) n As of July 2004, approximately 3400 employees

Value Proposition --- Offering products directly to customers, providing them with the best value for their money and unparalleled service and support

Executives & Management Wayne Inouye (Mar. 2004) President & CEO Adam Andersen (Mar. 2004) Senior Vice President, Chief Administrative Officer Scott Weinbrandt (Jan. 2003) Senior Vice President, Direct Bob Davidson (Mar. 2004) Senior Vice President, U. S. Retail Greg Memo (Mar. 2004) Senior Vice President, Platform Development & Operations Rod Sherwood (Sep. 2002) Senior Vice President, Chief Financial Officer

Products n PCs: desktops, notebooks, all-in-ones, n Consumer Electronics: digital TVs, n Other: accessories professional PC systems (networking, servers and storage) digital camera, MP 3 players, DVD players etc. and services

Distribution Channels n Direct Distribution: web, phone, 189 retail stores n n Third party sales through partners such as: Costco, Home Shopping Network, etc. Limited reseller relationships in Canada & Mexico

Major Competitors n n IBM Cisco Systems HP/Compaq Dell Inc.

Direct Competitor Comparison GTW DELL HPQ IBM Industry Market Cap: 2. 19 B 100. 96 B 58. 40 B 158. 68 B 111. 93 M Employ ees: 7, 400 53, 000 142, 000 319, 273 192 29. 80% 17. 10% 29. 10% 9. 80% 8. 40% Revenue (ttm): 3. 50 B 47. 26 B 78. 37 B 94. 74 B 77. 66 M Gross Margin (ttm): 9. 95% 18. 22% 24. 90% 37. 10% 27. 29% 552. 18 M 4. 37 B 4. 52 B 15. 33 B 24. 00 K 19. 43% 8. 56% 5. 03% 11. 22% 0. 17% 683. 44 M 3. 12 B 3. 27 B 8. 11 B 793. 00 K 1. 931 1. 21 1. 064 4. 703 N/A 33. 42 18. 18 20. 27 27. 14 Rev. Growth (ttm): EBITDA (ttm): Oper. Margins (ttm): Net Income (ttm): EPS (ttm): PE (ttm):

News Highlights n n e. Machines acquisition in March, 2004 Buy back shares from AOL

New Strategy n New Multi-Brand Segmentation Strategy • • n Segmented two-tier branding/positioning model Traditional e. Machines + GTW brand (e. g. Lexus & Toyota) Expanding e. Machines’ Distribution Internationally • • Japan: nearly 200 stores UK: 730 stores Mexico: 475 stores Follow-on expansion for Germany & France

Market Share n U. S. PC Market Share (by dollar amount) • 2001: 10% • 2002: 5. 5% - 6% n Decreased 4% • 2003: 3. 3 – 3. 8% n n Decreased 2% With its acquisition of e. Machines now complete, Gateway is the third-largest PC company in the U. S. and among the top ten worldwide.

Sales Divided by Regions

Sales Divided by Products

Recent Trend of Sales by Product Lines 2003 Mar-04 Jun-04 Sep-04 Desktop 2080 1510 604 476 795 642 931 Mar-04 Jun-04 Sep-04 Total Revenue $3, 402 $868 $838 $915 Desktop Total Units 2003 $1, 645 $428 $475 $508 $753 $169 $174 $215 $60 $11 $8 $9 $944 $261 $180 $183 732 Notebook Server 548 124 150 195 23 5 4 4 Server Non-PC

Revenue

Net Income

2003 -2004 Quarterly Income

Income Statement Analysis EPS

Price-Earnings Ratio

Profit Margin

Balance Sheet Analysis Cash & Cash Equivalent Trend

ROE

Debt to Equity

Asset Turnover

Price-to-Book Ratio

Financial Leverage

Cash Flow Statement Analysis Free Cash Flow Trend

Quarterly Financial Highlights 2003 Mar 04 Jun 04 Sep 04 Revenue $3, 402, $868, $837, $915, 364 383 592 132 EPS ($1. 62) P/E (2. 84) Profit Margin 0. 136 0. 132 0. 019 0. 101 ROE -71% -21% -83% -17% Debt to Equity 1. 54 1. 69 3. 10 3. 58 Price to Book 1. 62 1. 82 2. 76 3. 33 ($0. 4 9) ($0. 9 0) ($0. 1 6) (10. 7 (5. 00) 8) (30. 9 4)

Other Financial Statement Highlights n n Change in Accounting Policy (FAS 133) Law suits

Shareholder Highlight n n n Shares outstanding: 372 million Symbol: GTW Listing: NYSE since May 1997 after joining NASDAQ in December 1993 n Stock splits: Two 2 -for-1 splits, on June 16, 1997 and Sept. 7, 1999

Stock Information -- As of November 19, 2004: n Open: 5. 750 n Close: 5. 660 n High: 5. 760 n Low: 5. 620 n Volume: 1, 430, 700 n 52 -week High: 6. 620 n 52 -week Low: 3. 640

One Year Price Trend

One Year Comparison

Five Year Price Trend

Five Year Comparison

Growth Comparison S&P 500 Industry Stock

Analysts Recommendation RECOMMENDATION TRENDS Current Month Last Month Two Months Ago Three Months Ago Strong Buy 2 2 Buy Sell 2 6 2 2 5 2 2 6 2 Strong Sell 1 1 Hold

My Recommendation n For investors: • Risky • There are many good PC companies SELL n For speculators: n • Price is pretty low now • Might turn around after the new strategies started to working out BUY n

HP Compaq

HP – Background n n n Founded in 1939 and incorporated August 18, 1947 by Bill Hewlett and Dave Packard. Went public on November 6, 1957 for $16/share Trades on NYSE and NASDAQ, Symbol: HPQ Pre-Compaq: 88, 000 employees, $45. 2 billion in revenues Headquarters located in Palo Alto, California

Compaq - Background n n Formed in 1982 by Rod Canion, Jim Harris, and Bill Murto 1983 becomes publicly traded on NASDAQ, 1985 on NYSE; Traded around $11 prior to merger Pre-HP revenues of $42. 4 billion and over 70, 000 employees Was the 3 rd largest computer seller behind IBM and HP; acquisitions: • Tandem Computing (1997) • Digital Equipment Corp. (1998) • Inacom (2000)

HP – Compaq Merger n n Finalized May 7, 2002 (Announced Sept 4, 2001) New CEO: Carly Fiorina (Former HP CEO) Compaq became wholly owned subsidiary; Compaq common stock was traded for 0. 6325 shares of HP stock. 142, 000 employees in more than 170 countries

HP - Strategy n Corporate Strategy: • Is to offer products, services and solutions that are high tech and low cost and deliver the best customer experience. No other company has the portfolio, people and expertise to deliver all three. Low Cost High Tech Customer Best Customer Experience

HP Executive Team • Carly Fiorina, n n n n CEO & Director (1999 - HP) Ann O. Baskins, • Senior Vice President, General Counsel and Secretary (2002). Joined HP 1982. Gilles Bouchard, • CIO & Executive Vice President of Global Operations (1999). Joined HP 1990. Debra L. Dunn, • Senior Vice President of Corporate Affairs and Global Citizenship (2002). Joined HP 1983. Jon Flaxman, • Senior Vice President & Controller (2002) Joined HP 1981. Allison Johnson, • Senior Vice President, Corporate Marketing (2002) Joined HP 1999. Vyomesh (VJ) Joshi, • Executive Vice President, Imaging and Printing Group (2002) Joined HP 1980. Richard H. (Dick) Lampman, • Senior Vice President of Research, HP, and Director, HP Labs (2002) Joined HP 1971

HP Executive Team n n n n Catherine A. Lesjak, • Senior Vice President and Treasurer (2003) Joined HP 1998 Ann M. Livermore, • Executive Vice President, Technology Solutions Group (2002) Joined HP 1982. Steve Pavlovich, • Vice President, Investor Relations (2002) Joined HP 1993 Marcela Perez de Alonso, • Executive Vice President, Human Resources (2004) Joined HP 2004. Shane V. Robinson, • Executive Vice President and Chief Strategy and Technology Officer (2002) Joined Compaq 2000. Robert P. Wayman, • Executive Vice President & CFO (1992) Joined HP 1969. Michael J. Winkler, • Executive Vice President, Customer Solutions Group and Chief Marketing (2002) Joined Compaq 1995. Duane E. Zitzner, • Executive Vice President, Personal Systems Group (2002) Joined Compaq 1989.

Executive Compensation

HP - Distribution n Distribution mostly ‘big box’ retailers, as well as independent vendors, developers, and system integrators • Cultivate ‘partner’ (contracted) relationships

HP – Compaq Today n Business Areas include: • Technology Solutions Group: HP Services (HPS) n Enterprise Systems (ESS) n Software (SW) n • Personal Systems (PSG) • Imaging & Printing (IPG) • HP Financial Services (HPFS)

HP - Competitors Business Area: Main Competitors Technology Solutions Group: IBM, Dell, Sun Microsystems Personal Systems (PSG) Dell, Gateway, White Box, Apple Imaging & Printing (IPG) Epson, Canon, Lexmark, Dell

HP – Direct Competitors HPQ CAJ DELL IBM Industry Market Cap: 61. 36 B 43. 35 B 100. 54 B 158. 70 B 38. 45 M Employees: 142, 000 108, 554 53, 000 319, 273 123 Rev. Growth (ttm): 29. 10% 20. 40% 17. 10% 9. 80% 13. 90% Revenue (ttm): 79. 90 B 32. 46 B 47. 26 B 94. 74 B 36. 95 M Gross Margin (ttm): 24. 48% 49. 67% 18. 22% 37. 10% 35. 06% EBITDA (ttm): 4. 76 B 6. 86 B 4. 37 B 15. 33 B -382. 00 K Oper. Margins (ttm): 5. 20% 15. 51% 8. 56% 11. 22% 0. 18% Net Income (ttm): 3. 50 B 3. 24 B 3. 12 B 8. 11 B -768. 00 K EPS (ttm): 1. 149 3. 65 1. 21 4. 703 N/A PE (ttm): 17. 68 14. 02 33. 28 20. 27 25. 89 PEG (ttm): 1. 30 N/A 1. 32 1. 91 1. 25 PS (ttm): 0. 76 1. 43 2. 12 1. 68 1. 15 HPQ – Hewlett-Packard CAJ – Canon Inc

HP – Market Share Info

HP – Market Share Info

HP- Revenue Per Region

HP – Revenue Breakdown *in millions

HP – Operating Income *in millions

Operating Income

HP – Operating Margins

HP – Quarterly Revenue *in millions

HP – ESS Quarterly Results

Balance Sheet Analysis *in millions

Cash Flow Statement Analysis *in millions

Share Buyback

Key Statistics n n Most Recent split was 2000 Largest shareholder is The Packard Foundation with 5. 4% of (approx. 3 B) outstanding shares; 6. 62% held by company insiders Pays $0. 08 dividend quarterly; yield is 1. 50% Share Buyback & Options Exercised • 2003 - over 39 million share buyback • 2002 – over 39 million bought back • 2001 – over 45 million bought back • Q 4 FY 04 – bought back $2. 2 billion worth of shares; sold 32 million under ESO; $3. 3 billion bought back total for 2004

HP Statistics -- As of November 19, 2004: n Open: 20. 250 n Close: 20. 080 n High: 20. 340 n Low: 20. 080 n Volume: 10, 307, 000 n 52 -week High: 26. 280 n 52 -week Low: 16. 080

Interesting HP Statistics Profit Margin Operating Margin ROA ROE Total Cash per share Total Debt/Equity Current Ratio Book Value Per Share Price to Book Ratio Price to Sales 4. 38% 5. 20% 4. 68% 9. 15% $12. 97 B $4. 3 $0. 19 1. 431 $12. 656 $1. 60 $0. 76

Charts- Progress Report Revenue & EPS

1 Year Stock Chart

1 Year Comparison

5 Year Stock Chart

5 Year Comparison

HP - Recommendation n Strong Assets – high cash on hand Dividend payout Growth Possibilities n n n BUY Performance inconsistent Decreasing market share Decreasing market and increasing competition = smaller margins

DELL INC n Symbol • DELL n Founder • • • Michael S. Dell 1984 Originally known as PC’s Limited • Headquartered in Austin

History n In 1985 ØIntroduced an IBM-compatible PC clone called turbo ØStrategy (low-price leader) Direct telephone sales v Build computers only for order hence lower the inventory costs v Sales had grown to 69. 5 million in 1986 v

History… § Ø Ø § Ø In 1987 Took founder’s name and became Dell Computer Corporation Began selling application software and further differentiated itself from IBM and other rivals. In 1988 Made an initial public offering of common stock (3. 5 million shares at $8. 5 each)

Timeline… n n n 1989 -Introduces its first notebook computer 1992 -Fortune 500 roster of the world’s largest companies 1993 -Ranks of the top-five computer system maker worldwide 2000 -Sales via internet reach $50 million per day No. 1 in worldwide workstation shipments 2001 -No. 1 in global market share

Board of Directors n n n Chairman of the Board Micheal S. Dell (Since 1984) President and Chief Executive Officer: Kevin B. Rollins (since July 2004) Directors: Tomas W. Luce lll (since 1991) Donard J. Carty (since 1992) Klaus S. Luft (since 1995) Michael A. Miles (since 1995) Alex J. Mandl (since 1997) Samuel a. Nunn, Jr. (since 1999) William H. Gray, lll (since 2000) Judy C. Lewent (since 2001)

Compensation

Stock Option Compensation

More Facts… n n n n Code of conduct Trust Integrity Honesty Judgment Respect Courage Responsibility n n n “Soul of Dell” Customers The Dell Team Direct Relationship Global Citizenship Winning

The Direct Model Five Tenets of the Model n Most efficient path to the Customer • With no intermediaries n Single Point of Accountability • Dell the single point n Build-to-Order • Don’t maintain expensive inventory n Low-Cost Leader • Highly efficient supply chain n Standards-Based Technology

Products and Services Primary Ø Desktop computer system Ø Notebook computer system Ø Enterprise system Secondary Ø Software Ø Electronic such as printer and TV Ø Services support such as IT management services etc.

Manufacturers The company manufactures its computer systems in six locations: n n n Austin, Texas Nashville, Tenn Eldorado do Sul, Brazil (Americas) Limerick, Ireland (Europe, Middle East and Africa) Penang, Malaysia (Asia Pacific and Japan) Xiamen, China (China)

Competitors Ø Direct Competitors • IBM (International Business Machines Corp) • HPQ (Hewlett-Packard Co) • SUNW (Sun Microsystems Inc) Other competitors § CICO (Cisco Systems) § AAPL (Apple Comp Inc) § EMC (EMC Corp) - Competitors began to imitate Dell’s strategy Change its image from low price to one offering quality and extensive service

Data Information Ø As of Nov 12 Market Capitalization $100. 96 B Ø Ø Shares Outstanding 2. 50 B 11% held by All insider and 5% owners 64% held by Institutional & Mutual Fund Owners Employee 53000

Historical PC Market Share Data Q 2 CY 04 Q 2 CY 04 Q 1 CY 04 CY 03 CY 02 CY 01 CY 00 Rank Worldwide share: 1 18. 3% 18. 5% 16. 7% 15. 0% 12. 7% 10. 5% United States 1 33. 3% 33. 4% 31. 0% 28. 0% 23. 5% 18. 4% EMEA 2 12. 6% 12. 9% 10. 5% 9. 6% 9. 0% 7. 8% Asia Pacific 4 7. 1% 7. 0% 6. 1% 4. 9% 4. 4% 3. 4% Japan 3 12. 0% 10. 5% 9. 7% 7. 7% 5. 8% 4. 0% Worldwide share: Desktops 1 18. 5% 19. 1% 17. 0% 14. 9% 12. 3% 10. 2% Notebooks 1 16. 8% 16. 1% 15. 1% 14. 4% 13. 5% 11. 3% x 86 Servers 2 25. 1% 26. 2% 23. 3% 21. 6% 19. 3% 15. 4%

Net Revenue

Revenues by region

Revenue by Product

Percentage of Net Revenue FY 04 FY 03 FY 02 FY 01 18. 2 % 17. 9 % 17. 7 % 20. 2 % 8. 6 % 8. 9 % 10. 0 % 1. 1% 1. 3 % 1. 5 % Total operating expenses 9. 7% 9. 9 % 11. 8 % Operating income 8. 6% 8. 0 % 5. 8 % 8. 4 % 9. 0% 8. 6 % 5. 6 % 10. 1 % Net income 6. 4% 6. 0 % 4. 0 % 6. 8 % Income tax rate 29. 0 % 29. 9 % 28. 0 % 30. 0 % Gross margin Selling, general and administrative Research, development and engineering Income before income taxes

Net Income

Operating Income by region

Operating expenses

Financial highlight operating result (in millions) Fiscal-Year Ended Net revenue 30 -Jan-04 31 -Jan-03 Change 1 -Feb-02 2 -Feb-01 $41, 444 $35, 404 17. 10% $31, 168 $31, 888 Gross margin $7, 552 $6, 349 18. 90% $5, 507 $6, 443 Operating income $3, 544 $2, 844 24. 60% $1, 789 $2, 663 Net income $2, 645 $2, 122 24. 60% $1, 246 $2, 177 Basic $1. 03 $0. 82 25. 60% $0. 48 $0. 84 Diluted $1. 01 $0. 80 26. 30% $0. 46 $0. 79 Income per common share

Last Three Quarter (in millions) Q 3 -FY 05 Net Revenue $12, 502. 0 0 Sequential growth Q 2 -FY 05 Q 1 -FY 05 $11, 706. $11, 540. 00 00 6. 80% 1. 40% 0. 20% $2, 313. 00 $2, 134. 00 $2, 073. 00 $1, 095. 00 $1, 006. 00 $966. 00 $846. 00 $799. 00 $731. 00 Basic $0. 34 $0. 32 $0. 29 Diluted $0. 33 $0. 31 $0. 28 Gross Margin Operating Income Net Income EPS

Value measures and ratios (updated on Nov 12) Market Cap: 100. 96 B Trailing P/E 33. 42 Price/Sales (ttm) 1. 97 Price/Book (mrq) 15. 79 Return on Assets(ttm) 15. 92% Return on Equity (ttm) 51. 38% Total Debt/Equity (mrq) 0. 086 Current Ratio (mrq) 1. 112 Book Value Per Share (mrq) 2. 359

Direct Competitor Comparison DELL HPQ IBM SUN W Market Cap: 100. 9 6 B 58. 5 0 B 158. 6 8 B 16. 34 B 111. 9 3 M Employees: 5300 0 1420 00 3192 73 32600 192 Rev. Growth (ttm): 17. 10 % 29. 1 0% 9. 80 % 2. 20% 8. 40% Revenue (ttm) 47. 26 B 78. 3 7 B 94. 74 B 11. 28 B 77. 66 M Gross Margin (ttm) 18. 22 % 24. 9 0% 37. 10 % 40. 55 % 27. 29 % EBITDA (ttm): Oper. Margins (ttm): Net Income (ttm): EPS (ttm): Indus try 4. 37 B 4. 52 B 15. 33 B 1. 30 B 24. 00 K 8. 56 % 5. 03 % 11. 22 % 4. 64% 0. 17% 739. 0 0 K N/A 3. 12 B 3. 27 B 8. 11 B 249. 0 0 K 1. 21 1. 06 4 4. 703 -0. 079

DELL vs. Industry leaders Industry Leader DELL Rank Market Capitalization IBM 158. 68 B 100. 9 6 B 2/41 P/E Ratio (ttm) CSPI 150. 02 33. 42 7/41 PEG Ratio (tmm, 5 yr expected) SUNW 9. 91 1. 43 7/41 Revenue Growth (Qtrly Yo. Y) GEPT 173. 26% 17. 70 % 13/4 1 EPS Growth (Qtrly Yo. Y) SEAC 241. 18% 28. 68 % 8/41 Long-Term Growth Rate (5 yr) SEAC 30. 00% 17. 00 % 10/4 1 Return on Equity ( ttn) DELL 51. 48% - 1/41 7/41 N/A Long-Term Debt/Equity (mrq) MRCY 76. 20% 8. 60 % Dividend Yield (annual) IBM 0. 76% N/A

Stock history (Price of Today: $39. 97) Closing Stock Price Jan 30, 2004 $33. 44 Jan 31, 2003 $23. 86 Feb 01, 2002 $26. 80 Feb 02, 2001 $25. 19 Jan 28, 2000 $37. 25

Dell Stock Price -- As of November 19, 2004: n Open: 40. 250 n Close: 39. 970 n High: 40. 390 n Low: 39. 810 n Volume: 12, 951, 300 n 52 -week High: 40. 970 n 52 -week Low: 31. 140

One Year Stock Trend

Five Year Stock Price Trend

1 Year Comparison

5 Year Comparison

Analyst Estimates Curren t Next ye Ye ar ar Jan, 20 05 Jan, 2 0 06 Revenue Est 49. 33 B 56. 79 B No. of Analy sts 26 25 1. 28 1. 56 28 28 Earing Est No. of Analy sts This ye ar Next Ye ar Next five years(Av g)

Recommendation Trends Current Month Last Month Two Months Ago Three Months Ago 7 8 9 9 Buy 13 13 14 14 Hold 8 7 6 5 Sell 0 0 0 0 Strong Buy

Findings and Our Recommendation n n n Fiscal 2004 is the most successful of the 20 years. Product shipments grew 26%, nearly three times the average of other companies Revenues increased 17% to 41. 4 B; total sales by the rest of the industry declined. Operating Expenses just 9. 7% of revenue (lowest in history) EPS were up 26% to $1. 01 Expected continuous growth in the coming years BUY! Every penny you have

24c06edd45ac47e214fe59c33721026b.ppt