0d07683cb61b75368e7bdc218d3bb86f.ppt

- Количество слайдов: 48

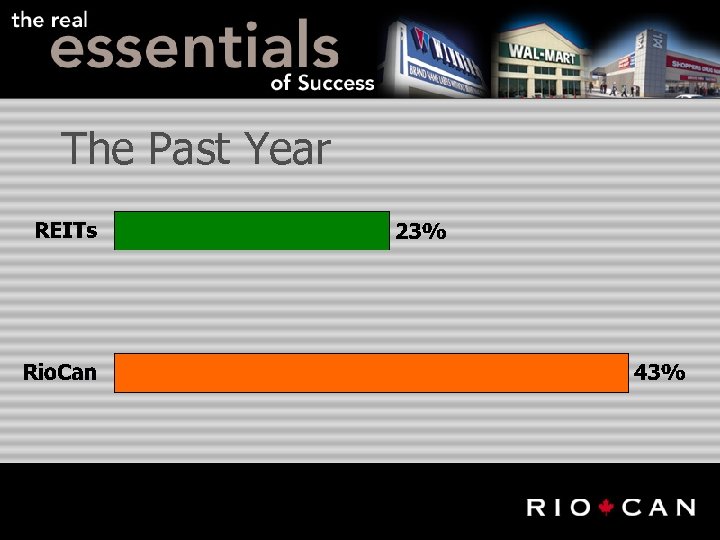

The Past Year

The Past Year

The Past Year § Unitholder approval to increase leverage to 60%. § Strategic alliance between Rio. Can and Kimco Realty Corporation.

The Past Year § Unitholder approval to increase leverage to 60%. § Strategic alliance between Rio. Can and Kimco Realty Corporation.

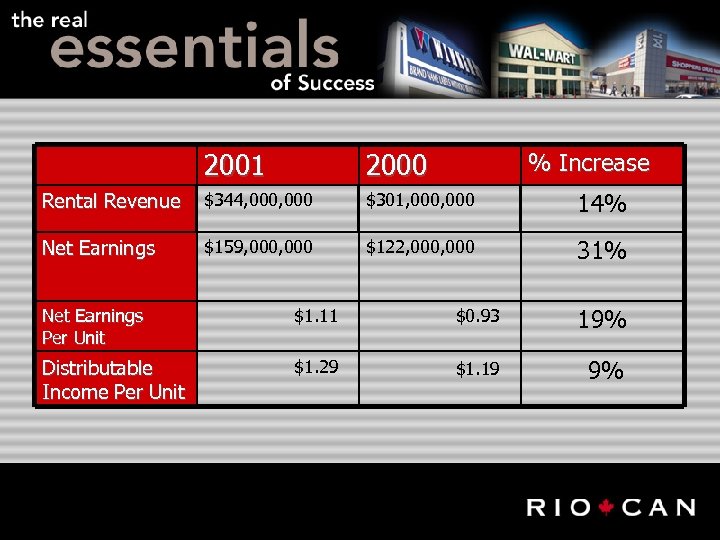

2001 2000 Rental Revenue $344, 000 $301, 000 14% Net Earnings $159, 000 $122, 000 31% % Increase Net Earnings Per Unit $1. 11 $0. 93 19% Distributable Income Per Unit $1. 29 $1. 19 9%

2001 2000 Rental Revenue $344, 000 $301, 000 14% Net Earnings $159, 000 $122, 000 31% % Increase Net Earnings Per Unit $1. 11 $0. 93 19% Distributable Income Per Unit $1. 29 $1. 19 9%

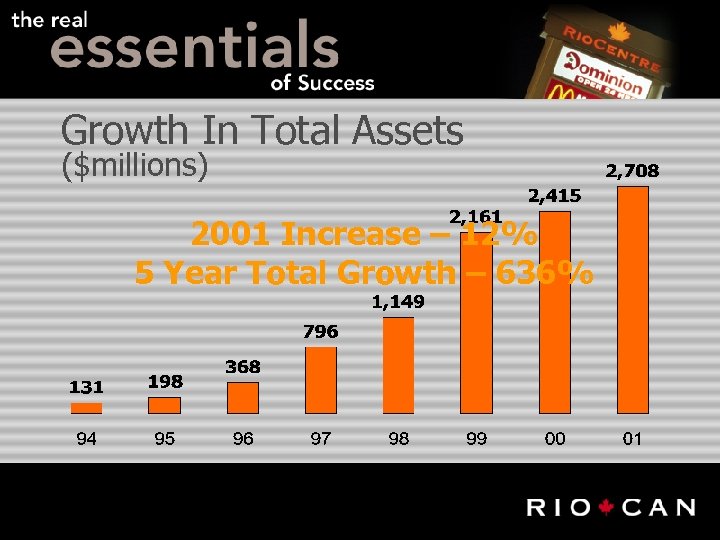

Growth In Total Assets ($millions) 2001 Increase – 12% 5 Year Total Growth – 636%

Growth In Total Assets ($millions) 2001 Increase – 12% 5 Year Total Growth – 636%

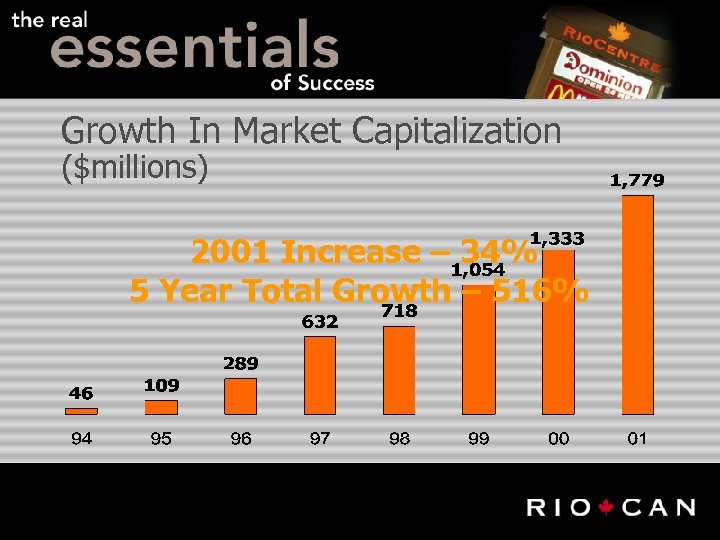

Growth In Market Capitalization ($millions) 2001 Increase – 34% 5 Year Total Growth – 516%

Growth In Market Capitalization ($millions) 2001 Increase – 34% 5 Year Total Growth – 516%

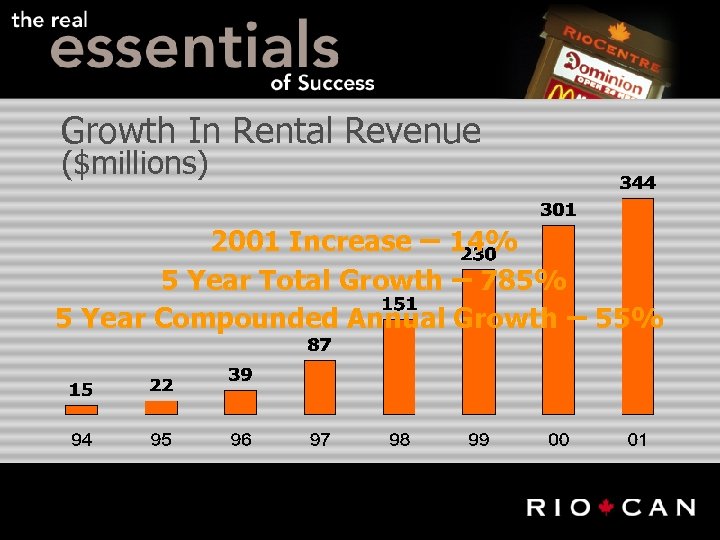

Growth In Rental Revenue ($millions) 2001 Increase – 14% 5 Year Total Growth – 785% 5 Year Compounded Annual Growth – 55%

Growth In Rental Revenue ($millions) 2001 Increase – 14% 5 Year Total Growth – 785% 5 Year Compounded Annual Growth – 55%

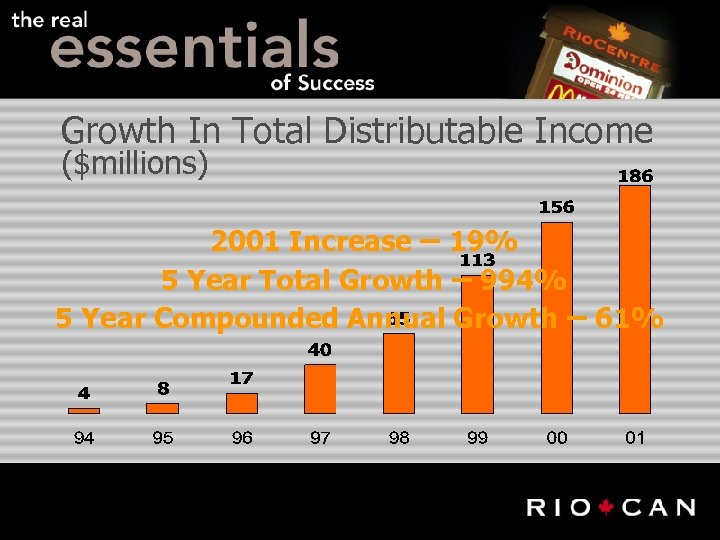

Growth In Total Distributable Income ($millions) 2001 Increase – 19% 5 Year Total Growth – 994% 5 Year Compounded Annual Growth – 61%

Growth In Total Distributable Income ($millions) 2001 Increase – 19% 5 Year Total Growth – 994% 5 Year Compounded Annual Growth – 61%

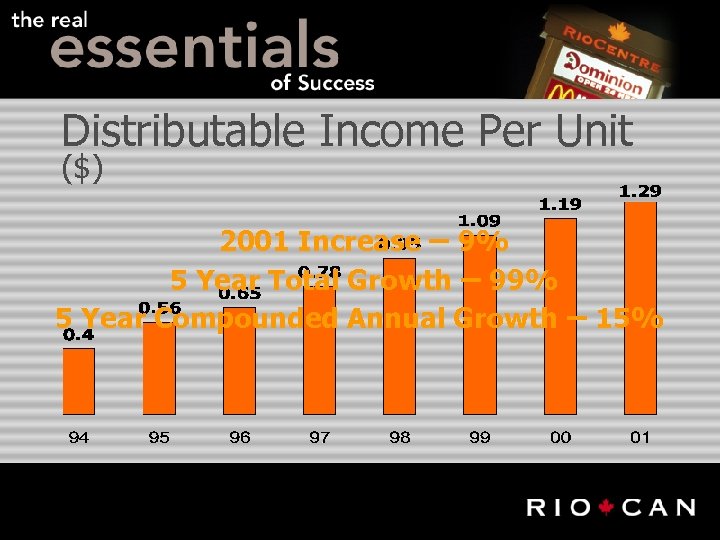

Distributable Income Per Unit ($) 2001 Increase – 9% 5 Year Total Growth – 99% 5 Year Compounded Annual Growth – 15%

Distributable Income Per Unit ($) 2001 Increase – 9% 5 Year Total Growth – 99% 5 Year Compounded Annual Growth – 15%

“Rio. Can’s premium valuation relative to other commercial real estate REITs is warranted for its size, liquidity and proven management. BUY Rio. Can for its diversification, stability and attractive taxefficient current yield. ” - Sam Damiani, CFA TD Newcrest

“Rio. Can’s premium valuation relative to other commercial real estate REITs is warranted for its size, liquidity and proven management. BUY Rio. Can for its diversification, stability and attractive taxefficient current yield. ” - Sam Damiani, CFA TD Newcrest

“With 22 million square feet of gross leaseable area in 144 shopping centres, Rio. Can REIT has become Canada’s ‘brand name’ in retail real estate. We rate Rio. Can’s units Outperform. ” -Neil Downey, CA, CFA RBC Capital Markets

“With 22 million square feet of gross leaseable area in 144 shopping centres, Rio. Can REIT has become Canada’s ‘brand name’ in retail real estate. We rate Rio. Can’s units Outperform. ” -Neil Downey, CA, CFA RBC Capital Markets

“In today’s competitive retail marketplace, Rio. Can’s focus on the value and discount sector, including big-box retailers, has allowed it to outperform the more traditional retail formats. We are maintaining our BUY recommendation. ” -Harry Rannala Raymond James

“In today’s competitive retail marketplace, Rio. Can’s focus on the value and discount sector, including big-box retailers, has allowed it to outperform the more traditional retail formats. We are maintaining our BUY recommendation. ” -Harry Rannala Raymond James

“Rio. Can offers stable income and growth potential with a capable in-house management and a clear shopping centres focus. We rate the units as Buy. ” -Rossa O’Reilly, CFA CIBC World Markets

“Rio. Can offers stable income and growth potential with a capable in-house management and a clear shopping centres focus. We rate the units as Buy. ” -Rossa O’Reilly, CFA CIBC World Markets

“We believe Rio. Can remains among the best operators, with limited competition and strong partners across our coverage universe. We are maintaining our Outperform rating and target price of $13. ” -Ron Rimer, CA BMO Nesbitt Burns Research

“We believe Rio. Can remains among the best operators, with limited competition and strong partners across our coverage universe. We are maintaining our Outperform rating and target price of $13. ” -Ron Rimer, CA BMO Nesbitt Burns Research

“We continue to rate REI an Intermediate -term Buy, and Long-term Strong Buy. We anticipate that investors should earn a low to mid-teens total return over twelve months. ” -Louis Forbes, Director Merrill Lynch

“We continue to rate REI an Intermediate -term Buy, and Long-term Strong Buy. We anticipate that investors should earn a low to mid-teens total return over twelve months. ” -Louis Forbes, Director Merrill Lynch

§ Assets of $2. 8 billion. § Almost 150 shopping centres. § $400 million gross revenue. § 3, 500 tenants. § 23 million square feet of retail.

§ Assets of $2. 8 billion. § Almost 150 shopping centres. § $400 million gross revenue. § 3, 500 tenants. § 23 million square feet of retail.

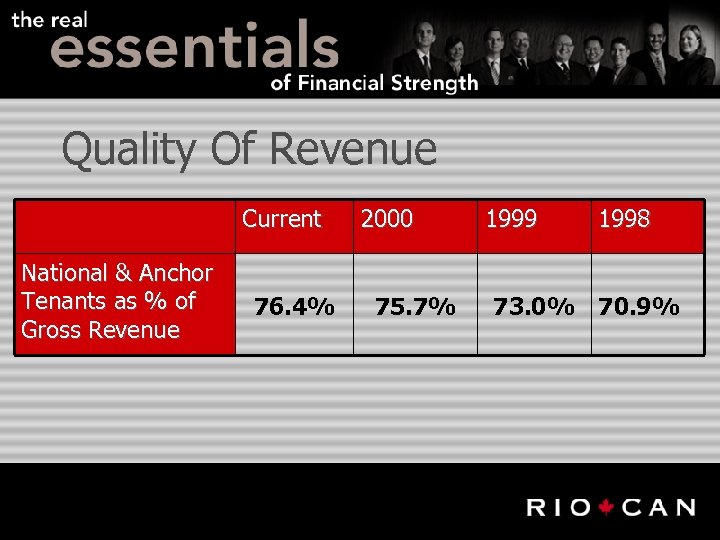

Quality Of Revenue Current National & Anchor Tenants as % of Gross Revenue 76. 4% 2000 75. 7% 1999 1998 73. 0% 70. 9%

Quality Of Revenue Current National & Anchor Tenants as % of Gross Revenue 76. 4% 2000 75. 7% 1999 1998 73. 0% 70. 9%

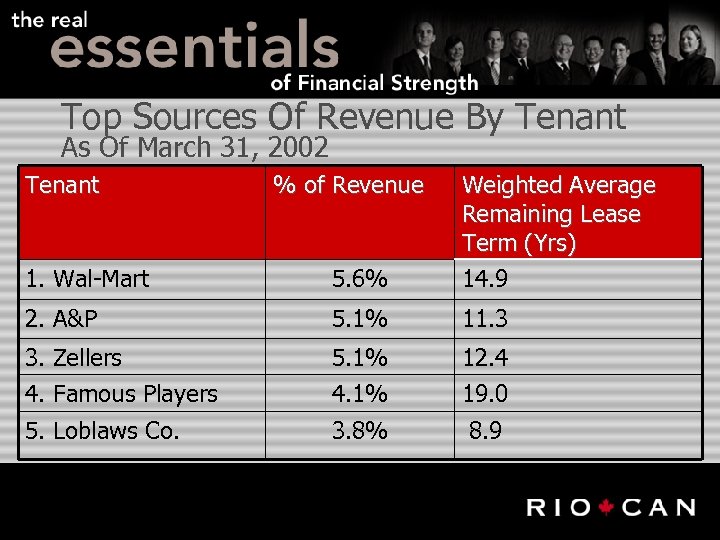

Top Sources Of Revenue By Tenant As Of March 31, 2002 Tenant % of Revenue 1. Wal-Mart 5. 6% Weighted Average Remaining Lease Term (Yrs) 14. 9 2. A&P 5. 1% 11. 3 3. Zellers 4. Famous Players 5. 1% 4. 1% 12. 4 19. 0 5. Loblaws Co. 3. 8% 8. 9

Top Sources Of Revenue By Tenant As Of March 31, 2002 Tenant % of Revenue 1. Wal-Mart 5. 6% Weighted Average Remaining Lease Term (Yrs) 14. 9 2. A&P 5. 1% 11. 3 3. Zellers 4. Famous Players 5. 1% 4. 1% 12. 4 19. 0 5. Loblaws Co. 3. 8% 8. 9

Future Growth § Acquisitions. § New Developments. § Redevelopments. § Generate more income from existing assets.

Future Growth § Acquisitions. § New Developments. § Redevelopments. § Generate more income from existing assets.

Future Growth – Acquisitions

Future Growth – Acquisitions

§ Acquisition of close to $1 billion in 2002.

§ Acquisition of close to $1 billion in 2002.

Future Growth – Acquisitions § 2. 5 million square feet. § $354 million. § 1. 3 million square feet.

Future Growth – Acquisitions § 2. 5 million square feet. § $354 million. § 1. 3 million square feet.

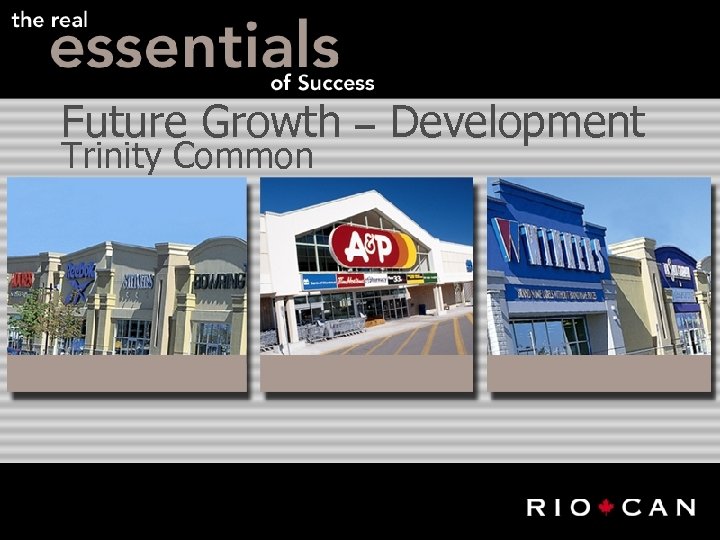

Future Growth Trinity Common – Development

Future Growth Trinity Common – Development

Future Growth – Development Rio. Centre Newmarket

Future Growth – Development Rio. Centre Newmarket

Future Growth Rio. Centre Oakville – Development

Future Growth Rio. Centre Oakville – Development

Future Growth – Development

Future Growth – Development

Future Growth Marketplace – Development

Future Growth Marketplace – Development

Future Growth – Development ü 7 new projects. ü 1. 2 million square feet.

Future Growth – Development ü 7 new projects. ü 1. 2 million square feet.

Future Growth – Development Newmarket § 400, 000 square feet § Loblaws and Costco Dufferin & Steeles § 250, 000 square feet § Loblaws

Future Growth – Development Newmarket § 400, 000 square feet § Loblaws and Costco Dufferin & Steeles § 250, 000 square feet § Loblaws

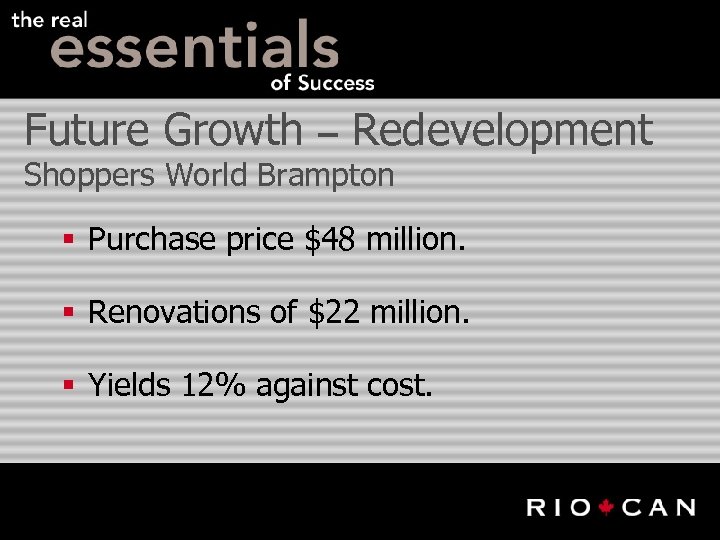

Shoppers World Brampton

Shoppers World Brampton

Shoppers World Brampton

Shoppers World Brampton

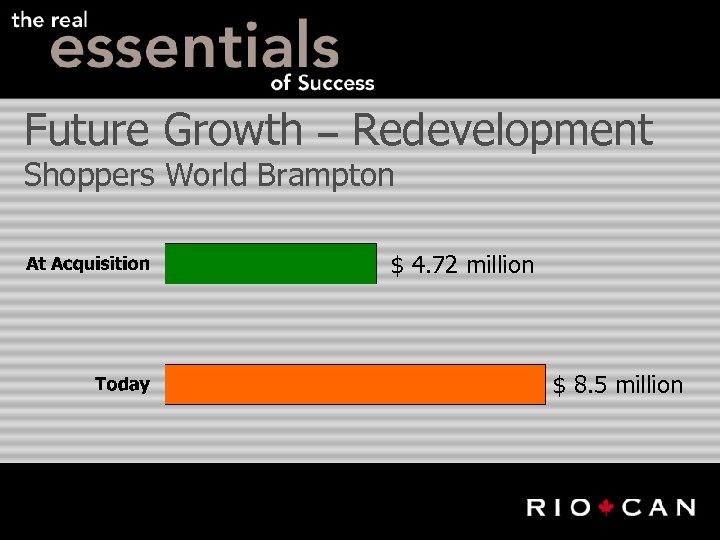

Future Growth – Redevelopment Shoppers World Brampton $ 4. 72 million $ 8. 5 million

Future Growth – Redevelopment Shoppers World Brampton $ 4. 72 million $ 8. 5 million

Future Growth – Redevelopment Shoppers World Brampton § Purchase price $48 million. § Renovations of $22 million. § Yields 12% against cost.

Future Growth – Redevelopment Shoppers World Brampton § Purchase price $48 million. § Renovations of $22 million. § Yields 12% against cost.

Future Growth – Joint Venture

Future Growth – Joint Venture

Kimco § 40 years of operation. § 525+ shopping centres. § In 41 states and Canada. § 70 million square feet of retail space.

Kimco § 40 years of operation. § 525+ shopping centres. § In 41 states and Canada. § 70 million square feet of retail space.

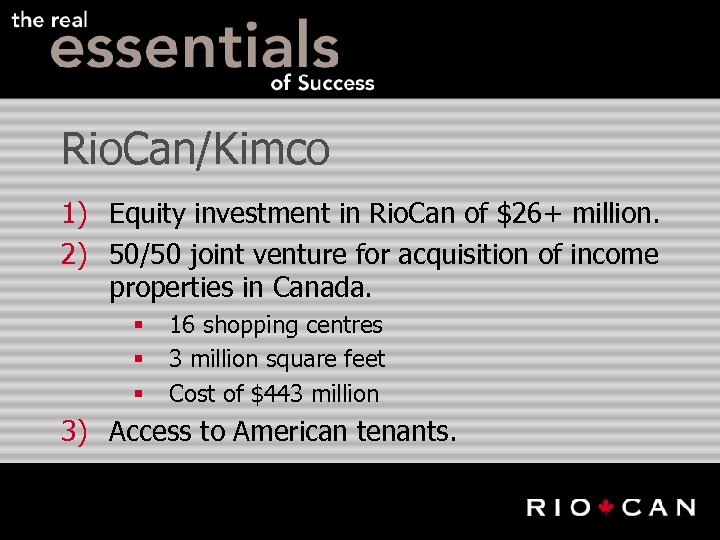

Rio. Can/Kimco 1) Equity investment in Rio. Can of $26+ million. 2) 50/50 joint venture for acquisition of income properties in Canada. § § § 16 shopping centres 3 million square feet Cost of $443 million 3) Access to American tenants.

Rio. Can/Kimco 1) Equity investment in Rio. Can of $26+ million. 2) 50/50 joint venture for acquisition of income properties in Canada. § § § 16 shopping centres 3 million square feet Cost of $443 million 3) Access to American tenants.

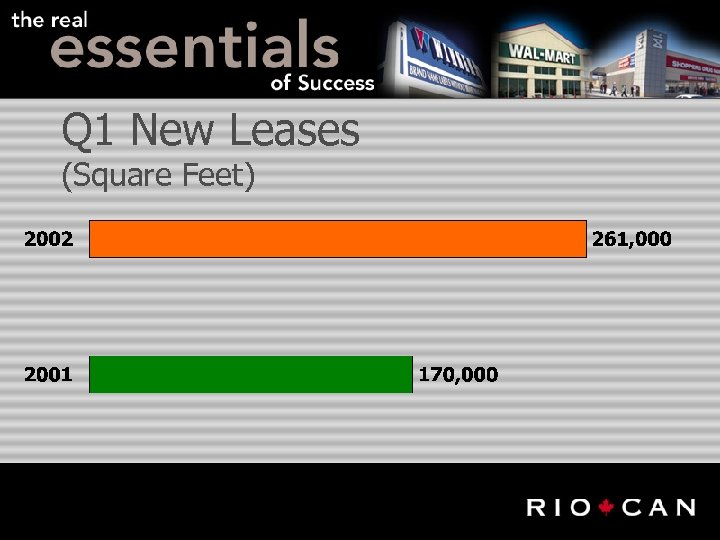

Q 1 New Leases (Square Feet)

Q 1 New Leases (Square Feet)

Rio. Can – Last Year Total Annual Return 30. 41%

Rio. Can – Last Year Total Annual Return 30. 41%

Rio. Can – This Year Total Annual Return 36. 35%

Rio. Can – This Year Total Annual Return 36. 35%

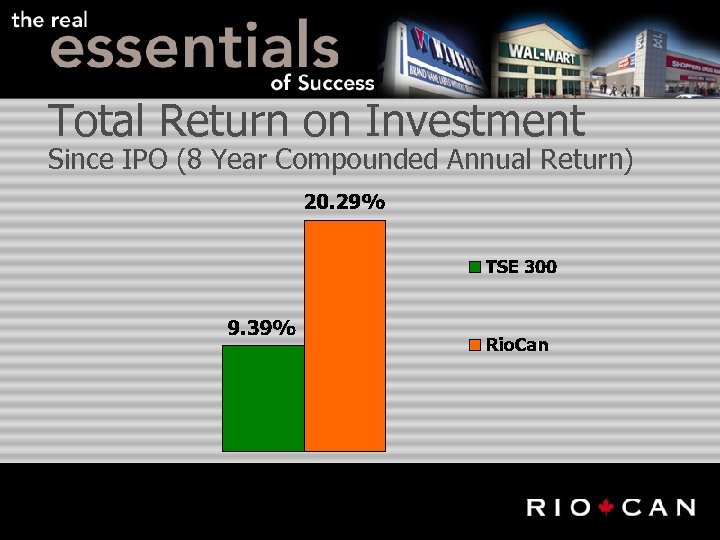

Total Return on Investment Since IPO (8 Year Compounded Annual Return) 20. 29%

Total Return on Investment Since IPO (8 Year Compounded Annual Return) 20. 29%

Total Return on Investment Since IPO (8 Year Compounded Annual Return)

Total Return on Investment Since IPO (8 Year Compounded Annual Return)