6b0db980a79e46066f46e840ff7ee230.ppt

- Количество слайдов: 40

The Parker Ranch installation in Hawaii Effective Models for Leveraging Public Financing for Renewable Energy and Energy Efficiency Financing Program Support for ARRA Recipients AUGUST 4, 2010

The Parker Ranch installation in Hawaii Effective Models for Leveraging Public Financing for Renewable Energy and Energy Efficiency Financing Program Support for ARRA Recipients AUGUST 4, 2010

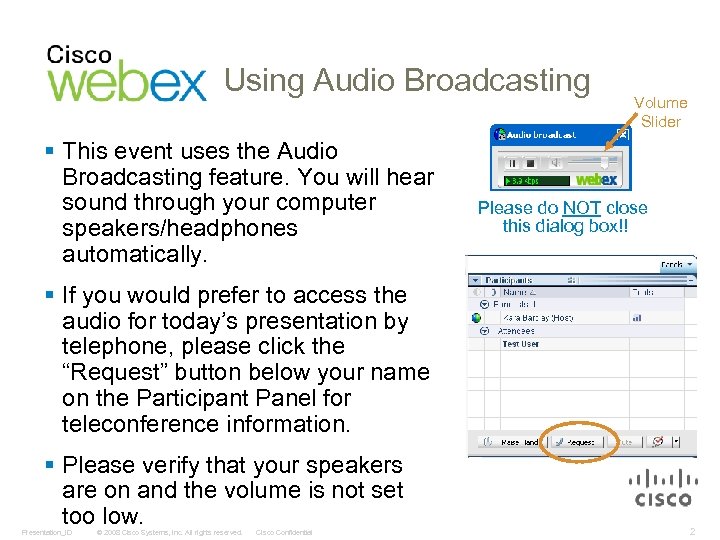

Using Audio Broadcasting § This event uses the Audio Broadcasting feature. You will hear sound through your computer speakers/headphones automatically. Volume Slider Please do NOT close this dialog box!! § If you would prefer to access the audio for today’s presentation by telephone, please click the “Request” button below your name on the Participant Panel for teleconference information. § Please verify that your speakers are on and the volume is not set too low. Presentation_ID © 2008 Cisco Systems, Inc. All rights reserved. Cisco Confidential 2

Using Audio Broadcasting § This event uses the Audio Broadcasting feature. You will hear sound through your computer speakers/headphones automatically. Volume Slider Please do NOT close this dialog box!! § If you would prefer to access the audio for today’s presentation by telephone, please click the “Request” button below your name on the Participant Panel for teleconference information. § Please verify that your speakers are on and the volume is not set too low. Presentation_ID © 2008 Cisco Systems, Inc. All rights reserved. Cisco Confidential 2

Welcome! A few housekeeping notes… • All participants are muted. Use chat window to ask questions throughout the session. • If you have technical difficulties, please type issue into the chat window. • Slides and audio will be available a few days after the webinar at this link: http: //www. eecbg. energy. gov/solutioncenter/webcasts/ Slide 3

Welcome! A few housekeeping notes… • All participants are muted. Use chat window to ask questions throughout the session. • If you have technical difficulties, please type issue into the chat window. • Slides and audio will be available a few days after the webinar at this link: http: //www. eecbg. energy. gov/solutioncenter/webcasts/ Slide 3

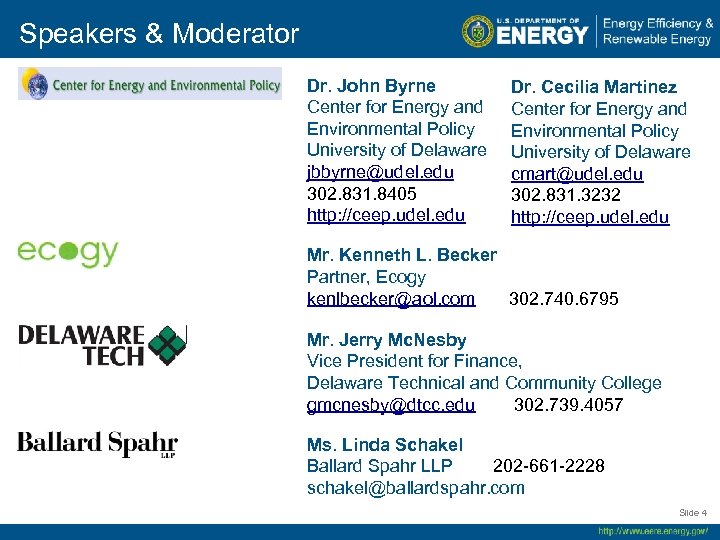

Speakers & Moderator Dr. John Byrne Center for Energy and Environmental Policy University of Delaware jbbyrne@udel. edu 302. 831. 8405 http: //ceep. udel. edu Dr. Cecilia Martinez Center for Energy and Environmental Policy University of Delaware cmart@udel. edu 302. 831. 3232 http: //ceep. udel. edu Mr. Kenneth L. Becker Partner, Ecogy kenlbecker@aol. com 302. 740. 6795 Mr. Jerry Mc. Nesby Vice President for Finance, Delaware Technical and Community College gmcnesby@dtcc. edu 302. 739. 4057 Ms. Linda Schakel Ballard Spahr LLP 202 -661 -2228 schakel@ballardspahr. com Slide 4

Speakers & Moderator Dr. John Byrne Center for Energy and Environmental Policy University of Delaware jbbyrne@udel. edu 302. 831. 8405 http: //ceep. udel. edu Dr. Cecilia Martinez Center for Energy and Environmental Policy University of Delaware cmart@udel. edu 302. 831. 3232 http: //ceep. udel. edu Mr. Kenneth L. Becker Partner, Ecogy kenlbecker@aol. com 302. 740. 6795 Mr. Jerry Mc. Nesby Vice President for Finance, Delaware Technical and Community College gmcnesby@dtcc. edu 302. 739. 4057 Ms. Linda Schakel Ballard Spahr LLP 202 -661 -2228 schakel@ballardspahr. com Slide 4

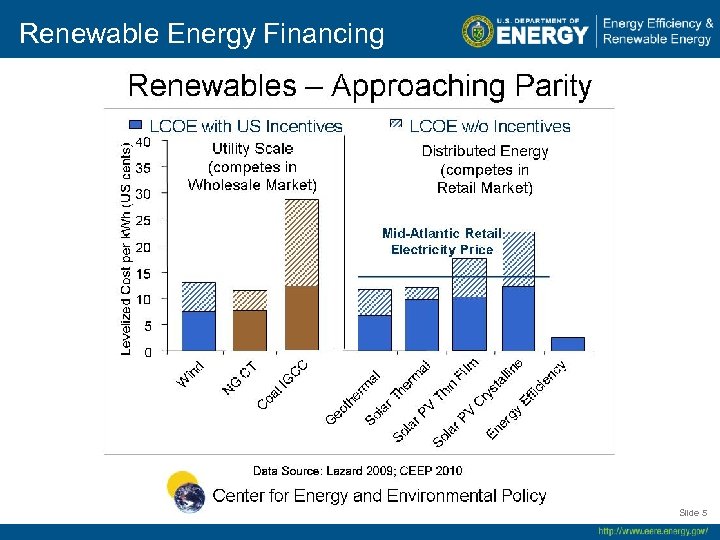

Renewable Energy Financing Slide 5

Renewable Energy Financing Slide 5

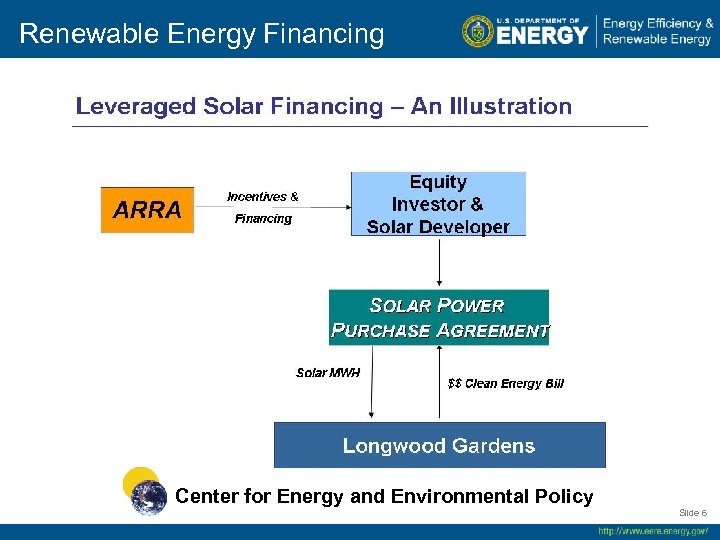

Renewable Energy Financing Center for Energy and Environmental Policy Slide 6

Renewable Energy Financing Center for Energy and Environmental Policy Slide 6

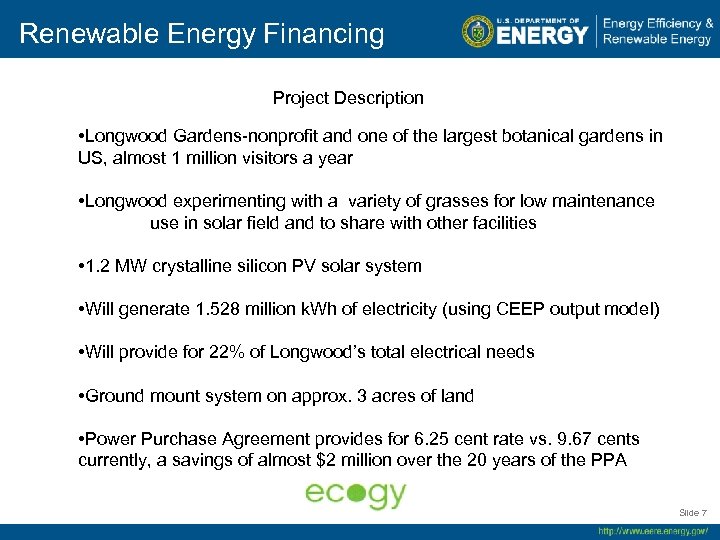

Renewable Energy Financing Project Description • Longwood Gardens-nonprofit and one of the largest botanical gardens in US, almost 1 million visitors a year • Longwood experimenting with a variety of grasses for low maintenance use in solar field and to share with other facilities • 1. 2 MW crystalline silicon PV solar system • Will generate 1. 528 million k. Wh of electricity (using CEEP output model) • Will provide for 22% of Longwood’s total electrical needs • Ground mount system on approx. 3 acres of land • Power Purchase Agreement provides for 6. 25 cent rate vs. 9. 67 cents currently, a savings of almost $2 million over the 20 years of the PPA Slide 7

Renewable Energy Financing Project Description • Longwood Gardens-nonprofit and one of the largest botanical gardens in US, almost 1 million visitors a year • Longwood experimenting with a variety of grasses for low maintenance use in solar field and to share with other facilities • 1. 2 MW crystalline silicon PV solar system • Will generate 1. 528 million k. Wh of electricity (using CEEP output model) • Will provide for 22% of Longwood’s total electrical needs • Ground mount system on approx. 3 acres of land • Power Purchase Agreement provides for 6. 25 cent rate vs. 9. 67 cents currently, a savings of almost $2 million over the 20 years of the PPA Slide 7

Renewable Energy Financing EQUITY INVESTOR AND SOLAR DEVELOPER • Ecogy is the equity investor, solar developer, and third party owner • Ecogy is a privately held venture capital firm that specializes in solar energy development and ownership • Experience in project finance and commodities trading • Brings both the equity and the debt financing to the project • Third party owners can monetize the tax benefits for use in the project Slide 8

Renewable Energy Financing EQUITY INVESTOR AND SOLAR DEVELOPER • Ecogy is the equity investor, solar developer, and third party owner • Ecogy is a privately held venture capital firm that specializes in solar energy development and ownership • Experience in project finance and commodities trading • Brings both the equity and the debt financing to the project • Third party owners can monetize the tax benefits for use in the project Slide 8

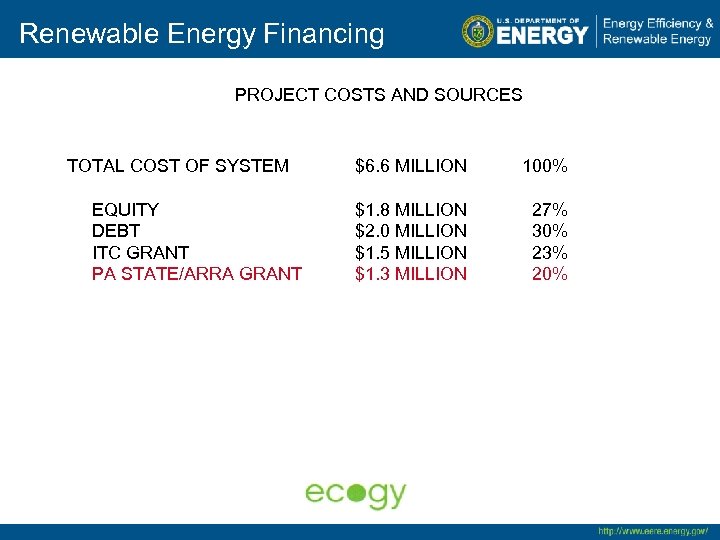

Renewable Energy Financing PROJECT COSTS AND SOURCES TOTAL COST OF SYSTEM $6. 6 MILLION 100% EQUITY DEBT ITC GRANT PA STATE/ARRA GRANT $1. 8 MILLION 27% $2. 0 MILLION 30% $1. 5 MILLION 23% $1. 3 MILLION 20%

Renewable Energy Financing PROJECT COSTS AND SOURCES TOTAL COST OF SYSTEM $6. 6 MILLION 100% EQUITY DEBT ITC GRANT PA STATE/ARRA GRANT $1. 8 MILLION 27% $2. 0 MILLION 30% $1. 5 MILLION 23% $1. 3 MILLION 20%

Renewable Energy Financing LEVERAGE CREATED • The PA State/ ARRA Grant simply made the project feasible • Grant Leverage Included the Following: • Made the project work by leveling technology costs • Allowed a sufficient return on equity to attract an equity investor • Allowed for a proper loan to value to attract a debt source • Allowed for a below market energy cost to the non-profit • Created enough leveling in the finance structure to make SRECs risk acceptable

Renewable Energy Financing LEVERAGE CREATED • The PA State/ ARRA Grant simply made the project feasible • Grant Leverage Included the Following: • Made the project work by leveling technology costs • Allowed a sufficient return on equity to attract an equity investor • Allowed for a proper loan to value to attract a debt source • Allowed for a below market energy cost to the non-profit • Created enough leveling in the finance structure to make SRECs risk acceptable

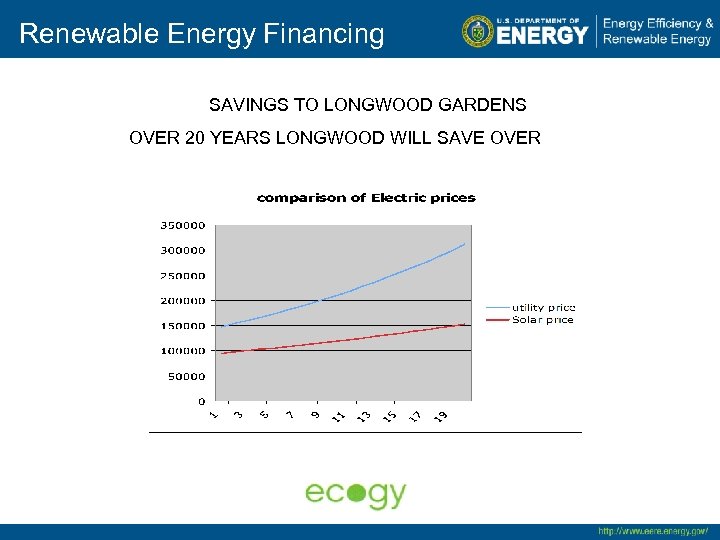

Renewable Energy Financing SAVINGS TO LONGWOOD GARDENS OVER 20 YEARS LONGWOOD WILL SAVE OVER

Renewable Energy Financing SAVINGS TO LONGWOOD GARDENS OVER 20 YEARS LONGWOOD WILL SAVE OVER

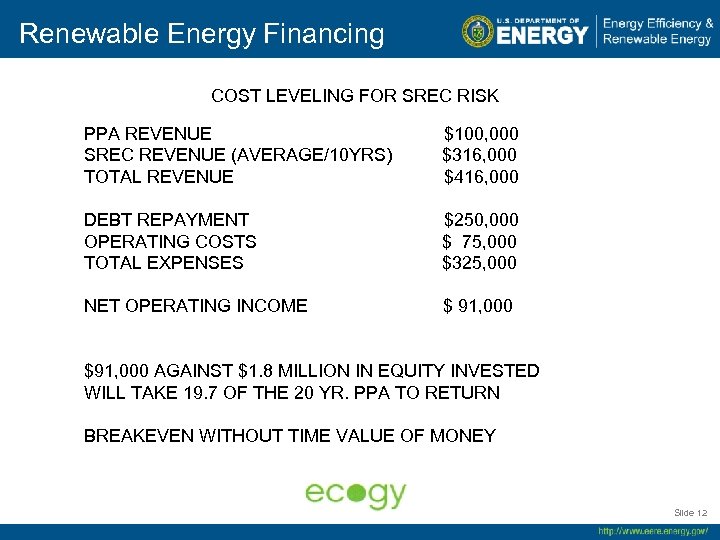

Renewable Energy Financing COST LEVELING FOR SREC RISK PPA REVENUE $100, 000 SREC REVENUE (AVERAGE/10 YRS) $316, 000 TOTAL REVENUE $416, 000 DEBT REPAYMENT $250, 000 OPERATING COSTS $ 75, 000 TOTAL EXPENSES $325, 000 NET OPERATING INCOME $ 91, 000 $91, 000 AGAINST $1. 8 MILLION IN EQUITY INVESTED WILL TAKE 19. 7 OF THE 20 YR. PPA TO RETURN BREAKEVEN WITHOUT TIME VALUE OF MONEY Slide 12

Renewable Energy Financing COST LEVELING FOR SREC RISK PPA REVENUE $100, 000 SREC REVENUE (AVERAGE/10 YRS) $316, 000 TOTAL REVENUE $416, 000 DEBT REPAYMENT $250, 000 OPERATING COSTS $ 75, 000 TOTAL EXPENSES $325, 000 NET OPERATING INCOME $ 91, 000 $91, 000 AGAINST $1. 8 MILLION IN EQUITY INVESTED WILL TAKE 19. 7 OF THE 20 YR. PPA TO RETURN BREAKEVEN WITHOUT TIME VALUE OF MONEY Slide 12

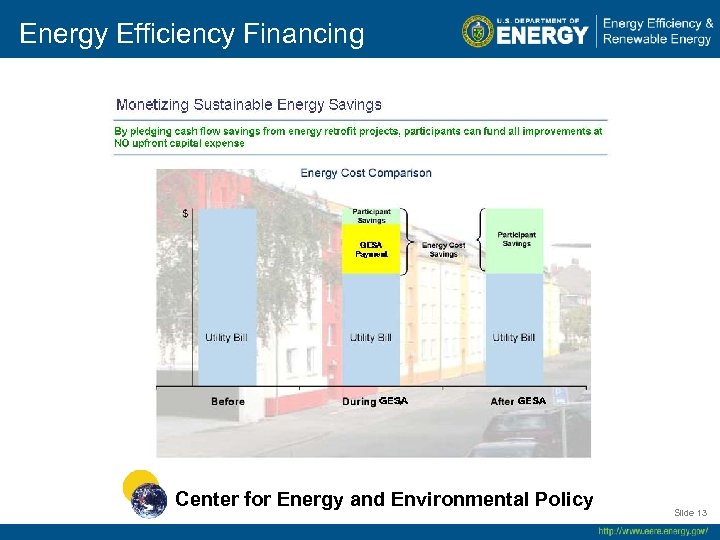

Energy Efficiency Financing Center for Energy and Environmental Policy Slide 13

Energy Efficiency Financing Center for Energy and Environmental Policy Slide 13

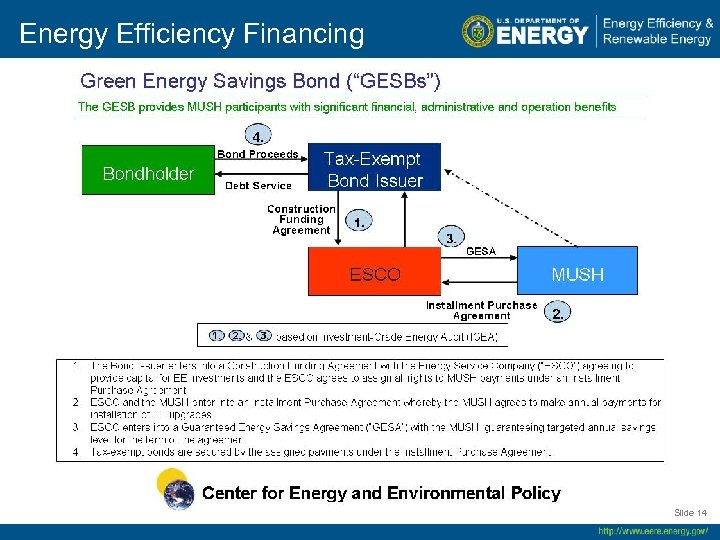

Energy Efficiency Financing Slide 14

Energy Efficiency Financing Slide 14

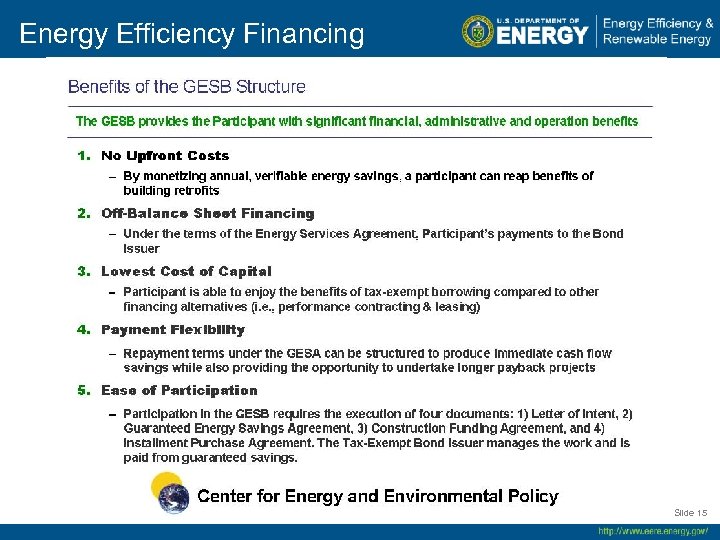

Energy Efficiency Financing Slide 15

Energy Efficiency Financing Slide 15

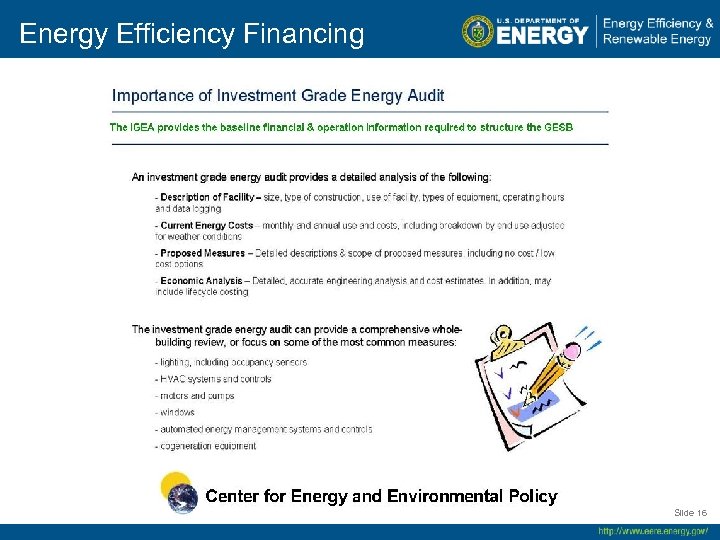

Energy Efficiency Financing Slide 16

Energy Efficiency Financing Slide 16

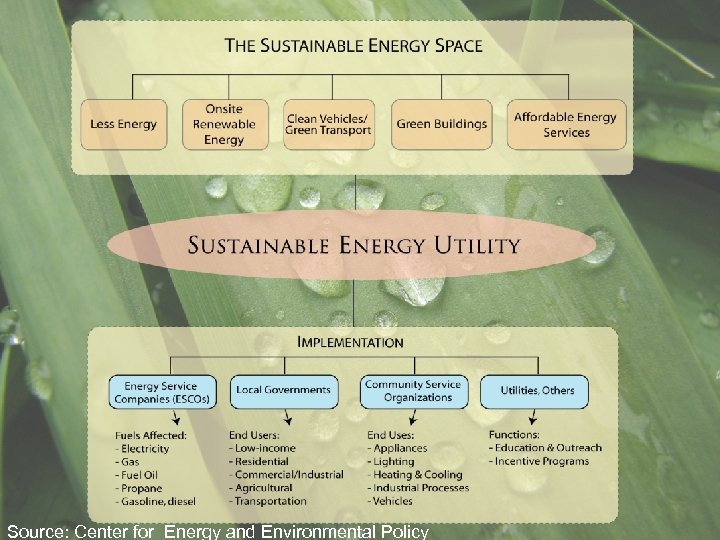

Source: Center for Energy and Environmental Policy

Source: Center for Energy and Environmental Policy

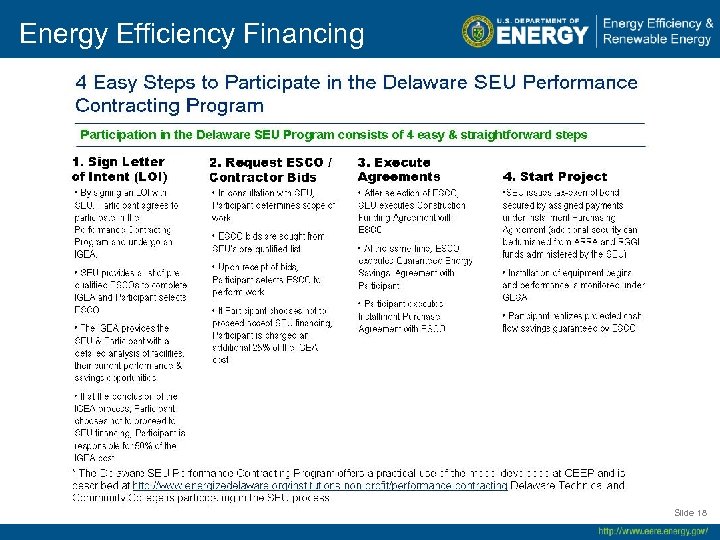

Energy Efficiency Financing Slide 18

Energy Efficiency Financing Slide 18

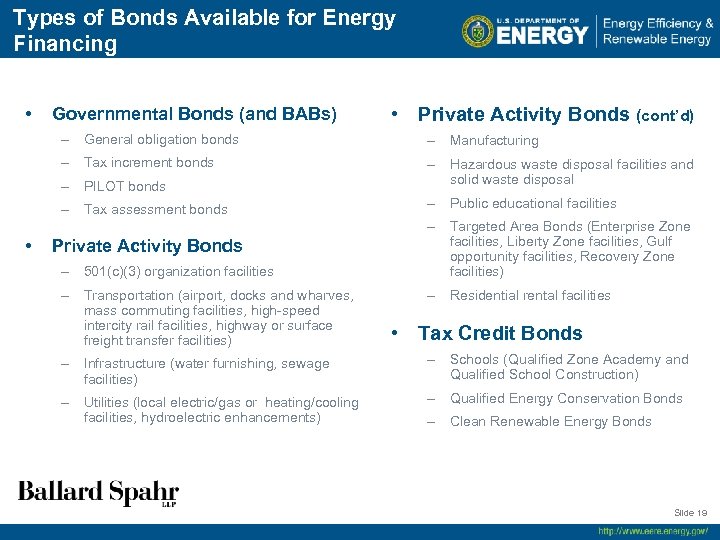

Types of Bonds Available for Energy Financing • • Private Activity Bonds (cont’d) Governmental Bonds (and BABs) – General obligation bonds – Tax increment bonds – PILOT bonds – Hazardous waste disposal facilities and solid waste disposal – Tax assessment bonds • – Manufacturing – Public educational facilities – Targeted Area Bonds (Enterprise Zone facilities, Liberty Zone facilities, Gulf opportunity facilities, Recovery Zone facilities) Private Activity Bonds – 501(c)(3) organization facilities – Transportation (airport, docks and wharves, mass commuting facilities, high-speed intercity rail facilities, highway or surface freight transfer facilities) – Residential rental facilities • Tax Credit Bonds – Infrastructure (water furnishing, sewage facilities) – Schools (Qualified Zone Academy and Qualified School Construction) – Utilities (local electric/gas or heating/cooling facilities, hydroelectric enhancements) – Qualified Energy Conservation Bonds – Clean Renewable Energy Bonds Slide 19

Types of Bonds Available for Energy Financing • • Private Activity Bonds (cont’d) Governmental Bonds (and BABs) – General obligation bonds – Tax increment bonds – PILOT bonds – Hazardous waste disposal facilities and solid waste disposal – Tax assessment bonds • – Manufacturing – Public educational facilities – Targeted Area Bonds (Enterprise Zone facilities, Liberty Zone facilities, Gulf opportunity facilities, Recovery Zone facilities) Private Activity Bonds – 501(c)(3) organization facilities – Transportation (airport, docks and wharves, mass commuting facilities, high-speed intercity rail facilities, highway or surface freight transfer facilities) – Residential rental facilities • Tax Credit Bonds – Infrastructure (water furnishing, sewage facilities) – Schools (Qualified Zone Academy and Qualified School Construction) – Utilities (local electric/gas or heating/cooling facilities, hydroelectric enhancements) – Qualified Energy Conservation Bonds – Clean Renewable Energy Bonds Slide 19

Governmental Bonds • Governmental Bonds (and BABs) – General obligation bonds – Tax increment bonds – PILOT bonds – Tax assessment bonds Slide 20

Governmental Bonds • Governmental Bonds (and BABs) – General obligation bonds – Tax increment bonds – PILOT bonds – Tax assessment bonds Slide 20

General Increased Market Access • Bank Qualified Bonds – Increase limit for 2009 and 2010 to permit $30 million per year by issuer that are not subject to interest expense disallowance – Plus permit banks to have up to 2% of total assets in bonds issued in 2009 and 2010 that are not subject to interest expense disallowance – 501(c)(3) organizations have their own $30 million Slide 21

General Increased Market Access • Bank Qualified Bonds – Increase limit for 2009 and 2010 to permit $30 million per year by issuer that are not subject to interest expense disallowance – Plus permit banks to have up to 2% of total assets in bonds issued in 2009 and 2010 that are not subject to interest expense disallowance – 501(c)(3) organizations have their own $30 million Slide 21

Build America Bonds • Build America Bonds – New taxable tax credit bond for general governmental purposes – Taxable interest + 35% tax credit to bondholder OR – Taxable interest to bondholder, 35% cash payment to issuer – Rates and maturity determined by market – No limit on amount of bonds that can be issued Slide 22

Build America Bonds • Build America Bonds – New taxable tax credit bond for general governmental purposes – Taxable interest + 35% tax credit to bondholder OR – Taxable interest to bondholder, 35% cash payment to issuer – Rates and maturity determined by market – No limit on amount of bonds that can be issued Slide 22

Build America Bonds • Build America Bonds – Must be issued in 2009 or 2010 – Qualified purposes = anything that could be financed with a governmental tax-exempt bond Slide 23

Build America Bonds • Build America Bonds – Must be issued in 2009 or 2010 – Qualified purposes = anything that could be financed with a governmental tax-exempt bond Slide 23

General Provisions for Tax Credit Bonds • Tax Credit Bonds Are Taxable Bonds – Different market than tax-exempt bonds – Marketable to pension funds and nonprofits – Tax Credit Version; Bondholder receives return as credit against its federal tax liability – no cash interest payment from issuer – Direct Subsidy Version: Bondholder receives taxable interest and issuer receives payment from IRS Slide 24

General Provisions for Tax Credit Bonds • Tax Credit Bonds Are Taxable Bonds – Different market than tax-exempt bonds – Marketable to pension funds and nonprofits – Tax Credit Version; Bondholder receives return as credit against its federal tax liability – no cash interest payment from issuer – Direct Subsidy Version: Bondholder receives taxable interest and issuer receives payment from IRS Slide 24

General Provisions for Tax Credit Bonds – Credit rate established by US Treasury and published daily – Credit rate currently in the 5. 20 – 5. 45% range – Direct Subsidy equal to lesser of (A) taxable interest on bonds or (b) interest paid at applicable tax credit rate Slide 25

General Provisions for Tax Credit Bonds – Credit rate established by US Treasury and published daily – Credit rate currently in the 5. 20 – 5. 45% range – Direct Subsidy equal to lesser of (A) taxable interest on bonds or (b) interest paid at applicable tax credit rate Slide 25

General Provisions for Tax Credit Bonds • Maturity of Tax Credit Bonds – Set by US Treasury for month, published daily – Current maturity limit is 17 years Slide 26

General Provisions for Tax Credit Bonds • Maturity of Tax Credit Bonds – Set by US Treasury for month, published daily – Current maturity limit is 17 years Slide 26

General Provisions for Tax Credit Bonds • Principal Repayment – Tax rules will permit issuer to set up sinking fund, and apply investment earnings if fund with equal annual sinking fund installments that build up with earnings to amount not in excess of what needed at maturity – Yield restriction on sinking fund investments (currently 4. 33%) Slide 27

General Provisions for Tax Credit Bonds • Principal Repayment – Tax rules will permit issuer to set up sinking fund, and apply investment earnings if fund with equal annual sinking fund installments that build up with earnings to amount not in excess of what needed at maturity – Yield restriction on sinking fund investments (currently 4. 33%) Slide 27

General Provisions for Tax Credit Bonds • Spending Bond Proceeds – 100% of proceeds, including investment earnings, must be spent on qualified purposes within 3 years of issuing bonds – Unspent bond proceeds at end of 3 years must be used to redeem bonds, unless IRS extends spending period – Up to 2% of proceeds can be used to pay costs of issuance – None of proceeds can be used for a reserve fund Slide 28

General Provisions for Tax Credit Bonds • Spending Bond Proceeds – 100% of proceeds, including investment earnings, must be spent on qualified purposes within 3 years of issuing bonds – Unspent bond proceeds at end of 3 years must be used to redeem bonds, unless IRS extends spending period – Up to 2% of proceeds can be used to pay costs of issuance – None of proceeds can be used for a reserve fund Slide 28

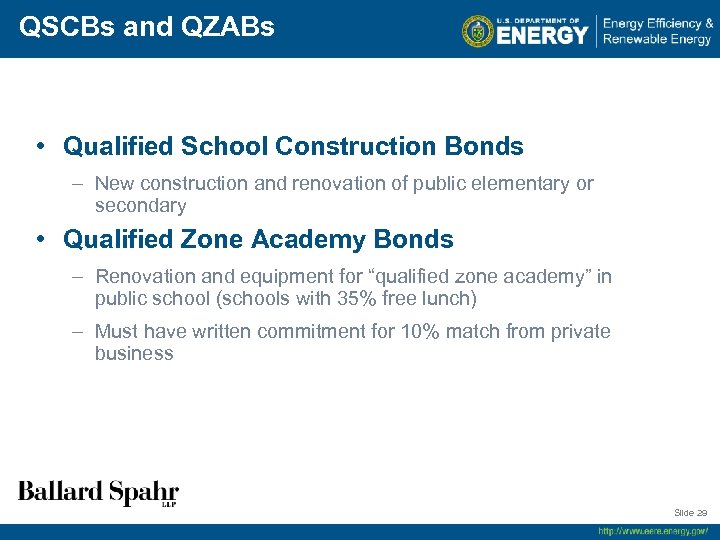

QSCBs and QZABs • Qualified School Construction Bonds – New construction and renovation of public elementary or secondary • Qualified Zone Academy Bonds – Renovation and equipment for “qualified zone academy” in public school (schools with 35% free lunch) – Must have written commitment for 10% match from private business Slide 29

QSCBs and QZABs • Qualified School Construction Bonds – New construction and renovation of public elementary or secondary • Qualified Zone Academy Bonds – Renovation and equipment for “qualified zone academy” in public school (schools with 35% free lunch) – Must have written commitment for 10% match from private business Slide 29

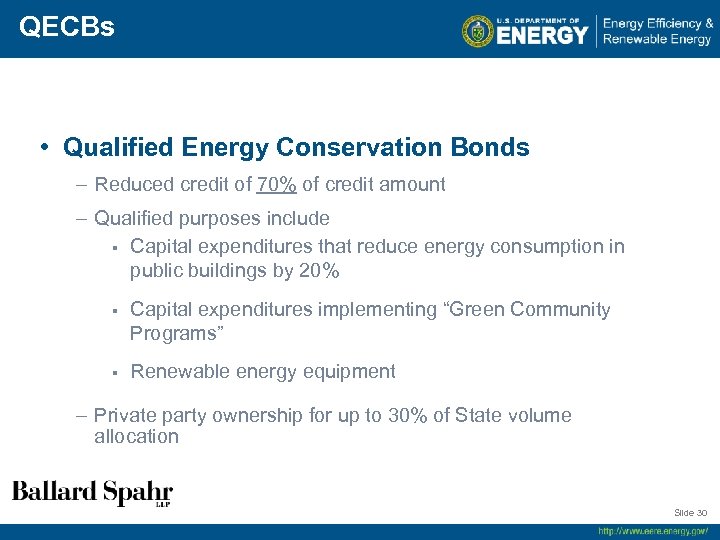

QECBs • Qualified Energy Conservation Bonds – Reduced credit of 70% of credit amount – Qualified purposes include § Capital expenditures that reduce energy consumption in public buildings by 20% § Capital expenditures implementing “Green Community Programs” § Renewable energy equipment – Private party ownership for up to 30% of State volume allocation Slide 30

QECBs • Qualified Energy Conservation Bonds – Reduced credit of 70% of credit amount – Qualified purposes include § Capital expenditures that reduce energy consumption in public buildings by 20% § Capital expenditures implementing “Green Community Programs” § Renewable energy equipment – Private party ownership for up to 30% of State volume allocation Slide 30

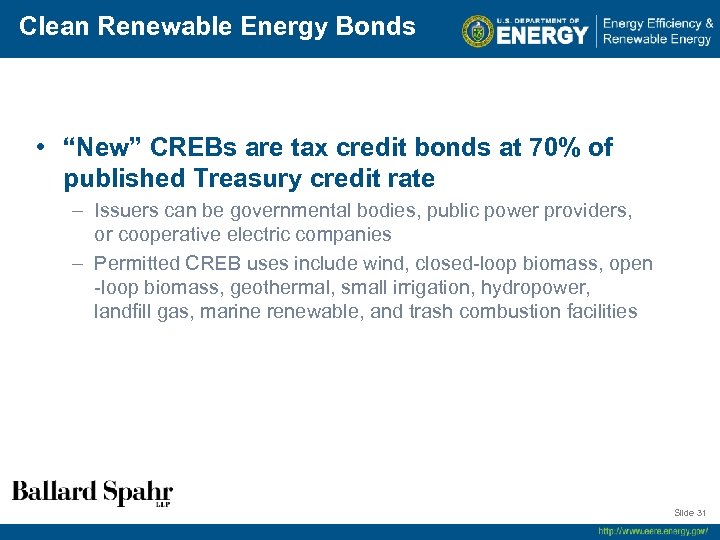

Clean Renewable Energy Bonds • “New” CREBs are tax credit bonds at 70% of published Treasury credit rate – Issuers can be governmental bodies, public power providers, or cooperative electric companies – Permitted CREB uses include wind, closed-loop biomass, open -loop biomass, geothermal, small irrigation, hydropower, landfill gas, marine renewable, and trash combustion facilities Slide 31

Clean Renewable Energy Bonds • “New” CREBs are tax credit bonds at 70% of published Treasury credit rate – Issuers can be governmental bodies, public power providers, or cooperative electric companies – Permitted CREB uses include wind, closed-loop biomass, open -loop biomass, geothermal, small irrigation, hydropower, landfill gas, marine renewable, and trash combustion facilities Slide 31

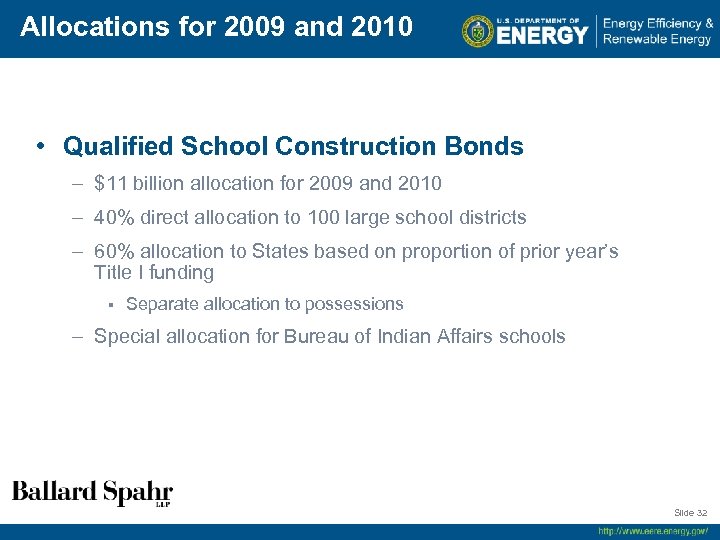

Allocations for 2009 and 2010 • Qualified School Construction Bonds – $11 billion allocation for 2009 and 2010 – 40% direct allocation to 100 large school districts – 60% allocation to States based on proportion of prior year’s Title I funding § Separate allocation to possessions – Special allocation for Bureau of Indian Affairs schools Slide 32

Allocations for 2009 and 2010 • Qualified School Construction Bonds – $11 billion allocation for 2009 and 2010 – 40% direct allocation to 100 large school districts – 60% allocation to States based on proportion of prior year’s Title I funding § Separate allocation to possessions – Special allocation for Bureau of Indian Affairs schools Slide 32

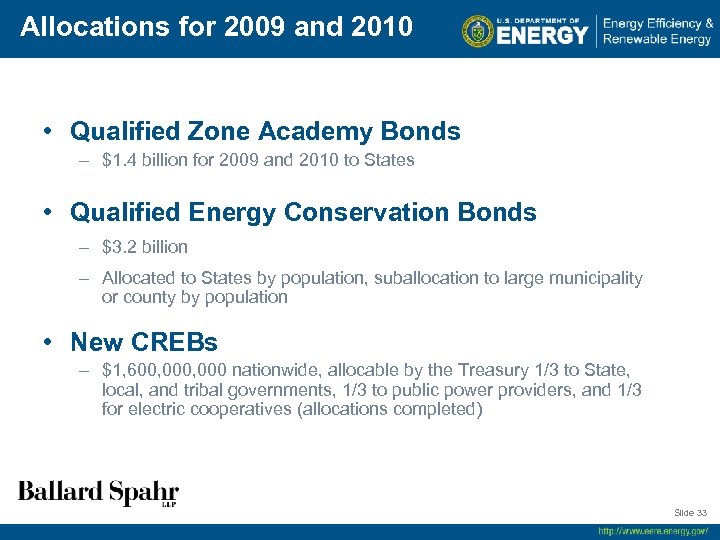

Allocations for 2009 and 2010 • Qualified Zone Academy Bonds – $1. 4 billion for 2009 and 2010 to States • Qualified Energy Conservation Bonds – $3. 2 billion – Allocated to States by population, suballocation to large municipality or county by population • New CREBs – $1, 600, 000 nationwide, allocable by the Treasury 1/3 to State, local, and tribal governments, 1/3 to public power providers, and 1/3 for electric cooperatives (allocations completed) Slide 33

Allocations for 2009 and 2010 • Qualified Zone Academy Bonds – $1. 4 billion for 2009 and 2010 to States • Qualified Energy Conservation Bonds – $3. 2 billion – Allocated to States by population, suballocation to large municipality or county by population • New CREBs – $1, 600, 000 nationwide, allocable by the Treasury 1/3 to State, local, and tribal governments, 1/3 to public power providers, and 1/3 for electric cooperatives (allocations completed) Slide 33

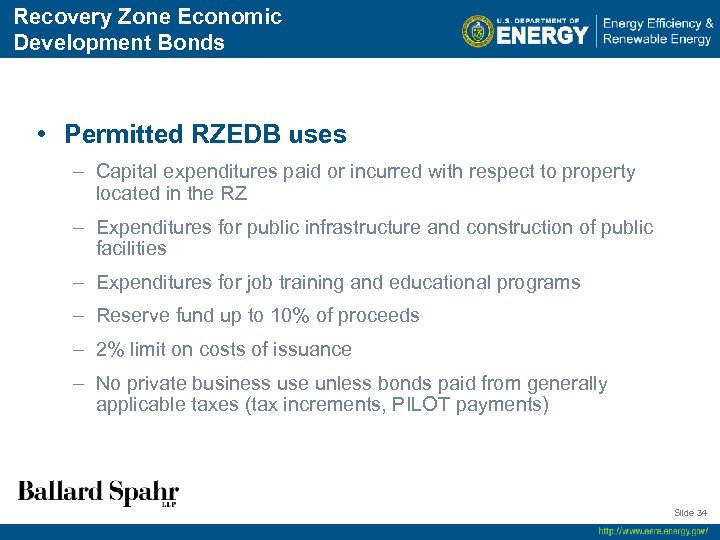

Recovery Zone Economic Development Bonds • Permitted RZEDB uses – Capital expenditures paid or incurred with respect to property located in the RZ – Expenditures for public infrastructure and construction of public facilities – Expenditures for job training and educational programs – Reserve fund up to 10% of proceeds – 2% limit on costs of issuance – No private business use unless bonds paid from generally applicable taxes (tax increments, PILOT payments) Slide 34

Recovery Zone Economic Development Bonds • Permitted RZEDB uses – Capital expenditures paid or incurred with respect to property located in the RZ – Expenditures for public infrastructure and construction of public facilities – Expenditures for job training and educational programs – Reserve fund up to 10% of proceeds – 2% limit on costs of issuance – No private business use unless bonds paid from generally applicable taxes (tax increments, PILOT payments) Slide 34

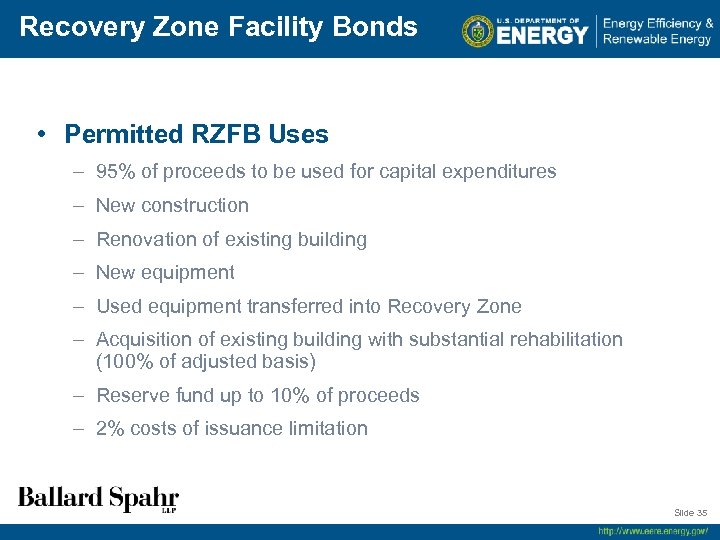

Recovery Zone Facility Bonds • Permitted RZFB Uses – 95% of proceeds to be used for capital expenditures – New construction – Renovation of existing building – New equipment – Used equipment transferred into Recovery Zone – Acquisition of existing building with substantial rehabilitation (100% of adjusted basis) – Reserve fund up to 10% of proceeds – 2% costs of issuance limitation Slide 35

Recovery Zone Facility Bonds • Permitted RZFB Uses – 95% of proceeds to be used for capital expenditures – New construction – Renovation of existing building – New equipment – Used equipment transferred into Recovery Zone – Acquisition of existing building with substantial rehabilitation (100% of adjusted basis) – Reserve fund up to 10% of proceeds – 2% costs of issuance limitation Slide 35

Dr. John Byrne Director, Center for Energy and Environmental Policy University of Delaware Dr. John Byrne is Distinguished Professor of Energy and Climate Policy at the University of Delaware. He is the architect of the Sustainable Energy Utility (SEU), an innovative mechanism for the promotion of public and private investments in energy efficiency, conservation, and distributed renewable energy The SEU enabled Delaware to be the first state to fully deploy ARRA appliance rebate funds. Dr Byrne conceived the investment strategy for the State of Delaware to attract over $25 million in green infrastructure investments for its public building stock through tax-exempt bond financing. He also designed the ‘Sustainable Communities’ program in Delaware that has attracted pledges of more than $15 million in private equity. In addition, through a unique public-private partnership, he helped to develop the SEU is an investor in one of the Mid-Atlantic region’s largest solar power plants, a 10 MW PV plant to be located on a converted brownfield. Dr. Byrne presently co-chairs the SEU oversight Board created by the General Assembly. Slide 36

Dr. John Byrne Director, Center for Energy and Environmental Policy University of Delaware Dr. John Byrne is Distinguished Professor of Energy and Climate Policy at the University of Delaware. He is the architect of the Sustainable Energy Utility (SEU), an innovative mechanism for the promotion of public and private investments in energy efficiency, conservation, and distributed renewable energy The SEU enabled Delaware to be the first state to fully deploy ARRA appliance rebate funds. Dr Byrne conceived the investment strategy for the State of Delaware to attract over $25 million in green infrastructure investments for its public building stock through tax-exempt bond financing. He also designed the ‘Sustainable Communities’ program in Delaware that has attracted pledges of more than $15 million in private equity. In addition, through a unique public-private partnership, he helped to develop the SEU is an investor in one of the Mid-Atlantic region’s largest solar power plants, a 10 MW PV plant to be located on a converted brownfield. Dr. Byrne presently co-chairs the SEU oversight Board created by the General Assembly. Slide 36

Kenneth L. Becker Partner, Ecogy Mr. Becker is founder and a partner of Ecogy and is responsible for structuring the capital aspects of projects. He works with private sector investors, banks, pension funds, and insurance companies to raise equity and debt capital needed for projects. Before founding Ecogy, Mr. Becker was an officer and director of Citigroup Global Markets Inc. for over 25 years. As Head of the Real Estate Group, and a senior member of the Structured and Project Finance groups, he was responsible for innovative financings, successfully structuring nearly $30 billion in capital transactions. He was twice nominated for an Institutional Deal of the Year Award and received an award from the U. S. Conference of Mayors. Prior to joining Citigroup, Mr. Becker received a Presidential appointment to a position in the U. S. Department of Housing and Urban Development and a position in the White House. Mr. Becker has his BA from the University of Delaware and an MA in Urban Affairs from the University of Delaware. Mr. Becker was honored to receive the Distinguished Alumni Award from the President of the University of Delaware. Slide 37

Kenneth L. Becker Partner, Ecogy Mr. Becker is founder and a partner of Ecogy and is responsible for structuring the capital aspects of projects. He works with private sector investors, banks, pension funds, and insurance companies to raise equity and debt capital needed for projects. Before founding Ecogy, Mr. Becker was an officer and director of Citigroup Global Markets Inc. for over 25 years. As Head of the Real Estate Group, and a senior member of the Structured and Project Finance groups, he was responsible for innovative financings, successfully structuring nearly $30 billion in capital transactions. He was twice nominated for an Institutional Deal of the Year Award and received an award from the U. S. Conference of Mayors. Prior to joining Citigroup, Mr. Becker received a Presidential appointment to a position in the U. S. Department of Housing and Urban Development and a position in the White House. Mr. Becker has his BA from the University of Delaware and an MA in Urban Affairs from the University of Delaware. Mr. Becker was honored to receive the Distinguished Alumni Award from the President of the University of Delaware. Slide 37

Jerry Mc. Nesby Vice President Finance for Delaware Technical and Community College. Mr. Mc. Nesby is responsible for the College’s overall financial operations for its four campuses throughout the state with a total operating budget of approx. $170 million. He also oversees the College’s Department of Information & Educational Technology. Mr. Mc. Nesby is currently leading the DTCC’s efforts on the installation of a 1. 5 MW solar generation system through a Power Purchase Agreement and the College’s participation in the Green Energy Savings Bond Program with the Delaware Sustainable Energy Utility Previously Mr. Mc. Nesby was the State of Delaware’s first administrator of the Transportation Trust Fund (1987 -1998), the bond issuing arm of the Delaware Department of Transportation that funds the State’s road projects. Slide 38

Jerry Mc. Nesby Vice President Finance for Delaware Technical and Community College. Mr. Mc. Nesby is responsible for the College’s overall financial operations for its four campuses throughout the state with a total operating budget of approx. $170 million. He also oversees the College’s Department of Information & Educational Technology. Mr. Mc. Nesby is currently leading the DTCC’s efforts on the installation of a 1. 5 MW solar generation system through a Power Purchase Agreement and the College’s participation in the Green Energy Savings Bond Program with the Delaware Sustainable Energy Utility Previously Mr. Mc. Nesby was the State of Delaware’s first administrator of the Transportation Trust Fund (1987 -1998), the bond issuing arm of the Delaware Department of Transportation that funds the State’s road projects. Slide 38

Linda B. Schakel Ballard Spahr LLP Ms. Schakel is a tax partner with Ballard Spahr LLP in Washington, DC, with a focus on tax-exempt bonds, tax credit bonds and New Markets Tax Credits. She served as an attorney adviser in the Office of Tax Policy of the U. S. Treasury with primary responsibility for tax legislative and regulatory projects in the areas of tax-exempt bonds and Low Income Housing, work-opportunity and welfare-to-work tax credits. She is a past president of the National Association of Bond Lawyers. Education Georgetown University Law Center (J. D. 1986, cum laude) University of South Florida (M. S. 1976; Ph. D. 1984) Iowa State University (B. S. 1970, with honors and distinction) Slide 39

Linda B. Schakel Ballard Spahr LLP Ms. Schakel is a tax partner with Ballard Spahr LLP in Washington, DC, with a focus on tax-exempt bonds, tax credit bonds and New Markets Tax Credits. She served as an attorney adviser in the Office of Tax Policy of the U. S. Treasury with primary responsibility for tax legislative and regulatory projects in the areas of tax-exempt bonds and Low Income Housing, work-opportunity and welfare-to-work tax credits. She is a past president of the National Association of Bond Lawyers. Education Georgetown University Law Center (J. D. 1986, cum laude) University of South Florida (M. S. 1976; Ph. D. 1984) Iowa State University (B. S. 1970, with honors and distinction) Slide 39

Resources Send feedback & requests for technical assistance to: Bret Kadison – Financing. Rapid. Response@ee. doe. gov Resource Portal for Financing Programs http: //www. eecbg. energy. gov/solutioncenter/financialproducts/ For further information on the content of this webinar please contact: Dr. John Byrne at jbbyrne@udel. edu Dr. Cecilia Martinez at cmart@udel. edu Slide 40

Resources Send feedback & requests for technical assistance to: Bret Kadison – Financing. Rapid. Response@ee. doe. gov Resource Portal for Financing Programs http: //www. eecbg. energy. gov/solutioncenter/financialproducts/ For further information on the content of this webinar please contact: Dr. John Byrne at jbbyrne@udel. edu Dr. Cecilia Martinez at cmart@udel. edu Slide 40