be1785acc95056851de102305a789eae.ppt

- Количество слайдов: 29

The Option Pit Method Covered Calls, Married Puts and Hedged Combos Option Pit

The Option Pit Method Covered Calls, Married Puts and Hedged Combos Option Pit

Managing Covered Calls, protective puts, collars and risk reversals What we will cover: • Covered call trading • Protective put trading • The collar and the risk reversal

Managing Covered Calls, protective puts, collars and risk reversals What we will cover: • Covered call trading • Protective put trading • The collar and the risk reversal

Managing Covered Calls, protective puts, collars and risk reversals • The Intent of most of these positions is a long term holder of the stock. Not money I want to lose! – Buy Writes are not short term trades! • There are exceptions… when IV is very high.

Managing Covered Calls, protective puts, collars and risk reversals • The Intent of most of these positions is a long term holder of the stock. Not money I want to lose! – Buy Writes are not short term trades! • There are exceptions… when IV is very high.

Managing Covered Calls, protective puts, collars and risk reversals • The position rationale should be the samewould I buy the stock at this level? If the investor is not forced to close, the buy writes usually work out better. • RISK! buy writing high dollars stocks, unless in them for the long term, is a dangerous game- AMZN Are you prepared to own at lower levels?

Managing Covered Calls, protective puts, collars and risk reversals • The position rationale should be the samewould I buy the stock at this level? If the investor is not forced to close, the buy writes usually work out better. • RISK! buy writing high dollars stocks, unless in them for the long term, is a dangerous game- AMZN Are you prepared to own at lower levels?

Managing Covered Calls, protective puts, collars and risk reversals • The best strategy is really stocks that are quality, but recently fairing poorly. • What Wall Street hates now, they tend to love down the road as you prepare to be short term wrong but long term right. – Coal and Solar?

Managing Covered Calls, protective puts, collars and risk reversals • The best strategy is really stocks that are quality, but recently fairing poorly. • What Wall Street hates now, they tend to love down the road as you prepare to be short term wrong but long term right. – Coal and Solar?

Managing Covered Calls, protective puts, collars and risk reversals • If you can take the stock, you can short a put. • If not consider the alternative to control risk • Put spread • Diagonal put spread- or the risk is simply too high?

Managing Covered Calls, protective puts, collars and risk reversals • If you can take the stock, you can short a put. • If not consider the alternative to control risk • Put spread • Diagonal put spread- or the risk is simply too high?

Covered Call Math • Look at a covered call position (short put) that produces a minimum of 1% per month- simple rule of thumb for generating theta (time decay) – How to calculate that? Take the stock price and divide it by the option price • MSFT is trading $38 and the Dec 13 Weekly 38. 5 call is trading. 57 is about 1. 5% for a 9 day hold. – Compounded that is not a bad return! You can be less aggressive from there if you chose.

Covered Call Math • Look at a covered call position (short put) that produces a minimum of 1% per month- simple rule of thumb for generating theta (time decay) – How to calculate that? Take the stock price and divide it by the option price • MSFT is trading $38 and the Dec 13 Weekly 38. 5 call is trading. 57 is about 1. 5% for a 9 day hold. – Compounded that is not a bad return! You can be less aggressive from there if you chose.

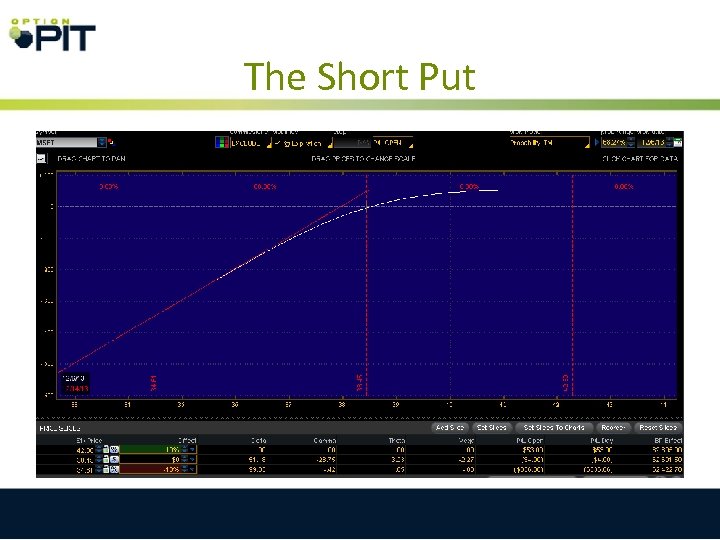

The Short Put

The Short Put

Some Volatility Mechanics • Why? - There has to be a good reason to sell a call too. You can like the stock but is it worth it so sell a call against the stock. • In general if the target term IV is lower than the HV 20, consider waiting on the call sale, or selling less volume. That will keep the stock with some upside.

Some Volatility Mechanics • Why? - There has to be a good reason to sell a call too. You can like the stock but is it worth it so sell a call against the stock. • In general if the target term IV is lower than the HV 20, consider waiting on the call sale, or selling less volume. That will keep the stock with some upside.

MSFT HV 20

MSFT HV 20

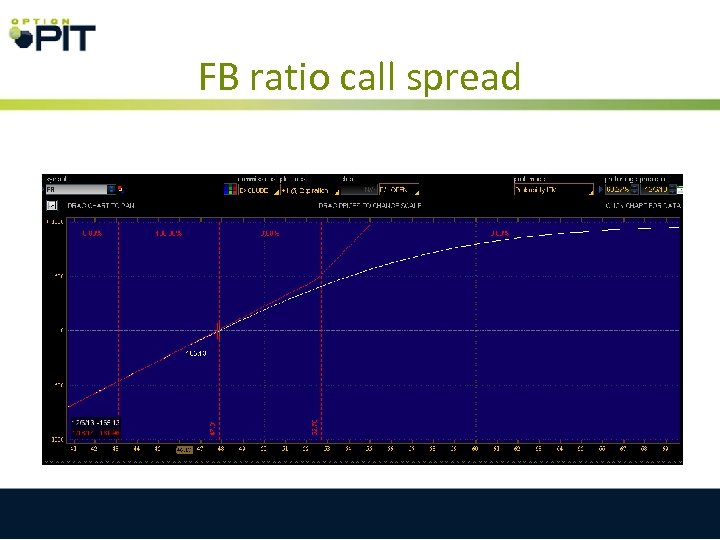

Call writing with a twist • Advanced Call Writing-There are overwriting and repair strategies. • Ratio call spreads- when the stock is beaten down and the IV is above normal • Super nice when skew is elevated but the IV is not great

Call writing with a twist • Advanced Call Writing-There are overwriting and repair strategies. • Ratio call spreads- when the stock is beaten down and the IV is above normal • Super nice when skew is elevated but the IV is not great

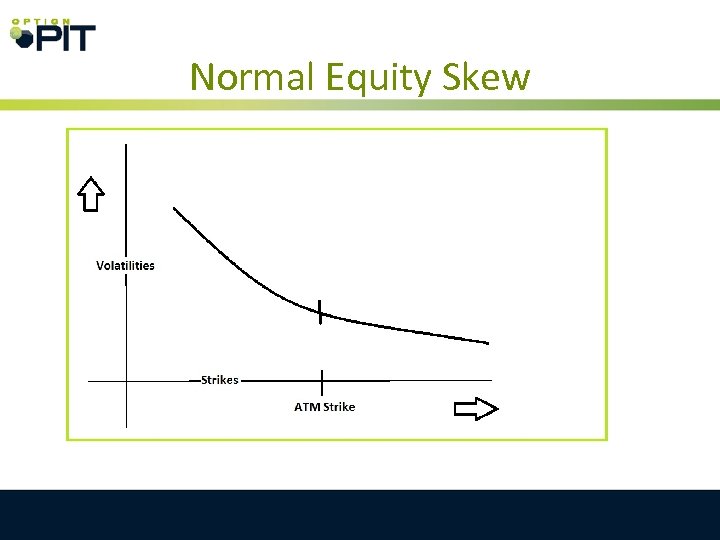

Normal Equity Skew

Normal Equity Skew

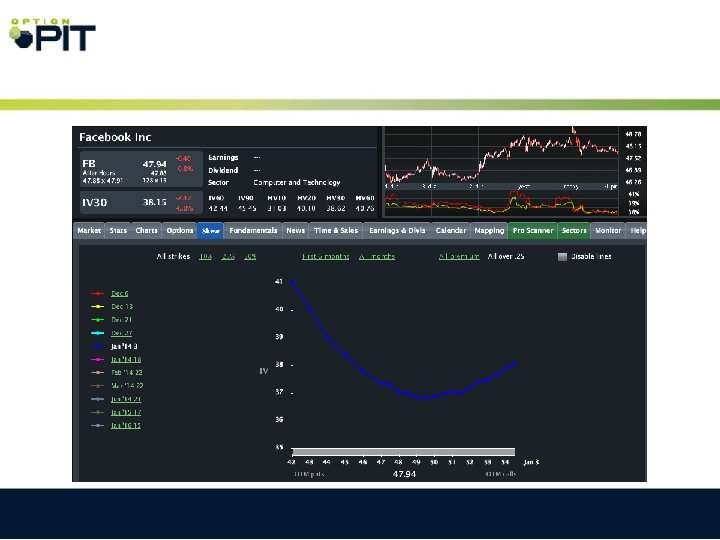

FB ratio call spread

FB ratio call spread

Married Puts • A protective put position is a long call with a kicker Remember that a long stock/long put position is a synthetic call. The intent is OWNSHIP OF THE UNDERLYING AND LONG BIAS. • The put provides some protection but just to the limit of a synthetic call

Married Puts • A protective put position is a long call with a kicker Remember that a long stock/long put position is a synthetic call. The intent is OWNSHIP OF THE UNDERLYING AND LONG BIAS. • The put provides some protection but just to the limit of a synthetic call

Married Puts • Traders can roll puts- they can do stuff! – If the market falls out of bed- The IV should jump helping the value of your put in a big way • Vega change will help the position outperform the delta of the trades • A big jump in IV is an invitation to roll down

Married Puts • Traders can roll puts- they can do stuff! – If the market falls out of bed- The IV should jump helping the value of your put in a big way • Vega change will help the position outperform the delta of the trades • A big jump in IV is an invitation to roll down

Married Puts • Why? Because by rolling down traders can reduce the Vega exposure and take profits. • A hedge is only a hedge unless you use it • Look at around 10% OTM and 3 -6 months out

Married Puts • Why? Because by rolling down traders can reduce the Vega exposure and take profits. • A hedge is only a hedge unless you use it • Look at around 10% OTM and 3 -6 months out

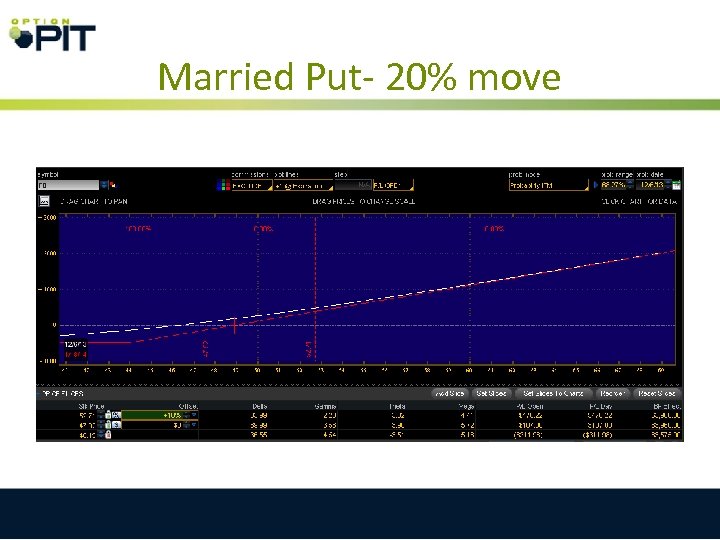

Married Put- 20% move

Married Put- 20% move

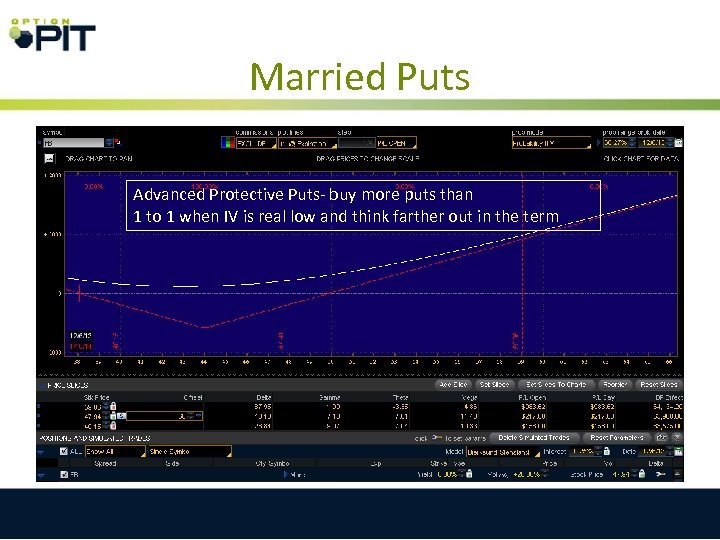

Married Puts Advanced Protective Puts- buy more puts than 1 to 1 when IV is real low and think farther out in the term

Married Puts Advanced Protective Puts- buy more puts than 1 to 1 when IV is real low and think farther out in the term

The Risk Reversal • The Risk Reversal is simply a long combination position (long call/short put) in the underlying with a skewed strike • What is the intent of the trade? – Long with an accelerating upside for no dollar cost but higher margin - Buying cheap IV relative to HV will help here.

The Risk Reversal • The Risk Reversal is simply a long combination position (long call/short put) in the underlying with a skewed strike • What is the intent of the trade? – Long with an accelerating upside for no dollar cost but higher margin - Buying cheap IV relative to HV will help here.

INTC is moving

INTC is moving

More Risk Reversals • Risk reversal are better in stocks that have just crashed or in markets with higher IV. • The key is to buy low- ALWAYS! Another position might work better. • Control the risk in an RR by writing the put first and buying the call later • Why? If the underlying moves up you win anyway and holding back on the call allows some risk control in case you are short term wrong but long term right

More Risk Reversals • Risk reversal are better in stocks that have just crashed or in markets with higher IV. • The key is to buy low- ALWAYS! Another position might work better. • Control the risk in an RR by writing the put first and buying the call later • Why? If the underlying moves up you win anyway and holding back on the call allows some risk control in case you are short term wrong but long term right

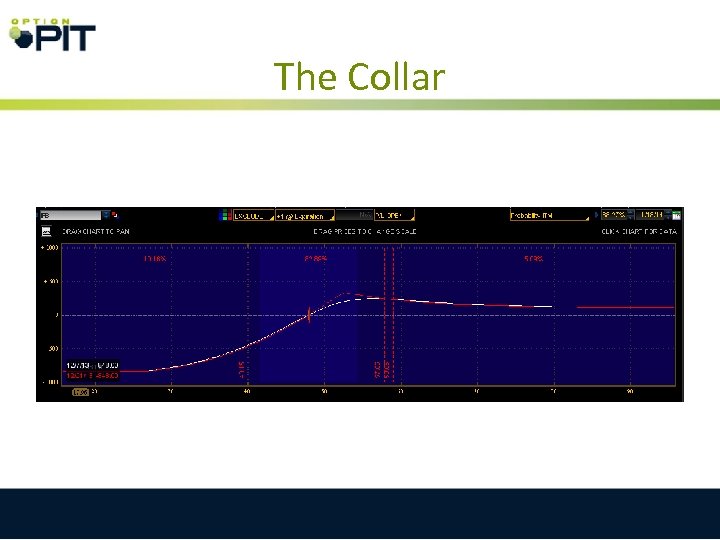

The Collar • The Collar with stock is a call spread so the intent is to get long, somewhat. -This is not a Go-Go long delta trade. The trader has to accept a more modest profile for this. -Decay is a factor here

The Collar • The Collar with stock is a call spread so the intent is to get long, somewhat. -This is not a Go-Go long delta trade. The trader has to accept a more modest profile for this. -Decay is a factor here

The Collar

The Collar

The Collar • Savvy traders mess with the traditional collarthe Vega long term (puts) and sell the higher decaying options short term (calls) • The idea is to manage the Gamma and take advantage of the Vega

The Collar • Savvy traders mess with the traditional collarthe Vega long term (puts) and sell the higher decaying options short term (calls) • The idea is to manage the Gamma and take advantage of the Vega

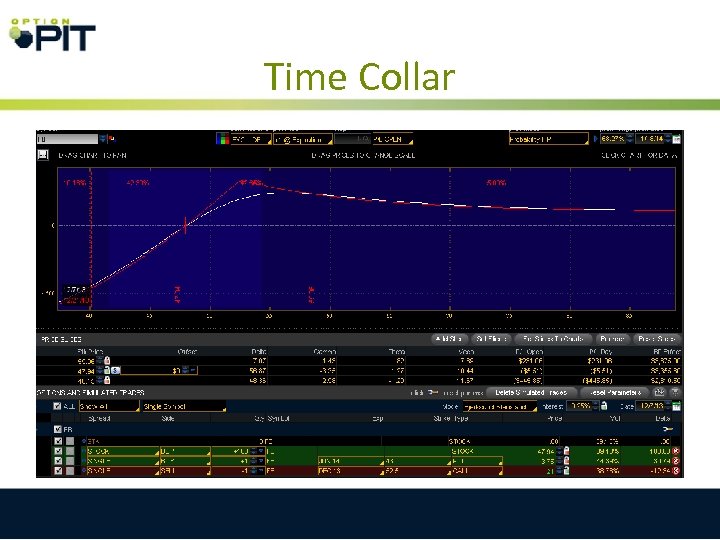

Time Collar

Time Collar

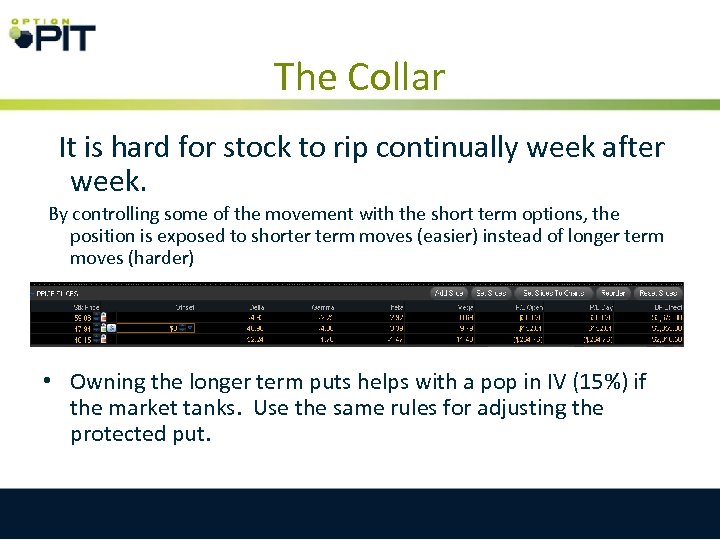

The Collar It is hard for stock to rip continually week after week. By controlling some of the movement with the short term options, the position is exposed to shorter term moves (easier) instead of longer term moves (harder) • Owning the longer term puts helps with a pop in IV (15%) if the market tanks. Use the same rules for adjusting the protected put.

The Collar It is hard for stock to rip continually week after week. By controlling some of the movement with the short term options, the position is exposed to shorter term moves (easier) instead of longer term moves (harder) • Owning the longer term puts helps with a pop in IV (15%) if the market tanks. Use the same rules for adjusting the protected put.

Summary • The intent of the position is paramount with options. • The buy write is just a short put- so when is the best time to sell a put? • The married put adds room with unlimited upside • The Risk Reversal is go-go upside positions with risk • The Collar is a controlled risk/reward long

Summary • The intent of the position is paramount with options. • The buy write is just a short put- so when is the best time to sell a put? • The married put adds room with unlimited upside • The Risk Reversal is go-go upside positions with risk • The Collar is a controlled risk/reward long

Thank you for attending! Use Longo 1 for a $98 Silver Course, $51 off the normal price. mark@optionpit. com andrew@optionpit. com 1(888) Trade-01

Thank you for attending! Use Longo 1 for a $98 Silver Course, $51 off the normal price. mark@optionpit. com andrew@optionpit. com 1(888) Trade-01