9797a3307d184ecc2f82921554144132.ppt

- Количество слайдов: 20

THE OPEN ECONOMY: INTERNATIONAL ASPECTS OF THE MACRO-ECONOMY 1. The balance of payments 2. The foreign exchange (forex) market 3. Fixed v floating exchange rates 4. Single currency areas 5. Globalisation and macro policy

THE OPEN ECONOMY: INTERNATIONAL ASPECTS OF THE MACRO-ECONOMY 1. The balance of payments 2. The foreign exchange (forex) market 3. Fixed v floating exchange rates 4. Single currency areas 5. Globalisation and macro policy

What is the balance of payments? Why are policy makers concerned about the BP? How can govts ‘correct’ a BP problem? How are exchange rates determined? How can the CB affect the exchange rate? Is a single currency for Europe desirable? Should the G 3 (G 7) co-ordinate their macro-policies?

What is the balance of payments? Why are policy makers concerned about the BP? How can govts ‘correct’ a BP problem? How are exchange rates determined? How can the CB affect the exchange rate? Is a single currency for Europe desirable? Should the G 3 (G 7) co-ordinate their macro-policies?

THE BALANCE OF PAYMENTS • records all flows of money between countries • BP = current acc + capital acc Current account (or financial account) - exports minus imports of goods / services - govt transfers (e. g. EU taxes / subsidies) Capital account - fixed investment (FDI) - bonds, equities, deposits (portfolio investment)

THE BALANCE OF PAYMENTS • records all flows of money between countries • BP = current acc + capital acc Current account (or financial account) - exports minus imports of goods / services - govt transfers (e. g. EU taxes / subsidies) Capital account - fixed investment (FDI) - bonds, equities, deposits (portfolio investment)

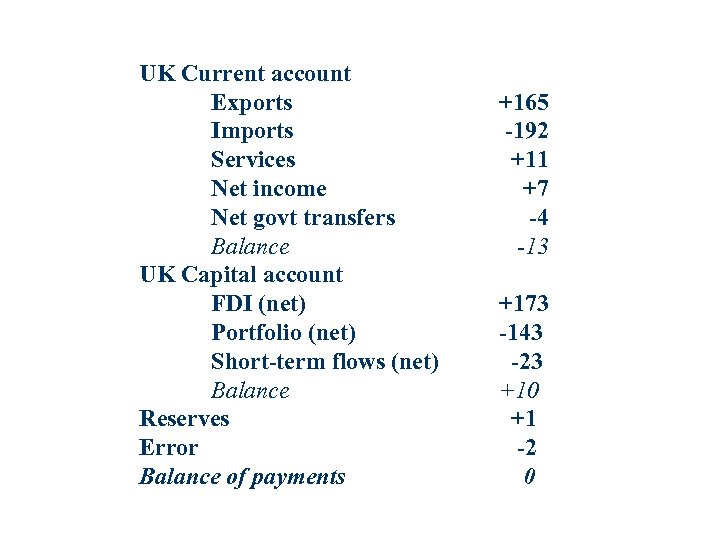

UK Current account Exports Imports Services Net income Net govt transfers Balance UK Capital account FDI (net) Portfolio (net) Short-term flows (net) Balance Reserves Error Balance of payments +165 -192 +11 +7 -4 -13 +173 -143 -23 +10 +1 -2 0

UK Current account Exports Imports Services Net income Net govt transfers Balance UK Capital account FDI (net) Portfolio (net) Short-term flows (net) Balance Reserves Error Balance of payments +165 -192 +11 +7 -4 -13 +173 -143 -23 +10 +1 -2 0

Surpluses and deficits in the BP Surplus: BP > 0 - foreign exchange reserves increase - accumulation of foreign assets - exchange rate ‘too high’ Deficit: BP < 0 - foreign exchange reserves decline - loss of foreign exchange reserves - deficit has to be financed (borrowing) - loss of control over domestic assets - downward pressure on exchange rate; inflationary

Surpluses and deficits in the BP Surplus: BP > 0 - foreign exchange reserves increase - accumulation of foreign assets - exchange rate ‘too high’ Deficit: BP < 0 - foreign exchange reserves decline - loss of foreign exchange reserves - deficit has to be financed (borrowing) - loss of control over domestic assets - downward pressure on exchange rate; inflationary

Determinants of the BP BP = exports - imports + net capital flows • exports = f (exch rate, competitiveness, world income) • imports = f (exch rate, competitiveness, income) • net capital flows = f (r / world r, country risk) Model: BP = f ( e, w/w*, y, r/r*) e = exchange rate (£/$) w = real wage; w* = world real wage y = income y* = world income r = interest rate r* = world interest rate

Determinants of the BP BP = exports - imports + net capital flows • exports = f (exch rate, competitiveness, world income) • imports = f (exch rate, competitiveness, income) • net capital flows = f (r / world r, country risk) Model: BP = f ( e, w/w*, y, r/r*) e = exchange rate (£/$) w = real wage; w* = world real wage y = income y* = world income r = interest rate r* = world interest rate

Govt intervention to ‘correct’ the BP • exchange rate policy: buying / selling domestic currency • fiscal / monetary policy to control AD - raise / lower r (capital account) - change G or T (trade account) • supply-side policies - improve competitiveness via labour market flexibility

Govt intervention to ‘correct’ the BP • exchange rate policy: buying / selling domestic currency • fiscal / monetary policy to control AD - raise / lower r (capital account) - change G or T (trade account) • supply-side policies - improve competitiveness via labour market flexibility

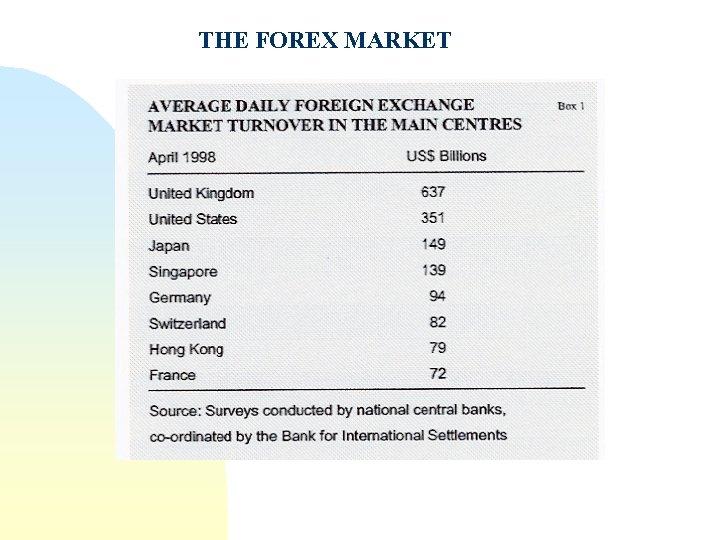

THE FOREX MARKET

THE FOREX MARKET

The exchange rate e = £ per $ (or s = $ per £) Determination of e: a simple model Demand for £s (= supply of $s) • importers of UK goods / services • tourists visiting UK • foreign students in UK universities • foreigners investing in UK • UK citizens with foreign income Supply of £s (= demand for $s) • opposite to above

The exchange rate e = £ per $ (or s = $ per £) Determination of e: a simple model Demand for £s (= supply of $s) • importers of UK goods / services • tourists visiting UK • foreign students in UK universities • foreigners investing in UK • UK citizens with foreign income Supply of £s (= demand for $s) • opposite to above

Model: e = f ( x - m, r - r*) When will exchange rate appreciate? Current account: • demand for exports increases • demand for imports decreases • competitiveness increases (w / w* increases) Capital account: • inflow of foreign investment (r / r* increases)

Model: e = f ( x - m, r - r*) When will exchange rate appreciate? Current account: • demand for exports increases • demand for imports decreases • competitiveness increases (w / w* increases) Capital account: • inflow of foreign investment (r / r* increases)

FIXED v FLOATING EXCHANGE RATES Advantages of a fixed exchange rate • certainty for exporters / importers/ investors • ‘no speculators’ within single currency area • imposes constraints on govt macro policy - constrained by effect on BP - constrained by effect of policies on inflation - govt has to achieve BP equilibrium over medium term

FIXED v FLOATING EXCHANGE RATES Advantages of a fixed exchange rate • certainty for exporters / importers/ investors • ‘no speculators’ within single currency area • imposes constraints on govt macro policy - constrained by effect on BP - constrained by effect of policies on inflation - govt has to achieve BP equilibrium over medium term

Disadvantages of a fixed exchange rate • economic policy will be constrained by fixed ER - chronic BP deficit requires deflationary policy - conflict between full employment and BP equilibrium • sudden ‘shocks’ cannot be absorbed by ER adjustment - shocks affect ‘real’ economy if prices are fixed • fixed ER encourages ‘protectionism’ - due to impact of shocks on ‘real’ variables • speculators cause financial / political crises

Disadvantages of a fixed exchange rate • economic policy will be constrained by fixed ER - chronic BP deficit requires deflationary policy - conflict between full employment and BP equilibrium • sudden ‘shocks’ cannot be absorbed by ER adjustment - shocks affect ‘real’ economy if prices are fixed • fixed ER encourages ‘protectionism’ - due to impact of shocks on ‘real’ variables • speculators cause financial / political crises

Advantages of floating exchange rates • govt ignores ER; no intervention needed • no need to worry about BP • economy is insulated from shocks (absorbed by ER) • govt can concentrate on internal policy objectives (inflation, unemployment, income distribution)

Advantages of floating exchange rates • govt ignores ER; no intervention needed • no need to worry about BP • economy is insulated from shocks (absorbed by ER) • govt can concentrate on internal policy objectives (inflation, unemployment, income distribution)

Disadvantages of floating exchange rates • exchange rate can be volatile in the short run - causes uncertainty (harmful to investment / trade) • capital flows can cause ER to get ‘out of line’ with its underlying (fundamental) value • loss of BP constraint on macro-policy may lead to inflationary bias - with a fixed ER, govt has to respond to BP deficits

Disadvantages of floating exchange rates • exchange rate can be volatile in the short run - causes uncertainty (harmful to investment / trade) • capital flows can cause ER to get ‘out of line’ with its underlying (fundamental) value • loss of BP constraint on macro-policy may lead to inflationary bias - with a fixed ER, govt has to respond to BP deficits

SINGLE CURRENCY AREAS Advantages of a single currency • lower transactions costs (no currency conversions) • increased price competitiveness - transparent pricing across countries • elimination of exchange rate uncertainty - encourages trade - encourages investment (inc. FDI) • lower inflation and interest rates - central bank independent of member govts - member states have to keep wage increases in line to maintain competitiveness

SINGLE CURRENCY AREAS Advantages of a single currency • lower transactions costs (no currency conversions) • increased price competitiveness - transparent pricing across countries • elimination of exchange rate uncertainty - encourages trade - encourages investment (inc. FDI) • lower inflation and interest rates - central bank independent of member govts - member states have to keep wage increases in line to maintain competitiveness

Disadvantages of a single currency • surrenders economic sovereignty to supra-national authority - no control over monetary policy - no control over exchange rate • deflationary effects in countries with high wage pressures • increase in regional disparities due to greater factor mobility • potential loss of control over fiscal policy - cannot use monetary expansion to pay for increase in G - tight control over govt borrowing (fiscal balance needed)

Disadvantages of a single currency • surrenders economic sovereignty to supra-national authority - no control over monetary policy - no control over exchange rate • deflationary effects in countries with high wage pressures • increase in regional disparities due to greater factor mobility • potential loss of control over fiscal policy - cannot use monetary expansion to pay for increase in G - tight control over govt borrowing (fiscal balance needed)

Why might the Euro Zone not be an optimal currency area? • labour markets are not flexible enough - wages may be sticky downwards - labour is not sufficiently mobile to respond to changes in demand - effects of changes in euro ER will vary between member states / regions • But: alternative methods of dealing with adverse effects of structural change - structural funds for re-training - structural funds for encouraging indigenous growth - infrastructure policies to revive declining regions

Why might the Euro Zone not be an optimal currency area? • labour markets are not flexible enough - wages may be sticky downwards - labour is not sufficiently mobile to respond to changes in demand - effects of changes in euro ER will vary between member states / regions • But: alternative methods of dealing with adverse effects of structural change - structural funds for re-training - structural funds for encouraging indigenous growth - infrastructure policies to revive declining regions

GLOBALISATION AND MACRO POLICY Interdependence • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instantaneously) - Fed has profound effect on rest of world’s economies

GLOBALISATION AND MACRO POLICY Interdependence • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instantaneously) - Fed has profound effect on rest of world’s economies

Co-operation between G 7: policy harmonisation • need for policy harmonisation to prevent world-wide recession / inflation - exchange rates should not be ‘out of line’ (need to keep current accounts in reasonable balance) - inflationary pressures are easily transmitted to other countries - co-ordination of interest rates may be needed to prevent adverse capital flows • G 7 needs to deal with the problem of developing country debt

Co-operation between G 7: policy harmonisation • need for policy harmonisation to prevent world-wide recession / inflation - exchange rates should not be ‘out of line’ (need to keep current accounts in reasonable balance) - inflationary pressures are easily transmitted to other countries - co-ordination of interest rates may be needed to prevent adverse capital flows • G 7 needs to deal with the problem of developing country debt