e8ecadad46e7c4b2c499c8eeb63f3526.ppt

- Количество слайдов: 36

The Nuts and Bolts of An Investment Plan Presented by: David Cox, CFA, CMT, FCSI, FMA, BMath Portfolio Manager October 8, 2013 Kitchener/Waterloo Shareclub, Waterloo, ON

Who Am I? § Bachelor of Mathematics – University of Waterloo § My family recently relocated to Guelph § One of 206 dual holders, globally, of both the Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT) designations § Passionate about the investment markets, skiing, golfing, mountain biking and poker 2

Our Agenda § What Are Your Objectives? § Understanding Diversification § Risk and Reward § Designing Filters/Investment Criteria § Portfolio Management/Maintenance 3

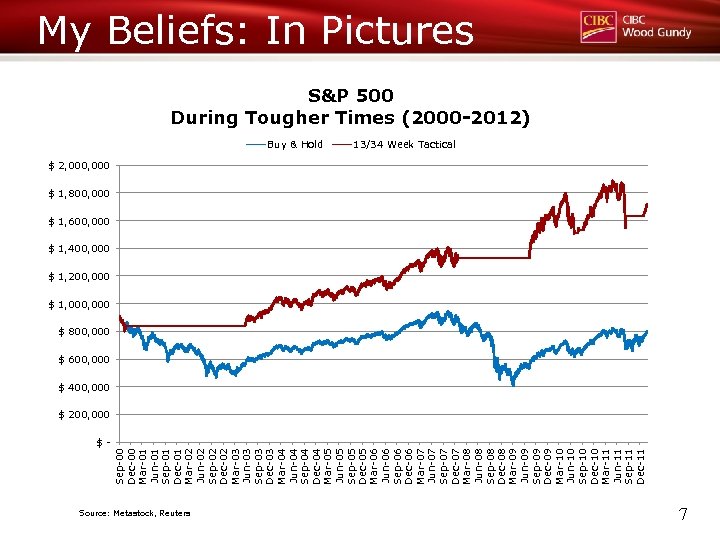

My Beliefs § Buy & Hold DOES NOT work § Stocks/markets/assets go through bullish (rising) periods, which are followed by bearish (falling) periods – extract profits regularly § Holding equities in a bear market/downtrend is akin to financial suicide § ANYTHING is possible § Small losses are preferred to big losses 4

Your Objectives? § Gains/income/preservation of capital § Short-term to long-term § ETFs/stocks/futures § Position-trading/buy & hold § MUST MATCH YOUR BELIEFS! 5

To Think About § Do you get emotional about money? § Have you ever held an investment to a loss > 50%? § How often do you look at your portfolio/the markets? § What % portfolio drawdown are you comfortable with? § Confirmation bias 6

Sep-00 Dec-00 Mar-01 Jun-01 Sep-01 Dec-01 Mar-02 Jun-02 Sep-02 Dec-02 Mar-03 Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 My Beliefs: In Pictures S&P 500 During Tougher Times (2000 -2012) Buy & Hold Source: Metastock, Reuters 13/34 Week Tactical $ 2, 000 $ 1, 800, 000 $ 1, 600, 000 $ 1, 400, 000 $ 1, 200, 000 $ 1, 000 $ 800, 000 $ 600, 000 $ 400, 000 $ 200, 000 $- 7

My Objectives § Take advantage of short-term opportunities to generate strong risk-adjusted returns irrespective of overall market direction § Identify and invest in the strongest trending largecap securities until the trend runs its course § Protect gains and minimize losses during market corrections and/or bear markets 8

Diversification § Balance out risks § One position rises and one position falls § Reduces the impact of being wrong 9

Overdiversification § More than 5 mutual funds § More than 10 ETFs § More than 30 stocks How is your conviction? 10

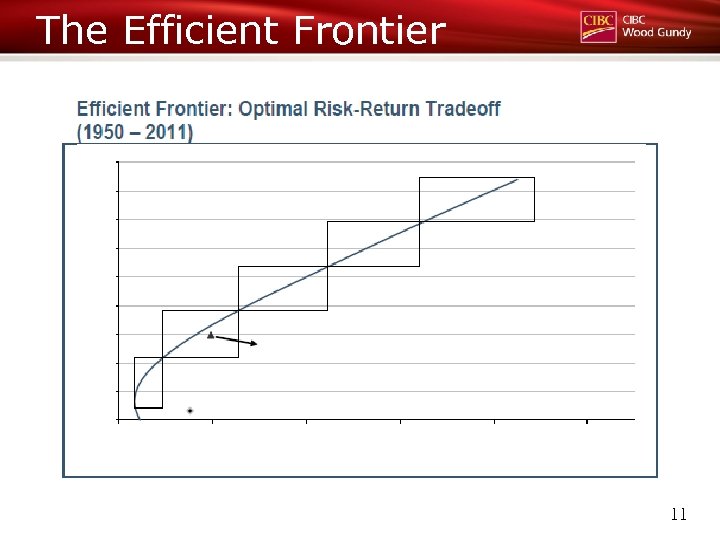

The Efficient Frontier 11

Risk and Reward § Potential % Upside § Potential % Downside § How do you determine when you’re wrong? § When is enough? § > 2: 1 or 3: 1 reward to risk § Where is your planned exit? 12

Look at the Market § A Rising Tide Lifts All Boats § Most stocks follow the general direction of the market § Stocks in the same sector/industry tend to behave similarly 13

Buying Sales § Full Price vs. Sale Price § Why is there a sale? 14

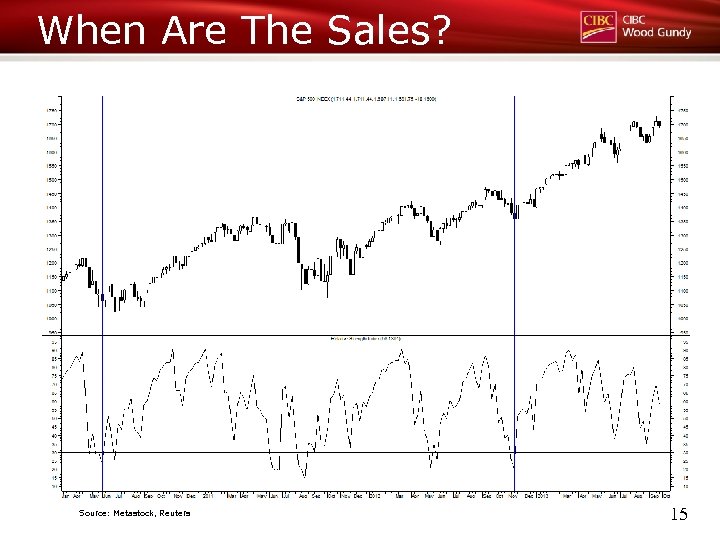

When Are The Sales? Source: Metastock, Reuters 15

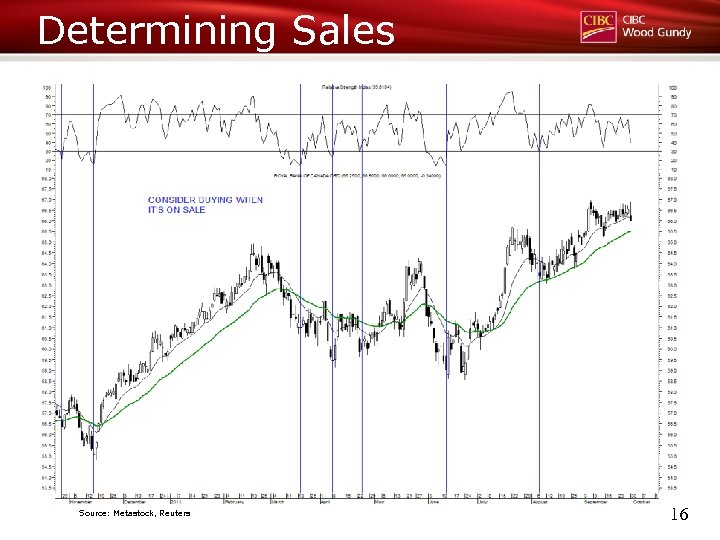

Determining Sales Source: Metastock, Reuters 16

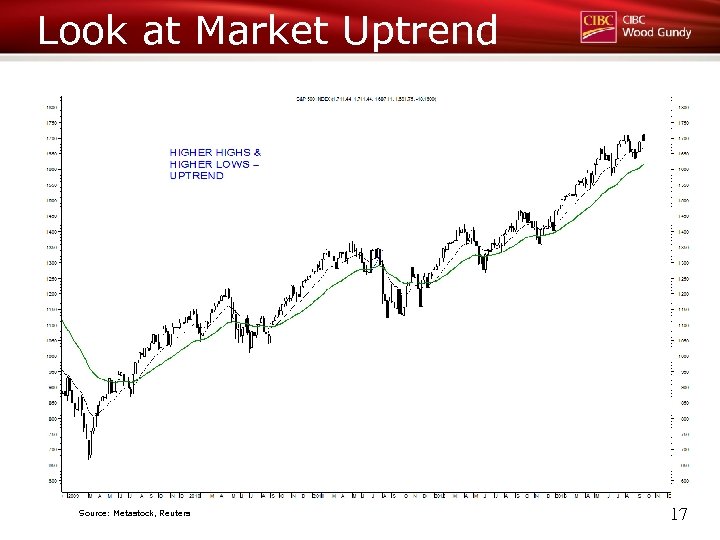

Look at Market Uptrend Source: Metastock, Reuters 17

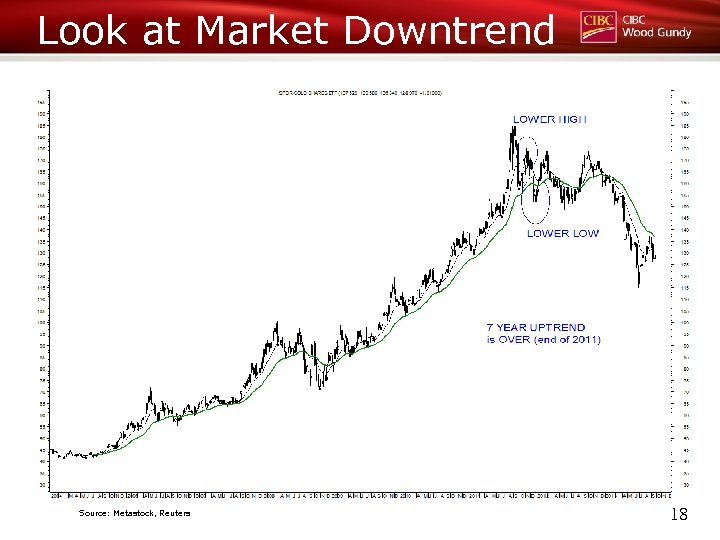

Look at Market Downtrend Source: Metastock, Reuters 18

Designing Filters § Should match your beliefs/objectives! § % Dividend Yield § Market Capitalization § EPS growth % § Strong stock performance § Low beta § Debt/Equity 19

Equity INtrend Process § 10 BIG Multi-BILLION $$$$ Companies § Only Buy Stocks Heading Up (Bottom Left to Top Right) § BUY the Strongest Stocks in the MARKET § RED Line in the Sand § PROTECT PROFITS § CUT LOSSES 20

Initiating Positions § Dart throwing § Pullbacks (RSI, moving averages, etc. ) § 52 week highs/52 week lows § Confirmation bias § Fear and/or greed § Low P/E, High P/E § Great news flow/analyst reports § Take the RSI(5) test! 21

Exiting Positions § Profit targets § Technical Objective § Market/sector trouble § Volatility Stop § Profit Stop § Max % loss § Candlesticks § Support/Resistance § % from Highest High Price 22

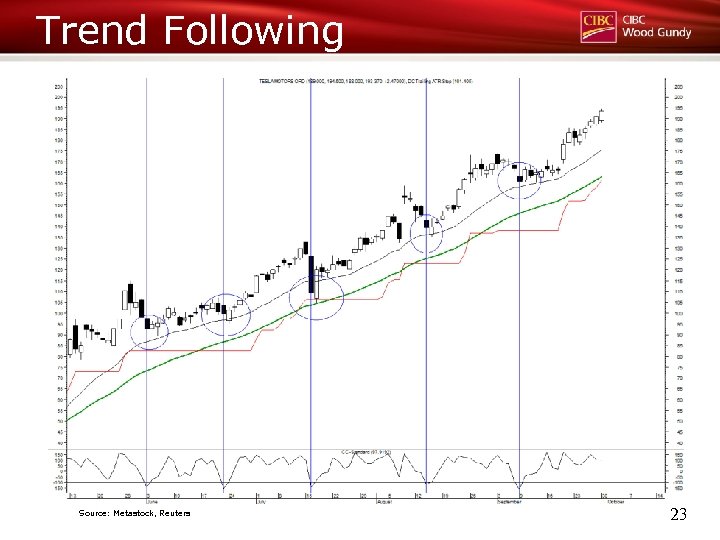

Trend Following Source: Metastock, Reuters 23

Good Reward: Risk Source: Metastock, Reuters 24

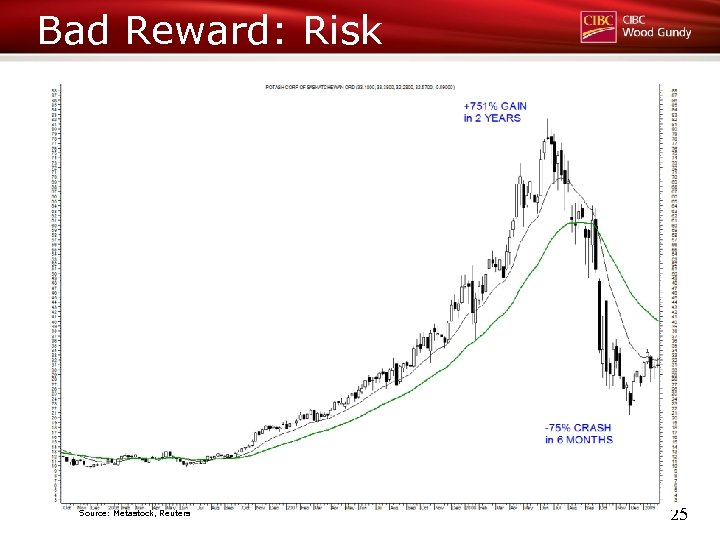

Bad Reward: Risk Source: Metastock, Reuters 25

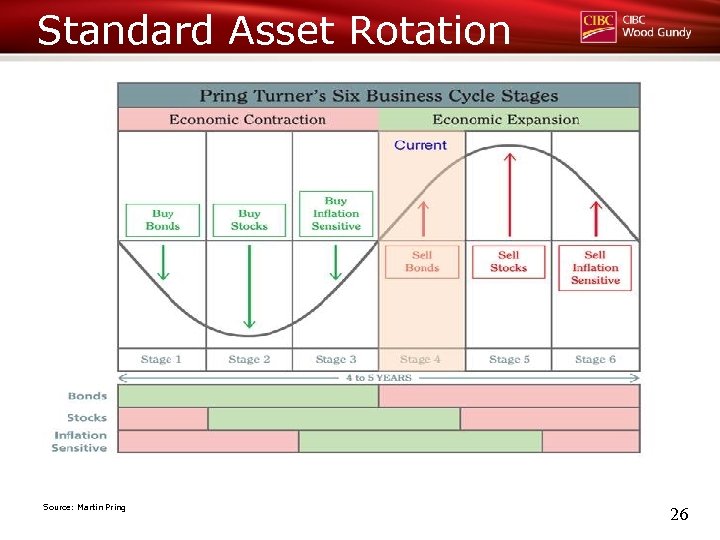

Standard Asset Rotation Source: Martin Pring 26

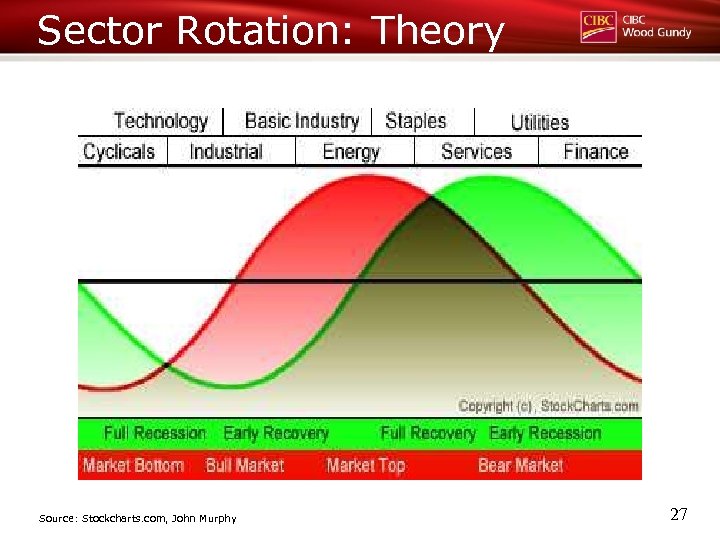

Sector Rotation: Theory Source: Stockcharts. com, John Murphy 27

Relative Strength § Stock vs. sector? § Sector vs. market? § Market vs. another market? 28

Rebalancing § Trim/sell winners § Buy/add during sales § Selling high and buying low 29

Key Lessons § Making money is more important than being right § Having a pre-planned exit is easier § Have a plan and follow it § Buying is simple => learn how to sell § Singles & doubles are easier to hit than homers § Consistent success is better than spotty erratic success Source: Metastock, Reuters 30

More Lessons § Small losses can become big easily § Stocks fall faster than they rise § Most stocks follow the broad market § It’s easier to make money on long side when things are rising (vice versa is true) § Bigger the loss -> harder it is to sell § Beware of confirmation bias § Earnings season is dangerous – understand news flow § Attachment to stocks is BAD § The market is smarter than you and I Source: Metastock, Reuters 31

My Process + § EMOTION FREE+ § DISCIPLINED § NIMBLE = CONFIDENCE PEACE OF MIND GREATER STABILITY § INCREASED BOTTOM LINE RESULTS 32

What Do I Do? § Run a small niche investment business based on a process that I invented § The process and techniques are unique, in that, they bring institutional quality tools to the retail investor 33

Upcoming Seminars § “ 2 nd Annual Investment Strategy: The Road Ahead” § Cutten Fields, Guelph, ON § Tuesday, October 29 th @ 8 am § The National Club, Toronto, ON § Tuesday, November 5 th @ 8: 30 am 34

Useful Tidbits § Monthly Market Chit Chat – monthly e-publication that discusses the risks and opportunities facing investors – email me to subscribe § Twitter: @David. Cox. WG § www. davidcox. ca – a variety of seminars, webinars and publications are published 35

Thank You 42 Wyndham St. N, Suite 201 | Guelph | Ontario | N 1 H 4 E 6 (519) 823 -4411 | (855)-246 -4076 CIBC Wood Gundy is a division of CIBC World Markets Inc. , a subsidiary of CIBC and a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor. These calculations and projections are for demonstration purposes only. They are based on a number of assumptions and consequently actual results may differ, possibly to a material degree. This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc. , their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2013.

e8ecadad46e7c4b2c499c8eeb63f3526.ppt