0c411dbcaf4ce3505aae5f62a903ed07.ppt

- Количество слайдов: 29

The novel matrix-type business structure for corporate banking. Case of ABN-AMRO

Table of contents 1 ABN AMRO 2 ABN AMRO’s Structure 3 Client Segmentation & Product Business Units 4 Profitability, Revenue Control & Capital Allocation 5 Basel II – Risk Advisory Services 2

1 ABN AMRO 3

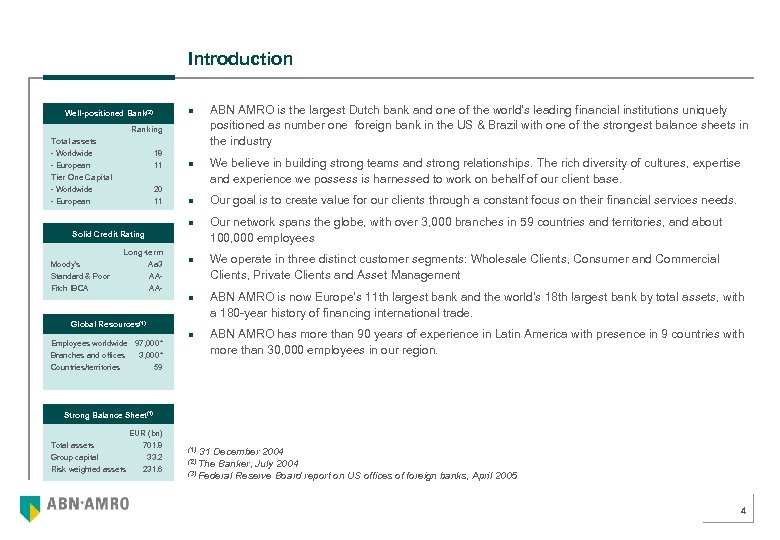

Introduction n Well-positioned Bank(2) Ranking Total assets - Worldwide - European Tier One Capital 18 11 n - Worldwide - European 20 11 n n Solid Credit Rating Moody’s Long-term Aa 3 Standard & Poor Fitch IBCA n AAAAn Global Resources(1) Employees worldwide 97, 000 + Branches and offices 3, 000 + Countries/territories 59 n ABN AMRO is the largest Dutch bank and one of the world’s leading financial institutions uniquely positioned as number one foreign bank in the US & Brazil with one of the strongest balance sheets in the industry We believe in building strong teams and strong relationships. The rich diversity of cultures, expertise and experience we possess is harnessed to work on behalf of our client base. Our goal is to create value for our clients through a constant focus on their financial services needs. Our network spans the globe, with over 3, 000 branches in 59 countries and territories, and about 100, 000 employees We operate in three distinct customer segments: Wholesale Clients, Consumer and Commercial Clients, Private Clients and Asset Management ABN AMRO is now Europe’s 11 th largest bank and the world’s 18 th largest bank by total assets, with a 180 -year history of financing international trade. ABN AMRO has more than 90 years of experience in Latin America with presence in 9 countries with more than 30, 000 employees in our region. Strong Balance Sheet(1) Total assets Group capital Risk weighted assets EUR (bn) 701. 8 33. 2 231. 6 31 December 2004 Banker, July 2004 (3) Federal Reserve Board report on US offices of foreign banks, April 2005 (1) (2) The 4

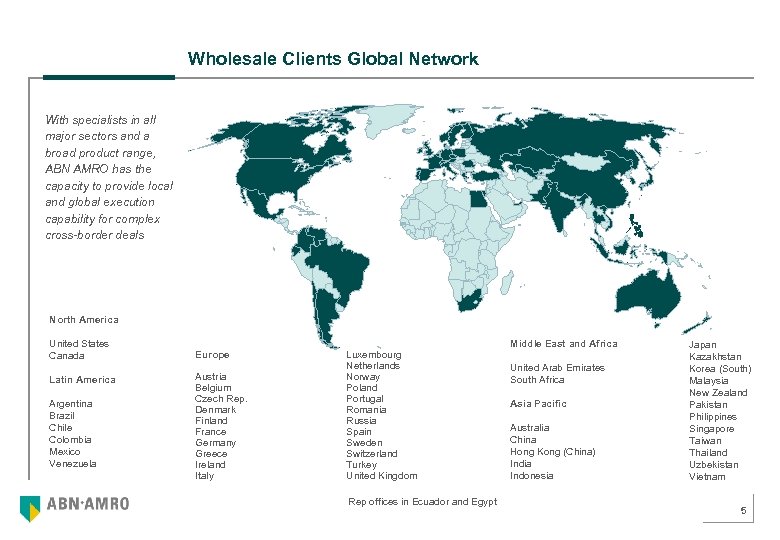

Wholesale Clients Global Network With specialists in all major sectors and a broad product range, ABN AMRO has the capacity to provide local and global execution capability for complex cross-border deals North America United States Canada Latin America Argentina Brazil Chile Colombia Mexico Venezuela Middle East and Africa Europe Austria Belgium Czech Rep. Denmark Finland France Germany Greece Ireland Italy Luxembourg Netherlands Norway Poland Portugal Romania Russia Spain Sweden Switzerland Turkey United Kingdom Rep offices in Ecuador and Egypt United Arab Emirates South Africa Asia Pacific Australia China Hong Kong (China) India Indonesia Japan Kazakhstan Korea (South) Malaysia New Zealand Pakistan Philippines Singapore Taiwan Thailand Uzbekistan Vietnam 5

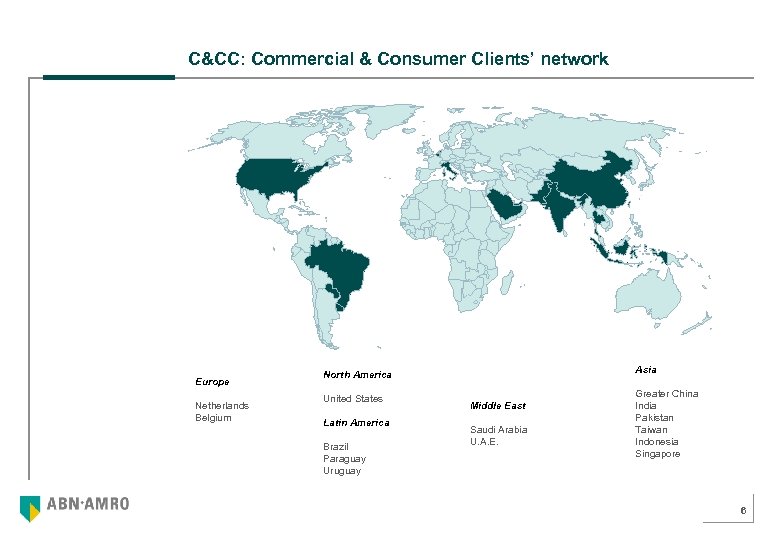

C&CC: Commercial & Consumer Clients’ network Europe Netherlands Belgium Asia North America United States Latin America Brazil Paraguay Uruguay Middle East Saudi Arabia U. A. E. Greater China India Pakistan Taiwan Indonesia Singapore 6

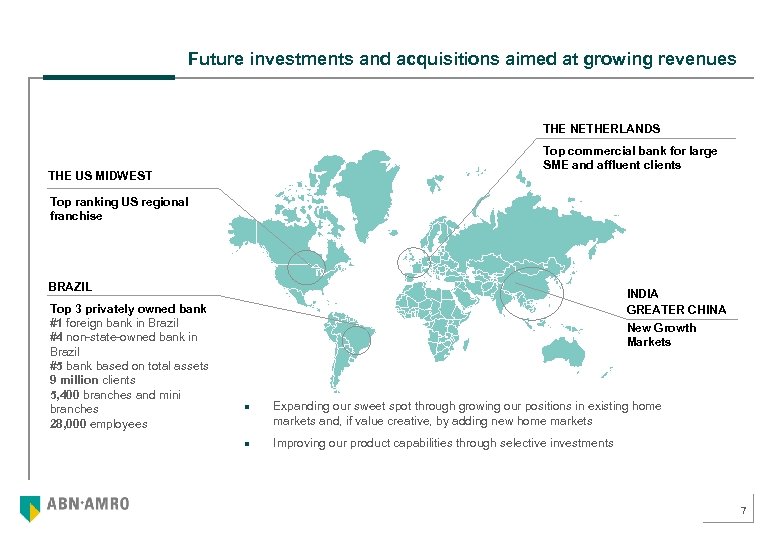

Future investments and acquisitions aimed at growing revenues THE NETHERLANDS Top commercial bank for large SME and affluent clients THE US MIDWEST Top ranking US regional franchise BRAZIL Top 3 privately owned bank #1 foreign bank in Brazil #4 non-state-owned bank in Brazil #5 bank based on total assets 9 million clients 5, 400 branches and mini branches 28, 000 employees INDIA GREATER CHINA New Growth Markets n n Expanding our sweet spot through growing our positions in existing home markets and, if value creative, by adding new home markets Improving our product capabilities through selective investments 7

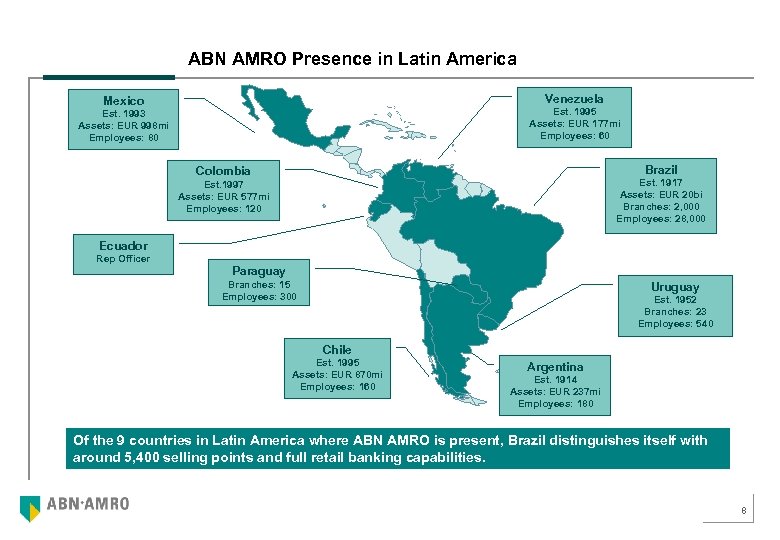

ABN AMRO Presence in Latin America Venezuela Mexico Est. 1995 Assets: EUR 177 mi Employees: 60 Est. 1993 Assets: EUR 998 mi Employees: 80 Brazil Colombia Est. 1917 Assets: EUR 20 bi Branches: 2, 000 Employees: 28, 000 Est. 1997 Assets: EUR 577 mi Employees: 120 Ecuador Rep Officer Paraguay Branches: 15 Employees: 300 Uruguay Est. 1952 Branches: 23 Employees: 540 Chile Est. 1995 Assets: EUR 870 mi Employees: 160 Argentina Est. 1914 Assets: EUR 237 mi Employees: 180 Of the 9 countries in Latin America where ABN AMRO is present, Brazil distinguishes itself with around 5, 400 selling points and full retail banking capabilities. 8

2 ABN-AMRO’s Global Structure 9

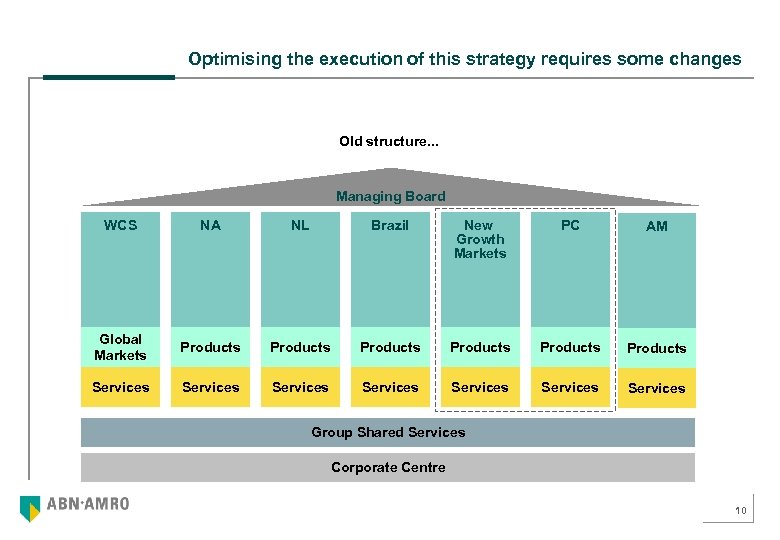

Optimising the execution of this strategy requires some changes Old structure. . . Managing Board WCS NA NL Brazil New Growth Markets PC AM Global Markets Products Products Services Services Group Shared Services Corporate Centre 10

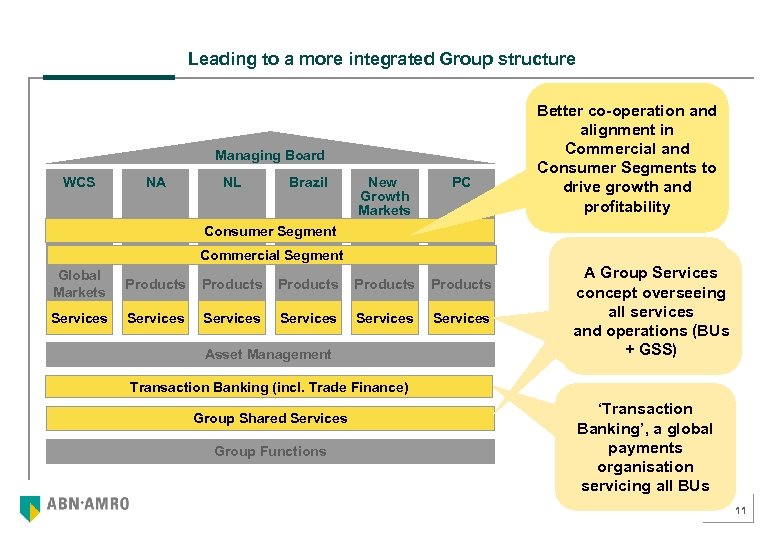

Leading to a more integrated Group structure Managing Board WCS NA NL Brazil New Growth Markets PC Better co-operation and alignment in Commercial and Consumer Segments to drive growth and profitability Consumer Segment Commercial Segment Global Markets Products Products Services Services Asset Management A Group Services concept overseeing all services and operations (BUs + GSS) Transaction Banking (incl. Trade Finance) Group Shared Services Group Functions ‘Transaction Banking’, a global payments organisation servicing all BUs 11

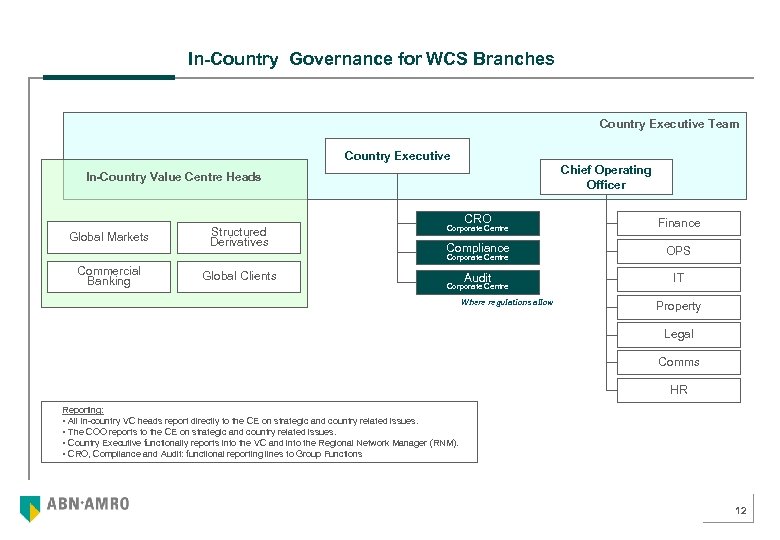

In-Country Governance for WCS Branches Country Executive Team Country Executive Chief Operating Officer In-Country Value Centre Heads Global Markets Structured Derivatives Corporate Centre CRO Finance Compliance OPS Audit IT Corporate Centre Commercial Banking Global Clients Corporate Centre Where regulations allow Property Legal Comms HR Reporting: • All in-country VC heads report directly to the CE on strategic and country related issues. • The COO reports to the CE on strategic and country related issues. • Country Executive functionally reports into the VC and into the Regional Network Manager (RNM). • CRO, Compliance and Audit: functional reporting lines to Group Functions 12

3 Client Segmentation & Product Business Units 13

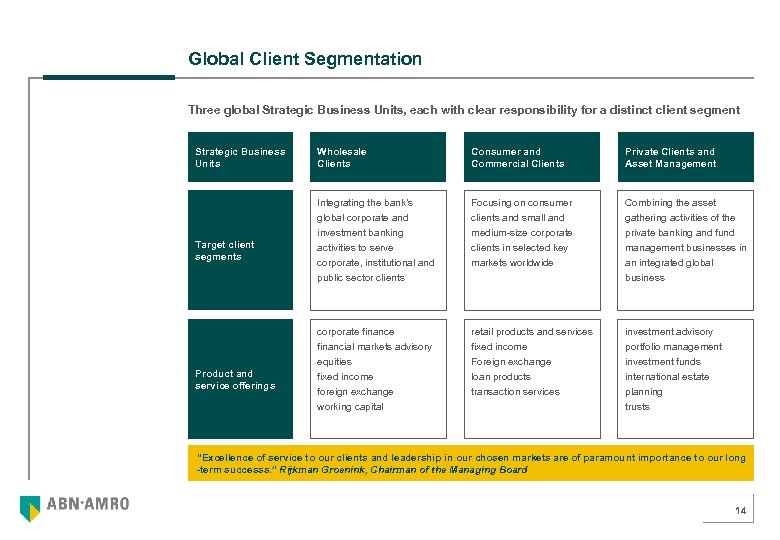

Global Client Segmentation Three global Strategic Business Units, each with clear responsibility for a distinct client segment Strategic Business Units Target client segments Product and service offerings Wholesale Clients Consumer and Commercial Clients Private Clients and Asset Management Integrating the bank’s global corporate and investment banking activities to serve Focusing on consumer clients and small and medium-size corporate clients in selected key Combining the asset gathering activities of the private banking and fund management businesses in corporate, institutional and public sector clients markets worldwide an integrated global business corporate financial markets advisory equities fixed income retail products and services fixed income Foreign exchange loan products investment advisory portfolio management investment funds international estate foreign exchange working capital transaction services planning trusts “Excellence of service to our clients and leadership in our chosen markets are of paramount importance to our long -term successs. ” Rijkman Groenink, Chairman of the Managing Board 14

Wholesale Clients Business Units Our sector specialists… … play a proactive role in developing relationships with clients, establishing a thorough understanding of client business objectives and challenges … work closely with our product experts to establish the best mix from our full range of products and services Financial Institutions and Public Sector That means we always offer advisory and financing responses custom-cut to the needs of the client Healthcare & Chemicals Industrials Integrated Energy Telecom, Media & Technology 15

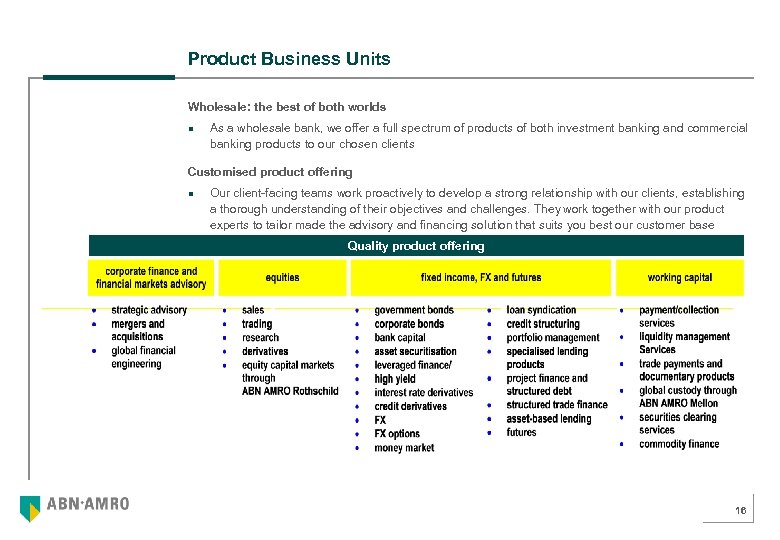

Product Business Units Wholesale: the best of both worlds n As a wholesale bank, we offer a full spectrum of products of both investment banking and commercial banking products to our chosen clients Customised product offering n Our client-facing teams work proactively to develop a strong relationship with our clients, establishing a thorough understanding of their objectives and challenges. They work together with our product experts to tailor made the advisory and financing solution that suits you best our customer base Quality product offering 16

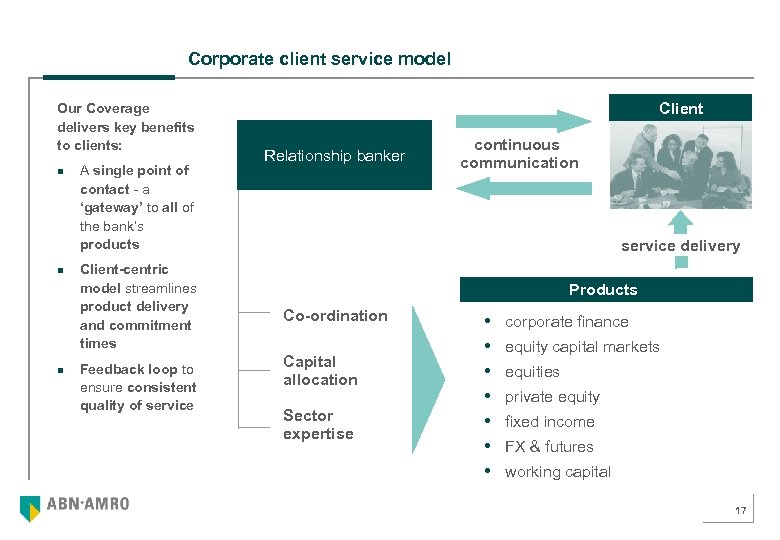

Corporate client service model Our Coverage delivers key benefits to clients: n n n A single point of contact - a ‘gateway’ to all of the bank’s products Client-centric model streamlines product delivery and commitment times Feedback loop to ensure consistent quality of service Client Relationship banker continuous communication service delivery Products Co-ordination Capital allocation Sector expertise corporate finance equity capital markets equities private equity fixed income FX & futures working capital 17

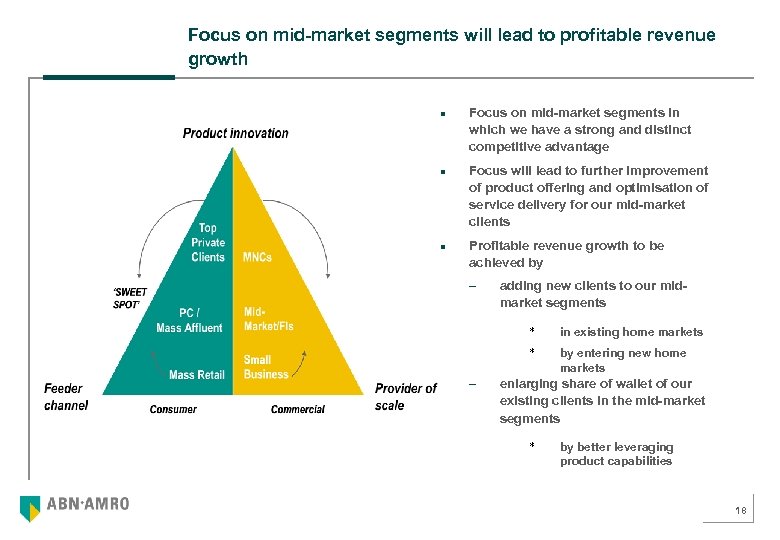

Focus on mid-market segments will lead to profitable revenue growth n n n Focus on mid-market segments in which we have a strong and distinct competitive advantage Focus will lead to further improvement of product offering and optimisation of service delivery for our mid-market clients Profitable revenue growth to be achieved by – adding new clients to our midmarket segments * * – in existing home markets by entering new home markets enlarging share of wallet of our existing clients in the mid-market segments * by better leveraging product capabilities 18

4 Profitability, Revenue Control & Capital Allocation 19

Wallet Sizing - How to measure client potential n n n Wallet sizing is the exercise of estimating, via client interviews and market data, how much is the total amount of financial services to be acquired by a client. After establishing the wallet potential the client service team estimates how much of this wallet could be won and which strategy need to be set to achieve it. After agreeing on the client strategy joint targets are set by the relationship manager and the product teams that will be the basis of their performance review Client results are tracked via a MIS system that recognizes 100% of the revenues for the relationship manager despite of the product or country where it is booked. Capital & Credit decisions are made taking in consideration such wallet exercise among other metrics like Economic Profit, Rating outlook, Sector concentration etc. . . Main benefit of such wallet exercise is to be the basis of a client led strategy that emphasiszes long term relationship gains instead of short term product returns. 20

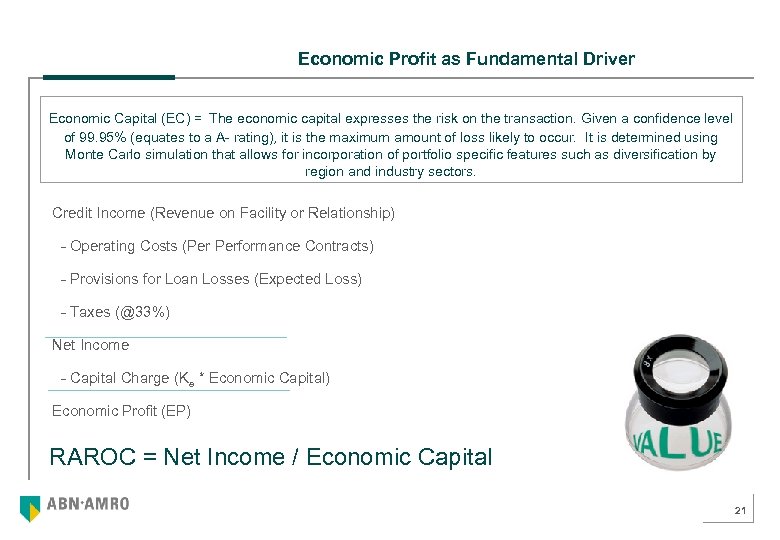

Economic Profit as Fundamental Driver Economic Capital (EC) = The economic capital expresses the risk on the transaction. Given a confidence level of 99. 95% (equates to a A- rating), it is the maximum amount of loss likely to occur. It is determined using Monte Carlo simulation that allows for incorporation of portfolio specific features such as diversification by region and industry sectors. Credit Income (Revenue on Facility or Relationship) - Operating Costs (Per Performance Contracts) - Provisions for Loan Losses (Expected Loss) - Taxes (@33%) Net Income - Capital Charge (Ke * Economic Capital) Economic Profit (EP) RAROC = Net Income / Economic Capital 21

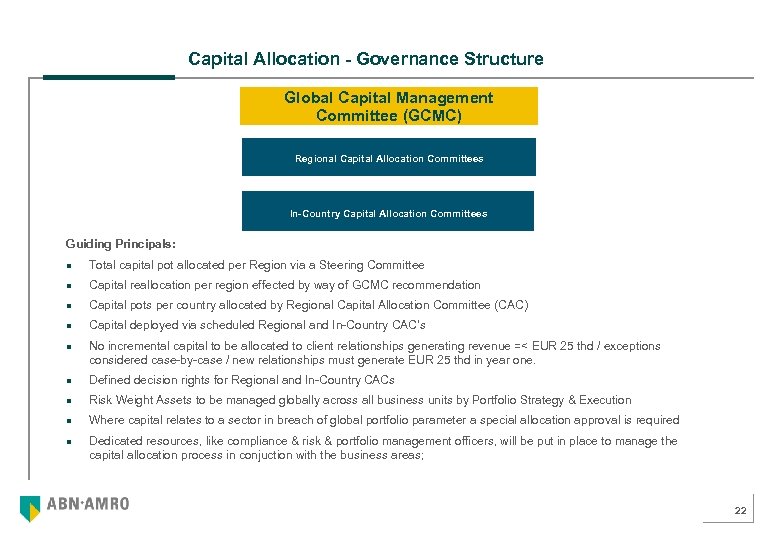

Capital Allocation - Governance Structure Global Capital Management Committee (GCMC) Regional Capital Allocation Committees In-Country Capital Allocation Committees Guiding Principals: n Total capital pot allocated per Region via a Steering Committee n Capital reallocation per region effected by way of GCMC recommendation n Capital pots per country allocated by Regional Capital Allocation Committee (CAC) n Capital deployed via scheduled Regional and In-Country CAC’s n No incremental capital to be allocated to client relationships generating revenue =< EUR 25 thd / exceptions considered case-by-case / new relationships must generate EUR 25 thd in year one. n Defined decision rights for Regional and In-Country CACs n Risk Weight Assets to be managed globally across all business units by Portfolio Strategy & Execution n Where capital relates to a sector in breach of global portfolio parameter a special allocation approval is required n Dedicated resources, like compliance & risk & portfolio management officers, will be put in place to manage the capital allocation process in conjuction with the business areas; 22

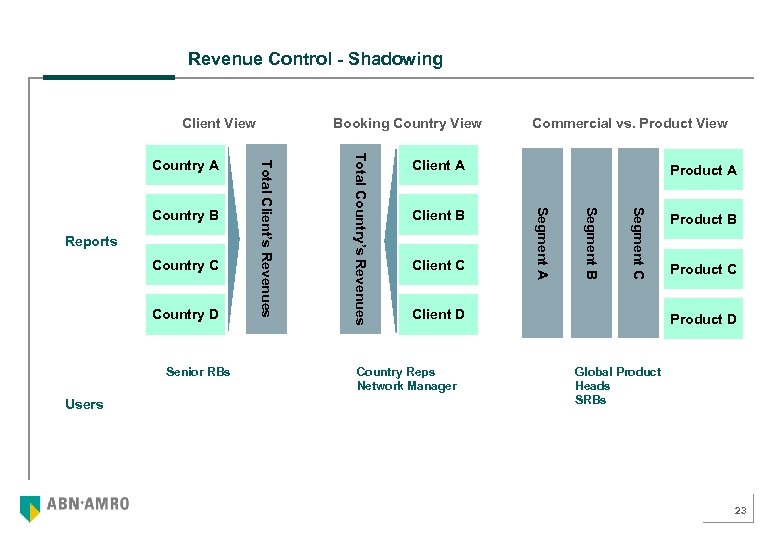

Revenue Control - Shadowing Client View Senior RBs Users Client B Client C Product A Segment C Country D Client A Segment B Country C Commercial vs. Product View Segment A Reports Total Country’s Revenues Country B Total Client’s Revenues Country A Booking Country View Client D Country Reps Network Manager Product B Product C Product D Global Product Heads SRBs 23

5 Basel II Risk Advisory Services 24

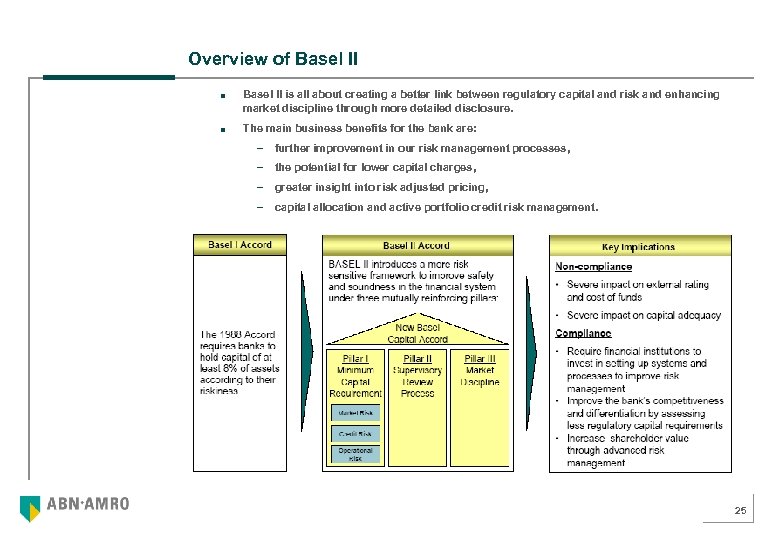

Overview of Basel II n n Basel II is all about creating a better link between regulatory capital and risk and enhancing market discipline through more detailed disclosure. The main business benefits for the bank are: – further improvement in our risk management processes, – the potential for lower capital charges, – greater insight into risk adjusted pricing, – capital allocation and active portfolio credit risk management. 25

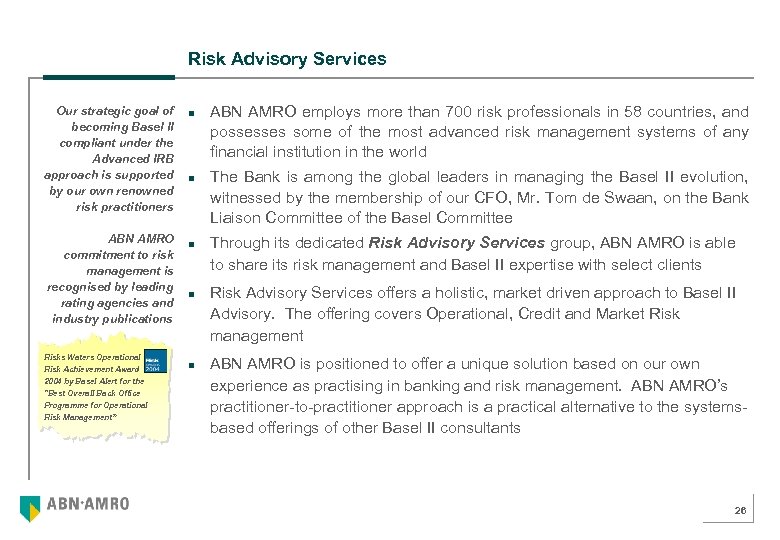

Risk Advisory Services Our strategic goal of becoming Basel II compliant under the Advanced IRB approach is supported by our own renowned risk practitioners ABN AMRO commitment to risk management is recognised by leading rating agencies and industry publications Risks Waters Operational Risk Achievement Award 2004 by Basel Alert for the "Best Overall Back Office Programme for Operational Risk Management” n n n ABN AMRO employs more than 700 risk professionals in 58 countries, and possesses some of the most advanced risk management systems of any financial institution in the world The Bank is among the global leaders in managing the Basel II evolution, witnessed by the membership of our CFO, Mr. Tom de Swaan, on the Bank Liaison Committee of the Basel Committee Through its dedicated Risk Advisory Services group, ABN AMRO is able to share its risk management and Basel II expertise with select clients Risk Advisory Services offers a holistic, market driven approach to Basel II Advisory. The offering covers Operational, Credit and Market Risk management ABN AMRO is positioned to offer a unique solution based on our own experience as practising in banking and risk management. ABN AMRO’s practitioner-to-practitioner approach is a practical alternative to the systemsbased offerings of other Basel II consultants 26

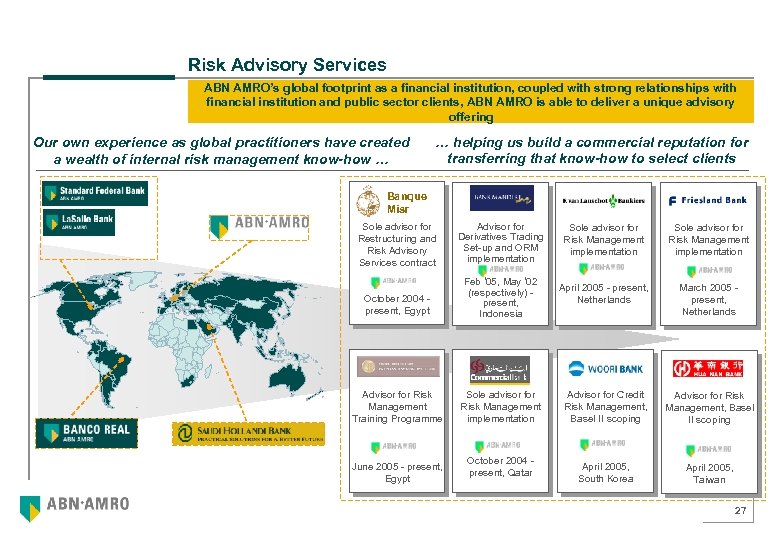

Risk Advisory Services ABN AMRO’s global footprint as a financial institution, coupled with strong relationships with financial institution and public sector clients, ABN AMRO is able to deliver a unique advisory offering Our own experience as global practitioners have created a wealth of internal risk management know-how … … helping us build a commercial reputation for transferring that know-how to select clients Banque Misr Sole advisor for Restructuring and Risk Advisory Services contract Advisor for Derivatives Trading Set-up and ORM implementation Sole advisor for Risk Management implementation October 2004 present, Egypt Feb ‘ 05, May ‘ 02 (respectively) present, Indonesia April 2005 - present, Netherlands March 2005 present, Netherlands Advisor for Risk Management Training Programme Sole advisor for Risk Management implementation Advisor for Credit Risk Management, Basel II scoping Advisor for Risk Management, Basel II scoping April 2005, South Korea April 2005, Taiwan June 2005 - present, Egypt October 2004 present, Qatar 27

Questions? Thank You! 28

Curriculum Vitae Carlos Braga is the Regional Network Manager for Spanish Speaking Latin America. Responsibilities include the coordination of the Bank’s WCS activities in Argentina, Chile, Colombia, Venezuela, Ecuador and Mexico. He brings to ABN AMRO´s customers a diversified background as Head of Financial Markets Latin America Business Unit (2002 -2004), Head of Loan Products Latin America group (20002002). Prior to this posting Mr. Braga held several postings in the product & corporate bank areas of ABN AMRO in Brazil and US. Mr. Braga joined ABN AMRO Bank in 1988. Mr. Braga received his Degree in International Trade Management from UCLA and his MBA from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Rio de Janeiro. Mr. Braga also has a Degree in Economics from Facultade Candido Mendes and a Management Corporate Resources Degree from IMD in Switzerland. CARLOS BRAGA Executive Director Regional Network Manager Latin America Tel. : 55 -11 -3174 7475 fax. : 55 -11 -3174 7477 e-mail: carlos. braga@br. abnamro. com

0c411dbcaf4ce3505aae5f62a903ed07.ppt