da359f5cd8150a63115b79d241a6b6c2.ppt

- Количество слайдов: 11

The Norwegian Petroleum Tax Model. Introduction by Håvard Holterud, Director Tax Audits and Economics, Norwegian Oil Taxation Office “Towards fiscal self-reliance: Capacity building for domestic revenue enhancement in Mozambique, Tanzania and Zambia”, 3031 st of March 2011, Cardoso Hotel, Maputo

Resource rent taxes in Norway Oil & Gas (production from 1971) • Resource rent tax introduced 1975 • Tax rate 50%, total marginal tax rate 78% • Net profit based • CO 2 tax and NOX tax (negative external effects) • Royalty phased out from 2000 Hydro power (production from 1900) • Resource rent tax introduced 1997 • Tax rate 30 %, total marginal tax rate 58% • The RRT is profit based • Property tax 0, 7 % (municipalities) • licence fee and entitlement to buy max 10 % of power generated

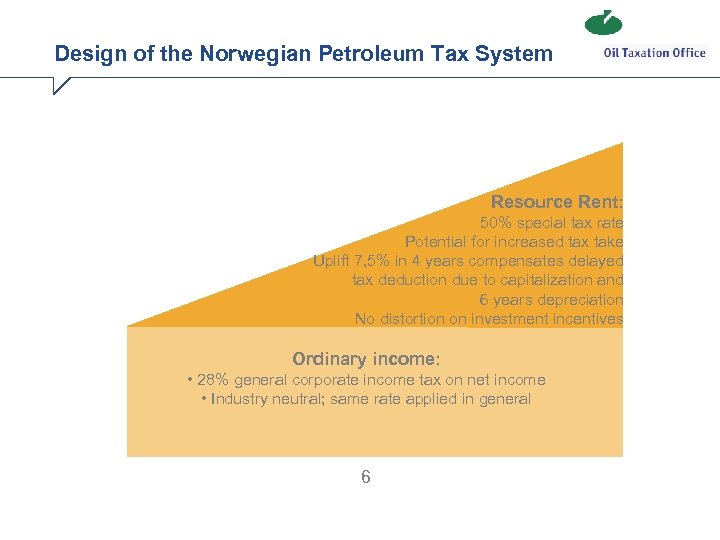

Design of the Norwegian Petroleum Tax System Resource Rent: 50% special tax rate Potential for increased tax take Uplift 7, 5% in 4 years compensates delayed tax deduction due to capitalization and 6 years depreciation No distortion on investment incentives Ordinary income: • 28% general corporate income tax on net income • Industry neutral; same rate applied in general 6

The Petroleum Tax System in Norway Sales income (norm prices for oil) - Operating costs (incl. exploration and decommissioning costs) - Capital depreciation (16, 7 pct. over 6 years) - Financial costs (special limitations) - (Losses carried forward) = Ordinary tax base liable to 28 pct. tax -(Uplift -7, 5% on development investment over 4 years=30%) = Special Tax base liable to 50 pct. tax • Uplift 7, 5% * 4 Years = 30%, deductible in Special Tax of 50%, • Tax (cash) deduction from uplift: 30%*50%=15% calculated on Development Expenditure

Losses Carried forward real Value Companies with no taxable income: • Can carry forward losses with annual interest • The interest equals risk free interest rate after tax: 5%*(1 -0, 28)= 3, 6% • Final losses can be sold or tax reimbursed from the state when business closed down Oil Taxation Office – tittel på presentasjonen 3/16/2018 5

Exploration Expenses Reimbursement Exploration Expenses representing a loss: • Taxpayer may elect refund (pay out) of exploration costs (instead of carrying real value of exploration expenses forward) • Exploration expenditure accordingly carried 78% by government and 22% by petroleum company in real terms • New entrants - often smaller sized petroleum companies - in equal after tax position compared to petroleum companies with taxable income to deduct exploration expenditure from • Company tax position neutral - decreases entrance barriers increases competition Oil Taxation Office – tittel på presentasjonen 3/16/2018 6

Financial Expenses – Allocation and Tax Deduction • Petroleum Tax Regime (Offshore) 78% Tax Rate • General Tax Regime (Onshore) 28% Tax Rate Financial Expenditure deductible Offshore in 78% Tax Regime equals: Net Financial Expenditure * 50% * Tax Value Offshore Assets Interest carrying Debt • Financial Expenditure includes interest and exchange losses • Positive Financial Expenditure allocated equally

Other Petroleum Revenue Sources Co 2 Emissions (1) • NOK 0, 47 per SM 3 Gas (2011) • NOK 0, 47 per liter Oil or Condensate (2011) NOx Emissions Offshore (turbines and flaring) • NOK 16, 43 per Kilo (2011) Area Fee: • NOK 33. 000 per M 2 Kilometer in 2007 – annually adjusted to real prices • From 2007 – new system where area fee similar to a tax on non-activity Royalty : • Abolished from 2000 1)Law 21. December 1990 nr. 72 - regarding CO 2 emissions on the Norwegian Continental Shelf Oil Taxation Office – tittel på presentasjonen 3/16/2018 8

Total Government Take from the Petroleum Sector

The State’s Direct Financial Interest (SDFI) • The state keeps a direct interest in a number of oil and gas fields • The state pays its share of investments and costs, and receives a corresponding share of the gross income from the license • Each interest is decided when licenses are awarded • The size of state interest depends on how promising the area is considered to be – 25% participation is common

Objectives of the Norwegian Petroleum Revenue system Transparent system and fair government share • Avoiding distortions of the investment incentives • Stability and predictability for the investors over time • Equal tax treatment of all petroleum companies (NOC) • No negotiations with the companies over tax rules • Simplicity, both for the tax administration and the tax payers • rules can be enforced effectively (without excessive costs) • possible for the companies to understand comply with the rules •

da359f5cd8150a63115b79d241a6b6c2.ppt