c0bf9efb7748c5ba8c74521e0bb628b5.ppt

- Количество слайдов: 22

The NFA Examination Process October 22 & 23, 2014 Patricia Cushing, Director, Compliance Cheryl Tulino, Director, Compliance Frank Carbonara, Manager, Compliance

Risk-Based Exam Selection 2 § Commenced development of NFA’s Risk Management System in 2006 § System analyzes the risk factors associated with each firm § Generally, NFA examines CPOs and CTAs every 3 -5 years § More frequent exams if risk factors deem necessary

Risk factors that may prompt an examination 3 § Customer complaints § Business background of principals § Concerns noted during a review of the firm’s promotional materials, disclosure documents and/or financial filings § Referrals received from other agencies/members § Time since registration or last exam

Use of PQR and PR data in Risk Analysis 4 § Funds under management § Degree of leverage § Types of investments § Performance returns

How to Prepare for an NFA Exam 5 Self-Examination Checklist § § First step toward a successful NFA exam General operations checklist Supplemental checklists for FCMs, IBs, CPOs and CTAs Signed attestation required

Other Available Resources 6 Publication: “NFA Regulatory Requirements for FCMs, IBs, CPOs and CTAs” § NFA Podcast (10 minutes): “Preparing for an NFA Audit” § NFA Podcast (10 minutes): “Registration Issues – Principals, APs and Branch Offices” § Appendices to Self-Exam Checklist: ethics training, privacy policy, disaster recovery §

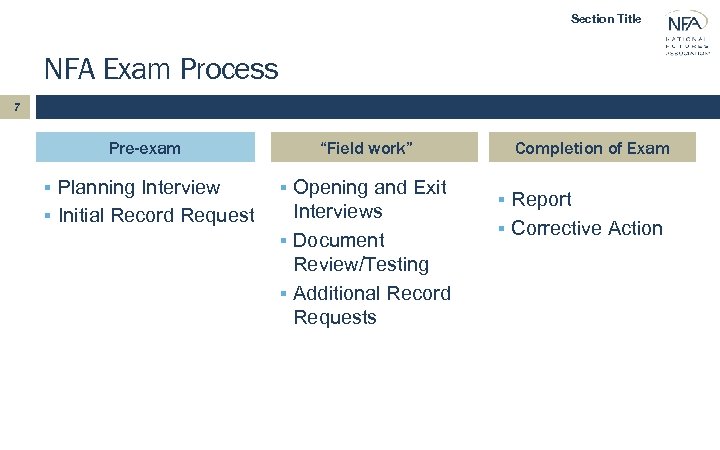

Section Title NFA Exam Process 7 Pre-exam “Field work” § Planning Interview § Opening and Exit § Initial Record Request Interviews § Document Review/Testing § Additional Record Requests Completion of Exam § Report § Corrective Action

Areas of Focus and Common Deficiencies

Areas of Focus 9 Renewed Focus on Internal Controls § § § Policies and procedures Separation of duties Access Backgrounds of key personnel Due diligence Risk management

Areas of Focus 10 § § § Registration of APs and principals Promotional material Account opening Trading Bunched orders Supervision

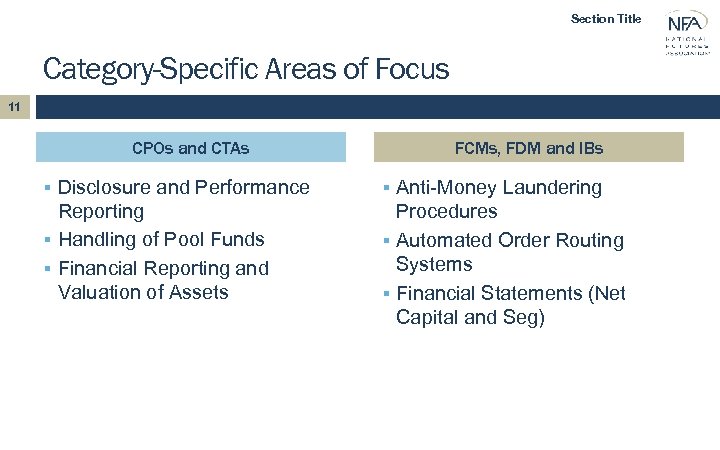

Section Title Category-Specific Areas of Focus 11 CPOs and CTAs FCMs, FDM and IBs § Disclosure and Performance § Anti-Money Laundering Reporting § Handling of Pool Funds § Financial Reporting and Valuation of Assets Procedures § Automated Order Routing Systems § Financial Statements (Net Capital and Seg)

Bylaw 1101: Due Diligence 12 § Does the account appear to require registration? § If not, why? (exemption, offshore) § If yes, why and is it registered? § Is the pool operator an NFA member? § Annually, review exempt entities (exemption affirmation)

Bylaw 1101: Where to look 13 § BASIC-Registration Status § Part 4 Exemption Look-Up in ORS and BASIC § Ask client for copy of exemption § In all cases, document findings

Areas of Focus on all Categories 14 § Promotional Materials and Sales Practices § Procedures, review and approval § Balanced presentation § Registration, Common Deficiencies § Unlisted principals and branch offices; unregistered APs; APs not terminated § Failing to update registration records § Tape Recording Requirements § FCMs, IBs and certain CTAs

Anti-Money Laundering Program 15 § Applies to FCMs, FDMs and IBs § Establish appropriate red flags § Monitor for suspicious activity § Provide training every 12 months § Conduct an independent AML audit every 12 months

Other FCM, FDM and IB areas 16 § Commissions receivable § Can only be current for 30 days of due date § Coding of Accounts § Non-customer accounts being coded as customer § Only certain employee accounts need to be non-customer § Undermargined Accounts § Length of time accounts are undermargined while continuing to trade

Bunched Orders 17 § Procedures for allocating split fills or partial fills § CTA must conduct a quarterly review of accounts to ensure that bunched orders are allocated in a nonpreferential manner

Pool Financial Reporting, Valuation of Assets And Handling of Pool Funds 18 § Common Deficiencies: Incomplete account statements § § § Information only included for the individual pool participant Statements must include information for the pool as a whole Statements do not properly itemize all required information

Pool Financial Reporting 19 § Required information is missing beneath the oath on each account statement: § The name of the individual signing the account statement § The capacity in which he or she is signing § The name of the commodity pool operator for whom he or she is signing § The name of the commodity pool for which the statement is being distributed

NFA Compliance Rule 2 -45 20 Prohibition on pools loaning money to the CPO or an affiliate: § § Interpretive Notice outlines permissible transactions Receivables from general partner may be deemed “loans” in certain circumstances

Disclosure Documents and Performance Reporting 21 § Operations inconsistent with disclosure § § § Fees Redemptions Trading strategy Conflicts of interest Banks, carrying brokers, custodians GP and/or CTA ownership interest § Performance Recordkeeping § Supporting worksheets § Partial funding documentation

Thank you.

c0bf9efb7748c5ba8c74521e0bb628b5.ppt