4e921b5b8e596b8b1715cd12b90a9eb2.ppt

- Количество слайдов: 29

The Newest Development of ICT Industry in Taiwan Dr. Victor Tsan General Director Market Intelligence Center Institute for Information Industry e-mail: victor@iii. org. tw http: //mic. iii. org. tw

The Newest Development of ICT Industry in Taiwan Dr. Victor Tsan General Director Market Intelligence Center Institute for Information Industry e-mail: victor@iii. org. tw http: //mic. iii. org. tw

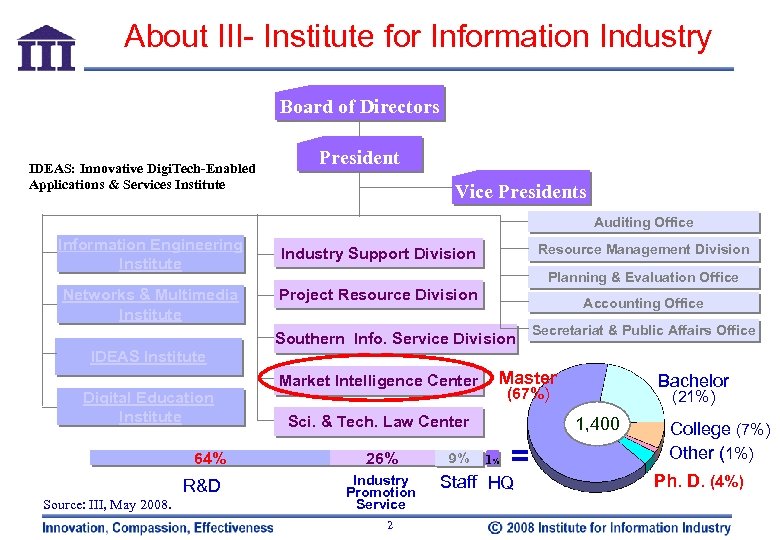

About III- Institute for Information Industry Board of Directors IDEAS: Innovative Digi. Tech-Enabled Applications & Services Institute President Vice Presidents Auditing Office Information Engineering Institute Networks & Multimedia Institute Resource Management Division Industry Support Division Planning & Evaluation Office Project Resource Division Accounting Office Southern Info. Service Division Secretariat & Public Affairs Office IDEAS Institute Digital Education Institute 64% R&D Source: III, May 2008. Market Intelligence Center Master Sci. & Tech. Law Center 26% Industry Promotion Service 2 9% Bachelor (67%) (21%) 1, 400 1% = Staff HQ College (7%) Other (1%) Ph. D. (4%)

About III- Institute for Information Industry Board of Directors IDEAS: Innovative Digi. Tech-Enabled Applications & Services Institute President Vice Presidents Auditing Office Information Engineering Institute Networks & Multimedia Institute Resource Management Division Industry Support Division Planning & Evaluation Office Project Resource Division Accounting Office Southern Info. Service Division Secretariat & Public Affairs Office IDEAS Institute Digital Education Institute 64% R&D Source: III, May 2008. Market Intelligence Center Master Sci. & Tech. Law Center 26% Industry Promotion Service 2 9% Bachelor (67%) (21%) 1, 400 1% = Staff HQ College (7%) Other (1%) Ph. D. (4%)

MIC at a Glance Mission ØAssist businesses in seizing market opportunities ØAssist the Taiwanese government in formulating industry development strategies Since 1987, MIC has been serving as a strategic think thank for senior decision makers in industries, public sectors, academic spheres, and investment communities: v Over 600 members, including Taiwan’s most prominent high-tech companies whose combined production value contribute to 85% of Taiwan’s annual IT industry output v 250 client-customized projects v 2, 000 research monographs v 500 major seminars v 50, 000 market and industry intelligence queries v First market research organization in Taiwan to be awarded ISO 9001 certification 3

MIC at a Glance Mission ØAssist businesses in seizing market opportunities ØAssist the Taiwanese government in formulating industry development strategies Since 1987, MIC has been serving as a strategic think thank for senior decision makers in industries, public sectors, academic spheres, and investment communities: v Over 600 members, including Taiwan’s most prominent high-tech companies whose combined production value contribute to 85% of Taiwan’s annual IT industry output v 250 client-customized projects v 2, 000 research monographs v 500 major seminars v 50, 000 market and industry intelligence queries v First market research organization in Taiwan to be awarded ISO 9001 certification 3

The Newest Development of ICT Industry in Taiwan 4

The Newest Development of ICT Industry in Taiwan 4

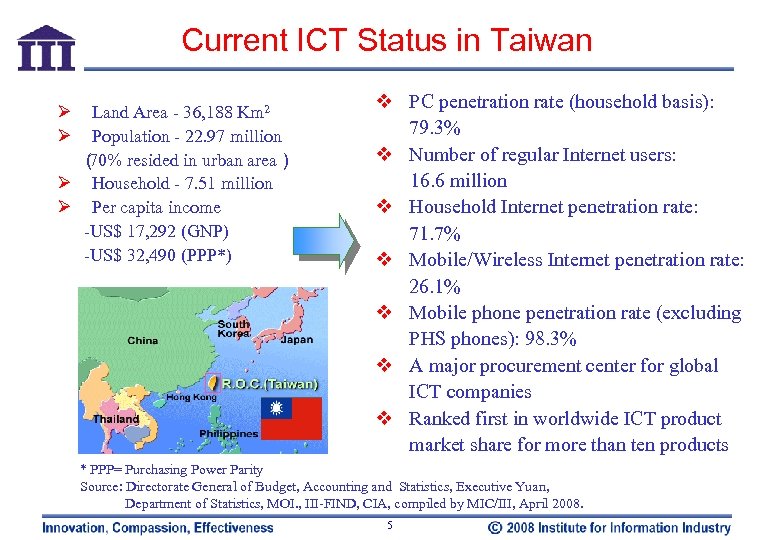

Current ICT Status in Taiwan Ø Ø Land Area - 36, 188 Km 2 Population - 22. 97 million ( 70% resided in urban area) Ø Household - 7. 51 million Ø Per capita income -US$ 17, 292 (GNP) -US$ 32, 490 (PPP*) v PC penetration rate (household basis): 79. 3% v Number of regular Internet users: 16. 6 million v Household Internet penetration rate: 71. 7% v Mobile/Wireless Internet penetration rate: 26. 1% v Mobile phone penetration rate (excluding PHS phones): 98. 3% v A major procurement center for global ICT companies v Ranked first in worldwide ICT product market share for more than ten products * PPP= Purchasing Power Parity Source: Directorate General of Budget, Accounting and Statistics, Executive Yuan, Department of Statistics, MOI. , III-FIND, CIA, compiled by MIC/III, April 2008. 5

Current ICT Status in Taiwan Ø Ø Land Area - 36, 188 Km 2 Population - 22. 97 million ( 70% resided in urban area) Ø Household - 7. 51 million Ø Per capita income -US$ 17, 292 (GNP) -US$ 32, 490 (PPP*) v PC penetration rate (household basis): 79. 3% v Number of regular Internet users: 16. 6 million v Household Internet penetration rate: 71. 7% v Mobile/Wireless Internet penetration rate: 26. 1% v Mobile phone penetration rate (excluding PHS phones): 98. 3% v A major procurement center for global ICT companies v Ranked first in worldwide ICT product market share for more than ten products * PPP= Purchasing Power Parity Source: Directorate General of Budget, Accounting and Statistics, Executive Yuan, Department of Statistics, MOI. , III-FIND, CIA, compiled by MIC/III, April 2008. 5

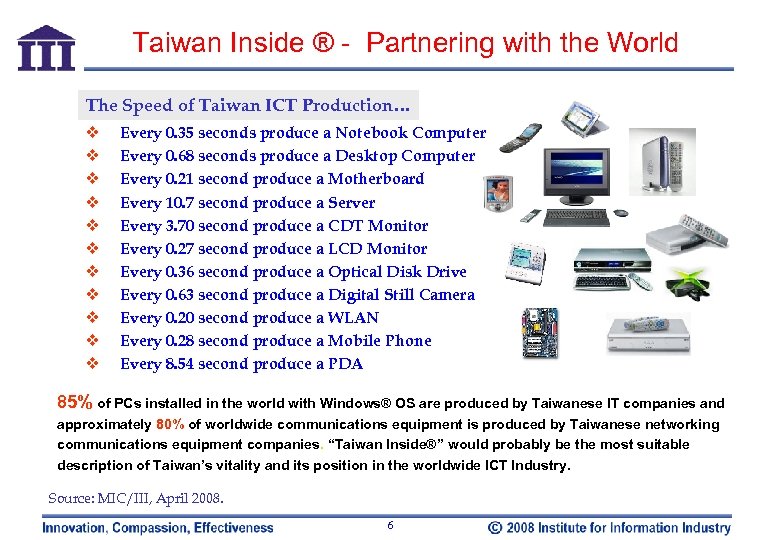

Taiwan Inside ® - Partnering with the World The Speed of Taiwan ICT Production… v v v Every 0. 35 seconds produce a Notebook Computer Every 0. 68 seconds produce a Desktop Computer Every 0. 21 second produce a Motherboard Every 10. 7 second produce a Server Every 3. 70 second produce a CDT Monitor Every 0. 27 second produce a LCD Monitor Every 0. 36 second produce a Optical Disk Drive Every 0. 63 second produce a Digital Still Camera Every 0. 20 second produce a WLAN Every 0. 28 second produce a Mobile Phone Every 8. 54 second produce a PDA 85% of PCs installed in the world with Windows® OS are produced by Taiwanese IT companies and approximately 80% of worldwide communications equipment is produced by Taiwanese networking communications equipment companies. “Taiwan Inside®” would probably be the most suitable description of Taiwan’s vitality and its position in the worldwide ICT Industry. Source: MIC/III, April 2008. 6

Taiwan Inside ® - Partnering with the World The Speed of Taiwan ICT Production… v v v Every 0. 35 seconds produce a Notebook Computer Every 0. 68 seconds produce a Desktop Computer Every 0. 21 second produce a Motherboard Every 10. 7 second produce a Server Every 3. 70 second produce a CDT Monitor Every 0. 27 second produce a LCD Monitor Every 0. 36 second produce a Optical Disk Drive Every 0. 63 second produce a Digital Still Camera Every 0. 20 second produce a WLAN Every 0. 28 second produce a Mobile Phone Every 8. 54 second produce a PDA 85% of PCs installed in the world with Windows® OS are produced by Taiwanese IT companies and approximately 80% of worldwide communications equipment is produced by Taiwanese networking communications equipment companies. “Taiwan Inside®” would probably be the most suitable description of Taiwan’s vitality and its position in the worldwide ICT Industry. Source: MIC/III, April 2008. 6

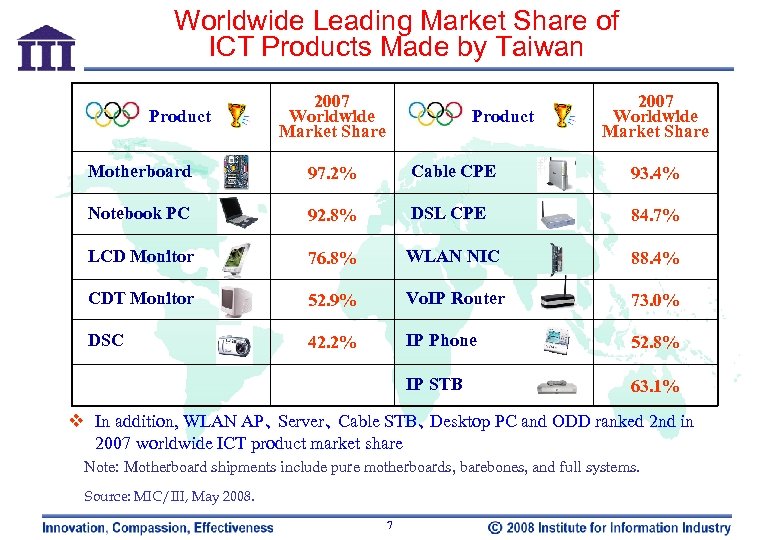

Worldwide Leading Market Share of ICT Products Made by Taiwan Product 2007 Worldwide Market Share Motherboard 97. 2% Cable CPE 93. 4% Notebook PC 92. 8% DSL CPE 84. 7% LCD Monitor 76. 8% WLAN NIC 88. 4% CDT Monitor 52. 9% Vo. IP Router 73. 0% DSC 42. 2% IP Phone 52. 8% IP STB 63. 1% v In addition, WLAN AP、 Server、 Cable STB、 Desktop PC and ODD ranked 2 nd in 2007 worldwide ICT product market share Note: Motherboard shipments include pure motherboards, barebones, and full systems. Source: MIC/III, May 2008. 7

Worldwide Leading Market Share of ICT Products Made by Taiwan Product 2007 Worldwide Market Share Motherboard 97. 2% Cable CPE 93. 4% Notebook PC 92. 8% DSL CPE 84. 7% LCD Monitor 76. 8% WLAN NIC 88. 4% CDT Monitor 52. 9% Vo. IP Router 73. 0% DSC 42. 2% IP Phone 52. 8% IP STB 63. 1% v In addition, WLAN AP、 Server、 Cable STB、 Desktop PC and ODD ranked 2 nd in 2007 worldwide ICT product market share Note: Motherboard shipments include pure motherboards, barebones, and full systems. Source: MIC/III, May 2008. 7

Taiwanese ICT Hardware Industry 8

Taiwanese ICT Hardware Industry 8

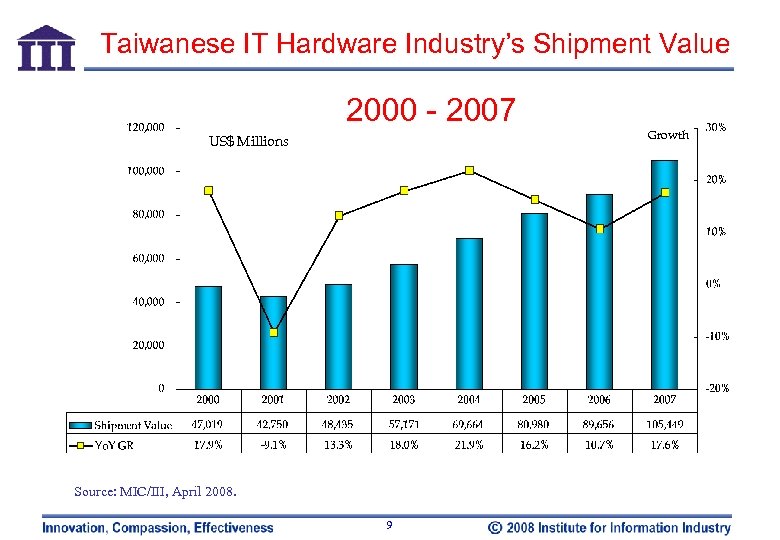

Taiwanese IT Hardware Industry’s Shipment Value 2000 - 2007 US$ Millions Source: MIC/III, April 2008. 9 Growth

Taiwanese IT Hardware Industry’s Shipment Value 2000 - 2007 US$ Millions Source: MIC/III, April 2008. 9 Growth

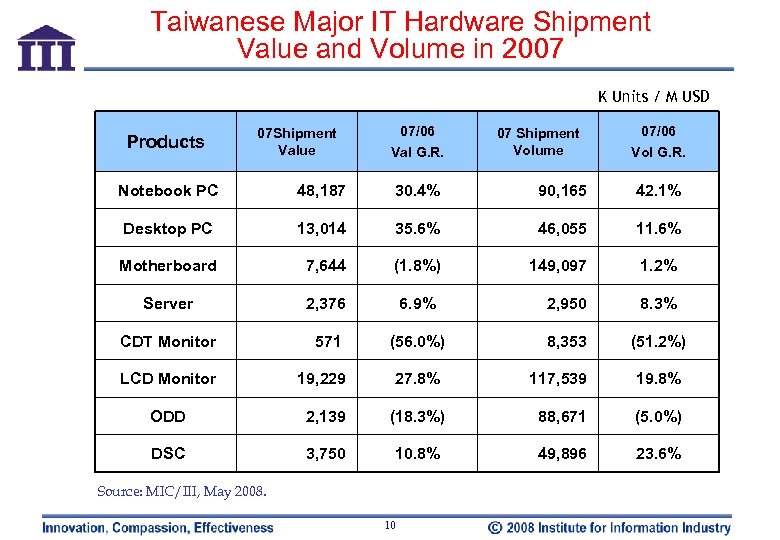

Taiwanese Major IT Hardware Shipment Value and Volume in 2007 K Units / M USD Products 07 Shipment Value 07/06 Val G. R. 07 Shipment Volume 07/06 Vol G. R. Notebook PC 48, 187 30. 4% 90, 165 42. 1% Desktop PC 13, 014 35. 6% 46, 055 11. 6% Motherboard 7, 644 (1. 8%) 149, 097 1. 2% Server 2, 376 6. 9% 2, 950 8. 3% CDT Monitor 571 (56. 0%) 8, 353 (51. 2%) LCD Monitor 19, 229 27. 8% 117, 539 19. 8% ODD 2, 139 (18. 3%) 88, 671 (5. 0%) DSC 3, 750 10. 8% 49, 896 23. 6% Source: MIC/III, May 2008. 10

Taiwanese Major IT Hardware Shipment Value and Volume in 2007 K Units / M USD Products 07 Shipment Value 07/06 Val G. R. 07 Shipment Volume 07/06 Vol G. R. Notebook PC 48, 187 30. 4% 90, 165 42. 1% Desktop PC 13, 014 35. 6% 46, 055 11. 6% Motherboard 7, 644 (1. 8%) 149, 097 1. 2% Server 2, 376 6. 9% 2, 950 8. 3% CDT Monitor 571 (56. 0%) 8, 353 (51. 2%) LCD Monitor 19, 229 27. 8% 117, 539 19. 8% ODD 2, 139 (18. 3%) 88, 671 (5. 0%) DSC 3, 750 10. 8% 49, 896 23. 6% Source: MIC/III, May 2008. 10

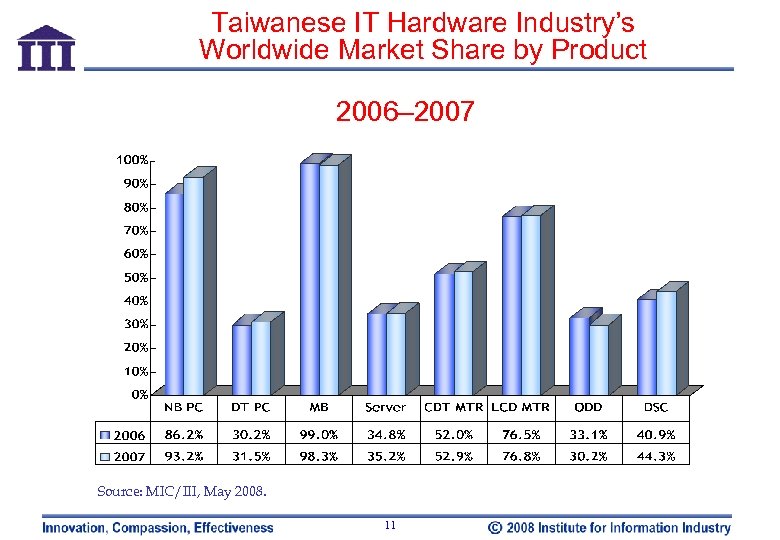

Taiwanese IT Hardware Industry’s Worldwide Market Share by Product 2006– 2007 Source: MIC/III, May 2008. 11

Taiwanese IT Hardware Industry’s Worldwide Market Share by Product 2006– 2007 Source: MIC/III, May 2008. 11

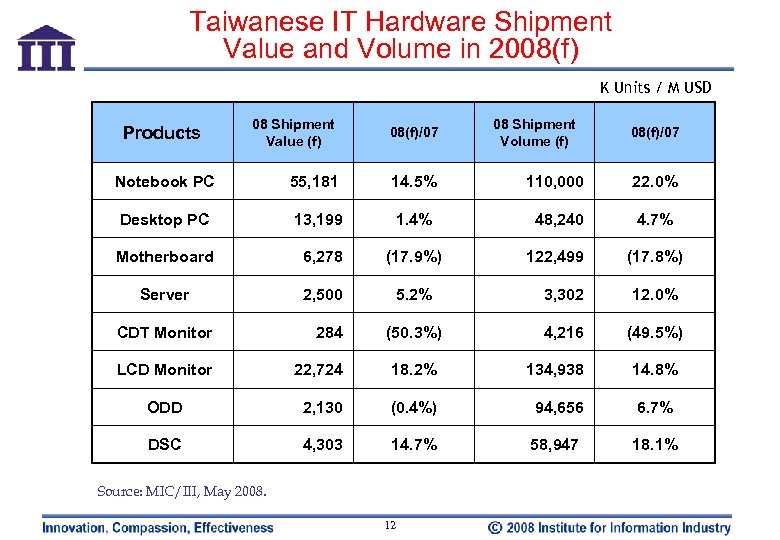

Taiwanese IT Hardware Shipment Value and Volume in 2008(f) K Units / M USD 08 Shipment Value (f) 08(f)/07 Notebook PC 55, 181 14. 5% 110, 000 22. 0% Desktop PC 13, 199 1. 4% 48, 240 4. 7% Motherboard 6, 278 (17. 9%) 122, 499 (17. 8%) Server 2, 500 5. 2% 3, 302 12. 0% (50. 3%) 4, 216 (49. 5%) Products 08 Shipment Volume (f) 08(f)/07 CDT Monitor 284 LCD Monitor 22, 724 18. 2% 134, 938 14. 8% ODD 2, 130 (0. 4%) 94, 656 6. 7% DSC 4, 303 14. 7% 58, 947 18. 1% Source: MIC/III, May 2008. 12

Taiwanese IT Hardware Shipment Value and Volume in 2008(f) K Units / M USD 08 Shipment Value (f) 08(f)/07 Notebook PC 55, 181 14. 5% 110, 000 22. 0% Desktop PC 13, 199 1. 4% 48, 240 4. 7% Motherboard 6, 278 (17. 9%) 122, 499 (17. 8%) Server 2, 500 5. 2% 3, 302 12. 0% (50. 3%) 4, 216 (49. 5%) Products 08 Shipment Volume (f) 08(f)/07 CDT Monitor 284 LCD Monitor 22, 724 18. 2% 134, 938 14. 8% ODD 2, 130 (0. 4%) 94, 656 6. 7% DSC 4, 303 14. 7% 58, 947 18. 1% Source: MIC/III, May 2008. 12

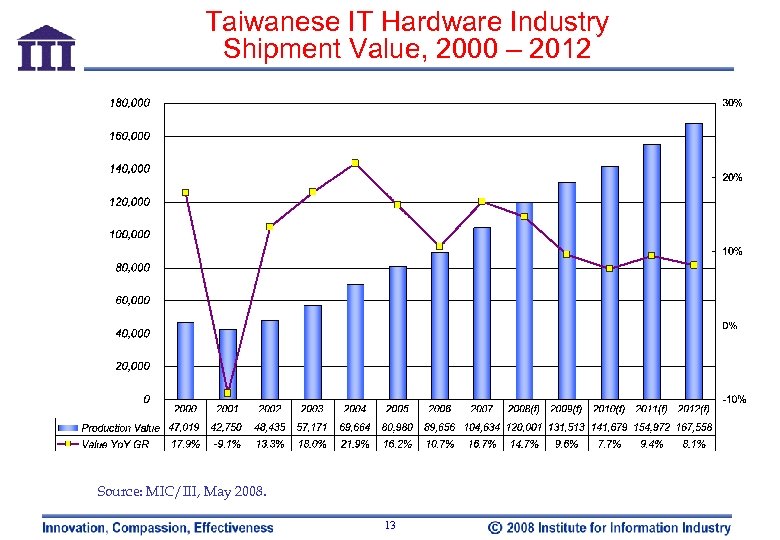

Taiwanese IT Hardware Industry Shipment Value, 2000 – 2012 Source: MIC/III, May 2008. 13

Taiwanese IT Hardware Industry Shipment Value, 2000 – 2012 Source: MIC/III, May 2008. 13

Taiwanese Data Communications Industry

Taiwanese Data Communications Industry

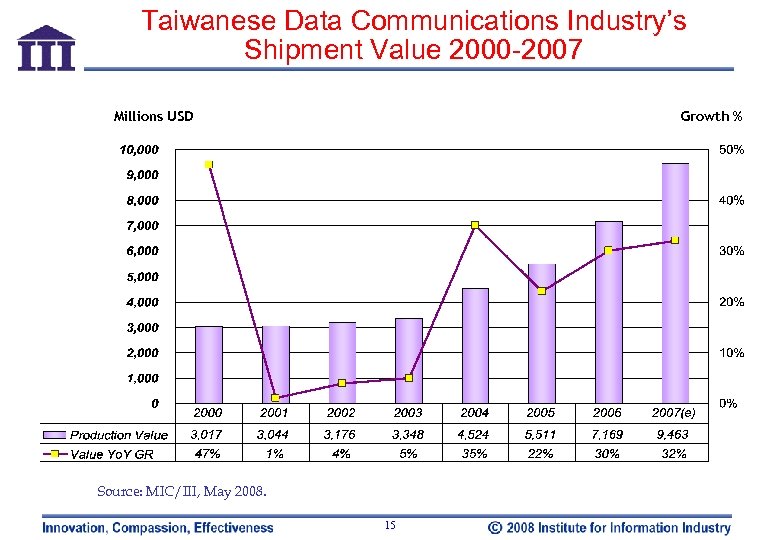

Taiwanese Data Communications Industry’s Shipment Value 2000 -2007 Millions USD Growth % Source: MIC/III, May 2008. 15

Taiwanese Data Communications Industry’s Shipment Value 2000 -2007 Millions USD Growth % Source: MIC/III, May 2008. 15

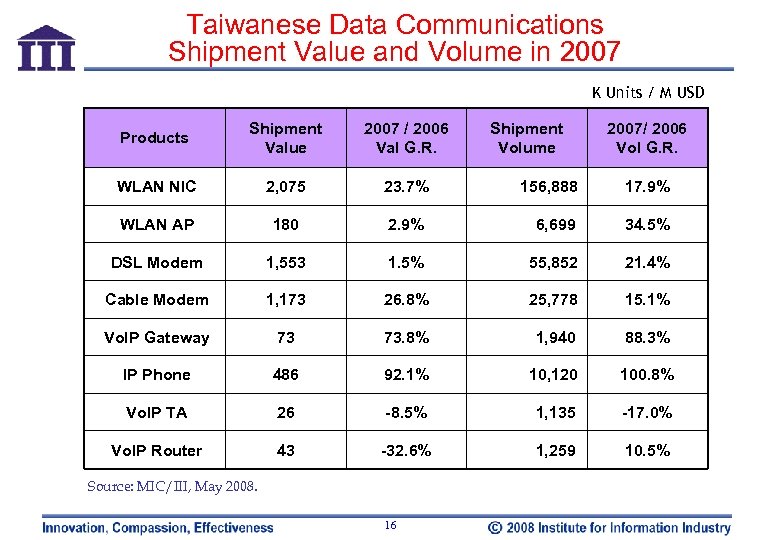

Taiwanese Data Communications Shipment Value and Volume in 2007 K Units / M USD Products Shipment Value 2007 / 2006 Val G. R. WLAN NIC 2, 075 23. 7% 156, 888 17. 9% WLAN AP 180 2. 9% 6, 699 34. 5% DSL Modem 1, 553 1. 5% 55, 852 21. 4% Cable Modem 1, 173 26. 8% 25, 778 15. 1% Vo. IP Gateway 73 73. 8% 1, 940 88. 3% IP Phone 486 92. 1% 10, 120 100. 8% Vo. IP TA 26 -8. 5% 1, 135 -17. 0% Vo. IP Router 43 -32. 6% 1, 259 10. 5% Source: MIC/III, May 2008. 16 Shipment Volume 2007/ 2006 Vol G. R.

Taiwanese Data Communications Shipment Value and Volume in 2007 K Units / M USD Products Shipment Value 2007 / 2006 Val G. R. WLAN NIC 2, 075 23. 7% 156, 888 17. 9% WLAN AP 180 2. 9% 6, 699 34. 5% DSL Modem 1, 553 1. 5% 55, 852 21. 4% Cable Modem 1, 173 26. 8% 25, 778 15. 1% Vo. IP Gateway 73 73. 8% 1, 940 88. 3% IP Phone 486 92. 1% 10, 120 100. 8% Vo. IP TA 26 -8. 5% 1, 135 -17. 0% Vo. IP Router 43 -32. 6% 1, 259 10. 5% Source: MIC/III, May 2008. 16 Shipment Volume 2007/ 2006 Vol G. R.

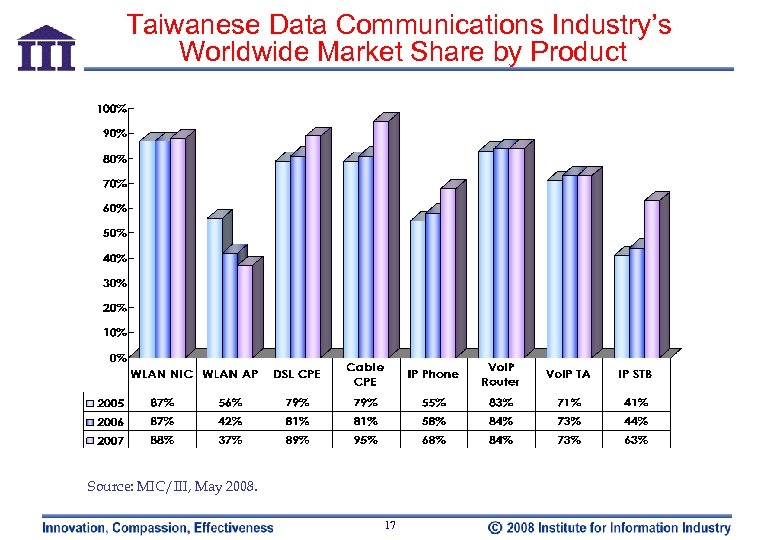

Taiwanese Data Communications Industry’s Worldwide Market Share by Product Source: MIC/III, May 2008. 17

Taiwanese Data Communications Industry’s Worldwide Market Share by Product Source: MIC/III, May 2008. 17

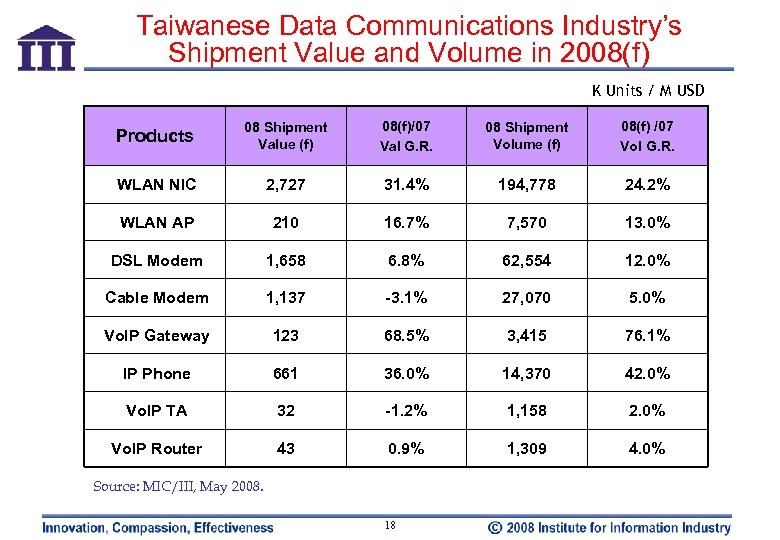

Taiwanese Data Communications Industry’s Shipment Value and Volume in 2008(f) K Units / M USD Products 08 Shipment Value (f) 08(f)/07 Val G. R. 08 Shipment Volume (f) 08(f) /07 Vol G. R. WLAN NIC 2, 727 31. 4% 194, 778 24. 2% WLAN AP 210 16. 7% 7, 570 13. 0% DSL Modem 1, 658 6. 8% 62, 554 12. 0% Cable Modem 1, 137 -3. 1% 27, 070 5. 0% Vo. IP Gateway 123 68. 5% 3, 415 76. 1% IP Phone 661 36. 0% 14, 370 42. 0% Vo. IP TA 32 -1. 2% 1, 158 2. 0% Vo. IP Router 43 0. 9% 1, 309 4. 0% Source: MIC/III, May 2008. 18

Taiwanese Data Communications Industry’s Shipment Value and Volume in 2008(f) K Units / M USD Products 08 Shipment Value (f) 08(f)/07 Val G. R. 08 Shipment Volume (f) 08(f) /07 Vol G. R. WLAN NIC 2, 727 31. 4% 194, 778 24. 2% WLAN AP 210 16. 7% 7, 570 13. 0% DSL Modem 1, 658 6. 8% 62, 554 12. 0% Cable Modem 1, 137 -3. 1% 27, 070 5. 0% Vo. IP Gateway 123 68. 5% 3, 415 76. 1% IP Phone 661 36. 0% 14, 370 42. 0% Vo. IP TA 32 -1. 2% 1, 158 2. 0% Vo. IP Router 43 0. 9% 1, 309 4. 0% Source: MIC/III, May 2008. 18

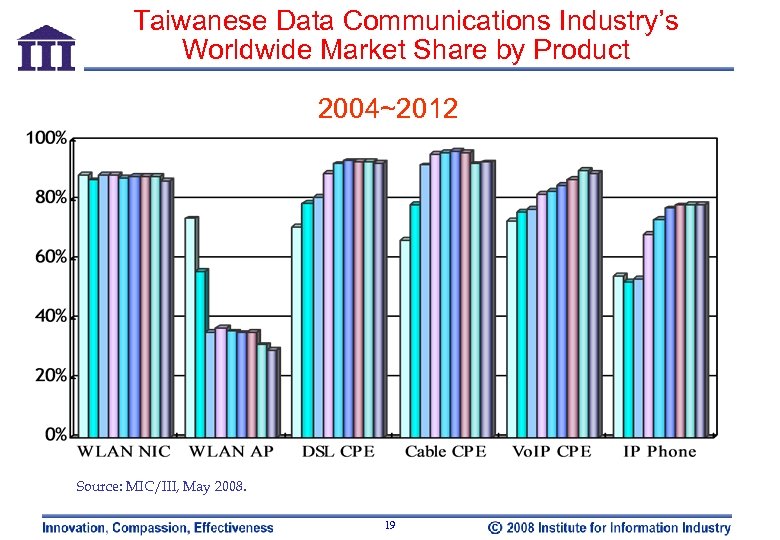

Taiwanese Data Communications Industry’s Worldwide Market Share by Product 2004~2012 Source: MIC/III, May 2008. 19

Taiwanese Data Communications Industry’s Worldwide Market Share by Product 2004~2012 Source: MIC/III, May 2008. 19

PC Industry Supply Chain: Opportunities & Challenges 20

PC Industry Supply Chain: Opportunities & Challenges 20

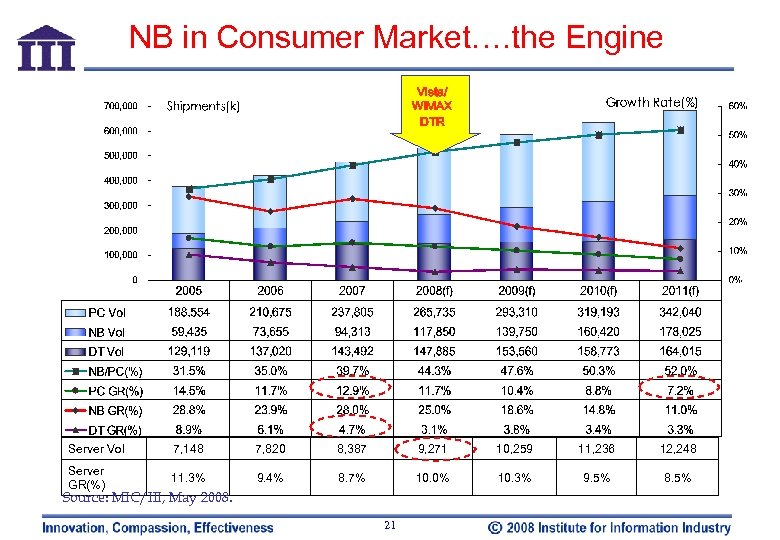

NB in Consumer Market…. the Engine Vista/ WIMAX DTR Server Vol 7, 148 7, 820 8, 387 9, 271 10, 259 11, 236 12, 248 Server GR(%) 11. 3% 9. 4% 8. 7% 10. 0% 10. 3% 9. 5% 8. 5% Source: MIC/III, May 2008. 21

NB in Consumer Market…. the Engine Vista/ WIMAX DTR Server Vol 7, 148 7, 820 8, 387 9, 271 10, 259 11, 236 12, 248 Server GR(%) 11. 3% 9. 4% 8. 7% 10. 0% 10. 3% 9. 5% 8. 5% Source: MIC/III, May 2008. 21

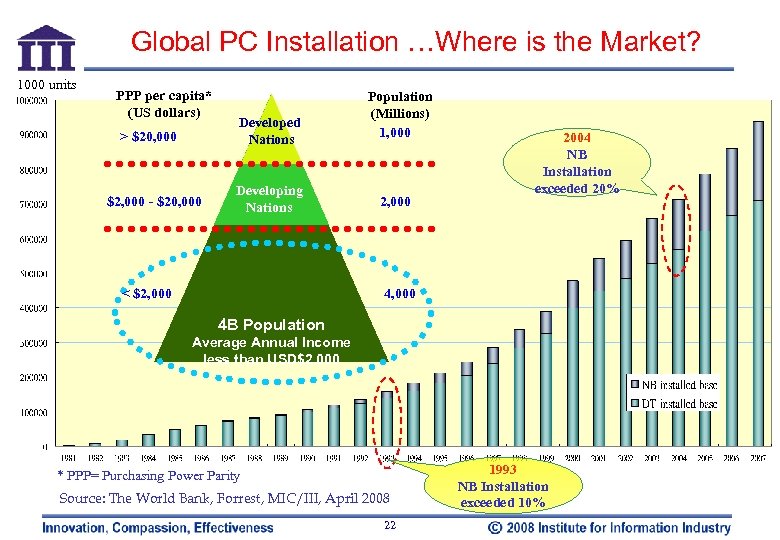

Global PC Installation …Where is the Market? 1000 units PPP per capita* (US dollars) > $20, 000 $2, 000 - $20, 000 Developed Nations Developing Nations < $2, 000 Population (Millions) 1, 000 2004 NB Installation exceeded 20% 4, 000 4 B Population Average Annual Income less than USD$2, 000 * PPP= Purchasing Power Parity Source: The World Bank, Forrest, MIC/III, April 2008 22 1993 NB Installation exceeded 10%

Global PC Installation …Where is the Market? 1000 units PPP per capita* (US dollars) > $20, 000 $2, 000 - $20, 000 Developed Nations Developing Nations < $2, 000 Population (Millions) 1, 000 2004 NB Installation exceeded 20% 4, 000 4 B Population Average Annual Income less than USD$2, 000 * PPP= Purchasing Power Parity Source: The World Bank, Forrest, MIC/III, April 2008 22 1993 NB Installation exceeded 10%

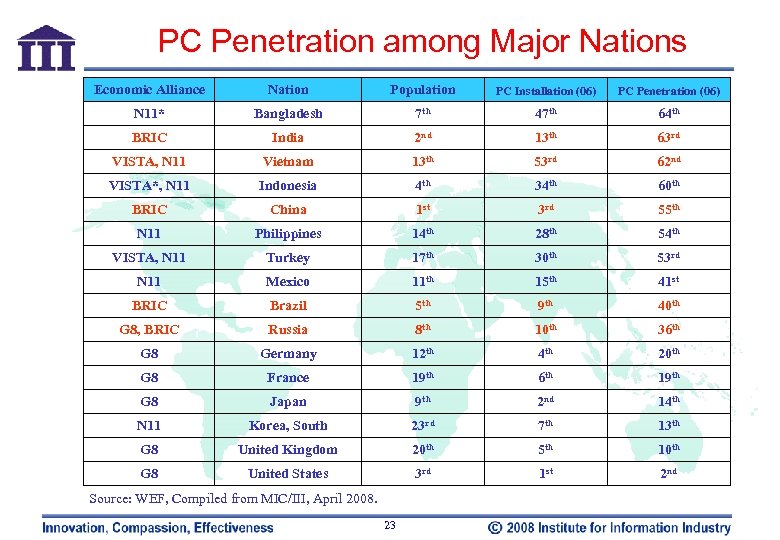

PC Penetration among Major Nations Economic Alliance Nation Population PC Installation (06) PC Penetration (06) N 11* Bangladesh 7 th 47 th 64 th BRIC India 2 nd 13 th 63 rd VISTA, N 11 Vietnam 13 th 53 rd 62 nd VISTA*, N 11 Indonesia 4 th 34 th 60 th BRIC China 1 st 3 rd 55 th N 11 Philippines 14 th 28 th 54 th VISTA, N 11 Turkey 17 th 30 th 53 rd N 11 Mexico 11 th 15 th 41 st BRIC Brazil 5 th 9 th 40 th G 8, BRIC Russia 8 th 10 th 36 th G 8 Germany 12 th 4 th 20 th G 8 France 19 th 6 th 19 th G 8 Japan 9 th 2 nd 14 th N 11 Korea, South 23 rd 7 th 13 th G 8 United Kingdom 20 th 5 th 10 th G 8 United States 3 rd 1 st 2 nd Source: WEF, Compiled from MIC/III, April 2008. 23

PC Penetration among Major Nations Economic Alliance Nation Population PC Installation (06) PC Penetration (06) N 11* Bangladesh 7 th 47 th 64 th BRIC India 2 nd 13 th 63 rd VISTA, N 11 Vietnam 13 th 53 rd 62 nd VISTA*, N 11 Indonesia 4 th 34 th 60 th BRIC China 1 st 3 rd 55 th N 11 Philippines 14 th 28 th 54 th VISTA, N 11 Turkey 17 th 30 th 53 rd N 11 Mexico 11 th 15 th 41 st BRIC Brazil 5 th 9 th 40 th G 8, BRIC Russia 8 th 10 th 36 th G 8 Germany 12 th 4 th 20 th G 8 France 19 th 6 th 19 th G 8 Japan 9 th 2 nd 14 th N 11 Korea, South 23 rd 7 th 13 th G 8 United Kingdom 20 th 5 th 10 th G 8 United States 3 rd 1 st 2 nd Source: WEF, Compiled from MIC/III, April 2008. 23

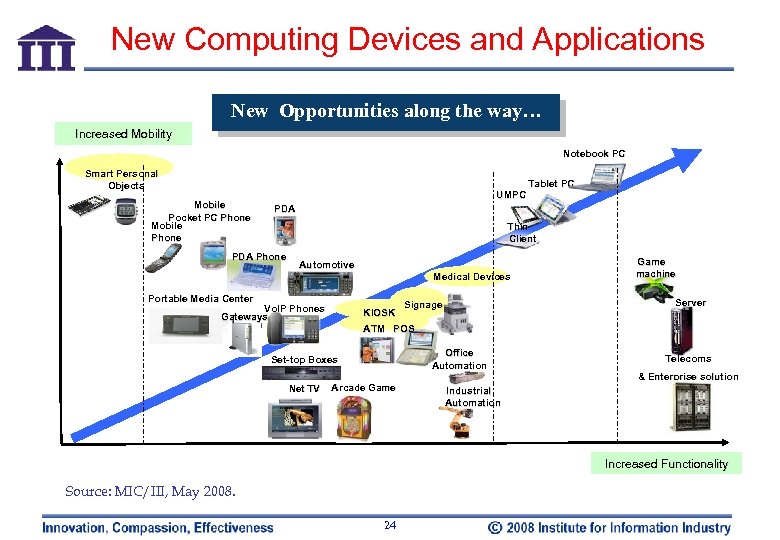

New Computing Devices and Applications New Opportunities along the way… Increased Mobility Notebook PC Smart Personal Objects Mobile Pocket PC Phone Mobile Phone UMPC Tablet PC PDA Thin Client PDA Phone Automotive Medical Devices Portable Media Center Vo. IP Phones Gateways KIOSK Game machine Server Signage ATM POS Office Automation Set-top Boxes Net TV Arcade Game Telecoms & Enterprise solution Industrial Automation Increased Functionality Source: MIC/III, May 2008. 24

New Computing Devices and Applications New Opportunities along the way… Increased Mobility Notebook PC Smart Personal Objects Mobile Pocket PC Phone Mobile Phone UMPC Tablet PC PDA Thin Client PDA Phone Automotive Medical Devices Portable Media Center Vo. IP Phones Gateways KIOSK Game machine Server Signage ATM POS Office Automation Set-top Boxes Net TV Arcade Game Telecoms & Enterprise solution Industrial Automation Increased Functionality Source: MIC/III, May 2008. 24

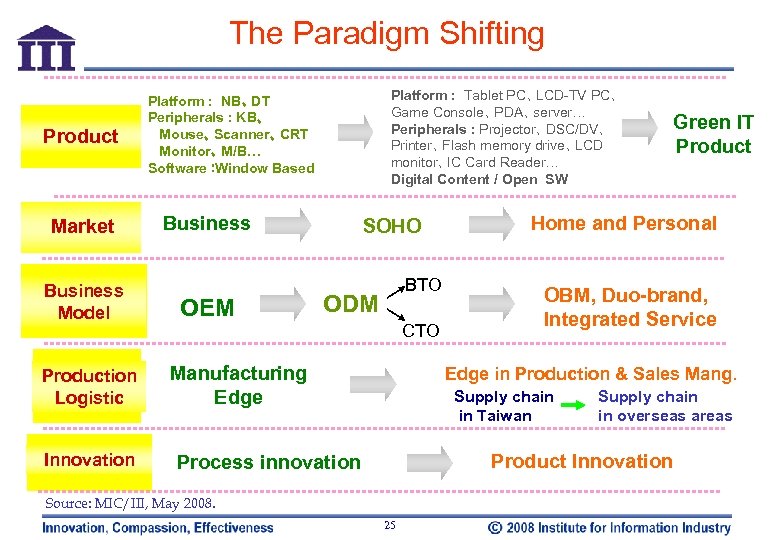

The Paradigm Shifting Product Market Business Model Production Logistic Innovation Platform : Tablet PC、 LCD-TV PC、 Game Console、 PDA、 server… Peripherals : Projector、 DSC/DV、 Printer、 Flash memory drive、 LCD monitor、 Card Reader… IC Digital Content / Open SW Platform : NB、 DT Peripherals : KB、 Mouse、 Scanner、 CRT Monitor、 M/B… Software: Window Based Business OEM SOHO BTO ODM CTO Manufacturing Edge Green IT Product Home and Personal OBM, Duo-brand, Integrated Service Edge in Production & Sales Mang. Supply chain in Taiwan Supply chain in overseas areas Product Innovation Process innovation Source: MIC/III, May 2008. 25

The Paradigm Shifting Product Market Business Model Production Logistic Innovation Platform : Tablet PC、 LCD-TV PC、 Game Console、 PDA、 server… Peripherals : Projector、 DSC/DV、 Printer、 Flash memory drive、 LCD monitor、 Card Reader… IC Digital Content / Open SW Platform : NB、 DT Peripherals : KB、 Mouse、 Scanner、 CRT Monitor、 M/B… Software: Window Based Business OEM SOHO BTO ODM CTO Manufacturing Edge Green IT Product Home and Personal OBM, Duo-brand, Integrated Service Edge in Production & Sales Mang. Supply chain in Taiwan Supply chain in overseas areas Product Innovation Process innovation Source: MIC/III, May 2008. 25

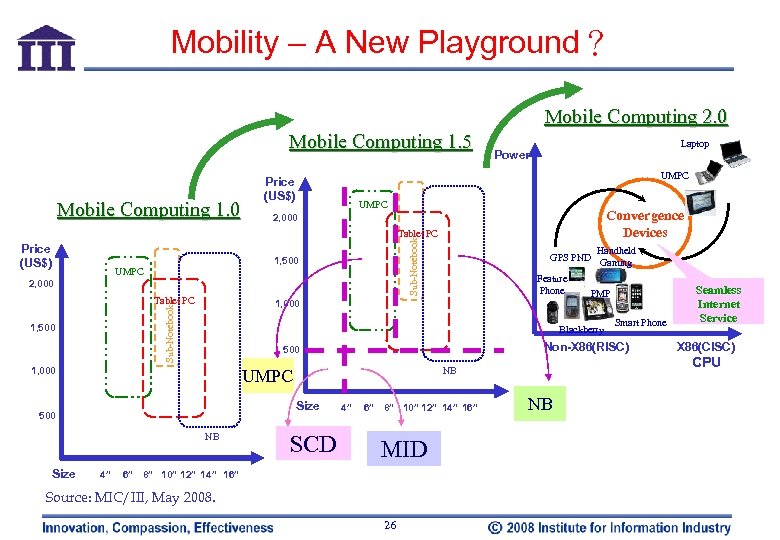

Mobility – A New Playground? Mobile Computing 2. 0 Mobile Computing 1. 5 Mobile Computing 1. 0 Laptop Power UMPC Price (US$) UMPC Convergence Devices 2, 000 Price (US$) Sub-Notebook Tablet PC 1, 500 UMPC 2, 000 Tablet PC NB Size 500 NB SCD Smart Phone Non-X 86(RISC) 500 UMPC 4” PMP Blackberry 1, 000 Size Feature Phone 1, 000 Sub-Notebook 1, 500 Handheld GPS PND Gaming 4” 6” 8” 10” 12” 14” 16” MID 6” 8” 10” 12” 14” 16” Source: MIC/III, May 2008. 26 NB Seamless Internet Service X 86(CISC) CPU

Mobility – A New Playground? Mobile Computing 2. 0 Mobile Computing 1. 5 Mobile Computing 1. 0 Laptop Power UMPC Price (US$) UMPC Convergence Devices 2, 000 Price (US$) Sub-Notebook Tablet PC 1, 500 UMPC 2, 000 Tablet PC NB Size 500 NB SCD Smart Phone Non-X 86(RISC) 500 UMPC 4” PMP Blackberry 1, 000 Size Feature Phone 1, 000 Sub-Notebook 1, 500 Handheld GPS PND Gaming 4” 6” 8” 10” 12” 14” 16” MID 6” 8” 10” 12” 14” 16” Source: MIC/III, May 2008. 26 NB Seamless Internet Service X 86(CISC) CPU

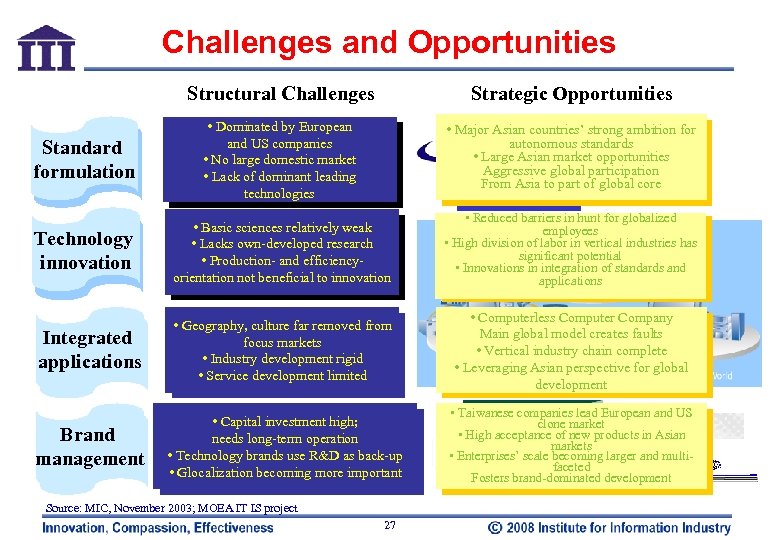

Challenges and Opportunities Structural Challenges Strategic Opportunities • Dominated by European and US companies • No large domestic market • Lack of dominant leading technologies • Major Asian countries’ strong ambition for autonomous standards • Large Asian market opportunities 數字電視標準 Aggressive global participation From Asia to part of global core • Basic sciences relatively weak • Lacks own-developed research • Production- and efficiencyorientation not beneficial to innovation • Reduced barriers in hunt for globalized employees • High division of labor in vertical industries has significant potential • Innovations in integration of standards and applications Integrated applications • Geography, culture far removed from focus markets • Industry development rigid • Service development limited • Computerless Computer Company Main global model creates faults • Vertical industry chain complete • Leveraging Asian perspective for global development Brand management • Capital investment high; needs long-term operation • Technology brands use R&D as back-up • Glocalization becoming more important • Taiwanese companies lead European and US clone market • High acceptance of new products in Asian markets • Enterprises’ scale becoming larger and multifaceted Fosters brand-dominated development Standard formulation Technology innovation TDSCDMA Source: MIC, November 2003; MOEA IT IS project 27

Challenges and Opportunities Structural Challenges Strategic Opportunities • Dominated by European and US companies • No large domestic market • Lack of dominant leading technologies • Major Asian countries’ strong ambition for autonomous standards • Large Asian market opportunities 數字電視標準 Aggressive global participation From Asia to part of global core • Basic sciences relatively weak • Lacks own-developed research • Production- and efficiencyorientation not beneficial to innovation • Reduced barriers in hunt for globalized employees • High division of labor in vertical industries has significant potential • Innovations in integration of standards and applications Integrated applications • Geography, culture far removed from focus markets • Industry development rigid • Service development limited • Computerless Computer Company Main global model creates faults • Vertical industry chain complete • Leveraging Asian perspective for global development Brand management • Capital investment high; needs long-term operation • Technology brands use R&D as back-up • Glocalization becoming more important • Taiwanese companies lead European and US clone market • High acceptance of new products in Asian markets • Enterprises’ scale becoming larger and multifaceted Fosters brand-dominated development Standard formulation Technology innovation TDSCDMA Source: MIC, November 2003; MOEA IT IS project 27

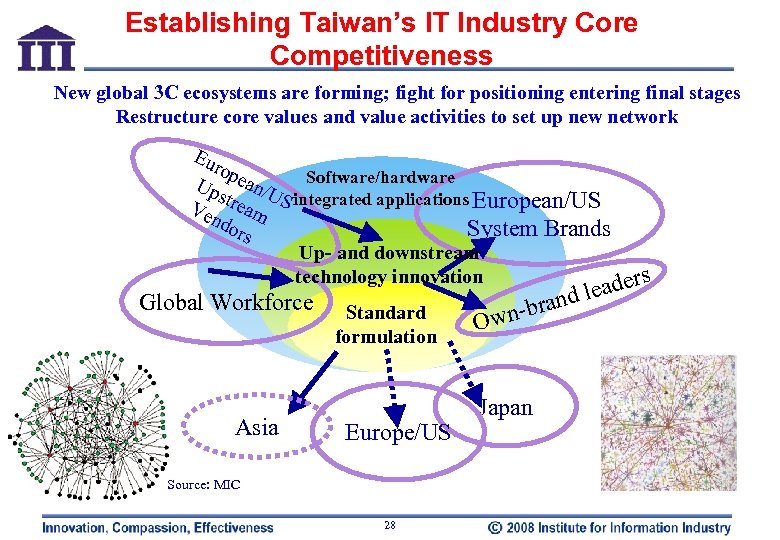

Establishing Taiwan’s IT Industry Core Competitiveness New global 3 C ecosystems are forming; fight for positioning entering final stages Restructure core values and value activities to set up new network Eu rop Up ean/U Software/hardware s Ve tream S integrated applications European/US ndo System Brands rs Up- and downstream technology innovation ders Global Workforce Asia a Standard formulation Europe/US Source: MIC 28 e and l -br Own Japan

Establishing Taiwan’s IT Industry Core Competitiveness New global 3 C ecosystems are forming; fight for positioning entering final stages Restructure core values and value activities to set up new network Eu rop Up ean/U Software/hardware s Ve tream S integrated applications European/US ndo System Brands rs Up- and downstream technology innovation ders Global Workforce Asia a Standard formulation Europe/US Source: MIC 28 e and l -br Own Japan

THANK YOU Insight with an Asian Perspective 29

THANK YOU Insight with an Asian Perspective 29