e4912db24023da5a2b5dd02f9d7c1ef4.ppt

- Количество слайдов: 49

The National Treasury WORKSHOP ON LESSONS LEARNT YEAR 2014/15 IN THE PREPARATION OF THE FINANCIAL STATEMENTS OF MDAs & PROJECTS

The National Treasury WORKSHOP ON LESSONS LEARNT YEAR 2014/15 IN THE PREPARATION OF THE FINANCIAL STATEMENTS OF MDAs & PROJECTS

DAY 1 30 NOVEMBER 2015

DAY 1 30 NOVEMBER 2015

Introduction and Overview The Government of Kenya has prioritized enhancing public financial integrity institutions as one of its top priorities underpinned in its Public Finance Management Strategy (PFMR) 2013 – 2018 and as spelt out in the Constitution of Kenya, 2010. PFM Act 2012 and Gazette Notice 5440 in 2014 led to the adoption of IPSAS for FY 2013/14. This is the second year of implementation. Page 3

Introduction and Overview The Government of Kenya has prioritized enhancing public financial integrity institutions as one of its top priorities underpinned in its Public Finance Management Strategy (PFMR) 2013 – 2018 and as spelt out in the Constitution of Kenya, 2010. PFM Act 2012 and Gazette Notice 5440 in 2014 led to the adoption of IPSAS for FY 2013/14. This is the second year of implementation. Page 3

Introduction and Overview PFM AGENDA The object of the PFM Act, 2012 is to ensure that - (a) Public finances are managed at both the national and the county levels of government in accordance with the principles set out in the Constitution; and (b) Page 4 Public officers who are given responsibility for managing the finances are accountable to the public for the management of those finances through Parliament and County Assemblies.

Introduction and Overview PFM AGENDA The object of the PFM Act, 2012 is to ensure that - (a) Public finances are managed at both the national and the county levels of government in accordance with the principles set out in the Constitution; and (b) Page 4 Public officers who are given responsibility for managing the finances are accountable to the public for the management of those finances through Parliament and County Assemblies.

Introduction and Overview The objective of the technical assistance is to support MDA Accountants in the preparation of financial statements and in the management of the audit process. The assignment to be covered in the following 3 phases ► Phase I: Preparation and consolidation of financial statements ► Phase II: Audit support and quality review ► Phase III: In-year reporting, training and continued support during audit Page 5

Introduction and Overview The objective of the technical assistance is to support MDA Accountants in the preparation of financial statements and in the management of the audit process. The assignment to be covered in the following 3 phases ► Phase I: Preparation and consolidation of financial statements ► Phase II: Audit support and quality review ► Phase III: In-year reporting, training and continued support during audit Page 5

Workshop Topics 1. Workshop Overview/Expectations 2. Introduction 3. Key highlights from the Consolidation 4. Top 10 Quality Review issues FY 2014/2015 5. Audit Page 6 of MDAs and areas of improvement

Workshop Topics 1. Workshop Overview/Expectations 2. Introduction 3. Key highlights from the Consolidation 4. Top 10 Quality Review issues FY 2014/2015 5. Audit Page 6 of MDAs and areas of improvement

Workshop Topics 6. Addressing IFMIS Challenges/ Practical presentations ( Cash Module, AR Module and GL Module) 7. Financial Statement Close Process 8. Tax Matters affecting MDAs 9. Fire Award Evaluation 10. Peer presentations 11. In year reporting Page 7

Workshop Topics 6. Addressing IFMIS Challenges/ Practical presentations ( Cash Module, AR Module and GL Module) 7. Financial Statement Close Process 8. Tax Matters affecting MDAs 9. Fire Award Evaluation 10. Peer presentations 11. In year reporting Page 7

EXPECTATIONS 1. What were your expectations from the Technical Assistance? 2. What are your expectations from the Workshop? Page 8

EXPECTATIONS 1. What were your expectations from the Technical Assistance? 2. What are your expectations from the Workshop? Page 8

HOUSE RULES 1. Active participation 2. No phones 3. Sharing experiences 4. Keep time Page 9

HOUSE RULES 1. Active participation 2. No phones 3. Sharing experiences 4. Keep time Page 9

OVERVIEW ON THE CONSOLIDATION GOVERNMENT OF KENYA Consolidated financial statements for the National Government Entities Under Lot 1 ► Part 1 : Ministries, Departments and Agencies (includes projects) ► Part 2 : Consolidated Fund Account Page 10

OVERVIEW ON THE CONSOLIDATION GOVERNMENT OF KENYA Consolidated financial statements for the National Government Entities Under Lot 1 ► Part 1 : Ministries, Departments and Agencies (includes projects) ► Part 2 : Consolidated Fund Account Page 10

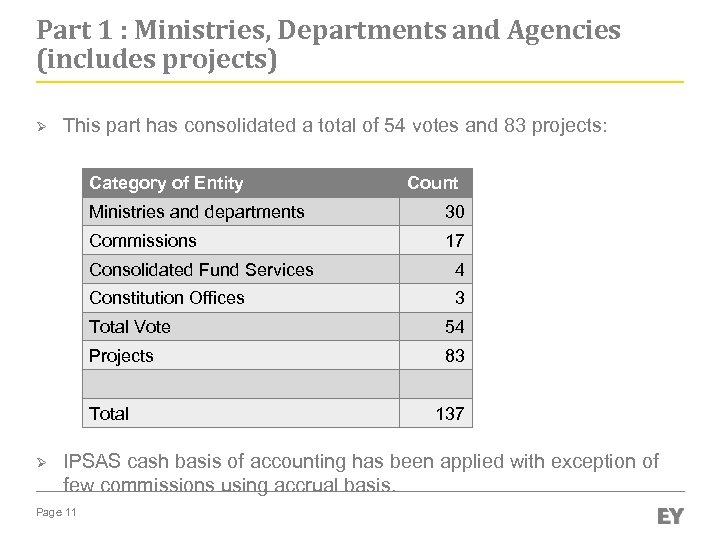

Part 1 : Ministries, Departments and Agencies (includes projects) Ø This part has consolidated a total of 54 votes and 83 projects: Category of Entity Count Ministries and departments 30 Commissions 17 Consolidated Fund Services 4 Constitution Offices 3 Total Vote 54 Projects 83 Total Ø 137 IPSAS cash basis of accounting has been applied with exception of few commissions using accrual basis. Page 11

Part 1 : Ministries, Departments and Agencies (includes projects) Ø This part has consolidated a total of 54 votes and 83 projects: Category of Entity Count Ministries and departments 30 Commissions 17 Consolidated Fund Services 4 Constitution Offices 3 Total Vote 54 Projects 83 Total Ø 137 IPSAS cash basis of accounting has been applied with exception of few commissions using accrual basis. Page 11

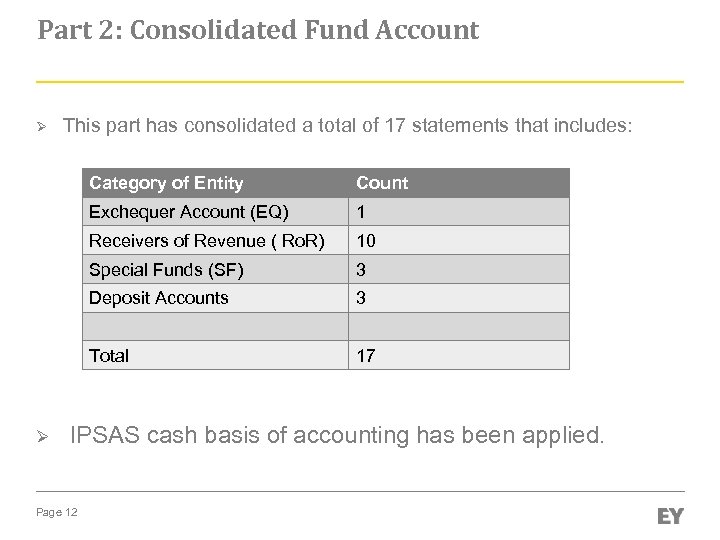

Part 2: Consolidated Fund Account Ø This part has consolidated a total of 17 statements that includes: Category of Entity Exchequer Account (EQ) 1 Receivers of Revenue ( Ro. R) 10 Special Funds (SF) 3 Deposit Accounts 3 Total Ø Count 17 IPSAS cash basis of accounting has been applied. Page 12

Part 2: Consolidated Fund Account Ø This part has consolidated a total of 17 statements that includes: Category of Entity Exchequer Account (EQ) 1 Receivers of Revenue ( Ro. R) 10 Special Funds (SF) 3 Deposit Accounts 3 Total Ø Count 17 IPSAS cash basis of accounting has been applied. Page 12

The MDAs Page 13

The MDAs Page 13

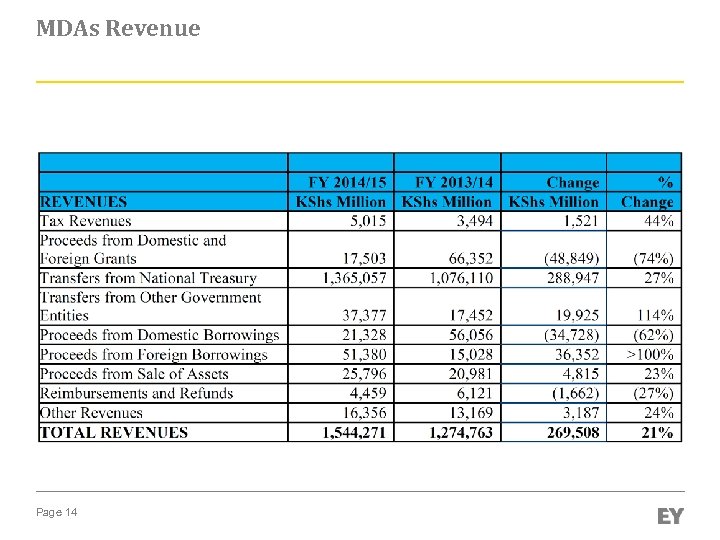

MDAs Revenue Page 14

MDAs Revenue Page 14

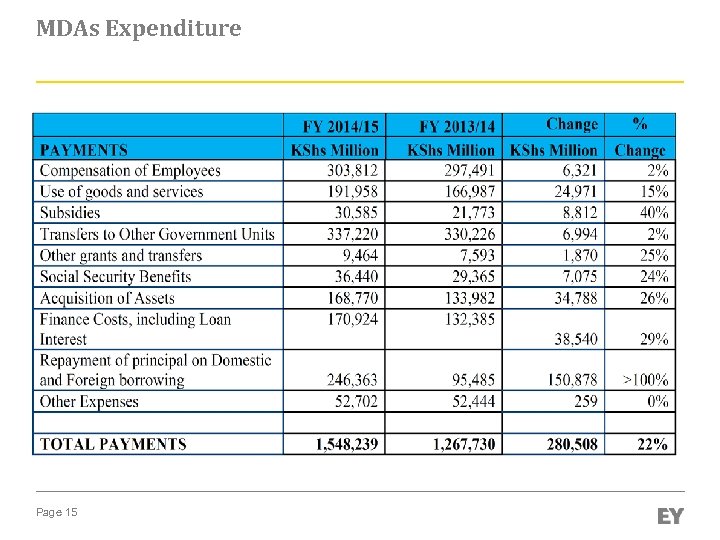

MDAs Expenditure Page 15

MDAs Expenditure Page 15

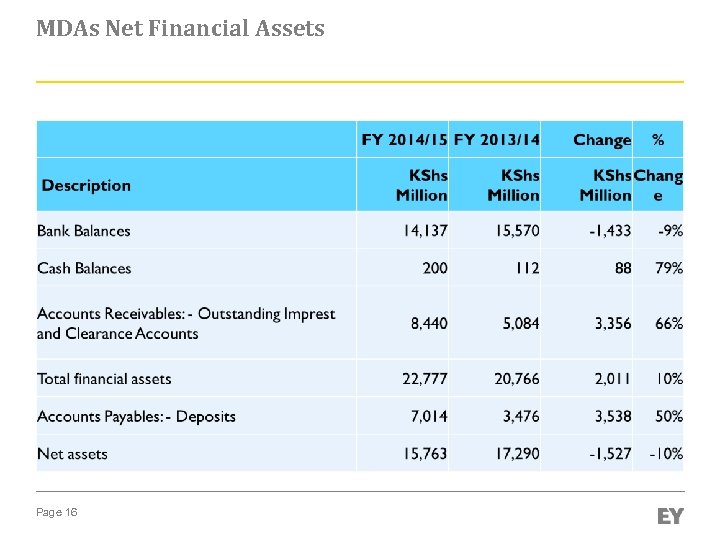

MDAs Net Financial Assets Page 16

MDAs Net Financial Assets Page 16

Annexure to MDAs Projects Implemented by Ministries Page 17

Annexure to MDAs Projects Implemented by Ministries Page 17

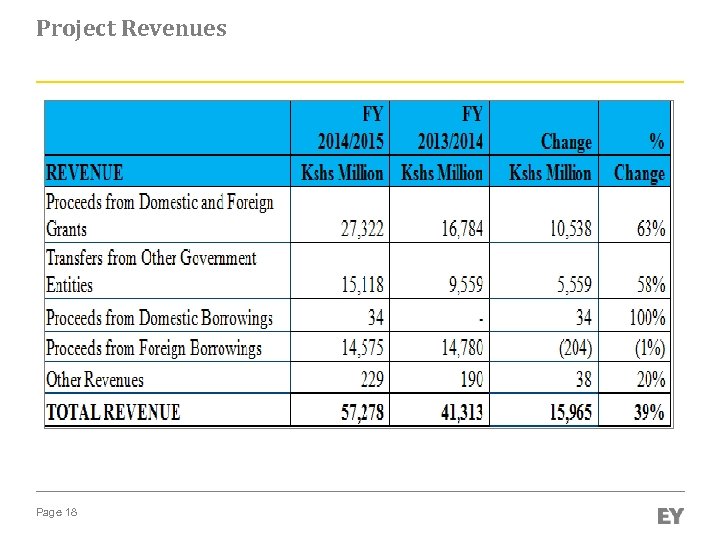

Project Revenues Page 18

Project Revenues Page 18

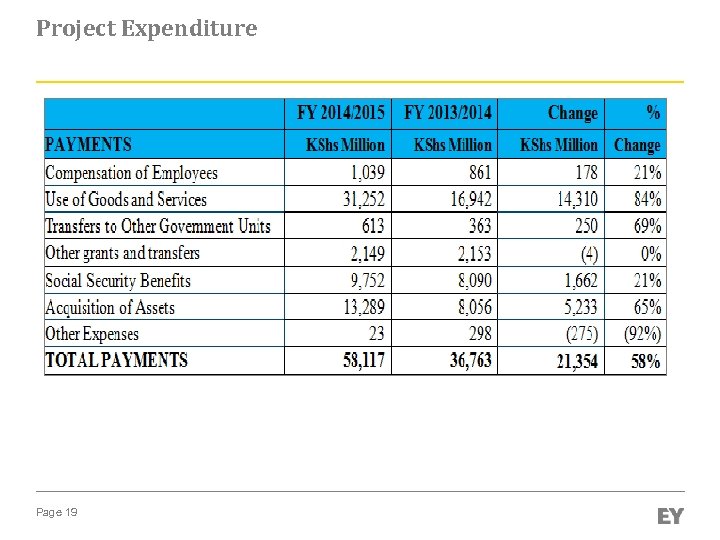

Project Expenditure Page 19

Project Expenditure Page 19

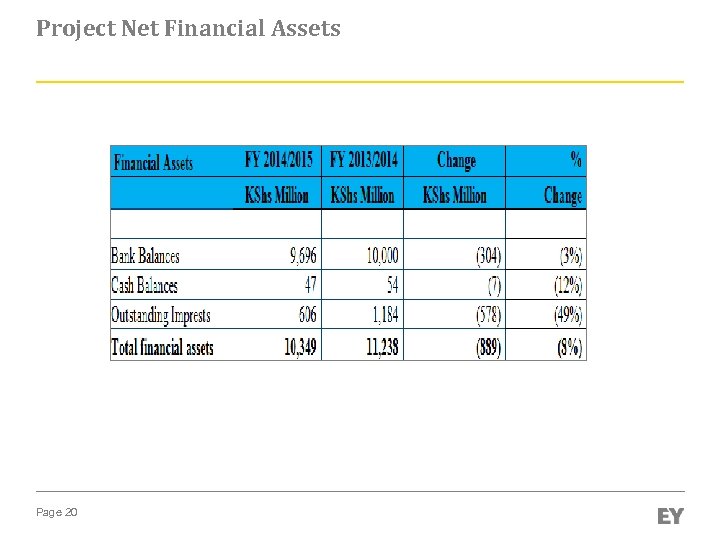

Project Net Financial Assets Page 20

Project Net Financial Assets Page 20

OVERVIEW ON THE CONSOLIDATION ►The Financial Statements submitted to OAG with copies to National Treasury were subjected to a further quality review ►The quality review was to ensure compliance with relevant accounting standards and formats prescribed by the Public Sector Accounting Standards Board ►A number of quality review issues were noted and a letter sent to the MDAs highlighting these issues that needed to be addressed before conclusion of FY 2014/2015 audit ►The lessons learnt workshop was informed by a number of key accounting issues that were cross-cutting in the MDAs as follows Page 21

OVERVIEW ON THE CONSOLIDATION ►The Financial Statements submitted to OAG with copies to National Treasury were subjected to a further quality review ►The quality review was to ensure compliance with relevant accounting standards and formats prescribed by the Public Sector Accounting Standards Board ►A number of quality review issues were noted and a letter sent to the MDAs highlighting these issues that needed to be addressed before conclusion of FY 2014/2015 audit ►The lessons learnt workshop was informed by a number of key accounting issues that were cross-cutting in the MDAs as follows Page 21

Top 10 Quality Review Issues for FY 2014/2015

Top 10 Quality Review Issues for FY 2014/2015

Top 10 Quality Review Issues FY 2014/2015 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Statement of Assets and Liabilities not Balancing resulting into a suspense Transfers to and Transfers from Government Entities Exchequer Issues/ Recoveries Financial statement prepared outside IFMIS Un-explained adjustment to the opening balance / "Prior year adjustment“ Historical and old balances Restating Comparatives Statement of Cash Flow Incomplete notes to the financial statements Other quality review issues Page 23

Top 10 Quality Review Issues FY 2014/2015 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Statement of Assets and Liabilities not Balancing resulting into a suspense Transfers to and Transfers from Government Entities Exchequer Issues/ Recoveries Financial statement prepared outside IFMIS Un-explained adjustment to the opening balance / "Prior year adjustment“ Historical and old balances Restating Comparatives Statement of Cash Flow Incomplete notes to the financial statements Other quality review issues Page 23

Top 10 Quality Review issues for FY 2014/2015 1. Statement of Assets and Liabilities not Balancing resulting into a suspense Observation ØThe financial statements of 20 entities did not balance resulting to a suspense in the consolidated financial statements of KShs 2. 5 billion. ØThe key reasons as to why individual financial statements did not balance were: casting errors , opening fund balance not tying to 2013/2014 brought forward balance and Inconsistencies between the notes and the financial statements Page 24

Top 10 Quality Review issues for FY 2014/2015 1. Statement of Assets and Liabilities not Balancing resulting into a suspense Observation ØThe financial statements of 20 entities did not balance resulting to a suspense in the consolidated financial statements of KShs 2. 5 billion. ØThe key reasons as to why individual financial statements did not balance were: casting errors , opening fund balance not tying to 2013/2014 brought forward balance and Inconsistencies between the notes and the financial statements Page 24

Top 10 Quality Review issues for FY 2014/2015 1. Statement of Assets and Liabilities not Balancing resulting into a suspense The following are the 20 entities whose financial statements did not balance. (extract from consolidated financial statements ) Suggested Resolution Page 25

Top 10 Quality Review issues for FY 2014/2015 1. Statement of Assets and Liabilities not Balancing resulting into a suspense The following are the 20 entities whose financial statements did not balance. (extract from consolidated financial statements ) Suggested Resolution Page 25

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities Observation Significant differences noted between the transfers to and from other government entities as per consolidated financial statements for MDAs compared to amounts in the consolidated financial statements of State Corporations and SAGAs and Projects. Page 26

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities Observation Significant differences noted between the transfers to and from other government entities as per consolidated financial statements for MDAs compared to amounts in the consolidated financial statements of State Corporations and SAGAs and Projects. Page 26

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities ► ► Transfers to- is money given to another entity that is then expected to report/disclose that it received the same amount, and also report on how it has utilized such funds (prepare its own financial statements). Transfers from, is money received from another reporting entity that shows the same amount as a transfer to Page 27

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities ► ► Transfers to- is money given to another entity that is then expected to report/disclose that it received the same amount, and also report on how it has utilized such funds (prepare its own financial statements). Transfers from, is money received from another reporting entity that shows the same amount as a transfer to Page 27

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities Issues noted at individual entity level; ► There is failure to disclose in the notes or have a listing appended, of Transfers to and Transfers from Government Entities ► Lack of follow up on inter-entity reconciliations ~ agreeing balances with the corresponding entities. ► Failure to distinguish between grants and transfer Suggested Resolution Page 28

Top 10 Quality Review issues for FY 2014/2015 2. Transfers to and Transfers from Government Entities Issues noted at individual entity level; ► There is failure to disclose in the notes or have a listing appended, of Transfers to and Transfers from Government Entities ► Lack of follow up on inter-entity reconciliations ~ agreeing balances with the corresponding entities. ► Failure to distinguish between grants and transfer Suggested Resolution Page 28

Top 10 Quality Review issues for FY 2014/2015 Note on other grants and transfers ► Grants are financial awards received from development partners directly through the exchequer and through ministries and departments. These could either be in monetary form or through appropriation in aid. ► For ministries to be eligible for grants, the Government is required in some cases to provide counterpart funding. ► From our review of financial statements we noted that some ministries were clearly not distinguishing transfers from grants yet these were meant to be disclosed separately. Page 29

Top 10 Quality Review issues for FY 2014/2015 Note on other grants and transfers ► Grants are financial awards received from development partners directly through the exchequer and through ministries and departments. These could either be in monetary form or through appropriation in aid. ► For ministries to be eligible for grants, the Government is required in some cases to provide counterpart funding. ► From our review of financial statements we noted that some ministries were clearly not distinguishing transfers from grants yet these were meant to be disclosed separately. Page 29

Top 10 Quality Review issues for FY 2014/2015 3. Exchequer Issues/ Recoveries Observation ► Treasury receives budget and uses the same to release funds to MDAs. The Treasury may however, not be able to fund the full budget, or may revise a budget such that amounts disbursed may exceed revised budget. ► Exchequer “over” and “under” issue should be separated from the actual cash releases (cash flow from treasury into MDA bank account. ). Treasury can adjust their budget books but MDA should report the actual received, with Exchequer reporting actual cash remitted. Actual release by Treasury=actual receipt by MDA. Page 30

Top 10 Quality Review issues for FY 2014/2015 3. Exchequer Issues/ Recoveries Observation ► Treasury receives budget and uses the same to release funds to MDAs. The Treasury may however, not be able to fund the full budget, or may revise a budget such that amounts disbursed may exceed revised budget. ► Exchequer “over” and “under” issue should be separated from the actual cash releases (cash flow from treasury into MDA bank account. ). Treasury can adjust their budget books but MDA should report the actual received, with Exchequer reporting actual cash remitted. Actual release by Treasury=actual receipt by MDA. Page 30

Top 10 Quality Review issues for FY 2014/2015 ► Recording of 4 th quarter releases remitted by Treasury at close of the year and received by the MDAs on the first day of the subsequent year. ( Cut-off issue). Should be recorded by MDAs in the year and treated as a reconciling item in bank ► MDAs not Tying Received Amount to Amount reflected in the IFMIS Reports ► Suggested Resolution Page 31

Top 10 Quality Review issues for FY 2014/2015 ► Recording of 4 th quarter releases remitted by Treasury at close of the year and received by the MDAs on the first day of the subsequent year. ( Cut-off issue). Should be recorded by MDAs in the year and treated as a reconciling item in bank ► MDAs not Tying Received Amount to Amount reflected in the IFMIS Reports ► Suggested Resolution Page 31

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Observation Ø Financial reporting was automated in IFMIS effective FY 2014/2015. Ø Only 3 entities have managed to reconcile their financial statements to IFMIS while 44 entities did not prepare their financial statements based on the numbers in IFMIS. The 3 are ; Controller of Budget, Director of Public Prosecutions and Ministry of Energy and Petroleum. Page 32

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Observation Ø Financial reporting was automated in IFMIS effective FY 2014/2015. Ø Only 3 entities have managed to reconcile their financial statements to IFMIS while 44 entities did not prepare their financial statements based on the numbers in IFMIS. The 3 are ; Controller of Budget, Director of Public Prosecutions and Ministry of Energy and Petroleum. Page 32

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - Cash Module Ø Knowledge gap (Running an Auto Rec) Ø Access Rights to IFMIS CM Module (Capacity) Ø Missing Bank Statements Ø Inconsistent Transaction Reference Numbers (IFMIS Vs CBK) Ø Resolving F 030 Report Outstanding Items Ø Causes, resolution and correlation between the Auto Rec and clearing System Required Liabilities and Cash Clearing Accounts Page 33

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - Cash Module Ø Knowledge gap (Running an Auto Rec) Ø Access Rights to IFMIS CM Module (Capacity) Ø Missing Bank Statements Ø Inconsistent Transaction Reference Numbers (IFMIS Vs CBK) Ø Resolving F 030 Report Outstanding Items Ø Causes, resolution and correlation between the Auto Rec and clearing System Required Liabilities and Cash Clearing Accounts Page 33

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - AR Module Ø Process of capturing Exchequer Receipts and Recoveries back to Treasury Ø Process of booking imprest and accounting for expenditure returns Ø Accounting/Posting of Appropriation in Aid Page 34

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - AR Module Ø Process of capturing Exchequer Receipts and Recoveries back to Treasury Ø Process of booking imprest and accounting for expenditure returns Ø Accounting/Posting of Appropriation in Aid Page 34

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - GL Module Ø IFMIS trial balances not balancing Ø IFMIS notes not tying to financial statements Ø Proper posting of opening balances Ø Inconsistent reports/ account analysis i. e imprest analysis not tying to amount reported in statement of assets and liabilities Ø Different totals in sub chapter TB, item level TB and sub item level TB Ø Incomplete appropriation accounts Ø Inability to run account analysis (knowledge gap) Page 35

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Areas of Focus - GL Module Ø IFMIS trial balances not balancing Ø IFMIS notes not tying to financial statements Ø Proper posting of opening balances Ø Inconsistent reports/ account analysis i. e imprest analysis not tying to amount reported in statement of assets and liabilities Ø Different totals in sub chapter TB, item level TB and sub item level TB Ø Incomplete appropriation accounts Ø Inability to run account analysis (knowledge gap) Page 35

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Suggested Resolution As a way forward, we have allocated 3 days of training to take the entities through practical sessions on how to resolve challenges faced around financial reporting in IFMIS. This will cover the following key modules ØCash Module ØAR Module ØGL Module Page 36

Top 10 Quality Review issues for FY 2014/2015 4. Financial statement prepared outside IFMIS Suggested Resolution As a way forward, we have allocated 3 days of training to take the entities through practical sessions on how to resolve challenges faced around financial reporting in IFMIS. This will cover the following key modules ØCash Module ØAR Module ØGL Module Page 36

Top 10 Quality Review issues for FY 2014/2015 5. Un-explained adjustment to the opening balance / "Prior year adjustment“ Observation ► Opening Balances - fund balance brought forward in the current year not agreeing to fund Balance carried forward from FY 2013/2014 ► Entities did not provide sufficient explanation in form of a note to support these prior year adjustments ► The consolidated financial statements for MDAs for FY 2015/2014 contained an adjustment of KShs 1, 069, 051, 931 that could not be properly supported. Page 37

Top 10 Quality Review issues for FY 2014/2015 5. Un-explained adjustment to the opening balance / "Prior year adjustment“ Observation ► Opening Balances - fund balance brought forward in the current year not agreeing to fund Balance carried forward from FY 2013/2014 ► Entities did not provide sufficient explanation in form of a note to support these prior year adjustments ► The consolidated financial statements for MDAs for FY 2015/2014 contained an adjustment of KShs 1, 069, 051, 931 that could not be properly supported. Page 37

Top 10 Quality Review issues for FY 2014/2015 5. Un-explained adjustment to the opening balance / "Prior year adjustment“ Suggested Resolution All entities are required to ensure that the opening balance adjustments /prior year adjustments are authorised an explanatory note provided as a note to financial statements. A copy of the approved journal voucher should also be provided. Page 38

Top 10 Quality Review issues for FY 2014/2015 5. Un-explained adjustment to the opening balance / "Prior year adjustment“ Suggested Resolution All entities are required to ensure that the opening balance adjustments /prior year adjustments are authorised an explanatory note provided as a note to financial statements. A copy of the approved journal voucher should also be provided. Page 38

Top 10 Quality Review issues for FY 2014/2015 6. Historical and old balances Observation Historical (old) balances were included in the audited financial statements of some MDAs for the year 2013/2014 and hence they form part of the balances in 2014/2015. These MDAs made and continue making presentations to the Taskforce on these old balances, and expect to be given clearance on their proposal on how to deal with these items. Page 39

Top 10 Quality Review issues for FY 2014/2015 6. Historical and old balances Observation Historical (old) balances were included in the audited financial statements of some MDAs for the year 2013/2014 and hence they form part of the balances in 2014/2015. These MDAs made and continue making presentations to the Taskforce on these old balances, and expect to be given clearance on their proposal on how to deal with these items. Page 39

Top 10 Quality Review issues for FY 2014/2015 6. Historical and old balances Suggested Resolution HAUs to propose and support treatment of the resolution of old balances in the books and submit their proposal to the Director General Accounting Services Office for approval on a case by case basis. Page 40

Top 10 Quality Review issues for FY 2014/2015 6. Historical and old balances Suggested Resolution HAUs to propose and support treatment of the resolution of old balances in the books and submit their proposal to the Director General Accounting Services Office for approval on a case by case basis. Page 40

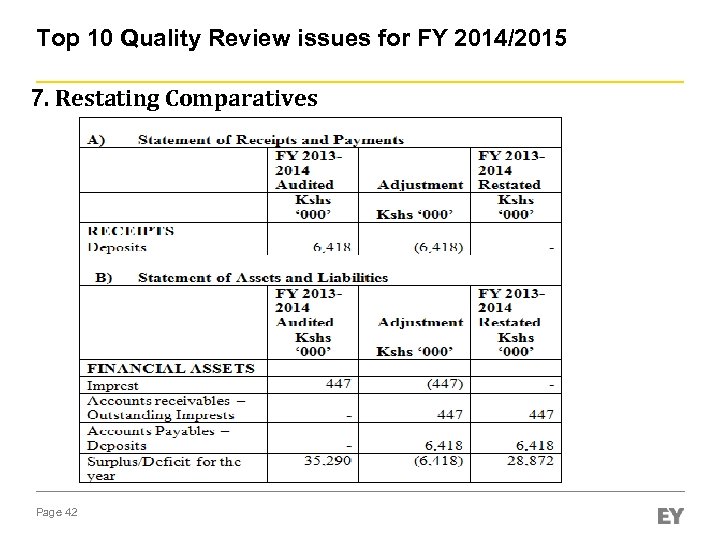

Top 10 Quality Review issues for FY 2014/2015 7. Restating Comparatives Observation The reporting template in the current was updated to include a change in presentation of ; Ø Accounts Receivable - Outstanding Imprest and Advances Ø Accounts Payable –Deposits and Retentions Due to change in presentation from PY audited numbers a discloure note was required to support this change. Page 41

Top 10 Quality Review issues for FY 2014/2015 7. Restating Comparatives Observation The reporting template in the current was updated to include a change in presentation of ; Ø Accounts Receivable - Outstanding Imprest and Advances Ø Accounts Payable –Deposits and Retentions Due to change in presentation from PY audited numbers a discloure note was required to support this change. Page 41

Top 10 Quality Review issues for FY 2014/2015 7. Restating Comparatives Page 42

Top 10 Quality Review issues for FY 2014/2015 7. Restating Comparatives Page 42

Top 10 Quality Review issues for FY 2014/2015 8. Statement of Cash Flow Cross cutting issues Reasons why your statement of cash flow will not balance Ø Net cash from operating activities (before adjustments) not tying to the Statement of Receipts and Payments Indirect – Ø Adjustments for none- cash items not made in the statement of cash flow. Change in receivables and payables Ø Cash and cash equivalent not agreeing to Cash and Bank Balances in the Statement of Assets & Liabilities and the note. ► Cash and cash equivalents at the beginning of the year 2014/2015 not tying to cash and cash equivalents and the end of the pevious year- 2013/2014. Suggested Resolution Page 43

Top 10 Quality Review issues for FY 2014/2015 8. Statement of Cash Flow Cross cutting issues Reasons why your statement of cash flow will not balance Ø Net cash from operating activities (before adjustments) not tying to the Statement of Receipts and Payments Indirect – Ø Adjustments for none- cash items not made in the statement of cash flow. Change in receivables and payables Ø Cash and cash equivalent not agreeing to Cash and Bank Balances in the Statement of Assets & Liabilities and the note. ► Cash and cash equivalents at the beginning of the year 2014/2015 not tying to cash and cash equivalents and the end of the pevious year- 2013/2014. Suggested Resolution Page 43

Top 10 Quality Review issues for FY 2014/2015 Ø Ø Ø Manual Bank Reconciliation Bank and Cash balances to use - Use of bank statement balances instead of cash book bank balances in the statement of assets and liabilities and statement of cash flow Receipts and payments in the bank not in cash book Use of Unrevised/misstated manual cash book balances in the financial statements. Ensuring the cash book is updated at the time of board of survey (Reconciled to the Cash Book Ledger) Long Outstanding Reconciling Items – this should be investigated and resolved. Page 44

Top 10 Quality Review issues for FY 2014/2015 Ø Ø Ø Manual Bank Reconciliation Bank and Cash balances to use - Use of bank statement balances instead of cash book bank balances in the statement of assets and liabilities and statement of cash flow Receipts and payments in the bank not in cash book Use of Unrevised/misstated manual cash book balances in the financial statements. Ensuring the cash book is updated at the time of board of survey (Reconciled to the Cash Book Ledger) Long Outstanding Reconciling Items – this should be investigated and resolved. Page 44

Top 10 Quality Review issues for FY 2014/2015 9 Incomplete notes to the financial statements Some financial statements include the following schedules of detailed listings - Accounts Payable - Accounts Receivables - pending bills - Summary of fixed assets. Missing Disclosures - Other Annexes ► IFMIS Report ► Progress on follow up of auditor recommendations Page 45

Top 10 Quality Review issues for FY 2014/2015 9 Incomplete notes to the financial statements Some financial statements include the following schedules of detailed listings - Accounts Payable - Accounts Receivables - pending bills - Summary of fixed assets. Missing Disclosures - Other Annexes ► IFMIS Report ► Progress on follow up of auditor recommendations Page 45

Top 10 Quality Review issues for FY 2014/2015 10. Other quality review issues ► Errors on schedules to the financials statements i. e. casting errors. ► Inconsistency between notes and financial statements ► Financial statements not properly formatted ► Notes to the financial statements not flowing and out of sequence. ► Notes without any information of data not deleted ► Errors in appropriation accounts Page 46

Top 10 Quality Review issues for FY 2014/2015 10. Other quality review issues ► Errors on schedules to the financials statements i. e. casting errors. ► Inconsistency between notes and financial statements ► Financial statements not properly formatted ► Notes to the financial statements not flowing and out of sequence. ► Notes without any information of data not deleted ► Errors in appropriation accounts Page 46

Challenges faced in preparation of the financial statements From observations in the field and from the quality of financial statements, there were quite a number of MDAs that did not produce good financial statements 1. What were the practical challenges faced in the preparation that were dealt with and which ones are still challenges? Page 47

Challenges faced in preparation of the financial statements From observations in the field and from the quality of financial statements, there were quite a number of MDAs that did not produce good financial statements 1. What were the practical challenges faced in the preparation that were dealt with and which ones are still challenges? Page 47

The Financial Statement Close Process – How to ensure completeness and accuracy in reporting Overview of the process and derivation of the numbers in preparation of financial statements ► Posting of transactions ► Generation of reports ► Continuous and Periodic reviews of the reports generated, both manual and electronic ► Timely Correction of errors ► Timely closure of books ► Timely reconciliations/confirmations ► Accurate Financial Statements Page 48

The Financial Statement Close Process – How to ensure completeness and accuracy in reporting Overview of the process and derivation of the numbers in preparation of financial statements ► Posting of transactions ► Generation of reports ► Continuous and Periodic reviews of the reports generated, both manual and electronic ► Timely Correction of errors ► Timely closure of books ► Timely reconciliations/confirmations ► Accurate Financial Statements Page 48

Questions?

Questions?