ce0c6cf92448c9948f1294df0f506544.ppt

- Количество слайдов: 17

The National Income Accounts § Gross national product (GNP) • The value of all final goods and services produced by a country’s factors of production, whether in-country or abroad and sold on the market in a given time period GNP is calculated by adding up the market value of all expenditures on final output Y = C + I + G + EX – IM Y = C + I + G + CA Copyright © 2003 Pearson Education, Inc.

The National Income Accounts § Gross national product (GNP) • The value of all final goods and services produced by a country’s factors of production, whether in-country or abroad and sold on the market in a given time period GNP is calculated by adding up the market value of all expenditures on final output Y = C + I + G + EX – IM Y = C + I + G + CA Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy §Consumption • The portion of GNP purchased by the private sector to fulfill current wants §Investment • The part of output used by private firms to produce future output §Government Purchases • Any goods and services purchased by federal, state, or local governments Copyright © 2003 Pearson Education, Inc. 2

National Income Accounting for an Open Economy §Consumption • The portion of GNP purchased by the private sector to fulfill current wants §Investment • The part of output used by private firms to produce future output §Government Purchases • Any goods and services purchased by federal, state, or local governments Copyright © 2003 Pearson Education, Inc. 2

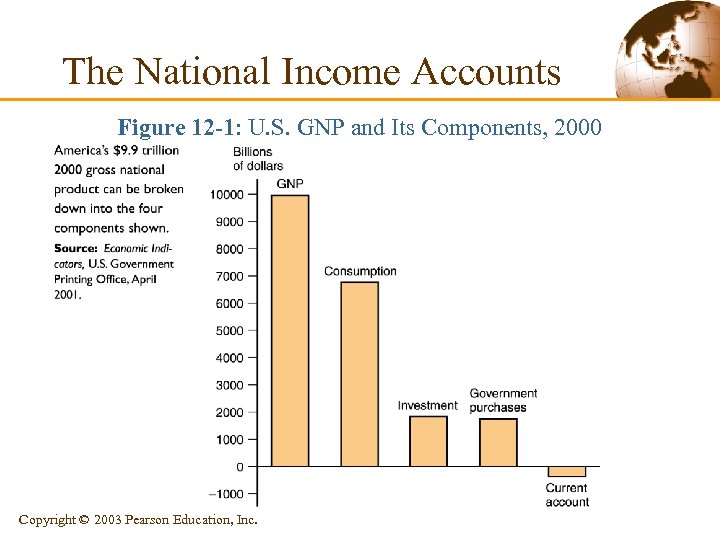

The National Income Accounts Figure 12 -1: U. S. GNP and Its Components, 2000 Copyright © 2003 Pearson Education, Inc.

The National Income Accounts Figure 12 -1: U. S. GNP and Its Components, 2000 Copyright © 2003 Pearson Education, Inc.

The National Income Accounts National Product and National Income • National Income: income earned by a nation’s factors of production over some period of time. – NI equals a country’s GNP net of receipts not available for distribution (depreciation, indirect business taxes). – Unilateral transfers from foreigners add to NI but not to GNP. Gross Domestic Product (GDP) • GDP measures the volume of production within a country’s • borders. GDP = GNP – [Net receipts of factor income from abroad]. – Income earned from production abroad obviously doesn’t count in gross domestic product. Copyright © 2003 Pearson Education, Inc.

The National Income Accounts National Product and National Income • National Income: income earned by a nation’s factors of production over some period of time. – NI equals a country’s GNP net of receipts not available for distribution (depreciation, indirect business taxes). – Unilateral transfers from foreigners add to NI but not to GNP. Gross Domestic Product (GDP) • GDP measures the volume of production within a country’s • borders. GDP = GNP – [Net receipts of factor income from abroad]. – Income earned from production abroad obviously doesn’t count in gross domestic product. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy • GNP is the sum of domestic and foreign expenditure on the goods and services produced by domestic factors of production, whether in-country or abroad: Y = C + I + G + EX – IM where: – – – Y is GNP C is consumption I is investment G is government purchases EX is exports IM is imports • In a closed economy, EX = IM = 0. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy • GNP is the sum of domestic and foreign expenditure on the goods and services produced by domestic factors of production, whether in-country or abroad: Y = C + I + G + EX – IM where: – – – Y is GNP C is consumption I is investment G is government purchases EX is exports IM is imports • In a closed economy, EX = IM = 0. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy § The Current Account and Foreign Indebtedness • Current account (CA) balance CA = EX – IM = Y – (C + I + G) CA measures the size and direction of international borrowing. – If we import more than we export (CA<0), we must pay for the difference by borrowing from foreigners. – A country’s current account balance equals the change in its net foreign wealth. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy § The Current Account and Foreign Indebtedness • Current account (CA) balance CA = EX – IM = Y – (C + I + G) CA measures the size and direction of international borrowing. – If we import more than we export (CA<0), we must pay for the difference by borrowing from foreigners. – A country’s current account balance equals the change in its net foreign wealth. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy CA = National income – (Domestic residents’ spending) Y – (C+ I + G) = CA CA balance is what we produce (Y) minus domestic demand or “absorption”. – We can “live beyond our means” if we run a current account deficit, import more than we export, and borrow the difference from foreigners. CA balance is the excess supply of domestic financing. – If we produce and earn more than we “absorb” (CA>0), we necessarily lend our “excess” saving to foreigners » Think of Japan – If we want foreigners to buy more currently produced things from us than we buy from them, we must lend them the difference Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy CA = National income – (Domestic residents’ spending) Y – (C+ I + G) = CA CA balance is what we produce (Y) minus domestic demand or “absorption”. – We can “live beyond our means” if we run a current account deficit, import more than we export, and borrow the difference from foreigners. CA balance is the excess supply of domestic financing. – If we produce and earn more than we “absorb” (CA>0), we necessarily lend our “excess” saving to foreigners » Think of Japan – If we want foreigners to buy more currently produced things from us than we buy from them, we must lend them the difference Copyright © 2003 Pearson Education, Inc.

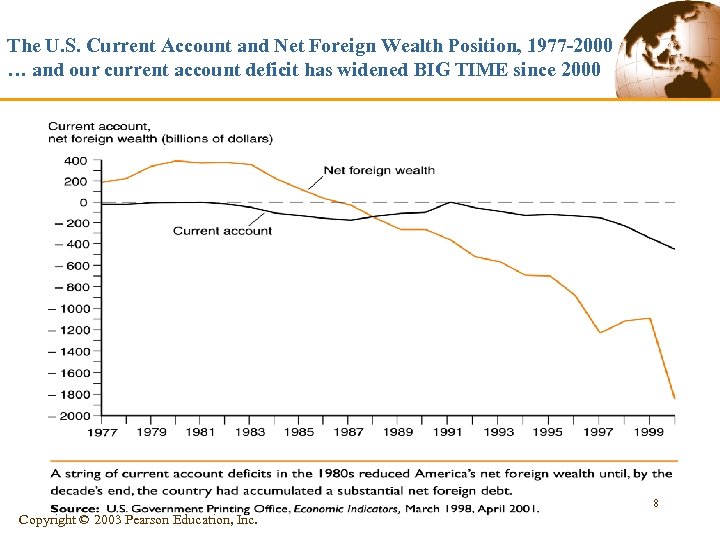

The U. S. Current Account and Net Foreign Wealth Position, 1977 -2000 … and our current account deficit has widened BIG TIME since 2000 8 Copyright © 2003 Pearson Education, Inc.

The U. S. Current Account and Net Foreign Wealth Position, 1977 -2000 … and our current account deficit has widened BIG TIME since 2000 8 Copyright © 2003 Pearson Education, Inc.

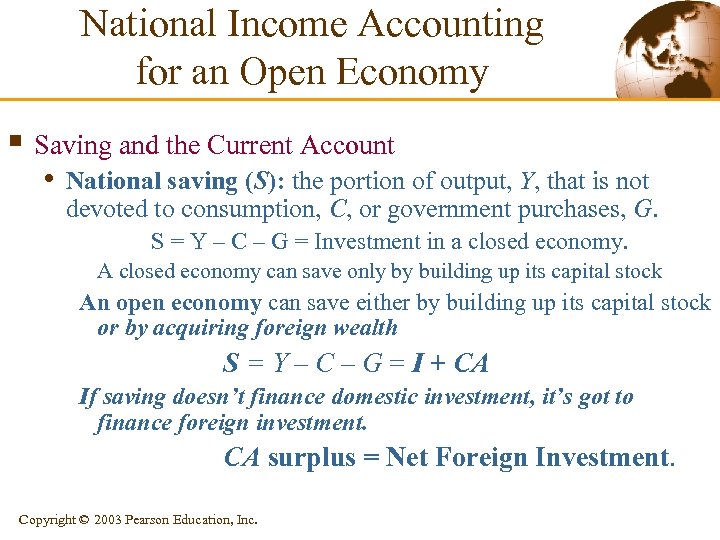

National Income Accounting for an Open Economy § Saving and the Current Account • National saving (S): the portion of output, Y, that is not devoted to consumption, C, or government purchases, G. S = Y – C – G = Investment in a closed economy. A closed economy can save only by building up its capital stock An open economy can save either by building up its capital stock or by acquiring foreign wealth S = Y – C – G = I + CA If saving doesn’t finance domestic investment, it’s got to finance foreign investment. CA surplus = Net Foreign Investment. Copyright © 2003 Pearson Education, Inc.

National Income Accounting for an Open Economy § Saving and the Current Account • National saving (S): the portion of output, Y, that is not devoted to consumption, C, or government purchases, G. S = Y – C – G = Investment in a closed economy. A closed economy can save only by building up its capital stock An open economy can save either by building up its capital stock or by acquiring foreign wealth S = Y – C – G = I + CA If saving doesn’t finance domestic investment, it’s got to finance foreign investment. CA surplus = Net Foreign Investment. Copyright © 2003 Pearson Education, Inc.

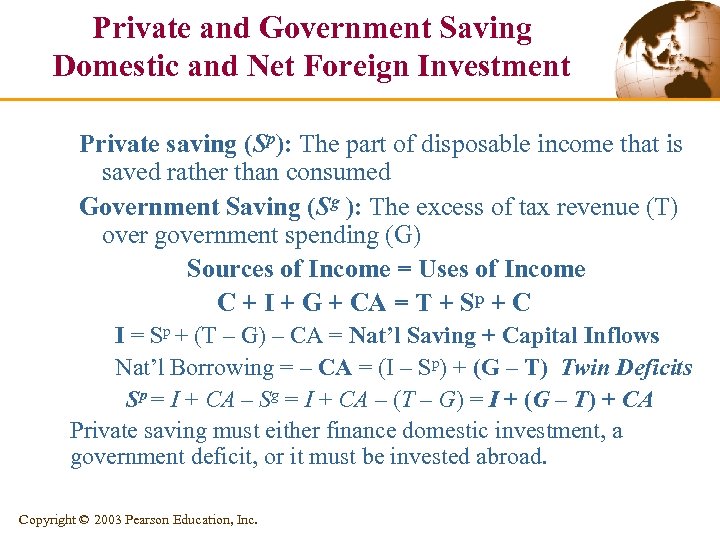

Private and Government Saving Domestic and Net Foreign Investment Private saving (Sp): The part of disposable income that is saved rather than consumed Government Saving (Sg ): The excess of tax revenue (T) over government spending (G) Sources of Income = Uses of Income C + I + G + CA = T + Sp + C I = Sp + (T – G) – CA = Nat’l Saving + Capital Inflows Nat’l Borrowing = – CA = (I – Sp) + (G – T) Twin Deficits Sp = I + CA – Sg = I + CA – (T – G) = I + (G – T) + CA Private saving must either finance domestic investment, a government deficit, or it must be invested abroad. Copyright © 2003 Pearson Education, Inc.

Private and Government Saving Domestic and Net Foreign Investment Private saving (Sp): The part of disposable income that is saved rather than consumed Government Saving (Sg ): The excess of tax revenue (T) over government spending (G) Sources of Income = Uses of Income C + I + G + CA = T + Sp + C I = Sp + (T – G) – CA = Nat’l Saving + Capital Inflows Nat’l Borrowing = – CA = (I – Sp) + (G – T) Twin Deficits Sp = I + CA – Sg = I + CA – (T – G) = I + (G – T) + CA Private saving must either finance domestic investment, a government deficit, or it must be invested abroad. Copyright © 2003 Pearson Education, Inc.

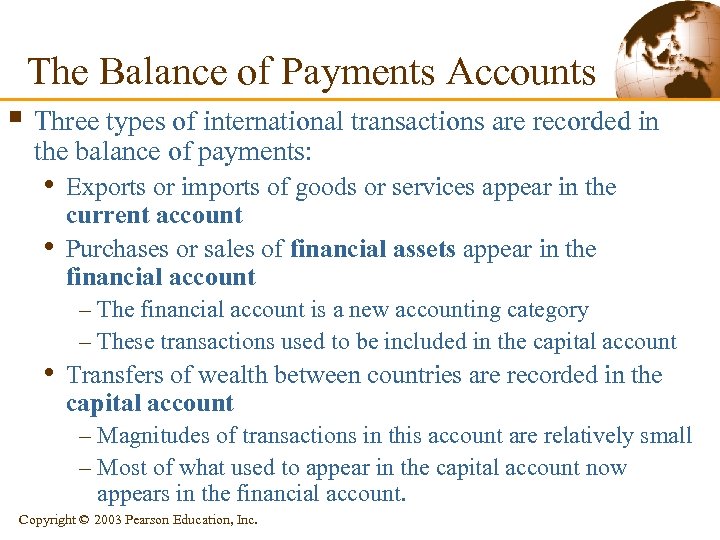

The Balance of Payments Accounts § Three types of international transactions are recorded in the balance of payments: • Exports or imports of goods or services appear in the • current account Purchases or sales of financial assets appear in the financial account – The financial account is a new accounting category – These transactions used to be included in the capital account • Transfers of wealth between countries are recorded in the capital account – Magnitudes of transactions in this account are relatively small – Most of what used to appear in the capital account now appears in the financial account. Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts § Three types of international transactions are recorded in the balance of payments: • Exports or imports of goods or services appear in the • current account Purchases or sales of financial assets appear in the financial account – The financial account is a new accounting category – These transactions used to be included in the capital account • Transfers of wealth between countries are recorded in the capital account – Magnitudes of transactions in this account are relatively small – Most of what used to appear in the capital account now appears in the financial account. Copyright © 2003 Pearson Education, Inc.

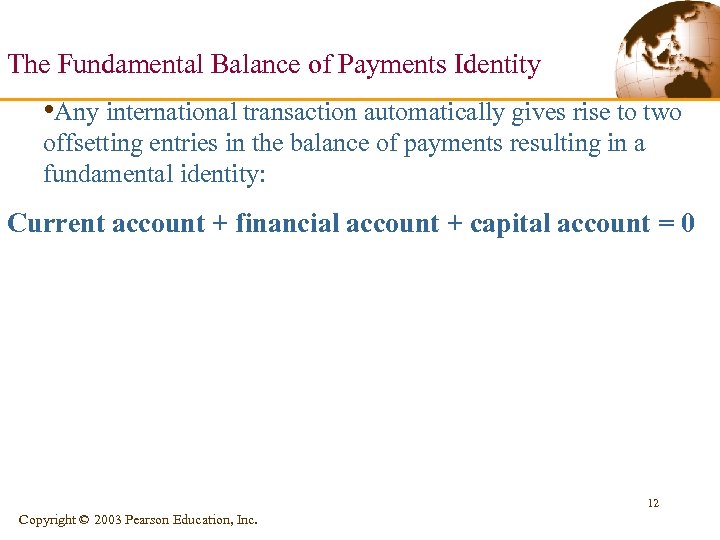

The Fundamental Balance of Payments Identity • Any international transaction automatically gives rise to two offsetting entries in the balance of payments resulting in a fundamental identity: Current account + financial account + capital account = 0 12 Copyright © 2003 Pearson Education, Inc.

The Fundamental Balance of Payments Identity • Any international transaction automatically gives rise to two offsetting entries in the balance of payments resulting in a fundamental identity: Current account + financial account + capital account = 0 12 Copyright © 2003 Pearson Education, Inc.

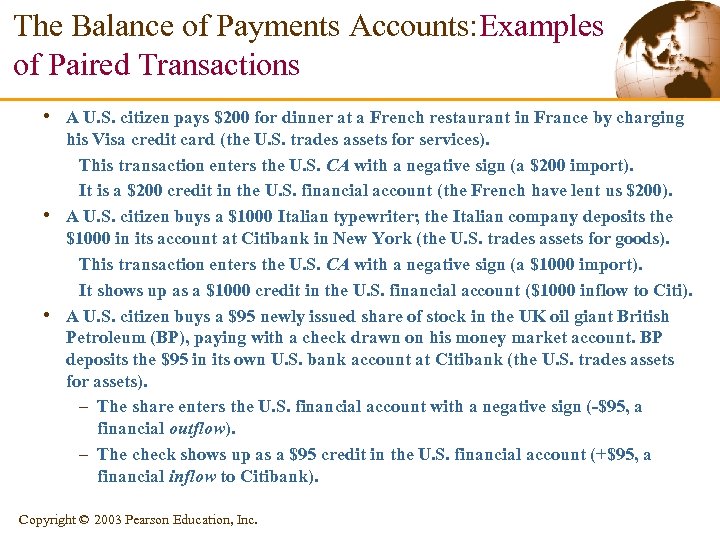

The Balance of Payments Accounts: Examples of Paired Transactions • A U. S. citizen pays $200 for dinner at a French restaurant in France by charging • • his Visa credit card (the U. S. trades assets for services). This transaction enters the U. S. CA with a negative sign (a $200 import). It is a $200 credit in the U. S. financial account (the French have lent us $200). A U. S. citizen buys a $1000 Italian typewriter; the Italian company deposits the $1000 in its account at Citibank in New York (the U. S. trades assets for goods). This transaction enters the U. S. CA with a negative sign (a $1000 import). It shows up as a $1000 credit in the U. S. financial account ($1000 inflow to Citi). A U. S. citizen buys a $95 newly issued share of stock in the UK oil giant British Petroleum (BP), paying with a check drawn on his money market account. BP deposits the $95 in its own U. S. bank account at Citibank (the U. S. trades assets for assets). – The share enters the U. S. financial account with a negative sign (-$95, a financial outflow). – The check shows up as a $95 credit in the U. S. financial account (+$95, a financial inflow to Citibank). Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts: Examples of Paired Transactions • A U. S. citizen pays $200 for dinner at a French restaurant in France by charging • • his Visa credit card (the U. S. trades assets for services). This transaction enters the U. S. CA with a negative sign (a $200 import). It is a $200 credit in the U. S. financial account (the French have lent us $200). A U. S. citizen buys a $1000 Italian typewriter; the Italian company deposits the $1000 in its account at Citibank in New York (the U. S. trades assets for goods). This transaction enters the U. S. CA with a negative sign (a $1000 import). It shows up as a $1000 credit in the U. S. financial account ($1000 inflow to Citi). A U. S. citizen buys a $95 newly issued share of stock in the UK oil giant British Petroleum (BP), paying with a check drawn on his money market account. BP deposits the $95 in its own U. S. bank account at Citibank (the U. S. trades assets for assets). – The share enters the U. S. financial account with a negative sign (-$95, a financial outflow). – The check shows up as a $95 credit in the U. S. financial account (+$95, a financial inflow to Citibank). Copyright © 2003 Pearson Education, Inc.

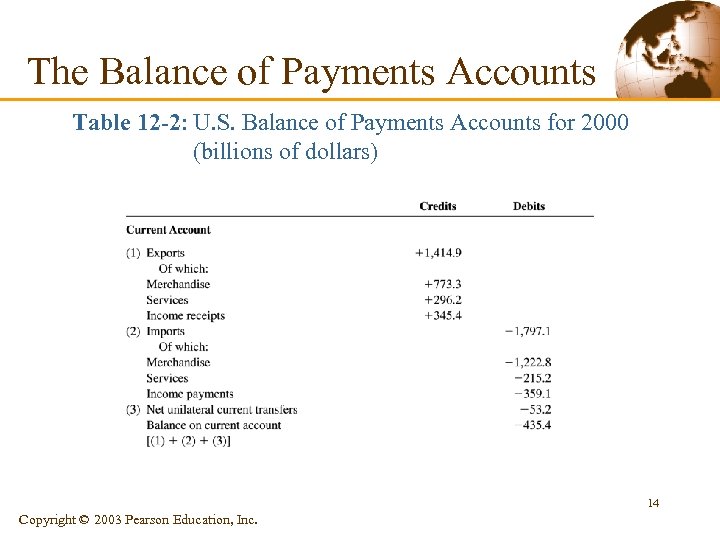

The Balance of Payments Accounts Table 12 -2: U. S. Balance of Payments Accounts for 2000 (billions of dollars) 14 Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts Table 12 -2: U. S. Balance of Payments Accounts for 2000 (billions of dollars) 14 Copyright © 2003 Pearson Education, Inc.

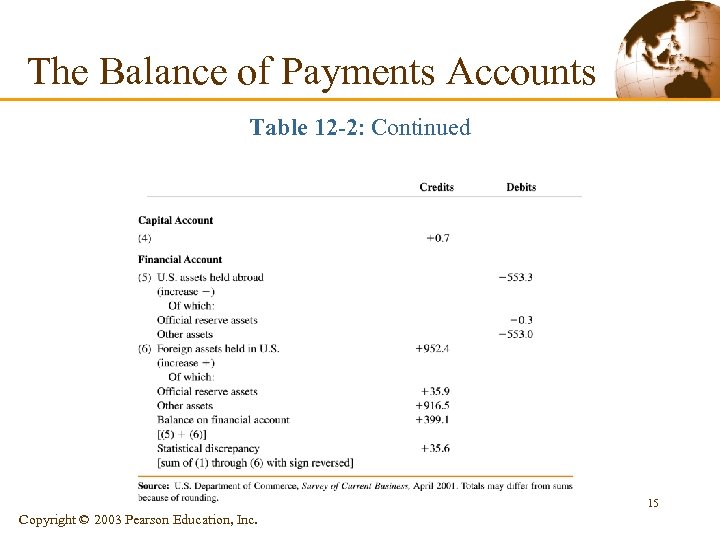

The Balance of Payments Accounts Table 12 -2: Continued 15 Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts Table 12 -2: Continued 15 Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts § Official Reserve Transactions • Central bank – The institution responsible for managing the supply of money • Official international reserves – Foreign assets held by central banks as a cushion against national economic misfortune • Official foreign exchange intervention – Central banks often buy or sell international reserves in private asset markets to affect macroeconomic conditions in their economies. Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts § Official Reserve Transactions • Central bank – The institution responsible for managing the supply of money • Official international reserves – Foreign assets held by central banks as a cushion against national economic misfortune • Official foreign exchange intervention – Central banks often buy or sell international reserves in private asset markets to affect macroeconomic conditions in their economies. Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts • Official settlements balance (Balance of Payments): the sum of the current account balance, the capital account balance, the nonreserve portion of the financial account balance, and the statistical discrepancy. – The U. S. Balance of Payments in 2000 was -$35. 6 billion, that is, the balance of official reserve transactions with its sign reversed. – Foreign central banks increased their dollar holdings by $35. 9 billion while the Fed increased its holdings of foreign currencies by $0. 3 billion, a balance of $35. 6 billion flowing out of the US. – A negative balance of payments may signal that a country is running down its international reserve assets or incurring debts to foreign monetary authorities. Copyright © 2003 Pearson Education, Inc.

The Balance of Payments Accounts • Official settlements balance (Balance of Payments): the sum of the current account balance, the capital account balance, the nonreserve portion of the financial account balance, and the statistical discrepancy. – The U. S. Balance of Payments in 2000 was -$35. 6 billion, that is, the balance of official reserve transactions with its sign reversed. – Foreign central banks increased their dollar holdings by $35. 9 billion while the Fed increased its holdings of foreign currencies by $0. 3 billion, a balance of $35. 6 billion flowing out of the US. – A negative balance of payments may signal that a country is running down its international reserve assets or incurring debts to foreign monetary authorities. Copyright © 2003 Pearson Education, Inc.