33740a710d92017af814f5f6ce0fa23a.ppt

- Количество слайдов: 18

The Most Effective Strategy For Properties Industry

The Most Effective Strategy For Properties Industry

Properties Industry Consists Of : 1. 2. 3. 4. 5. 6. Authorities Developers Consultants Bankers Investors Contractors

Properties Industry Consists Of : 1. 2. 3. 4. 5. 6. Authorities Developers Consultants Bankers Investors Contractors

The Most Effective Strategy For Properties Investors

The Most Effective Strategy For Properties Investors

Property Bubble / Risks? Any Suggestions / Ways To Overcome It ?

Property Bubble / Risks? Any Suggestions / Ways To Overcome It ?

Any % for Property Bubble? Any possibilities to happen? Where? Answer = We don’t know & unpredictable! HOWEVER!!! Unpredictable doesn’t mean that it will not happen. Therefore, the best we can do is prepare for it.

Any % for Property Bubble? Any possibilities to happen? Where? Answer = We don’t know & unpredictable! HOWEVER!!! Unpredictable doesn’t mean that it will not happen. Therefore, the best we can do is prepare for it.

Three Criteria For Property Investors To Buy Property 1. Choose Right Property (Location, Product Design, With High Demand or Occupancy Rate & Reasonable Price) 2. Return on investment must be higher than the cost of financing (current 4. 45 -4. 65%; target 6% yield) 3. Prepare two instalments years for your mortgage

Three Criteria For Property Investors To Buy Property 1. Choose Right Property (Location, Product Design, With High Demand or Occupancy Rate & Reasonable Price) 2. Return on investment must be higher than the cost of financing (current 4. 45 -4. 65%; target 6% yield) 3. Prepare two instalments years for your mortgage

Property Investors Will Bankrupt Under 3 Conditions 1. The ROI rate will fall to 0% from 6% 2. The bank interest will increase to 8. 8% from 4. 4. % (double) therefore the back up fund for 2 years mortgage instalment period will be reduced. 3. If these two circumstances happen & continue for more then 1 -1/2 years, then you are not able to pay your mortgage, bank will auction your property; the auction process will take minimum 6 months.

Property Investors Will Bankrupt Under 3 Conditions 1. The ROI rate will fall to 0% from 6% 2. The bank interest will increase to 8. 8% from 4. 4. % (double) therefore the back up fund for 2 years mortgage instalment period will be reduced. 3. If these two circumstances happen & continue for more then 1 -1/2 years, then you are not able to pay your mortgage, bank will auction your property; the auction process will take minimum 6 months.

The Most Effectives Strategy for Property Investors : 1. Prepare To Obtain The Property Loan From Bank(Reasonable Gearing) 2. Choose The Right Property 3. Renting Out The Property 4. Invest The Property In Long Term - 15 to 20 Years

The Most Effectives Strategy for Property Investors : 1. Prepare To Obtain The Property Loan From Bank(Reasonable Gearing) 2. Choose The Right Property 3. Renting Out The Property 4. Invest The Property In Long Term - 15 to 20 Years

1. Prepare To Obtain The Property Loan From Bank(Reasonable Gearing) Get Ready Documents for bank loan application: Smartly Pay Tax Knock The Bank Door; be friend with all bankers Target For Employee By age of 40 years old: obtain $3 M property loan from bank Target For SME Employer By age of 40 years old: obtain $30 M property loan from bank

1. Prepare To Obtain The Property Loan From Bank(Reasonable Gearing) Get Ready Documents for bank loan application: Smartly Pay Tax Knock The Bank Door; be friend with all bankers Target For Employee By age of 40 years old: obtain $3 M property loan from bank Target For SME Employer By age of 40 years old: obtain $30 M property loan from bank

Principal Of Gearing Two Types of Gearing : • Unreasonable Gearing - Buy big car or big houses • Reasonable Gearing - Buy the good assets with yield higher than the cost of funding and assets yearly appreciation higher then the inflation *Note : Gearing is go to the maximum but not over gearing

Principal Of Gearing Two Types of Gearing : • Unreasonable Gearing - Buy big car or big houses • Reasonable Gearing - Buy the good assets with yield higher than the cost of funding and assets yearly appreciation higher then the inflation *Note : Gearing is go to the maximum but not over gearing

2. Choose The Right Property • Residential, Commercial, Industrial, Land, Resort Homes • Right Location, Product , Designed , Pricing & etc ….

2. Choose The Right Property • Residential, Commercial, Industrial, Land, Resort Homes • Right Location, Product , Designed , Pricing & etc ….

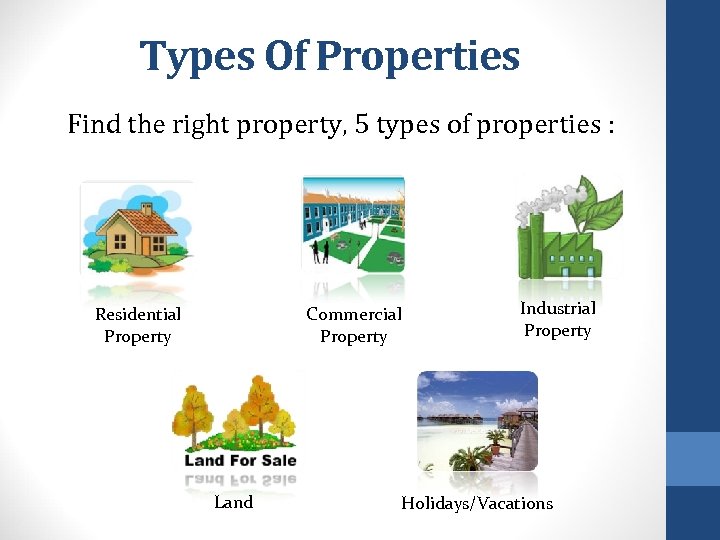

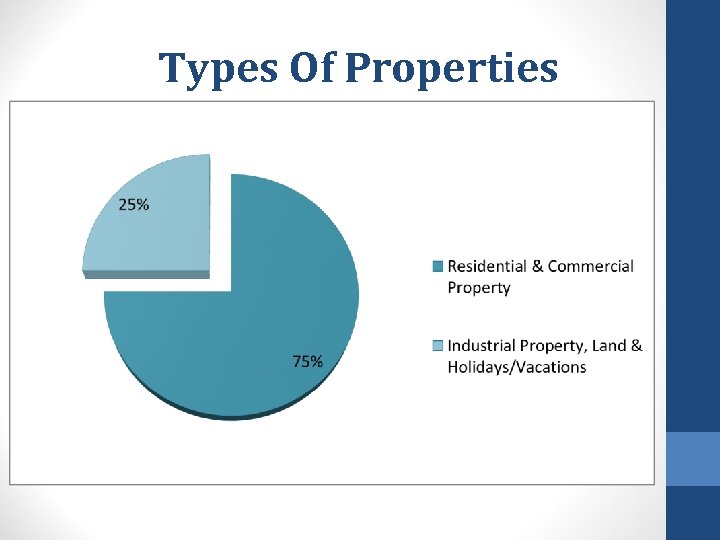

Types Of Properties Find the right property, 5 types of properties : Residential Property Commercial Property Land Industrial Property Holidays/Vacations

Types Of Properties Find the right property, 5 types of properties : Residential Property Commercial Property Land Industrial Property Holidays/Vacations

Types Of Properties

Types Of Properties

3. Renting Out The Property 1. Rental Need To be higher than the cost of financing (current 4. 45 -4. 65%; target 6% yield)

3. Renting Out The Property 1. Rental Need To be higher than the cost of financing (current 4. 45 -4. 65%; target 6% yield)

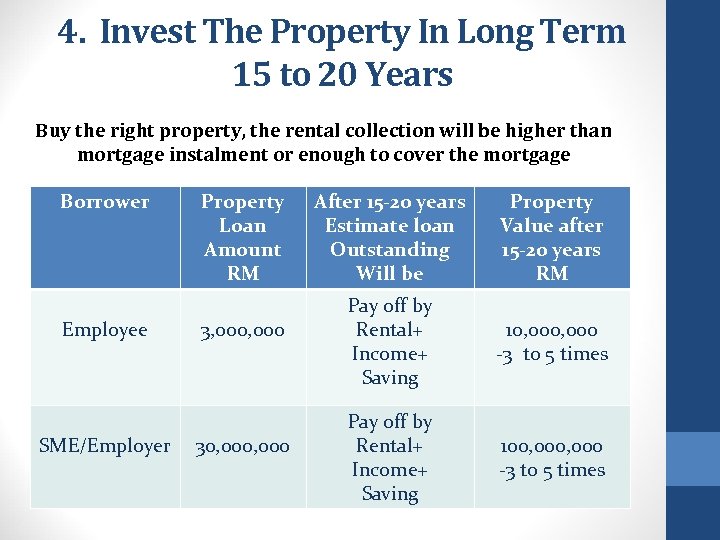

4. Invest The Property In Long Term 15 to 20 Years Buy the right property, the rental collection will be higher than mortgage instalment or enough to cover the mortgage Borrower Employee SME/Employer Property Loan Amount RM 3, 000 30, 000 After 15 -20 years Estimate loan Outstanding Will be Property Value after 15 -20 years RM Pay off by Rental+ Income+ Saving 10, 000 -3 to 5 times Pay off by Rental+ Income+ Saving 100, 000 -3 to 5 times

4. Invest The Property In Long Term 15 to 20 Years Buy the right property, the rental collection will be higher than mortgage instalment or enough to cover the mortgage Borrower Employee SME/Employer Property Loan Amount RM 3, 000 30, 000 After 15 -20 years Estimate loan Outstanding Will be Property Value after 15 -20 years RM Pay off by Rental+ Income+ Saving 10, 000 -3 to 5 times Pay off by Rental+ Income+ Saving 100, 000 -3 to 5 times

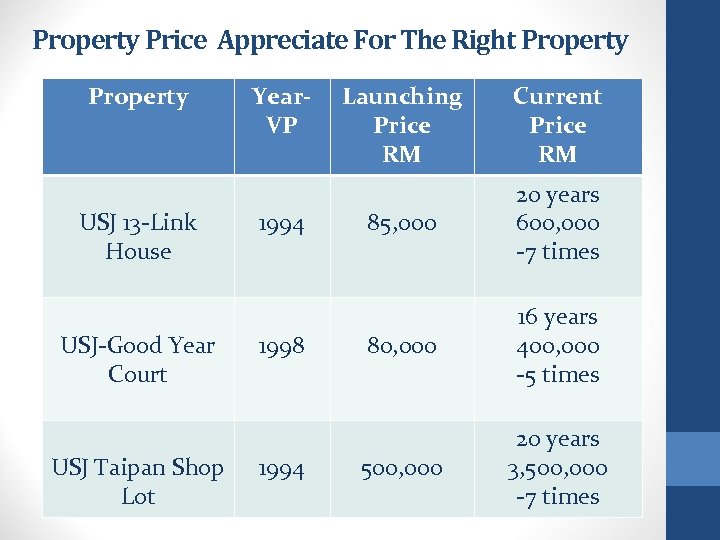

Property Price Appreciate For The Right Property USJ 13 -Link House USJ-Good Year Court USJ Taipan Shop Lot Year. VP 1994 1998 1994 Launching Price RM Current Price RM 85, 000 20 years 600, 000 -7 times 80, 000 16 years 400, 000 -5 times 500, 000 20 years 3, 500, 000 -7 times

Property Price Appreciate For The Right Property USJ 13 -Link House USJ-Good Year Court USJ Taipan Shop Lot Year. VP 1994 1998 1994 Launching Price RM Current Price RM 85, 000 20 years 600, 000 -7 times 80, 000 16 years 400, 000 -5 times 500, 000 20 years 3, 500, 000 -7 times

4. Invest The Property In Long Term 15 to 20 Years – Is Can ? Are U able to hold property for long term ; 15 to 20 years ? The Answer is Why Cannot ? Because Investors only came out 10% to 30% money; some more have tenant help u pay ur loan instalment

4. Invest The Property In Long Term 15 to 20 Years – Is Can ? Are U able to hold property for long term ; 15 to 20 years ? The Answer is Why Cannot ? Because Investors only came out 10% to 30% money; some more have tenant help u pay ur loan instalment

Thank you !

Thank you !