43de481ba2c589b354c632debe8eb573.ppt

- Количество слайдов: 50

The Monetary System EQ: What is money?

The Monetary System EQ: What is money?

Class Auction • Want to have this piece of candy? • What are you willing to trade for it? • What is required for this trade (barter) to work? • What is the solution for this “double coincidence of wants? ”

Class Auction • Want to have this piece of candy? • What are you willing to trade for it? • What is required for this trade (barter) to work? • What is the solution for this “double coincidence of wants? ”

With a partner, answer this question What is money?

With a partner, answer this question What is money?

What is Money? Money is the set of assets in an economy that people regularly use to buy goods and services from other people.

What is Money? Money is the set of assets in an economy that people regularly use to buy goods and services from other people.

Types of Money Commodity Money Fiat Money What type of money does the U. S. use?

Types of Money Commodity Money Fiat Money What type of money does the U. S. use?

Functions of Money • Medium of Exchange

Functions of Money • Medium of Exchange

Functions of Money • Standard of Value

Functions of Money • Standard of Value

Functions of Money • Store of Value

Functions of Money • Store of Value

Summary • Draw the 3 functions of money – do not label each function • Then with a partner, switch papers and each partner tries to identify each picture

Summary • Draw the 3 functions of money – do not label each function • Then with a partner, switch papers and each partner tries to identify each picture

Characteristics of Money It is important that money is ______ because…………… Portable Durable Divisible Limited

Characteristics of Money It is important that money is ______ because…………… Portable Durable Divisible Limited

Liquidity • Liquidity is the ease with which an asset can be converted into the economy’s medium of exchange. What is the most liquid asset? What are some less liquid assets?

Liquidity • Liquidity is the ease with which an asset can be converted into the economy’s medium of exchange. What is the most liquid asset? What are some less liquid assets?

Money in the U. S. Economy • Currency is the paper bills and coins in the hands of the public. • Demand deposits are balances in bank accounts that depositors can access on demand by writing a check.

Money in the U. S. Economy • Currency is the paper bills and coins in the hands of the public. • Demand deposits are balances in bank accounts that depositors can access on demand by writing a check.

Figure 1 Two Measures of the Money Stock for the U. S. Economy Billions of Dollars M 2 $6, 398 $1, 363 0 • Savings deposits • Small time deposits • Money market mutual funds • A few minor categories ($5, 035 billion) M 1 • Demand deposits • Traveler ’s checks • Other checkable deposits ($664 billion) • Currency ($699 billion) • Everything in M 1 ($1, 363 billion)

Figure 1 Two Measures of the Money Stock for the U. S. Economy Billions of Dollars M 2 $6, 398 $1, 363 0 • Savings deposits • Small time deposits • Money market mutual funds • A few minor categories ($5, 035 billion) M 1 • Demand deposits • Traveler ’s checks • Other checkable deposits ($664 billion) • Currency ($699 billion) • Everything in M 1 ($1, 363 billion)

CASE STUDY: Where Is All The Currency? • In 2004 there was $699 billion of U. S. currency outstanding. – That is $3, 134 in currency per adult. • Who is holding all this currency? – Currency held abroad – Currency held by illegal entities

CASE STUDY: Where Is All The Currency? • In 2004 there was $699 billion of U. S. currency outstanding. – That is $3, 134 in currency per adult. • Who is holding all this currency? – Currency held abroad – Currency held by illegal entities

Review Video

Review Video

What agency has authority to print currency in the U. S. ?

What agency has authority to print currency in the U. S. ?

The Federal Reserve System • The Federal Reserve (Fed) serves as the nation’s central bank – created 1913. – It is designed to oversee the banking system. – It regulates the quantity of money in the economy (monetary policy). – It is the lender of last resort.

The Federal Reserve System • The Federal Reserve (Fed) serves as the nation’s central bank – created 1913. – It is designed to oversee the banking system. – It regulates the quantity of money in the economy (monetary policy). – It is the lender of last resort.

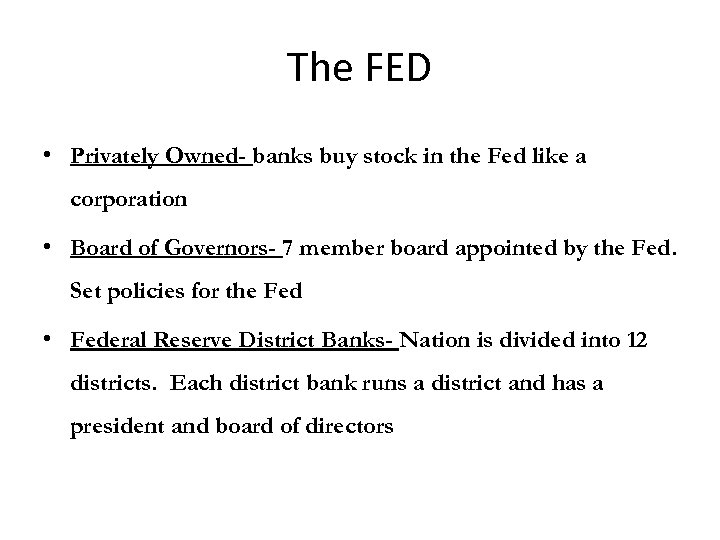

The FED • Privately Owned- banks buy stock in the Fed like a corporation • Board of Governors- 7 member board appointed by the Fed. Set policies for the Fed • Federal Reserve District Banks- Nation is divided into 12 districts. Each district bank runs a district and has a president and board of directors

The FED • Privately Owned- banks buy stock in the Fed like a corporation • Board of Governors- 7 member board appointed by the Fed. Set policies for the Fed • Federal Reserve District Banks- Nation is divided into 12 districts. Each district bank runs a district and has a president and board of directors

FED Chairman

FED Chairman

Monetary Policy Tools 1. Federal Open Market Operations Committee (FOMC) 2. Reserve Requirement 3. Discount Rate/Federal Funds Rate

Monetary Policy Tools 1. Federal Open Market Operations Committee (FOMC) 2. Reserve Requirement 3. Discount Rate/Federal Funds Rate

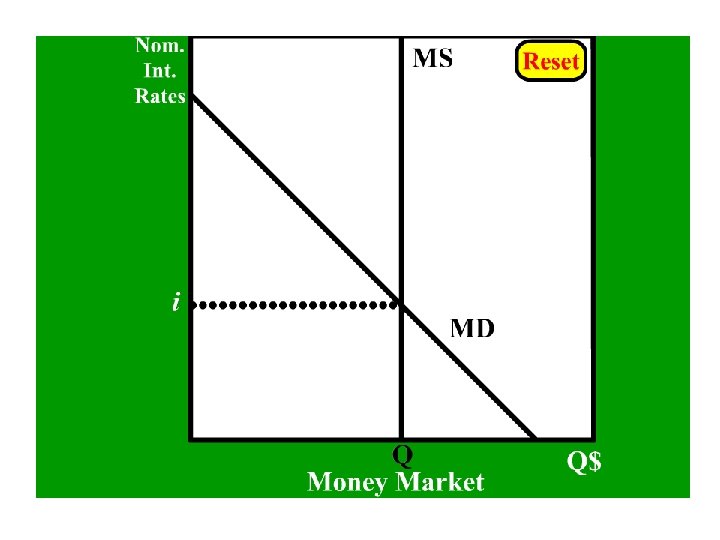

*******FOMC****** • To increase the money supply, the Fed buys government bonds from the public. • To decrease the money supply, the Fed sells government bonds to the public. • The Fed uses OMO to control the Fed Funds rate (the rate banks charge each other for over night lending) What does an increase in the money supply do to the nominal interest rate and price levels? Decrease?

*******FOMC****** • To increase the money supply, the Fed buys government bonds from the public. • To decrease the money supply, the Fed sells government bonds to the public. • The Fed uses OMO to control the Fed Funds rate (the rate banks charge each other for over night lending) What does an increase in the money supply do to the nominal interest rate and price levels? Decrease?

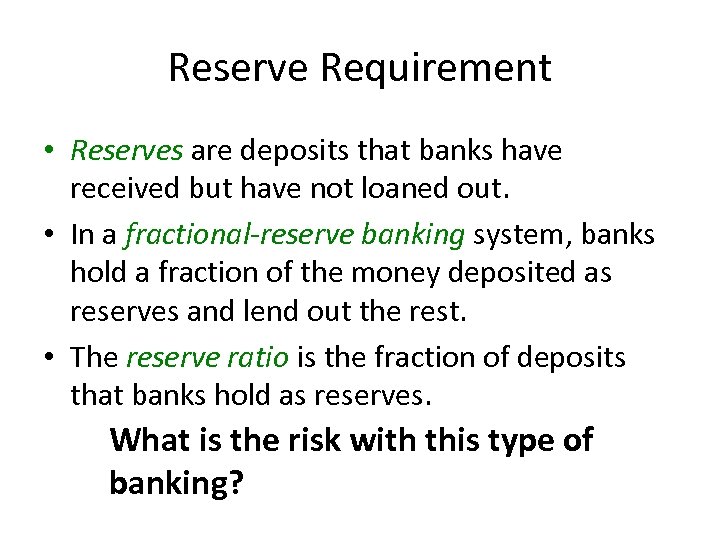

Reserve Requirement • Reserves are deposits that banks have received but have not loaned out. • In a fractional-reserve banking system, banks hold a fraction of the money deposited as reserves and lend out the rest. • The reserve ratio is the fraction of deposits that banks hold as reserves. What is the risk with this type of banking?

Reserve Requirement • Reserves are deposits that banks have received but have not loaned out. • In a fractional-reserve banking system, banks hold a fraction of the money deposited as reserves and lend out the rest. • The reserve ratio is the fraction of deposits that banks hold as reserves. What is the risk with this type of banking?

Banking Money Creation with Fractional-Reserve This T-Account shows a bank that… – accepts deposits, – keeps a portion as reserves, – and lends out the rest. It assumes a reserve ratio of 10%. First National Bank Assets Owns Reserves $10. 00 Loans Liabilities Owes Deposits $100. 00 $90. 00 Total Assets $100. 00 Total Liabilities $100. 00

Banking Money Creation with Fractional-Reserve This T-Account shows a bank that… – accepts deposits, – keeps a portion as reserves, – and lends out the rest. It assumes a reserve ratio of 10%. First National Bank Assets Owns Reserves $10. 00 Loans Liabilities Owes Deposits $100. 00 $90. 00 Total Assets $100. 00 Total Liabilities $100. 00

T Accounts – assume 1/5 rr 1. 2. 3. 4. 5. $1000 deposit into checking Bank issues $5000 in loans FED buys $1000 worth of govt securities FED sells $1000 worth of govt securities What is the money multiplier? Assets $2000 Required Reserves $6000 Excess Reserves $2000 Securities Liabilities $10000 Deposits

T Accounts – assume 1/5 rr 1. 2. 3. 4. 5. $1000 deposit into checking Bank issues $5000 in loans FED buys $1000 worth of govt securities FED sells $1000 worth of govt securities What is the money multiplier? Assets $2000 Required Reserves $6000 Excess Reserves $2000 Securities Liabilities $10000 Deposits

Money Creation… out of thin air… Increase in the Money Supply = $190. 00! First National Bank Assets Reserves $10. 00 Loans Liabilities Deposits $100. 00 Assets Reserves $9. 00 Loans $90. 00 Total Assets $100. 00 Second National Bank Total Liabilities $100. 00 Liabilities Deposits $90. 00 $81. 00 Total Assets $90. 00 Total Liabilities $90. 00

Money Creation… out of thin air… Increase in the Money Supply = $190. 00! First National Bank Assets Reserves $10. 00 Loans Liabilities Deposits $100. 00 Assets Reserves $9. 00 Loans $90. 00 Total Assets $100. 00 Second National Bank Total Liabilities $100. 00 Liabilities Deposits $90. 00 $81. 00 Total Assets $90. 00 Total Liabilities $90. 00

The Money Multiplier Original deposit = $100. 00 • 1 st Natl. Lending = 90. 00 (=. 9 x $100. 00) • 2 nd Natl. Lending = 81. 00 (=. 9 x $ 90. 00) • 3 rd Natl. Lending = 72. 90 (=. 9 x $ 81. 00) • … and on until there are just pennies left to lend! • Total money created by this $100. 00 deposit is $1000. (= 1/. 1 x $100. 00)

The Money Multiplier Original deposit = $100. 00 • 1 st Natl. Lending = 90. 00 (=. 9 x $100. 00) • 2 nd Natl. Lending = 81. 00 (=. 9 x $ 90. 00) • 3 rd Natl. Lending = 72. 90 (=. 9 x $ 81. 00) • … and on until there are just pennies left to lend! • Total money created by this $100. 00 deposit is $1000. (= 1/. 1 x $100. 00)

The Money Multiplier • The money multiplier is the reciprocal of the reserve ratio: M = 1/R • Example: – With a reserve requirement, R = 20% or. 2: – The money multiplier is 1/. 2 = 5.

The Money Multiplier • The money multiplier is the reciprocal of the reserve ratio: M = 1/R • Example: – With a reserve requirement, R = 20% or. 2: – The money multiplier is 1/. 2 = 5.

1 – 5 on L 4/A 38 wksht

1 – 5 on L 4/A 38 wksht

The Fed and the Reserve Requirement • What does changing the reserve requirement from 10% to 20% do the money supply? Nominal interest rates? Show me the new multiplier. • What does decreasing the reserve requirement do to the money supply? Nominal interest rates? Show me the new multiplier.

The Fed and the Reserve Requirement • What does changing the reserve requirement from 10% to 20% do the money supply? Nominal interest rates? Show me the new multiplier. • What does decreasing the reserve requirement do to the money supply? Nominal interest rates? Show me the new multiplier.

The Discount Rate (no longer used) • The discount rate is the interest rate the Fed charges banks for loans. – Increasing the discount rate decreases the money supply. – Decreasing the discount rate increases the money supply. Discount rate now set higher than FFR… why does this make the discount rate obsolete?

The Discount Rate (no longer used) • The discount rate is the interest rate the Fed charges banks for loans. – Increasing the discount rate decreases the money supply. – Decreasing the discount rate increases the money supply. Discount rate now set higher than FFR… why does this make the discount rate obsolete?

FED REVIEW • http: //www. youtube. com/watch? v=Hd. Zn. OQp 4 Sm. U

FED REVIEW • http: //www. youtube. com/watch? v=Hd. Zn. OQp 4 Sm. U

6 -12 on L 4/A 38 wksht finish remainder for HW

6 -12 on L 4/A 38 wksht finish remainder for HW

11/10 Warm up • A-F on worksheet

11/10 Warm up • A-F on worksheet

Warm-up • Scenario – high unemployment and low growth (show this on ASAD graph) 1. 2. 3. 4. Action by FED – loose or tight? OMO – Buy or sell bonds? Why? What happens to money supply (graph)? Why? What happens to nominal interest (same graph)? Why? 5. What happens to investment? Why? 6. What happens to aggregate demand? Why?

Warm-up • Scenario – high unemployment and low growth (show this on ASAD graph) 1. 2. 3. 4. Action by FED – loose or tight? OMO – Buy or sell bonds? Why? What happens to money supply (graph)? Why? What happens to nominal interest (same graph)? Why? 5. What happens to investment? Why? 6. What happens to aggregate demand? Why?

EQ: How do interest rates affect the macroeconomy?

EQ: How do interest rates affect the macroeconomy?

Watch the video to complete the chart Demand Deposit RR $20000 5% $20000 10% $20000 15% Money Multiplier Excess Reserves available for loans What is the max money created(not including original deposit)?

Watch the video to complete the chart Demand Deposit RR $20000 5% $20000 10% $20000 15% Money Multiplier Excess Reserves available for loans What is the max money created(not including original deposit)?

Review Video – Creating Money

Review Video – Creating Money

Watch the video to complete the chart Demand Deposit RR $20000 5% $20000 10% $20000 15% Money Multiplier Excess Reserves available for loans What is the max money created(not including original deposit)?

Watch the video to complete the chart Demand Deposit RR $20000 5% $20000 10% $20000 15% Money Multiplier Excess Reserves available for loans What is the max money created(not including original deposit)?

What are some potential problems with controlling the money supply? • The Fed’s control of the money supply is not precise. • The Fed must wrestle with two problems that arise due to fractional-reserve banking. – The Fed does not control the amount of money that households choose to hold as deposits in banks. – The Fed does not control the amount of money that bankers choose to lend.

What are some potential problems with controlling the money supply? • The Fed’s control of the money supply is not precise. • The Fed must wrestle with two problems that arise due to fractional-reserve banking. – The Fed does not control the amount of money that households choose to hold as deposits in banks. – The Fed does not control the amount of money that bankers choose to lend.

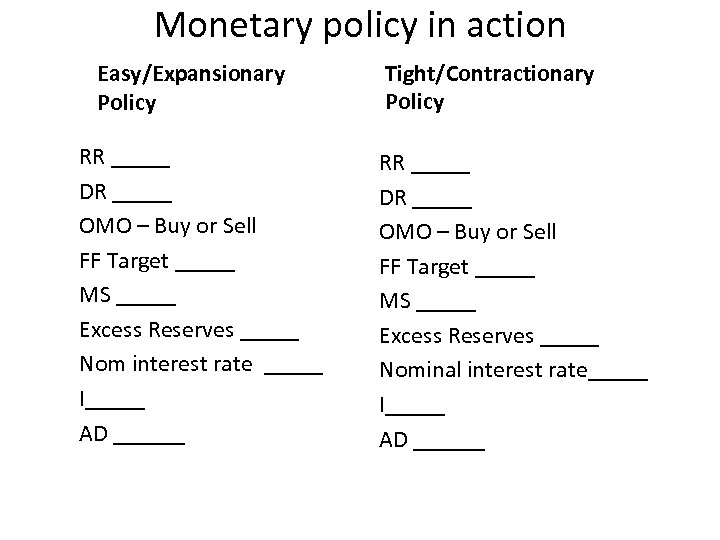

Monetary policy in action Easy/Expansionary Policy RR _____ DR _____ OMO – Buy or Sell FF Target _____ MS _____ Excess Reserves _____ Nom interest rate _____ I_____ AD ______ Tight/Contractionary Policy RR _____ DR _____ OMO – Buy or Sell FF Target _____ MS _____ Excess Reserves _____ Nominal interest rate_____ I_____ AD ______

Monetary policy in action Easy/Expansionary Policy RR _____ DR _____ OMO – Buy or Sell FF Target _____ MS _____ Excess Reserves _____ Nom interest rate _____ I_____ AD ______ Tight/Contractionary Policy RR _____ DR _____ OMO – Buy or Sell FF Target _____ MS _____ Excess Reserves _____ Nominal interest rate_____ I_____ AD ______

Monetary policy in action Easy Money ↓ RR= Banks can loan more $ Fed Buys OMO’s = bank have more $ fewer bonds ↓Discount Rate= Fed lowers cost of borrowing* ↓Federal Funds Rate Target = Fed lowers cost of bank borrowing and lending – done by OMO Tight Money ↑RR = Banks have less $ to loan out. Fed Sells OMO’s = banks have less $ and more Bonds ↑Discount Rate = Fed lowers cost of borrowing* ↑Federal Funds Rate Target = Fed increases the cost of bank borrowing and lending – done by OMO

Monetary policy in action Easy Money ↓ RR= Banks can loan more $ Fed Buys OMO’s = bank have more $ fewer bonds ↓Discount Rate= Fed lowers cost of borrowing* ↓Federal Funds Rate Target = Fed lowers cost of bank borrowing and lending – done by OMO Tight Money ↑RR = Banks have less $ to loan out. Fed Sells OMO’s = banks have less $ and more Bonds ↑Discount Rate = Fed lowers cost of borrowing* ↑Federal Funds Rate Target = Fed increases the cost of bank borrowing and lending – done by OMO

So…. How do monetary policies affect macroeconomic goals? Whiteboards

So…. How do monetary policies affect macroeconomic goals? Whiteboards

Draw and AD/AS graph starting with a Draw a money market What happens to recessionary gap. graph showing investment given What curve will expansionary monetary shift? What will the change in policy. happen to interest rates? employment, output, and prices?

Draw and AD/AS graph starting with a Draw a money market What happens to recessionary gap. graph showing investment given What curve will expansionary monetary shift? What will the change in policy. happen to interest rates? employment, output, and prices?

Draw a money market graph showing contractionary monetary policy. Draw and AD/AS graph starting with a inflationary What happens to gap. What curve investment given will shift? What the change in will happen to interest rates? employment, output, and prices?

Draw a money market graph showing contractionary monetary policy. Draw and AD/AS graph starting with a inflationary What happens to gap. What curve investment given will shift? What the change in will happen to interest rates? employment, output, and prices?

Review Video

Review Video

• http: //www. frbsf. org/education/activities/cha irman/ So…. How do monetary policies affect macroeconomic goals?

• http: //www. frbsf. org/education/activities/cha irman/ So…. How do monetary policies affect macroeconomic goals?