bca71faedfa2f45ff405ef4a26899c5b.ppt

- Количество слайдов: 38

The Middle East and North Africa telecoms market: interim forecast update 2013– 2018 Research Forecast Report The Middle East and North Africa telecoms market: interim forecast update 2013– 2018 June 2013 Karim Yaici © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market: interim forecast update 2013– 2018 Research Forecast Report The Middle East and North Africa telecoms market: interim forecast update 2013– 2018 June 2013 Karim Yaici © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 2 Contents Slide no. 6. 7. 17. Saudi Arabia is forecast to have the strongest IPTV growth in MENA, while adoption is likely to be marginal in Algeria, Egypt and Israel 18. The main trends in the MENA telecoms market have altered little, and mobile is clearly predominant over fixed 19. MENA had only around 628 000 LTE connections by the end of 2012; 21% of MBB connections and 8. 02% of handsets will be 4 G by 2018 20. Country-level analysis 21. Algeria mobile market: room for further growth in connections, but the delayed 3 G launch will limit data revenue growth 22. Algeria fixed market: historical fixed voice market has been revised, and DSL connections continue to dominate the broadband market 23. Egypt mobile market: mobile connections and traffic were higher than expected in 2012, which helped offset declining prices 24. Egypt fixed market: steady growth for the DSL market and resilience of fixed voice market in terms of connections 25. Israel mobile market: competition and price erosion hindered market growth, and even resulted in a decline in handset data revenue 26. Israel fixed market: adoption of mobile is accelerating the decline of fixed voice, while fixed broadband has been more resilient 27. Morocco mobile market: handset data revenue and voice traffic were higher than forecast in 2012, but MBB growth was lower 28. Morocco fixed market: fixed voice and broadband revenue declined fasted than expected because of higher adoption of mobile 8. 9. 10. 11. 12. 13. 14. 15. Executive summary MENA market summary: growth in handset data and broadband services will drive the telecoms market in 2013– 2018 About this report: we have updated and extended our five-year forecasts for MENA, reflecting the latest reported market data and trends Key forecast changes [1]: IPTV and M 2 M added; strong growth of mobile handset connections in Egypt; downward revision of 3 G in Algeria Key forecast changes [2]: Significant decline in data revenue in Israel; adoption of fibre in MENA exceeded expectations Key forecast changes [3]: take-up of LTE and smartphone penetration both increased more quickly than expected in the UAE Regional overview Mobile networks will account for 91% of voice connections and 71% of broadband connections in MENA by 2018 Smartphones will account for 69% of active broadband connections and a third of handsets by 2018; and 88% of them will be prepaid Demand for fixed broadband business services will offset declining fixed voice revenue during the forecast period 16. M 2 M is now on operators’ agendas in MENA; we expect strong growth in the most-developed countries such as Israel, Saudi Arabia and the UAE © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 2 Contents Slide no. 6. 7. 17. Saudi Arabia is forecast to have the strongest IPTV growth in MENA, while adoption is likely to be marginal in Algeria, Egypt and Israel 18. The main trends in the MENA telecoms market have altered little, and mobile is clearly predominant over fixed 19. MENA had only around 628 000 LTE connections by the end of 2012; 21% of MBB connections and 8. 02% of handsets will be 4 G by 2018 20. Country-level analysis 21. Algeria mobile market: room for further growth in connections, but the delayed 3 G launch will limit data revenue growth 22. Algeria fixed market: historical fixed voice market has been revised, and DSL connections continue to dominate the broadband market 23. Egypt mobile market: mobile connections and traffic were higher than expected in 2012, which helped offset declining prices 24. Egypt fixed market: steady growth for the DSL market and resilience of fixed voice market in terms of connections 25. Israel mobile market: competition and price erosion hindered market growth, and even resulted in a decline in handset data revenue 26. Israel fixed market: adoption of mobile is accelerating the decline of fixed voice, while fixed broadband has been more resilient 27. Morocco mobile market: handset data revenue and voice traffic were higher than forecast in 2012, but MBB growth was lower 28. Morocco fixed market: fixed voice and broadband revenue declined fasted than expected because of higher adoption of mobile 8. 9. 10. 11. 12. 13. 14. 15. Executive summary MENA market summary: growth in handset data and broadband services will drive the telecoms market in 2013– 2018 About this report: we have updated and extended our five-year forecasts for MENA, reflecting the latest reported market data and trends Key forecast changes [1]: IPTV and M 2 M added; strong growth of mobile handset connections in Egypt; downward revision of 3 G in Algeria Key forecast changes [2]: Significant decline in data revenue in Israel; adoption of fibre in MENA exceeded expectations Key forecast changes [3]: take-up of LTE and smartphone penetration both increased more quickly than expected in the UAE Regional overview Mobile networks will account for 91% of voice connections and 71% of broadband connections in MENA by 2018 Smartphones will account for 69% of active broadband connections and a third of handsets by 2018; and 88% of them will be prepaid Demand for fixed broadband business services will offset declining fixed voice revenue during the forecast period 16. M 2 M is now on operators’ agendas in MENA; we expect strong growth in the most-developed countries such as Israel, Saudi Arabia and the UAE © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Contents Slide no. 29. Saudi Arabia mobile market: LTE has had a strong start, while growth in the number of handsets was below expectations in 2012 30. Saudi Arabia fixed market: FTTH growth was stronger than forecast, and Wi. MAX showed more resilience in 2012 than expected 31. UAE mobile market: more connections and adoption of smartphones and LTE than expected, but revenue was lower than forecast 32. UAE fixed market: growth in the broadband sector with fibre compensated for the decline in fixed voice connections and revenue 33. About the author and Analysys Mason 34. About the author 35. About Analysys Mason 36. Research from Analysys Mason 37. Consulting from Analysys Mason © Analysys Mason Limited 2013 3

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Contents Slide no. 29. Saudi Arabia mobile market: LTE has had a strong start, while growth in the number of handsets was below expectations in 2012 30. Saudi Arabia fixed market: FTTH growth was stronger than forecast, and Wi. MAX showed more resilience in 2012 than expected 31. UAE mobile market: more connections and adoption of smartphones and LTE than expected, but revenue was lower than forecast 32. UAE fixed market: growth in the broadband sector with fibre compensated for the decline in fixed voice connections and revenue 33. About the author and Analysys Mason 34. About the author 35. About Analysys Mason 36. Research from Analysys Mason 37. Consulting from Analysys Mason © Analysys Mason Limited 2013 3

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 4 List of figures Figure 1: Retail revenue by service type, Middle East and North Africa, 2009– 2018 Figure 13: Fixed and mobile connections, Middle East and North Africa, 2009 – 2018 Figure 2: Growth rates of retail revenue by individual service types, Middle East and North Africa, 2009– 2018 Figure 3: Fixed and mobile voice connections, Middle East and North Africa, 2009– 2018 Figure 4: Broadband access connections by technology, Middle East and North Africa, 2009– 2018 Figure 5: Broadband connections by type, Middle East and North Africa, 2011– 2018 Figure 6: Smartphones as a percentage of mobile handsets, Middle East and North Africa, 2009– 2018 Figure 7: Prepaid and contract handset connections, Middle East and North Africa, 2009– 2018 Figure 8: Fixed penetration by service type, Middle East and North Africa, 2009– 2018 Figure 9: Fixed retail revenue by service type, Middle East and North Africa, 2009– 2018 Figure 10: M 2 M connections by country, Middle East and North Africa 2012– 2018 Figure 11: IPTV connections and revenue, Morocco, Saudi Arabia and UAE 2012– 2018 Figure 12: Fixed and mobile retail revenue, Middle East and North Africa, 2009– 2018 Figure 14: 4 G’s share of mobile handset and mobile broadband connections, Middle East and North Africa, 2009– 2018 Figure 15: Mobile connections and share of prepaid connections, Algeria, 2009– 2018 Figure 16: Share of 2 G and 3 G of total mobile active connections, Algeria, 2012– 2018 Figure 17: Fixed voice connections and fixed Mo. U, Algeria, 2009– 2018 Figure 18: DSL and FTTH connections, Algeria, 2009– 2018 Figure 19: Mobile handset connections and share of contract connections, Egypt, 2009– 2018 Figure 20: Mobile voice retail revenue and Mo. U, Egypt, 2009– 2018 Figure 21: Fixed voice connections, Egypt, 2009– 2018 Figure 22: DSL and fibre connections, Egypt, 2009– 2018 Figure 23: Mobile handset and mobile broadband connections, Israel, 2009– 2018 Figure 24: Mobile data revenue and share of total mobile service revenue, Israel, 2009– 2018 Figure 25: Fixed voice connections and revenue, Israel, 2009– 2018 Figure 26: DSL, cable and FTTH/B connections, Israel, 2009– 2018 Figure 27: Mobile broadband connections, Morocco, 2009– 2018 © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 4 List of figures Figure 1: Retail revenue by service type, Middle East and North Africa, 2009– 2018 Figure 13: Fixed and mobile connections, Middle East and North Africa, 2009 – 2018 Figure 2: Growth rates of retail revenue by individual service types, Middle East and North Africa, 2009– 2018 Figure 3: Fixed and mobile voice connections, Middle East and North Africa, 2009– 2018 Figure 4: Broadband access connections by technology, Middle East and North Africa, 2009– 2018 Figure 5: Broadband connections by type, Middle East and North Africa, 2011– 2018 Figure 6: Smartphones as a percentage of mobile handsets, Middle East and North Africa, 2009– 2018 Figure 7: Prepaid and contract handset connections, Middle East and North Africa, 2009– 2018 Figure 8: Fixed penetration by service type, Middle East and North Africa, 2009– 2018 Figure 9: Fixed retail revenue by service type, Middle East and North Africa, 2009– 2018 Figure 10: M 2 M connections by country, Middle East and North Africa 2012– 2018 Figure 11: IPTV connections and revenue, Morocco, Saudi Arabia and UAE 2012– 2018 Figure 12: Fixed and mobile retail revenue, Middle East and North Africa, 2009– 2018 Figure 14: 4 G’s share of mobile handset and mobile broadband connections, Middle East and North Africa, 2009– 2018 Figure 15: Mobile connections and share of prepaid connections, Algeria, 2009– 2018 Figure 16: Share of 2 G and 3 G of total mobile active connections, Algeria, 2012– 2018 Figure 17: Fixed voice connections and fixed Mo. U, Algeria, 2009– 2018 Figure 18: DSL and FTTH connections, Algeria, 2009– 2018 Figure 19: Mobile handset connections and share of contract connections, Egypt, 2009– 2018 Figure 20: Mobile voice retail revenue and Mo. U, Egypt, 2009– 2018 Figure 21: Fixed voice connections, Egypt, 2009– 2018 Figure 22: DSL and fibre connections, Egypt, 2009– 2018 Figure 23: Mobile handset and mobile broadband connections, Israel, 2009– 2018 Figure 24: Mobile data revenue and share of total mobile service revenue, Israel, 2009– 2018 Figure 25: Fixed voice connections and revenue, Israel, 2009– 2018 Figure 26: DSL, cable and FTTH/B connections, Israel, 2009– 2018 Figure 27: Mobile broadband connections, Morocco, 2009– 2018 © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update List of figures Figure 28: Mobile handset content and data revenue, and MOU, Morocco, 2009– 2018 Figure 29: Fixed voice connections and revenue, Morocco, 2009– 2018 Figure 30: Fixed broadband connections and revenue, Morocco, 2009– 2018 Figure 31: Mobile handset connections, and smartphones’ share of connections, Saudi Arabia, 2009– 2018 Figure 32: 4 G mobile broadband connections, Saudi Arabia, 2009– 2018 Figure 33: Fixed voice connections and revenue, Saudi Arabia, 2009– 2018 Figure 34: Fixed broadband connections and revenue, Saudi Arabia, 2009– 2018 Figure 35: Active mobile connections and population penetration, UAE, 2009 – 2018 Figure 36: Smartphones’ share of handsets and 4 G’s share of mobile connections, Canada, 2009– 2018 Figure 37: Fixed voice connections and revenue, UAE, 2009– 2018 Figure 38: DSL’s and FTTH’s share of broadband connections, and broadband revenue, UAE, 2009– 2018 © Analysys Mason Limited 2013 5

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update List of figures Figure 28: Mobile handset content and data revenue, and MOU, Morocco, 2009– 2018 Figure 29: Fixed voice connections and revenue, Morocco, 2009– 2018 Figure 30: Fixed broadband connections and revenue, Morocco, 2009– 2018 Figure 31: Mobile handset connections, and smartphones’ share of connections, Saudi Arabia, 2009– 2018 Figure 32: 4 G mobile broadband connections, Saudi Arabia, 2009– 2018 Figure 33: Fixed voice connections and revenue, Saudi Arabia, 2009– 2018 Figure 34: Fixed broadband connections and revenue, Saudi Arabia, 2009– 2018 Figure 35: Active mobile connections and population penetration, UAE, 2009 – 2018 Figure 36: Smartphones’ share of handsets and 4 G’s share of mobile connections, Canada, 2009– 2018 Figure 37: Fixed voice connections and revenue, UAE, 2009– 2018 Figure 38: DSL’s and FTTH’s share of broadband connections, and broadband revenue, UAE, 2009– 2018 © Analysys Mason Limited 2013 5

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 6

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 6

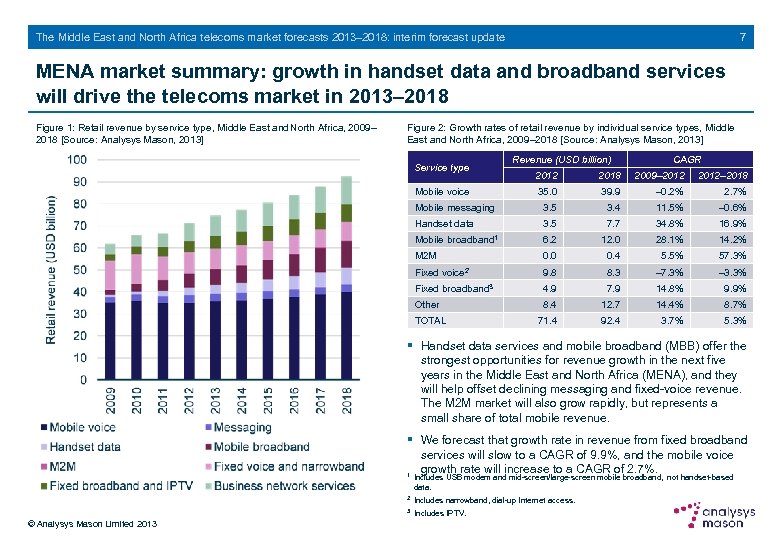

7 The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update MENA market summary: growth in handset data and broadband services will drive the telecoms market in 2013– 2018 Figure 1: Retail revenue by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Figure 2: Growth rates of retail revenue by individual service types, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Service type Revenue (USD billion) CAGR 2012 2018 2009– 2012– 2018 35. 0 39. 9 – 0. 2% 2. 7% Mobile messaging 3. 5 3. 4 11. 5% – 0. 6% Handset data 3. 5 7. 7 34. 8% 16. 9% Mobile broadband 1 6. 2 12. 0 28. 1% 14. 2% M 2 M 0. 0 0. 4 5. 5% 57. 3% Fixed voice 2 9. 8 8. 3 – 7. 3% – 3. 3% Fixed broadband 3 4. 9 7. 9 14. 8% 9. 9% Other 8. 4 12. 7 14. 4% 8. 7% 71. 4 92. 4 3. 7% 5. 3% Mobile voice TOTAL § Handset data services and mobile broadband (MBB) offer the strongest opportunities for revenue growth in the next five years in the Middle East and North Africa (MENA), and they will help offset declining messaging and fixed-voice revenue. The M 2 M market will also grow rapidly, but represents a small share of total mobile revenue. § We forecast that growth rate in revenue from fixed broadband services will slow to a CAGR of 9. 9%, and the mobile voice growth rate will increase to a CAGR of 2. 7%. 1 Includes USB modem and mid-screen/large-screen mobile broadband, not handset-based data. 2 Includes narrowband, dial-up Internet access. 3 Includes IPTV. © Analysys Mason Limited 2013

7 The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update MENA market summary: growth in handset data and broadband services will drive the telecoms market in 2013– 2018 Figure 1: Retail revenue by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Figure 2: Growth rates of retail revenue by individual service types, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Service type Revenue (USD billion) CAGR 2012 2018 2009– 2012– 2018 35. 0 39. 9 – 0. 2% 2. 7% Mobile messaging 3. 5 3. 4 11. 5% – 0. 6% Handset data 3. 5 7. 7 34. 8% 16. 9% Mobile broadband 1 6. 2 12. 0 28. 1% 14. 2% M 2 M 0. 0 0. 4 5. 5% 57. 3% Fixed voice 2 9. 8 8. 3 – 7. 3% – 3. 3% Fixed broadband 3 4. 9 7. 9 14. 8% 9. 9% Other 8. 4 12. 7 14. 4% 8. 7% 71. 4 92. 4 3. 7% 5. 3% Mobile voice TOTAL § Handset data services and mobile broadband (MBB) offer the strongest opportunities for revenue growth in the next five years in the Middle East and North Africa (MENA), and they will help offset declining messaging and fixed-voice revenue. The M 2 M market will also grow rapidly, but represents a small share of total mobile revenue. § We forecast that growth rate in revenue from fixed broadband services will slow to a CAGR of 9. 9%, and the mobile voice growth rate will increase to a CAGR of 2. 7%. 1 Includes USB modem and mid-screen/large-screen mobile broadband, not handset-based data. 2 Includes narrowband, dial-up Internet access. 3 Includes IPTV. © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 8 About this report: we have updated and extended our five-year forecasts for MENA, reflecting the latest reported market data and trends § The purpose of this report is to: - provide an interim update of Analysys Mason’s telecoms forecasts for MENA, which were previously published in October 20121 - extend the forecast horizon from 2017 to 2018 - present and explain the main revisions, which are reflected in the associated Excel forecast data annex. § The report discusses the MENA market overall, and then the key changes specific to the six core countries, and the drivers of these. § We monitor key drivers of our forecasts in individual countries. Upward or downward revisions to our previous forecasts occurred mainly for the following reasons. - Incorporation of reported operator and regulator data for the fourth quarter of 2012. We have updated our year -end 2012 figures to reflect the latest operator and regulator data. Where relevant, we have also revised our forecasts accordingly. - Changes to historical data because of newly available information and restated data, including from operators’ and regulators’ reports. § § - Market developments. Some market drivers were stronger or weaker than previously anticipated. § § Smartphone adoption exceeded our previous expectations for 2012 in Israel, Saudi Arabia and UAE. Continued growth in the take-up of smartphones and tablets caused mobile revenue to shift from voice to data more quickly than we previously forecast. 1 Available at www. analysysmason. com/MENA 2012. © Analysys Mason Limited 2013 § § In Algeria, the regulator made data available on the fixed voice market, including minutes of use (Mo. U), which helped revise the share of fixed-wireless lines and voice traffic. Data of mobile connections for 2011 has also been revised. We have now excluded payphones from the historical figures for fixed telephony market in Morocco. We have reviewed our forecast accordingly. We revised our historical figures for mobile subscribers in Egypt because new data became available from Mobinil. We revised estimated historical figures for two mobile operators in Israel: HOT Mobile and Partner (Orange) as new data on subscribers became available, and this resulted in a review of the forecasts for mobile connections.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 8 About this report: we have updated and extended our five-year forecasts for MENA, reflecting the latest reported market data and trends § The purpose of this report is to: - provide an interim update of Analysys Mason’s telecoms forecasts for MENA, which were previously published in October 20121 - extend the forecast horizon from 2017 to 2018 - present and explain the main revisions, which are reflected in the associated Excel forecast data annex. § The report discusses the MENA market overall, and then the key changes specific to the six core countries, and the drivers of these. § We monitor key drivers of our forecasts in individual countries. Upward or downward revisions to our previous forecasts occurred mainly for the following reasons. - Incorporation of reported operator and regulator data for the fourth quarter of 2012. We have updated our year -end 2012 figures to reflect the latest operator and regulator data. Where relevant, we have also revised our forecasts accordingly. - Changes to historical data because of newly available information and restated data, including from operators’ and regulators’ reports. § § - Market developments. Some market drivers were stronger or weaker than previously anticipated. § § Smartphone adoption exceeded our previous expectations for 2012 in Israel, Saudi Arabia and UAE. Continued growth in the take-up of smartphones and tablets caused mobile revenue to shift from voice to data more quickly than we previously forecast. 1 Available at www. analysysmason. com/MENA 2012. © Analysys Mason Limited 2013 § § In Algeria, the regulator made data available on the fixed voice market, including minutes of use (Mo. U), which helped revise the share of fixed-wireless lines and voice traffic. Data of mobile connections for 2011 has also been revised. We have now excluded payphones from the historical figures for fixed telephony market in Morocco. We have reviewed our forecast accordingly. We revised our historical figures for mobile subscribers in Egypt because new data became available from Mobinil. We revised estimated historical figures for two mobile operators in Israel: HOT Mobile and Partner (Orange) as new data on subscribers became available, and this resulted in a review of the forecasts for mobile connections.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 9 Key forecast changes [1]: IPTV and M 2 M added; strong growth of mobile handset connections in Egypt; downward revision of 3 G in Algeria § IPTV revenue is split out from broadband revenue in all countries § Broadband revenue now refers to data-only revenue, whereas IPTV shows revenue uplift attributed to the IPTV services part of a broadband service (a triple-play service, for example). This affects historical figures for broadband revenue in Morocco, Saudi Arabia and the UAE. § M 2 M is split out from handset connections in countries where M 2 M was launched. We expect strong growth in moredeveloped countries § Algeria, Egypt and Israel are believed to be among a few countries that have launched M 2 M. We have reviewed the historical figures forecast to account for M 2 M connections. § Further delay in 3 G auctions in Algeria because of ongoing dispute over Djezzy § We have pushed forward the forecast for 3 G connections because of further delays to the start of the auction process, which is believed to be linked to the ongoing dispute between Djezzy and the Algerian government over its acquisition. We have downgraded our outlook for 3 G connections to 15 million connections by 2018, compared with 16. 3 million previously expected. § We forecast that 1. 2% of MENA mobile connections will be M 2 M by the end of 2018, while M 2 M revenue will only represent only 0. 7% of mobile retail revenue. Growth will be strongest in Israel, Saudi Arabia and the UAE. § Mobile growth was stronger than expected in Egypt in 2012 § Mobile handset penetration was higher than anticipated in 2012, driven by more-aggressive acquisition strategies by the operators. We forecast the number of mobile handset connections will reach 111 million by the end of 2018, compared with 102 million previously estimated. § New fibre plans were announced, but we believe adoption will be slow § A number of real estate complex development projects with FTTH were announced in 2012 in the Cairo area, so our forecast for FTTx was brought forward to show faster growth in 2012 than previously forecast. However, we still believe that this service will be confined to the most affluent proportion of the population, and estimate that by 2018, fibre will represent 8. 8% of total fixed broadband connections in Egypt. © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 9 Key forecast changes [1]: IPTV and M 2 M added; strong growth of mobile handset connections in Egypt; downward revision of 3 G in Algeria § IPTV revenue is split out from broadband revenue in all countries § Broadband revenue now refers to data-only revenue, whereas IPTV shows revenue uplift attributed to the IPTV services part of a broadband service (a triple-play service, for example). This affects historical figures for broadband revenue in Morocco, Saudi Arabia and the UAE. § M 2 M is split out from handset connections in countries where M 2 M was launched. We expect strong growth in moredeveloped countries § Algeria, Egypt and Israel are believed to be among a few countries that have launched M 2 M. We have reviewed the historical figures forecast to account for M 2 M connections. § Further delay in 3 G auctions in Algeria because of ongoing dispute over Djezzy § We have pushed forward the forecast for 3 G connections because of further delays to the start of the auction process, which is believed to be linked to the ongoing dispute between Djezzy and the Algerian government over its acquisition. We have downgraded our outlook for 3 G connections to 15 million connections by 2018, compared with 16. 3 million previously expected. § We forecast that 1. 2% of MENA mobile connections will be M 2 M by the end of 2018, while M 2 M revenue will only represent only 0. 7% of mobile retail revenue. Growth will be strongest in Israel, Saudi Arabia and the UAE. § Mobile growth was stronger than expected in Egypt in 2012 § Mobile handset penetration was higher than anticipated in 2012, driven by more-aggressive acquisition strategies by the operators. We forecast the number of mobile handset connections will reach 111 million by the end of 2018, compared with 102 million previously estimated. § New fibre plans were announced, but we believe adoption will be slow § A number of real estate complex development projects with FTTH were announced in 2012 in the Cairo area, so our forecast for FTTx was brought forward to show faster growth in 2012 than previously forecast. However, we still believe that this service will be confined to the most affluent proportion of the population, and estimate that by 2018, fibre will represent 8. 8% of total fixed broadband connections in Egypt. © Analysys Mason Limited 2013

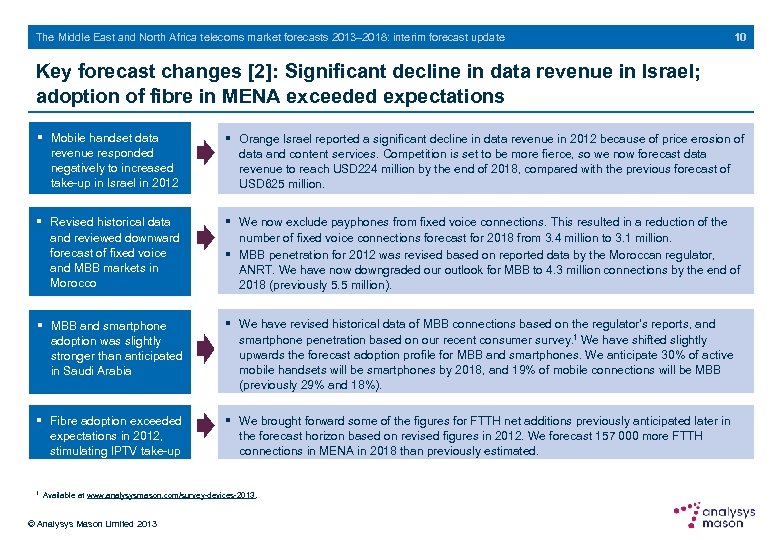

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 10 Key forecast changes [2]: Significant decline in data revenue in Israel; adoption of fibre in MENA exceeded expectations § Mobile handset data revenue responded negatively to increased take-up in Israel in 2012 § Orange Israel reported a significant decline in data revenue in 2012 because of price erosion of data and content services. Competition is set to be more fierce, so we now forecast data revenue to reach USD 224 million by the end of 2018, compared with the previous forecast of USD 625 million. § Revised historical data and reviewed downward forecast of fixed voice and MBB markets in Morocco § We now exclude payphones from fixed voice connections. This resulted in a reduction of the number of fixed voice connections forecast for 2018 from 3. 4 million to 3. 1 million. § MBB penetration for 2012 was revised based on reported data by the Moroccan regulator, ANRT. We have now downgraded our outlook for MBB to 4. 3 million connections by the end of 2018 (previously 5. 5 million). § MBB and smartphone adoption was slightly stronger than anticipated in Saudi Arabia § We have revised historical data of MBB connections based on the regulator’s reports, and smartphone penetration based on our recent consumer survey. 1 We have shifted slightly upwards the forecast adoption profile for MBB and smartphones. We anticipate 30% of active mobile handsets will be smartphones by 2018, and 19% of mobile connections will be MBB (previously 29% and 18%). § Fibre adoption exceeded expectations in 2012, stimulating IPTV take-up § We brought forward some of the figures for FTTH net additions previously anticipated later in the forecast horizon based on revised figures in 2012. We forecast 157 000 more FTTH connections in MENA in 2018 than previously estimated. 1 Available at www. analysysmason. com/survey-devices-2013. © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 10 Key forecast changes [2]: Significant decline in data revenue in Israel; adoption of fibre in MENA exceeded expectations § Mobile handset data revenue responded negatively to increased take-up in Israel in 2012 § Orange Israel reported a significant decline in data revenue in 2012 because of price erosion of data and content services. Competition is set to be more fierce, so we now forecast data revenue to reach USD 224 million by the end of 2018, compared with the previous forecast of USD 625 million. § Revised historical data and reviewed downward forecast of fixed voice and MBB markets in Morocco § We now exclude payphones from fixed voice connections. This resulted in a reduction of the number of fixed voice connections forecast for 2018 from 3. 4 million to 3. 1 million. § MBB penetration for 2012 was revised based on reported data by the Moroccan regulator, ANRT. We have now downgraded our outlook for MBB to 4. 3 million connections by the end of 2018 (previously 5. 5 million). § MBB and smartphone adoption was slightly stronger than anticipated in Saudi Arabia § We have revised historical data of MBB connections based on the regulator’s reports, and smartphone penetration based on our recent consumer survey. 1 We have shifted slightly upwards the forecast adoption profile for MBB and smartphones. We anticipate 30% of active mobile handsets will be smartphones by 2018, and 19% of mobile connections will be MBB (previously 29% and 18%). § Fibre adoption exceeded expectations in 2012, stimulating IPTV take-up § We brought forward some of the figures for FTTH net additions previously anticipated later in the forecast horizon based on revised figures in 2012. We forecast 157 000 more FTTH connections in MENA in 2018 than previously estimated. 1 Available at www. analysysmason. com/survey-devices-2013. © Analysys Mason Limited 2013

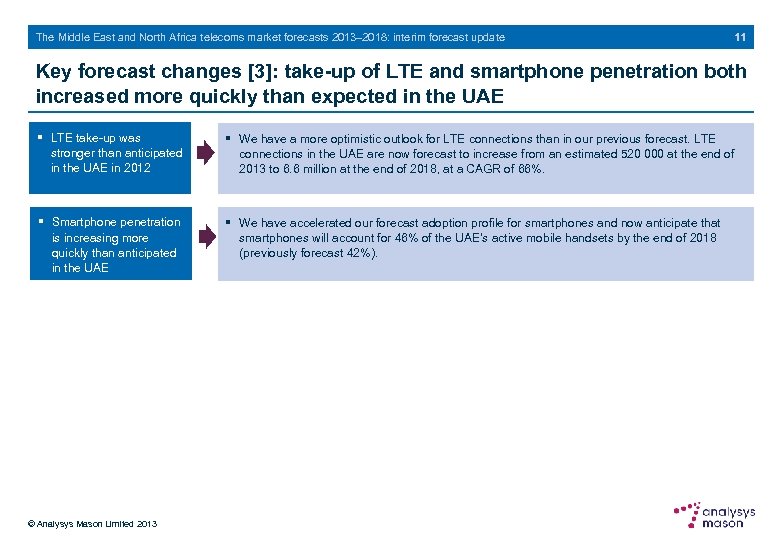

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 11 Key forecast changes [3]: take-up of LTE and smartphone penetration both increased more quickly than expected in the UAE § LTE take-up was stronger than anticipated in the UAE in 2012 § We have a more optimistic outlook for LTE connections than in our previous forecast. LTE connections in the UAE are now forecast to increase from an estimated 520 000 at the end of 2013 to 6. 6 million at the end of 2018, at a CAGR of 66%. § Smartphone penetration is increasing more quickly than anticipated in the UAE § We have accelerated our forecast adoption profile for smartphones and now anticipate that smartphones will account for 46% of the UAE’s active mobile handsets by the end of 2018 (previously forecast 42%). © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 11 Key forecast changes [3]: take-up of LTE and smartphone penetration both increased more quickly than expected in the UAE § LTE take-up was stronger than anticipated in the UAE in 2012 § We have a more optimistic outlook for LTE connections than in our previous forecast. LTE connections in the UAE are now forecast to increase from an estimated 520 000 at the end of 2013 to 6. 6 million at the end of 2018, at a CAGR of 66%. § Smartphone penetration is increasing more quickly than anticipated in the UAE § We have accelerated our forecast adoption profile for smartphones and now anticipate that smartphones will account for 46% of the UAE’s active mobile handsets by the end of 2018 (previously forecast 42%). © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 12

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 12

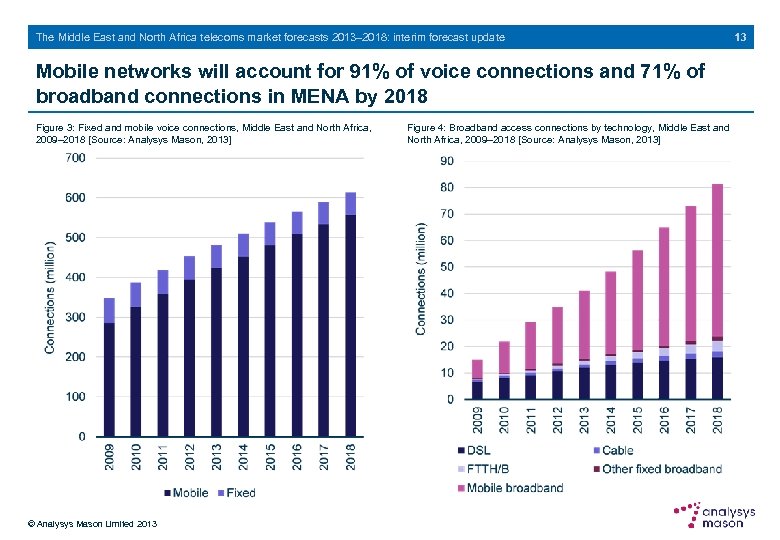

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Mobile networks will account for 91% of voice connections and 71% of broadband connections in MENA by 2018 Figure 3: Fixed and mobile voice connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013 Figure 4: Broadband access connections by technology, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] 13

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Mobile networks will account for 91% of voice connections and 71% of broadband connections in MENA by 2018 Figure 3: Fixed and mobile voice connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013 Figure 4: Broadband access connections by technology, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] 13

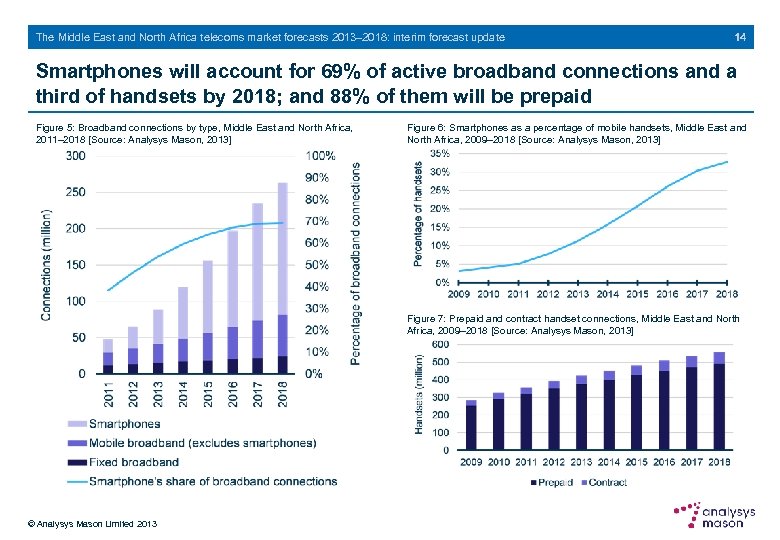

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 14 Smartphones will account for 69% of active broadband connections and a third of handsets by 2018; and 88% of them will be prepaid Figure 5: Broadband connections by type, Middle East and North Africa, 2011– 2018 [Source: Analysys Mason, 2013] Figure 6: Smartphones as a percentage of mobile handsets, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Figure 7: Prepaid and contract handset connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 14 Smartphones will account for 69% of active broadband connections and a third of handsets by 2018; and 88% of them will be prepaid Figure 5: Broadband connections by type, Middle East and North Africa, 2011– 2018 [Source: Analysys Mason, 2013] Figure 6: Smartphones as a percentage of mobile handsets, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] Figure 7: Prepaid and contract handset connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013

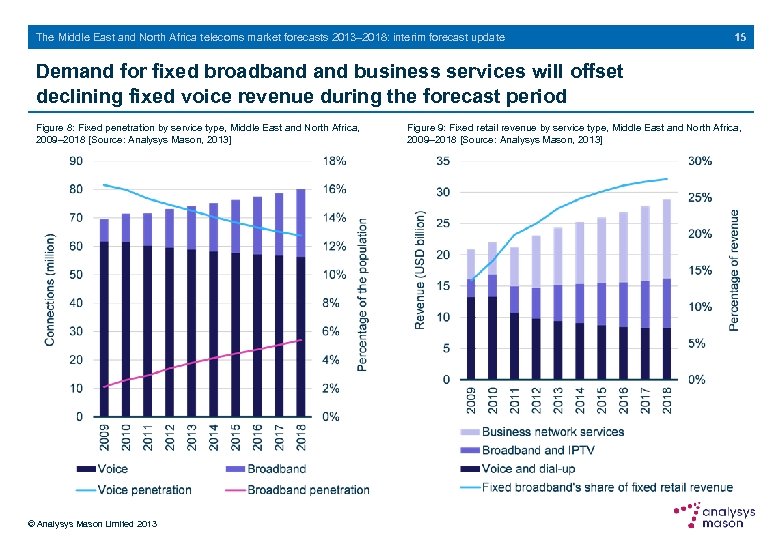

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 15 Demand for fixed broadband business services will offset declining fixed voice revenue during the forecast period Figure 8: Fixed penetration by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013 Figure 9: Fixed retail revenue by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 15 Demand for fixed broadband business services will offset declining fixed voice revenue during the forecast period Figure 8: Fixed penetration by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] © Analysys Mason Limited 2013 Figure 9: Fixed retail revenue by service type, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013]

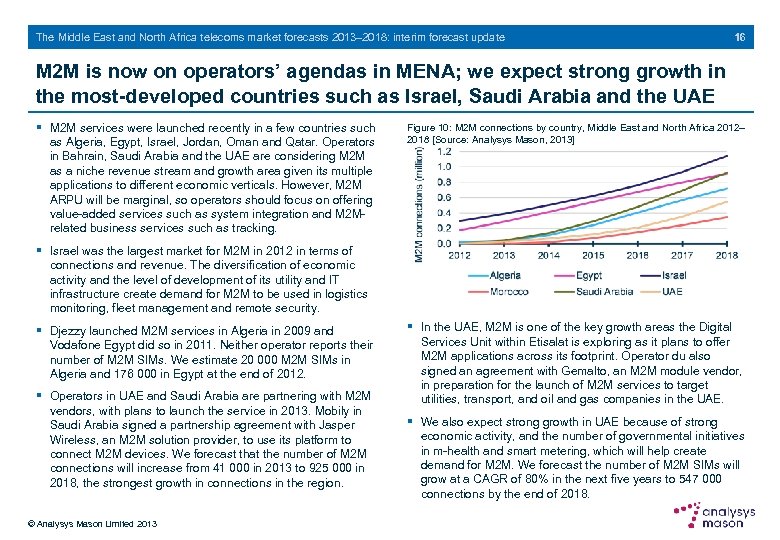

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 16 M 2 M is now on operators’ agendas in MENA; we expect strong growth in the most-developed countries such as Israel, Saudi Arabia and the UAE § M 2 M services were launched recently in a few countries such as Algeria, Egypt, Israel, Jordan, Oman and Qatar. Operators in Bahrain, Saudi Arabia and the UAE are considering M 2 M as a niche revenue stream and growth area given its multiple applications to different economic verticals. However, M 2 M ARPU will be marginal, so operators should focus on offering value-added services such as system integration and M 2 Mrelated business services such as tracking. Figure 10: M 2 M connections by country, Middle East and North Africa 2012– 2018 [Source: Analysys Mason, 2013] § Israel was the largest market for M 2 M in 2012 in terms of connections and revenue. The diversification of economic activity and the level of development of its utility and IT infrastructure create demand for M 2 M to be used in logistics monitoring, fleet management and remote security. § Djezzy launched M 2 M services in Algeria in 2009 and Vodafone Egypt did so in 2011. Neither operator reports their number of M 2 M SIMs. We estimate 20 000 M 2 M SIMs in Algeria and 176 000 in Egypt at the end of 2012. § Operators in UAE and Saudi Arabia are partnering with M 2 M vendors, with plans to launch the service in 2013. Mobily in Saudi Arabia signed a partnership agreement with Jasper Wireless, an M 2 M solution provider, to use its platform to connect M 2 M devices. We forecast that the number of M 2 M connections will increase from 41 000 in 2013 to 925 000 in 2018, the strongest growth in connections in the region. © Analysys Mason Limited 2013 § In the UAE, M 2 M is one of the key growth areas the Digital Services Unit within Etisalat is exploring as it plans to offer M 2 M applications across its footprint. Operator du also signed an agreement with Gemalto, an M 2 M module vendor, in preparation for the launch of M 2 M services to target utilities, transport, and oil and gas companies in the UAE. § We also expect strong growth in UAE because of strong economic activity, and the number of governmental initiatives in m-health and smart metering, which will help create demand for M 2 M. We forecast the number of M 2 M SIMs will grow at a CAGR of 80% in the next five years to 547 000 connections by the end of 2018.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 16 M 2 M is now on operators’ agendas in MENA; we expect strong growth in the most-developed countries such as Israel, Saudi Arabia and the UAE § M 2 M services were launched recently in a few countries such as Algeria, Egypt, Israel, Jordan, Oman and Qatar. Operators in Bahrain, Saudi Arabia and the UAE are considering M 2 M as a niche revenue stream and growth area given its multiple applications to different economic verticals. However, M 2 M ARPU will be marginal, so operators should focus on offering value-added services such as system integration and M 2 Mrelated business services such as tracking. Figure 10: M 2 M connections by country, Middle East and North Africa 2012– 2018 [Source: Analysys Mason, 2013] § Israel was the largest market for M 2 M in 2012 in terms of connections and revenue. The diversification of economic activity and the level of development of its utility and IT infrastructure create demand for M 2 M to be used in logistics monitoring, fleet management and remote security. § Djezzy launched M 2 M services in Algeria in 2009 and Vodafone Egypt did so in 2011. Neither operator reports their number of M 2 M SIMs. We estimate 20 000 M 2 M SIMs in Algeria and 176 000 in Egypt at the end of 2012. § Operators in UAE and Saudi Arabia are partnering with M 2 M vendors, with plans to launch the service in 2013. Mobily in Saudi Arabia signed a partnership agreement with Jasper Wireless, an M 2 M solution provider, to use its platform to connect M 2 M devices. We forecast that the number of M 2 M connections will increase from 41 000 in 2013 to 925 000 in 2018, the strongest growth in connections in the region. © Analysys Mason Limited 2013 § In the UAE, M 2 M is one of the key growth areas the Digital Services Unit within Etisalat is exploring as it plans to offer M 2 M applications across its footprint. Operator du also signed an agreement with Gemalto, an M 2 M module vendor, in preparation for the launch of M 2 M services to target utilities, transport, and oil and gas companies in the UAE. § We also expect strong growth in UAE because of strong economic activity, and the number of governmental initiatives in m-health and smart metering, which will help create demand for M 2 M. We forecast the number of M 2 M SIMs will grow at a CAGR of 80% in the next five years to 547 000 connections by the end of 2018.

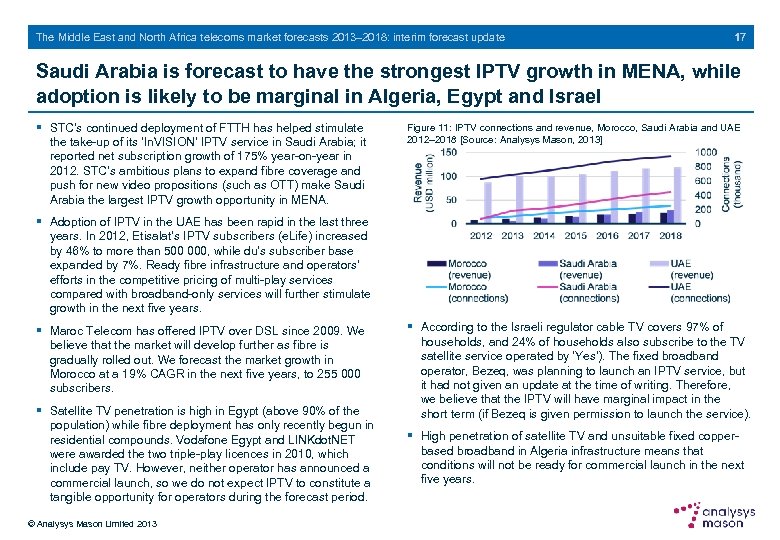

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 17 Saudi Arabia is forecast to have the strongest IPTV growth in MENA, while adoption is likely to be marginal in Algeria, Egypt and Israel § STC’s continued deployment of FTTH has helped stimulate the take-up of its ‘In. VISION’ IPTV service in Saudi Arabia; it reported net subscription growth of 175% year-on-year in 2012. STC’s ambitious plans to expand fibre coverage and push for new video propositions (such as OTT) make Saudi Arabia the largest IPTV growth opportunity in MENA. Figure 11: IPTV connections and revenue, Morocco, Saudi Arabia and UAE 2012– 2018 [Source: Analysys Mason, 2013] § Adoption of IPTV in the UAE has been rapid in the last three years. In 2012, Etisalat’s IPTV subscribers (e. Life) increased by 46% to more than 500 000, while du’s subscriber base expanded by 7%. Ready fibre infrastructure and operators’ efforts in the competitive pricing of multi-play services compared with broadband-only services will further stimulate growth in the next five years. § Maroc Telecom has offered IPTV over DSL since 2009. We believe that the market will develop further as fibre is gradually rolled out. We forecast the market growth in Morocco at a 19% CAGR in the next five years, to 255 000 subscribers. § Satellite TV penetration is high in Egypt (above 90% of the population) while fibre deployment has only recently begun in residential compounds. Vodafone Egypt and LINKdot. NET were awarded the two triple-play licences in 2010, which include pay TV. However, neither operator has announced a commercial launch, so we do not expect IPTV to constitute a tangible opportunity for operators during the forecast period. © Analysys Mason Limited 2013 § According to the Israeli regulator cable TV covers 97% of households, and 24% of households also subscribe to the TV satellite service operated by ‘Yes’). The fixed broadband operator, Bezeq, was planning to launch an IPTV service, but it had not given an update at the time of writing. Therefore, we believe that the IPTV will have marginal impact in the short term (if Bezeq is given permission to launch the service). § High penetration of satellite TV and unsuitable fixed copperbased broadband in Algeria infrastructure means that conditions will not be ready for commercial launch in the next five years.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 17 Saudi Arabia is forecast to have the strongest IPTV growth in MENA, while adoption is likely to be marginal in Algeria, Egypt and Israel § STC’s continued deployment of FTTH has helped stimulate the take-up of its ‘In. VISION’ IPTV service in Saudi Arabia; it reported net subscription growth of 175% year-on-year in 2012. STC’s ambitious plans to expand fibre coverage and push for new video propositions (such as OTT) make Saudi Arabia the largest IPTV growth opportunity in MENA. Figure 11: IPTV connections and revenue, Morocco, Saudi Arabia and UAE 2012– 2018 [Source: Analysys Mason, 2013] § Adoption of IPTV in the UAE has been rapid in the last three years. In 2012, Etisalat’s IPTV subscribers (e. Life) increased by 46% to more than 500 000, while du’s subscriber base expanded by 7%. Ready fibre infrastructure and operators’ efforts in the competitive pricing of multi-play services compared with broadband-only services will further stimulate growth in the next five years. § Maroc Telecom has offered IPTV over DSL since 2009. We believe that the market will develop further as fibre is gradually rolled out. We forecast the market growth in Morocco at a 19% CAGR in the next five years, to 255 000 subscribers. § Satellite TV penetration is high in Egypt (above 90% of the population) while fibre deployment has only recently begun in residential compounds. Vodafone Egypt and LINKdot. NET were awarded the two triple-play licences in 2010, which include pay TV. However, neither operator has announced a commercial launch, so we do not expect IPTV to constitute a tangible opportunity for operators during the forecast period. © Analysys Mason Limited 2013 § According to the Israeli regulator cable TV covers 97% of households, and 24% of households also subscribe to the TV satellite service operated by ‘Yes’). The fixed broadband operator, Bezeq, was planning to launch an IPTV service, but it had not given an update at the time of writing. Therefore, we believe that the IPTV will have marginal impact in the short term (if Bezeq is given permission to launch the service). § High penetration of satellite TV and unsuitable fixed copperbased broadband in Algeria infrastructure means that conditions will not be ready for commercial launch in the next five years.

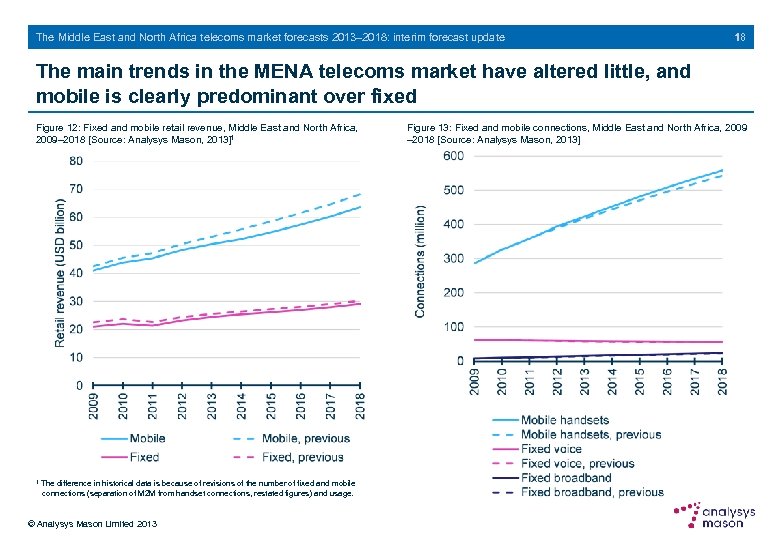

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 18 The main trends in the MENA telecoms market have altered little, and mobile is clearly predominant over fixed Figure 12: Fixed and mobile retail revenue, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013]1 1 The difference in historical data is because of revisions of the number of fixed and mobile connections (separation of M 2 M from handset connections, restated figures) and usage. © Analysys Mason Limited 2013 Figure 13: Fixed and mobile connections, Middle East and North Africa, 2009 – 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 18 The main trends in the MENA telecoms market have altered little, and mobile is clearly predominant over fixed Figure 12: Fixed and mobile retail revenue, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013]1 1 The difference in historical data is because of revisions of the number of fixed and mobile connections (separation of M 2 M from handset connections, restated figures) and usage. © Analysys Mason Limited 2013 Figure 13: Fixed and mobile connections, Middle East and North Africa, 2009 – 2018 [Source: Analysys Mason, 2013]

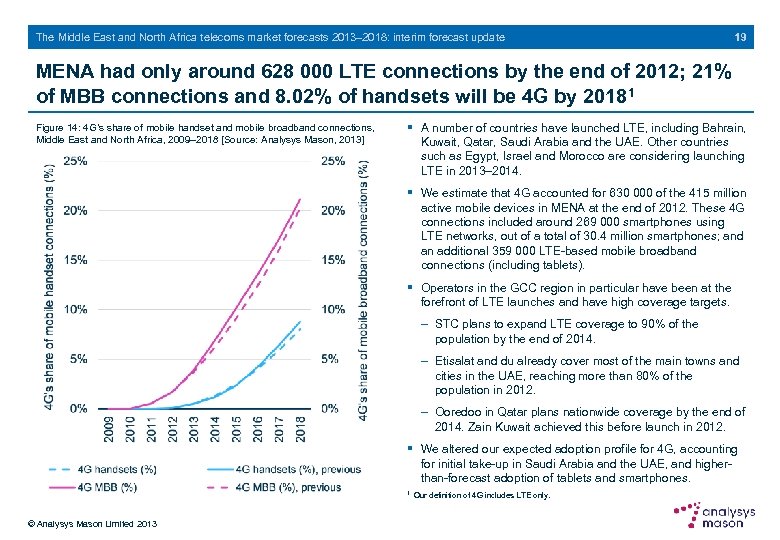

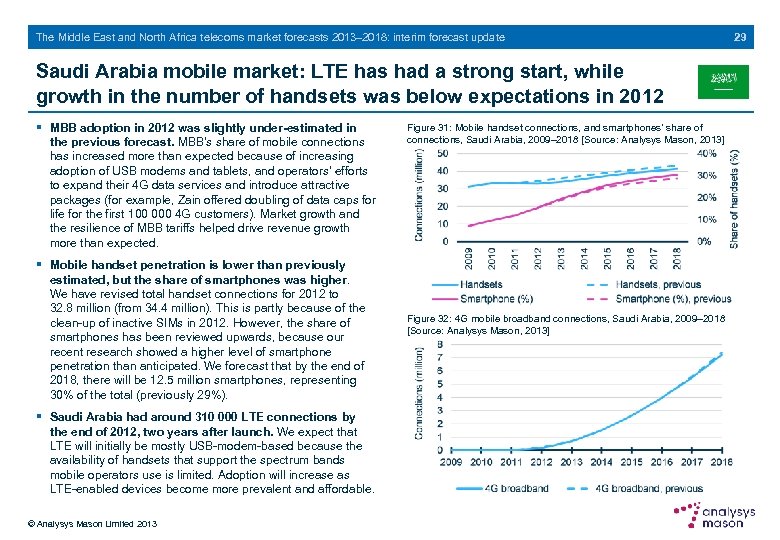

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 19 MENA had only around 628 000 LTE connections by the end of 2012; 21% of MBB connections and 8. 02% of handsets will be 4 G by 2018 1 Figure 14: 4 G’s share of mobile handset and mobile broadband connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] § A number of countries have launched LTE, including Bahrain, Kuwait, Qatar, Saudi Arabia and the UAE. Other countries such as Egypt, Israel and Morocco are considering launching LTE in 2013– 2014. § We estimate that 4 G accounted for 630 000 of the 415 million active mobile devices in MENA at the end of 2012. These 4 G connections included around 269 000 smartphones using LTE networks, out of a total of 30. 4 million smartphones; and an additional 359 000 LTE-based mobile broadband connections (including tablets). § Operators in the GCC region in particular have been at the forefront of LTE launches and have high coverage targets. - STC plans to expand LTE coverage to 90% of the population by the end of 2014. - Etisalat and du already cover most of the main towns and cities in the UAE, reaching more than 80% of the population in 2012. - Ooredoo in Qatar plans nationwide coverage by the end of 2014. Zain Kuwait achieved this before launch in 2012. § We altered our expected adoption profile for 4 G, accounting for initial take-up in Saudi Arabia and the UAE, and higherthan-forecast adoption of tablets and smartphones. 1 © Analysys Mason Limited 2013 Our definition of 4 G includes LTE only.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 19 MENA had only around 628 000 LTE connections by the end of 2012; 21% of MBB connections and 8. 02% of handsets will be 4 G by 2018 1 Figure 14: 4 G’s share of mobile handset and mobile broadband connections, Middle East and North Africa, 2009– 2018 [Source: Analysys Mason, 2013] § A number of countries have launched LTE, including Bahrain, Kuwait, Qatar, Saudi Arabia and the UAE. Other countries such as Egypt, Israel and Morocco are considering launching LTE in 2013– 2014. § We estimate that 4 G accounted for 630 000 of the 415 million active mobile devices in MENA at the end of 2012. These 4 G connections included around 269 000 smartphones using LTE networks, out of a total of 30. 4 million smartphones; and an additional 359 000 LTE-based mobile broadband connections (including tablets). § Operators in the GCC region in particular have been at the forefront of LTE launches and have high coverage targets. - STC plans to expand LTE coverage to 90% of the population by the end of 2014. - Etisalat and du already cover most of the main towns and cities in the UAE, reaching more than 80% of the population in 2012. - Ooredoo in Qatar plans nationwide coverage by the end of 2014. Zain Kuwait achieved this before launch in 2012. § We altered our expected adoption profile for 4 G, accounting for initial take-up in Saudi Arabia and the UAE, and higherthan-forecast adoption of tablets and smartphones. 1 © Analysys Mason Limited 2013 Our definition of 4 G includes LTE only.

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 20

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Executive summary Regional overview Country-level analysis About the author and Analysys Mason © Analysys Mason Limited 2013 20

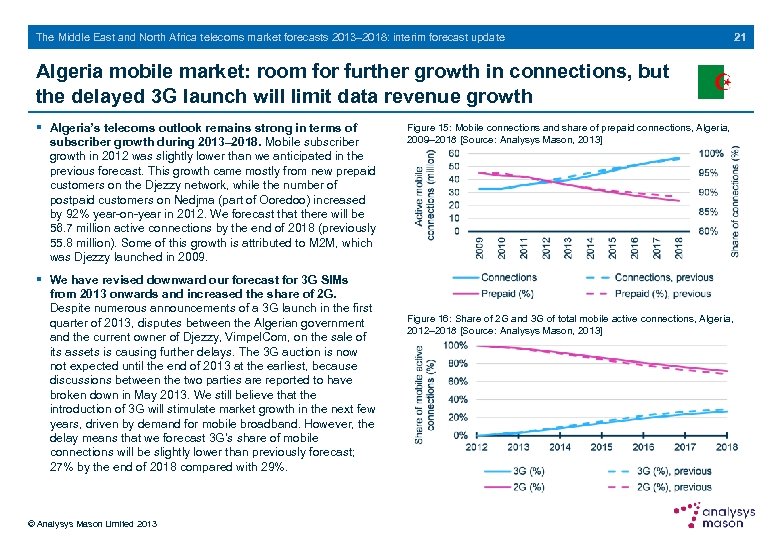

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 21 Algeria mobile market: room for further growth in connections, but the delayed 3 G launch will limit data revenue growth § Algeria’s telecoms outlook remains strong in terms of subscriber growth during 2013– 2018. Mobile subscriber growth in 2012 was slightly lower than we anticipated in the previous forecast. This growth came mostly from new prepaid customers on the Djezzy network, while the number of postpaid customers on Nedjma (part of Ooredoo) increased by 92% year-on-year in 2012. We forecast that there will be 56. 7 million active connections by the end of 2018 (previously 55. 8 million). Some of this growth is attributed to M 2 M, which was Djezzy launched in 2009. § We have revised downward our forecast for 3 G SIMs from 2013 onwards and increased the share of 2 G. Despite numerous announcements of a 3 G launch in the first quarter of 2013, disputes between the Algerian government and the current owner of Djezzy, Vimpel. Com, on the sale of its assets is causing further delays. The 3 G auction is now not expected until the end of 2013 at the earliest, because discussions between the two parties are reported to have broken down in May 2013. We still believe that the introduction of 3 G will stimulate market growth in the next few years, driven by demand for mobile broadband. However, the delay means that we forecast 3 G’s share of mobile connections will be slightly lower than previously forecast; 27% by the end of 2018 compared with 29%. © Analysys Mason Limited 2013 Figure 15: Mobile connections and share of prepaid connections, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] Figure 16: Share of 2 G and 3 G of total mobile active connections, Algeria, 2012– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 21 Algeria mobile market: room for further growth in connections, but the delayed 3 G launch will limit data revenue growth § Algeria’s telecoms outlook remains strong in terms of subscriber growth during 2013– 2018. Mobile subscriber growth in 2012 was slightly lower than we anticipated in the previous forecast. This growth came mostly from new prepaid customers on the Djezzy network, while the number of postpaid customers on Nedjma (part of Ooredoo) increased by 92% year-on-year in 2012. We forecast that there will be 56. 7 million active connections by the end of 2018 (previously 55. 8 million). Some of this growth is attributed to M 2 M, which was Djezzy launched in 2009. § We have revised downward our forecast for 3 G SIMs from 2013 onwards and increased the share of 2 G. Despite numerous announcements of a 3 G launch in the first quarter of 2013, disputes between the Algerian government and the current owner of Djezzy, Vimpel. Com, on the sale of its assets is causing further delays. The 3 G auction is now not expected until the end of 2013 at the earliest, because discussions between the two parties are reported to have broken down in May 2013. We still believe that the introduction of 3 G will stimulate market growth in the next few years, driven by demand for mobile broadband. However, the delay means that we forecast 3 G’s share of mobile connections will be slightly lower than previously forecast; 27% by the end of 2018 compared with 29%. © Analysys Mason Limited 2013 Figure 15: Mobile connections and share of prepaid connections, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] Figure 16: Share of 2 G and 3 G of total mobile active connections, Algeria, 2012– 2018 [Source: Analysys Mason, 2013]

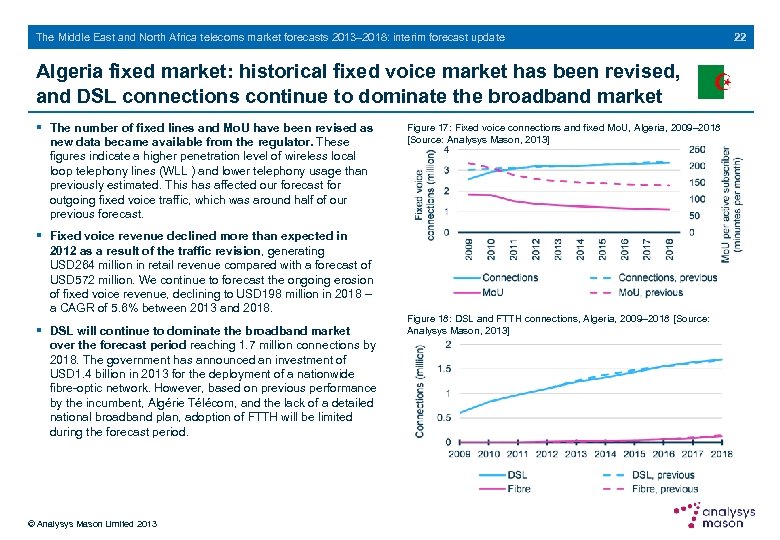

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Algeria fixed market: historical fixed voice market has been revised, and DSL connections continue to dominate the broadband market § The number of fixed lines and Mo. U have been revised as new data became available from the regulator. These figures indicate a higher penetration level of wireless local loop telephony lines (WLL ) and lower telephony usage than previously estimated. This has affected our forecast for outgoing fixed voice traffic, which was around half of our previous forecast. § Fixed voice revenue declined more than expected in 2012 as a result of the traffic revision, generating USD 264 million in retail revenue compared with a forecast of USD 572 million. We continue to forecast the ongoing erosion of fixed voice revenue, declining to USD 198 million in 2018 – a CAGR of 5. 6% between 2013 and 2018. § DSL will continue to dominate the broadband market over the forecast period reaching 1. 7 million connections by 2018. The government has announced an investment of USD 1. 4 billion in 2013 for the deployment of a nationwide fibre-optic network. However, based on previous performance by the incumbent, Algérie Télécom, and the lack of a detailed national broadband plan, adoption of FTTH will be limited during the forecast period. © Analysys Mason Limited 2013 Figure 17: Fixed voice connections and fixed Mo. U, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] Figure 18: DSL and FTTH connections, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] 22

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update Algeria fixed market: historical fixed voice market has been revised, and DSL connections continue to dominate the broadband market § The number of fixed lines and Mo. U have been revised as new data became available from the regulator. These figures indicate a higher penetration level of wireless local loop telephony lines (WLL ) and lower telephony usage than previously estimated. This has affected our forecast for outgoing fixed voice traffic, which was around half of our previous forecast. § Fixed voice revenue declined more than expected in 2012 as a result of the traffic revision, generating USD 264 million in retail revenue compared with a forecast of USD 572 million. We continue to forecast the ongoing erosion of fixed voice revenue, declining to USD 198 million in 2018 – a CAGR of 5. 6% between 2013 and 2018. § DSL will continue to dominate the broadband market over the forecast period reaching 1. 7 million connections by 2018. The government has announced an investment of USD 1. 4 billion in 2013 for the deployment of a nationwide fibre-optic network. However, based on previous performance by the incumbent, Algérie Télécom, and the lack of a detailed national broadband plan, adoption of FTTH will be limited during the forecast period. © Analysys Mason Limited 2013 Figure 17: Fixed voice connections and fixed Mo. U, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] Figure 18: DSL and FTTH connections, Algeria, 2009– 2018 [Source: Analysys Mason, 2013] 22

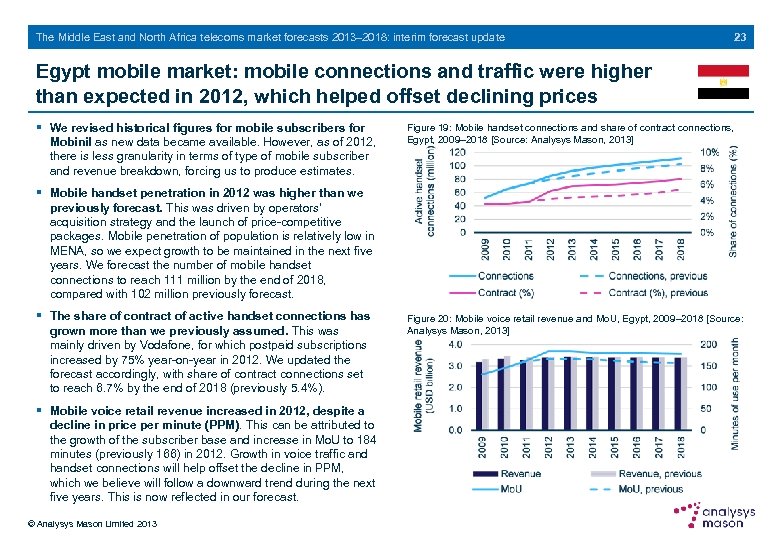

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 23 Egypt mobile market: mobile connections and traffic were higher than expected in 2012, which helped offset declining prices § We revised historical figures for mobile subscribers for Mobinil as new data became available. However, as of 2012, there is less granularity in terms of type of mobile subscriber and revenue breakdown, forcing us to produce estimates. Figure 19: Mobile handset connections and share of contract connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013] § Mobile handset penetration in 2012 was higher than we previously forecast. This was driven by operators’ acquisition strategy and the launch of price-competitive packages. Mobile penetration of population is relatively low in MENA, so we expect growth to be maintained in the next five years. We forecast the number of mobile handset connections to reach 111 million by the end of 2018, compared with 102 million previously forecast. § The share of contract of active handset connections has grown more than we previously assumed. This was mainly driven by Vodafone, for which postpaid subscriptions increased by 75% year-on-year in 2012. We updated the forecast accordingly, with share of contract connections set to reach 6. 7% by the end of 2018 (previously 5. 4%). § Mobile voice retail revenue increased in 2012, despite a decline in price per minute (PPM). This can be attributed to the growth of the subscriber base and increase in Mo. U to 184 minutes (previously 166) in 2012. Growth in voice traffic and handset connections will help offset the decline in PPM, which we believe will follow a downward trend during the next five years. This is now reflected in our forecast. © Analysys Mason Limited 2013 Figure 20: Mobile voice retail revenue and Mo. U, Egypt, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 23 Egypt mobile market: mobile connections and traffic were higher than expected in 2012, which helped offset declining prices § We revised historical figures for mobile subscribers for Mobinil as new data became available. However, as of 2012, there is less granularity in terms of type of mobile subscriber and revenue breakdown, forcing us to produce estimates. Figure 19: Mobile handset connections and share of contract connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013] § Mobile handset penetration in 2012 was higher than we previously forecast. This was driven by operators’ acquisition strategy and the launch of price-competitive packages. Mobile penetration of population is relatively low in MENA, so we expect growth to be maintained in the next five years. We forecast the number of mobile handset connections to reach 111 million by the end of 2018, compared with 102 million previously forecast. § The share of contract of active handset connections has grown more than we previously assumed. This was mainly driven by Vodafone, for which postpaid subscriptions increased by 75% year-on-year in 2012. We updated the forecast accordingly, with share of contract connections set to reach 6. 7% by the end of 2018 (previously 5. 4%). § Mobile voice retail revenue increased in 2012, despite a decline in price per minute (PPM). This can be attributed to the growth of the subscriber base and increase in Mo. U to 184 minutes (previously 166) in 2012. Growth in voice traffic and handset connections will help offset the decline in PPM, which we believe will follow a downward trend during the next five years. This is now reflected in our forecast. © Analysys Mason Limited 2013 Figure 20: Mobile voice retail revenue and Mo. U, Egypt, 2009– 2018 [Source: Analysys Mason, 2013]

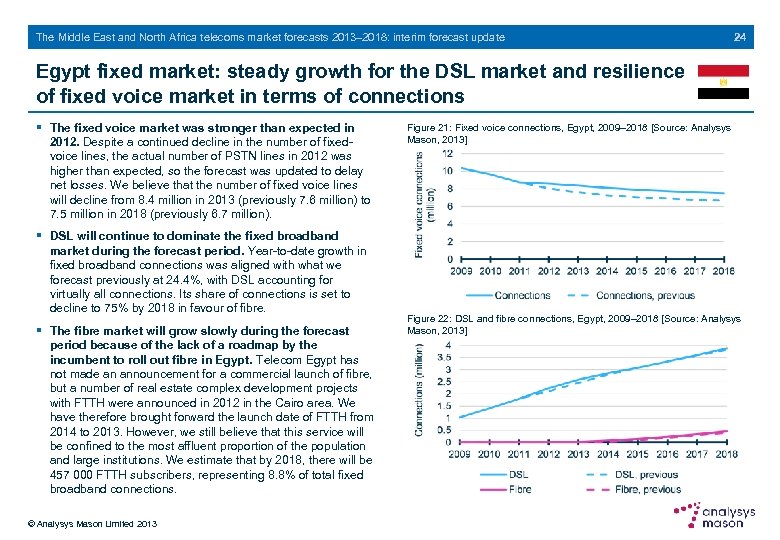

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 24 Egypt fixed market: steady growth for the DSL market and resilience of fixed voice market in terms of connections § The fixed voice market was stronger than expected in 2012. Despite a continued decline in the number of fixedvoice lines, the actual number of PSTN lines in 2012 was higher than expected, so the forecast was updated to delay net losses. We believe that the number of fixed voice lines will decline from 8. 4 million in 2013 (previously 7. 6 million) to 7. 5 million in 2018 (previously 6. 7 million). § DSL will continue to dominate the fixed broadband market during the forecast period. Year-to-date growth in fixed broadband connections was aligned with what we forecast previously at 24. 4%, with DSL accounting for virtually all connections. Its share of connections is set to decline to 75% by 2018 in favour of fibre. § The fibre market will grow slowly during the forecast period because of the lack of a roadmap by the incumbent to roll out fibre in Egypt. Telecom Egypt has not made an announcement for a commercial launch of fibre, but a number of real estate complex development projects with FTTH were announced in 2012 in the Cairo area. We have therefore brought forward the launch date of FTTH from 2014 to 2013. However, we still believe that this service will be confined to the most affluent proportion of the population and large institutions. We estimate that by 2018, there will be 457 000 FTTH subscribers, representing 8. 8% of total fixed broadband connections. © Analysys Mason Limited 2013 Figure 21: Fixed voice connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013] Figure 22: DSL and fibre connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 24 Egypt fixed market: steady growth for the DSL market and resilience of fixed voice market in terms of connections § The fixed voice market was stronger than expected in 2012. Despite a continued decline in the number of fixedvoice lines, the actual number of PSTN lines in 2012 was higher than expected, so the forecast was updated to delay net losses. We believe that the number of fixed voice lines will decline from 8. 4 million in 2013 (previously 7. 6 million) to 7. 5 million in 2018 (previously 6. 7 million). § DSL will continue to dominate the fixed broadband market during the forecast period. Year-to-date growth in fixed broadband connections was aligned with what we forecast previously at 24. 4%, with DSL accounting for virtually all connections. Its share of connections is set to decline to 75% by 2018 in favour of fibre. § The fibre market will grow slowly during the forecast period because of the lack of a roadmap by the incumbent to roll out fibre in Egypt. Telecom Egypt has not made an announcement for a commercial launch of fibre, but a number of real estate complex development projects with FTTH were announced in 2012 in the Cairo area. We have therefore brought forward the launch date of FTTH from 2014 to 2013. However, we still believe that this service will be confined to the most affluent proportion of the population and large institutions. We estimate that by 2018, there will be 457 000 FTTH subscribers, representing 8. 8% of total fixed broadband connections. © Analysys Mason Limited 2013 Figure 21: Fixed voice connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013] Figure 22: DSL and fibre connections, Egypt, 2009– 2018 [Source: Analysys Mason, 2013]

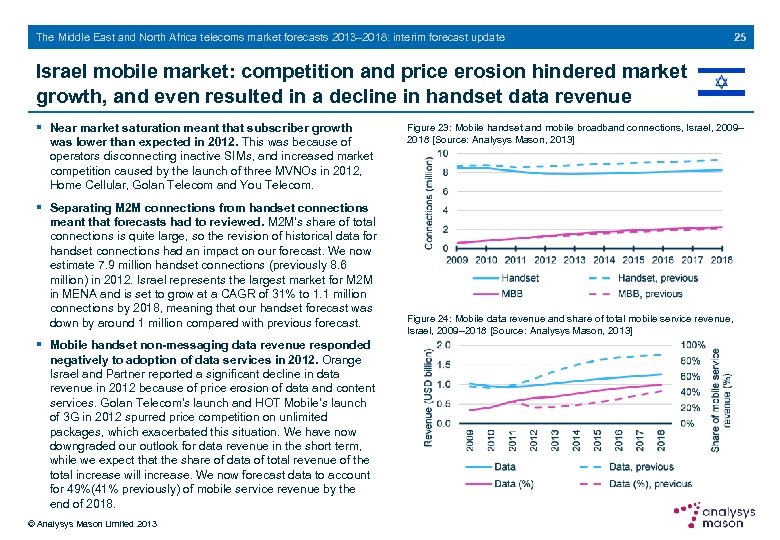

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 25 Israel mobile market: competition and price erosion hindered market growth, and even resulted in a decline in handset data revenue § Near market saturation meant that subscriber growth was lower than expected in 2012. This was because of operators disconnecting inactive SIMs, and increased market competition caused by the launch of three MVNOs in 2012, Home Cellular, Golan Telecom and You Telecom. § Separating M 2 M connections from handset connections meant that forecasts had to reviewed. M 2 M’s share of total connections is quite large, so the revision of historical data for handset connections had an impact on our forecast. We now estimate 7. 9 million handset connections (previously 8. 6 million) in 2012. Israel represents the largest market for M 2 M in MENA and is set to grow at a CAGR of 31% to 1. 1 million connections by 2018, meaning that our handset forecast was down by around 1 million compared with previous forecast. § Mobile handset non-messaging data revenue responded negatively to adoption of data services in 2012. Orange Israel and Partner reported a significant decline in data revenue in 2012 because of price erosion of data and content services. Golan Telecom’s launch and HOT Mobile’s launch of 3 G in 2012 spurred price competition on unlimited packages, which exacerbated this situation. We have now downgraded our outlook for data revenue in the short term, while we expect that the share of data of total revenue of the total increase will increase. We now forecast data to account for 49%(41% previously) of mobile service revenue by the end of 2018. © Analysys Mason Limited 2013 Figure 23: Mobile handset and mobile broadband connections, Israel, 2009– 2018 [Source: Analysys Mason, 2013] Figure 24: Mobile data revenue and share of total mobile service revenue, Israel, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 25 Israel mobile market: competition and price erosion hindered market growth, and even resulted in a decline in handset data revenue § Near market saturation meant that subscriber growth was lower than expected in 2012. This was because of operators disconnecting inactive SIMs, and increased market competition caused by the launch of three MVNOs in 2012, Home Cellular, Golan Telecom and You Telecom. § Separating M 2 M connections from handset connections meant that forecasts had to reviewed. M 2 M’s share of total connections is quite large, so the revision of historical data for handset connections had an impact on our forecast. We now estimate 7. 9 million handset connections (previously 8. 6 million) in 2012. Israel represents the largest market for M 2 M in MENA and is set to grow at a CAGR of 31% to 1. 1 million connections by 2018, meaning that our handset forecast was down by around 1 million compared with previous forecast. § Mobile handset non-messaging data revenue responded negatively to adoption of data services in 2012. Orange Israel and Partner reported a significant decline in data revenue in 2012 because of price erosion of data and content services. Golan Telecom’s launch and HOT Mobile’s launch of 3 G in 2012 spurred price competition on unlimited packages, which exacerbated this situation. We have now downgraded our outlook for data revenue in the short term, while we expect that the share of data of total revenue of the total increase will increase. We now forecast data to account for 49%(41% previously) of mobile service revenue by the end of 2018. © Analysys Mason Limited 2013 Figure 23: Mobile handset and mobile broadband connections, Israel, 2009– 2018 [Source: Analysys Mason, 2013] Figure 24: Mobile data revenue and share of total mobile service revenue, Israel, 2009– 2018 [Source: Analysys Mason, 2013]

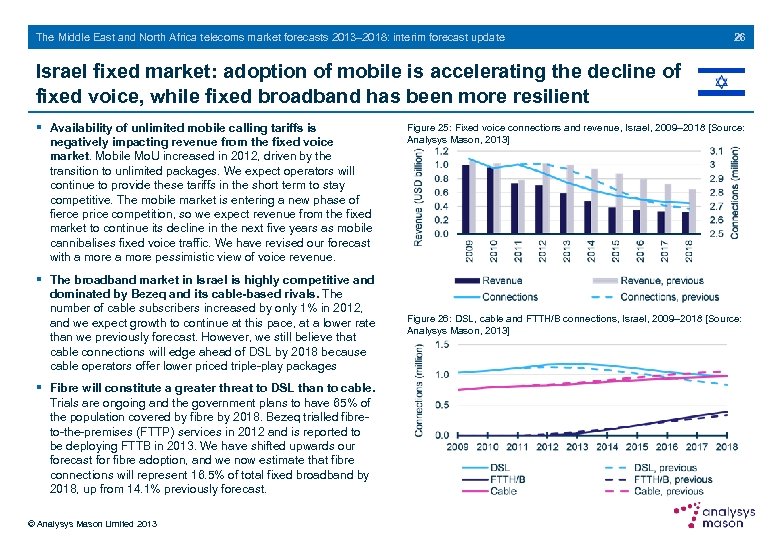

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 26 Israel fixed market: adoption of mobile is accelerating the decline of fixed voice, while fixed broadband has been more resilient § Availability of unlimited mobile calling tariffs is negatively impacting revenue from the fixed voice market. Mobile Mo. U increased in 2012, driven by the transition to unlimited packages. We expect operators will continue to provide these tariffs in the short term to stay competitive. The mobile market is entering a new phase of fierce price competition, so we expect revenue from the fixed market to continue its decline in the next five years as mobile cannibalises fixed voice traffic. We have revised our forecast with a more pessimistic view of voice revenue. § The broadband market in Israel is highly competitive and dominated by Bezeq and its cable-based rivals. The number of cable subscribers increased by only 1% in 2012, and we expect growth to continue at this pace, at a lower rate than we previously forecast. However, we still believe that cable connections will edge ahead of DSL by 2018 because cable operators offer lower priced triple-play packages § Fibre will constitute a greater threat to DSL than to cable. Trials are ongoing and the government plans to have 65% of the population covered by fibre by 2018. Bezeq trialled fibreto-the-premises (FTTP) services in 2012 and is reported to be deploying FTTB in 2013. We have shifted upwards our forecast for fibre adoption, and we now estimate that fibre connections will represent 16. 5% of total fixed broadband by 2018, up from 14. 1% previously forecast. © Analysys Mason Limited 2013 Figure 25: Fixed voice connections and revenue, Israel, 2009– 2018 [Source: Analysys Mason, 2013] Figure 26: DSL, cable and FTTH/B connections, Israel, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 26 Israel fixed market: adoption of mobile is accelerating the decline of fixed voice, while fixed broadband has been more resilient § Availability of unlimited mobile calling tariffs is negatively impacting revenue from the fixed voice market. Mobile Mo. U increased in 2012, driven by the transition to unlimited packages. We expect operators will continue to provide these tariffs in the short term to stay competitive. The mobile market is entering a new phase of fierce price competition, so we expect revenue from the fixed market to continue its decline in the next five years as mobile cannibalises fixed voice traffic. We have revised our forecast with a more pessimistic view of voice revenue. § The broadband market in Israel is highly competitive and dominated by Bezeq and its cable-based rivals. The number of cable subscribers increased by only 1% in 2012, and we expect growth to continue at this pace, at a lower rate than we previously forecast. However, we still believe that cable connections will edge ahead of DSL by 2018 because cable operators offer lower priced triple-play packages § Fibre will constitute a greater threat to DSL than to cable. Trials are ongoing and the government plans to have 65% of the population covered by fibre by 2018. Bezeq trialled fibreto-the-premises (FTTP) services in 2012 and is reported to be deploying FTTB in 2013. We have shifted upwards our forecast for fibre adoption, and we now estimate that fibre connections will represent 16. 5% of total fixed broadband by 2018, up from 14. 1% previously forecast. © Analysys Mason Limited 2013 Figure 25: Fixed voice connections and revenue, Israel, 2009– 2018 [Source: Analysys Mason, 2013] Figure 26: DSL, cable and FTTH/B connections, Israel, 2009– 2018 [Source: Analysys Mason, 2013]

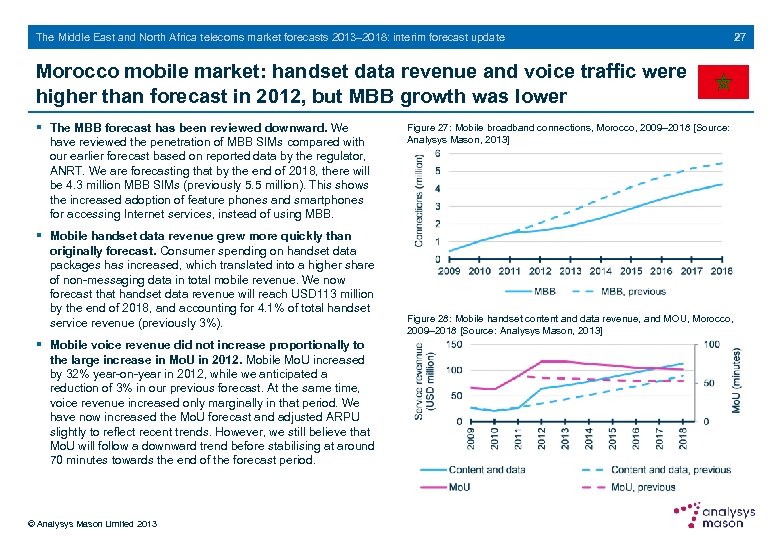

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 27 Morocco mobile market: handset data revenue and voice traffic were higher than forecast in 2012, but MBB growth was lower § The MBB forecast has been reviewed downward. We have reviewed the penetration of MBB SIMs compared with our earlier forecast based on reported data by the regulator, ANRT. We are forecasting that by the end of 2018, there will be 4. 3 million MBB SIMs (previously 5. 5 million). This shows the increased adoption of feature phones and smartphones for accessing Internet services, instead of using MBB. § Mobile handset data revenue grew more quickly than originally forecast. Consumer spending on handset data packages has increased, which translated into a higher share of non-messaging data in total mobile revenue. We now forecast that handset data revenue will reach USD 113 million by the end of 2018, and accounting for 4. 1% of total handset service revenue (previously 3%). § Mobile voice revenue did not increase proportionally to the large increase in Mo. U in 2012. Mobile Mo. U increased by 32% year-on-year in 2012, while we anticipated a reduction of 3% in our previous forecast. At the same time, voice revenue increased only marginally in that period. We have now increased the Mo. U forecast and adjusted ARPU slightly to reflect recent trends. However, we still believe that Mo. U will follow a downward trend before stabilising at around 70 minutes towards the end of the forecast period. © Analysys Mason Limited 2013 Figure 27: Mobile broadband connections, Morocco, 2009– 2018 [Source: Analysys Mason, 2013] Figure 28: Mobile handset content and data revenue, and MOU, Morocco, 2009– 2018 [Source: Analysys Mason, 2013]

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 27 Morocco mobile market: handset data revenue and voice traffic were higher than forecast in 2012, but MBB growth was lower § The MBB forecast has been reviewed downward. We have reviewed the penetration of MBB SIMs compared with our earlier forecast based on reported data by the regulator, ANRT. We are forecasting that by the end of 2018, there will be 4. 3 million MBB SIMs (previously 5. 5 million). This shows the increased adoption of feature phones and smartphones for accessing Internet services, instead of using MBB. § Mobile handset data revenue grew more quickly than originally forecast. Consumer spending on handset data packages has increased, which translated into a higher share of non-messaging data in total mobile revenue. We now forecast that handset data revenue will reach USD 113 million by the end of 2018, and accounting for 4. 1% of total handset service revenue (previously 3%). § Mobile voice revenue did not increase proportionally to the large increase in Mo. U in 2012. Mobile Mo. U increased by 32% year-on-year in 2012, while we anticipated a reduction of 3% in our previous forecast. At the same time, voice revenue increased only marginally in that period. We have now increased the Mo. U forecast and adjusted ARPU slightly to reflect recent trends. However, we still believe that Mo. U will follow a downward trend before stabilising at around 70 minutes towards the end of the forecast period. © Analysys Mason Limited 2013 Figure 27: Mobile broadband connections, Morocco, 2009– 2018 [Source: Analysys Mason, 2013] Figure 28: Mobile handset content and data revenue, and MOU, Morocco, 2009– 2018 [Source: Analysys Mason, 2013]

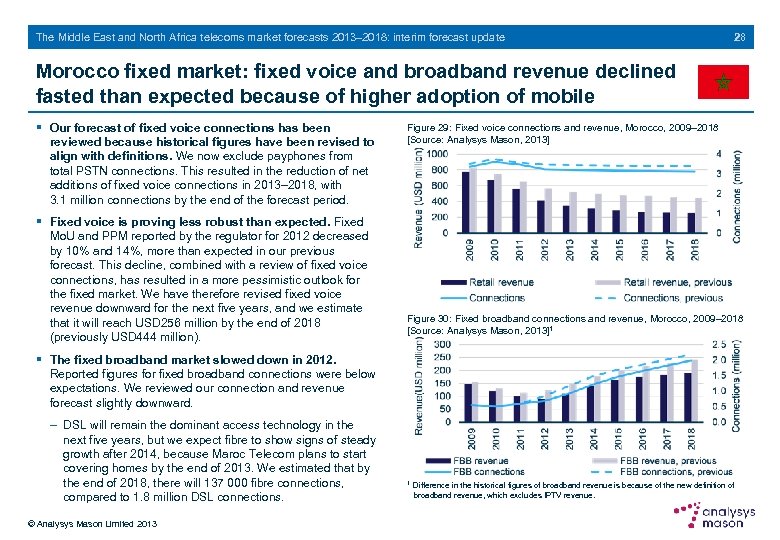

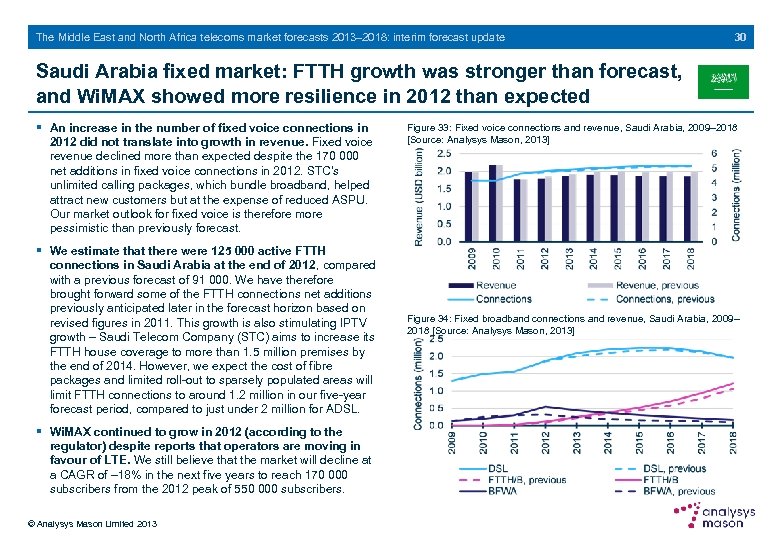

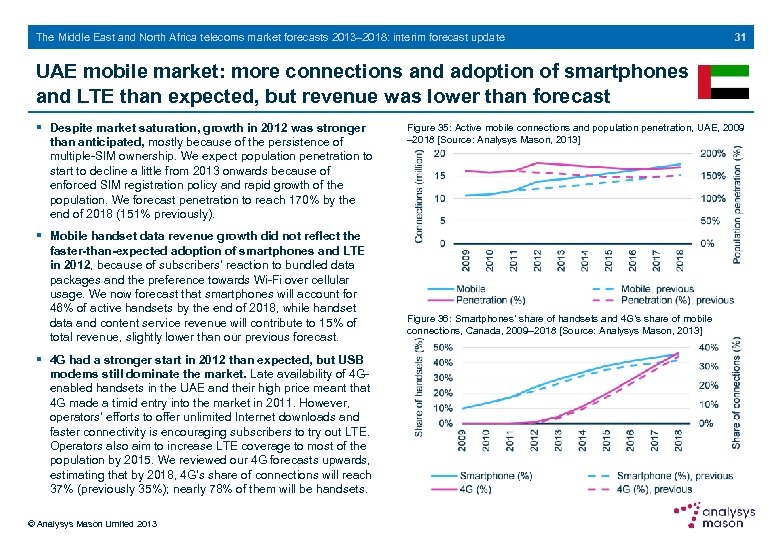

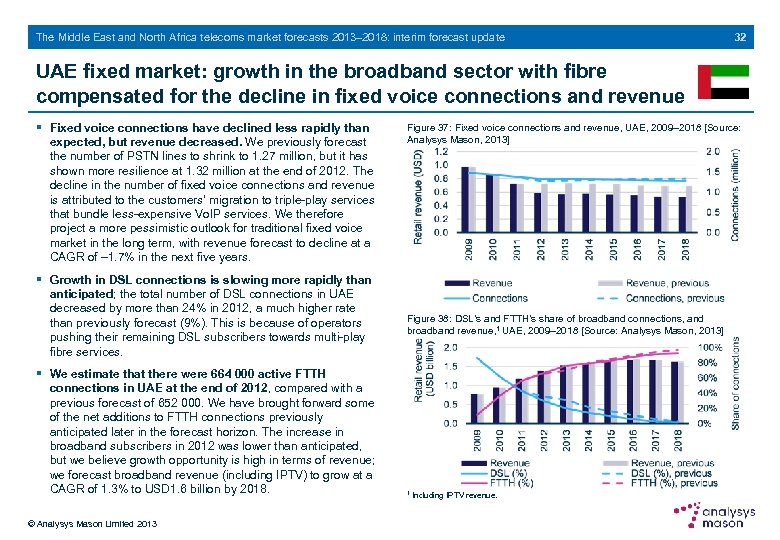

The Middle East and North Africa telecoms market forecasts 2013– 2018: interim forecast update 28 Morocco fixed market: fixed voice and broadband revenue declined fasted than expected because of higher adoption of mobile § Our forecast of fixed voice connections has been reviewed because historical figures have been revised to align with definitions. We now exclude payphones from total PSTN connections. This resulted in the reduction of net additions of fixed voice connections in 2013– 2018, with 3. 1 million connections by the end of the forecast period. § Fixed voice is proving less robust than expected. Fixed Mo. U and PPM reported by the regulator for 2012 decreased by 10% and 14%, more than expected in our previous forecast. This decline, combined with a review of fixed voice connections, has resulted in a more pessimistic outlook for the fixed market. We have therefore revised fixed voice revenue downward for the next five years, and we estimate that it will reach USD 256 million by the end of 2018 (previously USD 444 million). Figure 29: Fixed voice connections and revenue, Morocco, 2009– 2018 [Source: Analysys Mason, 2013] Figure 30: Fixed broadband connections and revenue, Morocco, 2009– 2018 [Source: Analysys Mason, 2013]1 § The fixed broadband market slowed down in 2012. Reported figures for fixed broadband connections were below expectations. We reviewed our connection and revenue forecast slightly downward. - DSL will remain the dominant access technology in the next five years, but we expect fibre to show signs of steady growth after 2014, because Maroc Telecom plans to start covering homes by the end of 2013. We estimated that by the end of 2018, there will 137 000 fibre connections, compared to 1. 8 million DSL connections. © Analysys Mason Limited 2013 1 Difference in the historical figures of broadband revenue is because of the new definition of broadband revenue, which excludes IPTV revenue.