The Michigan Fair. Tax Replaces Current 6% sales tax on goods. Michigan 4. 35% Personal Income Tax (PIT) Michigan 6% Corporate Income Tax (CIT) Business Personal Property Tax (PPT) 6 mill State Education Tax on business (SET) Sales tax on business purchases 2

The Michigan Fair. Tax Replaces Current 6% sales tax on goods. Michigan 4. 35% Personal Income Tax (PIT) Michigan 6% Corporate Income Tax (CIT) Business Personal Property Tax (PPT) 6 mill State Education Tax on business (SET) Sales tax on business purchases 2

The Michigan Fair. Tax Replaces Michigan Personal Income and Business Taxes with a 9% sales tax on new goods and services. Lowers the cost of goods and services produced in Michigan by removing the cost of business taxes that are hidden in today's prices. This improves competitiveness creating Michigan jobs. 3

The Michigan Fair. Tax Replaces Michigan Personal Income and Business Taxes with a 9% sales tax on new goods and services. Lowers the cost of goods and services produced in Michigan by removing the cost of business taxes that are hidden in today's prices. This improves competitiveness creating Michigan jobs. 3

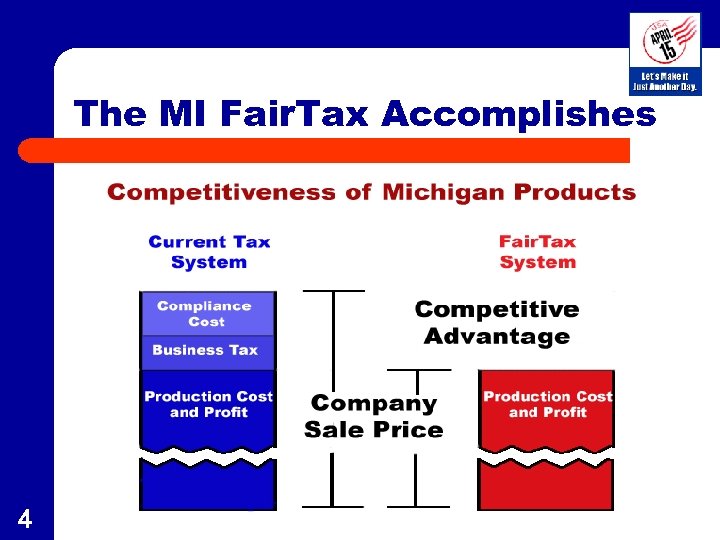

The MI Fair. Tax Accomplishes 4

The MI Fair. Tax Accomplishes 4

The Michigan Fair. Tax Base MI Fair. Tax taxes citizens directly and honestly with a visible retail sales tax MI Fair. Tax is NOT imposed on: – Business to Business sales – Non-profit organizations 5

The Michigan Fair. Tax Base MI Fair. Tax taxes citizens directly and honestly with a visible retail sales tax MI Fair. Tax is NOT imposed on: – Business to Business sales – Non-profit organizations 5

The MI Fair. Tax Accomplishes 6

The MI Fair. Tax Accomplishes 6

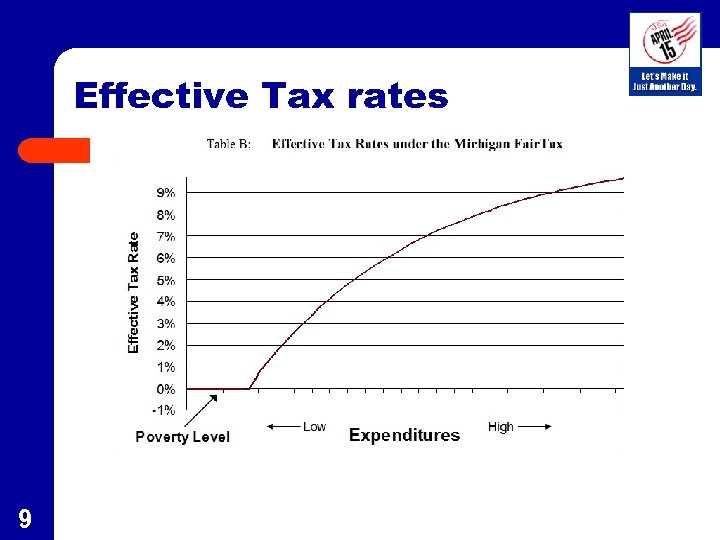

Special Provisions Prebate to all legal Michigan residents to pay tax on the necessities of life – MI Fair. Tax is Progressive --- Households at the poverty level have a zero tax rate – As spending increases the effective tax rate increases – Effective Tax Rate for the typical MI family of four is 2. 5% after prebate and untaxed items 7

Special Provisions Prebate to all legal Michigan residents to pay tax on the necessities of life – MI Fair. Tax is Progressive --- Households at the poverty level have a zero tax rate – As spending increases the effective tax rate increases – Effective Tax Rate for the typical MI family of four is 2. 5% after prebate and untaxed items 7

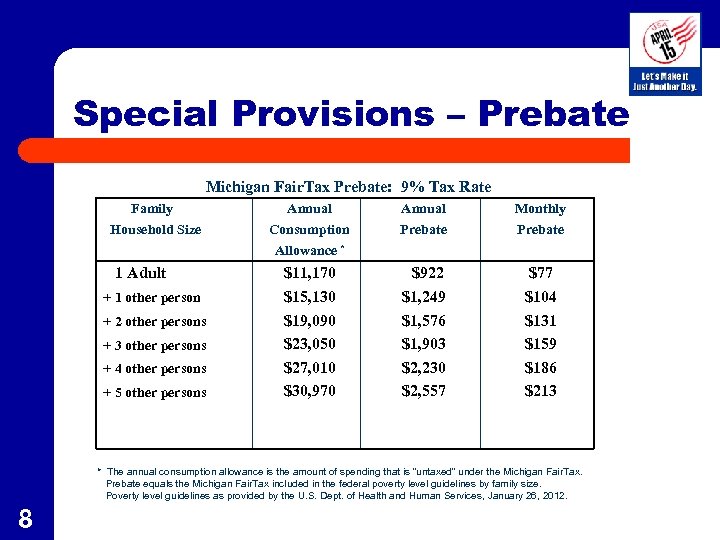

Special Provisions – Prebate Michigan Fair. Tax Prebate: 9% Tax Rate Family Annual Monthly Household Size Consumption Prebate Allowance * 1 Adult $11, 170 $15, 130 $19, 090 $23, 050 $27, 010 $30, 970 + 1 other person + 2 other persons + 3 other persons + 4 other persons + 5 other persons $922 $1, 249 $1, 576 $1, 903 $2, 230 $2, 557 $77 $104 $131 $159 $186 $213 * The annual consumption allowance is the amount of spending that is "untaxed" under the Michigan Fair. Tax. Prebate equals the Michigan Fair. Tax included in the federal poverty level guidelines by family size. Poverty level guidelines as provided by the U. S. Dept. of Health and Human Services, January 26, 2012. 8

Special Provisions – Prebate Michigan Fair. Tax Prebate: 9% Tax Rate Family Annual Monthly Household Size Consumption Prebate Allowance * 1 Adult $11, 170 $15, 130 $19, 090 $23, 050 $27, 010 $30, 970 + 1 other person + 2 other persons + 3 other persons + 4 other persons + 5 other persons $922 $1, 249 $1, 576 $1, 903 $2, 230 $2, 557 $77 $104 $131 $159 $186 $213 * The annual consumption allowance is the amount of spending that is "untaxed" under the Michigan Fair. Tax. Prebate equals the Michigan Fair. Tax included in the federal poverty level guidelines by family size. Poverty level guidelines as provided by the U. S. Dept. of Health and Human Services, January 26, 2012. 8

Effective Tax rates 9

Effective Tax rates 9

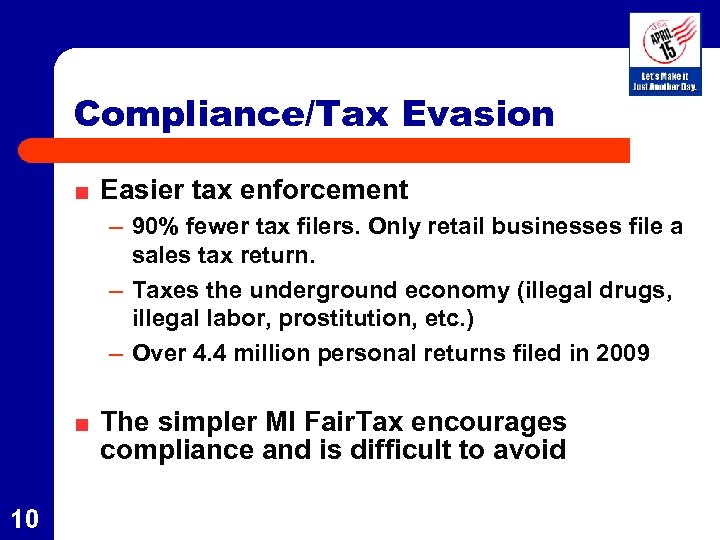

Compliance/Tax Evasion Easier tax enforcement – 90% fewer tax filers. Only retail businesses file a sales tax return. – Taxes the underground economy (illegal drugs, illegal labor, prostitution, etc. ) – Over 4. 4 million personal returns filed in 2009 The simpler MI Fair. Tax encourages compliance and is difficult to avoid 10

Compliance/Tax Evasion Easier tax enforcement – 90% fewer tax filers. Only retail businesses file a sales tax return. – Taxes the underground economy (illegal drugs, illegal labor, prostitution, etc. ) – Over 4. 4 million personal returns filed in 2009 The simpler MI Fair. Tax encourages compliance and is difficult to avoid 10

The MI Fair. Tax Accomplishes: Eliminates all tax loopholes Eliminates the buying and selling of tax favors for special interests that today corrupts our political system It makes our true tax burden visible on every sales receipt -- not hidden in the prices of the things we buy 11

The MI Fair. Tax Accomplishes: Eliminates all tax loopholes Eliminates the buying and selling of tax favors for special interests that today corrupts our political system It makes our true tax burden visible on every sales receipt -- not hidden in the prices of the things we buy 11

The MI Fair. Tax Simple Efficient Fair Promotes Business Simulates Michigan’s Economy Creates Jobs! 12

The MI Fair. Tax Simple Efficient Fair Promotes Business Simulates Michigan’s Economy Creates Jobs! 12

Fuel the message!

Fuel the message!

What do we want from you? Go to our Web Site www. mifairtax. org and download our MI Fair. Tax flyer & other info Get involved. Contact your local MI Fair. Tax Representative via the web site, and volunteer Invite a MI Fair. Tax Spokesperson to speak to a group or the media in your community Ask community leaders and friends to advocate for the MI Fair. Tax Make a Financial Contribution to the MI Fair. Tax 14

What do we want from you? Go to our Web Site www. mifairtax. org and download our MI Fair. Tax flyer & other info Get involved. Contact your local MI Fair. Tax Representative via the web site, and volunteer Invite a MI Fair. Tax Spokesperson to speak to a group or the media in your community Ask community leaders and friends to advocate for the MI Fair. Tax Make a Financial Contribution to the MI Fair. Tax 14