b8054946c54e29cc5ff9217bd8d091c2.ppt

- Количество слайдов: 17

The Market for “Lemons”: Quality Uncertainty and the Market Mechanism George A. Akerlof, (1970). Quarterly Journal of Economics, 84 (3): 488 -500 Group 1: Meredith, Barclay, Woo-je, & Kumar

The Market for “Lemons”: Quality Uncertainty and the Market Mechanism George A. Akerlof, (1970). Quarterly Journal of Economics, 84 (3): 488 -500 Group 1: Meredith, Barclay, Woo-je, & Kumar

Introduction In many markets where buyers use a market statistic to judge quality, there is an economic incentive for sellers to market poor quality products, since economic returns for good quality accrue mainly to the group (and not to the individual) Thus, there tends to be a reduction in average quality of goods and also a reduction in the size of the market

Introduction In many markets where buyers use a market statistic to judge quality, there is an economic incentive for sellers to market poor quality products, since economic returns for good quality accrue mainly to the group (and not to the individual) Thus, there tends to be a reduction in average quality of goods and also a reduction in the size of the market

The Model Akerlof (1970) uses the automobiles market (specifically the used car market) for its concreteness and ease in understanding An individual’s new car may be good or it may be a lemon (bad quality car), the individual does not know when initially purchasing the new car After a length of time, the owner has a better estimate of the quality of the car, based on firsthand experience with a particular car

The Model Akerlof (1970) uses the automobiles market (specifically the used car market) for its concreteness and ease in understanding An individual’s new car may be good or it may be a lemon (bad quality car), the individual does not know when initially purchasing the new car After a length of time, the owner has a better estimate of the quality of the car, based on firsthand experience with a particular car

The Model An asymmetry in available information has developed: the sellers have more information about the quality of a car than the buyers But good cars and bad cars must sell at the same price – since it is impossible for a buyer to tell the difference between a good car and a lemon Thus, an owner of a good car cannot receive its true economic value, and the owner is locked in The result: Most cars traded are “lemons”, and good cars may not be traded at all!

The Model An asymmetry in available information has developed: the sellers have more information about the quality of a car than the buyers But good cars and bad cars must sell at the same price – since it is impossible for a buyer to tell the difference between a good car and a lemon Thus, an owner of a good car cannot receive its true economic value, and the owner is locked in The result: Most cars traded are “lemons”, and good cars may not be traded at all!

“Gresham’s Law” Akerlof (1970) suggests that bad cars drive out lemons in much the same way that “bad money drives out good money” This is a reference to Gresham’s Law Gresham (1519 -1579) lightened or worn coins traded at same value as coins with more precious metal content Precious metal content coins saved, “bad” coins left to be traded Akerlof stresses a difference: bad cars sell at same price as good cars because of asymmetric information, yet in Gresham’s law presumably buyer and seller distinguish good from bad money

“Gresham’s Law” Akerlof (1970) suggests that bad cars drive out lemons in much the same way that “bad money drives out good money” This is a reference to Gresham’s Law Gresham (1519 -1579) lightened or worn coins traded at same value as coins with more precious metal content Precious metal content coins saved, “bad” coins left to be traded Akerlof stresses a difference: bad cars sell at same price as good cars because of asymmetric information, yet in Gresham’s law presumably buyer and seller distinguish good from bad money

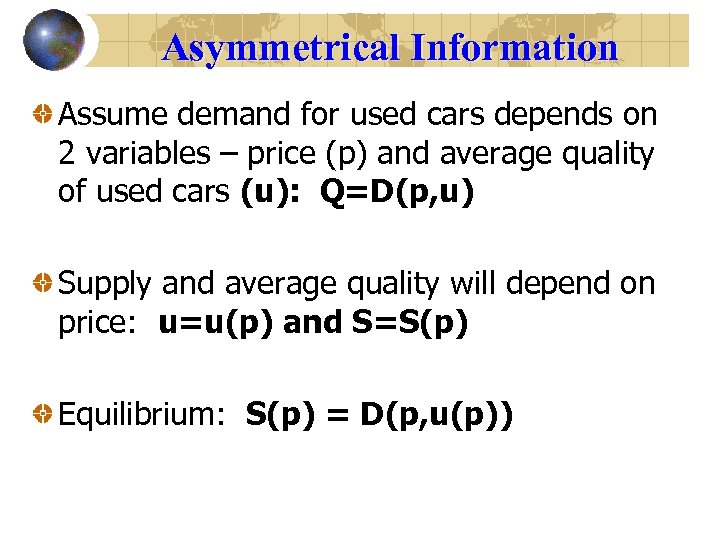

Asymmetrical Information Assume demand for used cars depends on 2 variables – price (p) and average quality of used cars (u): Q=D(p, u) Supply and average quality will depend on price: u=u(p) and S=S(p) Equilibrium: S(p) = D(p, u(p))

Asymmetrical Information Assume demand for used cars depends on 2 variables – price (p) and average quality of used cars (u): Q=D(p, u) Supply and average quality will depend on price: u=u(p) and S=S(p) Equilibrium: S(p) = D(p, u(p))

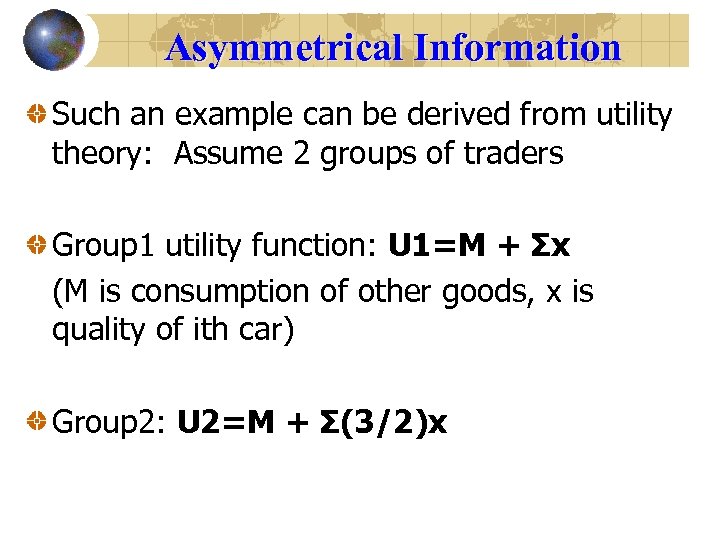

Asymmetrical Information Such an example can be derived from utility theory: Assume 2 groups of traders Group 1 utility function: U 1=M + Σx (M is consumption of other goods, x is quality of ith car) Group 2: U 2=M + Σ(3/2)x

Asymmetrical Information Such an example can be derived from utility theory: Assume 2 groups of traders Group 1 utility function: U 1=M + Σx (M is consumption of other goods, x is quality of ith car) Group 2: U 2=M + Σ(3/2)x

Asymmetrical Information Assumptions: Both traders utility maximizers Group 1 has N cars with uniformly distributed quality x, 0≤x≤ 2, Group 2 has no cars Price of M (other goods) is unity

Asymmetrical Information Assumptions: Both traders utility maximizers Group 1 has N cars with uniformly distributed quality x, 0≤x≤ 2, Group 2 has no cars Price of M (other goods) is unity

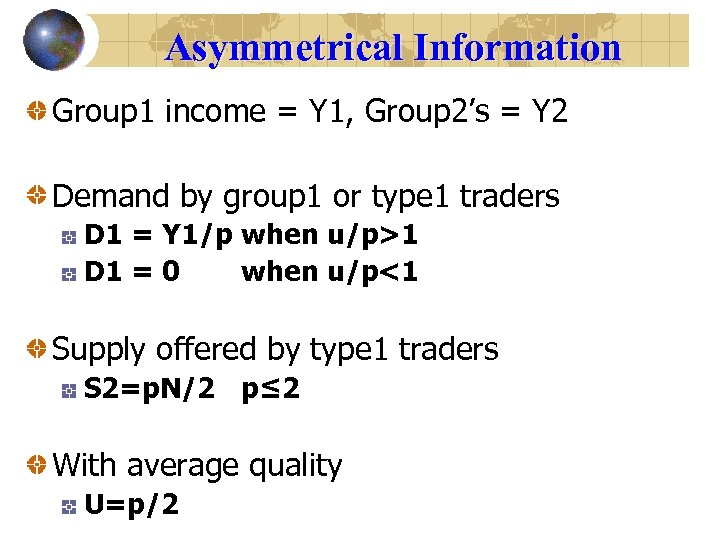

Asymmetrical Information Group 1 income = Y 1, Group 2’s = Y 2 Demand by group 1 or type 1 traders D 1 = Y 1/p when u/p>1 D 1 = 0 when u/p<1 Supply offered by type 1 traders S 2=p. N/2 p≤ 2 With average quality U=p/2

Asymmetrical Information Group 1 income = Y 1, Group 2’s = Y 2 Demand by group 1 or type 1 traders D 1 = Y 1/p when u/p>1 D 1 = 0 when u/p<1 Supply offered by type 1 traders S 2=p. N/2 p≤ 2 With average quality U=p/2

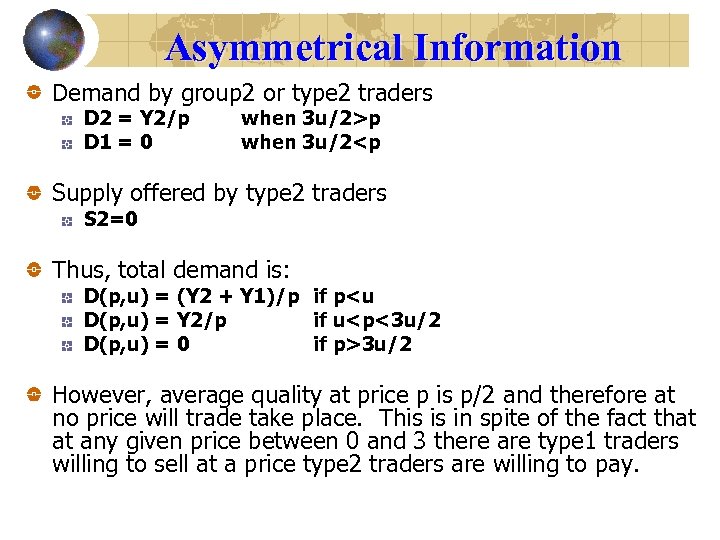

Asymmetrical Information Demand by group 2 or type 2 traders D 2 = Y 2/p D 1 = 0 when 3 u/2>p when 3 u/2

Asymmetrical Information Demand by group 2 or type 2 traders D 2 = Y 2/p D 1 = 0 when 3 u/2>p when 3 u/2

3 u/2 However, average quality at price p is p/2 and therefore at no price will trade take place. This is in spite of the fact that at any given price between 0 and 3 there are type 1 traders willing to sell at a price type 2 traders are willing to pay.

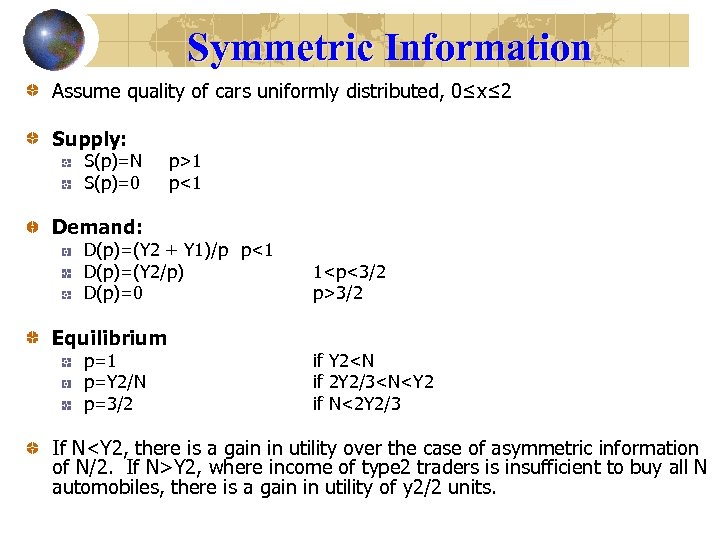

Symmetric Information Assume quality of cars uniformly distributed, 0≤x≤ 2 Supply: S(p)=N S(p)=0 p>1 p<1 Demand: D(p)=(Y 2 + Y 1)/p p<1 D(p)=(Y 2/p) D(p)=0 Equilibrium p=1 p=Y 2/N p=3/2 1

Symmetric Information Assume quality of cars uniformly distributed, 0≤x≤ 2 Supply: S(p)=N S(p)=0 p>1 p<1 Demand: D(p)=(Y 2 + Y 1)/p p<1 D(p)=(Y 2/p) D(p)=0 Equilibrium p=1 p=Y 2/N p=3/2 1

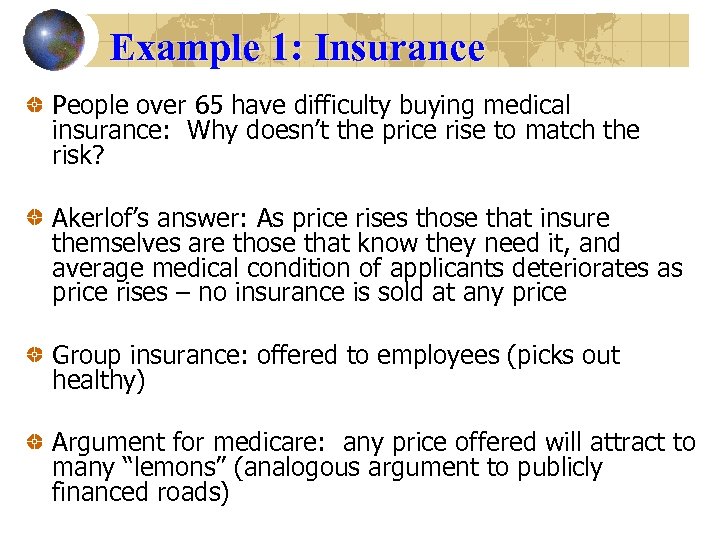

Example 1: Insurance People over 65 have difficulty buying medical insurance: Why doesn’t the price rise to match the risk? Akerlof’s answer: As price rises those that insure themselves are those that know they need it, and average medical condition of applicants deteriorates as price rises – no insurance is sold at any price Group insurance: offered to employees (picks out healthy) Argument for medicare: any price offered will attract to many “lemons” (analogous argument to publicly financed roads)

Example 1: Insurance People over 65 have difficulty buying medical insurance: Why doesn’t the price rise to match the risk? Akerlof’s answer: As price rises those that insure themselves are those that know they need it, and average medical condition of applicants deteriorates as price rises – no insurance is sold at any price Group insurance: offered to employees (picks out healthy) Argument for medicare: any price offered will attract to many “lemons” (analogous argument to publicly financed roads)

Example 2: Employment of Minorities Employers may refuse to higher minorities for certain jobs Profit maximization – race may serve as a good statistic for social background, quality of schooling, general job capabilities Good quality schooling-Substitute Credibility of school must be good Rewards for work in slum schools accrue to the group, not to individuals

Example 2: Employment of Minorities Employers may refuse to higher minorities for certain jobs Profit maximization – race may serve as a good statistic for social background, quality of schooling, general job capabilities Good quality schooling-Substitute Credibility of school must be good Rewards for work in slum schools accrue to the group, not to individuals

Example 3: Costs of Dishonesty Dishonest dealings tend to drive honest dealings out of the market (same logic as before: presence of people willing to offer inferior goods tends to drive market out of existence) Cost of dishonesty not just that purchaser is cheated, but that legitimate business is driven out of business

Example 3: Costs of Dishonesty Dishonest dealings tend to drive honest dealings out of the market (same logic as before: presence of people willing to offer inferior goods tends to drive market out of existence) Cost of dishonesty not just that purchaser is cheated, but that legitimate business is driven out of business

Example 4: Credit Markets in Underdeveloped Countries Indian “managing agencies” are generally classified by communal origin Sources of finance are limited to local communal groups that can use communal or family ties to encourage honest dealing

Example 4: Credit Markets in Underdeveloped Countries Indian “managing agencies” are generally classified by communal origin Sources of finance are limited to local communal groups that can use communal or family ties to encourage honest dealing

Counteracting Institutions that counteract the effects of quality uncertainty Guarantees Brand-names Chains (hotels, restaurants) Licenses (meaning professional licensing of doctors, lawyers, barbers, Ph, D. , Nobel Prize)

Counteracting Institutions that counteract the effects of quality uncertainty Guarantees Brand-names Chains (hotels, restaurants) Licenses (meaning professional licensing of doctors, lawyers, barbers, Ph, D. , Nobel Prize)

Conclusions Akerlof (1970) provides a thorough treatment of the effects of asymmetric information on trading in markets (quality of products in market, size and existence of market) The last part of the article points out some institutions that counteract the effects of asymmetric information – this relates directly to some areas in strategic management (i. e. choice of governance form, principal-agent problems)

Conclusions Akerlof (1970) provides a thorough treatment of the effects of asymmetric information on trading in markets (quality of products in market, size and existence of market) The last part of the article points out some institutions that counteract the effects of asymmetric information – this relates directly to some areas in strategic management (i. e. choice of governance form, principal-agent problems)