4176f6e8621bf6f2c57e8c1ecca83662.ppt

- Количество слайдов: 16

The “make or take” decision in an electronic market: Evidence on the evolution of liquidity Journal of Financial Economics 75, 2005 Robert Bloomfield, Maureen O’hara, Gideon Sarr Presented by Doug Chung

The “make or take” decision in an electronic market: Evidence on the evolution of liquidity Journal of Financial Economics 75, 2005 Robert Bloomfield, Maureen O’hara, Gideon Sarr Presented by Doug Chung

Introduction ► Increased presence of electronic markets world wide ► Many electronic markets are organized as limit order books q No designated liquidity providers (market makers, dealers) ► Questions addressed q q q How do informed/liquidity traders differ in provision/use of liquidity? How do characteristics of market affect these strategies? How do characteristics of the underlying asset affect provision of market liquidity? ► Results q q Informed traders take as well as make liquidity When value of private info is high the informed trade via market orders When value of private info is low the informed trade via limit orders Unlike previous models the informed profit further as liquidity providers and earn the spread

Introduction ► Increased presence of electronic markets world wide ► Many electronic markets are organized as limit order books q No designated liquidity providers (market makers, dealers) ► Questions addressed q q q How do informed/liquidity traders differ in provision/use of liquidity? How do characteristics of market affect these strategies? How do characteristics of the underlying asset affect provision of market liquidity? ► Results q q Informed traders take as well as make liquidity When value of private info is high the informed trade via market orders When value of private info is low the informed trade via limit orders Unlike previous models the informed profit further as liquidity providers and earn the spread

Introduction ► Trader types q q Informed traders: trade with their information to gain profit Liquidity traders: trade based on their liquidity needs ► Order type q q Limit order: provides liquidity Market order: takes liquidity

Introduction ► Trader types q q Informed traders: trade with their information to gain profit Liquidity traders: trade based on their liquidity needs ► Order type q q Limit order: provides liquidity Market order: takes liquidity

Experimental design ► Definition q q q Cohort: group of six traders who always trade together Security: claim of terminal dividend identified by the value and liquidity needs Market: time interval of which trade is possible for a specific security Only one security is traded in each market Session: 75 min period where traders trade in a series of markets Each cohort trades 20 securities sequentially in a session

Experimental design ► Definition q q q Cohort: group of six traders who always trade together Security: claim of terminal dividend identified by the value and liquidity needs Market: time interval of which trade is possible for a specific security Only one security is traded in each market Session: 75 min period where traders trade in a series of markets Each cohort trades 20 securities sequentially in a session

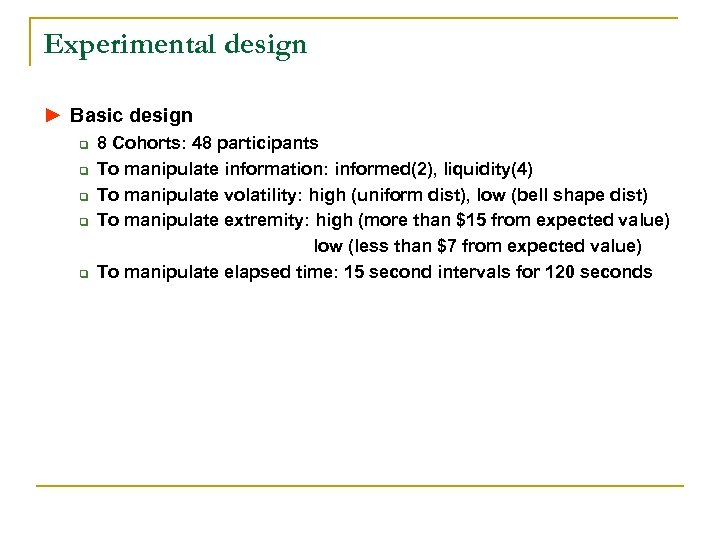

Experimental design ► Basic design q q q 8 Cohorts: 48 participants To manipulate information: informed(2), liquidity(4) To manipulate volatility: high (uniform dist), low (bell shape dist) To manipulate extremity: high (more than $15 from expected value) low (less than $7 from expected value) To manipulate elapsed time: 15 second intervals for 120 seconds

Experimental design ► Basic design q q q 8 Cohorts: 48 participants To manipulate information: informed(2), liquidity(4) To manipulate volatility: high (uniform dist), low (bell shape dist) To manipulate extremity: high (more than $15 from expected value) low (less than $7 from expected value) To manipulate elapsed time: 15 second intervals for 120 seconds

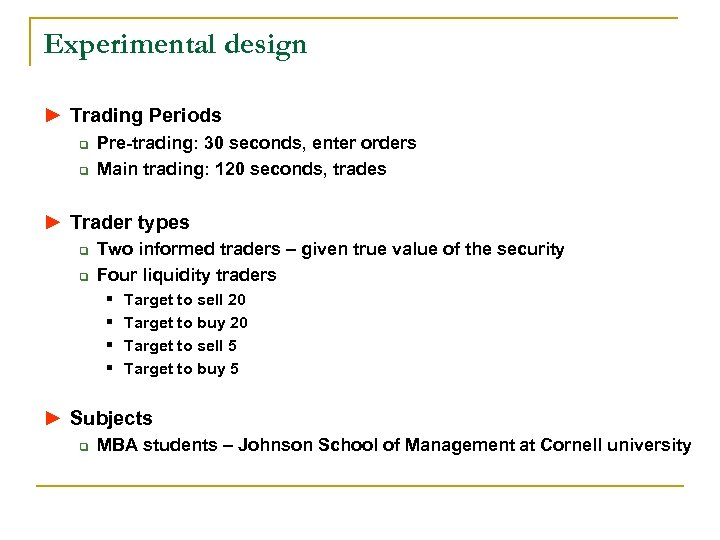

Experimental design ► Trading Periods q q Pre-trading: 30 seconds, enter orders Main trading: 120 seconds, trades ► Trader types q q Two informed traders – given true value of the security Four liquidity traders § § Target to sell 20 Target to buy 20 Target to sell 5 Target to buy 5 ► Subjects q MBA students – Johnson School of Management at Cornell university

Experimental design ► Trading Periods q q Pre-trading: 30 seconds, enter orders Main trading: 120 seconds, trades ► Trader types q q Two informed traders – given true value of the security Four liquidity traders § § Target to sell 20 Target to buy 20 Target to sell 5 Target to buy 5 ► Subjects q MBA students – Johnson School of Management at Cornell university

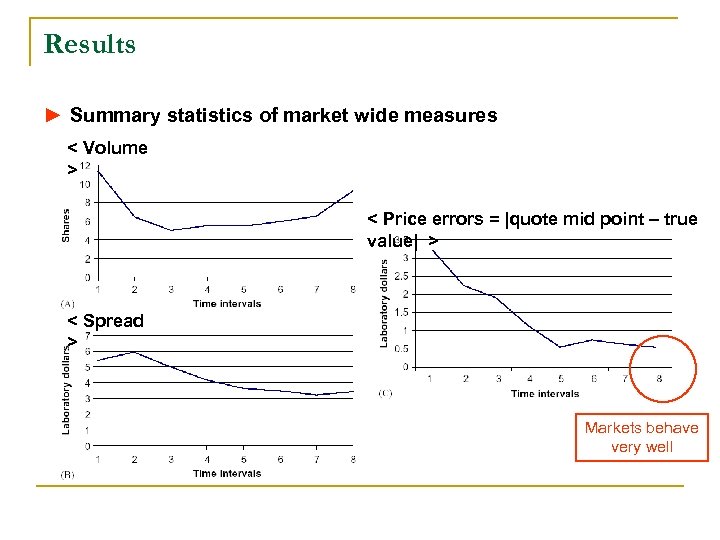

Results ► Summary statistics of market wide measures < Volume > < Price errors = |quote mid point – true value| > < Spread > Markets behave very well

Results ► Summary statistics of market wide measures < Volume > < Price errors = |quote mid point – true value| > < Spread > Markets behave very well

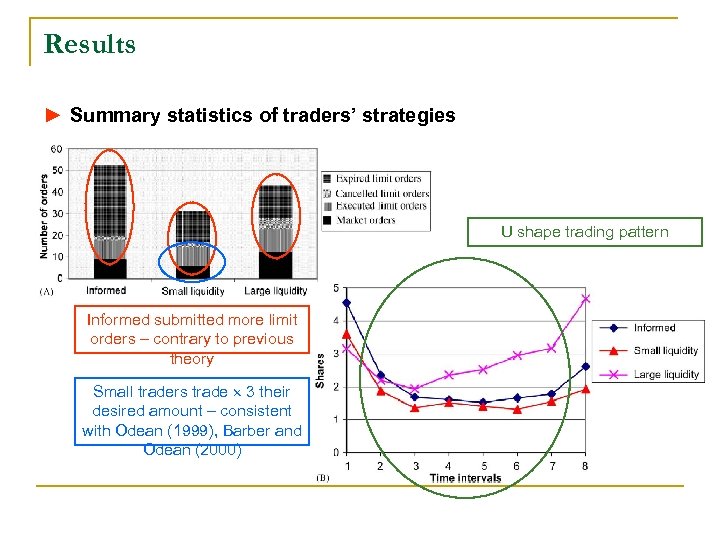

Results ► Summary statistics of traders’ strategies U shape trading pattern Informed submitted more limit orders – contrary to previous theory Small traders trade 3 their desired amount – consistent with Odean (1999), Barber and Odean (2000)

Results ► Summary statistics of traders’ strategies U shape trading pattern Informed submitted more limit orders – contrary to previous theory Small traders trade 3 their desired amount – consistent with Odean (1999), Barber and Odean (2000)

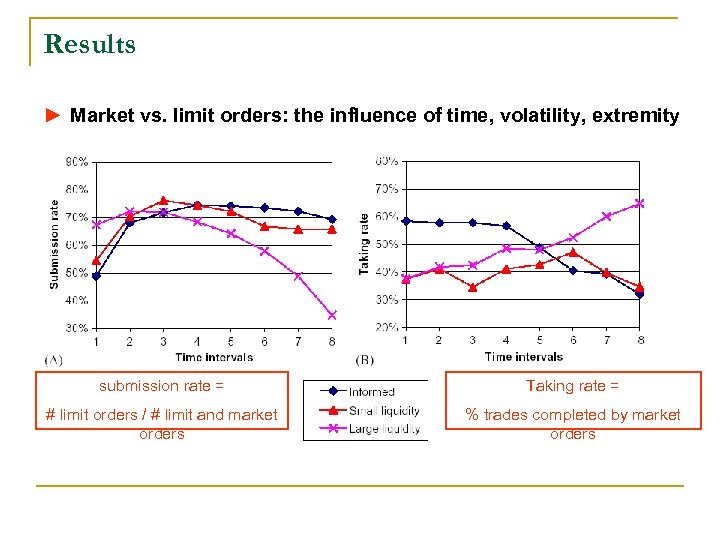

Results ► Market vs. limit orders: the influence of time, volatility, extremity submission rate = Taking rate = # limit orders / # limit and market orders % trades completed by market orders

Results ► Market vs. limit orders: the influence of time, volatility, extremity submission rate = Taking rate = # limit orders / # limit and market orders % trades completed by market orders

Results ► The role of time q q Liquidity traders: use of limit orders decline with time – consistent with Harris (1998) Informed traders: use of limit orders increase with time (provide liquidity) – inconsistent with previous theoretical models

Results ► The role of time q q Liquidity traders: use of limit orders decline with time – consistent with Harris (1998) Informed traders: use of limit orders increase with time (provide liquidity) – inconsistent with previous theoretical models

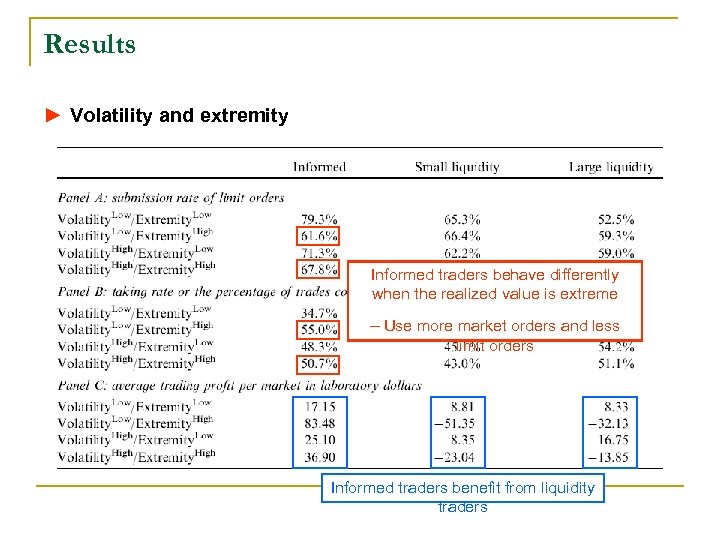

Results ► Volatility and extremity Informed traders behave differently when the realized value is extreme – Use more market orders and less limit orders Informed traders benefit from liquidity traders

Results ► Volatility and extremity Informed traders behave differently when the realized value is extreme – Use more market orders and less limit orders Informed traders benefit from liquidity traders

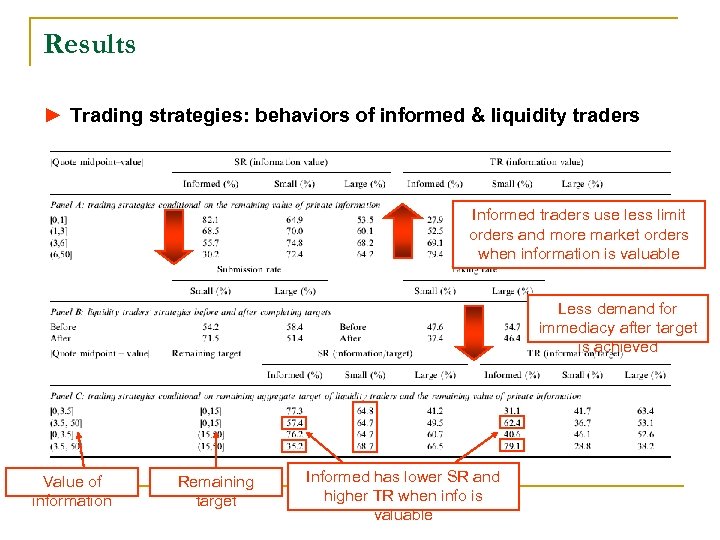

Results ► Trading strategies: behaviors of informed & liquidity traders Informed traders use less limit orders and more market orders when information is valuable Less demand for immediacy after target is achieved Value of information Remaining target Informed has lower SR and higher TR when info is valuable

Results ► Trading strategies: behaviors of informed & liquidity traders Informed traders use less limit orders and more market orders when information is valuable Less demand for immediacy after target is achieved Value of information Remaining target Informed has lower SR and higher TR when info is valuable

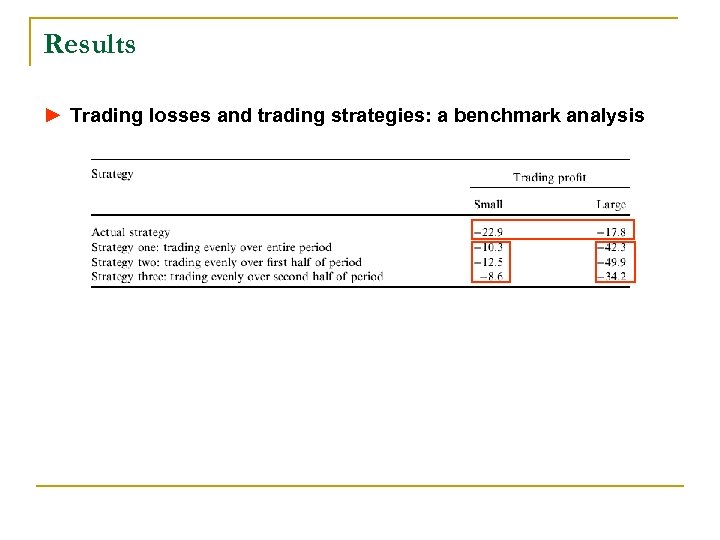

Results ► Trading losses and trading strategies: a benchmark analysis

Results ► Trading losses and trading strategies: a benchmark analysis

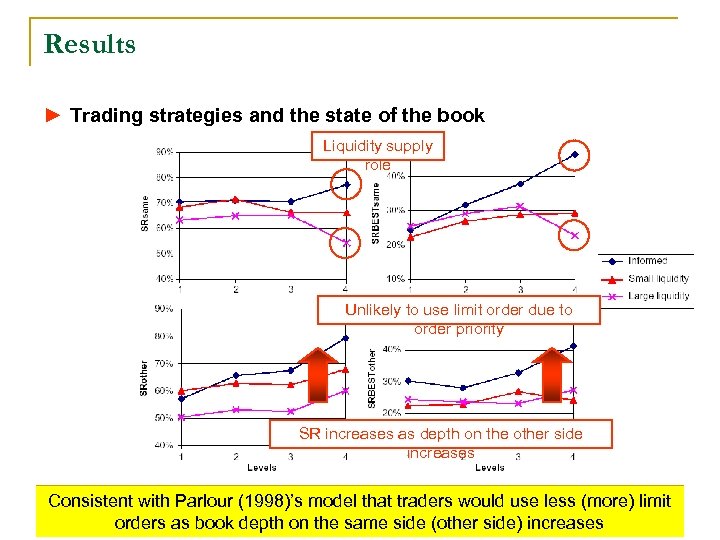

Results ► Trading strategies and the state of the book Liquidity supply role Unlikely to use limit order due to order priority SR increases as depth on the other side increases Consistent with Parlour (1998)’s model that traders would use less (more) limit orders as book depth on the same side (other side) increases

Results ► Trading strategies and the state of the book Liquidity supply role Unlikely to use limit order due to order priority SR increases as depth on the other side increases Consistent with Parlour (1998)’s model that traders would use less (more) limit orders as book depth on the same side (other side) increases

Conclusion ► Analysis of the evolution of liquidity in an electronic limit order market ► Large Liquidity traders prefer limit orders in the beginning but preference shift towards using more of market orders q Consistent with predictions of previous theoretical models ► Informed traders employ market orders in the beginning but over time shift to trading mostly limit orders q q Another source of profit: the spread by providing liquidity Inconsistent with predictions of previous theoretical models ► Explains why electronic markets can endogenously create liquidity even in the presence of information asymmetry

Conclusion ► Analysis of the evolution of liquidity in an electronic limit order market ► Large Liquidity traders prefer limit orders in the beginning but preference shift towards using more of market orders q Consistent with predictions of previous theoretical models ► Informed traders employ market orders in the beginning but over time shift to trading mostly limit orders q q Another source of profit: the spread by providing liquidity Inconsistent with predictions of previous theoretical models ► Explains why electronic markets can endogenously create liquidity even in the presence of information asymmetry

Thank You

Thank You