5c185f0754769c1539a8d7829e23eeb9.ppt

- Количество слайдов: 80

The Mad Hedge Fund Trader “Short Squeeze!” With John Thomas from San Francisco, October 7, 2015 www. madhedgefundtrader. com

The Mad Hedge Fund Trader “Short Squeeze!” With John Thomas from San Francisco, October 7, 2015 www. madhedgefundtrader. com

Trade Alert Performance New All Time High! *January +0. 53% Final *February +7. 73% Final *March +3. 00% Final *April +6. 62% Final *May +5. 15% Final *June +3. 68% Final *July +6. 42% Final *August +1. 27% Final *September 11. 99% Final *October MTD -5. 19% *2015 Year to Date +39. 03% compared to -5. 6% for the Dow Average *Trailing 1 year return +29. 64%, +191. 84% sinception, *Average annualized return of 39. 69%

Trade Alert Performance New All Time High! *January +0. 53% Final *February +7. 73% Final *March +3. 00% Final *April +6. 62% Final *May +5. 15% Final *June +3. 68% Final *July +6. 42% Final *August +1. 27% Final *September 11. 99% Final *October MTD -5. 19% *2015 Year to Date +39. 03% compared to -5. 6% for the Dow Average *Trailing 1 year return +29. 64%, +191. 84% sinception, *Average annualized return of 39. 69%

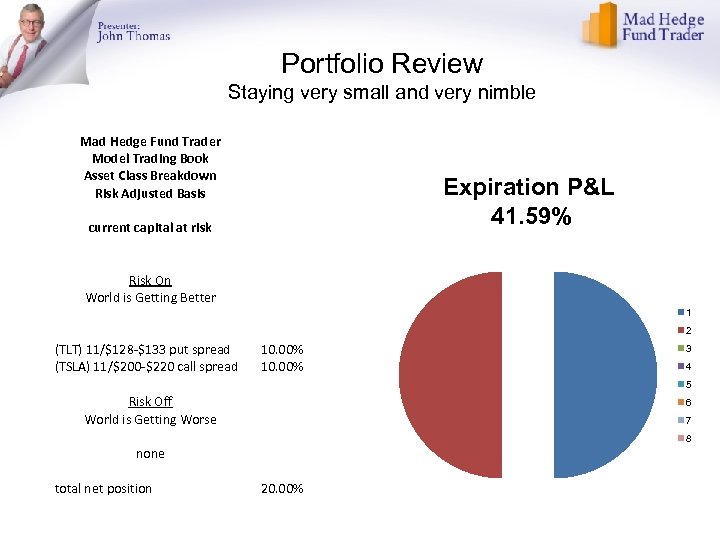

Portfolio Review Staying very small and very nimble Mad Hedge Fund Trader Model Trading Book Asset Class Breakdown Risk Adjusted Basis Expiration P&L 41. 59% current capital at risk Risk On World is Getting Better 1 2 (TLT) 11/$128 -$133 put spread (TSLA) 11/$200 -$220 call spread 10. 00% 3 4 5 Risk Off World is Getting Worse 6 7 8 none total net position 20. 00%

Portfolio Review Staying very small and very nimble Mad Hedge Fund Trader Model Trading Book Asset Class Breakdown Risk Adjusted Basis Expiration P&L 41. 59% current capital at risk Risk On World is Getting Better 1 2 (TLT) 11/$128 -$133 put spread (TSLA) 11/$200 -$220 call spread 10. 00% 3 4 5 Risk Off World is Getting Worse 6 7 8 none total net position 20. 00%

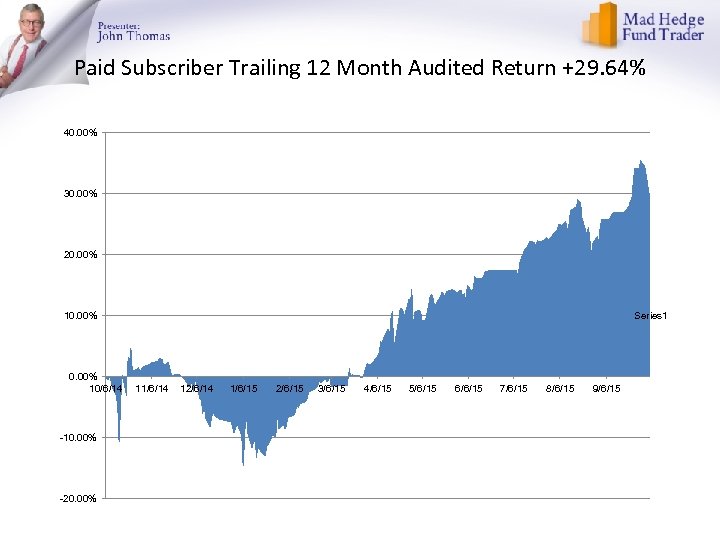

Paid Subscriber Trailing 12 Month Audited Return +29. 64% 40. 00% 30. 00% 20. 00% 10/6/14 -10. 00% -20. 00% Series 1 11/6/14 12/6/14 1/6/15 2/6/15 3/6/15 4/6/15 5/6/15 6/6/15 7/6/15 8/6/15 9/6/15

Paid Subscriber Trailing 12 Month Audited Return +29. 64% 40. 00% 30. 00% 20. 00% 10/6/14 -10. 00% -20. 00% Series 1 11/6/14 12/6/14 1/6/15 2/6/15 3/6/15 4/6/15 5/6/15 6/6/15 7/6/15 8/6/15 9/6/15

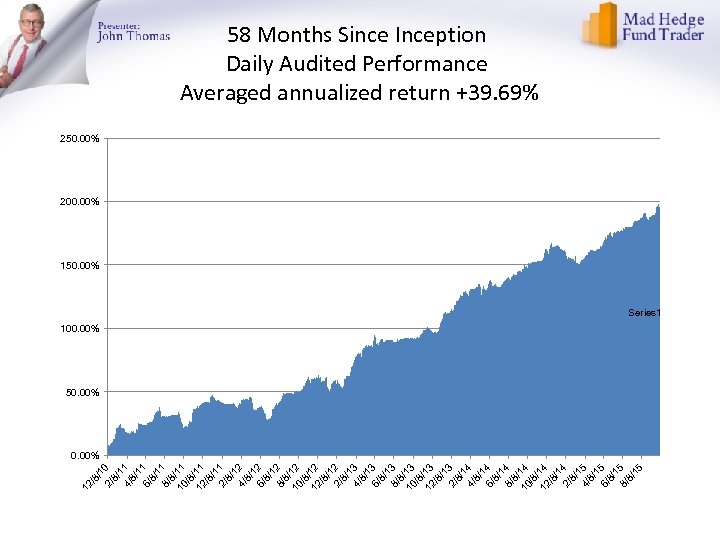

/1 2/ 0 8/ 1 4/ 1 8/ 1 6/ 1 8/ 10 11 /8 / 12 11 /8 /1 2/ 1 8/ 1 4/ 2 8/ 1 6/ 2 8/ 1 8/ 2 8/ 10 12 /8 / 12 12 /8 /1 2/ 2 8/ 1 4/ 3 8/ 1 6/ 3 8/ 1 8/ 3 8/ 10 13 /8 / 12 13 /8 /1 2/ 3 8/ 1 4/ 4 8/ 1 6/ 4 8/ 1 8/ 4 8/ 10 14 /8 / 12 14 /8 /1 2/ 4 8/ 1 4/ 5 8/ 1 6/ 5 8/ 1 8/ 5 8/ 15 12 /8 58 Months Since Inception Daily Audited Performance Averaged annualized return +39. 69% 250. 00% 200. 00% 150. 00% Series 1 100. 00% 50. 00%

/1 2/ 0 8/ 1 4/ 1 8/ 1 6/ 1 8/ 10 11 /8 / 12 11 /8 /1 2/ 1 8/ 1 4/ 2 8/ 1 6/ 2 8/ 1 8/ 2 8/ 10 12 /8 / 12 12 /8 /1 2/ 2 8/ 1 4/ 3 8/ 1 6/ 3 8/ 1 8/ 3 8/ 10 13 /8 / 12 13 /8 /1 2/ 3 8/ 1 4/ 4 8/ 1 6/ 4 8/ 1 8/ 4 8/ 10 14 /8 / 12 14 /8 /1 2/ 4 8/ 1 4/ 5 8/ 1 6/ 5 8/ 1 8/ 5 8/ 15 12 /8 58 Months Since Inception Daily Audited Performance Averaged annualized return +39. 69% 250. 00% 200. 00% 150. 00% Series 1 100. 00% 50. 00%

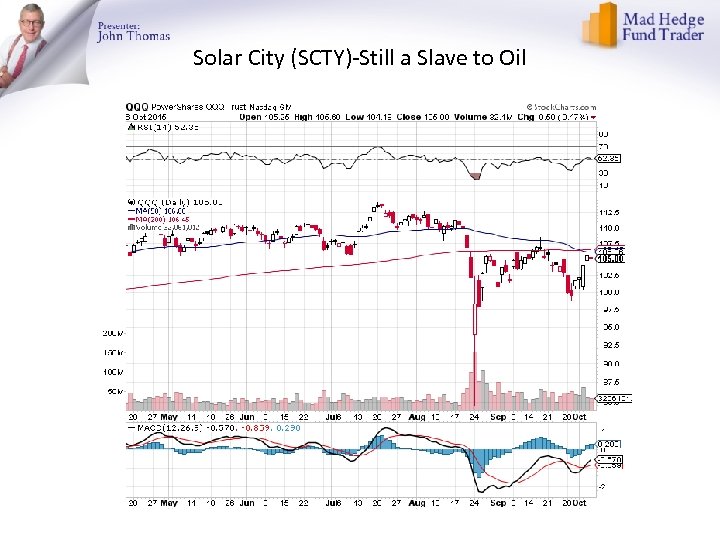

10 Stocks to Buy at the Bottom Lennar Homes (LEN) $53. 45 Home Depot (HD) $116. 16 Walt Disney (DIS) $98. 84 General Motors (GM) $29. 60 Tesla (TSLA) $230. 77 Apple (AAPL) $105. 76 Solar City (SCTY) $40. 99 Gilead Sciences (GILD) $105. 33 Wisdom Tree Japan Hedged Equity (DXJ) $52. 01 Wisdom Tree Europe Hedged Equity (HEDJ) $56. 95

10 Stocks to Buy at the Bottom Lennar Homes (LEN) $53. 45 Home Depot (HD) $116. 16 Walt Disney (DIS) $98. 84 General Motors (GM) $29. 60 Tesla (TSLA) $230. 77 Apple (AAPL) $105. 76 Solar City (SCTY) $40. 99 Gilead Sciences (GILD) $105. 33 Wisdom Tree Japan Hedged Equity (DXJ) $52. 01 Wisdom Tree Europe Hedged Equity (HEDJ) $56. 95

Strategy Outlook-Setting Up the “BUY” *Rumors flying that the Fed may raise rates in October *The bottom in stocks may be in, but expect a retest, and another flash crash, thanks to structurally poor liquidity *Oil trapped in wide $44 -$48 range, entering seasonal weakness *Weak September nonfarm payroll at 142, 000 creates a great bond market spike to sell into *Dollar flat lines after Fed decision-no trade *Gold stalls again at the bottom *Ags clearly discounting major damage from an el nino winter

Strategy Outlook-Setting Up the “BUY” *Rumors flying that the Fed may raise rates in October *The bottom in stocks may be in, but expect a retest, and another flash crash, thanks to structurally poor liquidity *Oil trapped in wide $44 -$48 range, entering seasonal weakness *Weak September nonfarm payroll at 142, 000 creates a great bond market spike to sell into *Dollar flat lines after Fed decision-no trade *Gold stalls again at the bottom *Ags clearly discounting major damage from an el nino winter

The Bill Davis View The Mad Day Trader Upgrade for $1, 500 a year more short term Trade Alerts, morning opening commentary, and biweekly webinars Picks of the Week Buys: Go. Pro, Inc (GPRO) $31. 50 Target to $44 (Wait for close above $31. 50) Amazon. com (AMZN) $520 Target to $580 Starbucks Corp (SBUX) $57 Target to $62 Facebook, Inc. (FB) $91 Target to $98 Sells: Trip. Advisor, INC. (TRIP) $69 Target to $56 Workday, Inc. (WDAY) $75 Target to $66 Baidu, Inc. (BIDU) $150 Target to $120 Agrium (AGU) $97 Target to $87 Whirlpool Corp (WHR) $162 Target to $150 Martin Marietta (MLM) $165 Target to $145

The Bill Davis View The Mad Day Trader Upgrade for $1, 500 a year more short term Trade Alerts, morning opening commentary, and biweekly webinars Picks of the Week Buys: Go. Pro, Inc (GPRO) $31. 50 Target to $44 (Wait for close above $31. 50) Amazon. com (AMZN) $520 Target to $580 Starbucks Corp (SBUX) $57 Target to $62 Facebook, Inc. (FB) $91 Target to $98 Sells: Trip. Advisor, INC. (TRIP) $69 Target to $56 Workday, Inc. (WDAY) $75 Target to $66 Baidu, Inc. (BIDU) $150 Target to $120 Agrium (AGU) $97 Target to $87 Whirlpool Corp (WHR) $162 Target to $150 Martin Marietta (MLM) $165 Target to $145

The Global Economy-Conflicted *US Q 2 GDP revised up from a hot 3. 7% to a hotter 3. 9% *But September nonfarm payroll says otherwise at 142, 000, 5. 1% unemployment *Japan falls back into deflation, with -0. 1% YOY consumer prices, Abe promises to boost GDP by 22% *China closed for the week, so data goes cold *Next to come is a “RISK ON” global synchronized growth

The Global Economy-Conflicted *US Q 2 GDP revised up from a hot 3. 7% to a hotter 3. 9% *But September nonfarm payroll says otherwise at 142, 000, 5. 1% unemployment *Japan falls back into deflation, with -0. 1% YOY consumer prices, Abe promises to boost GDP by 22% *China closed for the week, so data goes cold *Next to come is a “RISK ON” global synchronized growth

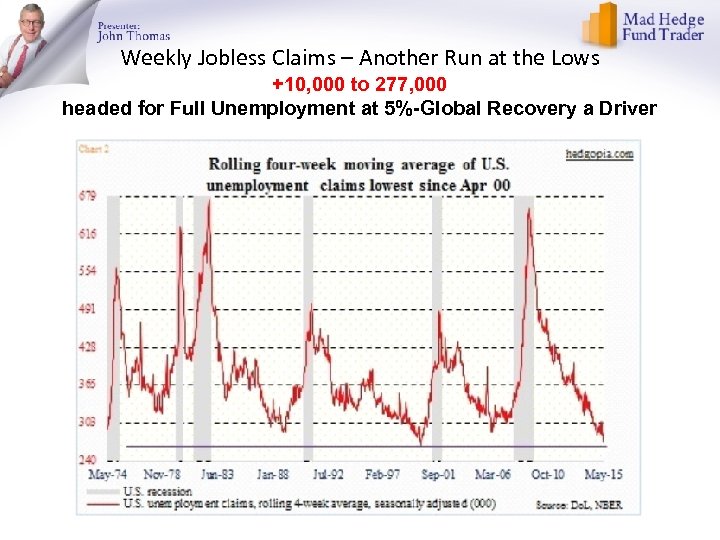

Weekly Jobless Claims – Another Run at the Lows +10, 000 to 277, 000 headed for Full Unemployment at 5%-Global Recovery a Driver

Weekly Jobless Claims – Another Run at the Lows +10, 000 to 277, 000 headed for Full Unemployment at 5%-Global Recovery a Driver

Bonds-Back on the “SELL” Side *Huge spike off weak September nonfarm payroll is whacked immediately *A perfect triple bottom sets up at 1. 85%-1. 90% for Ten year Treasury bonds *High prices belie poor liquidity *New lows for Junk bonds follow the equity short squeeze back up *Piling back into the (TBT)

Bonds-Back on the “SELL” Side *Huge spike off weak September nonfarm payroll is whacked immediately *A perfect triple bottom sets up at 1. 85%-1. 90% for Ten year Treasury bonds *High prices belie poor liquidity *New lows for Junk bonds follow the equity short squeeze back up *Piling back into the (TBT)

Ten Year Treasuries (TLT) 2. 04% The down trend is in place! Sell Rallies!

Ten Year Treasuries (TLT) 2. 04% The down trend is in place! Sell Rallies!

Ten Year Treasury Yield ($TNX) 2. 16% 1. 90% Support Holds

Ten Year Treasury Yield ($TNX) 2. 16% 1. 90% Support Holds

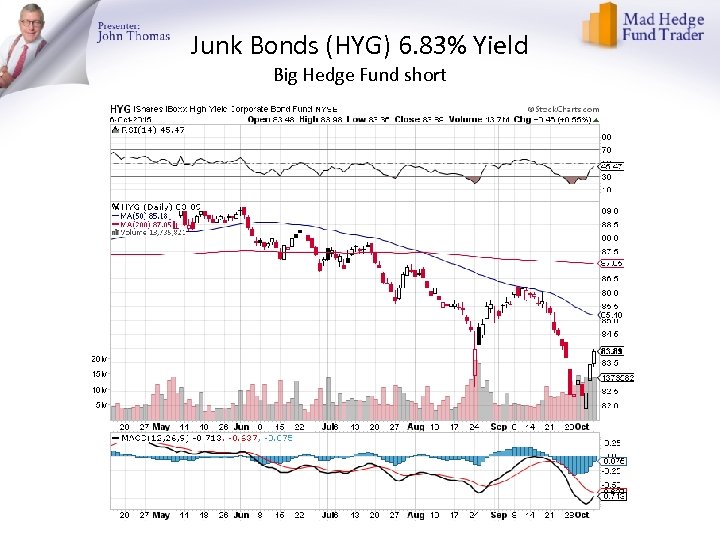

Junk Bonds (HYG) 6. 83% Yield Big Hedge Fund short

Junk Bonds (HYG) 6. 83% Yield Big Hedge Fund short

2 X Short Treasuries (TBT)-Second Half Big Trade? Buy at the Dip, $41 will hold

2 X Short Treasuries (TBT)-Second Half Big Trade? Buy at the Dip, $41 will hold

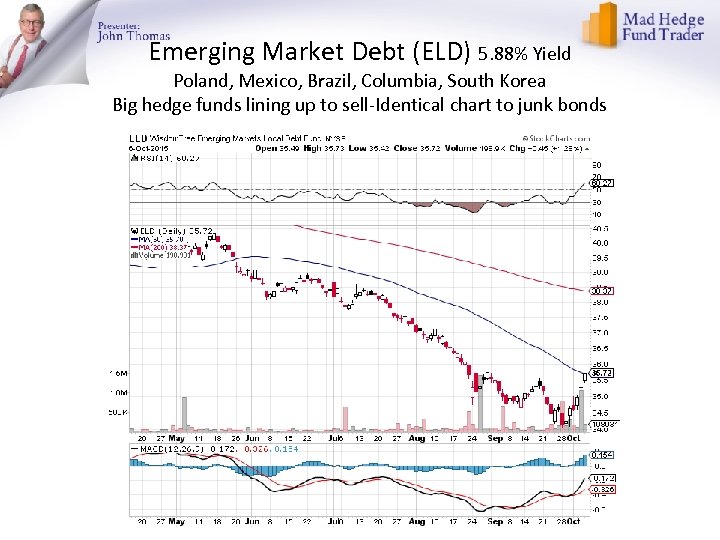

Emerging Market Debt (ELD) 5. 88% Yield Poland, Mexico, Brazil, Columbia, South Korea Big hedge funds lining up to sell-Identical chart to junk bonds

Emerging Market Debt (ELD) 5. 88% Yield Poland, Mexico, Brazil, Columbia, South Korea Big hedge funds lining up to sell-Identical chart to junk bonds

Municipal Bonds (MUB)-1. 73% yield Mix of AAA, and A rated bonds-flight to safety

Municipal Bonds (MUB)-1. 73% yield Mix of AAA, and A rated bonds-flight to safety

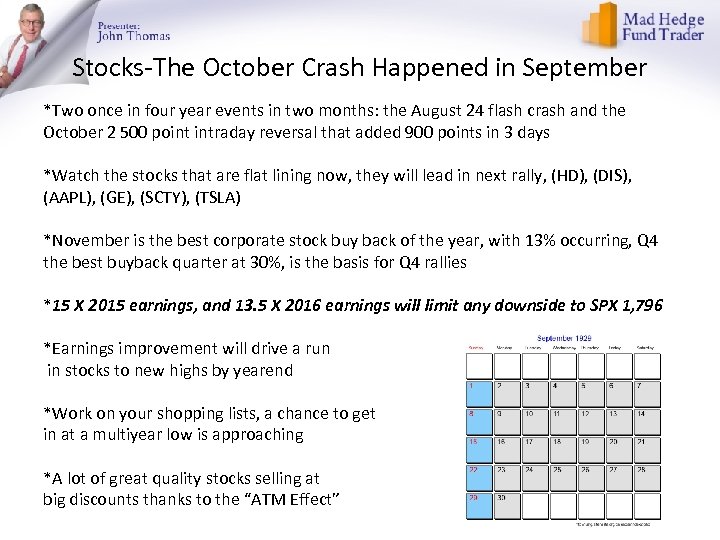

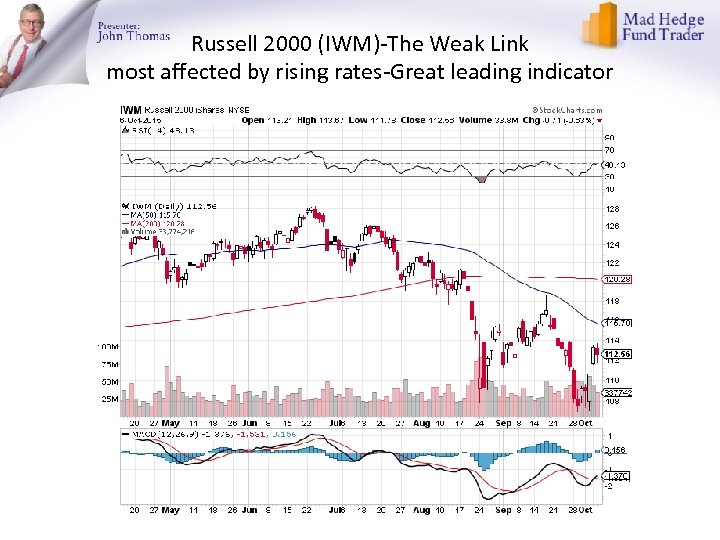

Stocks-The October Crash Happened in September *Two once in four year events in two months: the August 24 flash crash and the October 2 500 point intraday reversal that added 900 points in 3 days *Watch the stocks that are flat lining now, they will lead in next rally, (HD), (DIS), (AAPL), (GE), (SCTY), (TSLA) *November is the best corporate stock buy back of the year, with 13% occurring, Q 4 the best buyback quarter at 30%, is the basis for Q 4 rallies *15 X 2015 earnings, and 13. 5 X 2016 earnings will limit any downside to SPX 1, 796 *Earnings improvement will drive a run in stocks to new highs by yearend *Work on your shopping lists, a chance to get in at a multiyear low is approaching *A lot of great quality stocks selling at big discounts thanks to the “ATM Effect”

Stocks-The October Crash Happened in September *Two once in four year events in two months: the August 24 flash crash and the October 2 500 point intraday reversal that added 900 points in 3 days *Watch the stocks that are flat lining now, they will lead in next rally, (HD), (DIS), (AAPL), (GE), (SCTY), (TSLA) *November is the best corporate stock buy back of the year, with 13% occurring, Q 4 the best buyback quarter at 30%, is the basis for Q 4 rallies *15 X 2015 earnings, and 13. 5 X 2016 earnings will limit any downside to SPX 1, 796 *Earnings improvement will drive a run in stocks to new highs by yearend *Work on your shopping lists, a chance to get in at a multiyear low is approaching *A lot of great quality stocks selling at big discounts thanks to the “ATM Effect”

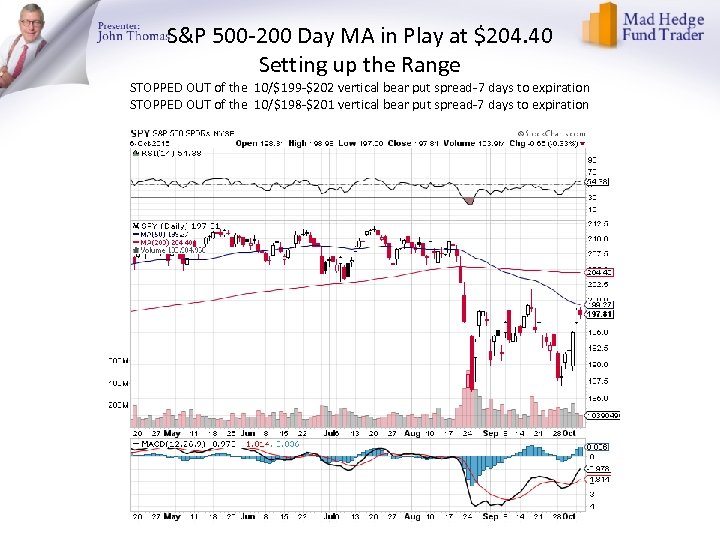

S&P 500 -200 Day MA in Play at $204. 40 Setting up the Range STOPPED OUT of the 10/$199 -$202 vertical bear put spread-7 days to expiration STOPPED OUT of the 10/$198 -$201 vertical bear put spread-7 days to expiration

S&P 500 -200 Day MA in Play at $204. 40 Setting up the Range STOPPED OUT of the 10/$199 -$202 vertical bear put spread-7 days to expiration STOPPED OUT of the 10/$198 -$201 vertical bear put spread-7 days to expiration

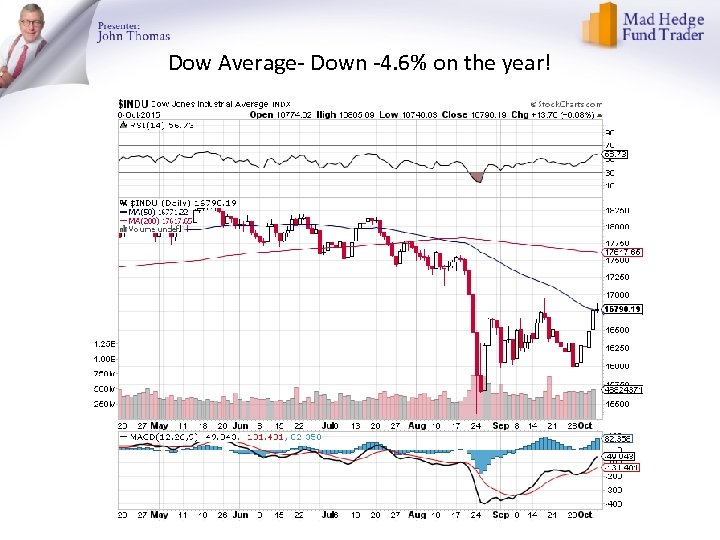

Dow Average- Down -4. 6% on the year!

Dow Average- Down -4. 6% on the year!

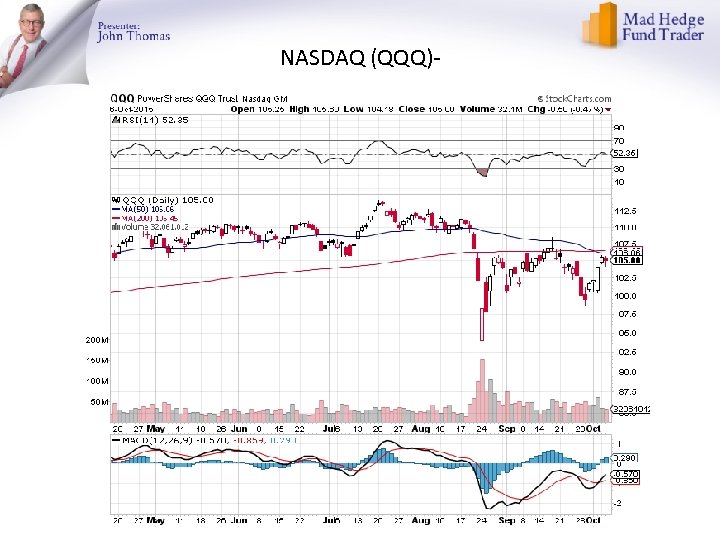

NASDAQ (QQQ)-

NASDAQ (QQQ)-

Solar City (SCTY)-Still a Slave to Oil

Solar City (SCTY)-Still a Slave to Oil

Europe Hedged Equity (HEDJ)-

Europe Hedged Equity (HEDJ)-

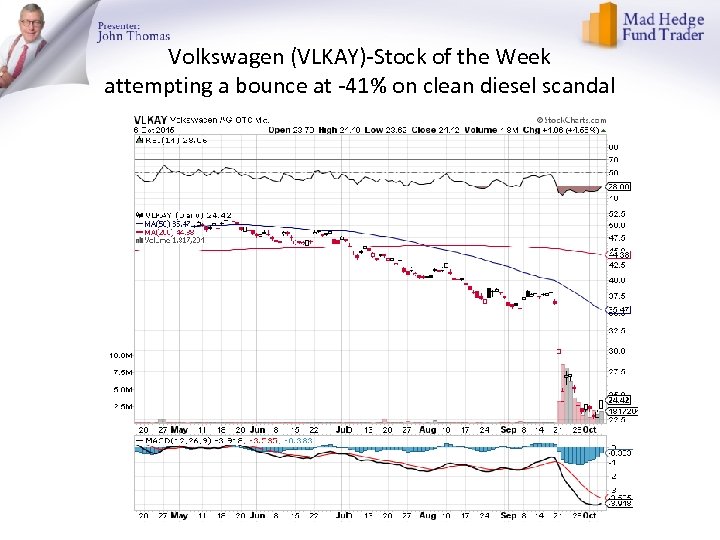

Volkswagen (VLKAY)-Stock of the Week attempting a bounce at -41% on clean diesel scandal

Volkswagen (VLKAY)-Stock of the Week attempting a bounce at -41% on clean diesel scandal

(VIX)-Bleeding Off From Four Year High!

(VIX)-Bleeding Off From Four Year High!

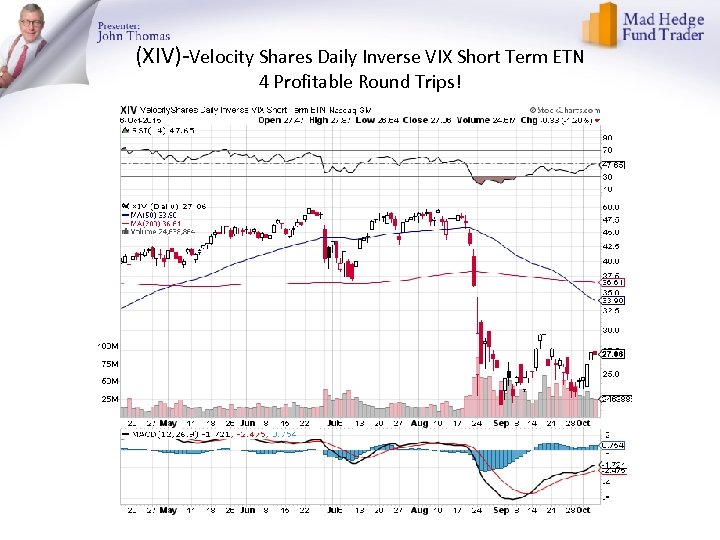

(XIV)-Velocity Shares Daily Inverse VIX Short Term ETN 4 Profitable Round Trips!

(XIV)-Velocity Shares Daily Inverse VIX Short Term ETN 4 Profitable Round Trips!

Russell 2000 (IWM)-The Weak Link most affected by rising rates-Great leading indicator

Russell 2000 (IWM)-The Weak Link most affected by rising rates-Great leading indicator

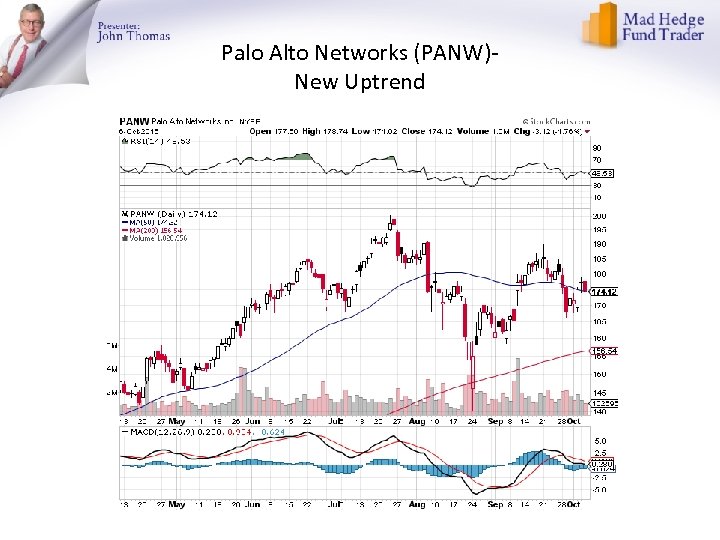

Palo Alto Networks (PANW)New Uptrend

Palo Alto Networks (PANW)New Uptrend

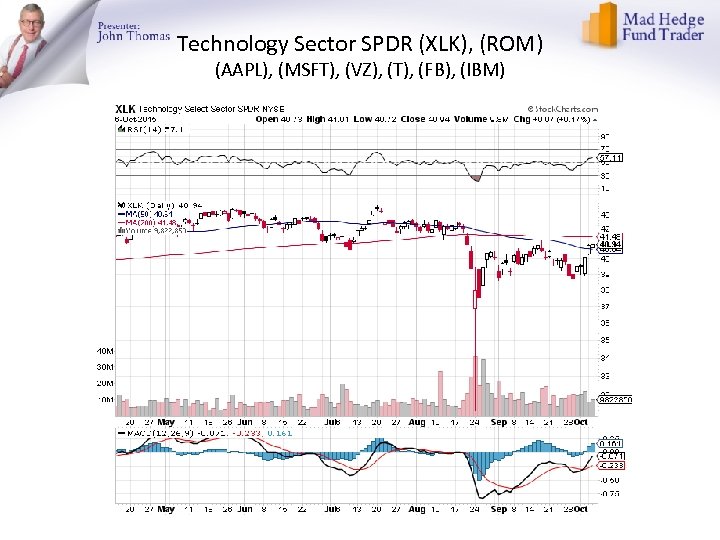

Technology Sector SPDR (XLK), (ROM) (AAPL), (MSFT), (VZ), (T), (FB), (IBM)

Technology Sector SPDR (XLK), (ROM) (AAPL), (MSFT), (VZ), (T), (FB), (IBM)

Industrials Sector SPDR (XLI)-Dow Mainstay (GE), (MMM), (UNP), (UTX), (BA), (HON)

Industrials Sector SPDR (XLI)-Dow Mainstay (GE), (MMM), (UNP), (UTX), (BA), (HON)

Transports Sector SPDR (XTN)-Another Dow Mainstay (ALGT), (ALK), (JBLU), (LUV), (CHRW), (DAL),

Transports Sector SPDR (XTN)-Another Dow Mainstay (ALGT), (ALK), (JBLU), (LUV), (CHRW), (DAL),

Health Care Sector SPDR (XLV), (RXL) (JNJ), (PFE), (MRK), (GILD), (ACT), (AMGN)

Health Care Sector SPDR (XLV), (RXL) (JNJ), (PFE), (MRK), (GILD), (ACT), (AMGN)

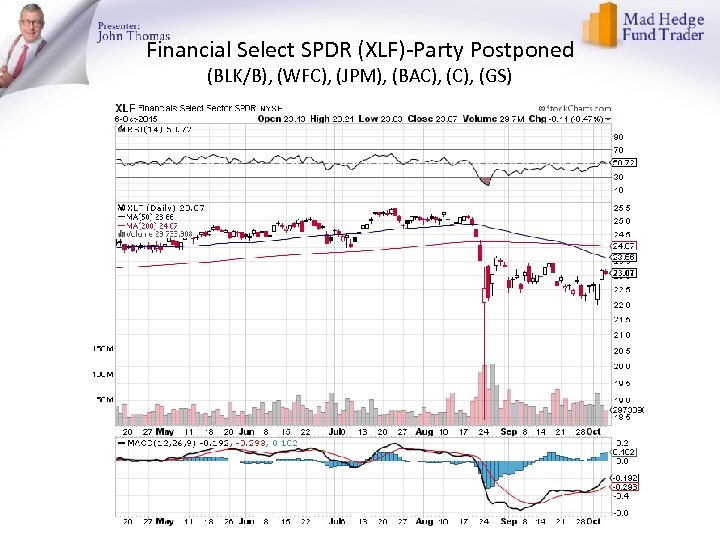

Financial Select SPDR (XLF)-Party Postponed (BLK/B), (WFC), (JPM), (BAC), (GS)

Financial Select SPDR (XLF)-Party Postponed (BLK/B), (WFC), (JPM), (BAC), (GS)

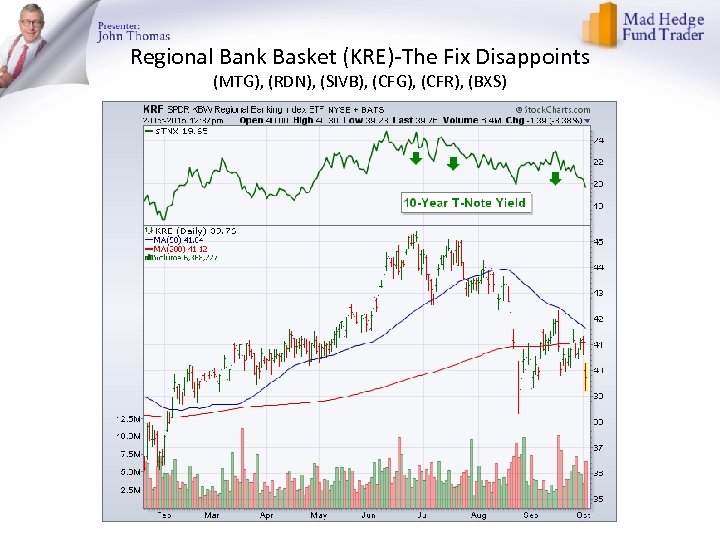

Regional Bank Basket (KRE)-The Fix Disappoints (MTG), (RDN), (SIVB), (CFG), (CFR), (BXS)

Regional Bank Basket (KRE)-The Fix Disappoints (MTG), (RDN), (SIVB), (CFG), (CFR), (BXS)

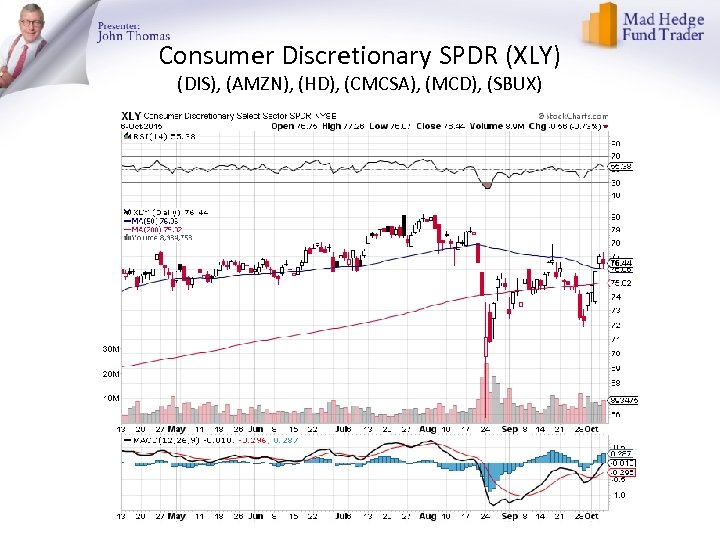

Consumer Discretionary SPDR (XLY) (DIS), (AMZN), (HD), (CMCSA), (MCD), (SBUX)

Consumer Discretionary SPDR (XLY) (DIS), (AMZN), (HD), (CMCSA), (MCD), (SBUX)

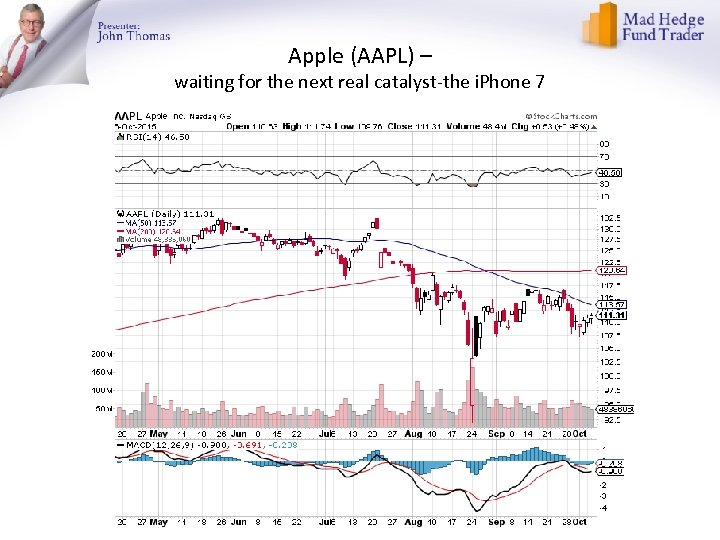

Apple (AAPL) – waiting for the next real catalyst-the i. Phone 7

Apple (AAPL) – waiting for the next real catalyst-the i. Phone 7

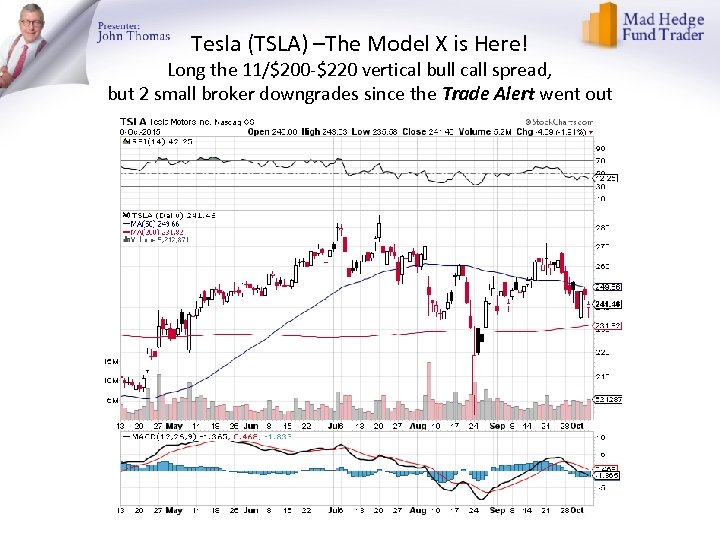

Tesla (TSLA) –The Model X is Here! Long the 11/$200 -$220 vertical bull call spread, but 2 small broker downgrades since the Trade Alert went out

Tesla (TSLA) –The Model X is Here! Long the 11/$200 -$220 vertical bull call spread, but 2 small broker downgrades since the Trade Alert went out

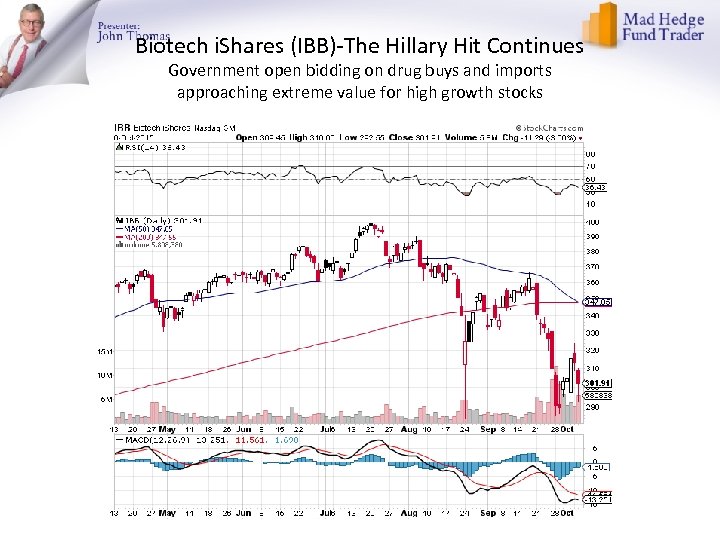

Biotech i. Shares (IBB)-The Hillary Hit Continues Government open bidding on drug buys and imports approaching extreme value for high growth stocks

Biotech i. Shares (IBB)-The Hillary Hit Continues Government open bidding on drug buys and imports approaching extreme value for high growth stocks

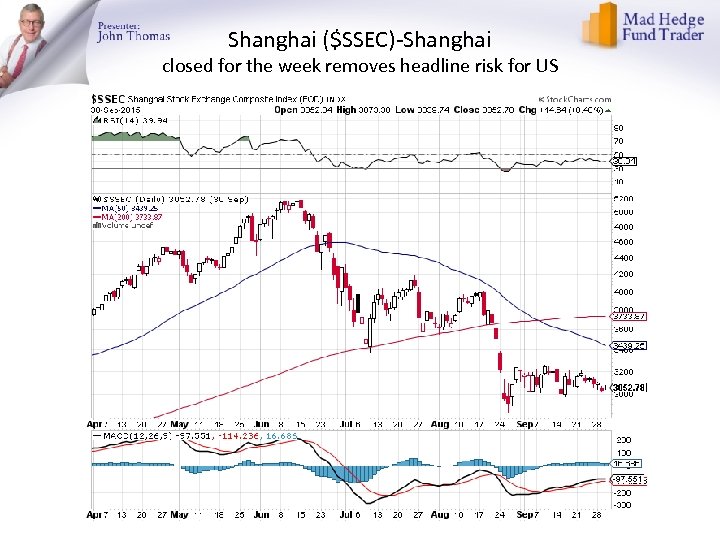

Shanghai ($SSEC)-Shanghai closed for the week removes headline risk for US

Shanghai ($SSEC)-Shanghai closed for the week removes headline risk for US

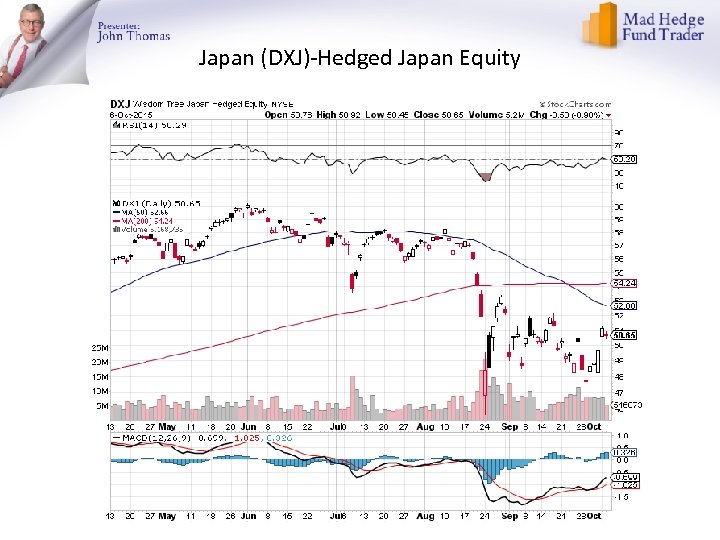

Japan (DXJ)-Hedged Japan Equity

Japan (DXJ)-Hedged Japan Equity

Sony (SNE)-Buy Territory

Sony (SNE)-Buy Territory

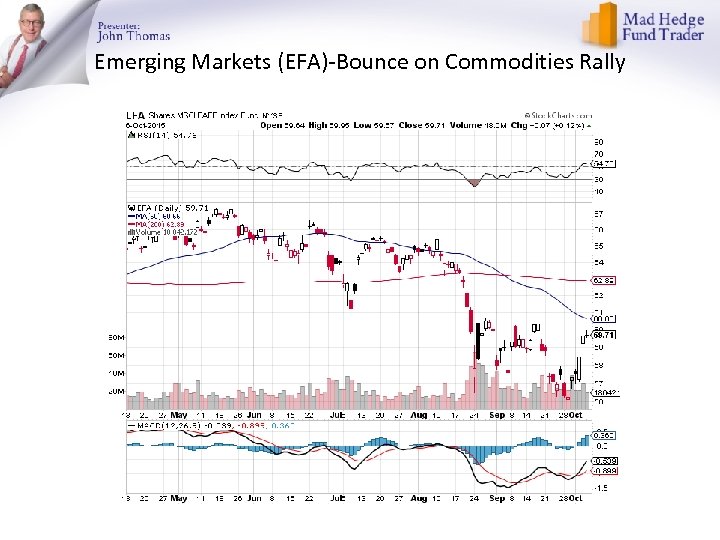

Emerging Markets (EFA)-Bounce on Commodities Rally

Emerging Markets (EFA)-Bounce on Commodities Rally

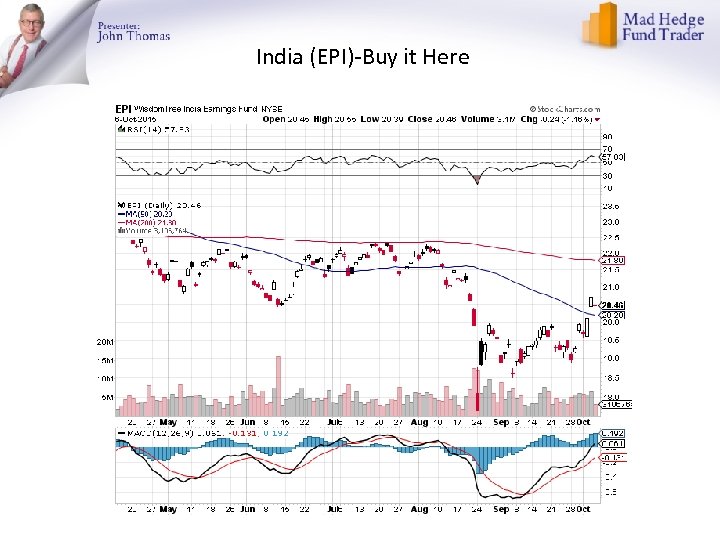

India (EPI)-Buy it Here

India (EPI)-Buy it Here

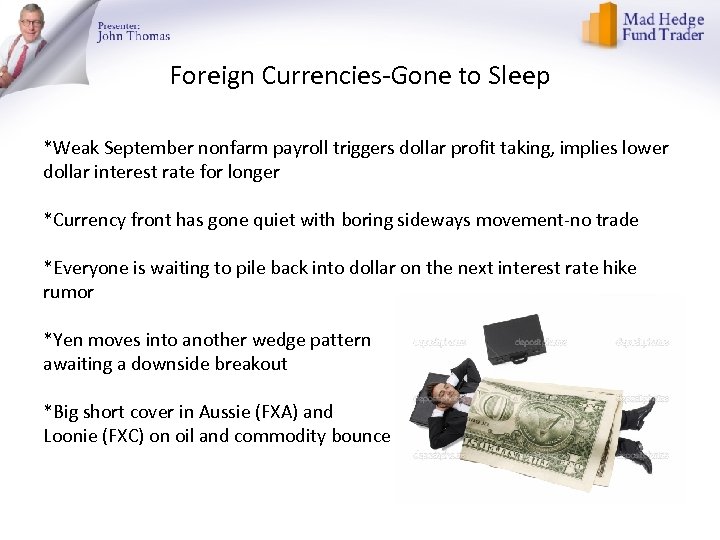

Foreign Currencies-Gone to Sleep *Weak September nonfarm payroll triggers dollar profit taking, implies lower dollar interest rate for longer *Currency front has gone quiet with boring sideways movement-no trade *Everyone is waiting to pile back into dollar on the next interest rate hike rumor *Yen moves into another wedge pattern awaiting a downside breakout *Big short cover in Aussie (FXA) and Loonie (FXC) on oil and commodity bounce

Foreign Currencies-Gone to Sleep *Weak September nonfarm payroll triggers dollar profit taking, implies lower dollar interest rate for longer *Currency front has gone quiet with boring sideways movement-no trade *Everyone is waiting to pile back into dollar on the next interest rate hike rumor *Yen moves into another wedge pattern awaiting a downside breakout *Big short cover in Aussie (FXA) and Loonie (FXC) on oil and commodity bounce

Euro ($XEU), (FXE), (EUO)-Playing Both Asides

Euro ($XEU), (FXE), (EUO)-Playing Both Asides

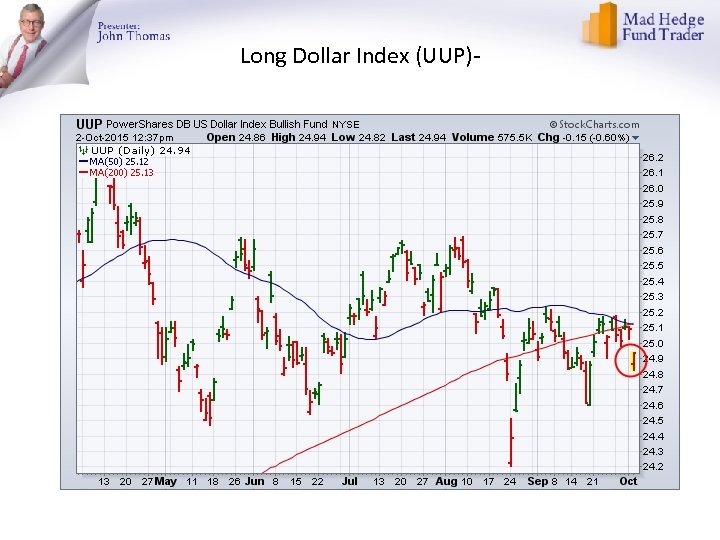

Long Dollar Index (UUP)-

Long Dollar Index (UUP)-

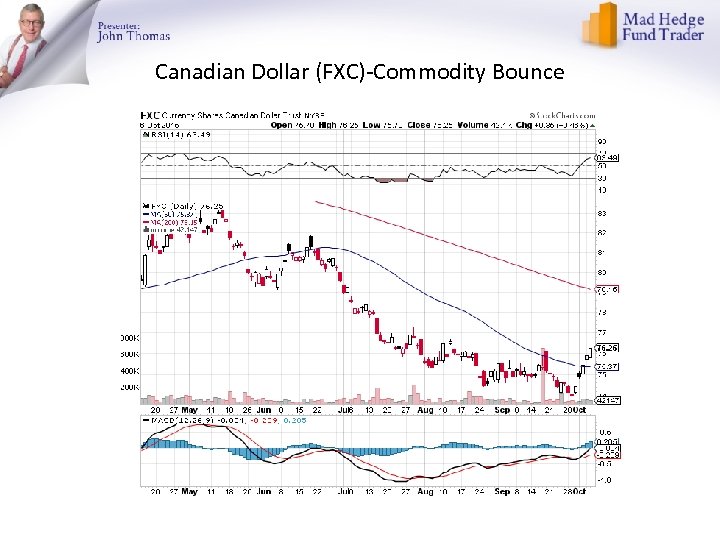

Canadian Dollar (FXC)-Commodity Bounce

Canadian Dollar (FXC)-Commodity Bounce

Japanese Yen (FXY)-

Japanese Yen (FXY)-

Short Japanese Yen ETF (YCS)

Short Japanese Yen ETF (YCS)

Australian Dollar (FXA) –Bounce

Australian Dollar (FXA) –Bounce

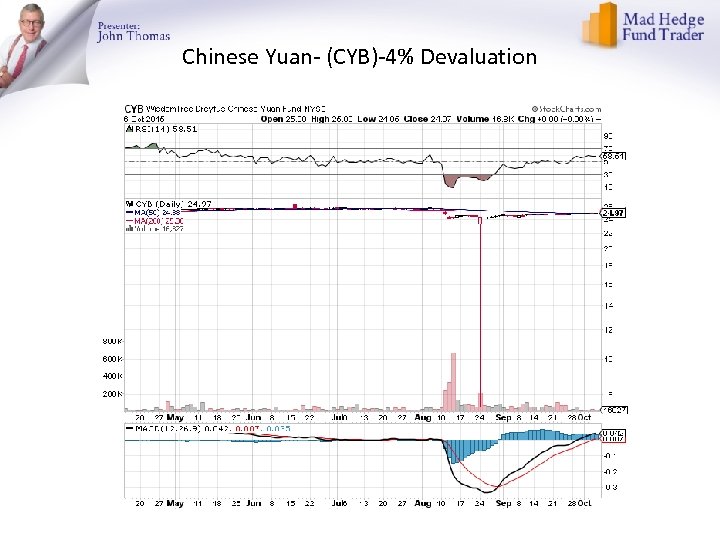

Chinese Yuan- (CYB)-4% Devaluation

Chinese Yuan- (CYB)-4% Devaluation

Emerging Market Currencies (CEW) another hedge fund short target and flash crash

Emerging Market Currencies (CEW) another hedge fund short target and flash crash

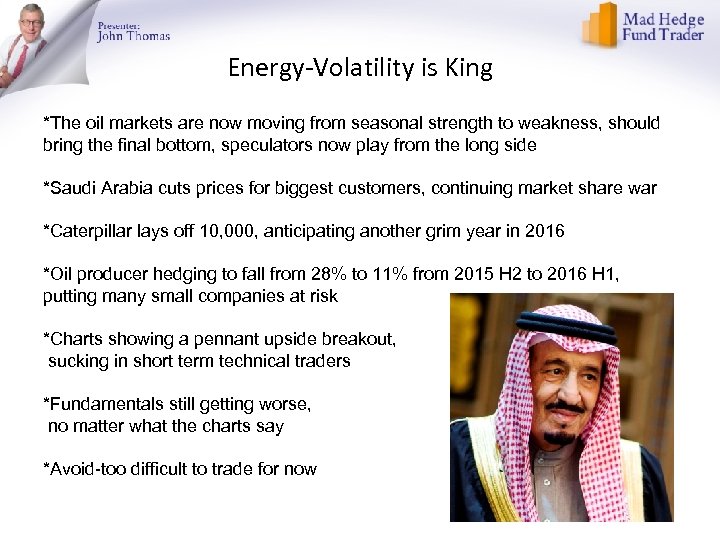

Energy-Volatility is King *The oil markets are now moving from seasonal strength to weakness, should bring the final bottom, speculators now play from the long side *Saudi Arabia cuts prices for biggest customers, continuing market share war *Caterpillar lays off 10, 000, anticipating another grim year in 2016 *Oil producer hedging to fall from 28% to 11% from 2015 H 2 to 2016 H 1, putting many small companies at risk *Charts showing a pennant upside breakout, sucking in short term technical traders *Fundamentals still getting worse, no matter what the charts say *Avoid-too difficult to trade for now

Energy-Volatility is King *The oil markets are now moving from seasonal strength to weakness, should bring the final bottom, speculators now play from the long side *Saudi Arabia cuts prices for biggest customers, continuing market share war *Caterpillar lays off 10, 000, anticipating another grim year in 2016 *Oil producer hedging to fall from 28% to 11% from 2015 H 2 to 2016 H 1, putting many small companies at risk *Charts showing a pennant upside breakout, sucking in short term technical traders *Fundamentals still getting worse, no matter what the charts say *Avoid-too difficult to trade for now

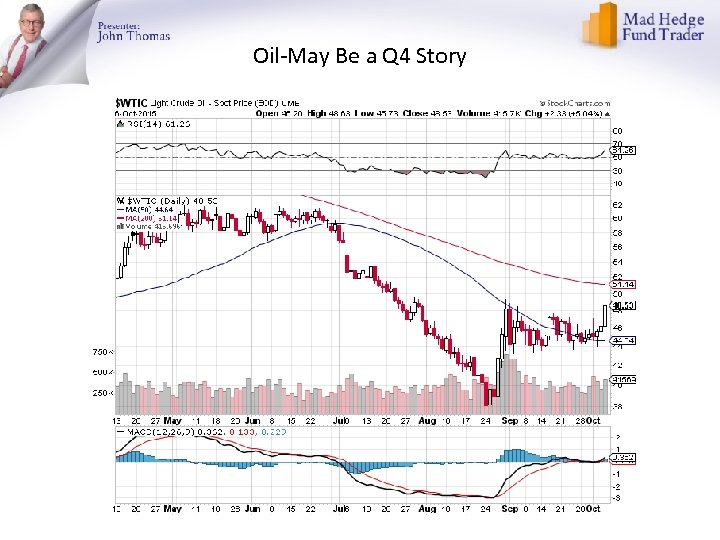

Oil-May Be a Q 4 Story

Oil-May Be a Q 4 Story

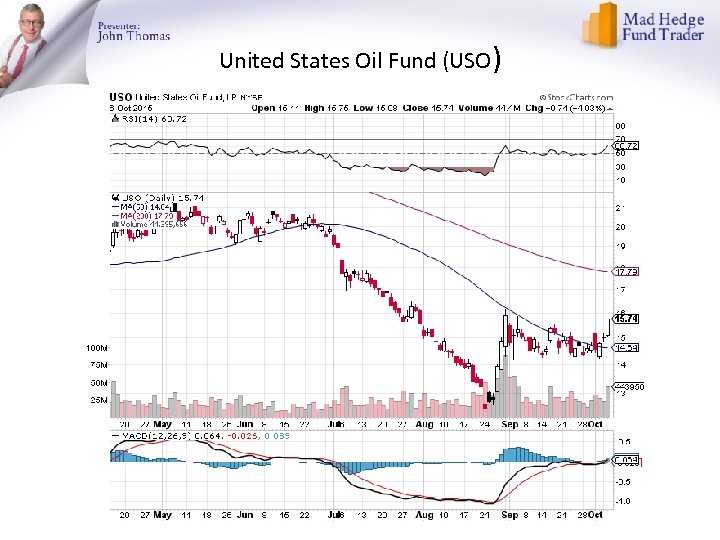

United States Oil Fund (USO)

United States Oil Fund (USO)

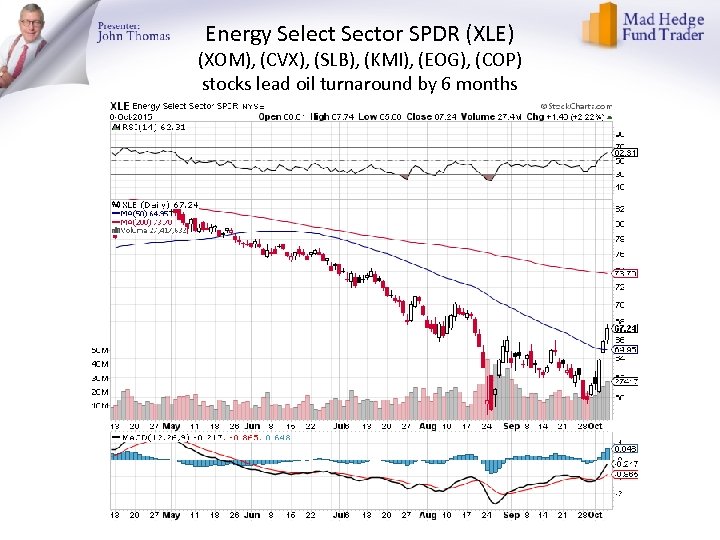

Energy Select Sector SPDR (XLE) (XOM), (CVX), (SLB), (KMI), (EOG), (COP) stocks lead oil turnaround by 6 months

Energy Select Sector SPDR (XLE) (XOM), (CVX), (SLB), (KMI), (EOG), (COP) stocks lead oil turnaround by 6 months

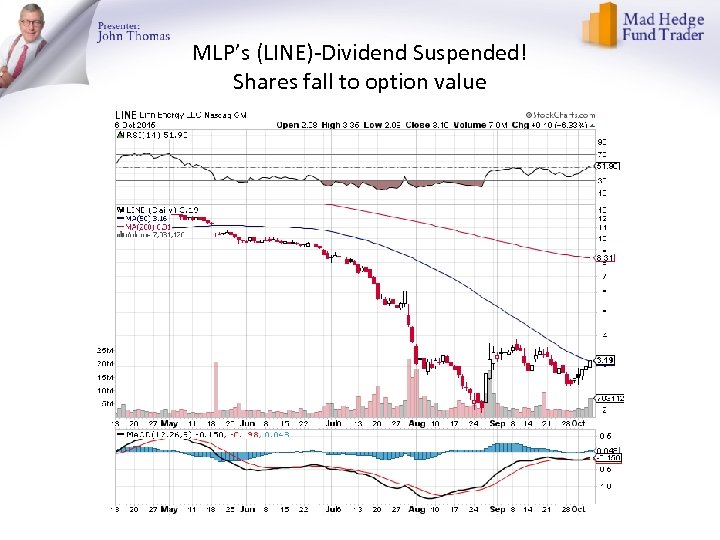

MLP’s (LINE)-Dividend Suspended! Shares fall to option value

MLP’s (LINE)-Dividend Suspended! Shares fall to option value

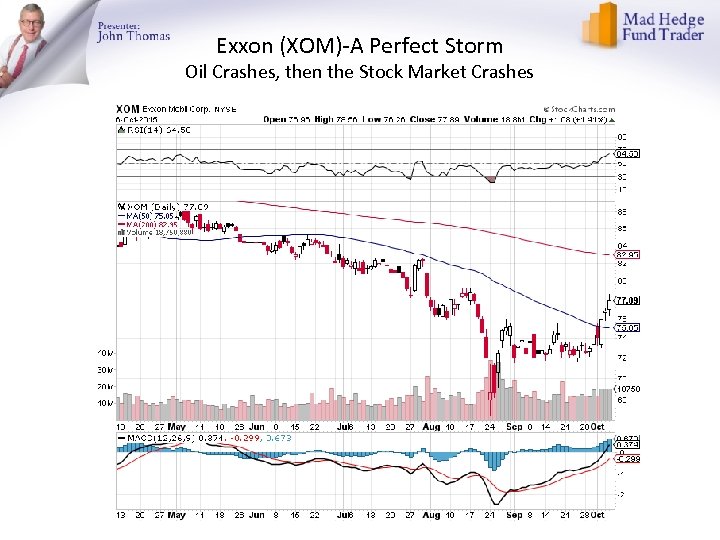

Exxon (XOM)-A Perfect Storm Oil Crashes, then the Stock Market Crashes

Exxon (XOM)-A Perfect Storm Oil Crashes, then the Stock Market Crashes

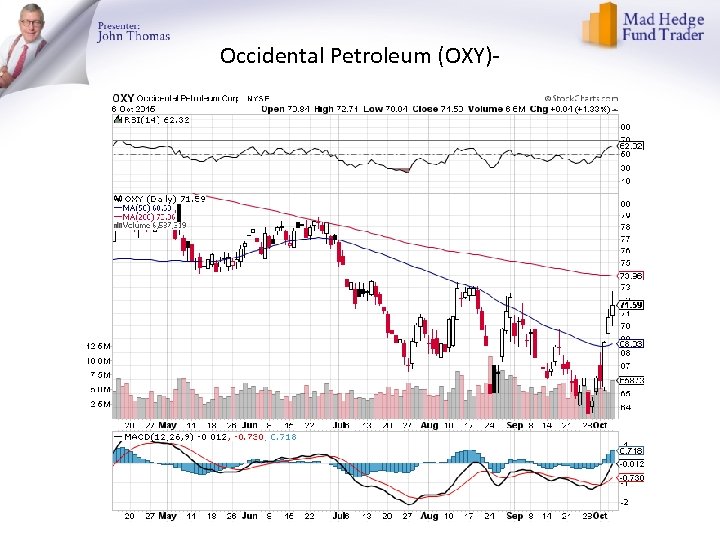

Occidental Petroleum (OXY)-

Occidental Petroleum (OXY)-

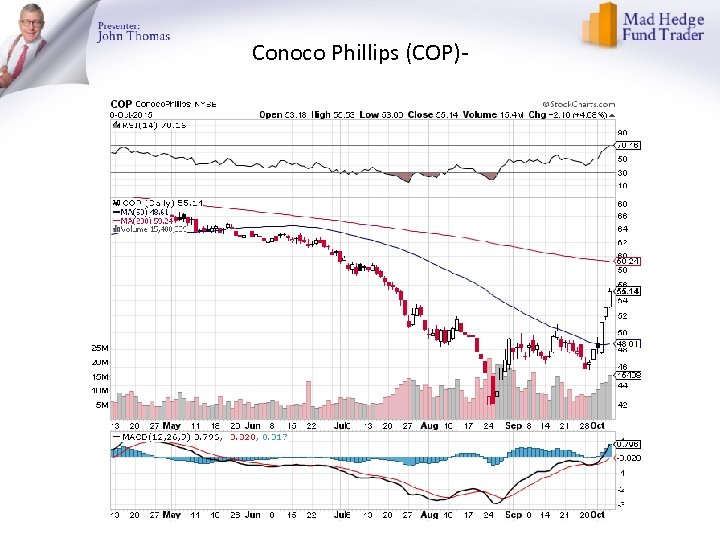

Conoco Phillips (COP)-

Conoco Phillips (COP)-

Natural Gas (UNG)-new Lows!

Natural Gas (UNG)-new Lows!

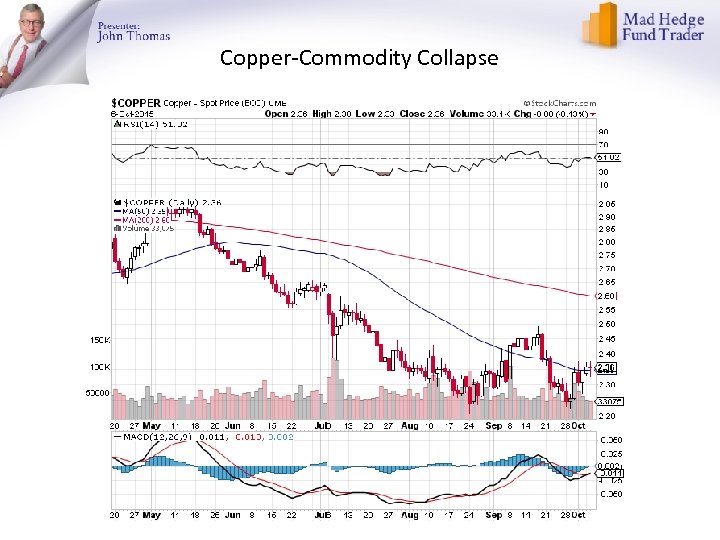

Copper-Commodity Collapse

Copper-Commodity Collapse

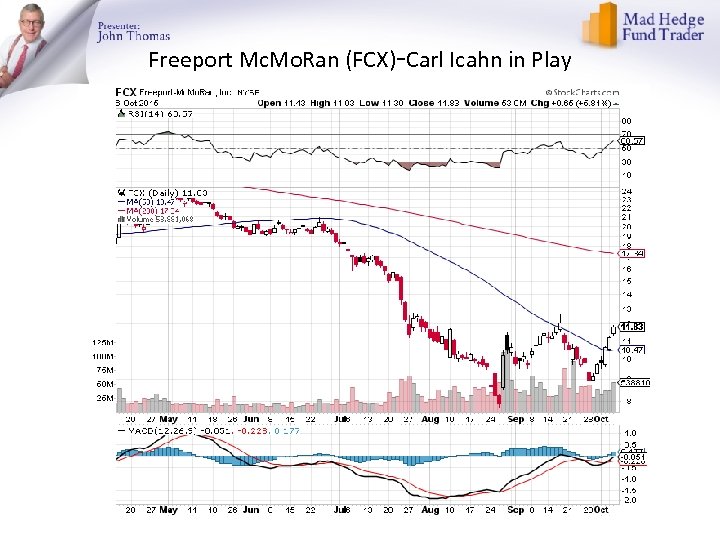

Freeport Mc. Mo. Ran (FCX)-Carl Icahn in Play

Freeport Mc. Mo. Ran (FCX)-Carl Icahn in Play

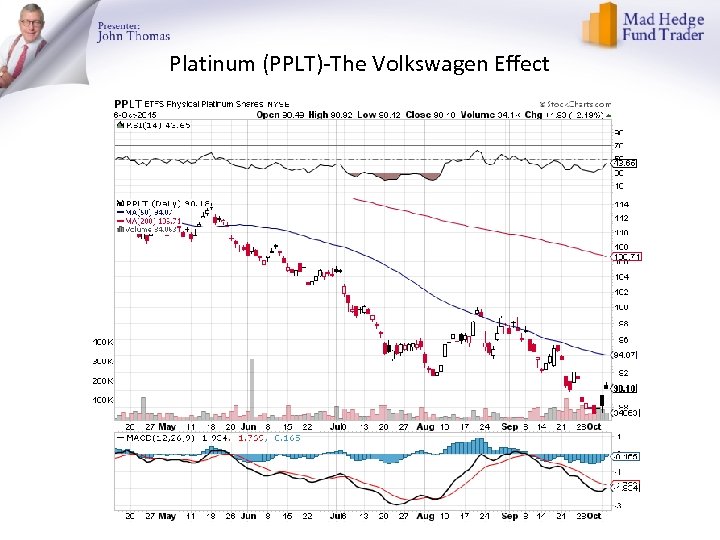

Precious Metals-Short Covering Rally *Gold Trying to bottom on the charts with a sideways pennant *Stock market short squeeze bring huge outperformance by mining stocks *VW Diesel crisis weights on platinum (PPLT) to the benefit of palladium (PALL) because diesel uses (PPLT) while gasoline engines depend on (PALL) *UAE doubles gold holding in July from 2. 53 to 4. 93 metric tonnes *Stay away, better fish to fly elsewhere

Precious Metals-Short Covering Rally *Gold Trying to bottom on the charts with a sideways pennant *Stock market short squeeze bring huge outperformance by mining stocks *VW Diesel crisis weights on platinum (PPLT) to the benefit of palladium (PALL) because diesel uses (PPLT) while gasoline engines depend on (PALL) *UAE doubles gold holding in July from 2. 53 to 4. 93 metric tonnes *Stay away, better fish to fly elsewhere

Gold (GLD)- Finally, A Flight to Safety

Gold (GLD)- Finally, A Flight to Safety

Market Vectors Gold Miners ETF- (GDX)

Market Vectors Gold Miners ETF- (GDX)

Silver (SLV)-

Silver (SLV)-

Silver Miners (SIL)

Silver Miners (SIL)

Platinum (PPLT)-The Volkswagen Effect

Platinum (PPLT)-The Volkswagen Effect

Palladium (PALL)-The Non Diesel Play

Palladium (PALL)-The Non Diesel Play

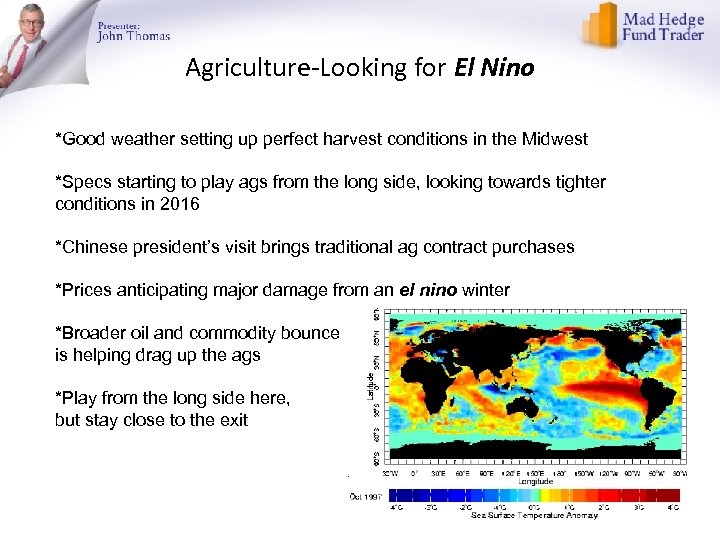

Agriculture-Looking for El Nino *Good weather setting up perfect harvest conditions in the Midwest *Specs starting to play ags from the long side, looking towards tighter conditions in 2016 *Chinese president’s visit brings traditional ag contract purchases *Prices anticipating major damage from an el nino winter *Broader oil and commodity bounce is helping drag up the ags *Play from the long side here, but stay close to the exit

Agriculture-Looking for El Nino *Good weather setting up perfect harvest conditions in the Midwest *Specs starting to play ags from the long side, looking towards tighter conditions in 2016 *Chinese president’s visit brings traditional ag contract purchases *Prices anticipating major damage from an el nino winter *Broader oil and commodity bounce is helping drag up the ags *Play from the long side here, but stay close to the exit

(CORN)

(CORN)

(WEAT)

(WEAT)

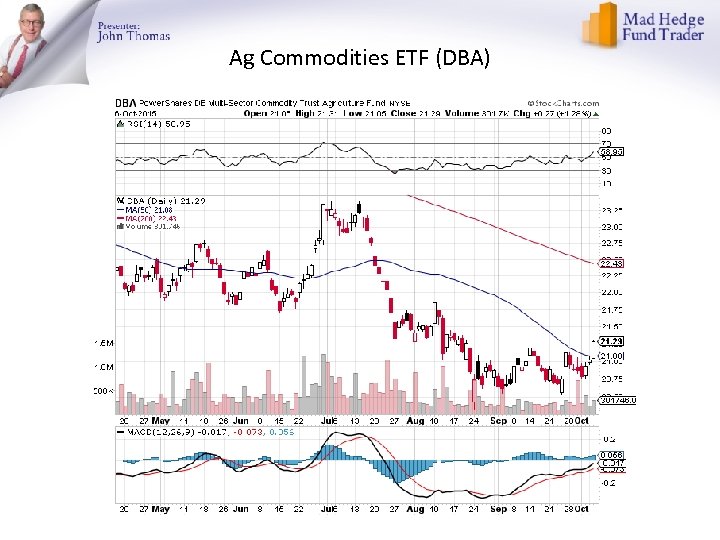

Ag Commodities ETF (DBA)

Ag Commodities ETF (DBA)

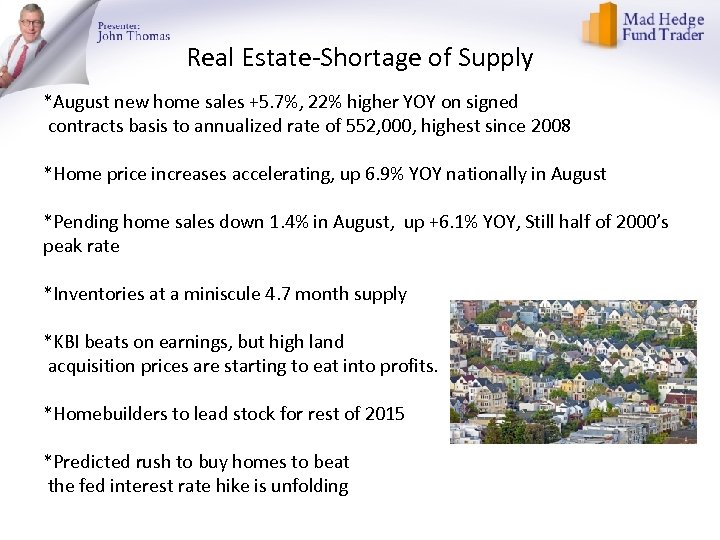

Real Estate-Shortage of Supply *August new home sales +5. 7%, 22% higher YOY on signed contracts basis to annualized rate of 552, 000, highest since 2008 *Home price increases accelerating, up 6. 9% YOY nationally in August *Pending home sales down 1. 4% in August, up +6. 1% YOY, Still half of 2000’s peak rate *Inventories at a miniscule 4. 7 month supply *KBI beats on earnings, but high land acquisition prices are starting to eat into profits. *Homebuilders to lead stock for rest of 2015 *Predicted rush to buy homes to beat the fed interest rate hike is unfolding

Real Estate-Shortage of Supply *August new home sales +5. 7%, 22% higher YOY on signed contracts basis to annualized rate of 552, 000, highest since 2008 *Home price increases accelerating, up 6. 9% YOY nationally in August *Pending home sales down 1. 4% in August, up +6. 1% YOY, Still half of 2000’s peak rate *Inventories at a miniscule 4. 7 month supply *KBI beats on earnings, but high land acquisition prices are starting to eat into profits. *Homebuilders to lead stock for rest of 2015 *Predicted rush to buy homes to beat the fed interest rate hike is unfolding

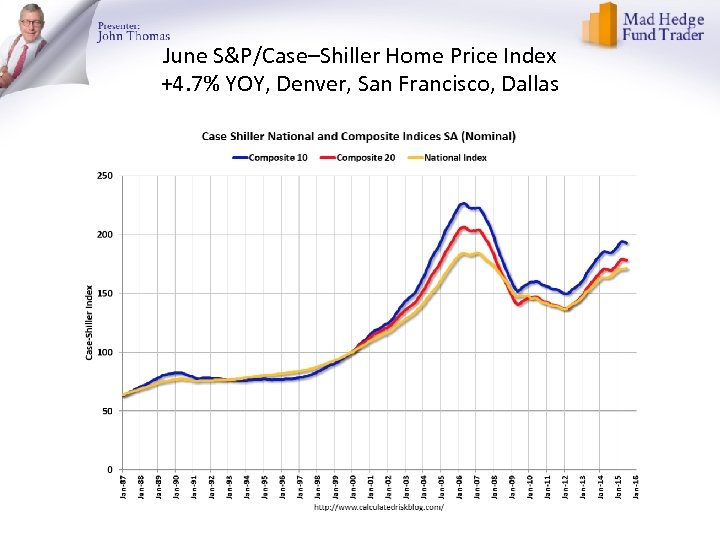

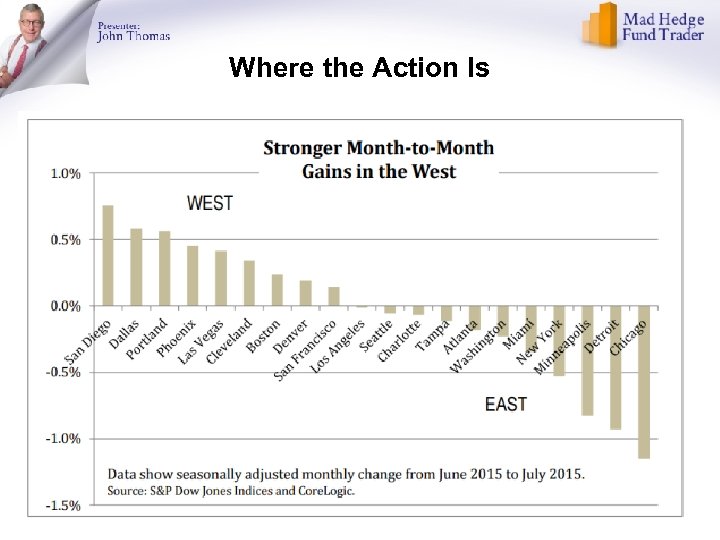

June S&P/Case–Shiller Home Price Index +4. 7% YOY, Denver, San Francisco, Dallas

June S&P/Case–Shiller Home Price Index +4. 7% YOY, Denver, San Francisco, Dallas

Where the Action Is

Where the Action Is

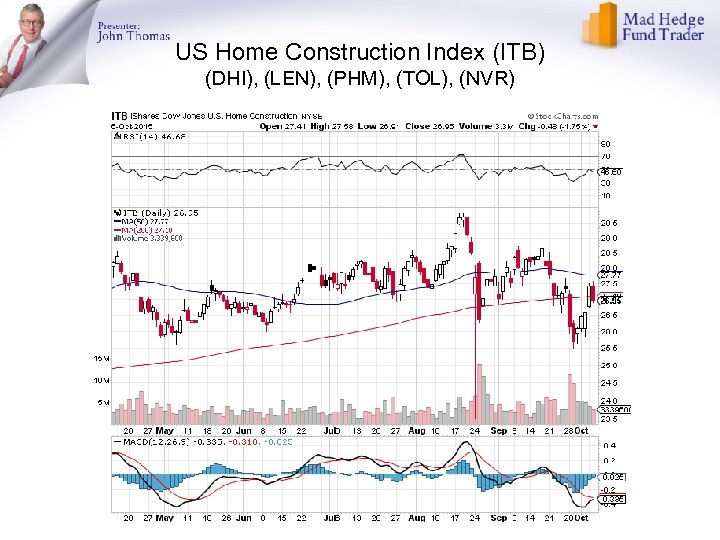

US Home Construction Index (ITB) (DHI), (LEN), (PHM), (TOL), (NVR)

US Home Construction Index (ITB) (DHI), (LEN), (PHM), (TOL), (NVR)

Trade Sheet So What Do We Do About All This? *Stocks- buy the big dips in best names only *Bonds-the top is in, sell rallies, buy (TBT) *Commodities-stand aside, buy the next oil down leg *Currencies- Sell short the Yen and Euro on rallies *Precious Metals –stand aside, wait for new low *Volatility-sell short spikes through (XIV) *The Ags –wait for new lows *Real estate-buy the homebuilders LT

Trade Sheet So What Do We Do About All This? *Stocks- buy the big dips in best names only *Bonds-the top is in, sell rallies, buy (TBT) *Commodities-stand aside, buy the next oil down leg *Currencies- Sell short the Yen and Euro on rallies *Precious Metals –stand aside, wait for new low *Volatility-sell short spikes through (XIV) *The Ags –wait for new lows *Real estate-buy the homebuilders LT

To buy strategy luncheon tickets Please go to: www. madhedgefundtrader. com Next Strategy Webinar 12: 00 EST Wednesday, October 21, 2015 Incline Village, Nevada USA! Good Luck and Good Trading!

To buy strategy luncheon tickets Please go to: www. madhedgefundtrader. com Next Strategy Webinar 12: 00 EST Wednesday, October 21, 2015 Incline Village, Nevada USA! Good Luck and Good Trading!