c70e82efaaf6b5d34fecf3a49ecd49d9.ppt

- Количество слайдов: 18

The linked movement of house price and stock price with shocks Yoon, Jae-Ho 2017. 5. 18 http: //sites. google. com/site/beowulfkorea/

The linked movement of house price and stock price with shocks Yoon, Jae-Ho 2017. 5. 18 http: //sites. google. com/site/beowulfkorea/

Ⅰ. Introduction Ⅱ. Model Ⅲ. Data Ⅳ. Empirical Results Ⅴ. Conclusion PAGE 1

Ⅰ. Introduction Ⅱ. Model Ⅲ. Data Ⅳ. Empirical Results Ⅴ. Conclusion PAGE 1

1. Introduction Motivation q The relationship between house price and stock price has been assumed to be positive and linear in the long run. q However, Okunev, J and Wilson, PJ (1997) found that real estate and equity markets are segmented with linear test, whereas the markets are fractionally integrated with nonlinear model. q Mc. Millan (2012) also found that house price and stock price are nonlinear co -integrated in the long run. The Purpose of this paper q To find out whethere are really co-movements between house price and stock price for U. S. and U. K. . PAGE 2

1. Introduction Motivation q The relationship between house price and stock price has been assumed to be positive and linear in the long run. q However, Okunev, J and Wilson, PJ (1997) found that real estate and equity markets are segmented with linear test, whereas the markets are fractionally integrated with nonlinear model. q Mc. Millan (2012) also found that house price and stock price are nonlinear co -integrated in the long run. The Purpose of this paper q To find out whethere are really co-movements between house price and stock price for U. S. and U. K. . PAGE 2

1. Introduction Methods q To establish the nonlinear relationship between house and stock price, we adopt Markov-Switching Model by Hamilton (1989) q To find the common co-movement of house price and stock price for U. S and U. K, we adopt FIML Markov-Switching Model by Yoon (2006). The findings of this paper q House price for U. S. and U. K. showed common business cycle with stock price during the 1970 s, 1990 s oil shocks periods. q House price is also procyclical in movement with stock price during 1980 s, IT bubble collapse and housing bubble burst in 2008. => International big shocks, such as oil shocks and the burst housing bubble in 2008, cause common business cycle of house price and stock price for U. S. and U. K. . PAGE 3

1. Introduction Methods q To establish the nonlinear relationship between house and stock price, we adopt Markov-Switching Model by Hamilton (1989) q To find the common co-movement of house price and stock price for U. S and U. K, we adopt FIML Markov-Switching Model by Yoon (2006). The findings of this paper q House price for U. S. and U. K. showed common business cycle with stock price during the 1970 s, 1990 s oil shocks periods. q House price is also procyclical in movement with stock price during 1980 s, IT bubble collapse and housing bubble burst in 2008. => International big shocks, such as oil shocks and the burst housing bubble in 2008, cause common business cycle of house price and stock price for U. S. and U. K. . PAGE 3

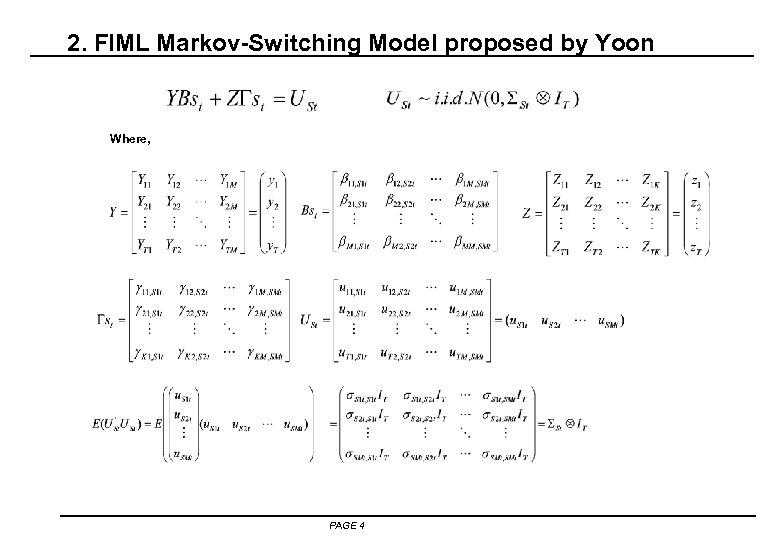

2. FIML Markov-Switching Model proposed by Yoon Where, PAGE 4

2. FIML Markov-Switching Model proposed by Yoon Where, PAGE 4

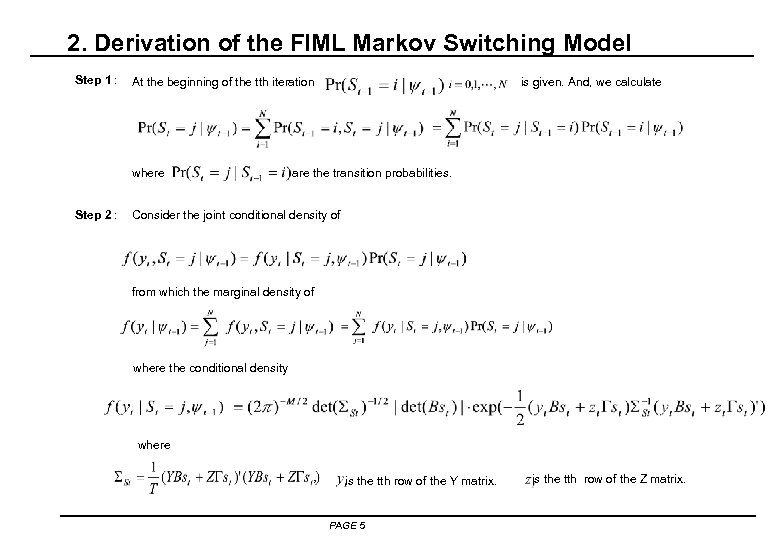

2. Derivation of the FIML Markov Switching Model Step 1 : where Step 2 : is given. And, we calculate At the beginning of the tth iteration are the transition probabilities. Consider the joint conditional density of from which the marginal density of where the conditional density where , is the tth row of the Y matrix. PAGE 5 is the tth row of the Z matrix.

2. Derivation of the FIML Markov Switching Model Step 1 : where Step 2 : is given. And, we calculate At the beginning of the tth iteration are the transition probabilities. Consider the joint conditional density of from which the marginal density of where the conditional density where , is the tth row of the Y matrix. PAGE 5 is the tth row of the Z matrix.

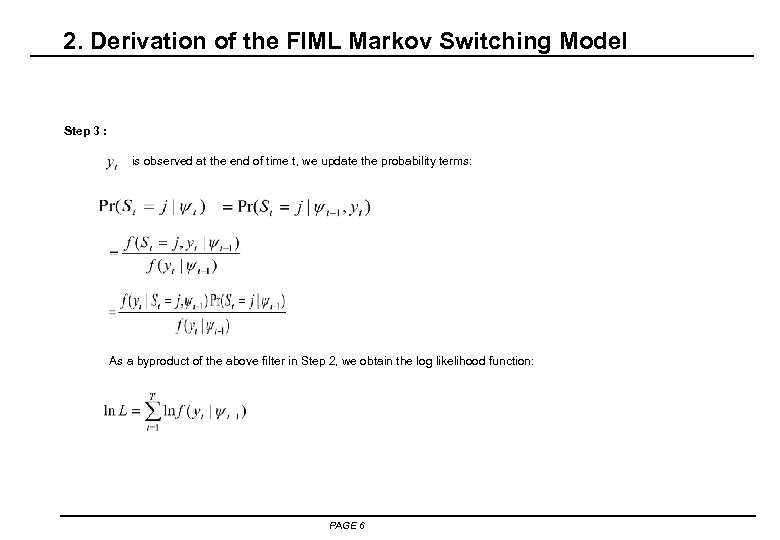

2. Derivation of the FIML Markov Switching Model Step 3 : is observed at the end of time t, we update the probability terms: As a byproduct of the above filter in Step 2, we obtain the log likelihood function: PAGE 6

2. Derivation of the FIML Markov Switching Model Step 3 : is observed at the end of time t, we update the probability terms: As a byproduct of the above filter in Step 2, we obtain the log likelihood function: PAGE 6

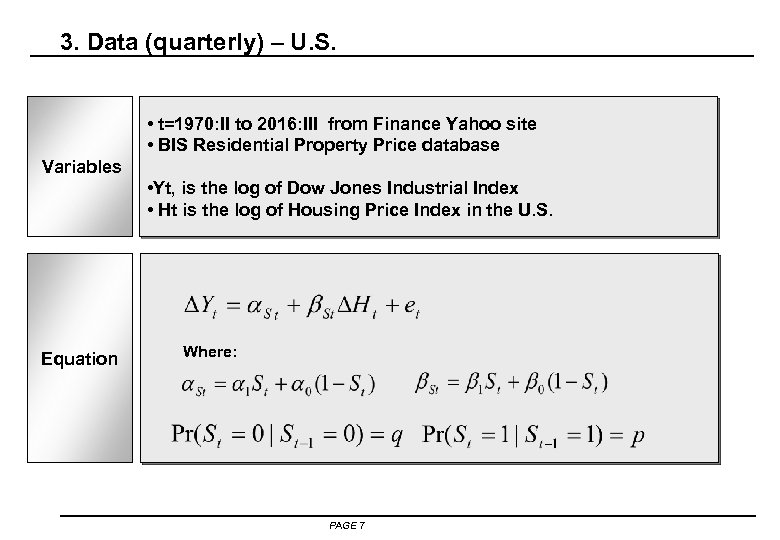

3. Data (quarterly) – U. S. • t=1970: II to 2016: III from Finance Yahoo site • BIS Residential Property Price database Variables • Yt, is the log of Dow Jones Industrial Index • Ht is the log of Housing Price Index in the U. S. Equation Where: PAGE 7

3. Data (quarterly) – U. S. • t=1970: II to 2016: III from Finance Yahoo site • BIS Residential Property Price database Variables • Yt, is the log of Dow Jones Industrial Index • Ht is the log of Housing Price Index in the U. S. Equation Where: PAGE 7

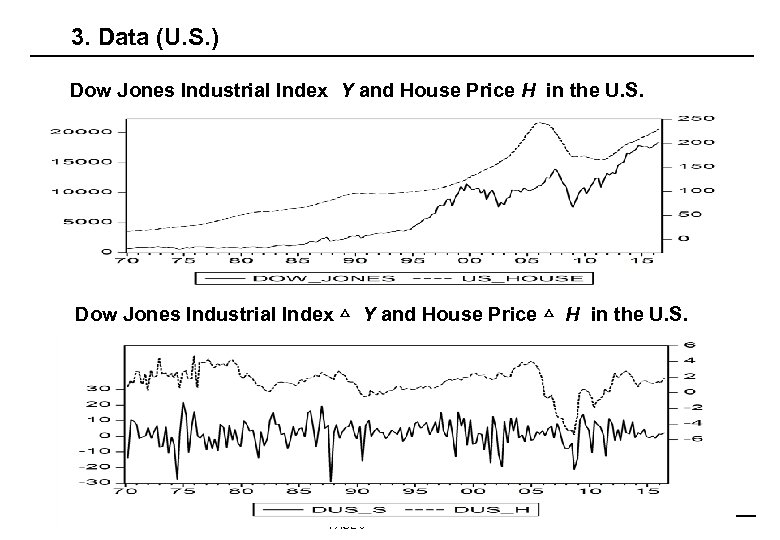

3. Data (U. S. ) Dow Jones Industrial Index Y and House Price H in the U. S. Dow Jones Industrial Index △ Y and House Price △ H in the U. S. PAGE 8

3. Data (U. S. ) Dow Jones Industrial Index Y and House Price H in the U. S. Dow Jones Industrial Index △ Y and House Price △ H in the U. S. PAGE 8

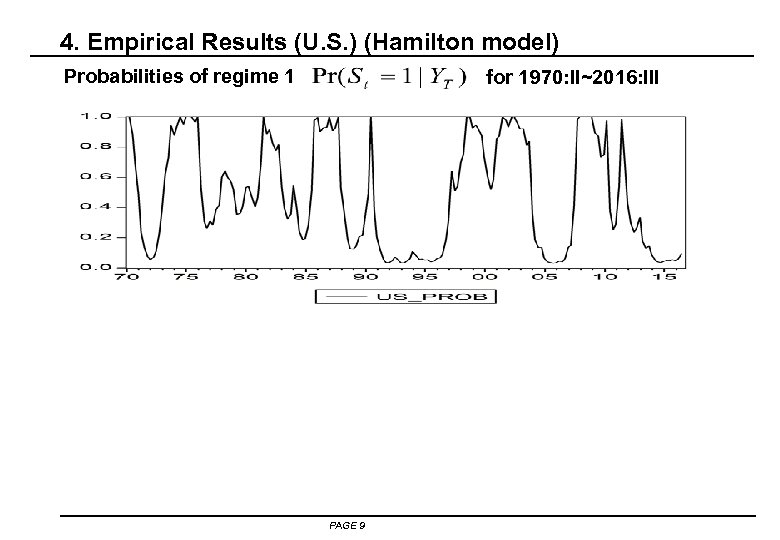

4. Empirical Results (U. S. ) (Hamilton model) Probabilities of regime 1 for 1970: II~2016: III PAGE 9

4. Empirical Results (U. S. ) (Hamilton model) Probabilities of regime 1 for 1970: II~2016: III PAGE 9

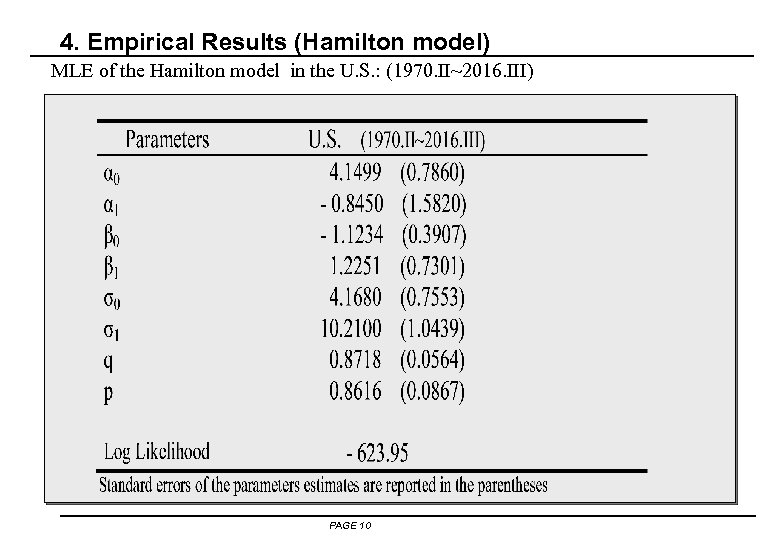

4. Empirical Results (Hamilton model) MLE of the Hamilton model in the U. S. : (1970. II~2016. III) PAGE 10

4. Empirical Results (Hamilton model) MLE of the Hamilton model in the U. S. : (1970. II~2016. III) PAGE 10

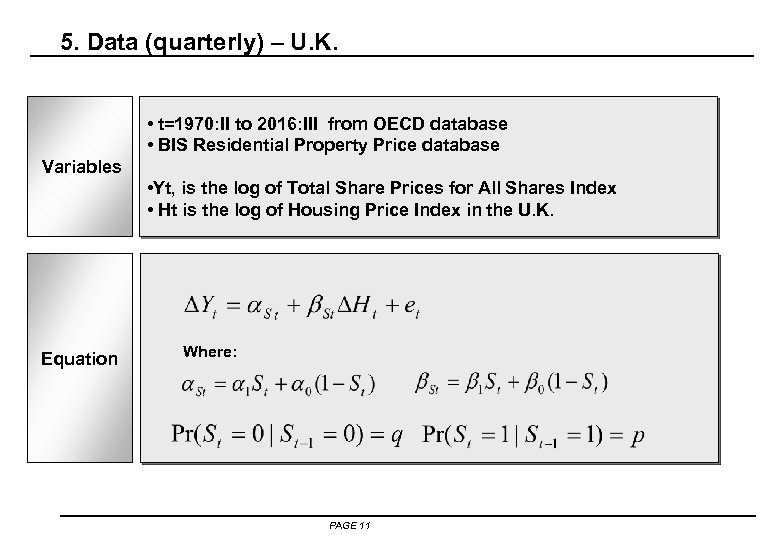

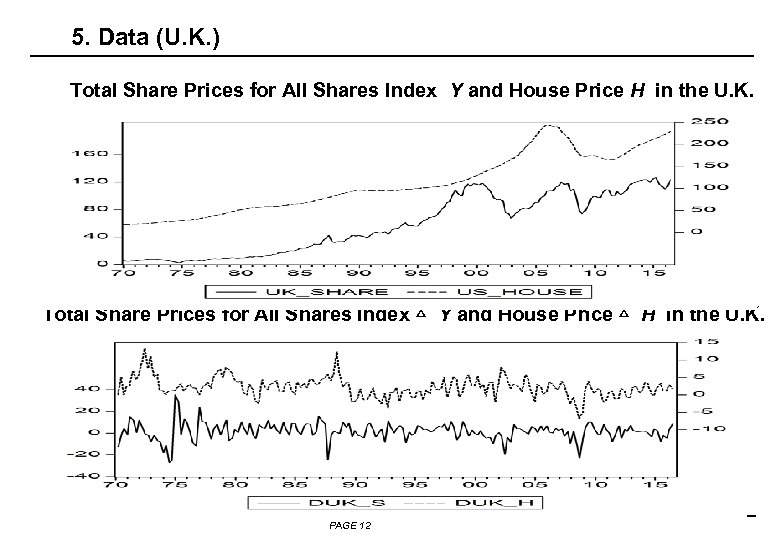

5. Data (quarterly) – U. K. • t=1970: II to 2016: III from OECD database • BIS Residential Property Price database Variables • Yt, is the log of Total Share Prices for All Shares Index • Ht is the log of Housing Price Index in the U. K. Equation Where: PAGE 11

5. Data (quarterly) – U. K. • t=1970: II to 2016: III from OECD database • BIS Residential Property Price database Variables • Yt, is the log of Total Share Prices for All Shares Index • Ht is the log of Housing Price Index in the U. K. Equation Where: PAGE 11

5. Data (U. K. ) Total Share Prices for All Shares Index Y and House Price H in the U. K. Total Share Prices for All Shares Index △ Y and House Price △ H in the U. K. PAGE 12

5. Data (U. K. ) Total Share Prices for All Shares Index Y and House Price H in the U. K. Total Share Prices for All Shares Index △ Y and House Price △ H in the U. K. PAGE 12

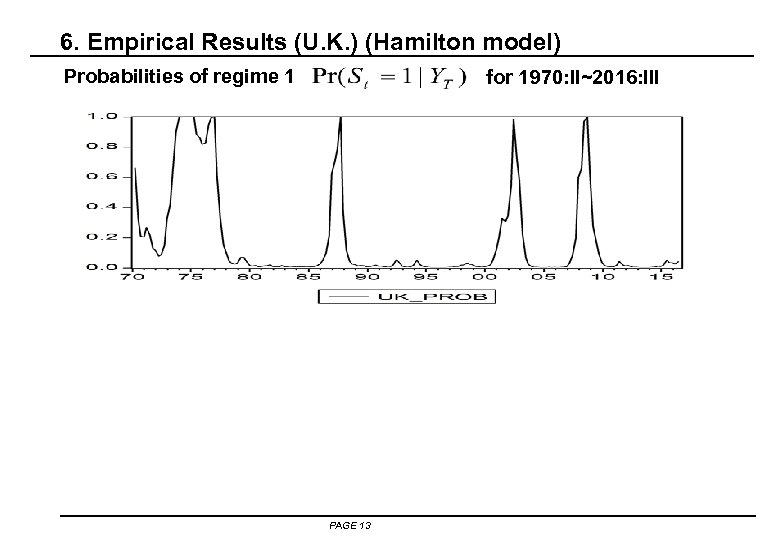

6. Empirical Results (U. K. ) (Hamilton model) Probabilities of regime 1 for 1970: II~2016: III PAGE 13

6. Empirical Results (U. K. ) (Hamilton model) Probabilities of regime 1 for 1970: II~2016: III PAGE 13

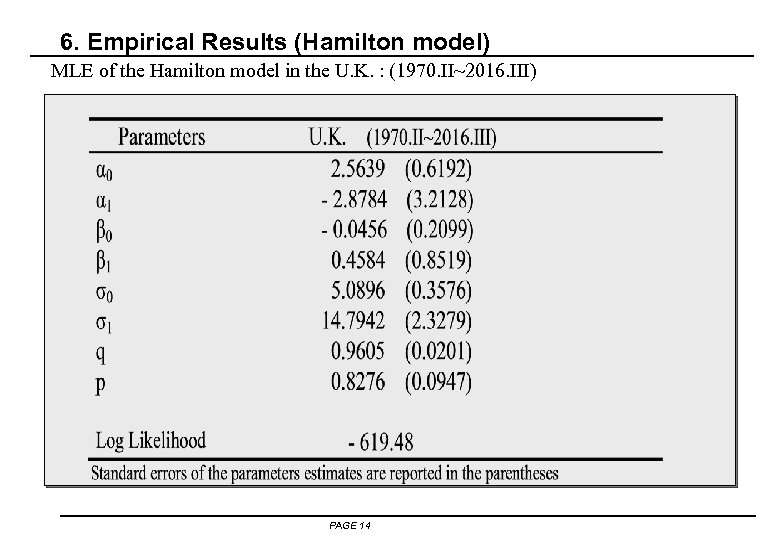

6. Empirical Results (Hamilton model) MLE of the Hamilton model in the U. K. : (1970. II~2016. III) PAGE 14

6. Empirical Results (Hamilton model) MLE of the Hamilton model in the U. K. : (1970. II~2016. III) PAGE 14

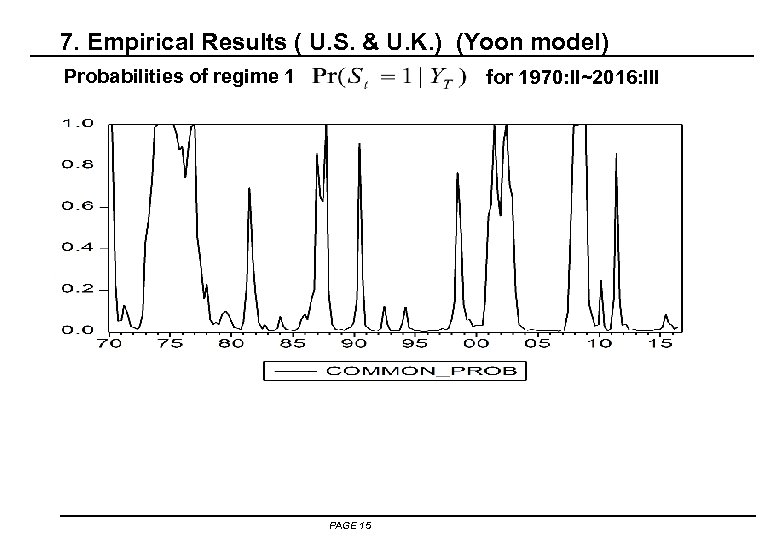

7. Empirical Results ( U. S. & U. K. ) (Yoon model) Probabilities of regime 1 for 1970: II~2016: III PAGE 15

7. Empirical Results ( U. S. & U. K. ) (Yoon model) Probabilities of regime 1 for 1970: II~2016: III PAGE 15

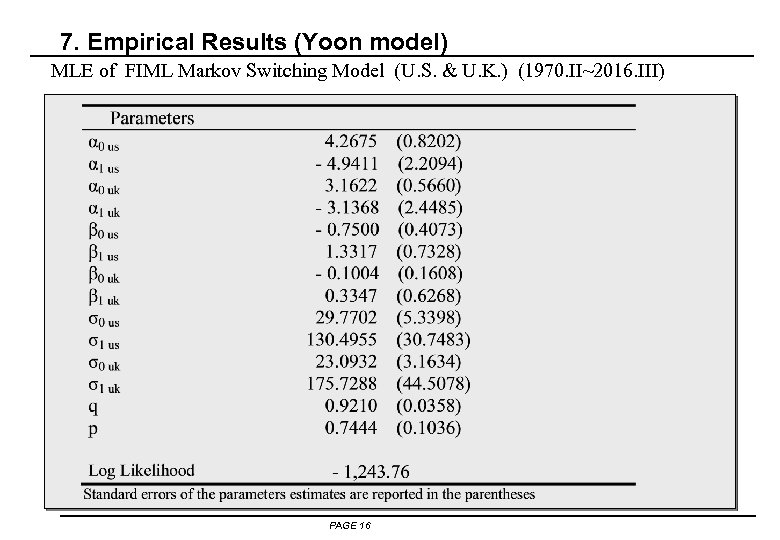

7. Empirical Results (Yoon model) MLE of FIML Markov Switching Model (U. S. & U. K. ) (1970. II~2016. III) PAGE 16

7. Empirical Results (Yoon model) MLE of FIML Markov Switching Model (U. S. & U. K. ) (1970. II~2016. III) PAGE 16

8. Conclusion • The findings of this paper are as follows: house price is procyclical in movement with stock price during 1970 s’ and 1990 s’ oil shocks periods, and house price is also procyclical in movement with stock price during 1980 s, IT bubble collapse and financial shock in 2008. • These results showed that international big shocks, such as oil shocks and the burst housing bubble in 2008, cause common business cycle of house price and stock price for U. S. and U. K. . PAGE 17

8. Conclusion • The findings of this paper are as follows: house price is procyclical in movement with stock price during 1970 s’ and 1990 s’ oil shocks periods, and house price is also procyclical in movement with stock price during 1980 s, IT bubble collapse and financial shock in 2008. • These results showed that international big shocks, such as oil shocks and the burst housing bubble in 2008, cause common business cycle of house price and stock price for U. S. and U. K. . PAGE 17