e2ff27851d7d04a11bd33f22a22c152e.ppt

- Количество слайдов: 29

The limits of finance-led capitalism in the US Trevor Evans Berlin School of Economics and Law

The limits of finance-led capitalism in the US Trevor Evans Berlin School of Economics and Law

Key features of US economy since 1980 • Strengthened position of financial sector • Major corporations plan globally; outsourcing • Redistribution of income to top • Dependence on credit expansion (and asset bubbles) sustained by expansionary monetary (& fiscal) policy • Net inflows of financial capital

Key features of US economy since 1980 • Strengthened position of financial sector • Major corporations plan globally; outsourcing • Redistribution of income to top • Dependence on credit expansion (and asset bubbles) sustained by expansionary monetary (& fiscal) policy • Net inflows of financial capital

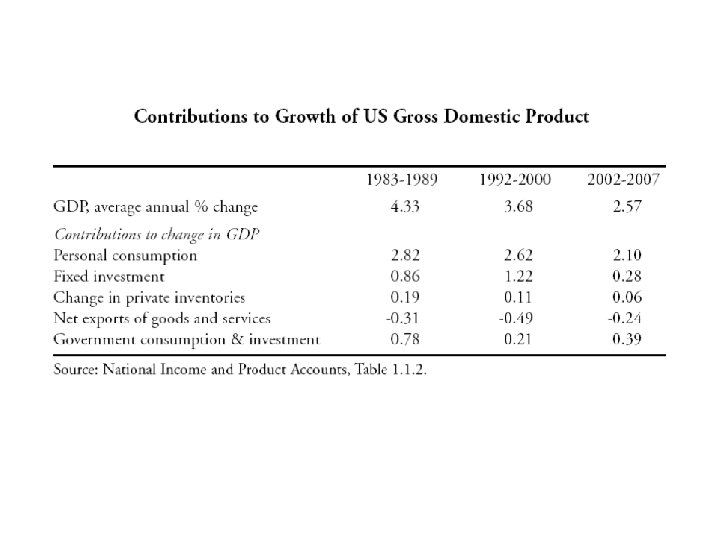

The rhythm of growth

The rhythm of growth

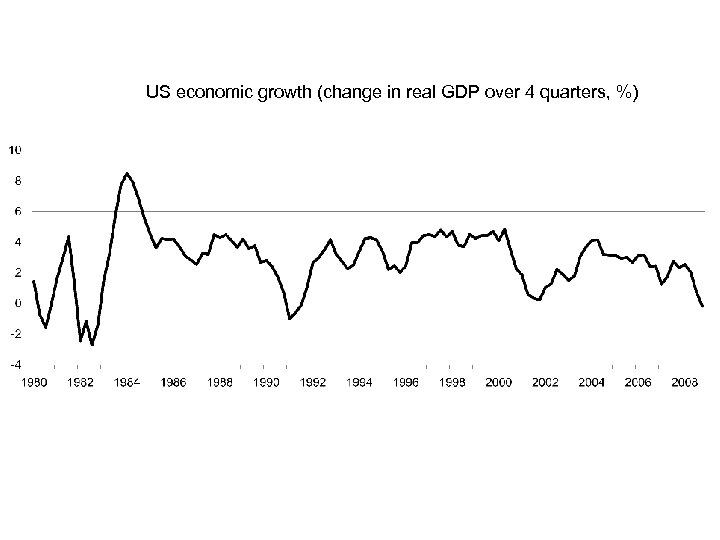

US economic growth (change in real GDP over 4 quarters, %)

US economic growth (change in real GDP over 4 quarters, %)

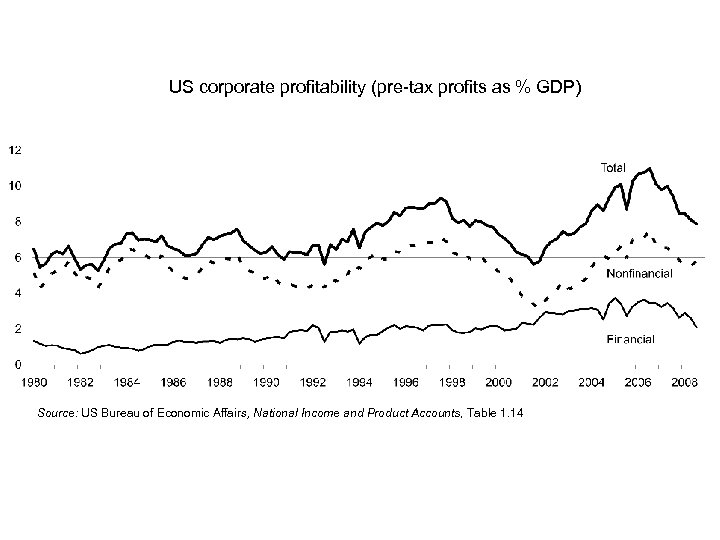

Corporate profitability & investment

Corporate profitability & investment

US corporate profitability (pre-tax profits as % GDP) Source: US Bureau of Economic Affairs, National Income and Product Accounts, Table 1. 14

US corporate profitability (pre-tax profits as % GDP) Source: US Bureau of Economic Affairs, National Income and Product Accounts, Table 1. 14

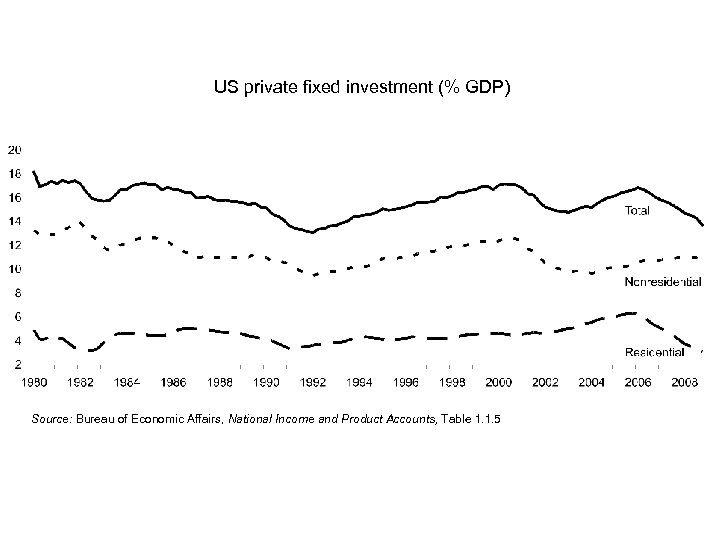

US private fixed investment (% GDP) Source: Bureau of Economic Affairs, National Income and Product Accounts, Table 1. 1. 5

US private fixed investment (% GDP) Source: Bureau of Economic Affairs, National Income and Product Accounts, Table 1. 1. 5

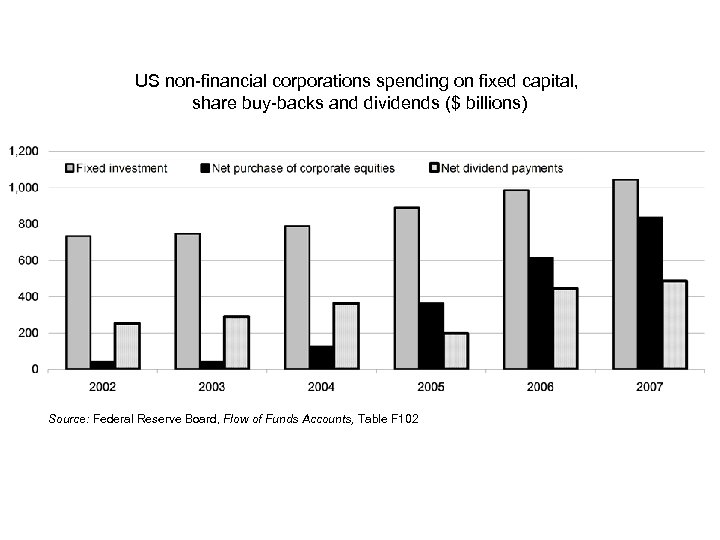

US non-financial corporations spending on fixed capital, share buy-backs and dividends ($ billions) Source: Federal Reserve Board, Flow of Funds Accounts, Table F 102

US non-financial corporations spending on fixed capital, share buy-backs and dividends ($ billions) Source: Federal Reserve Board, Flow of Funds Accounts, Table F 102

Employment & income

Employment & income

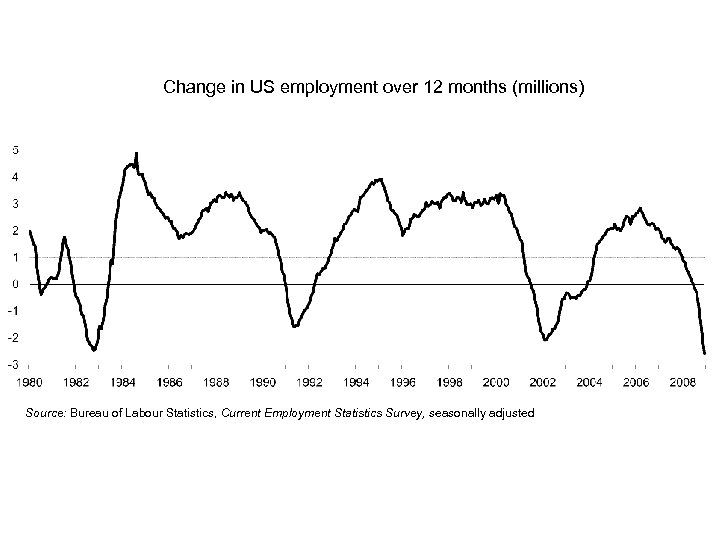

Change in US employment over 12 months (millions) Source: Bureau of Labour Statistics, Current Employment Statistics Survey, seasonally adjusted

Change in US employment over 12 months (millions) Source: Bureau of Labour Statistics, Current Employment Statistics Survey, seasonally adjusted

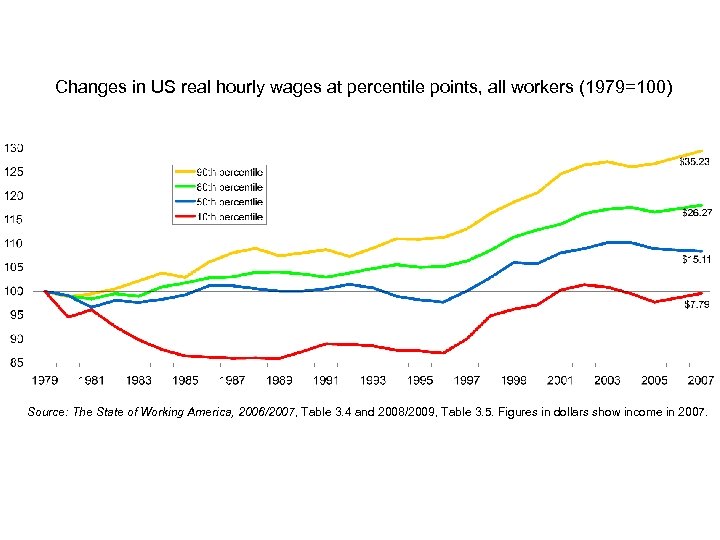

Changes in US real hourly wages at percentile points, all workers (1979=100) Source: The State of Working America, 2006/2007, Table 3. 4 and 2008/2009, Table 3. 5. Figures in dollars show income in 2007.

Changes in US real hourly wages at percentile points, all workers (1979=100) Source: The State of Working America, 2006/2007, Table 3. 4 and 2008/2009, Table 3. 5. Figures in dollars show income in 2007.

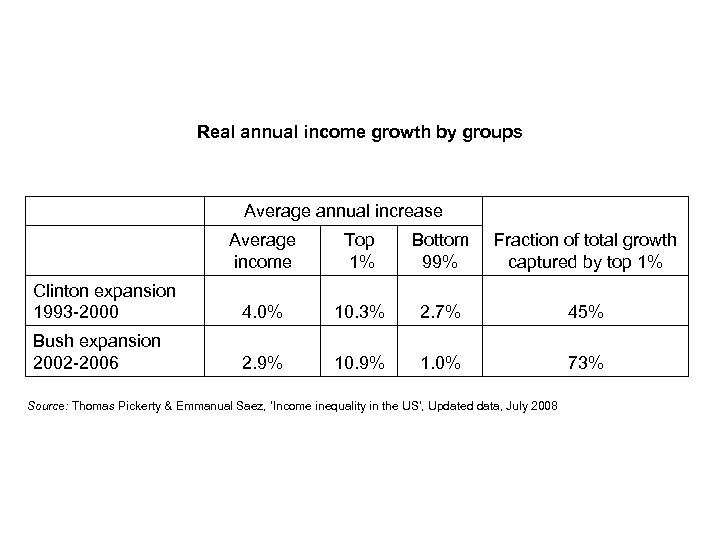

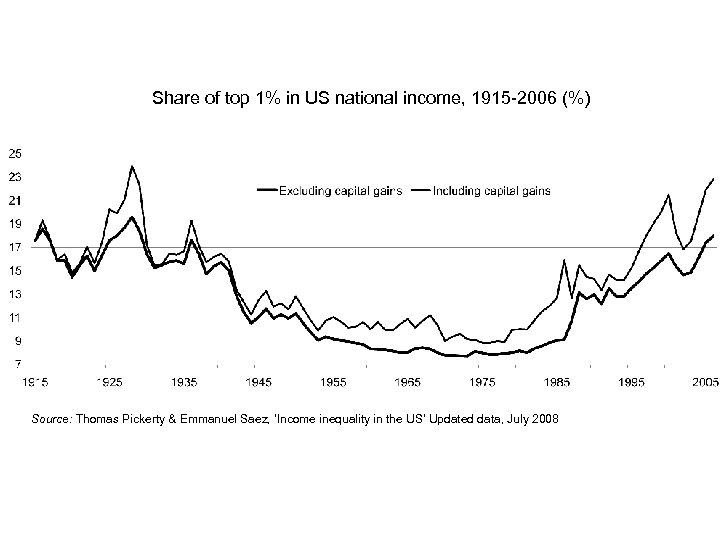

Real annual income growth by groups Average annual increase Average income Top 1% Bottom 99% Fraction of total growth captured by top 1% Clinton expansion 1993 -2000 4. 0% 10. 3% 2. 7% 45% Bush expansion 2002 -2006 2. 9% 10. 9% 1. 0% 73% Source: Thomas Pickerty & Emmanual Saez, ‘Income inequality in the US’, Updated data, July 2008

Real annual income growth by groups Average annual increase Average income Top 1% Bottom 99% Fraction of total growth captured by top 1% Clinton expansion 1993 -2000 4. 0% 10. 3% 2. 7% 45% Bush expansion 2002 -2006 2. 9% 10. 9% 1. 0% 73% Source: Thomas Pickerty & Emmanual Saez, ‘Income inequality in the US’, Updated data, July 2008

Share of top 1% in US national income, 1915 -2006 (%) Source: Thomas Pickerty & Emmanuel Saez, ‘Income inequality in the US’ Updated data, July 2008

Share of top 1% in US national income, 1915 -2006 (%) Source: Thomas Pickerty & Emmanuel Saez, ‘Income inequality in the US’ Updated data, July 2008

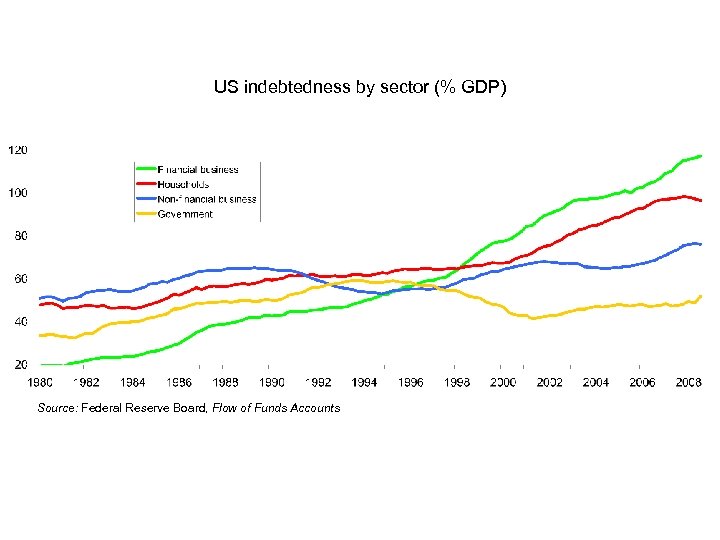

US indebtedness by sector (% GDP) Source: Federal Reserve Board, Flow of Funds Accounts

US indebtedness by sector (% GDP) Source: Federal Reserve Board, Flow of Funds Accounts

The Crisis

The Crisis

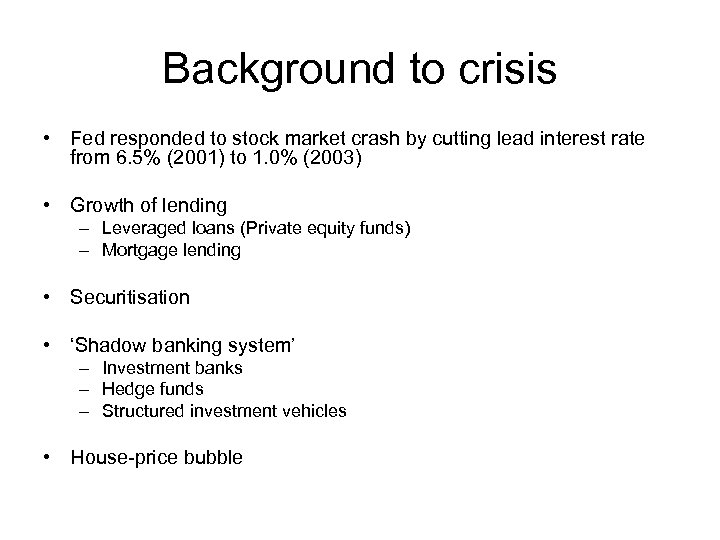

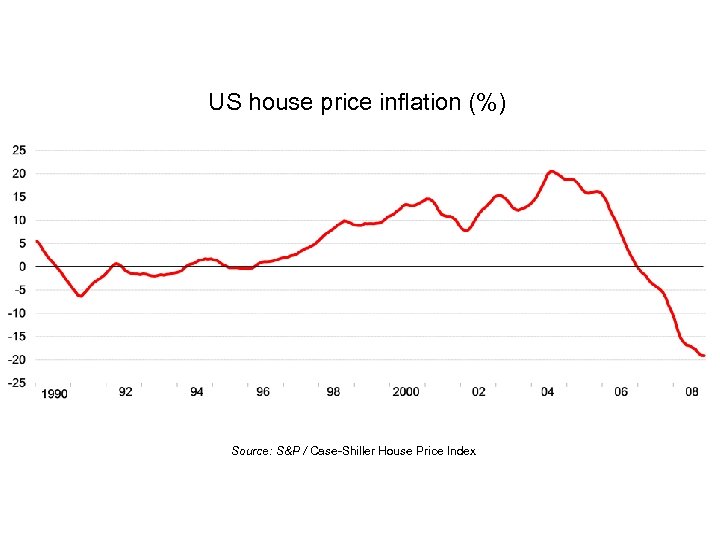

Background to crisis • Fed responded to stock market crash by cutting lead interest rate from 6. 5% (2001) to 1. 0% (2003) • Growth of lending – Leveraged loans (Private equity funds) – Mortgage lending • Securitisation • ‘Shadow banking system’ – Investment banks – Hedge funds – Structured investment vehicles • House-price bubble

Background to crisis • Fed responded to stock market crash by cutting lead interest rate from 6. 5% (2001) to 1. 0% (2003) • Growth of lending – Leveraged loans (Private equity funds) – Mortgage lending • Securitisation • ‘Shadow banking system’ – Investment banks – Hedge funds – Structured investment vehicles • House-price bubble

US house price inflation (%) Source: S&P / Case-Shiller House Price Index

US house price inflation (%) Source: S&P / Case-Shiller House Price Index

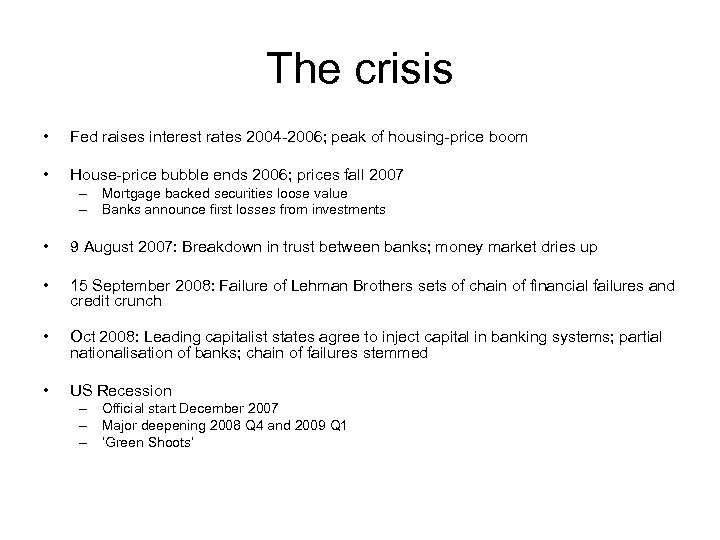

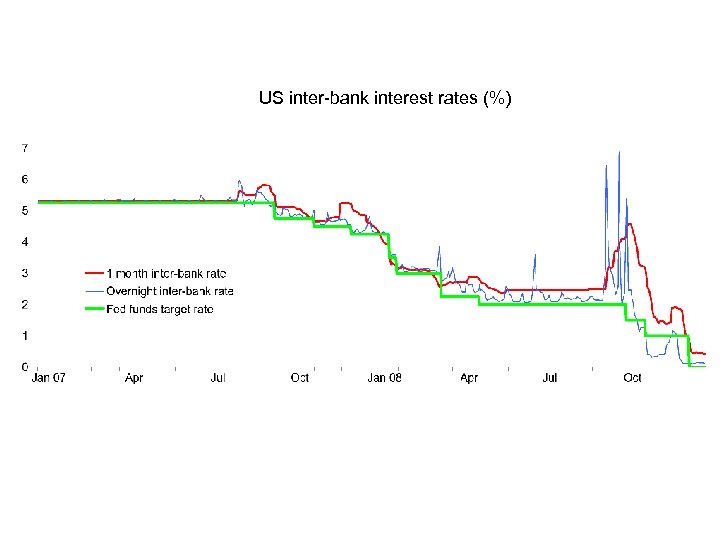

The crisis • Fed raises interest rates 2004 -2006; peak of housing-price boom • House-price bubble ends 2006; prices fall 2007 – Mortgage backed securities loose value – Banks announce first losses from investments • 9 August 2007: Breakdown in trust between banks; money market dries up • 15 September 2008: Failure of Lehman Brothers sets of chain of financial failures and credit crunch • Oct 2008: Leading capitalist states agree to inject capital in banking systems; partial nationalisation of banks; chain of failures stemmed • US Recession – Official start December 2007 – Major deepening 2008 Q 4 and 2009 Q 1 – ‘Green Shoots’

The crisis • Fed raises interest rates 2004 -2006; peak of housing-price boom • House-price bubble ends 2006; prices fall 2007 – Mortgage backed securities loose value – Banks announce first losses from investments • 9 August 2007: Breakdown in trust between banks; money market dries up • 15 September 2008: Failure of Lehman Brothers sets of chain of financial failures and credit crunch • Oct 2008: Leading capitalist states agree to inject capital in banking systems; partial nationalisation of banks; chain of failures stemmed • US Recession – Official start December 2007 – Major deepening 2008 Q 4 and 2009 Q 1 – ‘Green Shoots’

US inter-bank interest rates (%)

US inter-bank interest rates (%)

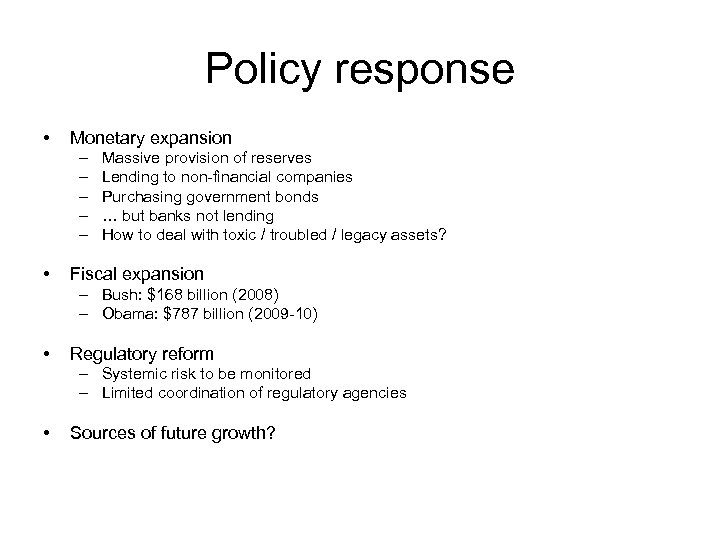

Policy response • Monetary expansion – – – • Massive provision of reserves Lending to non-financial companies Purchasing government bonds … but banks not lending How to deal with toxic / troubled / legacy assets? Fiscal expansion – Bush: $168 billion (2008) – Obama: $787 billion (2009 -10) • Regulatory reform – Systemic risk to be monitored – Limited coordination of regulatory agencies • Sources of future growth?

Policy response • Monetary expansion – – – • Massive provision of reserves Lending to non-financial companies Purchasing government bonds … but banks not lending How to deal with toxic / troubled / legacy assets? Fiscal expansion – Bush: $168 billion (2008) – Obama: $787 billion (2009 -10) • Regulatory reform – Systemic risk to be monitored – Limited coordination of regulatory agencies • Sources of future growth?

International transmission

International transmission

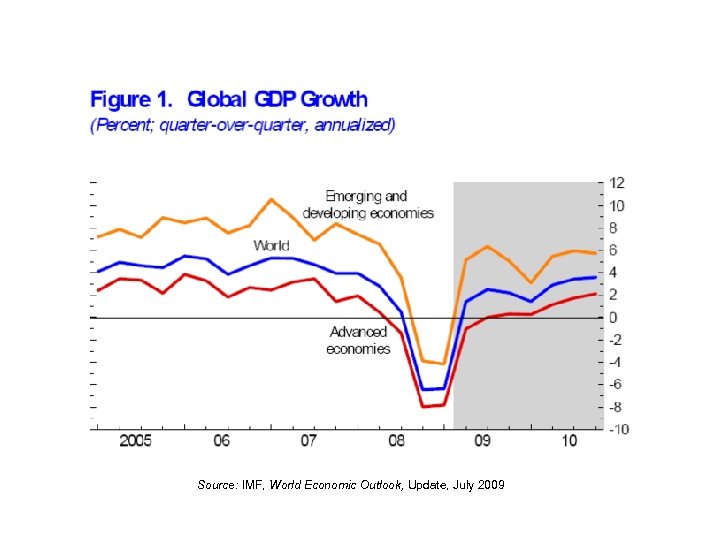

Source: IMF, World Economic Outlook, Update, July 2009

Source: IMF, World Economic Outlook, Update, July 2009

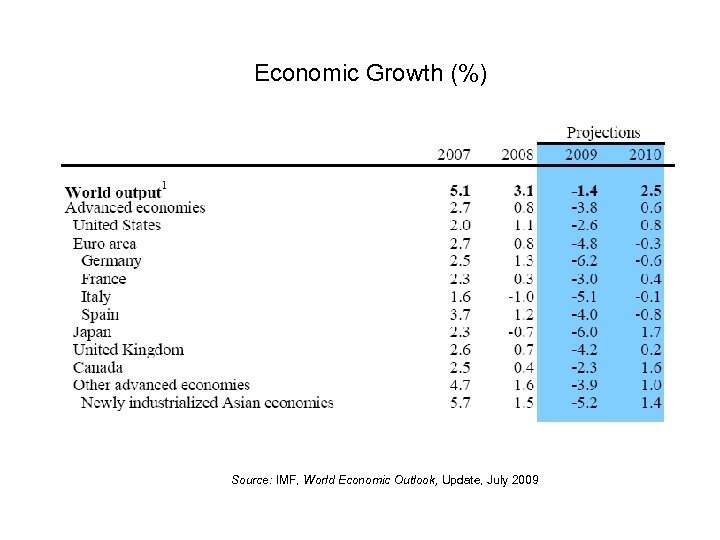

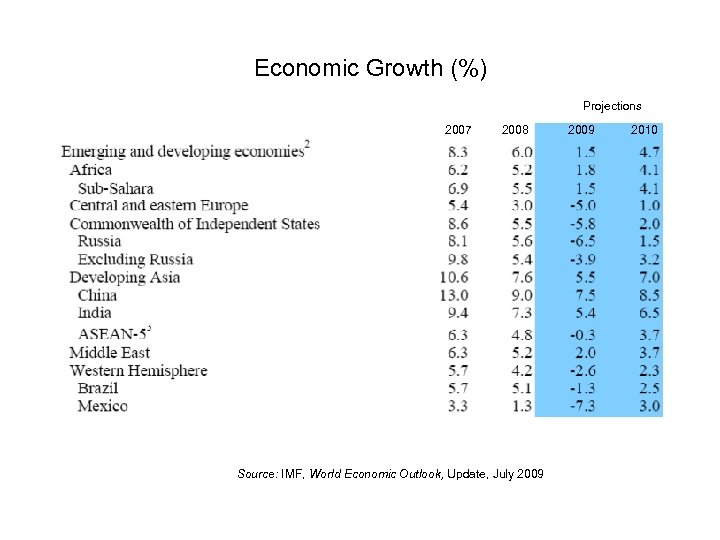

Economic Growth (%) Source: IMF, World Economic Outlook, Update, July 2009

Economic Growth (%) Source: IMF, World Economic Outlook, Update, July 2009

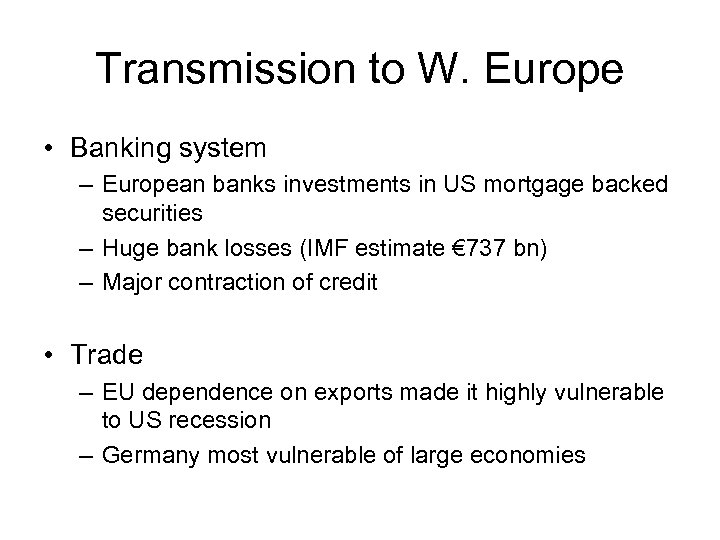

Transmission to W. Europe • Banking system – European banks investments in US mortgage backed securities – Huge bank losses (IMF estimate € 737 bn) – Major contraction of credit • Trade – EU dependence on exports made it highly vulnerable to US recession – Germany most vulnerable of large economies

Transmission to W. Europe • Banking system – European banks investments in US mortgage backed securities – Huge bank losses (IMF estimate € 737 bn) – Major contraction of credit • Trade – EU dependence on exports made it highly vulnerable to US recession – Germany most vulnerable of large economies

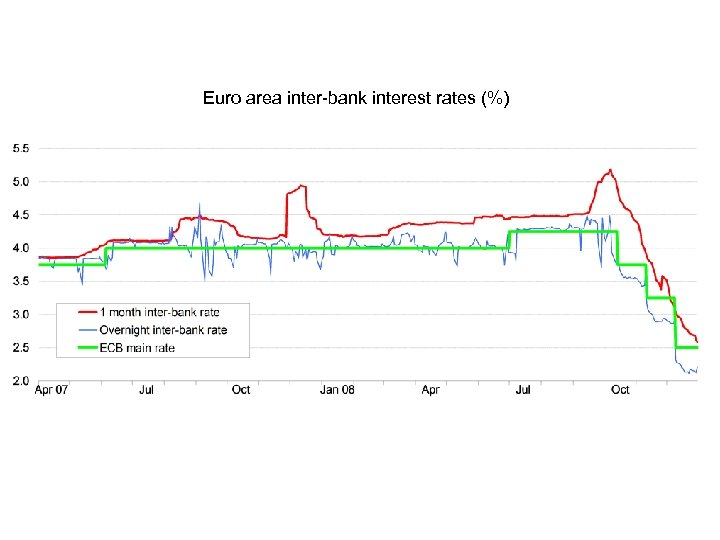

Euro area inter-bank interest rates (%)

Euro area inter-bank interest rates (%)

Transmission to E. Europe • Financing current account deficits – Hungary – Baltic states (Estonia, Latvia, Lithuania) • Contraction of credit by W. European owned banks • Exports to W. Europe – Czech Republic – Slovakia – Slovenia

Transmission to E. Europe • Financing current account deficits – Hungary – Baltic states (Estonia, Latvia, Lithuania) • Contraction of credit by W. European owned banks • Exports to W. Europe – Czech Republic – Slovakia – Slovenia

Transmission to rest of world • Demand for manufactured goods in US and Europe (Japan, China, India …) • Primary commodity prices – Oil (Russia, Middle East, Venezuela) – Mineral & agricultural products (Latin America, Africa) • Remittances (Mexico, Central America, Indonesia, India)

Transmission to rest of world • Demand for manufactured goods in US and Europe (Japan, China, India …) • Primary commodity prices – Oil (Russia, Middle East, Venezuela) – Mineral & agricultural products (Latin America, Africa) • Remittances (Mexico, Central America, Indonesia, India)

Economic Growth (%) Projections 2007 2008 Source: IMF, World Economic Outlook, Update, July 2009 2010

Economic Growth (%) Projections 2007 2008 Source: IMF, World Economic Outlook, Update, July 2009 2010