2947cf44cfb2b1c01fcb02ba4f50752e.ppt

- Количество слайдов: 20

The Lemonade Stand Creating a Business

Step #2: Lemonade Stand Expenses • Start-up Costs • Variable Costs • Fixed Costs

Start-Up Costs • Start-Up Costs – the amount of money required to start your business. – Brainstorm: • What items will you need to start your business? • Estimate how much each item will cost.

Variable Costs • Variable Costs – how much it costs to make or buy each product you plan to sell. – Ex: Retailer of neckties buys each tie at wholesale for $5. 00. • Variable Cost per unit (per tie) = $5. 00 – Ex: Retailer of neckties buys 10 ties at wholesale for $5. 00 • Total Variable Cost (10 / 5. 00) = $50. 00

Variable Costs • Most businesses keep track of their variable costs as they sell their products. • Ex: If you sold 20 ties, you would say you have a variable cost of $100. 00 – It’s called variable cost because the total cost varies depending on how many products you sell. • Ex: Buy 20 @ $5. 00; only sell 15 – VCP = $75. 00 – Lemonade Stand • Variable cost per unit = 1 cup of lemonade

Variable Costs • Activity: – Make a list of all ingredients that make up one cup of lemonade. – Next to each item, write down how much you will need to make each cup. – Calculate how much each cup of lemonade will cost you to make.

Fixed Costs • Fixed Costs – the costs a business has to pay on a regular basis. Fixed costs are not directly related to how many products you sell. – Ex: Telephone bill, rent payment – Keep fixed costs low; the higher the fixed costs, the more you have to sell in order to make enough money just to pay your bills! – Overhead – the total of your fixed costs

Fixed Costs • • • U = Utilities (telephone, electricity) S = Salaries A = Advertising (flyers & posters each month) I = Insurance I = Interest (only if you borrowed money for start-up R = Rent (free; business is at home) • Lemonade Stand Fixed Expenses = $20 adv.

Tips to Remember “Do what it takes to set yourself apart from others” • Final Project: When you make your lemonade stand, you will have to differentiate yourself from your competition to make the most profit by the end of the class.

Step #3: Don’t Let Your Business Go Sour! • REVENUE – the money brought into a business. – Ex: A pizzeria owner sells pizza for $1. 00 per slice. • Revenue per unit is $1. 00 – Ex: If he sells 22 slices in one day, his revenue for the day is $22. 00

Pricing • In order to calculate revenue, you must first set the selling price. • #1: Consider your variable cost per unit. Selling price must be higher to make a profit. – Keystoning – selling the product for double the cost • Ex: Lemonade costs $. 10 per unit; sell at $. 20

Procedure for Setting Prices • A. Begin with a list of suggested prices for selling lemonade • B. Estimate the total number of cups of lemonade you might sell at each price • C. Calculate potential profit for each price – See graph on board for example

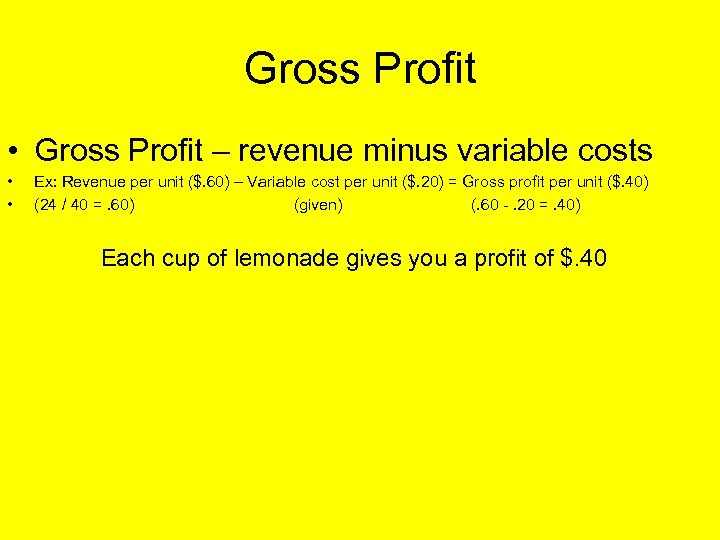

Gross Profit • Gross Profit – revenue minus variable costs • • Ex: Revenue per unit ($. 60) – Variable cost per unit ($. 20) = Gross profit per unit ($. 40) (24 / 40 =. 60) (given) (. 60 -. 20 =. 40) Each cup of lemonade gives you a profit of $. 40

Tip of the Day • Every business person should know how many products the business must sell each month in order to stay in business.

Break-Even Formula • Break-Even Point in Units: • Total Monthly Fixed Costs/Gross Profit per unit • (Sales Price per unit-Variable cost per unit) • Lemonade Stand: $20/$. 40 = 50 • In other words: You must sell 50 cups of lemonade each month to “break-even” • Break-Even Point in Dollars: • Break-Even Point in Units x Sales Price per Unit • Lemonade Stand: 50 x. 60 = $30. 00

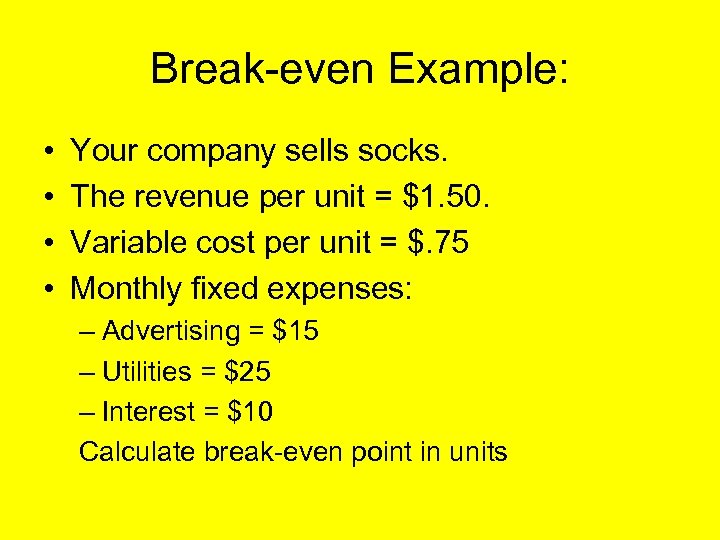

Break-even Example: • • Your company sells socks. The revenue per unit = $1. 50. Variable cost per unit = $. 75 Monthly fixed expenses: – Advertising = $15 – Utilities = $25 – Interest = $10 Calculate break-even point in units

Answer: • • 1. 50 -. 75 =. 75 15 + 25 + 10 = 50 50 / $. 75 = 66. 7 You must sell 66. 7 (or) 67 socks each month to break-even.

Step #4: The Bottom Line • Sales Forecast - how many products you can sale in a given time period • Sales Forecast Example: – See overhead

#5: The Income Statement • Income Statement – a financial statement that indicates how much money a business earns or loses during a particular period. – Also know as profit and loss statement

2947cf44cfb2b1c01fcb02ba4f50752e.ppt