69b0a4be0145587037b13acbf934a384.ppt

- Количество слайдов: 22

The IPO Process

The IPO Process

Why Do Companies Go Public? • • • Fund Growth Plans Currency for M&A Recap (retire debt) Liquidity Employee compensation Enhanced Image – Landlords – Creditors/Suppliers – Recruiting/Retention

Why Do Companies Go Public? • • • Fund Growth Plans Currency for M&A Recap (retire debt) Liquidity Employee compensation Enhanced Image – Landlords – Creditors/Suppliers – Recruiting/Retention

Underwriter’s Criteria Company Characteristics • • • Growth Prospects Predictability of Results Management Team Historical Track Record – Size; Profitability First Mover Advantage Sponsorship

Underwriter’s Criteria Company Characteristics • • • Growth Prospects Predictability of Results Management Team Historical Track Record – Size; Profitability First Mover Advantage Sponsorship

Underwriter’s Criteria Sector/Market Characteristics • • • Overall Size Growth Rate Competitive Dynamics Comparable Companies’ Performance Institutional Appetite

Underwriter’s Criteria Sector/Market Characteristics • • • Overall Size Growth Rate Competitive Dynamics Comparable Companies’ Performance Institutional Appetite

Underwriter’s Criteria IPO Market Conditions • • • Backlog Cash Inflows to Mutual Funds Deals Pricing Below/Within/Above Range Withdrawn vs. Completed Offerings Market Performance of Recent IPOs Stable Economic Climate

Underwriter’s Criteria IPO Market Conditions • • • Backlog Cash Inflows to Mutual Funds Deals Pricing Below/Within/Above Range Withdrawn vs. Completed Offerings Market Performance of Recent IPOs Stable Economic Climate

Underwriter’s Criteria Firm Focus • • • Research Expertise Distribution Capabilities Corporate Finance Focus Chemistry Geography (retail offices)

Underwriter’s Criteria Firm Focus • • • Research Expertise Distribution Capabilities Corporate Finance Focus Chemistry Geography (retail offices)

Selecting Underwriters • Types of Investment Banks • Lead vs. Co-managers • Distribution Capabilities – Institutional, Retail, International • After Market Support – Research – Trading • Ongoing Corporate Finance Support • Culture of Firm

Selecting Underwriters • Types of Investment Banks • Lead vs. Co-managers • Distribution Capabilities – Institutional, Retail, International • After Market Support – Research – Trading • Ongoing Corporate Finance Support • Culture of Firm

Lead Manager • Orchestrates Drafting, Due Diligence, Syndicate, Sales, After Market • Negotiates Fee Split • Allocates Shares • Leads Pricing Call • 15% Over Allotment Option

Lead Manager • Orchestrates Drafting, Due Diligence, Syndicate, Sales, After Market • Negotiates Fee Split • Allocates Shares • Leads Pricing Call • 15% Over Allotment Option

Fee Structure • Gross Spread - 7% – Management Fee – Underwriting Fee – Selling Consession • Jump Ball • Fixed Fee

Fee Structure • Gross Spread - 7% – Management Fee – Underwriting Fee – Selling Consession • Jump Ball • Fixed Fee

Pitch Book • • Executive Summary Capital Markets Update Company Positioning Valuation Structure and Timing of IPO Process Track Record of Investment Bank Team Members…Commitment References

Pitch Book • • Executive Summary Capital Markets Update Company Positioning Valuation Structure and Timing of IPO Process Track Record of Investment Bank Team Members…Commitment References

Organizational Meeting • Participants – Company Counsel – Underwriters (two or more) – Underwriter’s Counsel – Company’s Accountants

Organizational Meeting • Participants – Company Counsel – Underwriters (two or more) – Underwriter’s Counsel – Company’s Accountants

Organizational Meeting • • • Transaction Issues Due Diligence Interviews Document Request List Facility and/or Store Tours Initial Drafting – Outline Story – Position the Company • Schedule of Key Dates

Organizational Meeting • • • Transaction Issues Due Diligence Interviews Document Request List Facility and/or Store Tours Initial Drafting – Outline Story – Position the Company • Schedule of Key Dates

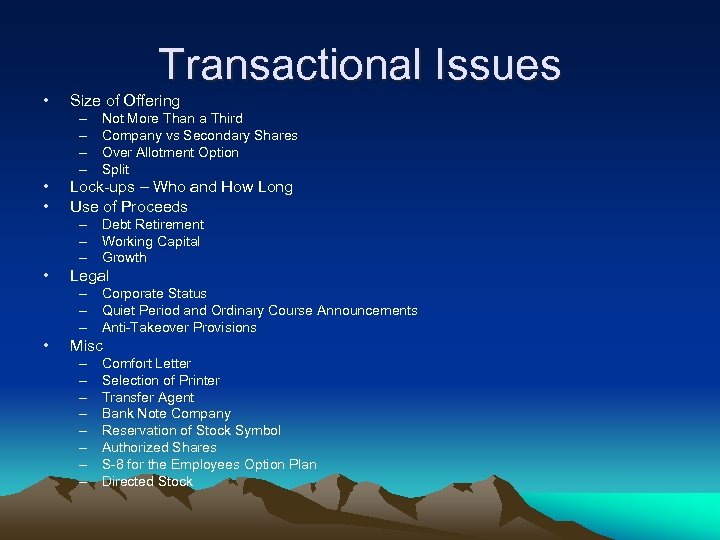

Transactional Issues • Size of Offering – – • • Not More Than a Third Company vs Secondary Shares Over Allotment Option Split Lock-ups – Who and How Long Use of Proceeds – Debt Retirement – Working Capital – Growth • Legal – Corporate Status – Quiet Period and Ordinary Course Announcements – Anti-Takeover Provisions • Misc – – – – Comfort Letter Selection of Printer Transfer Agent Bank Note Company Reservation of Stock Symbol Authorized Shares S-8 for the Employees Option Plan Directed Stock

Transactional Issues • Size of Offering – – • • Not More Than a Third Company vs Secondary Shares Over Allotment Option Split Lock-ups – Who and How Long Use of Proceeds – Debt Retirement – Working Capital – Growth • Legal – Corporate Status – Quiet Period and Ordinary Course Announcements – Anti-Takeover Provisions • Misc – – – – Comfort Letter Selection of Printer Transfer Agent Bank Note Company Reservation of Stock Symbol Authorized Shares S-8 for the Employees Option Plan Directed Stock

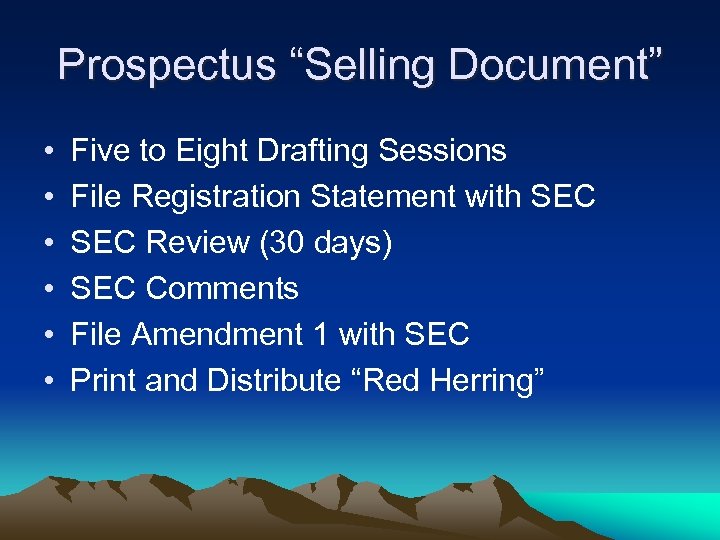

Prospectus “Selling Document” • • • Five to Eight Drafting Sessions File Registration Statement with SEC Review (30 days) SEC Comments File Amendment 1 with SEC Print and Distribute “Red Herring”

Prospectus “Selling Document” • • • Five to Eight Drafting Sessions File Registration Statement with SEC Review (30 days) SEC Comments File Amendment 1 with SEC Print and Distribute “Red Herring”

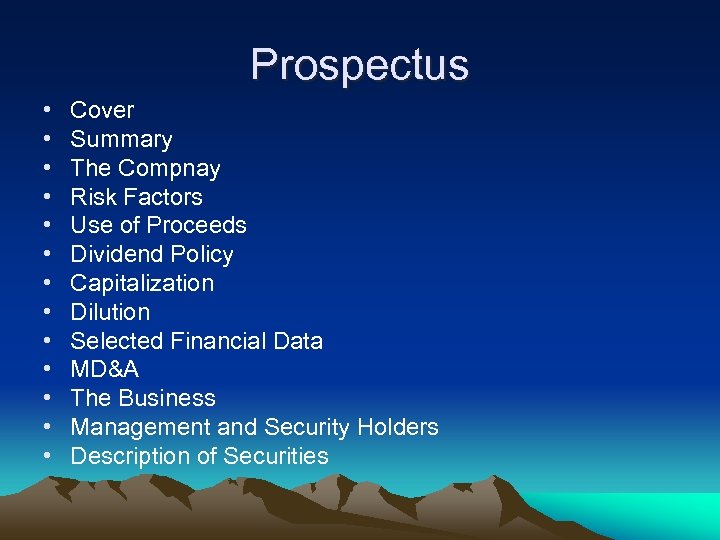

Prospectus • • • • Cover Summary The Compnay Risk Factors Use of Proceeds Dividend Policy Capitalization Dilution Selected Financial Data MD&A The Business Management and Security Holders Description of Securities

Prospectus • • • • Cover Summary The Compnay Risk Factors Use of Proceeds Dividend Policy Capitalization Dilution Selected Financial Data MD&A The Business Management and Security Holders Description of Securities

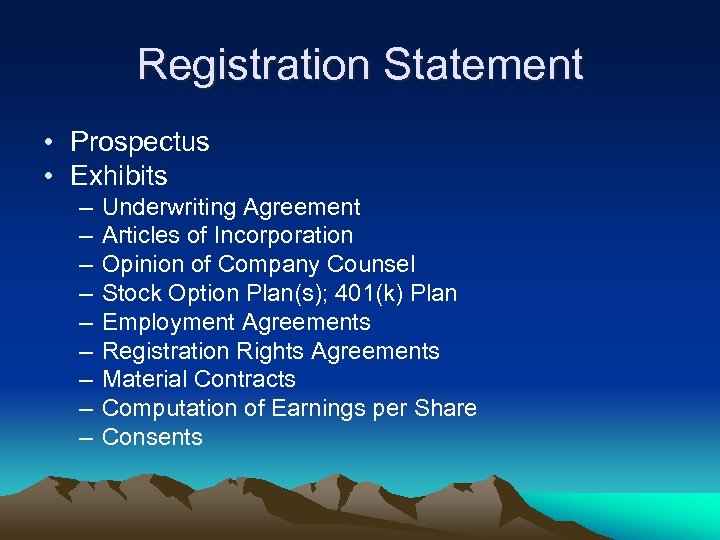

Registration Statement • Prospectus • Exhibits – – – – – Underwriting Agreement Articles of Incorporation Opinion of Company Counsel Stock Option Plan(s); 401(k) Plan Employment Agreements Registration Rights Agreements Material Contracts Computation of Earnings per Share Consents

Registration Statement • Prospectus • Exhibits – – – – – Underwriting Agreement Articles of Incorporation Opinion of Company Counsel Stock Option Plan(s); 401(k) Plan Employment Agreements Registration Rights Agreements Material Contracts Computation of Earnings per Share Consents

Marketing Process • Marketing Documents – – Prospectus Roadshow Presentation Insitutional Sales Teach In Retail Broker Fact Sheet • Distribution Strategy – – – Mix of Institutional and Retail Directed Shares Syndicate Structure Roadshow Share Allocation

Marketing Process • Marketing Documents – – Prospectus Roadshow Presentation Insitutional Sales Teach In Retail Broker Fact Sheet • Distribution Strategy – – – Mix of Institutional and Retail Directed Shares Syndicate Structure Roadshow Share Allocation

Marketing Strategy • Institutions with history of buying, holding and increasing positions • Institutions which own comparable companies • Build momentum before NY and Boston • Create perception of scarcity

Marketing Strategy • Institutions with history of buying, holding and increasing positions • Institutions which own comparable companies • Build momentum before NY and Boston • Create perception of scarcity

The Road Show • Two to Three Weeks • Organized and paid for by underwriter • Provides info about the company in one-on -one meetings with prospective investors • Build the book

The Road Show • Two to Three Weeks • Organized and paid for by underwriter • Provides info about the company in one-on -one meetings with prospective investors • Build the book

Going Effective • Acceleration Request • Pricing the Offering • Final Prospectus Printed

Going Effective • Acceleration Request • Pricing the Offering • Final Prospectus Printed

After Market Support • Timely, Accurate and Insightful Research – Coverage begins after a 25 day quiet period • Follow up Road Shows • Investor Conferences • Active Market Making

After Market Support • Timely, Accurate and Insightful Research – Coverage begins after a 25 day quiet period • Follow up Road Shows • Investor Conferences • Active Market Making

Life As a Public Company • Reporting – Qs, Ks, Press Releases, Conference Calls, Reg FD, Forward-looking Statements, • • • Trading Blackouts Proxys BOD Liability Investor Relations Secondary Offerings – Additional Cash – Enhance the Float – Orderly Exit for Large Holders

Life As a Public Company • Reporting – Qs, Ks, Press Releases, Conference Calls, Reg FD, Forward-looking Statements, • • • Trading Blackouts Proxys BOD Liability Investor Relations Secondary Offerings – Additional Cash – Enhance the Float – Orderly Exit for Large Holders