7a1abe0d6c1b779b6413717ce16ec514.ppt

- Количество слайдов: 47

The investment in reliable foundations J. W. Construction Holding – presentation Poland's largest residential developer PREZENTACJA PLANÓW ROZWOJU FIRMY I WYNIKÓW FINANSOWYCH ZA 2006 ROK Warszawa, December 2008 Warsaw, październik 2007 r. 1

Presentation agenda § The Company in the background of the market – structure and positioning § The characteristics of developer activity § The description of essential investments § The characteristics of housing activity § The characteristics of hotel services § The financial standing Appendix – the analysis of housing market in Poland PRESENTATION of JW Construction Holding S. A. – December 2007 2

The Company in the background of the market – structure and positioning PRESENTATION of JW Construction Holding S. A. – December 2007 3

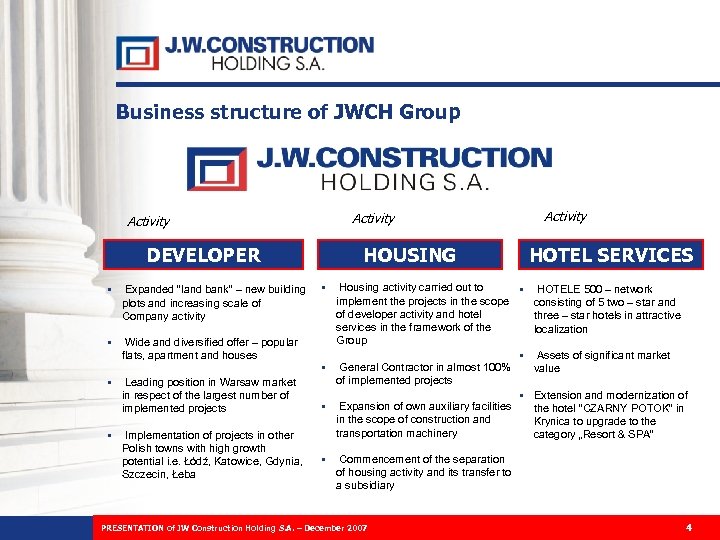

Business structure of JWCH Group Activity DEVELOPER § Expanded “land bank” – new building plots and increasing scale of Company activity § Wide and diversified offer – popular flats, apartment and houses § Leading position in Warsaw market in respect of the largest number of implemented projects § Implementation of projects in other Polish towns with high growth potential i. e. Łódź, Katowice, Gdynia, Szczecin, Łeba HOUSING Activity HOTEL SERVICES § Housing activity carried out to § HOTELE 500 – network implement the projects in the scope consisting of 5 two – star and of developer activity and hotel three – star hotels in attractive services in the framework of the localization Group § Assets of significant market § General Contractor in almost 100% value of implemented projects § Extension and modernization of § Expansion of own auxiliary facilities the hotel “CZARNY POTOK” in in the scope of construction and Krynica to upgrade to the transportation machinery category „Resort & SPA” § Commencement of the separation of housing activity and its transfer to a subsidiary PRESENTATION of JW Construction Holding S. A. – December 2007 4

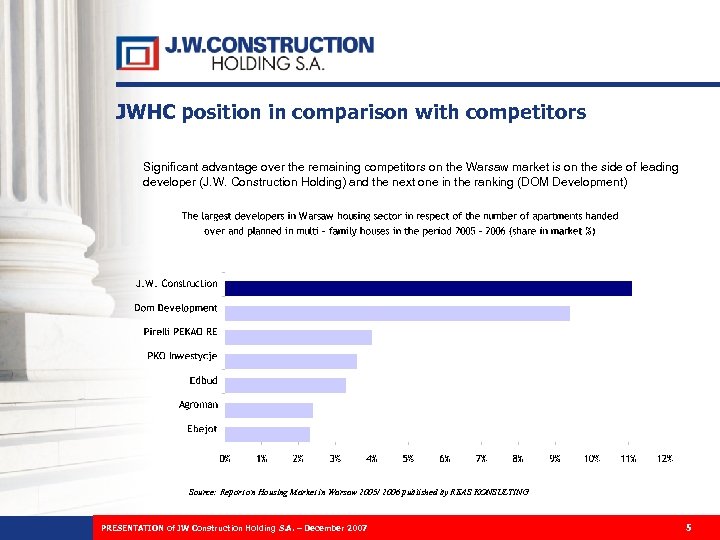

JWHC position in comparison with competitors Significant advantage over the remaining competitors on the Warsaw market is on the side of leading developer (J. W. Construction Holding) and the next one in the ranking (DOM Development) Source: Report on Housing Market in Warsaw 2005/ 2006 published by REAS KONSULTING PRESENTATION of JW Construction Holding S. A. – December 2007 5

Competition on the housing market The main competitors of JW Construction Holding in particular market segments: § Popular flats segment: Dom Development, Budimex Nieruchomości, Acciona Nieruchomości, Dolcan (Warsaw market), Invest Comfort, Allcon Osiedla (3 -City), BRE Locum, Maxbud, Unibud (ŁÓdź), Profit Development, A. S. M Investycje, As Bau, Gant Development (Wrocław) § Increased standard apartments segment: Dom Development, Echo Investment, , Marvipol, Pirelli Pekao Real Estate, Fadesa Prokom (Warsaw market), small entities (all markets) § Single – family houses segment; GTC, Sedno (Warsaw market), large group of small entities (all markets) PRESENTATION of JW Construction Holding S. A. – December 2007 6

Competitive advantages § Own erection and assembling potential § Highly recognized brand § Assets owned by the Company enabling the conclusion of occasional contracts on sales of larger packages of flats with foreign institutional clients § Offer diversification – holiday apartments in Łeba § Complex credit service – flats purchase financing system favourable for the client – long term cooperation with the banks PRESENTATION of JW Construction Holding S. A. – December 2007 7

Competitive advantages § The first Polish office selling the flats established in United Kingdom § Innovative sales systems 10/90 and 20/80 § Effective costs control § Top standard of client service – short period between the first contact and transaction finalization and professional Sales Department § Professional and stable team as well as wide experience and leading position in the market § ISO systems and implemented SAP system PRESENTATION of JW Construction Holding S. A. – December 2007 8

Strategic objectives § Extension of “land market” trough the purchase of new building lots on favourable conditions – increase of the scale of activity and further dynamic development of the Company § Consolidation of leader’s position – as the largest housing developer in Warsaw market and vicinity § Expansion to the markets with high growth potential among others Łódź, Katowice, Gdynia, Szczecin, Łeba and abroad (among others Russia and Bulgaria) § Consolidation in the scope of erection and assembling activity - commencement of the process of its separation and transfer to a subsidiary in order to increase the independence of external subcontractors PRESENTATION of JW Construction Holding S. A. – December 2007 9

Characteristics of developer activity PRESENTATION of JW Construction Holding S. A. – December 2007 10

Growth in the scope of developer activity In course of recent months, the Company initiated several activities in order to extend the scale of activity Warsaw market and vicinity § Purchase of new building lots –the area exceeding 40 ha in Ożarów Mazowiecki § Consolidation of sales network – opening of new offices selling the apartments § Wide commercial offer in various market segments – flats, apartments and houses Entering into the markets out of Warsaw § Purchase of new building lots out of Warsaw – finalization of building lot purchase in Łeba § Project of the erection of the highest building in Szczecin § Continuation of the investment in Łódź (commencement of 2 nd phase of the project) § Commenced housing investment in Katowice § Presence on the market in Gdynia Activity on foreign markets § Implementation of the project in Russia – continuation of the erection of Housing Estate in Kołomna § Establishing of sales office in United Kingdom – promotion and marketing activities § Establishing of cooperation with foreign partners (registration of a subsidiary in Bulgaria) PRESENTATION of JW Construction Holding S. A. – December 2007 11

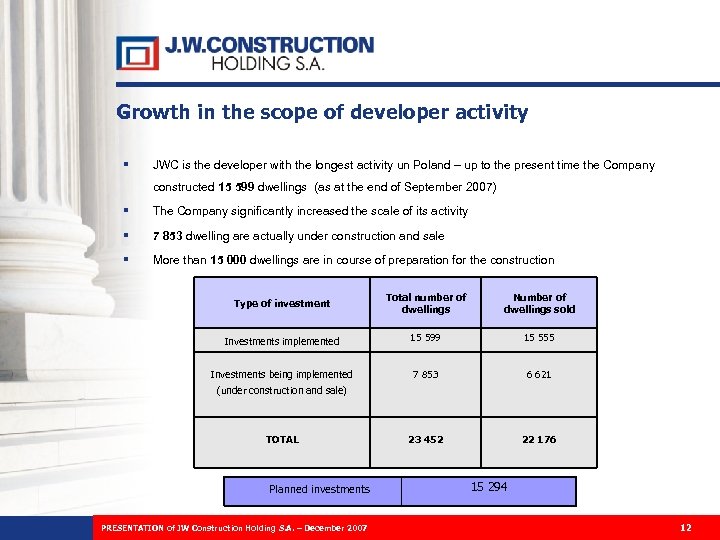

Growth in the scope of developer activity § JWC is the developer with the longest activity un Poland – up to the present time the Company constructed 15 599 dwellings (as at the end of September 2007) § The Company significantly increased the scale of its activity § 7 853 dwelling are actually under construction and sale § More than 15 000 dwellings are in course of preparation for the construction Type of investment Total number of dwellings Number of dwellings sold Investments implemented 15 599 15 555 Investments being implemented 7 853 6 621 23 452 22 176 (under construction and sale) TOTAL Planned investments PRESENTATION of JW Construction Holding S. A. – December 2007 15 294 12

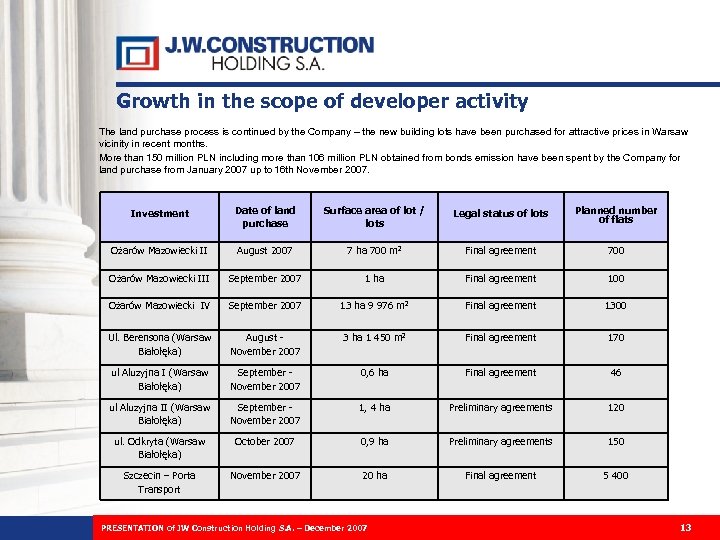

Growth in the scope of developer activity The land purchase process is continued by the Company – the new building lots have been purchased for attractive prices in Warsaw vicinity in recent months. More than 150 million PLN including more than 106 million PLN obtained from bonds emission have been spent by the Company for land purchase from January 2007 up to 16 th November 2007. Investment Date of land purchase Surface area of lot / lots Legal status of lots Planned number of flats Ożarów Mazowiecki II August 2007 7 ha 700 m 2 Final agreement 700 Ożarów Mazowiecki III September 2007 1 ha Final agreement 100 Ożarów Mazowiecki IV September 2007 13 ha 9 976 m 2 Final agreement 1300 Ul. Berensona (Warsaw Białołęka) August November 2007 3 ha 1 450 m 2 Final agreement 170 ul Aluzyjna I (Warsaw Białołęka) September November 2007 0, 6 ha Final agreement 46 ul Aluzyjna II (Warsaw Białołęka) September November 2007 1, 4 ha Preliminary agreements 120 ul. Odkryta (Warsaw Białołęka) October 2007 0, 9 ha Preliminary agreements 150 Szczecin – Porta Transport November 2007 20 ha Final agreement 5 400 PRESENTATION of JW Construction Holding S. A. – December 2007 13

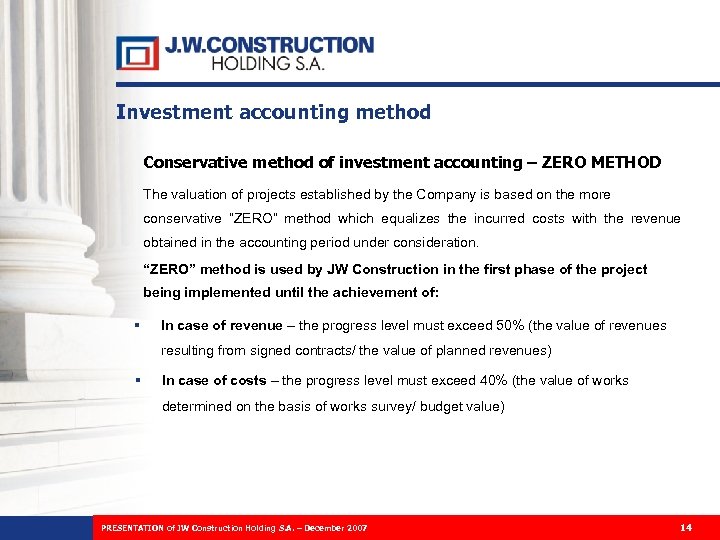

Investment accounting method Conservative method of investment accounting – ZERO METHOD The valuation of projects established by the Company is based on the more conservative “ZERO” method which equalizes the incurred costs with the revenue obtained in the accounting period under consideration. “ZERO” method is used by JW Construction in the first phase of the project being implemented until the achievement of: § In case of revenue – the progress level must exceed 50% (the value of revenues resulting from signed contracts/ the value of planned revenues) § In case of costs – the progress level must exceed 40% (the value of works determined on the basis of works survey/ budget value) PRESENTATION of JW Construction Holding S. A. – December 2007 14

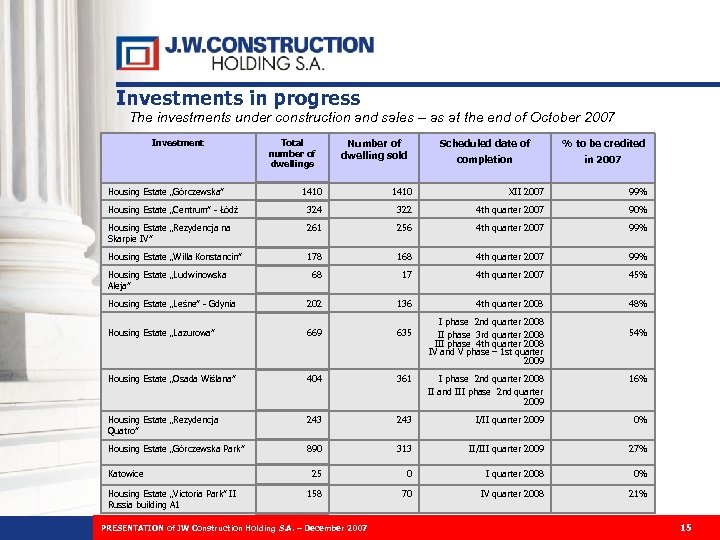

Investments in progress The investments under construction and sales – as at the end of October 2007 Investment Housing Estate „Górczewska” Total number of dwellings Number of dwelling sold Scheduled date of % to be credited completion in 2007 1410 XII 2007 99% Housing Estate „Centrum” - Łódź 324 322 4 th quarter 2007 90% Housing Estate „Rezydencja na Skarpie IV” 261 256 4 th quarter 2007 99% Housing Estate „Willa Konstancin” 178 168 4 th quarter 2007 99% 68 17 4 th quarter 2007 45% Housing Estate „Leśne” - Gdynia 202 136 4 th quarter 2008 48% Housing Estate „Lazurowa” 669 635 Housing Estate „Osada Wiślana” 404 361 I phase 2 nd quarter 2008 II and III phase 2 nd quarter 2009 16% Housing Estate „Rezydencja Quatro” 243 I/II quarter 2009 0% Housing Estate „Górczewska Park” 890 313 II/III quarter 2009 27% 25 0 I quarter 2008 0% 158 70 IV quarter 2008 21% Housing Estate „Ludwinowska Aleja” Katowice Housing Estate „Victoria Park” II Russia building A 1 PRESENTATION of JW Construction Holding S. A. – December 2007 I phase 2 nd II phase 3 rd III phase 4 th IV and V phase quarter 2008 – 1 st quarter 2009 54% 15

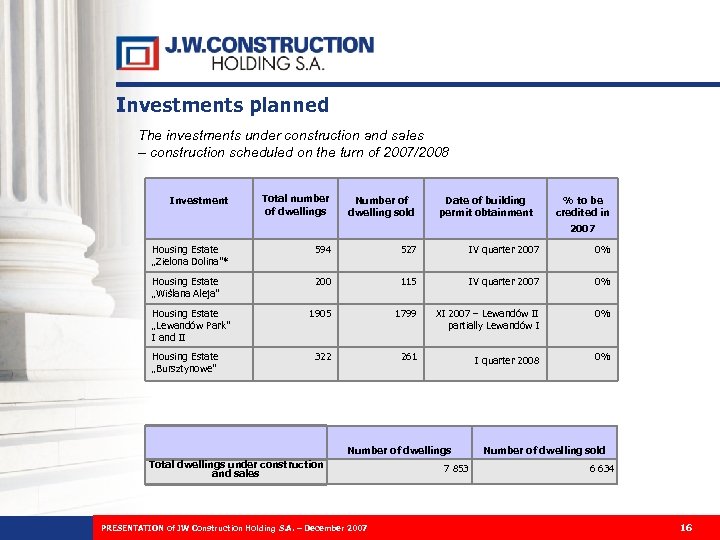

Investments planned The investments under construction and sales – construction scheduled on the turn of 2007/2008 Investment Total number of dwellings Number of dwelling sold Date of building permit obtainment % to be credited in 2007 Housing Estate „Zielona Dolina”* 594 527 IV quarter 2007 0% Housing Estate „Wiślana Aleja” 200 115 IV quarter 2007 0% 1905 1799 XI 2007 – Lewandów II partially Lewandów I 0% 322 261 I quarter 2008 0% Housing Estate „Lewandów Park” I and II Housing Estate „Bursztynowe” Number of dwellings Total dwellings under construction and sales PRESENTATION of JW Construction Holding S. A. – December 2007 7 853 Number of dwelling sold 6 634 16

Investments planned The investments planned – data as at the end of December 2007 Investment Market segment Town/ quarter Number of dwellings / houses Approximate usable and residential area in m 2 Housing Estate „Lewandów Park” III Warsaw / Białołęka Popular flats 465 25 575 Housing Estate „Zielona Dolina” (Zdziarska) Warsaw/ Białołęka Popular flats 911 50 105 Światowida Warsaw / Białołęka Popular flats 223 12 265 Housing Estate „Centrum” II Łódź Popular flats 432 23 760 Pogonowskiego – Łódź Popular flats 109 5 995 Uroczysko – Katowice Popular flats 563 30 965 Szczecin, Wyzwolenia Avenue Szczecin Apartments / commercial 400 32 000 Szczecin – Porta Transport Szczecin Popular flats 5 400 297 000 Ożarów Mazowiecki I Ożarów Mazowiecki Popular flats 1 973 108 515 Ożarów Mazowiecki II Ożarów Mazowiecki Popular flats 700 38 500 Ożarów Mazowiecki III Ożarów Mazowiecki Popular flats 100 5 500 Ożarów Mazowiecki IV Ożarów Mazowiecki Popular flats 1 300 71 500 Łeba Popular flats 400 22 000 Berensona Warsaw / Białołęka Popular flats 170 9 350 Housing Estate „Marymoncka” II Warsaw / Bielany Flats in increased standard 23 1 265 PRESENTATION of JW Construction Holding S. A. – December 2007 17

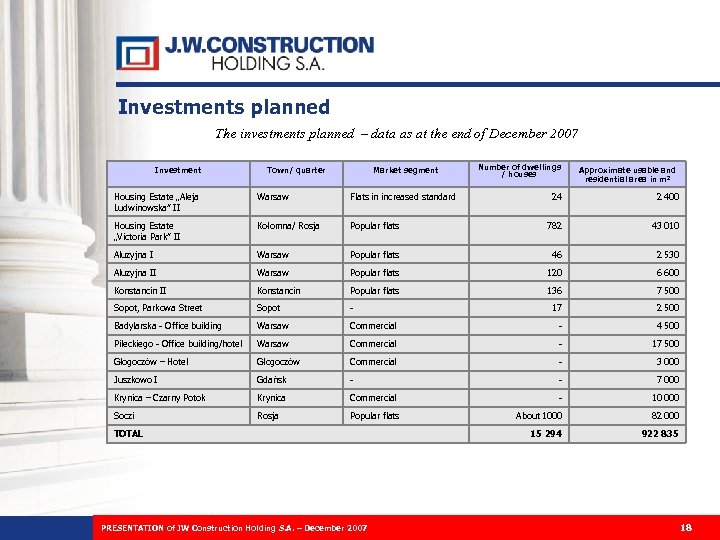

Investments planned The investments planned – data as at the end of December 2007 Investment Market segment Town/ quarter Housing Estate „Aleja Ludwinowska” II Warsaw Flats in increased standard Housing Estate „Victoria Park” II Kołomna/ Rosja Aluzyjna I Number of dwellings / houses Approximate usable and residential area in m 2 24 2 400 Popular flats 782 43 010 Warsaw Popular flats 46 2 530 Aluzyjna II Warsaw Popular flats 120 6 600 Konstancin II Konstancin Popular flats 136 7 500 Sopot, Parkowa Street Sopot - 17 2 500 Badylarska - Office building Warsaw Commercial - 4 500 Pileckiego - Office building/hotel Warsaw Commercial - 17 500 Głogoczów – Hotel Głogoczów Commercial - 3 000 Juszkowo I Gdańsk - - 7 000 Krynica – Czarny Potok Krynica Commercial - 10 000 Soczi Rosja Popular flats About 1000 82 000 15 294 922 835 TOTAL PRESENTATION of JW Construction Holding S. A. – December 2007 18

Description of essential investments PRESENTATION of JW Construction Holding S. A. – December 2007 19

Warsaw market Housing Estate „Górczewska” Secured residential object with service areas and 1410 apartments and parking places under the building. A recreation area and housing estate mall will be provided. Investment Floorage of the apartments Revenue Costs Housing Estate „Górczewska” 74 729 319 372 204 617 PRESENTATION of JW Construction Holding S. A. – December 2007 20

Warsaw market Housing Estate „Rezydencja na Skarpie” The investment in Bukowińska Street next to two projects implemented before – Mokotów Plaza I and II. Total number of high standard dwellings will amount 261 Investment Floorage of the apartments Revenue Costs Housing Estate „Rezydencja na Skarpie” 16 530 116 876 66 301 PRESENTATION of JW Construction Holding S. A. – December 2007 21

Warsaw market Housing Estate „Lazurowa” Investment Floorage of the apartments Revenue Costs Housing Estate „Lazurowa” 33 727 243 161 185 953 PRESENTATION of JW Construction Holding S. A. – December 2007 22

Warsaw market Housing Estate „Górczewska Park” “Górczewska Park” project consists of 12 multi – family house localized in Górczewska / Olbrachta Street with 886 flats and 4 service shops. Investment Floorage of the apartments Revenue Costs Housing Estate „Górczewska Park” 44 929 426 872 244 579 PRESENTATION of JW Construction Holding S. A. – December 2007 23

Warsaw market Housing Estate „Ludwinowska Aleja” Secured residential complex consisting of 17 semi – detached four – family houses in Ludwinowska Street in Warsaw with 68 flats with garages and parking places. Investment Floorage of the apartments Revenue Costs Housing Estate „Ludwinowska Aleja” 7 877 59 118 28 350 PRESENTATION of JW Construction Holding S. A. – December 2007 24

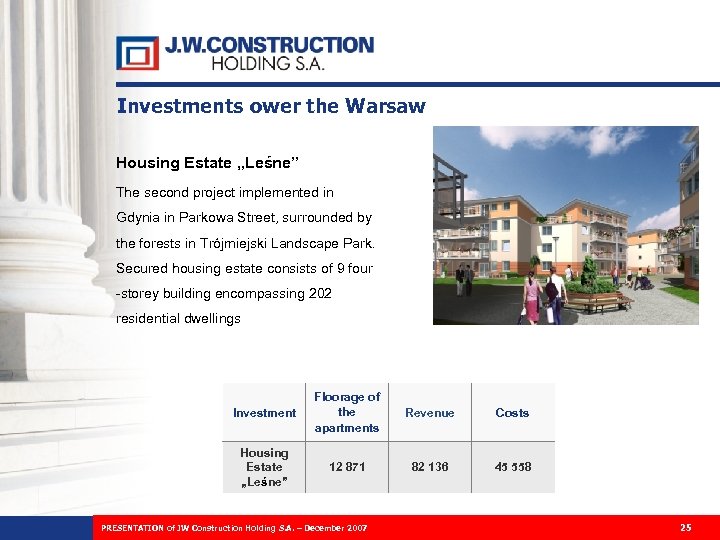

Investments ower the Warsaw Housing Estate „Leśne” The second project implemented in Gdynia in Parkowa Street, surrounded by the forests in Trójmiejski Landscape Park. Secured housing estate consists of 9 four -storey building encompassing 202 residential dwellings Investment Floorage of the apartments Revenue Costs Housing Estate „Leśne” 12 871 82 136 45 558 PRESENTATION of JW Construction Holding S. A. – December 2007 25

Foreign investments Housing Estate „Victoria Park” Secured housing estate encompassing 6 multi-family projects implemented in Kołomna Town in vicinity of Moscow (Russia). The project encompasses more than 1100 high standard apartments. The completion of the whole project is expected in 2012. Investment Floorage of the apartments Revenue Costs Housing Estate „Victoria Park” 58 196 443 967 254 628 PRESENTATION of JW Construction Holding S. A. – December 2007 26

The characteristics of housing activity PRESENTATION of JW Construction Holding S. A. – December 2007 27

Development of housing activity High potential of own erection and assembling capabilities § JW Construction acts in the majority of projects being implemented as the General Contractor § Permanent staff encompasses 333 skilled labourers § Long term cooperation with experienced contractors § The Company is in the possession of own construction machinery and plants § The Company spent 1, 7 million EURO as the investment in the scope of modern construction machinery and plants (concrete batching plants, tractors, dump trucks, excavators – loaders and telescope loaders) § The works associated with launching of construction elements prefabrication PRESENTATION of JW Construction Holding S. A. – December 2007 28

Separation of housing activity JWC Holding is engaged into the group structure modification commencing the works associated with the separation of housing and designing activity in order to enable further development § On 21 st September 2007 two new divisions i. e. “BUDOWNICTWO” responsible for erection and assembling activity and “Pracownia Architektoniczna” responsible for the activity in the scope architecture and engineering were created in the framework of the Company structure § On 26 th September 2007 JW Construction SA has been established as 100% subsidiary of JWC Holding – in future the company will continue the economic activity in housing sector after the property transfer § the activity in the scope architecture and engineering concentrated in the division “Pracownia Architektoniczna” has been relocated to the subsidiary Dremet The purpose of the works associated with the separation of housing and designing activity in the subsidiary is to increase the value of the Group PRESENTATION of JW Construction Holding S. A. – December 2007 29

Separation of housing activity Advantages resulting from the separation of housing segment § Increased transparency of the Group § Possibility to achieve the valuation of the erection and assembling segment and achievement higher financial transparency § Facilitating of the acquisition of the companies from building sector, anticipated in future § Possibility to place the orders out of JWC Holding § Improvement of functioning efficiency of individual companies and increase of their effectiveness by clear determination of competences of individual entities PRESENTATION of JW Construction Holding S. A. – December 2007 30

The characteristics of hotel services PRESENTATION of JW Construction Holding S. A. – December 2007 31

Development of hotel services § Actually JW Construction Group is in the possession of 5 (two – and three – star) hotels localized in Zegrze, Stryków, Cieszyn, Tarnowo Podgórne and Święta Lipka § The offer in the scope of hotel services is addressed mainly to the institutional clients – companies and institutions (conferences, trainings, seminaries) and to individual clients – tourists § In 2005, the Company purchased “Czarny Potok” tourism center in Krynica. Actually its modernization and extension is continued in order to upgrade the object to Resort & SPA category. § The hotel in Strykowo close to Łódź is situated in direct vicinity of highway and hotel in Tarnowo Podgórne in vicinity of international communication route A 2 PRESENTATION of JW Construction Holding S. A. – December 2007 32

Financial standing PRESENTATION of JW Construction Holding S. A. – December 2007 33

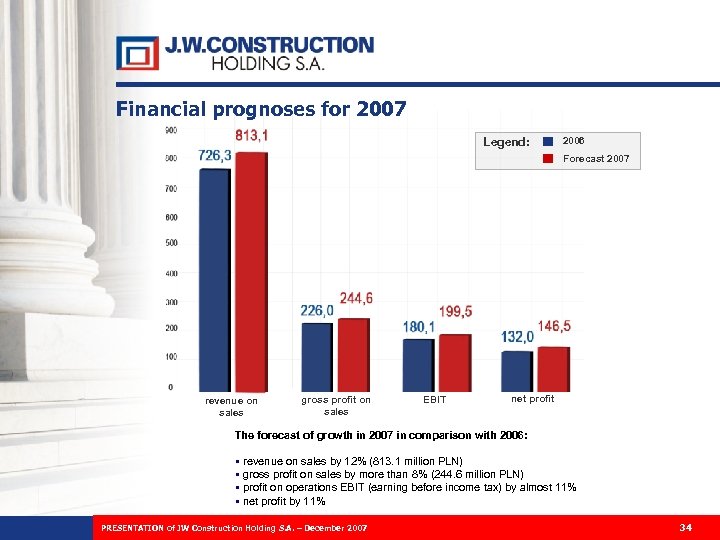

Financial prognoses for 2007 Legend: 2006 Forecast 2007 revenue on sales gross profit on sales EBIT net profit The forecast of growth in 2007 in comparison with 2006: § revenue on sales by 12% (813. 1 million PLN) § gross profit on sales by more than 8% (244. 6 million PLN) § profit on operations EBIT (earning before income tax) by almost 11% § net profit by 11% PRESENTATION of JW Construction Holding S. A. – December 2007 34

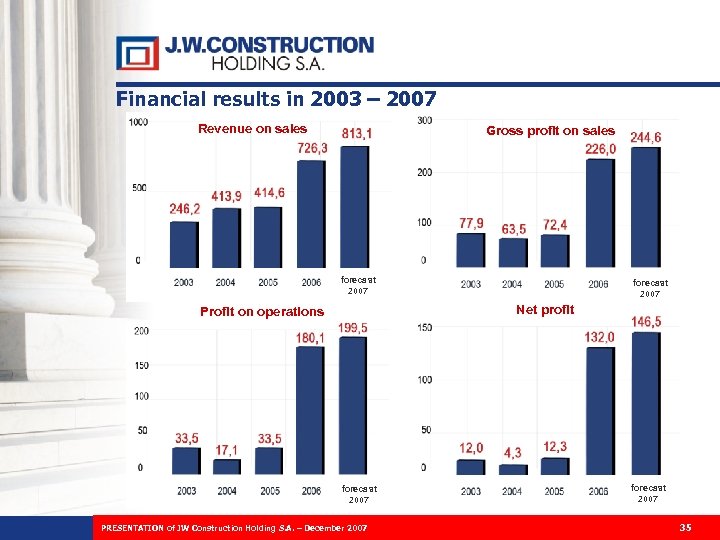

Financial results in 2003 – 2007 Revenue on sales Gross profit on sales forecast 2007 Net profit Profit on operations forecast 2007 PRESENTATION of JW Construction Holding S. A. – December 2007 35 forecast 2007 35

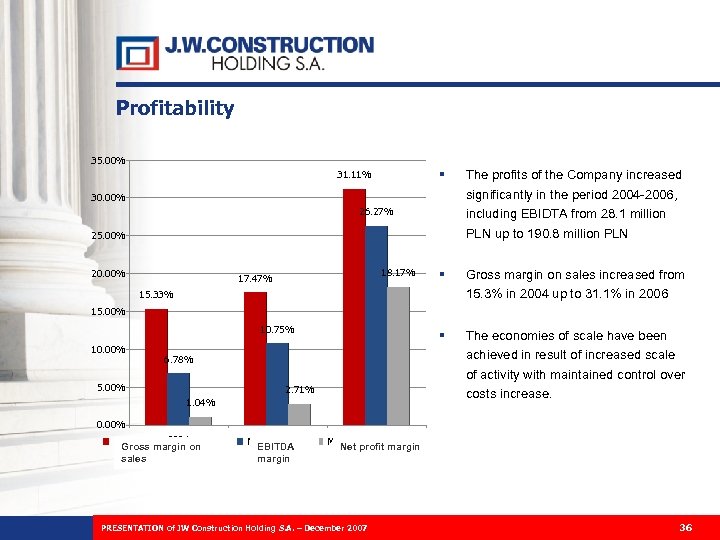

Profitability 35. 00% § The profits of the Company increased significantly in the period 2004 -2006, including EBIDTA from 28. 1 million PLN up to 190. 8 million PLN § Gross margin on sales increased from 15. 3% in 2004 up to 31. 1% in 2006 § 31. 11% The economies of scale have been achieved in result of increased scale of activity with maintained control over costs increase. 30. 00% 26. 27% 25. 00% 20. 00% 18. 17% 17. 47% 15. 33% 15. 00% 10. 75% 10. 00% 6. 78% 5. 00% 2. 71% 1. 04% 0. 00% Marża brutto 2004 na sprzedaży Gross margin on sales 2005 Marża EBITDA margin 2006 Marża zysku netto Net profit margin PRESENTATION of JW Construction Holding S. A. – December 2007 36

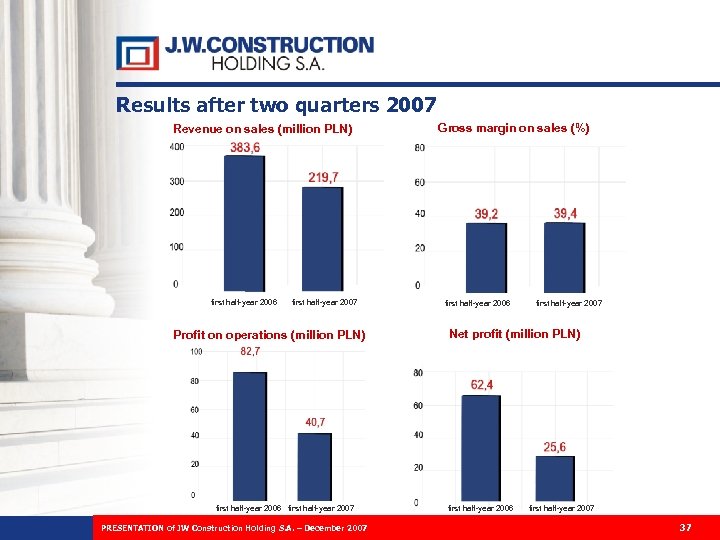

Results after two quarters 2007 Revenue on sales (million PLN) first half-year 2006 first half-year 2007 Profit on operations (million PLN) first half-year 2006 first half-year 2007 PRESENTATION of JW Construction Holding S. A. – December 2007 Gross margin on sales (%) first half-year 2006 first half-year 2007 Net profit (million PLN) first half-year 2006 first half-year 2007 37

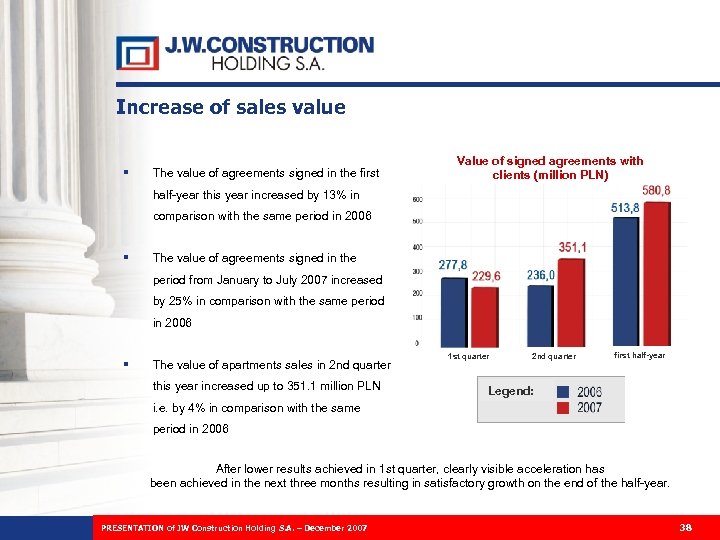

Increase of sales value § The value of agreements signed in the first Value of signed agreements with clients (million PLN) half-year this year increased by 13% in comparison with the same period in 2006 § The value of agreements signed in the period from January to July 2007 increased by 25% in comparison with the same period in 2006 § The value of apartments sales in 2 nd quarter this year increased up to 351. 1 million PLN 1 st quarter 2 nd quarter first half-year Legend: i. e. by 4% in comparison with the same period in 2006 After lower results achieved in 1 st quarter, clearly visible acceleration has been achieved in the next three months resulting in satisfactory growth on the end of the half-year. PRESENTATION of JW Construction Holding S. A. – December 2007 38

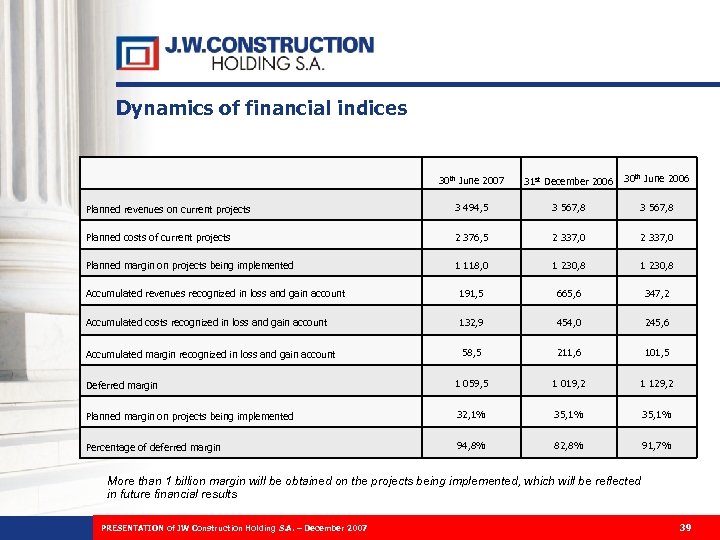

Dynamics of financial indices 30 th June 2007 31 st December 2006 30 th June 2006 Planned revenues on current projects 3 494, 5 3 567, 8 Planned costs of current projects 2 376, 5 2 337, 0 Planned margin on projects being implemented 1 118, 0 1 230, 8 Accumulated revenues recognized in loss and gain account 191, 5 665, 6 347, 2 Accumulated costs recognized in loss and gain account 132, 9 454, 0 245, 6 Accumulated margin recognized in loss and gain account 58, 5 211, 6 101, 5 Deferred margin 1 059, 5 1 019, 2 1 129, 2 Planned margin on projects being implemented 32, 1% 35, 1% Percentage of deferred margin 94, 8% 82, 8% 91, 7% More than 1 billion margin will be obtained on the projects being implemented, which will be reflected in future financial results PRESENTATION of JW Construction Holding S. A. – December 2007 39

Financing structure Achievement of optimal financing structure § Obtainment of gross revenues over 240 million PLN on new bonds emission for land purchase § Withdrawal from the financing form used before – credit of up to 80% of land purchase price § As a rule, the percentage of projects implemented using the bank credits is not higher than 40% of the whole costs § Possibility of complete use of the bonds emission program in amount of 250 million PLN PRESENTATION of JW Construction Holding S. A. – December 2007 40

APPENDIX The analysis of housing market in Poland PRESENTATION of JW Construction Holding S. A. – December 2007 41

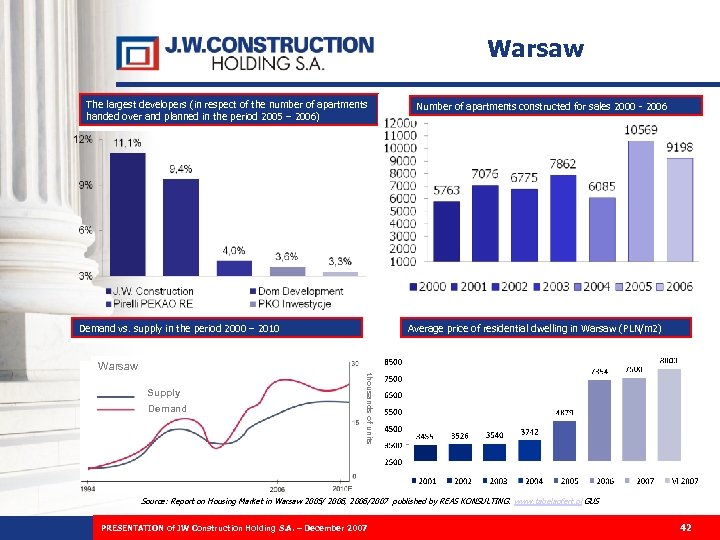

Warsaw The largest developers (in respect of the number of apartments handed over and planned in the period 2005 – 2006) Demand vs. supply in the period 2000 – 2010 Number of apartments constructed for sales 2000 - 2006 Average price of residential dwelling in Warsaw (PLN/m 2) Warsaw Demand thousands of units Supply Source: Report on Housing Market in Warsaw 2005/ 2006, 2006/2007 published by REAS KONSULTING. www. tabelaofert. pl GUS PRESENTATION of JW Construction Holding S. A. – December 2007 42

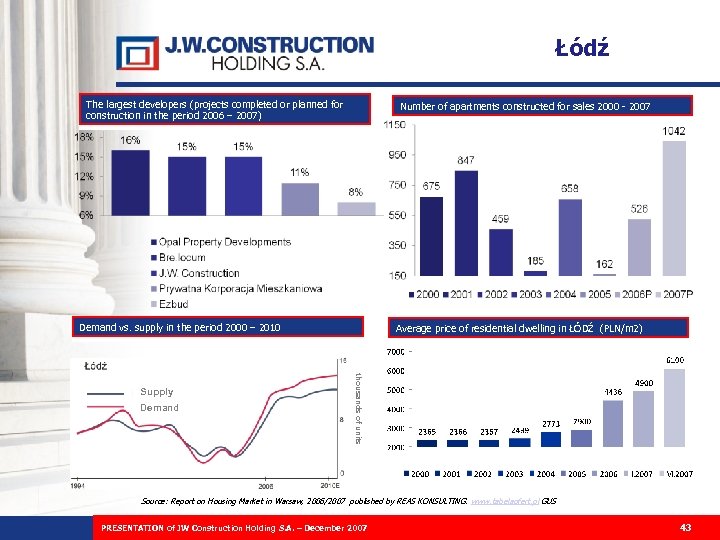

Łódź The largest developers (projects completed or planned for construction in the period 2006 – 2007) Number of apartments constructed for sales 2000 - 2007 Demand vs. supply in the period 2000 – 2010 Demand thousands of units Supply Average price of residential dwelling in ŁÓDŹ (PLN/m 2) Source: Report on Housing Market in Warsaw, 2006/2007 published by REAS KONSULTING. www. tabelaofert. pl GUS PRESENTATION of JW Construction Holding S. A. – December 2007 43

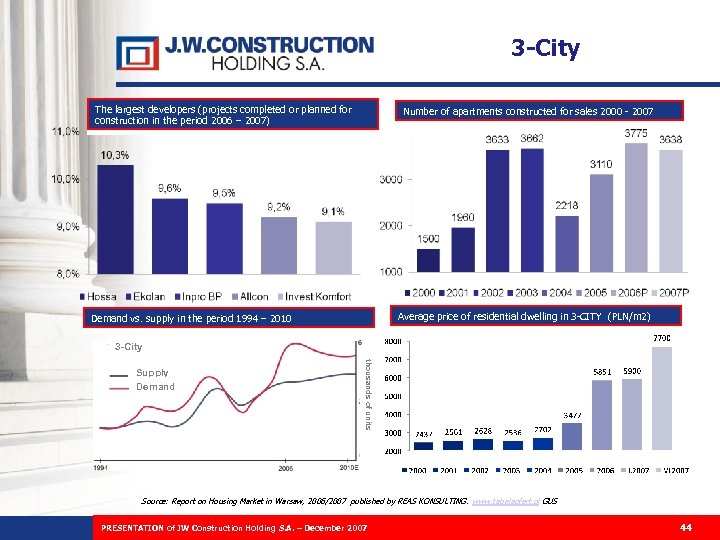

3 -City The largest developers (projects completed or planned for construction in the period 2006 – 2007) Number of apartments constructed for sales 2000 - 2007 Average price of residential dwelling in 3 -CITY (PLN/m 2) Demand vs. supply in the period 1994 – 2010 3 -City thousands of units Supply Demand Source: Report on Housing Market in Warsaw, 2006/2007 published by REAS KONSULTING. www. tabelaofert. pl GUS PRESENTATION of JW Construction Holding S. A. – December 2007 44

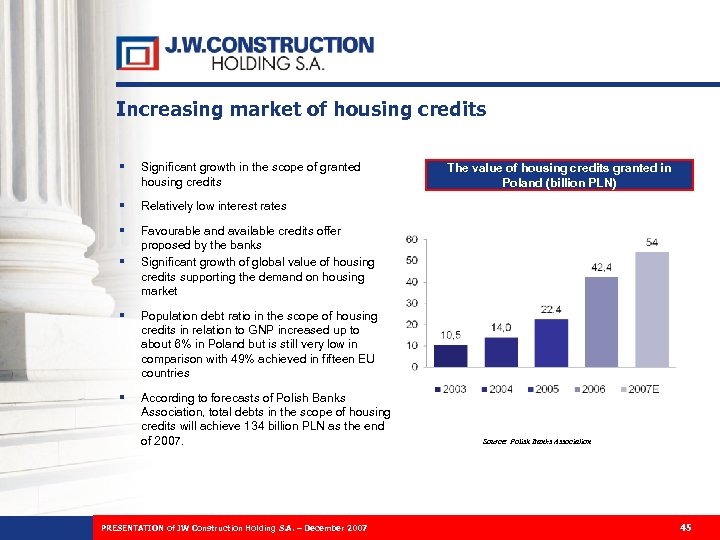

Increasing market of housing credits § Significant growth in the scope of granted housing credits § Relatively low interest rates § Favourable and available credits offer proposed by the banks Significant growth of global value of housing credits supporting the demand on housing market § § Population debt ratio in the scope of housing credits in relation to GNP increased up to about 6% in Poland but is still very low in comparison with 49% achieved in fifteen EU countries § According to forecasts of Polish Banks Association, total debts in the scope of housing credits will achieve 134 billion PLN as the end of 2007. The value of housing credits granted in Poland (billion PLN) PRESENTATION of JW Construction Holding S. A. – December 2007 Source: Polish Banks Association 45

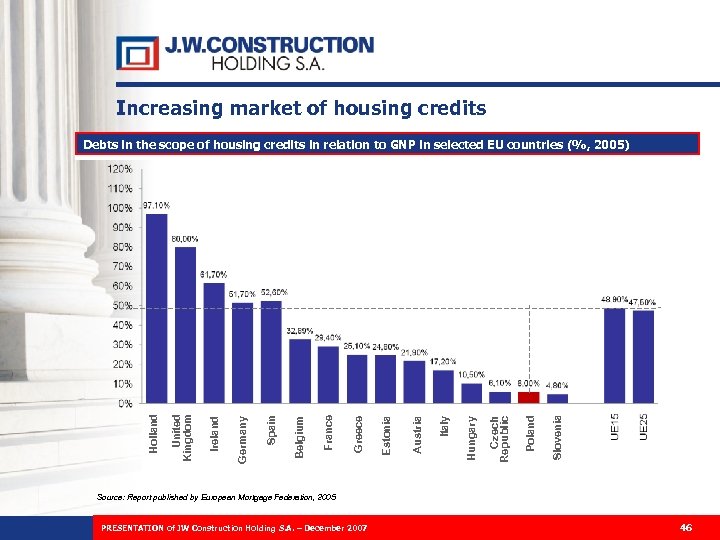

Increasing market of housing credits Slovenia Poland Czech Republic Hungary Italy Austria Estonia Greece France Belgium Spain Germany Ireland United Kingdom Holland Debts in the scope of housing credits in relation to GNP in selected EU countries (%, 2005) Source: Report published by European Mortgage Federation, 2005 PRESENTATION of JW Construction Holding S. A. – December 2007 46

INVESTOR RELATION OFFICE - CONTACT DATA: Małgorzata Szwarc-Sroka Liquidity Management Director and Investor Relations Office Director ph. : 0 22 771 77 85 ph. : 0 22 771 75 10 e-mail: relacje. inwestorskie@jwconstruction. com. pl PRESENTATION of JW Construction Holding S. A. – December 2007 47

7a1abe0d6c1b779b6413717ce16ec514.ppt