822f6f1589b2f39e854ec1e760abb360.ppt

- Количество слайдов: 54

THE INTERNATIONAL FINANCIAL SYSTEM PART I: THE FOREIGN EXCHANGE MARKET

THE INTERNATIONAL FINANCIAL SYSTEM PART I: THE FOREIGN EXCHANGE MARKET

Foreign Exchange (Forex) • A commodity that consists of currencies issued by countries other than one’s own.

Foreign Exchange (Forex) • A commodity that consists of currencies issued by countries other than one’s own.

Foreign Exchange Market • The Foreign Exchange Market: a market for converting the currency of one country into the currency of another country. • An Exchange Rate: is the rate at which one currency is converted into another. – Example: 1. 7600 S$/US$ 0. 5682 US$/S$ Bid Offered Spread (direct quote) (indirect quote) 1. 7645 1. 7655 . 0010 = 10 points

Foreign Exchange Market • The Foreign Exchange Market: a market for converting the currency of one country into the currency of another country. • An Exchange Rate: is the rate at which one currency is converted into another. – Example: 1. 7600 S$/US$ 0. 5682 US$/S$ Bid Offered Spread (direct quote) (indirect quote) 1. 7645 1. 7655 . 0010 = 10 points

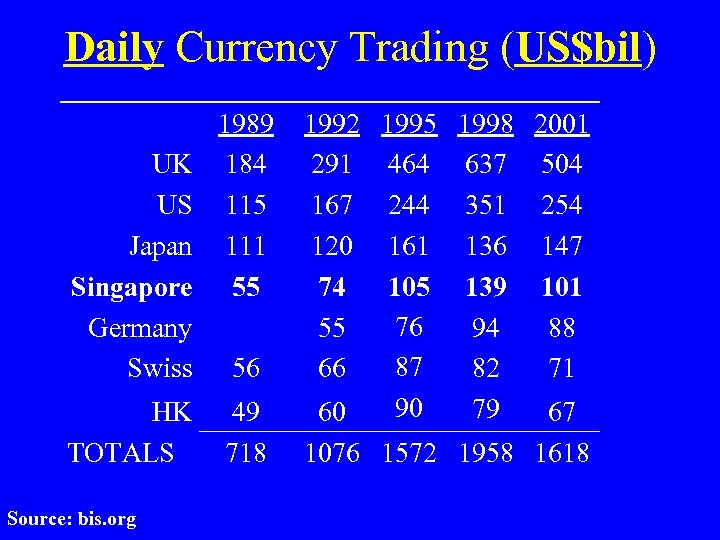

Daily Currency Trading (US$bil) UK US Japan Singapore Germany Swiss HK TOTALS Source: bis. org 1989 184 115 111 55 56 49 718 1992 1995 1998 291 464 637 167 244 351 120 161 136 74 105 139 76 55 94 87 66 82 90 79 60 2001 504 254 147 101 88 71 67 1076 1572 1958 1618

Daily Currency Trading (US$bil) UK US Japan Singapore Germany Swiss HK TOTALS Source: bis. org 1989 184 115 111 55 56 49 718 1992 1995 1998 291 464 637 167 244 351 120 161 136 74 105 139 76 55 94 87 66 82 90 79 60 2001 504 254 147 101 88 71 67 1076 1572 1958 1618

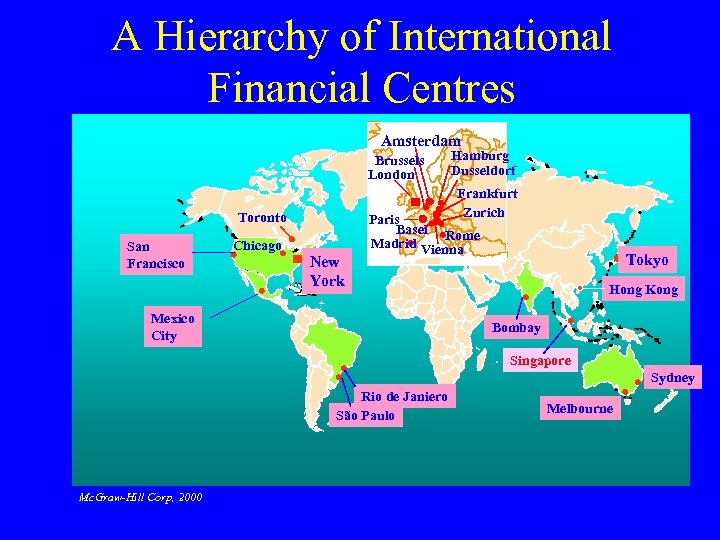

A Hierarchy of International Financial Centres Amsterdam Brussels London Frankfurt Zurich Toronto San Francisco Hamburg Dusseldorf Chicago New York Paris Basel Rome Madrid Vienna Mexico City Tokyo Hong Kong Bombay Singapore Sydney Rio de Janiero São Paulo Melbourne Note: Size of dots (squares) indicates cities’ relative importance Mc. Graw-Hill Corp, 2000

A Hierarchy of International Financial Centres Amsterdam Brussels London Frankfurt Zurich Toronto San Francisco Hamburg Dusseldorf Chicago New York Paris Basel Rome Madrid Vienna Mexico City Tokyo Hong Kong Bombay Singapore Sydney Rio de Janiero São Paulo Melbourne Note: Size of dots (squares) indicates cities’ relative importance Mc. Graw-Hill Corp, 2000

Forex market contracts to reduce Risk • Spot Exchange: when two parties agree to exchange currency and execute the deal immediately. • Forward Exchange: when two parties agree to exchange currency and execute the deal at some specific future date. • Swap: the simultaneous purchase and sale of foreign exchange for two different value dates.

Forex market contracts to reduce Risk • Spot Exchange: when two parties agree to exchange currency and execute the deal immediately. • Forward Exchange: when two parties agree to exchange currency and execute the deal at some specific future date. • Swap: the simultaneous purchase and sale of foreign exchange for two different value dates.

Foreign Exchange Transactions April 2001 (%)

Foreign Exchange Transactions April 2001 (%)

Economic theories to explain the Determinants of Forex rates • At lowest level = supply/demand. • Inflation (Law of One Price and Purchasing Power Parity). • Interest rates (International Fisher Effect --IFE). (So – Sn) / So x 100 = i. S$ – i. US$ • Governments Notation: • Investor psychology. Sn = forward rate So = spot rate i. S$ = S’pore interest i. US$ = US interest

Economic theories to explain the Determinants of Forex rates • At lowest level = supply/demand. • Inflation (Law of One Price and Purchasing Power Parity). • Interest rates (International Fisher Effect --IFE). (So – Sn) / So x 100 = i. S$ – i. US$ • Governments Notation: • Investor psychology. Sn = forward rate So = spot rate i. S$ = S’pore interest i. US$ = US interest

Law of One Price • In competitive markets free of transportation costs and barriers to trade, identical products sold in different countries must sell for the same price when their price is expressed in terms of the same currency. • Example: US/French exchange rate: $1 = FFr 5. A jacket selling for $50 in New York should retail for FFr 250 in Paris (50 x 5)

Law of One Price • In competitive markets free of transportation costs and barriers to trade, identical products sold in different countries must sell for the same price when their price is expressed in terms of the same currency. • Example: US/French exchange rate: $1 = FFr 5. A jacket selling for $50 in New York should retail for FFr 250 in Paris (50 x 5)

Purchasing Power Parity • By comparing the prices of identical products in different currencies, it should be possible to determine the PPP exchange rate -- if markets were efficient. • In relatively efficient markets (few impediments to trade and investment) then a ‘basket of goods’ should be roughly equivalent in each country.

Purchasing Power Parity • By comparing the prices of identical products in different currencies, it should be possible to determine the PPP exchange rate -- if markets were efficient. • In relatively efficient markets (few impediments to trade and investment) then a ‘basket of goods’ should be roughly equivalent in each country.

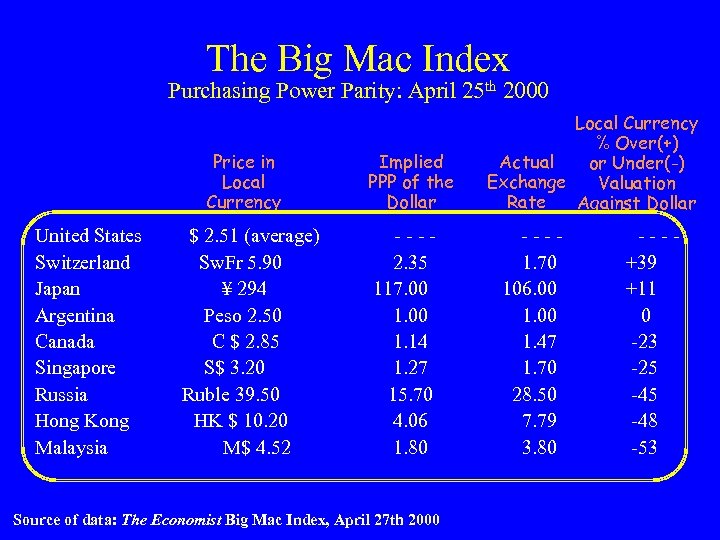

The Big Mac Index Purchasing Power Parity: April 25 th 2000 Price in Local Currency Implied PPP of the Dollar Local Currency % Over(+) Actual or Under(-) Exchange Valuation Rate Against Dollar United States $ 2. 51 (average) - - - - - - - Switzerland Sw. Fr 5. 90 2. 35 1. 70 +39 Japan ¥ 294 117. 00 106. 00 +11 Argentina Peso 2. 50 1. 00 0 Canada C $ 2. 85 1. 14 1. 47 -23 Singapore S$ 3. 20 1. 27 1. 70 -25 Russia Ruble 39. 50 15. 70 28. 50 -45 Hong Kong HK $ 10. 20 4. 06 7. 79 -48 Malaysia M$ 4. 52 1. 80 3. 80 -53 Source of data: The Economist Big Mac Index, April 27 th 2000

The Big Mac Index Purchasing Power Parity: April 25 th 2000 Price in Local Currency Implied PPP of the Dollar Local Currency % Over(+) Actual or Under(-) Exchange Valuation Rate Against Dollar United States $ 2. 51 (average) - - - - - - - Switzerland Sw. Fr 5. 90 2. 35 1. 70 +39 Japan ¥ 294 117. 00 106. 00 +11 Argentina Peso 2. 50 1. 00 0 Canada C $ 2. 85 1. 14 1. 47 -23 Singapore S$ 3. 20 1. 27 1. 70 -25 Russia Ruble 39. 50 15. 70 28. 50 -45 Hong Kong HK $ 10. 20 4. 06 7. 79 -48 Malaysia M$ 4. 52 1. 80 3. 80 -53 Source of data: The Economist Big Mac Index, April 27 th 2000

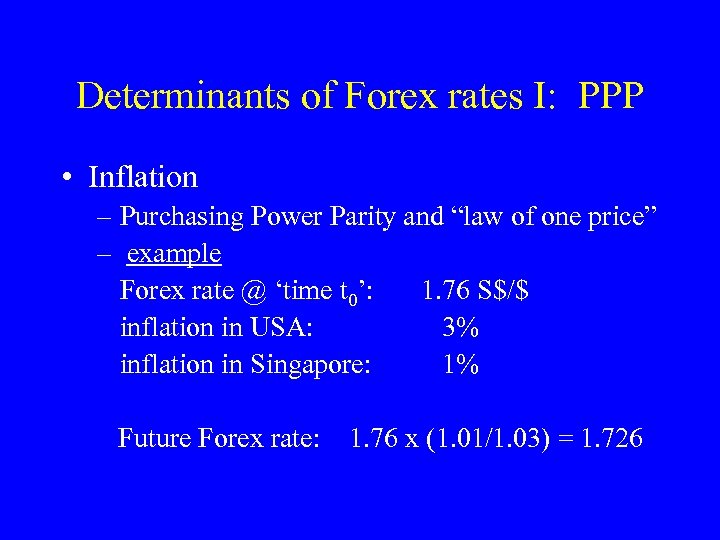

Determinants of Forex rates I: PPP • Inflation – Purchasing Power Parity and “law of one price” – example Forex rate @ ‘time t 0’: 1. 76 S$/$ inflation in USA: 3% inflation in Singapore: 1% Future Forex rate: 1. 76 x (1. 01/1. 03) = 1. 726

Determinants of Forex rates I: PPP • Inflation – Purchasing Power Parity and “law of one price” – example Forex rate @ ‘time t 0’: 1. 76 S$/$ inflation in USA: 3% inflation in Singapore: 1% Future Forex rate: 1. 76 x (1. 01/1. 03) = 1. 726

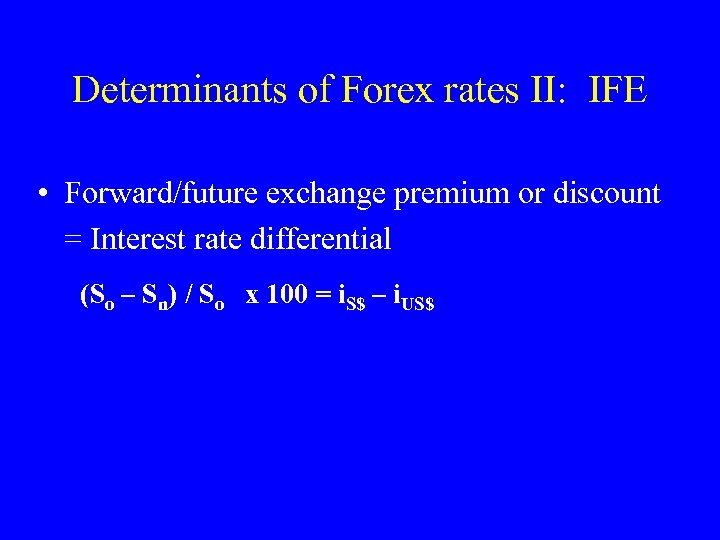

Determinants of Forex rates II: IFE • Forward/future exchange premium or discount = Interest rate differential (So – Sn) / So x 100 = i. S$ – i. US$

Determinants of Forex rates II: IFE • Forward/future exchange premium or discount = Interest rate differential (So – Sn) / So x 100 = i. S$ – i. US$

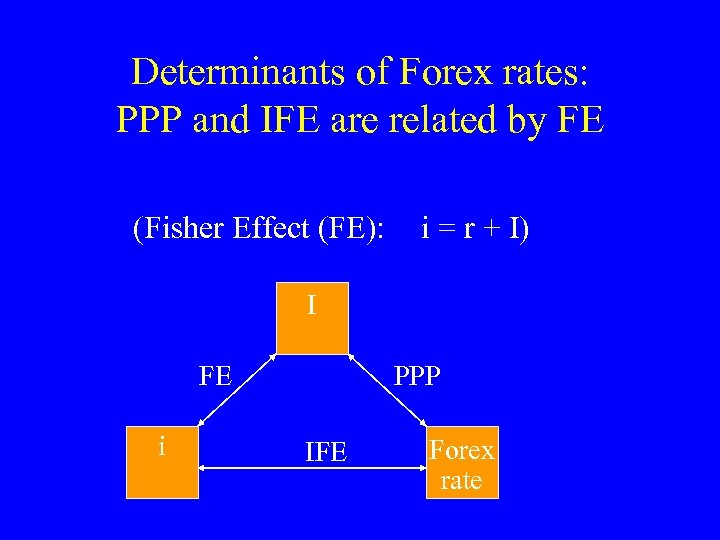

Determinants of Forex rates: PPP and IFE are related by FE (Fisher Effect (FE): i = r + I) I FE i PPP IFE Forex rate

Determinants of Forex rates: PPP and IFE are related by FE (Fisher Effect (FE): i = r + I) I FE i PPP IFE Forex rate

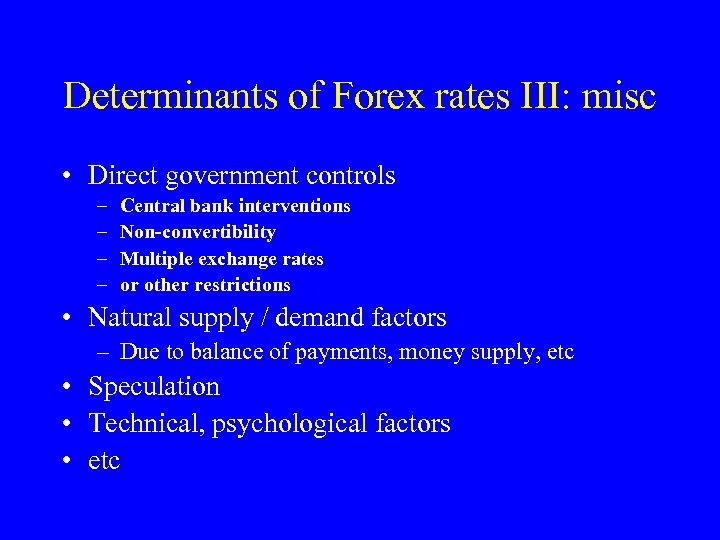

Determinants of Forex rates III: misc • Direct government controls – – Central bank interventions Non-convertibility Multiple exchange rates or other restrictions • Natural supply / demand factors – Due to balance of payments, money supply, etc • Speculation • Technical, psychological factors • etc

Determinants of Forex rates III: misc • Direct government controls – – Central bank interventions Non-convertibility Multiple exchange rates or other restrictions • Natural supply / demand factors – Due to balance of payments, money supply, etc • Speculation • Technical, psychological factors • etc

Exchange Rate Forecasting • Efficient market: where prices reflect all available public information. – Forward exchange rate is an unbiased predictor of future spot rates. (F= Sn) • Inefficient market: where prices do not reflect all available information. Forward exchange rates are not the best predicators of future spot exchange rates. – Use fundamental or technical analysis to predict the exchange rates.

Exchange Rate Forecasting • Efficient market: where prices reflect all available public information. – Forward exchange rate is an unbiased predictor of future spot rates. (F= Sn) • Inefficient market: where prices do not reflect all available information. Forward exchange rates are not the best predicators of future spot exchange rates. – Use fundamental or technical analysis to predict the exchange rates.

THE INTERNATIONAL FINANCIAL SYSTEM PART II: THE GLOBAL MONETARY SYSTEM

THE INTERNATIONAL FINANCIAL SYSTEM PART II: THE GLOBAL MONETARY SYSTEM

History of the global monetary system Bretton Woods Gold Standard ~ 1880 1914 Bretton Woods System ~ 1944 1973 Managed Float ? • Unresolved issue: Which is best, fixed or floating exchange rates? NEW HAMPSHIRE

History of the global monetary system Bretton Woods Gold Standard ~ 1880 1914 Bretton Woods System ~ 1944 1973 Managed Float ? • Unresolved issue: Which is best, fixed or floating exchange rates? NEW HAMPSHIRE

(International Bank for Reconstruction and Development) • Created at Bretton Woods • Created to fund Europe’s reconstruction and help less-developed countries. • Overshadowed in Europe by Marshall Plan, so the bank turned to development.

(International Bank for Reconstruction and Development) • Created at Bretton Woods • Created to fund Europe’s reconstruction and help less-developed countries. • Overshadowed in Europe by Marshall Plan, so the bank turned to development.

International Monetary Fund (IMF) • Created to police Bretton Woods monetary system by ensuring maintenance of fixed-exchange rates. • To allow adjustment for Balance of Payments disequilibrium, the IMF created: – Lending facilities to help countries with payment deficits (short term imbalances). • Persistent borrowings leads to IMF control of a country’s economic policy. – Adjustable parities (for fundamental imbalance). • Today: Surveillance of international payments and exchange rate policies. (No longer fixed rate exchange. ) – IMF has become a global crisis manager.

International Monetary Fund (IMF) • Created to police Bretton Woods monetary system by ensuring maintenance of fixed-exchange rates. • To allow adjustment for Balance of Payments disequilibrium, the IMF created: – Lending facilities to help countries with payment deficits (short term imbalances). • Persistent borrowings leads to IMF control of a country’s economic policy. – Adjustable parities (for fundamental imbalance). • Today: Surveillance of international payments and exchange rate policies. (No longer fixed rate exchange. ) – IMF has become a global crisis manager.

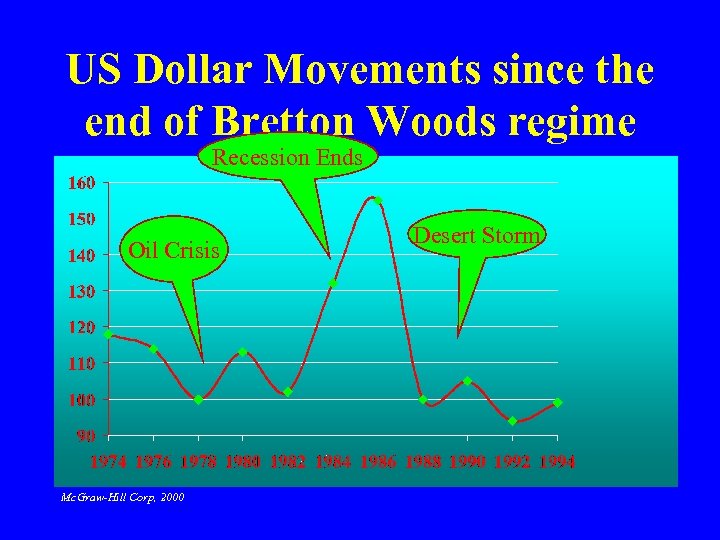

US Dollar Movements since the end of Bretton Woods regime Recession Ends Oil Crisis Mc. Graw-Hill Corp, 2000 Desert Storm

US Dollar Movements since the end of Bretton Woods regime Recession Ends Oil Crisis Mc. Graw-Hill Corp, 2000 Desert Storm

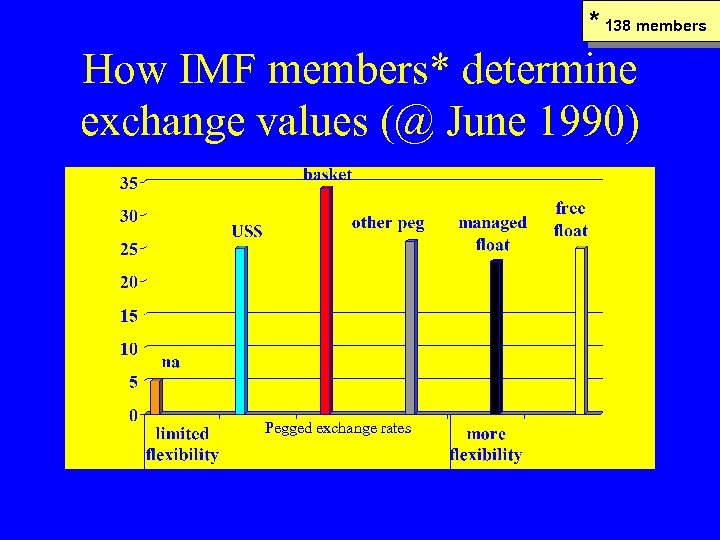

* 138 members How IMF members* determine exchange values (@ June 1990) Pegged exchange rates

* 138 members How IMF members* determine exchange values (@ June 1990) Pegged exchange rates

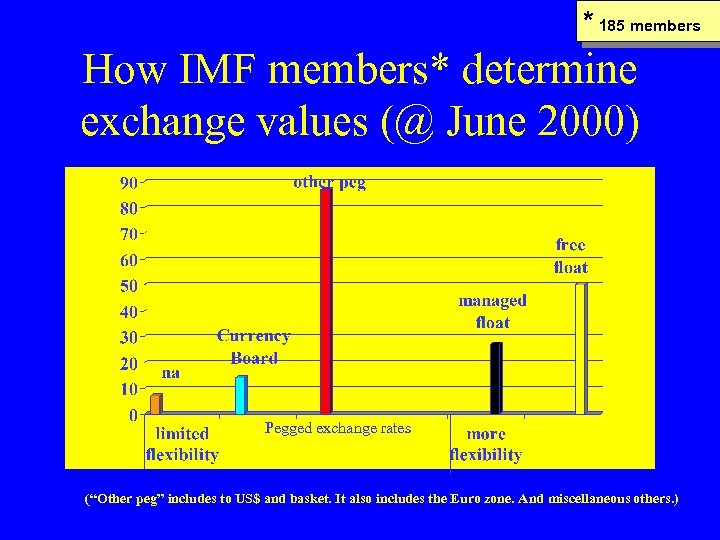

* 185 members How IMF members* determine exchange values (@ June 2000) Pegged exchange rates (“Other peg” includes to US$ and basket. It also includes the Euro zone. And miscellaneous others. )

* 185 members How IMF members* determine exchange values (@ June 2000) Pegged exchange rates (“Other peg” includes to US$ and basket. It also includes the Euro zone. And miscellaneous others. )

TOWARDS A NEW FINANCIAL SYSTEM • Today’s non-system emerged from the wreckage of Bretton Woods. • Reforms will have to heed: –Global financial community –Country stakeholders VIEWS FROM THE ECONOMIST: 1. “Capital controversies” 2. 2. “Currency dilemmas”

TOWARDS A NEW FINANCIAL SYSTEM • Today’s non-system emerged from the wreckage of Bretton Woods. • Reforms will have to heed: –Global financial community –Country stakeholders VIEWS FROM THE ECONOMIST: 1. “Capital controversies” 2. 2. “Currency dilemmas”

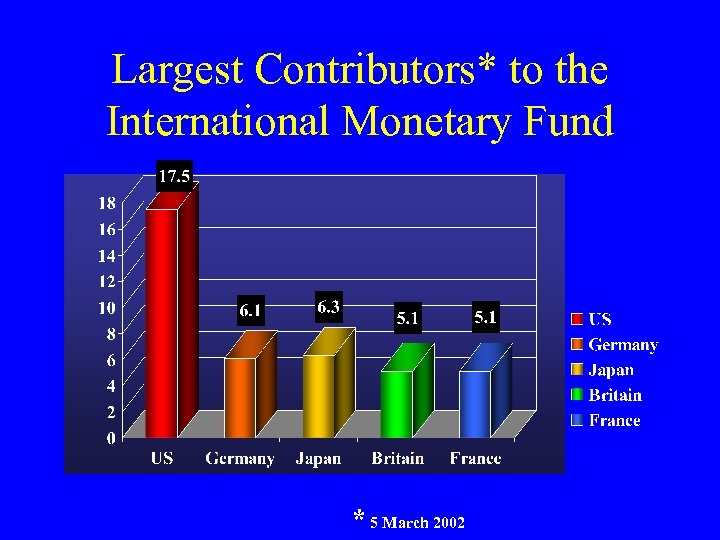

Largest Contributors* to the International Monetary Fund * 5 March 2002

Largest Contributors* to the International Monetary Fund * 5 March 2002

What logic shapes current IMF advice? • “Currency dilemmas, ” The Economist 18 -11 -2000) – Free float: allows monetary policy autonomy • But for most, there is a “fear of floating”. – Currency board: creates the strongest fixed rate • But sacrificing monetary independence involves real economic costs. – other regimes –fixed rates but not quite– attempt to achieve the “impossible trinity”.

What logic shapes current IMF advice? • “Currency dilemmas, ” The Economist 18 -11 -2000) – Free float: allows monetary policy autonomy • But for most, there is a “fear of floating”. – Currency board: creates the strongest fixed rate • But sacrificing monetary independence involves real economic costs. – other regimes –fixed rates but not quite– attempt to achieve the “impossible trinity”.

“Capital controversies” The Economist, May 5 th 1998 • “. . . a revisionist chorus is gaining voice. ” – Is theoretical case for free capital markets robust? – Does experience show benefits of free capital markets exceed costs? • “…capital liberalisation should proceed cautiously, not that it should be stalled. ”

“Capital controversies” The Economist, May 5 th 1998 • “. . . a revisionist chorus is gaining voice. ” – Is theoretical case for free capital markets robust? – Does experience show benefits of free capital markets exceed costs? • “…capital liberalisation should proceed cautiously, not that it should be stalled. ”

IMF Policy Criticisms • “One size fits all” prescription for countries. • Rescue efforts exacerbate the ‘moral hazard’ problem. • Too powerful without accountability.

IMF Policy Criticisms • “One size fits all” prescription for countries. • Rescue efforts exacerbate the ‘moral hazard’ problem. • Too powerful without accountability.

The radical critique The Asian Financial Crisis may be seen as a failure of “Asian capitalism” or alternatively, a failure of the “international financial system”. • Mahathir Mohamed: “The fight for independence will have to begin all over again for the present market rules will surely result in a new imperialism more noxious and debilitating than the old. ” • George Soros: “I’m afraid that the prevailing view, which is one of extending the market mechanism to all domains, has the potential of destroying society. ”

The radical critique The Asian Financial Crisis may be seen as a failure of “Asian capitalism” or alternatively, a failure of the “international financial system”. • Mahathir Mohamed: “The fight for independence will have to begin all over again for the present market rules will surely result in a new imperialism more noxious and debilitating than the old. ” • George Soros: “I’m afraid that the prevailing view, which is one of extending the market mechanism to all domains, has the potential of destroying society. ”

Problems leading to Crisis in Asian market economies • Cronyism. • Too much money, dependence on speculative capital inflows. • Lack of transparency in the financial sector. • Currencies tied to strengthening dollar. • Increasing current account deficits. • Weakness in the Japanese economy Currency devaluation. • Impact of IMF policies on the Countries • • • Capital flight. Rising prices. Rising unemployment. Rising poverty. Rising resentment? Investment impacts • • Loss of investment confidence. Deflation of asset values. Huge corporate debt burdens. Reversal of capital flows – Declining access to operating cash. • Declines in domestic demand. – Decline of intra regional trade.

Problems leading to Crisis in Asian market economies • Cronyism. • Too much money, dependence on speculative capital inflows. • Lack of transparency in the financial sector. • Currencies tied to strengthening dollar. • Increasing current account deficits. • Weakness in the Japanese economy Currency devaluation. • Impact of IMF policies on the Countries • • • Capital flight. Rising prices. Rising unemployment. Rising poverty. Rising resentment? Investment impacts • • Loss of investment confidence. Deflation of asset values. Huge corporate debt burdens. Reversal of capital flows – Declining access to operating cash. • Declines in domestic demand. – Decline of intra regional trade.

THE INTERNATIONAL FINANCIAL SYSTEM Further notes: THE FOREIGN EXCHANGE MARKET

THE INTERNATIONAL FINANCIAL SYSTEM Further notes: THE FOREIGN EXCHANGE MARKET

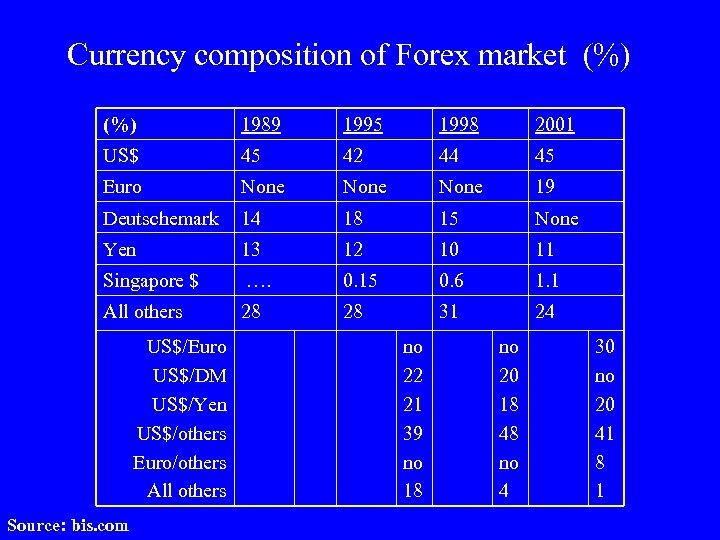

Currency composition of Forex market (%) 1989 1995 US$ 45 42 44 45 Euro None 19 Deutschemark 14 18 15 None Yen 13 12 10 11 Singapore $ …. 0. 15 0. 6 1. 1 All others 28 28 31 24 US$/Euro US$/DM US$/Yen US$/others Euro/others All others Source: bis. com 1998 no 22 21 39 no 18 2001 no 20 18 48 no 4 30 no 20 41 8 1

Currency composition of Forex market (%) 1989 1995 US$ 45 42 44 45 Euro None 19 Deutschemark 14 18 15 None Yen 13 12 10 11 Singapore $ …. 0. 15 0. 6 1. 1 All others 28 28 31 24 US$/Euro US$/DM US$/Yen US$/others Euro/others All others Source: bis. com 1998 no 22 21 39 no 18 2001 no 20 18 48 no 4 30 no 20 41 8 1

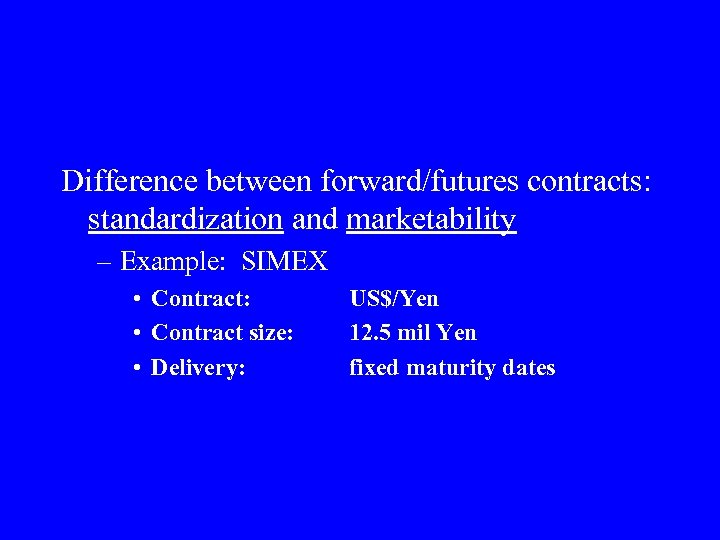

Difference between forward/futures contracts: standardization and marketability – Example: SIMEX • Contract: • Contract size: • Delivery: US$/Yen 12. 5 mil Yen fixed maturity dates

Difference between forward/futures contracts: standardization and marketability – Example: SIMEX • Contract: • Contract size: • Delivery: US$/Yen 12. 5 mil Yen fixed maturity dates

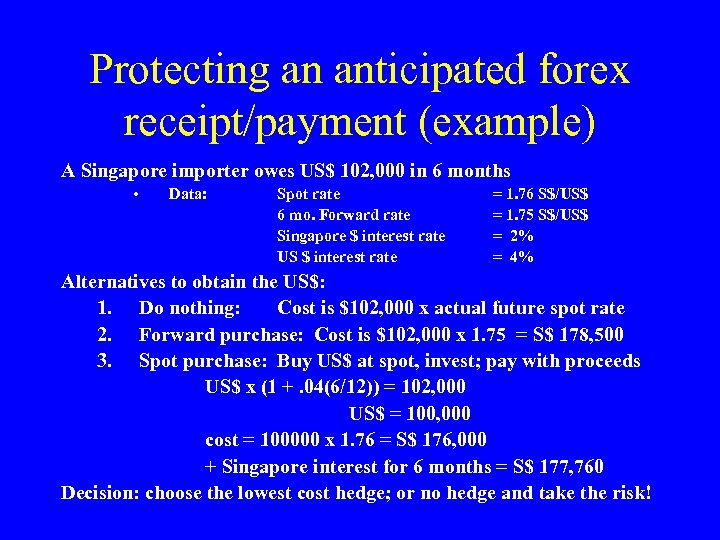

Protecting an anticipated forex receipt/payment (example) A Singapore importer owes US$ 102, 000 in 6 months • Data: Spot rate 6 mo. Forward rate Singapore $ interest rate US $ interest rate = 1. 76 S$/US$ = 1. 75 S$/US$ = 2% = 4% Alternatives to obtain the US$: 1. Do nothing: Cost is $102, 000 x actual future spot rate 2. Forward purchase: Cost is $102, 000 x 1. 75 = S$ 178, 500 3. Spot purchase: Buy US$ at spot, invest; pay with proceeds US$ x (1 +. 04(6/12)) = 102, 000 US$ = 100, 000 cost = 100000 x 1. 76 = S$ 176, 000 + Singapore interest for 6 months = S$ 177, 760 Decision: choose the lowest cost hedge; or no hedge and take the risk!

Protecting an anticipated forex receipt/payment (example) A Singapore importer owes US$ 102, 000 in 6 months • Data: Spot rate 6 mo. Forward rate Singapore $ interest rate US $ interest rate = 1. 76 S$/US$ = 1. 75 S$/US$ = 2% = 4% Alternatives to obtain the US$: 1. Do nothing: Cost is $102, 000 x actual future spot rate 2. Forward purchase: Cost is $102, 000 x 1. 75 = S$ 178, 500 3. Spot purchase: Buy US$ at spot, invest; pay with proceeds US$ x (1 +. 04(6/12)) = 102, 000 US$ = 100, 000 cost = 100000 x 1. 76 = S$ 176, 000 + Singapore interest for 6 months = S$ 177, 760 Decision: choose the lowest cost hedge; or no hedge and take the risk!

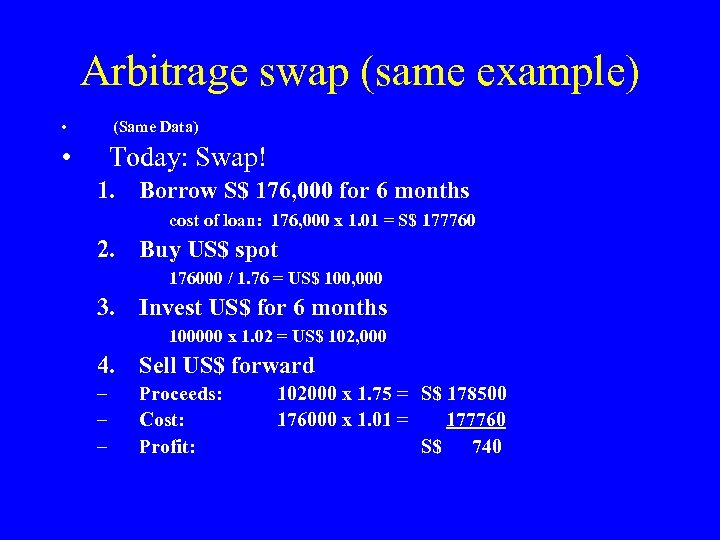

Arbitrage swap (same example) • (Same Data) • Today: Swap! 1. Borrow S$ 176, 000 for 6 months cost of loan: 176, 000 x 1. 01 = S$ 177760 2. Buy US$ spot 176000 / 1. 76 = US$ 100, 000 3. Invest US$ for 6 months 100000 x 1. 02 = US$ 102, 000 4. Sell US$ forward – – – Proceeds: Cost: Profit: 102000 x 1. 75 = S$ 178500 176000 x 1. 01 = 177760 S$ 740

Arbitrage swap (same example) • (Same Data) • Today: Swap! 1. Borrow S$ 176, 000 for 6 months cost of loan: 176, 000 x 1. 01 = S$ 177760 2. Buy US$ spot 176000 / 1. 76 = US$ 100, 000 3. Invest US$ for 6 months 100000 x 1. 02 = US$ 102, 000 4. Sell US$ forward – – – Proceeds: Cost: Profit: 102000 x 1. 75 = S$ 178500 176000 x 1. 01 = 177760 S$ 740

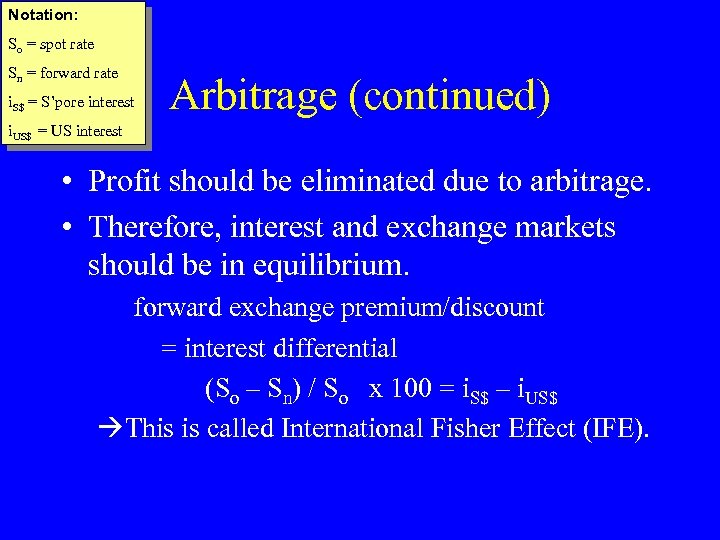

Notation: So = spot rate Sn = forward rate i. S$ = S’pore interest Arbitrage (continued) i. US$ = US interest • Profit should be eliminated due to arbitrage. • Therefore, interest and exchange markets should be in equilibrium. forward exchange premium/discount = interest differential (So – Sn) / So x 100 = i. S$ – i. US$ This is called International Fisher Effect (IFE).

Notation: So = spot rate Sn = forward rate i. S$ = S’pore interest Arbitrage (continued) i. US$ = US interest • Profit should be eliminated due to arbitrage. • Therefore, interest and exchange markets should be in equilibrium. forward exchange premium/discount = interest differential (So – Sn) / So x 100 = i. S$ – i. US$ This is called International Fisher Effect (IFE).

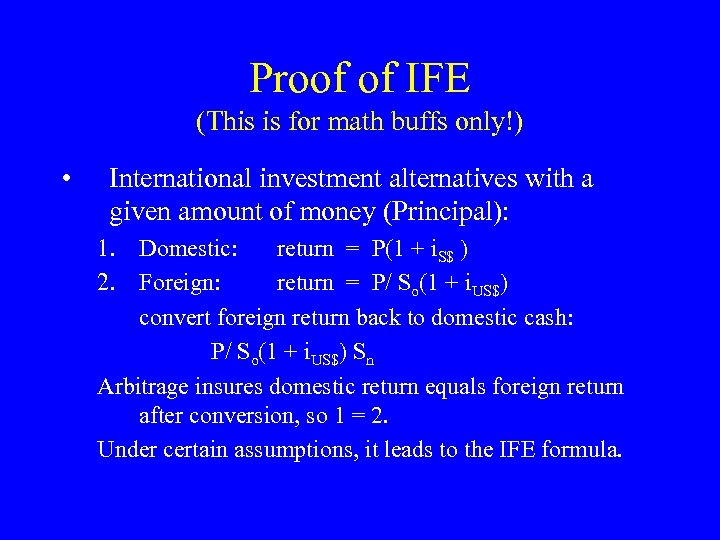

Proof of IFE (This is for math buffs only!) • International investment alternatives with a given amount of money (Principal): 1. Domestic: return = P(1 + i. S$ ) 2. Foreign: return = P/ So(1 + i. US$) convert foreign return back to domestic cash: P/ So(1 + i. US$) Sn Arbitrage insures domestic return equals foreign return after conversion, so 1 = 2. Under certain assumptions, it leads to the IFE formula.

Proof of IFE (This is for math buffs only!) • International investment alternatives with a given amount of money (Principal): 1. Domestic: return = P(1 + i. S$ ) 2. Foreign: return = P/ So(1 + i. US$) convert foreign return back to domestic cash: P/ So(1 + i. US$) Sn Arbitrage insures domestic return equals foreign return after conversion, so 1 = 2. Under certain assumptions, it leads to the IFE formula.

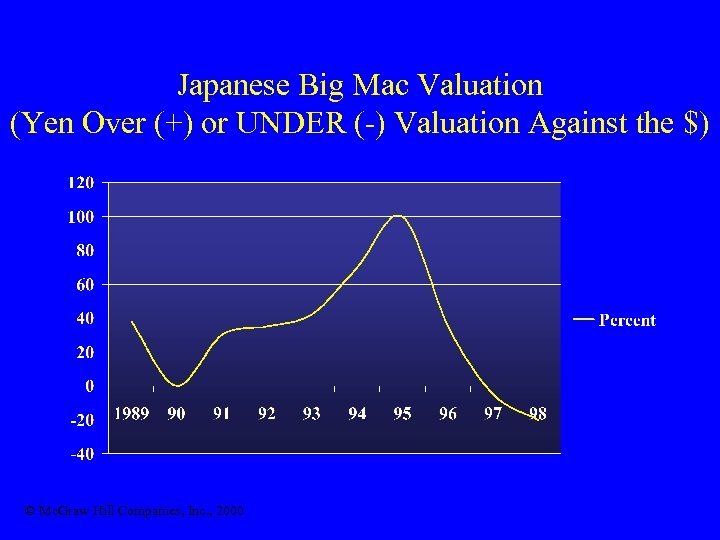

Japanese Big Mac Valuation (Yen Over (+) or UNDER (-) Valuation Against the $) © Mc. Graw Hill Companies, Inc. , 2000

Japanese Big Mac Valuation (Yen Over (+) or UNDER (-) Valuation Against the $) © Mc. Graw Hill Companies, Inc. , 2000

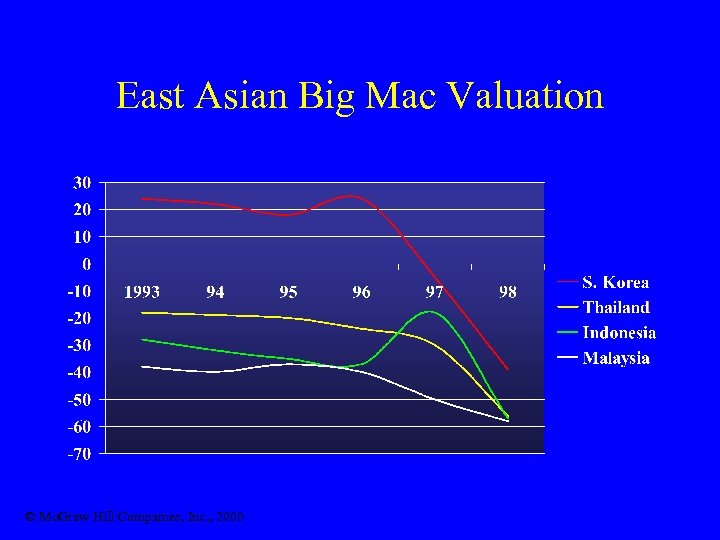

East Asian Big Mac Valuation © Mc. Graw Hill Companies, Inc. , 2000

East Asian Big Mac Valuation © Mc. Graw Hill Companies, Inc. , 2000

THE INTERNATIONAL FINANCIAL SYSTEM Further notes: THE GLOBAL MONETARY SYSTEM

THE INTERNATIONAL FINANCIAL SYSTEM Further notes: THE GLOBAL MONETARY SYSTEM

The Gold Standard • Has its roots in old mercantile trade. • Inconvenient to ship gold, changed to paper - redeemable for gold. • Reflected international desire to achieve ‘balance-of-trade equilibrium’

The Gold Standard • Has its roots in old mercantile trade. • Inconvenient to ship gold, changed to paper - redeemable for gold. • Reflected international desire to achieve ‘balance-of-trade equilibrium’

Between the Wars • Post WWI, war heavy expenditures affected the value of currencies against gold. • Countries engaged in competitive devaluations. • Gradually, gold convertibility was suspended.

Between the Wars • Post WWI, war heavy expenditures affected the value of currencies against gold. • Countries engaged in competitive devaluations. • Gradually, gold convertibility was suspended.

The Bretton Woods System • In 1944, 44 countries met in New Hampshire, US. • Countries agreed to peg their currencies to US$ which was convertible to gold at $35/oz. • Agreed not to engage in competitive devaluations for trade purposes and to defend their currencies. • Created IMF and World Bank.

The Bretton Woods System • In 1944, 44 countries met in New Hampshire, US. • Countries agreed to peg their currencies to US$ which was convertible to gold at $35/oz. • Agreed not to engage in competitive devaluations for trade purposes and to defend their currencies. • Created IMF and World Bank.

Collapse of the B. W. regime • Under BW, US Treasury required to deliver 1 oz of gold to any IMF member that redeemed US $35. 00. • 1958 – 1971: US ran accumulated deficit of $56 billion. US gold reserves shrank from $34. 8 bil to $12. 2 bil. • August 8, 1971, USA left gold standard. • March 19, 1972, Japan and most of Europe floated their currencies. • Fully collapsed in 1973. – Vietnam War was blamed. • Floating currencies considered to be a temporary fix. – Still going on today.

Collapse of the B. W. regime • Under BW, US Treasury required to deliver 1 oz of gold to any IMF member that redeemed US $35. 00. • 1958 – 1971: US ran accumulated deficit of $56 billion. US gold reserves shrank from $34. 8 bil to $12. 2 bil. • August 8, 1971, USA left gold standard. • March 19, 1972, Japan and most of Europe floated their currencies. • Fully collapsed in 1973. – Vietnam War was blamed. • Floating currencies considered to be a temporary fix. – Still going on today.

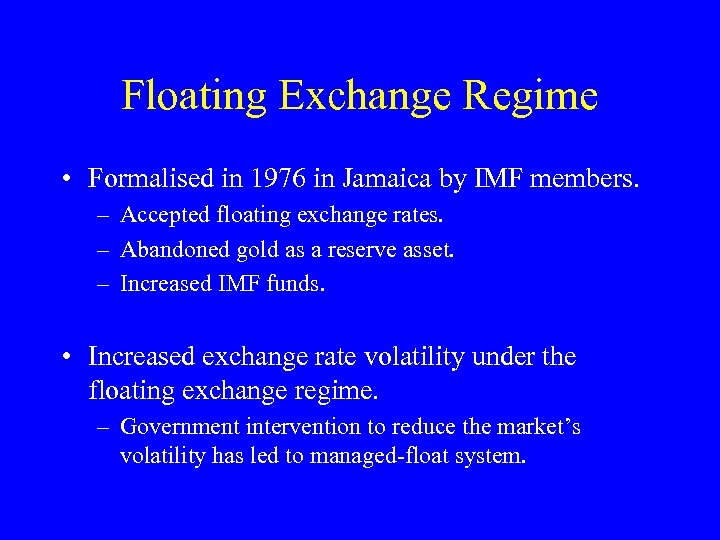

Floating Exchange Regime • Formalised in 1976 in Jamaica by IMF members. – Accepted floating exchange rates. – Abandoned gold as a reserve asset. – Increased IMF funds. • Increased exchange rate volatility under the floating exchange regime. – Government intervention to reduce the market’s volatility has led to managed-float system.

Floating Exchange Regime • Formalised in 1976 in Jamaica by IMF members. – Accepted floating exchange rates. – Abandoned gold as a reserve asset. – Increased IMF funds. • Increased exchange rate volatility under the floating exchange regime. – Government intervention to reduce the market’s volatility has led to managed-float system.

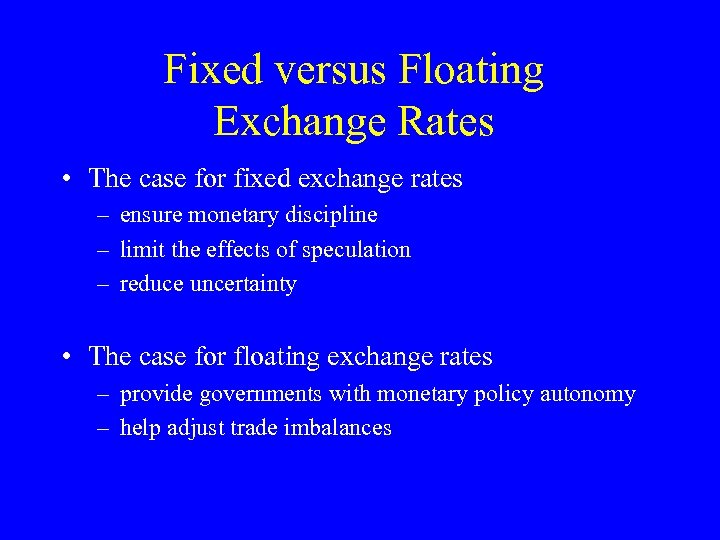

Fixed versus Floating Exchange Rates • The case for fixed exchange rates – ensure monetary discipline – limit the effects of speculation – reduce uncertainty • The case for floating exchange rates – provide governments with monetary policy autonomy – help adjust trade imbalances

Fixed versus Floating Exchange Rates • The case for fixed exchange rates – ensure monetary discipline – limit the effects of speculation – reduce uncertainty • The case for floating exchange rates – provide governments with monetary policy autonomy – help adjust trade imbalances

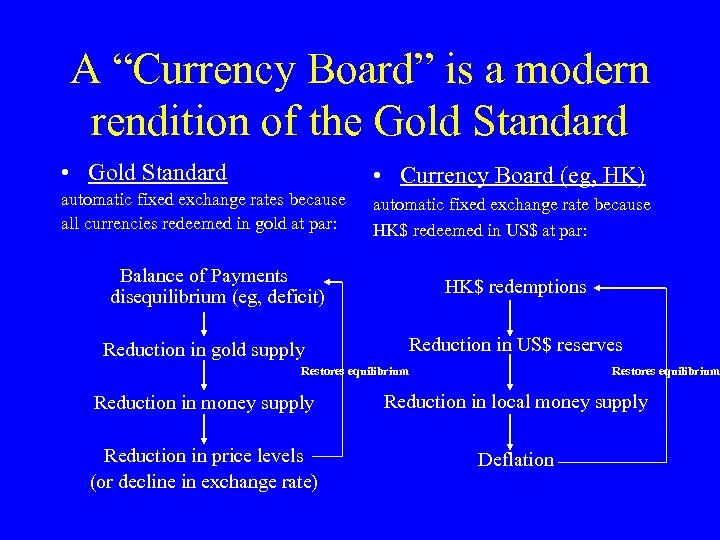

A “Currency Board” is a modern rendition of the Gold Standard • Gold Standard • Currency Board (eg, HK) automatic fixed exchange rates because all currencies redeemed in gold at par: automatic fixed exchange rate because HK$ redeemed in US$ at par: Balance of Payments disequilibrium (eg, deficit) HK$ redemptions Reduction in US$ reserves Reduction in gold supply Restores equilibrium Reduction in money supply Reduction in local money supply Reduction in price levels (or decline in exchange rate) Deflation

A “Currency Board” is a modern rendition of the Gold Standard • Gold Standard • Currency Board (eg, HK) automatic fixed exchange rates because all currencies redeemed in gold at par: automatic fixed exchange rate because HK$ redeemed in US$ at par: Balance of Payments disequilibrium (eg, deficit) HK$ redemptions Reduction in US$ reserves Reduction in gold supply Restores equilibrium Reduction in money supply Reduction in local money supply Reduction in price levels (or decline in exchange rate) Deflation

Largest Borrowers from the IMF $ Billion © Mc. Graw Hill Companies, Inc. , 2000 (Recently, these loans were exceeded by commitments to Turkey and Brazil. )

Largest Borrowers from the IMF $ Billion © Mc. Graw Hill Companies, Inc. , 2000 (Recently, these loans were exceeded by commitments to Turkey and Brazil. )

The radical argument • Today’s dominant economic doctrines rule out any interpretation, or resolution, of global financial crises (such as the Asian Crisis) that puts part of the blame on the effects of the ideology of globalized markets. – The Asian Financial Crisis may be seen as a failure of “Asian capitalism” or alternatively, a failure of the “international financial system”.

The radical argument • Today’s dominant economic doctrines rule out any interpretation, or resolution, of global financial crises (such as the Asian Crisis) that puts part of the blame on the effects of the ideology of globalized markets. – The Asian Financial Crisis may be seen as a failure of “Asian capitalism” or alternatively, a failure of the “international financial system”.

Global capitalism The “New Imperialism” (? ) • Mahathir Mohamed: “…the fight for independence will have to begin all over again for the present market rules will surely result in a new imperialism more noxious and debilitating than the old. ” • George Soros: “I’m afraid that the prevailing view, which is one of extending the market mechanism to all domains, has the potential of destroying society. ”

Global capitalism The “New Imperialism” (? ) • Mahathir Mohamed: “…the fight for independence will have to begin all over again for the present market rules will surely result in a new imperialism more noxious and debilitating than the old. ” • George Soros: “I’m afraid that the prevailing view, which is one of extending the market mechanism to all domains, has the potential of destroying society. ”

One culprit: the IMF • The IMF is the institution responsible for the “system”. • Nationalists from the Global South are critical of the IMF for (at least): – Forcing countries to open up to foreign competition and takeovers – Forcing liberalization American-style – Bailing out foreign banks, while insisting on bankruptcy for local banks – Fiscal and monetary restraints that kill local businesses – Dictating policy from Washington DC – Lack of transparency

One culprit: the IMF • The IMF is the institution responsible for the “system”. • Nationalists from the Global South are critical of the IMF for (at least): – Forcing countries to open up to foreign competition and takeovers – Forcing liberalization American-style – Bailing out foreign banks, while insisting on bankruptcy for local banks – Fiscal and monetary restraints that kill local businesses – Dictating policy from Washington DC – Lack of transparency

Another culprit: market speculators • The case for free capital movement is weaker than the case for free trade. • George Soros himself believes there must be reform of the “system” and hedge funds like his own should be controlled. • Radical reforms are occasionally implemented: – Debt write-offs, capital controls, market intervention • Conventional solutions are relied upon: – Better information, sound financial practices, less government involvement, improved banking and corporate governance, etc

Another culprit: market speculators • The case for free capital movement is weaker than the case for free trade. • George Soros himself believes there must be reform of the “system” and hedge funds like his own should be controlled. • Radical reforms are occasionally implemented: – Debt write-offs, capital controls, market intervention • Conventional solutions are relied upon: – Better information, sound financial practices, less government involvement, improved banking and corporate governance, etc

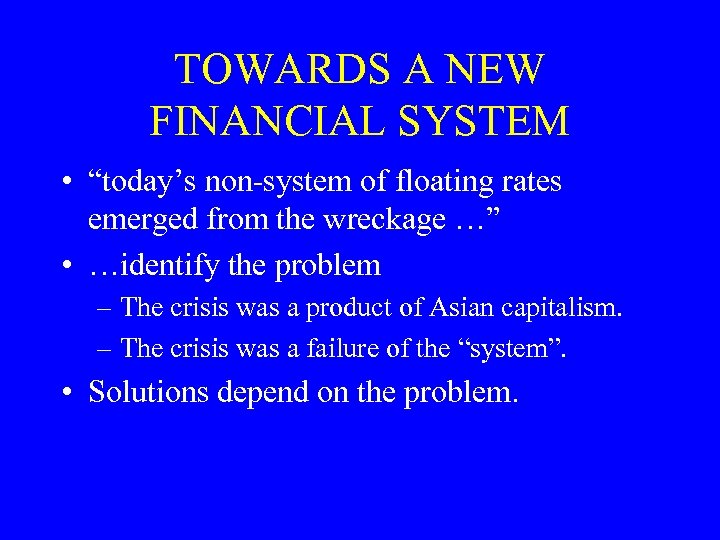

TOWARDS A NEW FINANCIAL SYSTEM • “today’s non-system of floating rates emerged from the wreckage …” • …identify the problem – The crisis was a product of Asian capitalism. – The crisis was a failure of the “system”. • Solutions depend on the problem.

TOWARDS A NEW FINANCIAL SYSTEM • “today’s non-system of floating rates emerged from the wreckage …” • …identify the problem – The crisis was a product of Asian capitalism. – The crisis was a failure of the “system”. • Solutions depend on the problem.

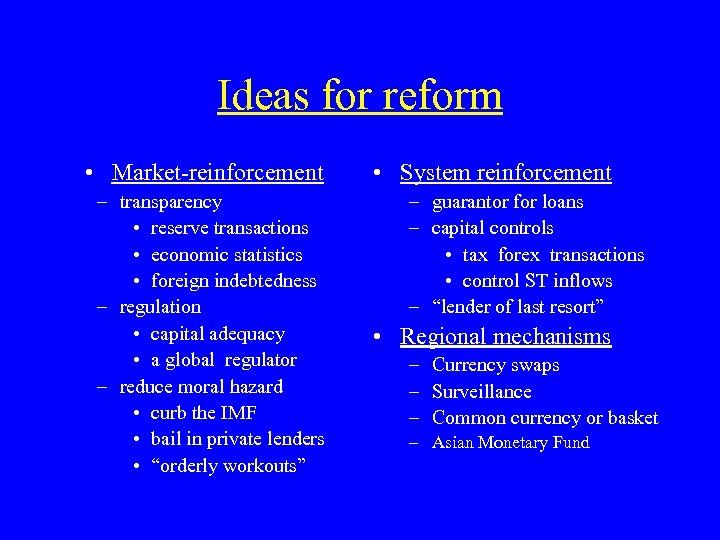

Ideas for reform • Market-reinforcement – transparency • reserve transactions • economic statistics • foreign indebtedness – regulation • capital adequacy • a global regulator – reduce moral hazard • curb the IMF • bail in private lenders • “orderly workouts” • System reinforcement – guarantor for loans – capital controls • tax forex transactions • control ST inflows – “lender of last resort” • Regional mechanisms – Currency swaps – Surveillance – Common currency or basket – Asian Monetary Fund

Ideas for reform • Market-reinforcement – transparency • reserve transactions • economic statistics • foreign indebtedness – regulation • capital adequacy • a global regulator – reduce moral hazard • curb the IMF • bail in private lenders • “orderly workouts” • System reinforcement – guarantor for loans – capital controls • tax forex transactions • control ST inflows – “lender of last resort” • Regional mechanisms – Currency swaps – Surveillance – Common currency or basket – Asian Monetary Fund