d952223141ff7039d3403ac363afcb5f.ppt

- Количество слайдов: 15

The Infrastructure Financing Landscape “Financing The Coming Capital Cycle” David Nastro Head of Global Power & Utilities Group October 10, 2008

The Infrastructure Financing Landscape “Financing The Coming Capital Cycle” David Nastro Head of Global Power & Utilities Group October 10, 2008

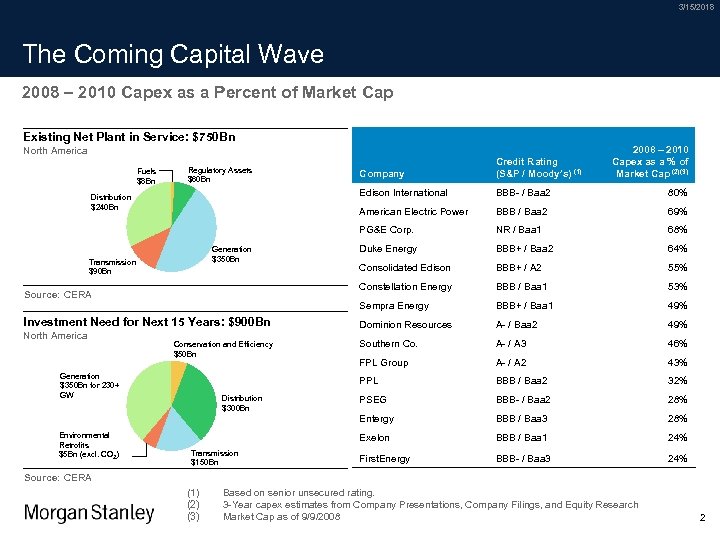

3/15/2018 The Coming Capital Wave 2008 – 2010 Capex as a Percent of Market Cap Existing Net Plant in Service: $750 Bn North America 2008 – 2010 Capex as a % of Market Cap (2)(3) Edison International North America Generation $350 Bn for 230+ GW Environmental Retrofits $5 Bn (excl. CO 2) Distribution $300 Bn Transmission $150 Bn 68% Duke Energy BBB+ / Baa 2 64% Consolidated Edison BBB+ / A 2 55% BBB / Baa 1 53% BBB+ / Baa 1 49% Dominion Resources A- / Baa 2 49% Southern Co. A- / A 3 46% FPL Group A- / A 2 43% BBB / Baa 2 32% PSEG BBB- / Baa 2 28% BBB / Baa 3 28% Exelon Conservation and Efficiency $50 Bn NR / Baa 1 Entergy Investment Need for Next 15 Years: $900 Bn 69% PPL Source: CERA BBB / Baa 2 Sempra Energy Generation $350 Bn Transmission $90 Bn 80% Constellation Energy Distribution $240 Bn BBB- / Baa 2 American Electric Power Regulatory Assets $60 Bn Company PG&E Corp. Fuels $8 Bn Credit Rating (S&P / Moody’s) (1) BBB / Baa 1 24% First. Energy BBB- / Baa 3 24% Source: CERA (1) (2) (3) Based on senior unsecured rating. 3 -Year capex estimates from Company Presentations, Company Filings, and Equity Research Market Cap as of 9/9/2008 2

3/15/2018 The Coming Capital Wave 2008 – 2010 Capex as a Percent of Market Cap Existing Net Plant in Service: $750 Bn North America 2008 – 2010 Capex as a % of Market Cap (2)(3) Edison International North America Generation $350 Bn for 230+ GW Environmental Retrofits $5 Bn (excl. CO 2) Distribution $300 Bn Transmission $150 Bn 68% Duke Energy BBB+ / Baa 2 64% Consolidated Edison BBB+ / A 2 55% BBB / Baa 1 53% BBB+ / Baa 1 49% Dominion Resources A- / Baa 2 49% Southern Co. A- / A 3 46% FPL Group A- / A 2 43% BBB / Baa 2 32% PSEG BBB- / Baa 2 28% BBB / Baa 3 28% Exelon Conservation and Efficiency $50 Bn NR / Baa 1 Entergy Investment Need for Next 15 Years: $900 Bn 69% PPL Source: CERA BBB / Baa 2 Sempra Energy Generation $350 Bn Transmission $90 Bn 80% Constellation Energy Distribution $240 Bn BBB- / Baa 2 American Electric Power Regulatory Assets $60 Bn Company PG&E Corp. Fuels $8 Bn Credit Rating (S&P / Moody’s) (1) BBB / Baa 1 24% First. Energy BBB- / Baa 3 24% Source: CERA (1) (2) (3) Based on senior unsecured rating. 3 -Year capex estimates from Company Presentations, Company Filings, and Equity Research Market Cap as of 9/9/2008 2

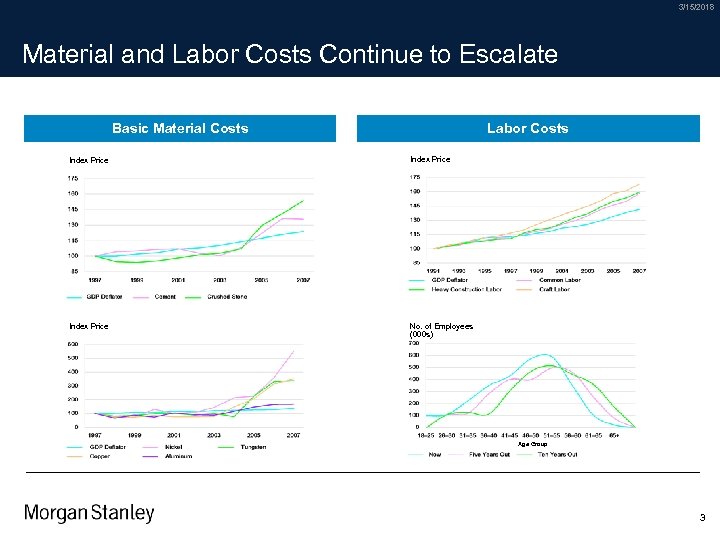

3/15/2018 Material and Labor Costs Continue to Escalate Basic Material Costs Labor Costs Index Price No. of Employees (000 s) Age Group 3

3/15/2018 Material and Labor Costs Continue to Escalate Basic Material Costs Labor Costs Index Price No. of Employees (000 s) Age Group 3

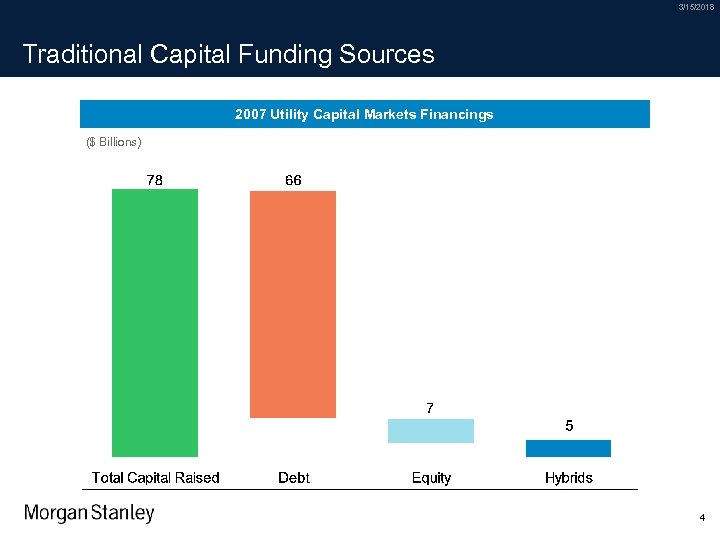

3/15/2018 Traditional Capital Funding Sources 2007 Utility Capital Markets Financings ($ Billions) 4

3/15/2018 Traditional Capital Funding Sources 2007 Utility Capital Markets Financings ($ Billions) 4

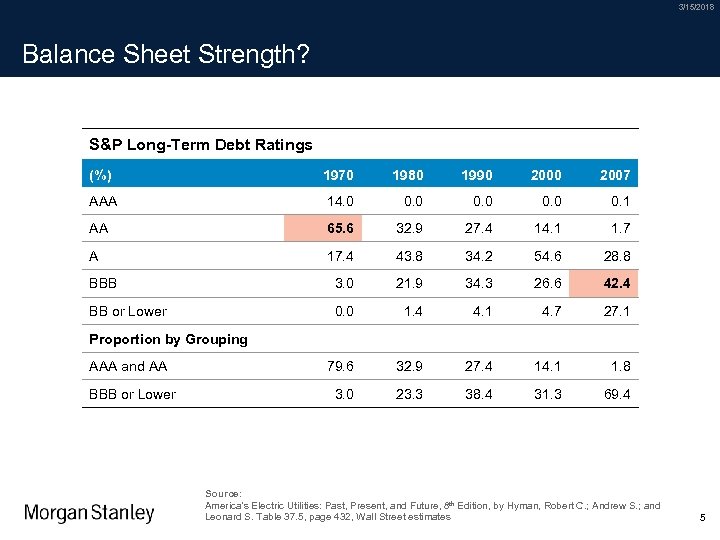

3/15/2018 Balance Sheet Strength? S&P Long-Term Debt Ratings (%) 1970 1980 1990 2007 AAA 14. 0 0. 1 AA 65. 6 32. 9 27. 4 14. 1 1. 7 A 17. 4 43. 8 34. 2 54. 6 28. 8 BBB 3. 0 21. 9 34. 3 26. 6 42. 4 BB or Lower 0. 0 1. 4 4. 1 4. 7 27. 1 79. 6 32. 9 27. 4 14. 1 1. 8 3. 0 23. 3 38. 4 31. 3 69. 4 Proportion by Grouping AAA and AA BBB or Lower Source: America’s Electric Utilities: Past, Present, and Future, 8 th Edition, by Hyman, Robert C. ; Andrew S. ; and Leonard S. Table 37. 5, page 432, Wall Street estimates 5

3/15/2018 Balance Sheet Strength? S&P Long-Term Debt Ratings (%) 1970 1980 1990 2007 AAA 14. 0 0. 1 AA 65. 6 32. 9 27. 4 14. 1 1. 7 A 17. 4 43. 8 34. 2 54. 6 28. 8 BBB 3. 0 21. 9 34. 3 26. 6 42. 4 BB or Lower 0. 0 1. 4 4. 1 4. 7 27. 1 79. 6 32. 9 27. 4 14. 1 1. 8 3. 0 23. 3 38. 4 31. 3 69. 4 Proportion by Grouping AAA and AA BBB or Lower Source: America’s Electric Utilities: Past, Present, and Future, 8 th Edition, by Hyman, Robert C. ; Andrew S. ; and Leonard S. Table 37. 5, page 432, Wall Street estimates 5

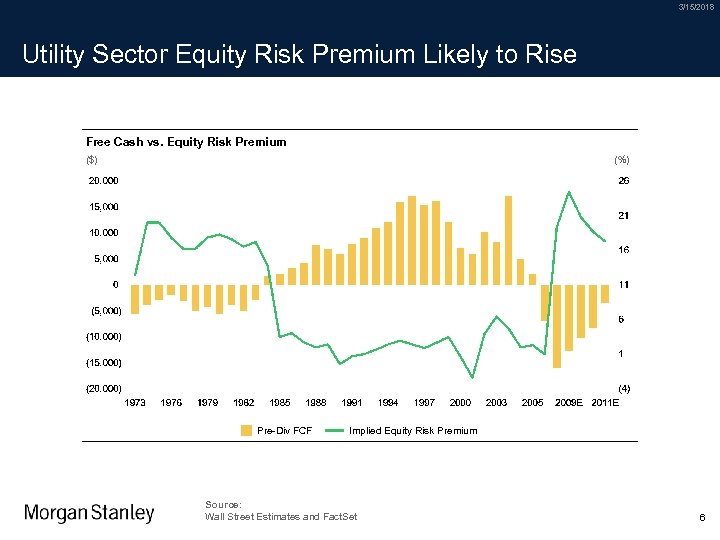

3/15/2018 Utility Sector Equity Risk Premium Likely to Rise Free Cash vs. Equity Risk Premium ($) (%) Pre-Div FCF Implied Equity Risk Premium Source: Wall Street Estimates and Fact. Set 6

3/15/2018 Utility Sector Equity Risk Premium Likely to Rise Free Cash vs. Equity Risk Premium ($) (%) Pre-Div FCF Implied Equity Risk Premium Source: Wall Street Estimates and Fact. Set 6

3/15/2018 Less Traditional Financing Alternatives · Joint Ventures · Asset Monetization · Securitization Technology · Alternative Sources of Capital 7

3/15/2018 Less Traditional Financing Alternatives · Joint Ventures · Asset Monetization · Securitization Technology · Alternative Sources of Capital 7

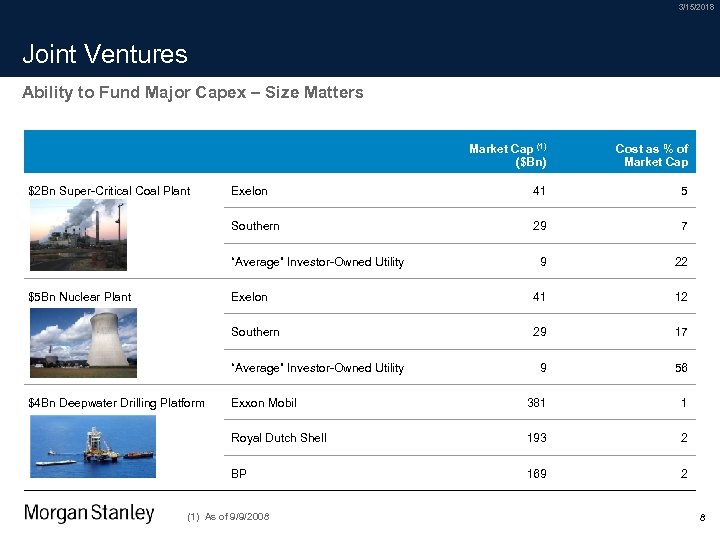

3/15/2018 Joint Ventures Ability to Fund Major Capex – Size Matters Market Cap (1) ($Bn) Exelon 41 5 Southern 29 7 9 22 Exelon 41 12 Southern 29 17 9 56 Exxon Mobil 381 1 Royal Dutch Shell 193 2 BP $2 Bn Super-Critical Coal Plant Cost as % of Market Cap 169 2 “Average” Investor-Owned Utility $5 Bn Nuclear Plant “Average” Investor-Owned Utility $4 Bn Deepwater Drilling Platform (1) As of 9/9/2008 8

3/15/2018 Joint Ventures Ability to Fund Major Capex – Size Matters Market Cap (1) ($Bn) Exelon 41 5 Southern 29 7 9 22 Exelon 41 12 Southern 29 17 9 56 Exxon Mobil 381 1 Royal Dutch Shell 193 2 BP $2 Bn Super-Critical Coal Plant Cost as % of Market Cap 169 2 “Average” Investor-Owned Utility $5 Bn Nuclear Plant “Average” Investor-Owned Utility $4 Bn Deepwater Drilling Platform (1) As of 9/9/2008 8

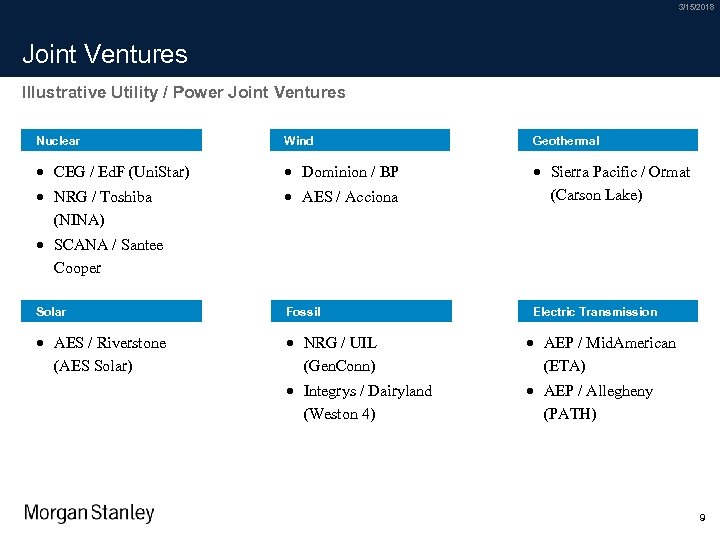

3/15/2018 Joint Ventures Illustrative Utility / Power Joint Ventures Nuclear Wind Geothermal · CEG / Ed. F (Uni. Star) · Dominion / BP · NRG / Toshiba (NINA) · AES / Acciona · Sierra Pacific / Ormat (Carson Lake) Solar Fossil Electric Transmission · AES / Riverstone (AES Solar) · NRG / UIL (Gen. Conn) · AEP / Mid. American (ETA) · Integrys / Dairyland (Weston 4) · AEP / Allegheny (PATH) · SCANA / Santee Cooper 9

3/15/2018 Joint Ventures Illustrative Utility / Power Joint Ventures Nuclear Wind Geothermal · CEG / Ed. F (Uni. Star) · Dominion / BP · NRG / Toshiba (NINA) · AES / Acciona · Sierra Pacific / Ormat (Carson Lake) Solar Fossil Electric Transmission · AES / Riverstone (AES Solar) · NRG / UIL (Gen. Conn) · AEP / Mid. American (ETA) · Integrys / Dairyland (Weston 4) · AEP / Allegheny (PATH) · SCANA / Santee Cooper 9

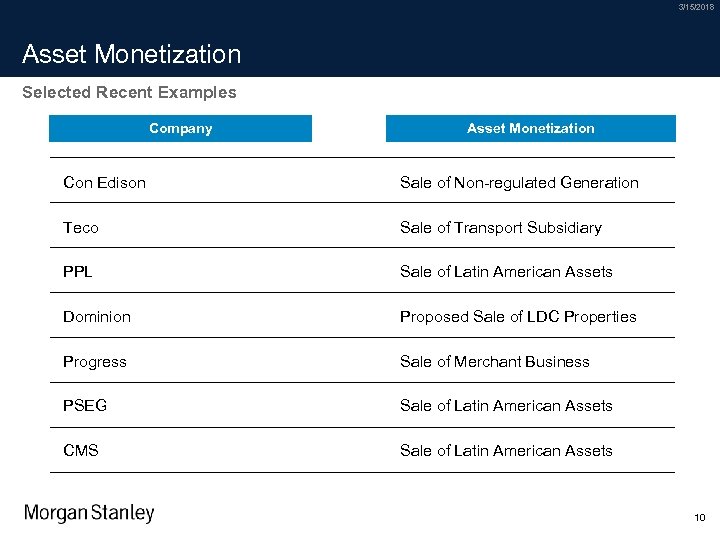

3/15/2018 Asset Monetization Selected Recent Examples Company Asset Monetization Con Edison Sale of Non-regulated Generation Teco Sale of Transport Subsidiary PPL Sale of Latin American Assets Dominion Proposed Sale of LDC Properties Progress Sale of Merchant Business PSEG Sale of Latin American Assets CMS Sale of Latin American Assets 10

3/15/2018 Asset Monetization Selected Recent Examples Company Asset Monetization Con Edison Sale of Non-regulated Generation Teco Sale of Transport Subsidiary PPL Sale of Latin American Assets Dominion Proposed Sale of LDC Properties Progress Sale of Merchant Business PSEG Sale of Latin American Assets CMS Sale of Latin American Assets 10

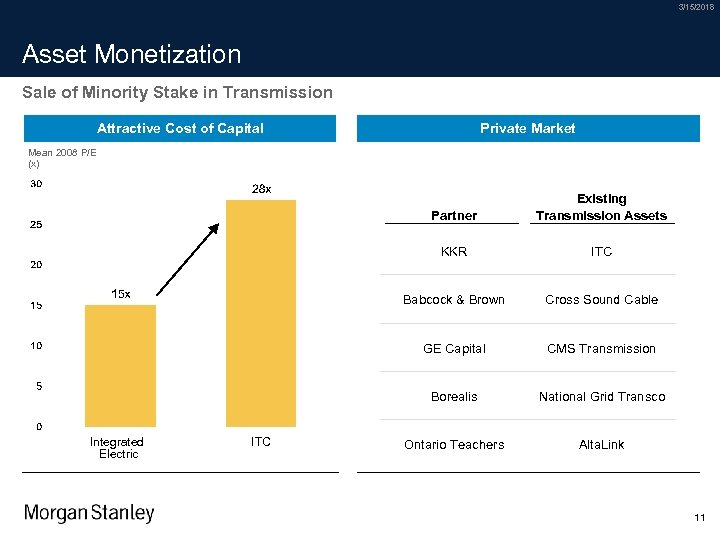

3/15/2018 Asset Monetization Sale of Minority Stake in Transmission Attractive Cost of Capital Private Market Mean 2008 P/E (x) Partner KKR Cross Sound Cable GE Capital CMS Transmission Borealis ITC Babcock & Brown Integrated Electric Existing Transmission Assets National Grid Transco Ontario Teachers Alta. Link 11

3/15/2018 Asset Monetization Sale of Minority Stake in Transmission Attractive Cost of Capital Private Market Mean 2008 P/E (x) Partner KKR Cross Sound Cable GE Capital CMS Transmission Borealis ITC Babcock & Brown Integrated Electric Existing Transmission Assets National Grid Transco Ontario Teachers Alta. Link 11

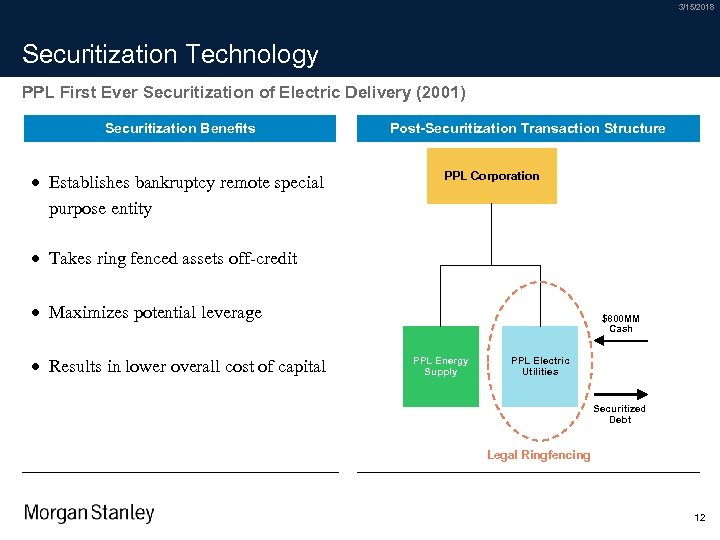

3/15/2018 Securitization Technology PPL First Ever Securitization of Electric Delivery (2001) Securitization Benefits · Establishes bankruptcy remote special purpose entity Post-Securitization Transaction Structure PPL Corporation · Takes ring fenced assets off-credit · Maximizes potential leverage · Results in lower overall cost of capital $800 MM Cash PPL Energy Supply PPL Electric Utilities Securitized Debt Legal Ringfencing 12

3/15/2018 Securitization Technology PPL First Ever Securitization of Electric Delivery (2001) Securitization Benefits · Establishes bankruptcy remote special purpose entity Post-Securitization Transaction Structure PPL Corporation · Takes ring fenced assets off-credit · Maximizes potential leverage · Results in lower overall cost of capital $800 MM Cash PPL Energy Supply PPL Electric Utilities Securitized Debt Legal Ringfencing 12

3/15/2018 Alternative Sources of Capital Illustrative List of Less Traditional Capital Sources Private Equity Funds Infrastructure Funds · AIG Highstar · Alinda · Apollo · Babcock & Brown · Arc. Light · Borealis Infrastructure · Blackstone · Brookfield · Carlyle / Riverstone · Citi Infrastructure Fund · Energy Capital Partners · CPP Investment Board · GE · Global Infrastructure Partners · KKR · Madison Dearborn · Tenaska · TPG · Warburg Pincus · Macquarie · Morgan Stanley Infrastructure Partners · Ontario Teachers Infrastructure Fund Sovereign Related Entities Wealth Funds · Abu Dhabi Investment Authority · China Investment Corporation · Government Investment Corporation (Singapore) · Int’l Petroleum Investment Corp. (Abu Dhabi) · Investment Corp. of Dubai · Kuwait Investment Authority · Qatar Investment Authority · TAQA (Abu Dhabi) · Temasek 13

3/15/2018 Alternative Sources of Capital Illustrative List of Less Traditional Capital Sources Private Equity Funds Infrastructure Funds · AIG Highstar · Alinda · Apollo · Babcock & Brown · Arc. Light · Borealis Infrastructure · Blackstone · Brookfield · Carlyle / Riverstone · Citi Infrastructure Fund · Energy Capital Partners · CPP Investment Board · GE · Global Infrastructure Partners · KKR · Madison Dearborn · Tenaska · TPG · Warburg Pincus · Macquarie · Morgan Stanley Infrastructure Partners · Ontario Teachers Infrastructure Fund Sovereign Related Entities Wealth Funds · Abu Dhabi Investment Authority · China Investment Corporation · Government Investment Corporation (Singapore) · Int’l Petroleum Investment Corp. (Abu Dhabi) · Investment Corp. of Dubai · Kuwait Investment Authority · Qatar Investment Authority · TAQA (Abu Dhabi) · Temasek 13

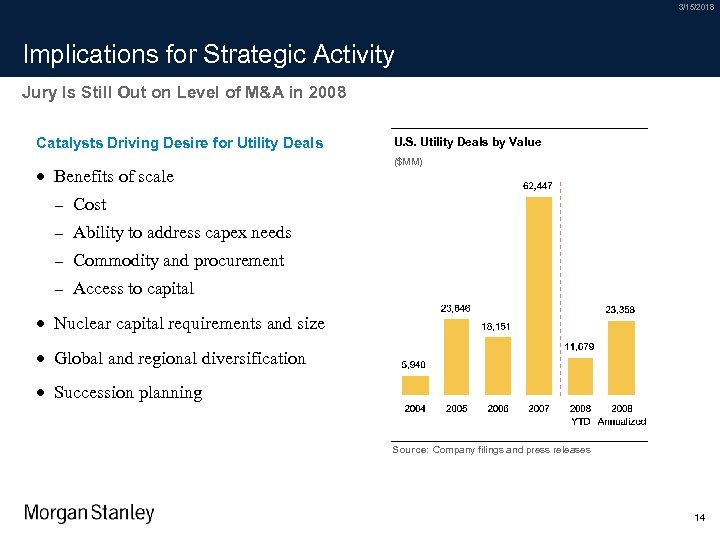

3/15/2018 Implications for Strategic Activity Jury Is Still Out on Level of M&A in 2008 Catalysts Driving Desire for Utility Deals · Benefits of scale - Ability to address capex needs - Commodity and procurement - ($MM) Cost - U. S. Utility Deals by Value Access to capital · Nuclear capital requirements and size · Global and regional diversification · Succession planning Source: Company filings and press releases 14

3/15/2018 Implications for Strategic Activity Jury Is Still Out on Level of M&A in 2008 Catalysts Driving Desire for Utility Deals · Benefits of scale - Ability to address capex needs - Commodity and procurement - ($MM) Cost - U. S. Utility Deals by Value Access to capital · Nuclear capital requirements and size · Global and regional diversification · Succession planning Source: Company filings and press releases 14

3/15/2018 Key Takeaways · Traditional Access to Capital Facing Headwinds · Formation of Partnerships / Joint Ventures - International Utilities - Financial Parties · Emergence of New Pools of Capital - Sovereign Wealth Funds - Middle Eastern Investors - South East Asian Investors - Japanese Investors - Pensions and Endowments · More Creativity!!! 15

3/15/2018 Key Takeaways · Traditional Access to Capital Facing Headwinds · Formation of Partnerships / Joint Ventures - International Utilities - Financial Parties · Emergence of New Pools of Capital - Sovereign Wealth Funds - Middle Eastern Investors - South East Asian Investors - Japanese Investors - Pensions and Endowments · More Creativity!!! 15