6e3675c2988cdfd30bf3cff05d13f53f.ppt

- Количество слайдов: 14

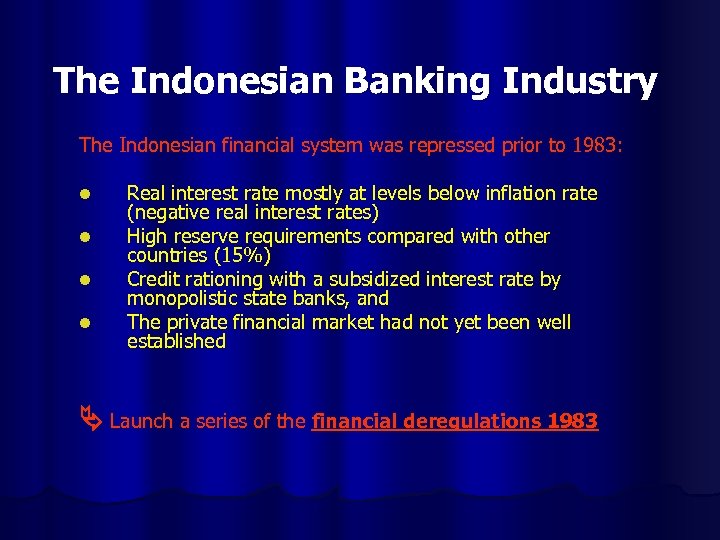

The Indonesian Banking Industry The Indonesian financial system was repressed prior to 1983: l l Real interest rate mostly at levels below inflation rate (negative real interest rates) High reserve requirements compared with other countries (15%) Credit rationing with a subsidized interest rate by monopolistic state banks, and The private financial market had not yet been well established Launch a series of the financial deregulations 1983

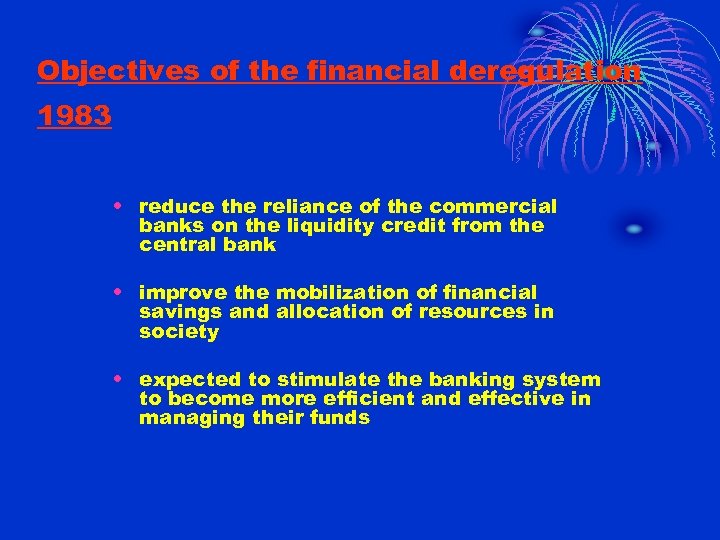

Objectives of the financial deregulation 1983 • reduce the reliance of the commercial banks on the liquidity credit from the central bank • improve the mobilization of financial savings and allocation of resources in society • expected to stimulate the banking system to become more efficient and effective in managing their funds

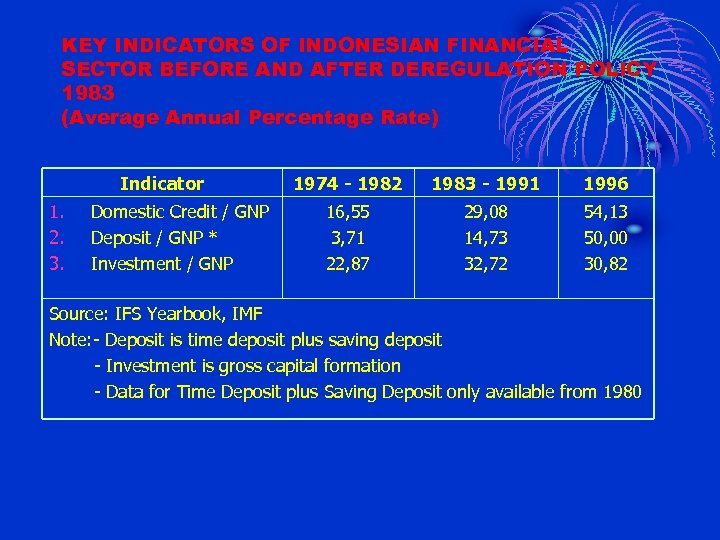

KEY INDICATORS OF INDONESIAN FINANCIAL SECTOR BEFORE AND AFTER DEREGULATION POLICY 1983 (Average Annual Percentage Rate) Indicator 1. 2. 3. Domestic Credit / GNP Deposit / GNP * Investment / GNP 1974 - 1982 1983 - 1991 1996 16, 55 3, 71 22, 87 29, 08 14, 73 32, 72 54, 13 50, 00 30, 82 Source: IFS Yearbook, IMF Note: - Deposit is time deposit plus saving deposit - Investment is gross capital formation - Data for Time Deposit plus Saving Deposit only available from 1980

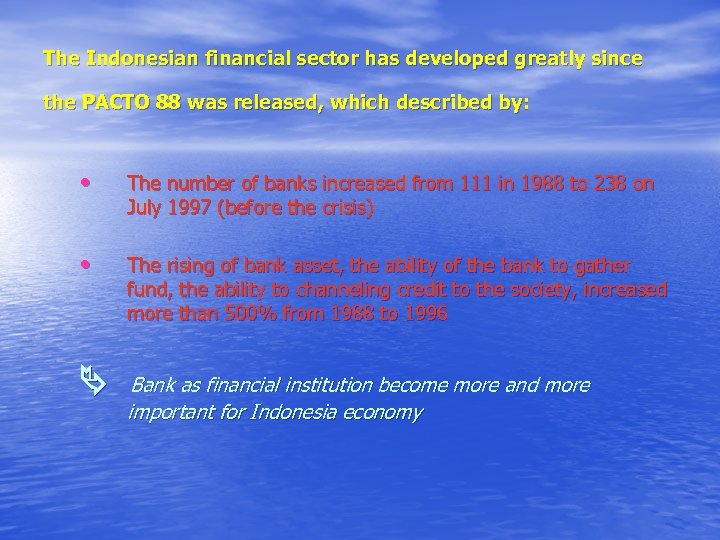

The Indonesian financial sector has developed greatly since the PACTO 88 was released, which described by: • The number of banks increased from 111 in 1988 to 238 on July 1997 (before the crisis) • The rising of bank asset, the ability of the bank to gather fund, the ability to channeling credit to the society, increased more than 500% from 1988 to 1996 Bank as financial institution become more and more important for Indonesia economy

Conditions of Indonesian Financial Sector: n n The rapid development was not supported by good infrastructure such as banking supervision The regulatory framework has not already yet to develop a healthy and efficient banking industry Human resources have not already yet Many corruption, collusion and nepotism either in government or private institutions Causes: n n Many credits are not lend properly Many legal lending limit are abused by bankers

Finally decreasing Rupiah, increasing interest rate or decreasing economic growth places banks in a difficult position where NPL increasing (from 7, 2% in the end 1997 to 57, 2% in the end of 1998). The government disciplined the banking industry by liquidating 16 banks on November 1, 1997, without any preparation, socialization and explanation shocked the society’s belief in banking industry BANK PANICS

The continuing crisis followed by: § more than 300% increasing of the interbank rate of interest, § bank must still carry negative burden of net interest margin as the result of vast enough negative spread, and § the economic, social and politic environment that getting worse The banking in Indonesia finally facing crisis and needs total restructuring in banking industry

BANKING RESTRUCTURING DEFINITION Banking restructuring can be defined as the package of macroeconomic, microeconomic, institutional, and regulatory measures taken in order to correct incentives and to restore problem banking system to sustainable financial solvency and profitability. Consequently, bank restructuring must tackle the causes and the effects of individual bank problems, or of widespread bank distress

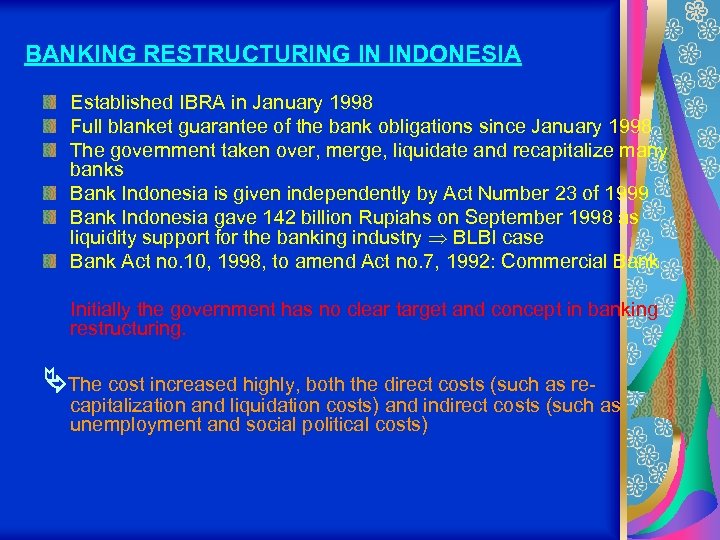

BANKING RESTRUCTURING IN INDONESIA Established IBRA in January 1998 Full blanket guarantee of the bank obligations since January 1998 The government taken over, merge, liquidate and recapitalize many banks Bank Indonesia is given independently by Act Number 23 of 1999 Bank Indonesia gave 142 billion Rupiahs on September 1998 as liquidity support for the banking industry BLBI case Bank Act no. 10, 1998, to amend Act no. 7, 1992: Commercial Bank Initially the government has no clear target and concept in banking restructuring. The cost increased highly, both the direct costs (such as re- capitalization and liquidation costs) and indirect costs (such as unemployment and social political costs)

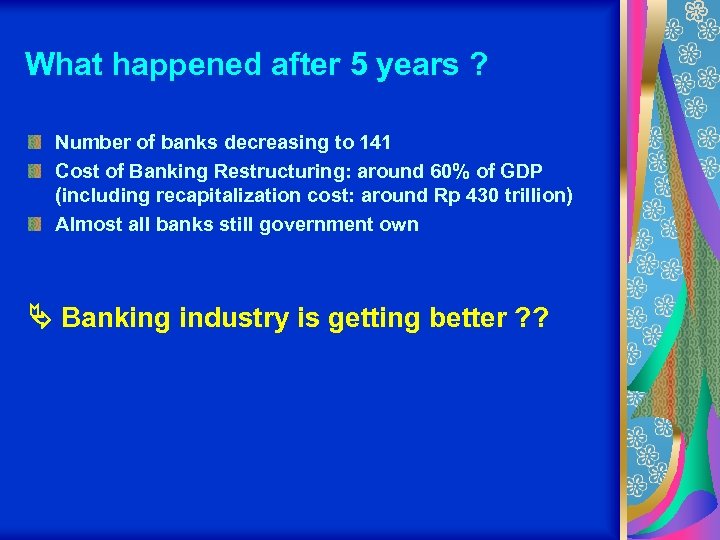

What happened after 5 years ? Number of banks decreasing to 141 Cost of Banking Restructuring: around 60% of GDP (including recapitalization cost: around Rp 430 trillion) Almost all banks still government own Banking industry is getting better ? ?

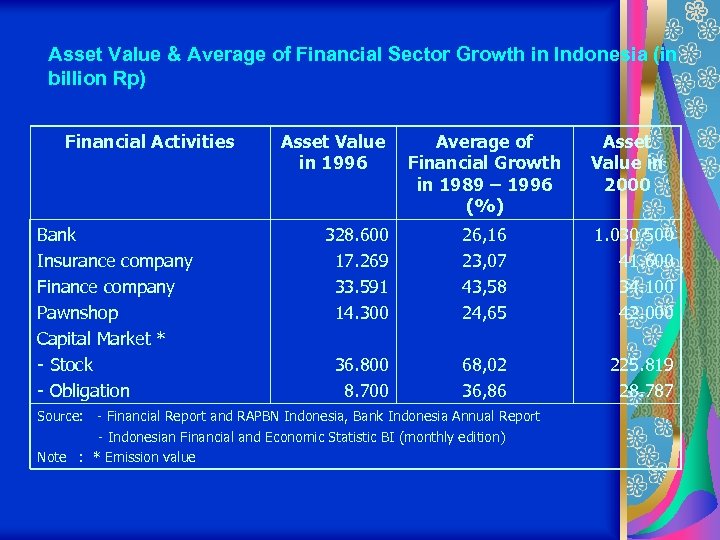

Asset Value & Average of Financial Sector Growth in Indonesia (in billion Rp) Financial Activities Bank Insurance company Finance company Pawnshop Capital Market * - Stock - Obligation Asset Value in 1996 Average of Financial Growth in 1989 – 1996 (%) Asset Value in 2000 328. 600 17. 269 33. 591 14. 300 26, 16 23, 07 43, 58 24, 65 1. 030. 500 41. 600 34. 100 42. 000 36. 800 8. 700 68, 02 36, 86 225. 819 28. 787 Source: - Financial Report and RAPBN Indonesia, Bank Indonesia Annual Report - Indonesian Financial and Economic Statistic BI (monthly edition) Note : * Emission value

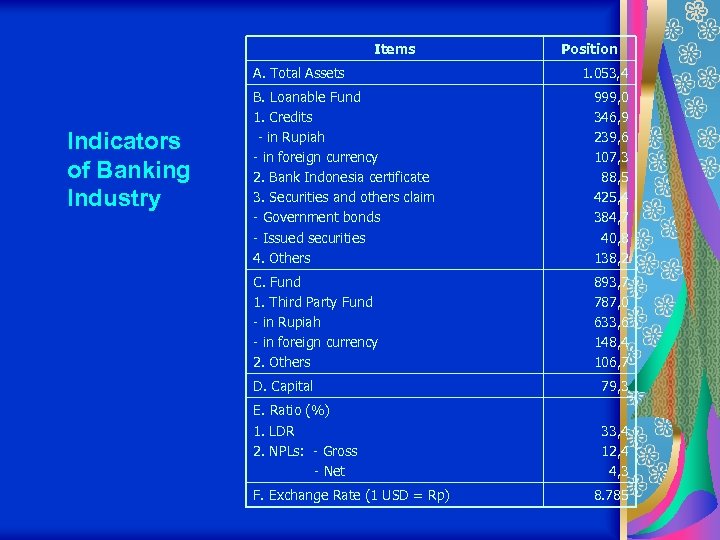

Items A. Total Assets Indicators of Banking Industry Position 1. 053, 4 B. Loanable Fund 1. Credits - in Rupiah - in foreign currency 2. Bank Indonesia certificate 3. Securities and others claim - Government bonds - Issued securities 4. Others 999, 0 346, 9 239, 6 107, 3 88, 5 425, 4 384, 7 40, 8 138, 2 C. Fund 1. Third Party Fund - in Rupiah - in foreign currency 2. Others 893, 7 787, 0 633, 6 148, 4 106, 7 D. Capital 79, 3 E. Ratio (%) 1. LDR 2. NPLs: - Gross - Net 33, 4 12, 4 4, 3 F. Exchange Rate (1 USD = Rp) 8. 785

Financial Industry in Indonesia Items Total Assets (billion Rp) Share (%) Firms (Unit) 1. Banking industry * 2. Insurance Companies 2. 1. Life Insurance Companies 2. 2. Property-Casualty Insurance 3. Pawnshop 3. 1. 1. State owners ** 3. 1. 2. Non State owners ** 3. 2. Financial Pawnshop 4. Finance Companies 5. Securities Firm 1. 048. 836. 389 36. 403. 744 22. 269. 114 14. 134. 630 29. 547. 653 27. 611. 983 22. 286. 366 5. 325. 617 1. 935. 518 23. 980. 597 6. 590. 382 91, 57 3, 18 1, 94 1, 23 2, 58 2, 41 1, 95 0, 46 0, 17 2, 09 0, 58 145 153 52 101 306 283 73 210 23 106 183 TOTAL 1. 145. 358. 613 100 893 * Per June 2002 ** Per December 2000 Source: Infobank

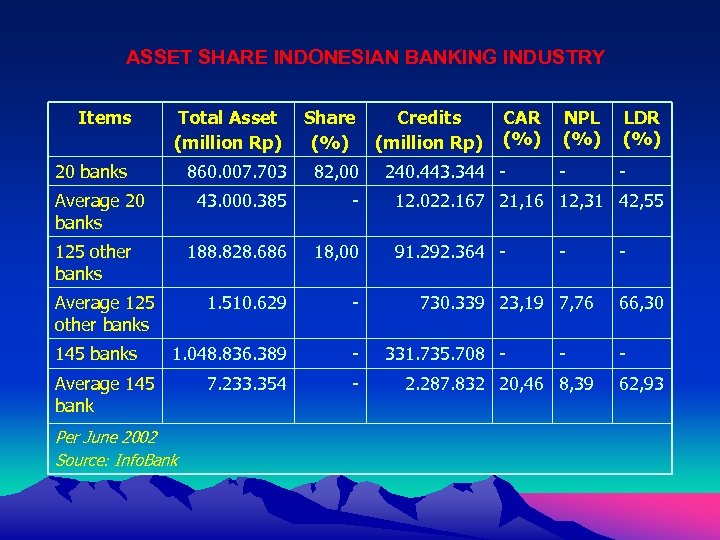

ASSET SHARE INDONESIAN BANKING INDUSTRY Items Total Asset (million Rp) Share (%) 20 banks 860. 007. 703 82, 00 43. 000. 385 - 188. 828. 686 18, 00 1. 510. 629 - 1. 048. 836. 389 - 7. 233. 354 - Average 20 banks 125 other banks Average 125 other banks 145 banks Average 145 bank Per June 2002 Source: Info. Bank Credits (million Rp) CAR (%) 240. 443. 344 - NPL (%) LDR (%) - - 12. 022. 167 21, 16 12, 31 42, 55 91. 292. 364 - - 730. 339 23, 19 7, 76 331. 735. 708 - - 2. 287. 832 20, 46 8, 39 66, 30 62, 93

6e3675c2988cdfd30bf3cff05d13f53f.ppt