AF215_2012_Indigo_Analysis.ppt

- Количество слайдов: 16

THE INDIGO BUSINESS STRATEGY, ACCOUNTING, AND FINANCIAL ANALYSIS

Business Strategy Analysis of the Retail Clothing Industry w Competitive industry: n n No reason to expect industry growth at rates in excess of overall economy-wide expansion; Presence of many competitors; Low customer switching costs; Few barriers to entry except for economies of scale in brand development;

Business Competitive Strategy w Product differentiation strategy, with a strong focus on brand development and advertising; w Operations within a niche where customers care about fashion but only so long as it can be delivered at a moderate price Ø Barriers to mobility: brand image?

Implications of Strategy Analysis for Financial Analysis w Expectation of high profit margins: n Higher than normal gross margins reflecting the apparently successful attempt at differentiation; w Expectation of high net operating asset turnover: n n n Sparse decor in The Indigo’s stores; Simple product line; Policy of chopping prices on old merchandise;

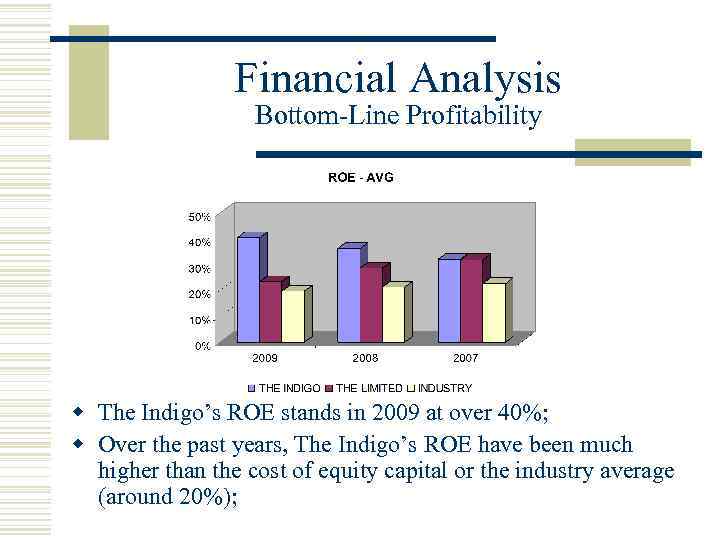

Financial Analysis Bottom-Line Profitability w The Indigo’s ROE stands in 2009 at over 40%; w Over the past years, The Indigo’s ROE have been much higher than the cost of equity capital or the industry average (around 20%);

Accounting Analysis w Are The Indigo’s high ROE purely an artifact of accounting?

Accounting Analysis w No! n n n Earnings contain no unusual gains; Accounting methods are standard; Cash flow from operations is higher than operating income; Receivables are too small to be an issue in earnings quality; Inventory growth broadly in line with sales growth;

Accounting Analysis w But The Indigo’s ROE could be distorted by the: n n Expensing of advertising; Accounting for leases; w Distortions are however likely to be small!

Financial Analysis Technical Note: Decomposition of ROE w ROE = OROA + (NFL * Spread) n n n OROA=NOPAT/BVA (Operating ROA: Return on Net Operating Assets) NFL=BVND/BVE ( Net Financial Leverage); Spread = OROA - NIC; w ROE=ROA*LEV=ROS*AT*LEV n n ROA=NP/ASSETS (Return on Assets); ROS=NP/SALES (Return on Sales); AT=SALES/ASSETS (Asset Turnover); LEV= ASSETS/BVE (Leverage)

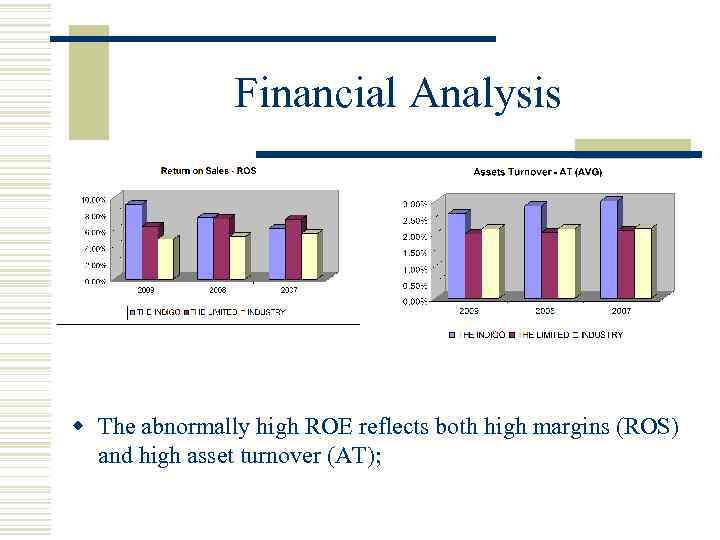

Financial Analysis w The abnormally high ROE reflects both high margins (ROS) and high asset turnover (AT);

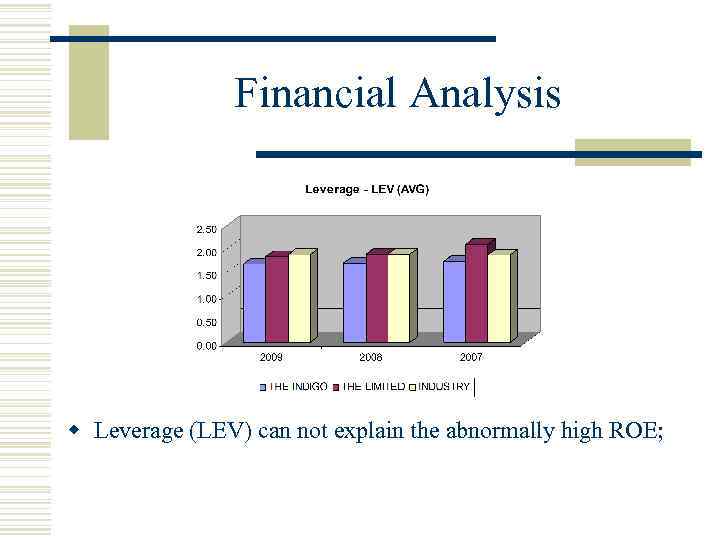

Financial Analysis w Leverage (LEV) can not explain the abnormally high ROE;

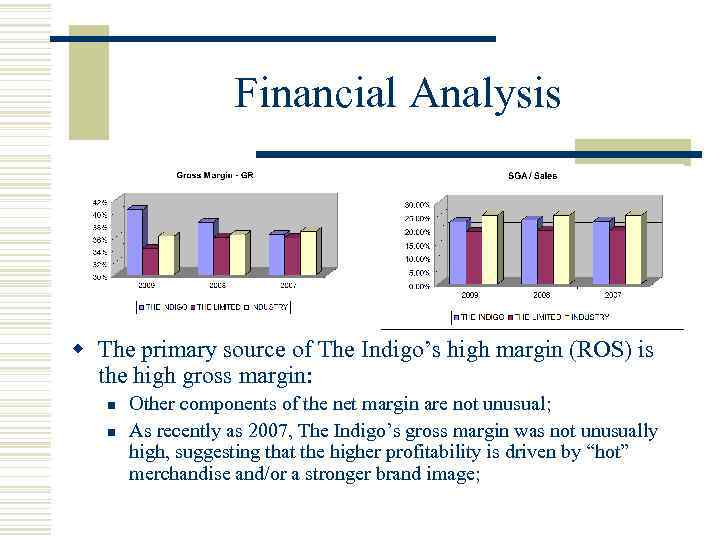

Financial Analysis w The primary source of The Indigo’s high margin (ROS) is the high gross margin: n n Other components of the net margin are not unusual; As recently as 2007, The Indigo’s gross margin was not unusually high, suggesting that the higher profitability is driven by “hot” merchandise and/or a stronger brand image;

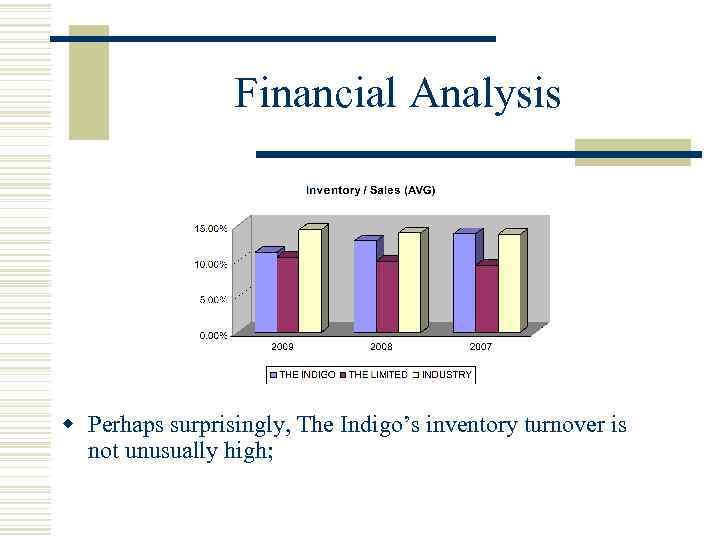

Financial Analysis w Perhaps surprisingly, The Indigo’s inventory turnover is not unusually high;

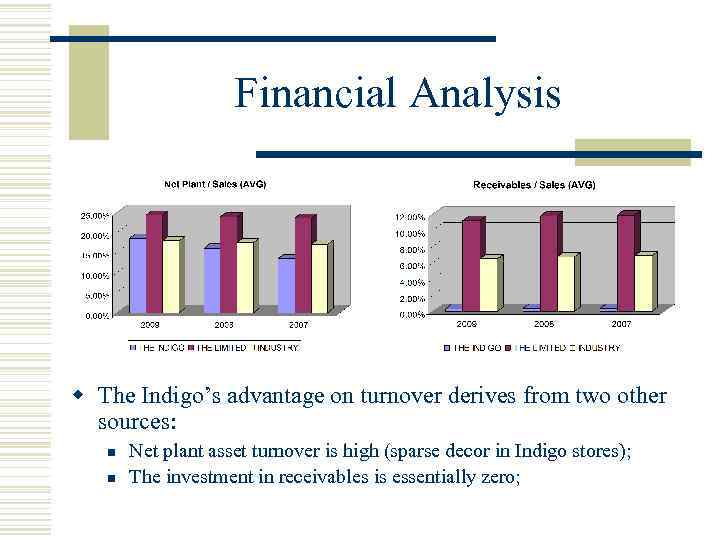

Financial Analysis w The Indigo’s advantage on turnover derives from two other sources: n n Net plant asset turnover is high (sparse decor in Indigo stores); The investment in receivables is essentially zero;

Summary of Financial Analysis w Overall, the analysis points to two keys for The Indigo’s high ROE in 2009: n n An unusually high gross margin relative to the industry and relative to The Indigo’s own historical experience; A high asset turnover, primarily because The Indigo avoids the investment necessary to support its own credit card operation; w The higher asset turnover is probably sustainable, although its overall benefit depends on how the fees from major credit card companies affect The Indigo’s margin;

Summary of Financial Analysis w The higher gross margin would be more difficult to sustain: n n To some extent, it may reflect profits on “fads”; To the extent that it reflects a more long-run shift in consumer tastes, the high margin may attract more competition;

AF215_2012_Indigo_Analysis.ppt