edacef868162593a95e2147ba4684ef9.ppt

- Количество слайдов: 41

The Impact of Globalization on the U. S. Dairy Industry: Threats, Opportunities, and Implications Tom Suber June 3 -4, 2010 Presentation to the Dairy Industry Advisory Committee

Goals for this discussion ■ Provide an overview of project objectives/approach ■ Review the expected evolution of the global dairy industry and the implications for U. S. dairy ■ Discuss strategic options for the U. S. ■ Recommendations for developing the appropriate option June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 2

Original project objectives defined by the Task Force Primary: Provide a strategic analysis of the global dairy landscape to provide a common understanding of the challenges, opportunities and threats posed by increasing globalization to the U. S. dairy industry Secondary: From the analysis, determine if there are suitable programs of work at the industry level to address the opportunities and challenges of globalization June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 3

Key themes ■ 1 Globalization of the dairy industry will increase in the coming years, with significant impact on domestic and international trade ■ 2 Demand for dairy products will grow faster than available supply, driven disproportionately by emerging markets June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 4

Goals for this discussion ■ Provide an overview of project objectives/approach ■ Review the expected evolution of the global dairy industry and the implications for U. S. dairy ■ Discuss strategic options for the U. S. ■ Recommendations for developing the appropriate option June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 5

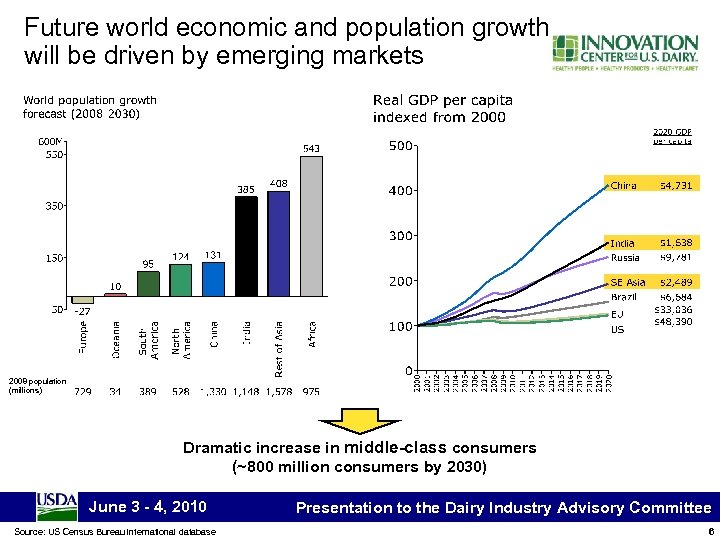

Future world economic and population growth will be driven by emerging markets 2008 population (millions) Dramatic increase in middle-class consumers (~800 million consumers by 2030) June 3 - 4, 2010 Source: US Census Bureau international database Presentation to the Dairy Industry Advisory Committee 6

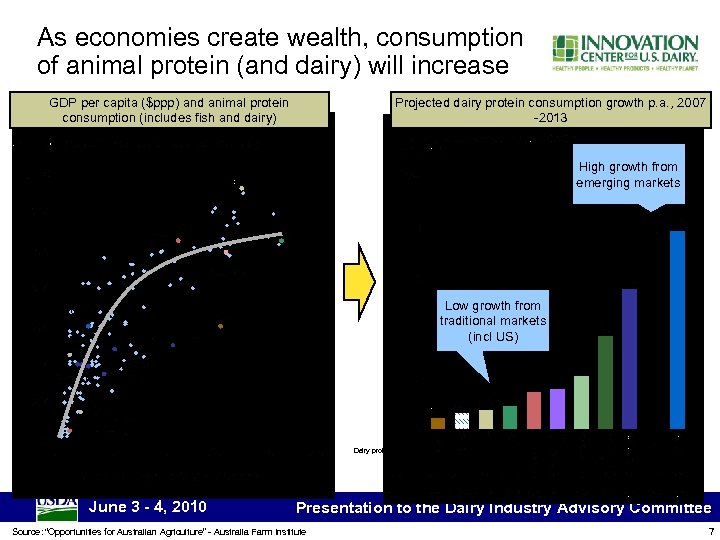

As economies create wealth, consumption of animal protein (and dairy) will increase GDP per capita ($ppp) and animal protein consumption (includes fish and dairy) Projected dairy protein consumption growth p. a. , 2007 -2013 High growth from emerging markets Low growth from traditional markets (incl US) Dairy protein consumption (K MT) June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee Source: “Opportunities for Australian Agriculture” - Australia Farm Institute 7

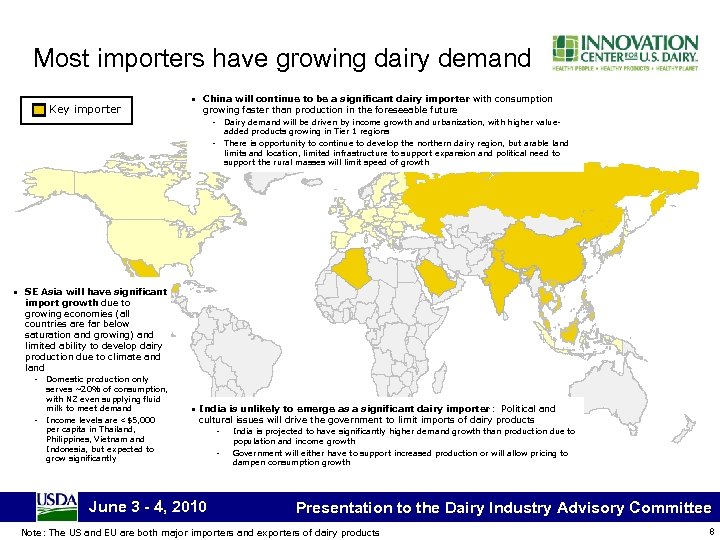

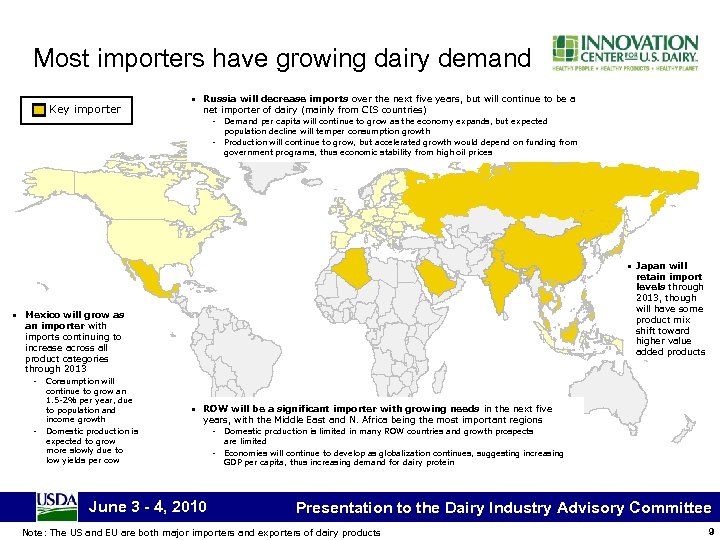

Most importers have growing dairy demand Key importer • China will continue to be a significant dairy importer with consumption growing faster than production in the foreseeable future - Dairy demand will be driven by income growth and urbanization, with higher valueadded products growing in Tier 1 regions There is opportunity to continue to develop the northern dairy region, but arable land limits and location, limited infrastructure to support expansion and political need to support the rural masses will limit speed of growth - • SE Asia will have significant import growth due to growing economies (all countries are far below saturation and growing) and limited ability to develop dairy production due to climate and land - - Domestic production only serves ~20% of consumption, with NZ even supplying fluid milk to meet demand Income levels are <$5, 000 per capita in Thailand, Philippines, Vietnam and Indonesia, but expected to grow significantly • India is unlikely to emerge as a significant dairy importer: Political and cultural issues will drive the government to limit imports of dairy products June 3 - 4, 2010 - India is projected to have significantly higher demand growth than production due to population and income growth Government will either have to support increased production or will allow pricing to dampen consumption growth Presentation to the Dairy Industry Advisory Committee Note: The US and EU are both major importers and exporters of dairy products 8

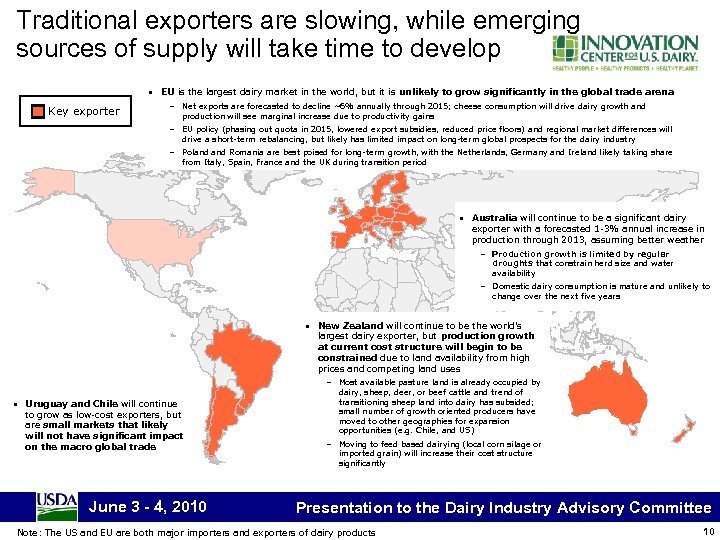

Most importers have growing dairy demand Key importer • Russia will decrease imports over the next five years, but will continue to be a net importer of dairy (mainly from CIS countries) - Demand per capita will continue to grow as the economy expands, but expected population decline will temper consumption growth Production will continue to grow, but accelerated growth would depend on funding from government programs, thus economic stability from high oil prices • Japan will retain import levels through 2013, though will have some product mix shift toward higher value added products • Mexico will grow as an importer with imports continuing to increase across all product categories through 2013 - - Consumption will continue to grow an 1. 5 -2% per year, due to population and income growth Domestic production is expected to grow more slowly due to low yields per cow • ROW will be a significant importer with growing needs in the next five years, with the Middle East and N. Africa being the most important regions June 3 - 4, 2010 - Domestic production is limited in many ROW countries and growth prospects are limited Economies will continue to develop as globalization continues, suggesting increasing GDP per capita, thus increasing demand for dairy protein Presentation to the Dairy Industry Advisory Committee Note: The US and EU are both major importers and exporters of dairy products 9

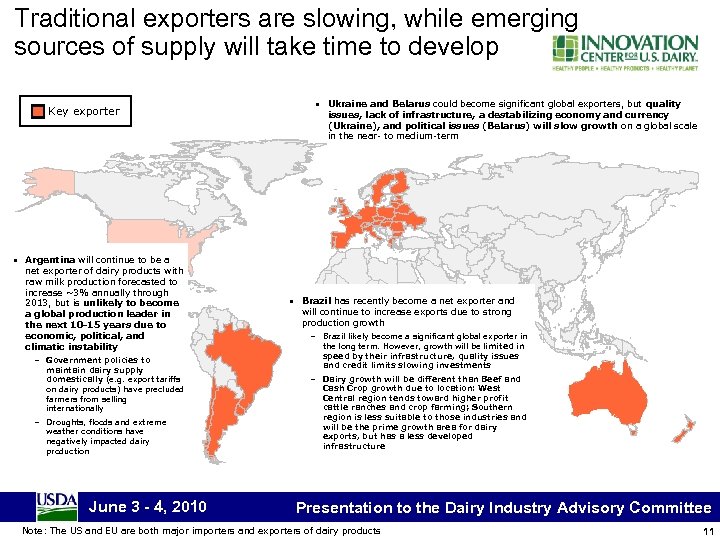

Traditional exporters are slowing, while emerging sources of supply will take time to develop • EU is the largest dairy market in the world, but it is unlikely to grow significantly in the global trade arena Key exporter – Net exports are forecasted to decline ~6% annually through 2015; cheese consumption will drive dairy growth and production will see marginal increase due to productivity gains – EU policy (phasing out quota in 2015, lowered export subsidies, reduced price floors) and regional market differences will drive a short-term rebalancing, but likely has limited impact on long-term global prospects for the dairy industry – Poland Romania are best poised for long-term growth, with the Netherlands, Germany and Ireland likely taking share from Italy, Spain, France and the UK during transition period • Australia will continue to be a significant dairy exporter with a forecasted 1 -3% annual increase in production through 2013, assuming better weather – Production growth is limited by regular droughts that constrain herd size and water availability – Domestic dairy consumption is mature and unlikely to change over the next five years • New Zealand will continue to be the world’s largest dairy exporter, but production growth at current cost structure will begin to be constrained due to land availability from high prices and competing land uses – Most available pasture land is already occupied by • Uruguay and Chile will continue to grow as low-cost exporters, but are small markets that likely will not have significant impact on the macro global trade June 3 - 4, 2010 dairy, sheep, deer, or beef cattle and trend of transitioning sheep land into dairy has subsided; small number of growth oriented producers have moved to other geographies for expansion opportunities (e. g. Chile, and US) – Moving to feed based dairying (local corn silage or imported grain) will increase their cost structure significantly Presentation to the Dairy Industry Advisory Committee Note: The US and EU are both major importers and exporters of dairy products 10

Traditional exporters are slowing, while emerging sources of supply will take time to develop Key exporter • Ukraine and Belarus could become significant global exporters, but quality issues, lack of infrastructure, a destabilizing economy and currency (Ukraine), and political issues (Belarus) will slow growth on a global scale in the near- to medium-term • Argentina will continue to be a net exporter of dairy products with raw milk production forecasted to increase ~3% annually through 2013, but is unlikely to become a global production leader in the next 10 -15 years due to economic, political, and climatic instability – Government policies to maintain dairy supply domestically (e. g. export tariffs on dairy products) have precluded farmers from selling internationally – Droughts, floods and extreme weather conditions have negatively impacted dairy production June 3 - 4, 2010 • Brazil has recently become a net exporter and will continue to increase exports due to strong production growth – Brazil likely become a significant global exporter in the long term. However, growth will be limited in speed by their infrastructure, quality issues and credit limits slowing investments – Dairy growth will be different than Beef and Cash Crop growth due to location: West Central region tends toward higher profit cattle ranches and crop farming; Southern region is less suitable to those industries and will be the prime growth area for dairy exports, but has a less developed infrastructure Presentation to the Dairy Industry Advisory Committee Note: The US and EU are both major importers and exporters of dairy products 11

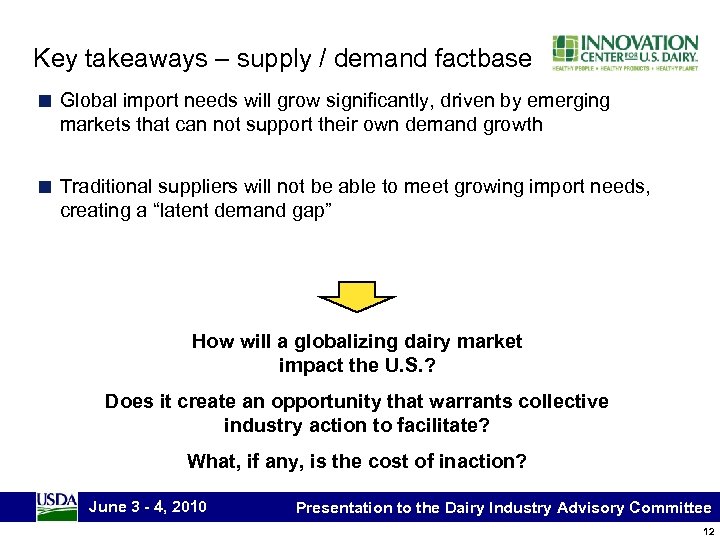

Key takeaways – supply / demand factbase ■ Global import needs will grow significantly, driven by emerging markets that can not support their own demand growth ■ Traditional suppliers will not be able to meet growing import needs, creating a “latent demand gap” How will a globalizing dairy market impact the U. S. ? Does it create an opportunity that warrants collective industry action to facilitate? What, if any, is the cost of inaction? June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 12

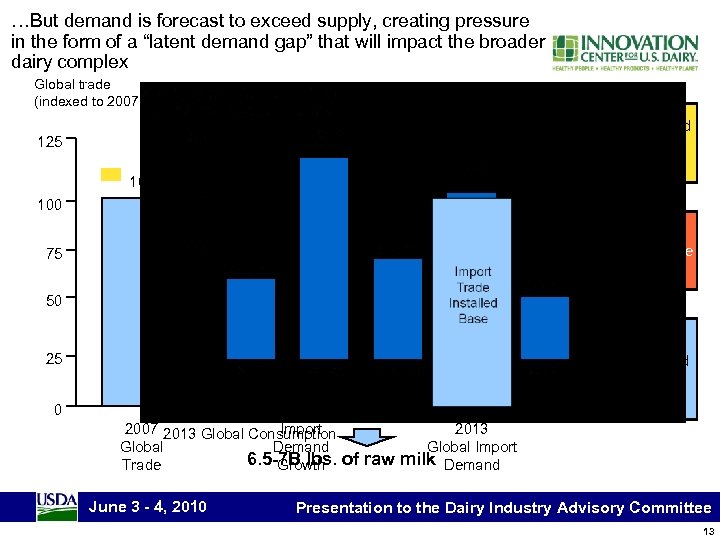

…But demand is forecast to exceed supply, creating pressure in the form of a “latent demand gap” that will impact the broader dairy complex Global trade (indexed to 2007 = 100) 125 14 114 Latent Demand Gap 100 Import Growth 100 75 50 Projected demand with no obvious supply source Processors serving internal market consumption All dairy processors Growth where connected to supply sources are global market will predictable see supplyconstrained market dynamic Existing trade where U. S. would have to steal share to grow 25 0 2007 2013 Global Consumption Import Global Demand 6. 5 -7 B lbs. Trade Growth June 3 - 4, 2010 of raw 2013 Global Import milk Demand Presentation to the Dairy Industry Advisory Committee 13

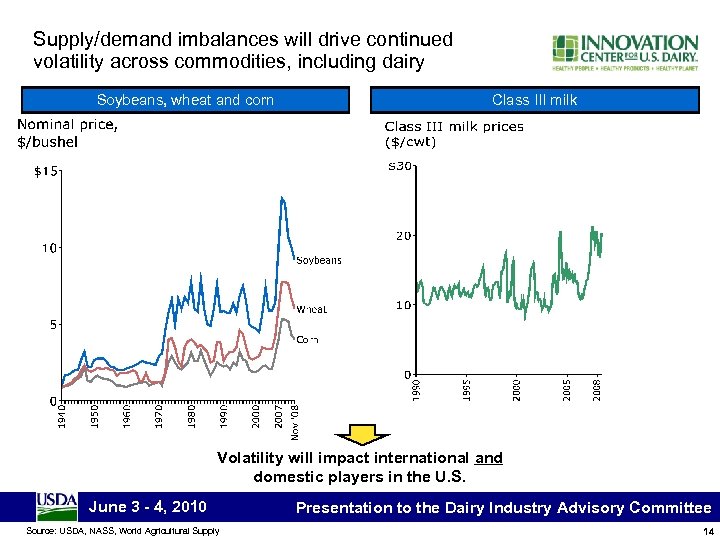

Supply/demand imbalances will drive continued volatility across commodities, including dairy Soybeans, wheat and corn Class III milk Volatility will impact international and domestic players in the U. S. June 3 - 4, 2010 Source: USDA, NASS, World Agricultural Supply Presentation to the Dairy Industry Advisory Committee 14

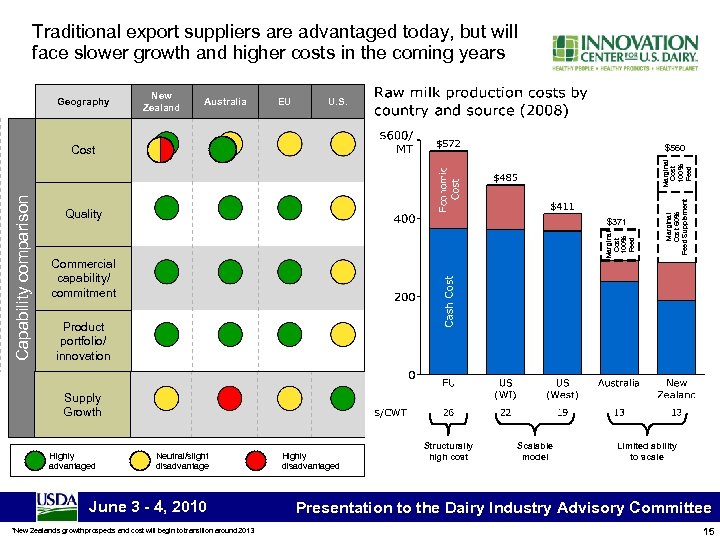

Traditional export suppliers are advantaged today, but will face slower growth and higher costs in the coming years Geography New Zealand Australia EU U. S. $560 $371 Commercial capability/ commitment Marginal Cost 50% Feed Supplement Quality Marginal Cost 100% Feed Capability comparison Marginal Cost 100% Feed Cost Product portfolio/ innovation Supply Growth Highly advantaged Neutral/slight disadvantage June 3 - 4, 2010 *New Zealand’s growth prospects and cost will begin to transition around 2013 Highly disadvantaged Structurally high cost Scalable model Limited ability to scale Presentation to the Dairy Industry Advisory Committee 15

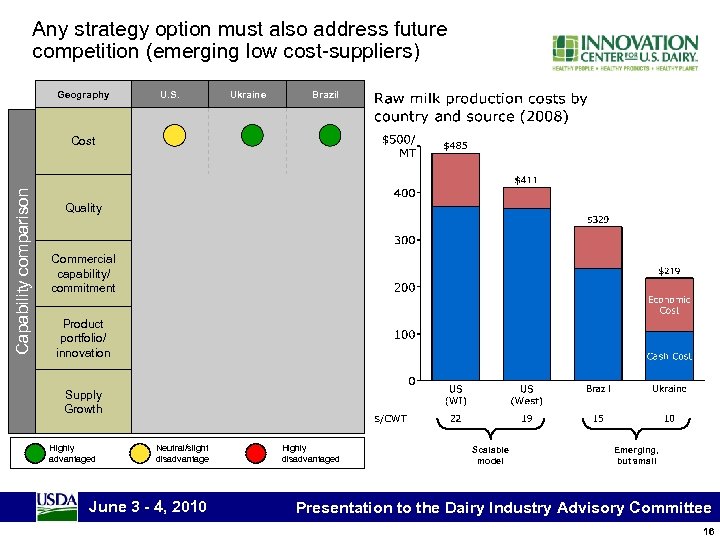

Any strategy option must also address future competition (emerging low cost-suppliers) Geography U. S. Ukraine Brazil Capability comparison Cost Quality Commercial capability/ commitment Product portfolio/ innovation Supply Growth Highly advantaged Neutral/slight disadvantage June 3 - 4, 2010 Highly disadvantaged Scalable model Emerging, but small Presentation to the Dairy Industry Advisory Committee 16

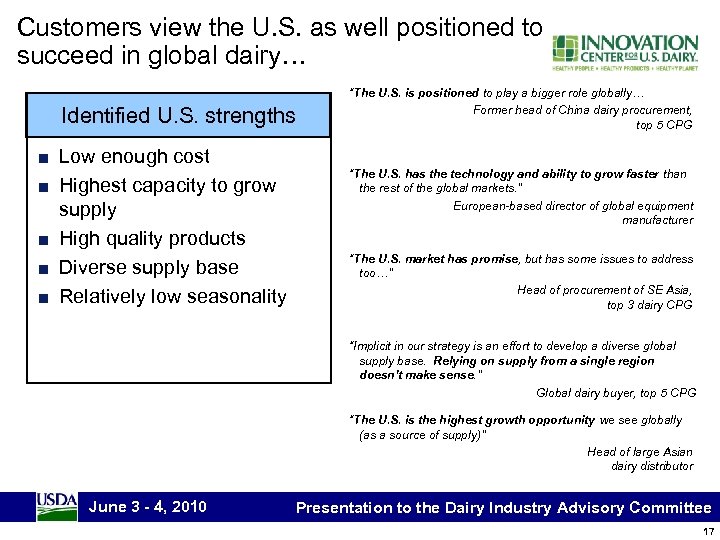

Customers view the U. S. as well positioned to succeed in global dairy… Identified U. S. strengths ■ Low enough cost ■ Highest capacity to grow supply ■ High quality products ■ Diverse supply base ■ Relatively low seasonality “The U. S. is positioned to play a bigger role globally… Former head of China dairy procurement, top 5 CPG “The U. S. has the technology and ability to grow faster than the rest of the global markets. ” European-based director of global equipment manufacturer “The U. S. market has promise, but has some issues to address too…” Head of procurement of SE Asia, top 3 dairy CPG “Implicit in our strategy is an effort to develop a diverse global supply base. Relying on supply from a single region doesn’t make sense. ” Global dairy buyer, top 5 CPG “The U. S. is the highest growth opportunity we see globally (as a source of supply)” Head of large Asian dairy distributor June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 17

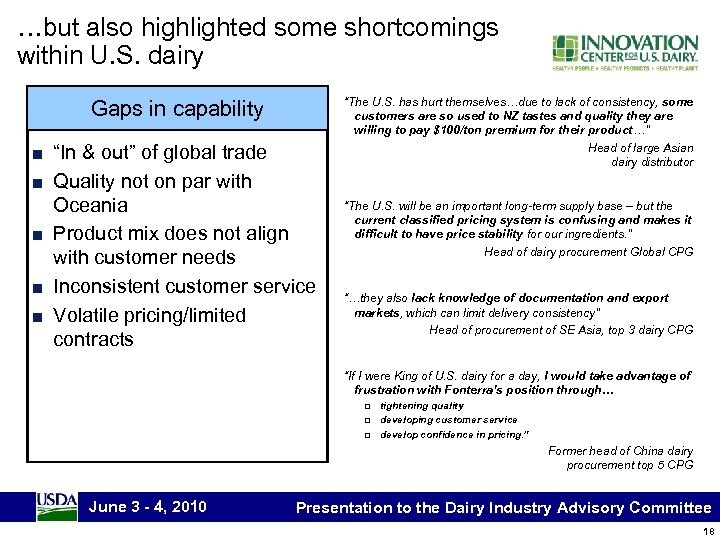

…but also highlighted some shortcomings within U. S. dairy Gaps in capability ■ “In & out” of global trade ■ Quality not on par with Oceania ■ Product mix does not align with customer needs ■ Inconsistent customer service ■ Volatile pricing/limited contracts “The U. S. has hurt themselves…due to lack of consistency, some customers are so used to NZ tastes and quality they are willing to pay $100/ton premium for their product…” Head of large Asian dairy distributor “The U. S. will be an important long-term supply base – but the current classified pricing system is confusing and makes it difficult to have price stability for our ingredients. ” Head of dairy procurement Global CPG “…they also lack knowledge of documentation and export markets, which can limit delivery consistency” Head of procurement of SE Asia, top 3 dairy CPG “If I were King of U. S. dairy for a day, I would take advantage of frustration with Fonterra’s position through… q q q tightening quality developing customer service develop confidence in pricing. ” Former head of China dairy procurement top 5 CPG June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 18

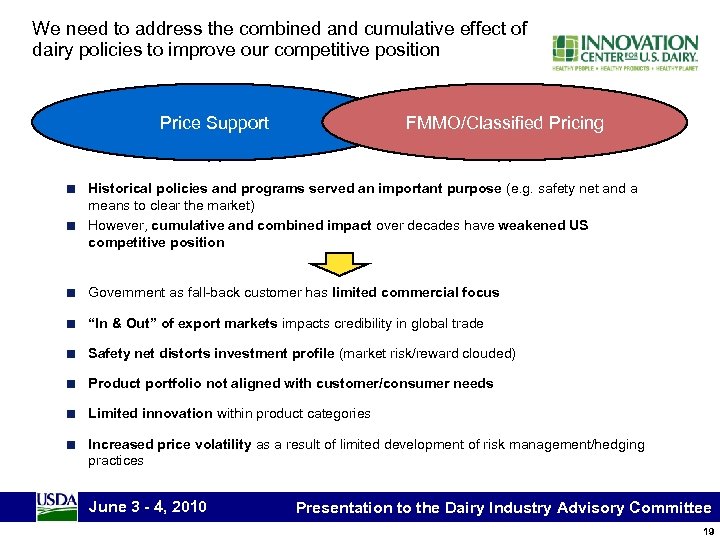

We need to address the combined and cumulative effect of dairy policies to improve our competitive position Price Support ■ ■ FMMO/Classified Pricing Historical policies and programs served an important purpose (e. g. safety net and a means to clear the market) However, cumulative and combined impact over decades have weakened US competitive position ■ Government as fall-back customer has limited commercial focus ■ “In & Out” of export markets impacts credibility in global trade ■ Safety net distorts investment profile (market risk/reward clouded) ■ Product portfolio not aligned with customer/consumer needs ■ Limited innovation within product categories ■ Increased price volatility as a result of limited development of risk management/hedging practices June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 19

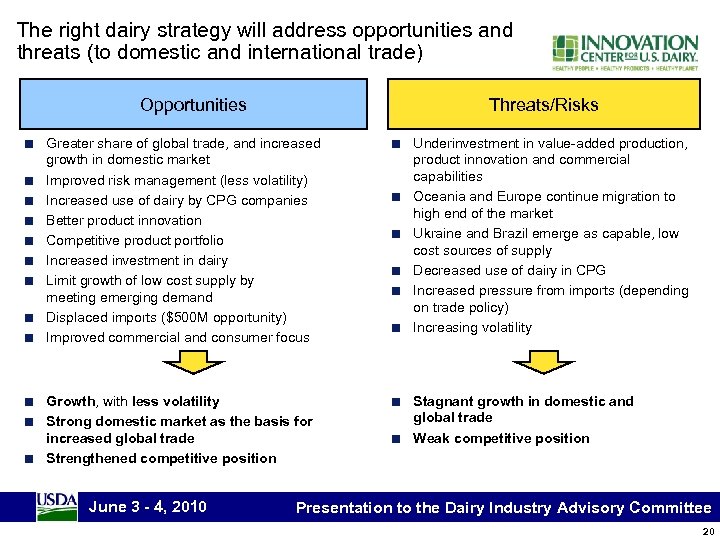

The right dairy strategy will address opportunities and threats (to domestic and international trade) Opportunities ■ ■ ■ Threats/Risks Greater share of global trade, and increased growth in domestic market Improved risk management (less volatility) Increased use of dairy by CPG companies Better product innovation Competitive product portfolio Increased investment in dairy Limit growth of low cost supply by meeting emerging demand Displaced imports ($500 M opportunity) Improved commercial and consumer focus ■ Growth, with less volatility Strong domestic market as the basis for increased global trade Strengthened competitive position ■ June 3 - 4, 2010 ■ ■ ■ Underinvestment in value-added production, product innovation and commercial capabilities Oceania and Europe continue migration to high end of the market Ukraine and Brazil emerge as capable, low cost sources of supply Decreased use of dairy in CPG Increased pressure from imports (depending on trade policy) Increasing volatility Stagnant growth in domestic and global trade Weak competitive position Presentation to the Dairy Industry Advisory Committee 20

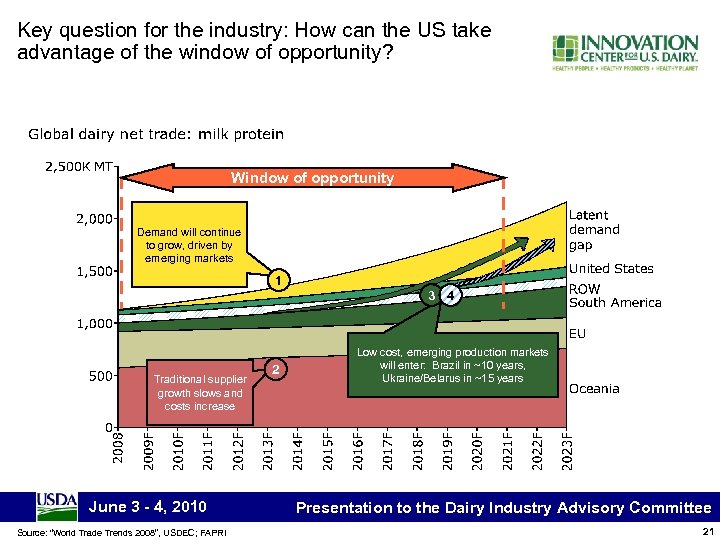

Key question for the industry: How can the US take advantage of the window of opportunity? Window of opportunity Demand will continue to grow, driven by emerging markets 1 3 4 Traditional supplier growth slows and costs increase June 3 - 4, 2010 Source: “World Trade Trends 2008”, USDEC; FAPRI 2 Low cost, emerging production markets will enter: Brazil in ~10 years, Ukraine/Belarus in ~15 years Presentation to the Dairy Industry Advisory Committee 21

Goals for this discussion ■ Provide an overview of project objectives/approach ■ Review the expected evolution of the global dairy industry and the implications for U. S. dairy ■ Discuss strategic options for the U. S. ■ Recommendations for developing the appropriate option June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 22

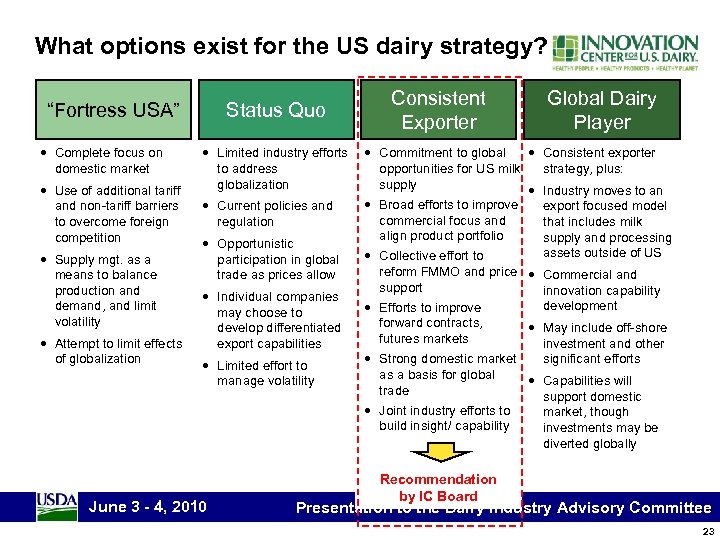

What options exist for the US dairy strategy? “Fortress USA” • Complete focus on domestic market • Use of additional tariff and non-tariff barriers to overcome foreign competition • Supply mgt. as a means to balance production and demand, and limit volatility • Attempt to limit effects of globalization Status Quo • Limited industry efforts to address globalization • Current policies and regulation • Opportunistic participation in global trade as prices allow • Individual companies may choose to develop differentiated export capabilities • Limited effort to manage volatility June 3 - 4, 2010 Consistent Exporter Global Dairy Player • Commitment to global • Consistent exporter opportunities for US milk strategy, plus: supply • Industry moves to an • Broad efforts to improve export focused model commercial focus and that includes milk align product portfolio supply and processing assets outside of US • Collective effort to reform FMMO and price • Commercial and support innovation capability development • Efforts to improve forward contracts, • May include off-shore futures markets investment and other • Strong domestic market significant efforts as a basis for global • Capabilities will trade support domestic • Joint industry efforts to market, though build insight/ capability investments may be diverted globally Recommendation by IC Board Presentation to the Dairy Industry Advisory Committee 23

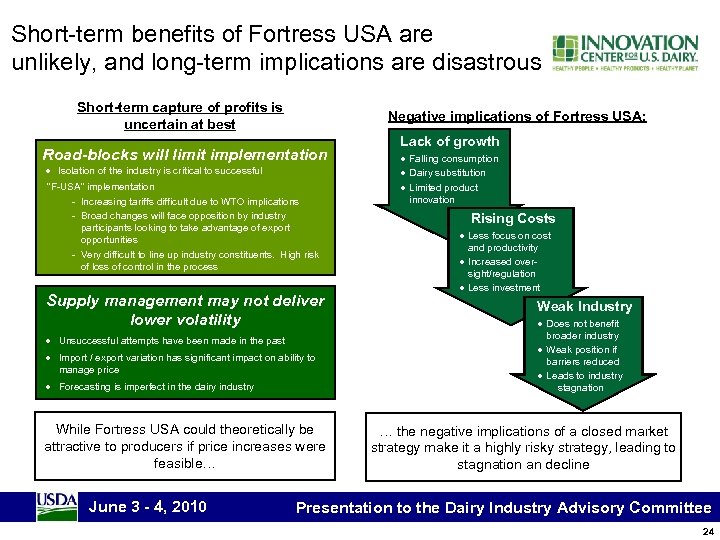

Short-term benefits of Fortress USA are unlikely, and long-term implications are disastrous Short-term capture of profits is uncertain at best Negative implications of Fortress USA: Road-blocks will limit implementation • Isolation of the industry is critical to successful “F-USA” implementation - Increasing tariffs difficult due to WTO implications - Broad changes will face opposition by industry participants looking to take advantage of export opportunities - Very difficult to line up industry constituents. High risk of loss of control in the process Supply management may not deliver lower volatility • Unsuccessful attempts have been made in the past • Import / export variation has significant impact on ability to manage price • Forecasting is imperfect in the dairy industry While Fortress USA could theoretically be attractive to producers if price increases were feasible… June 3 - 4, 2010 Lack of growth • Falling consumption • Dairy substitution • Limited product innovation Rising Costs • Less focus on cost and productivity • Increased oversight/regulation • Less investment Weak Industry • Does not benefit broader industry • Weak position if barriers reduced • Leads to industry stagnation … the negative implications of a closed market strategy make it a highly risky strategy, leading to stagnation an decline Presentation to the Dairy Industry Advisory Committee 24

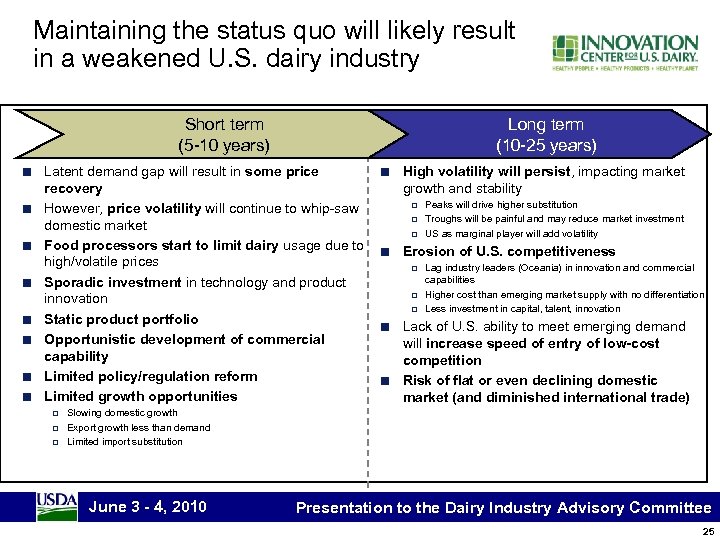

Maintaining the status quo will likely result in a weakened U. S. dairy industry Short term (5 -10 years) ■ ■ ■ ■ Long term (10 -25 years) ■ High volatility will persist, impacting market Latent demand gap will result in some price growth and stability recovery q Peaks will drive higher substitution However, price volatility will continue to whip-saw q Troughs will be painful and may reduce market investment domestic market q US as marginal player will add volatility Food processors start to limit dairy usage due to ■ Erosion of U. S. competitiveness high/volatile prices q Lag industry leaders (Oceania) in innovation and commercial capabilities Sporadic investment in technology and product q Higher cost than emerging market supply with no differentiation innovation q Less investment in capital, talent, innovation Static product portfolio Inaction in a period of changing market dynamics ■ Lack of U. S. ability to meet emerging demand Opportunistic development of commercial is a questionable industry strategy of entry of low-cost will increase speed capability competition Limited policy/regulation reform ■ Risk of flat or even declining domestic Limited growth opportunities market (and diminished international trade) q q q Slowing domestic growth Export growth less than demand Limited import substitution June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 25

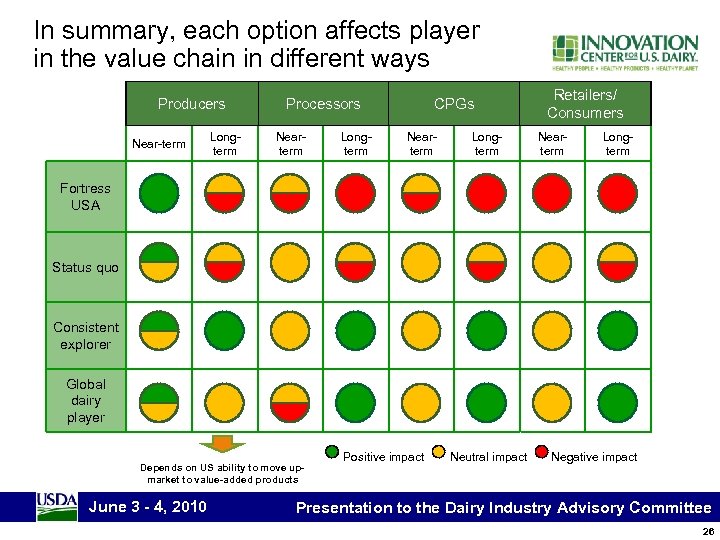

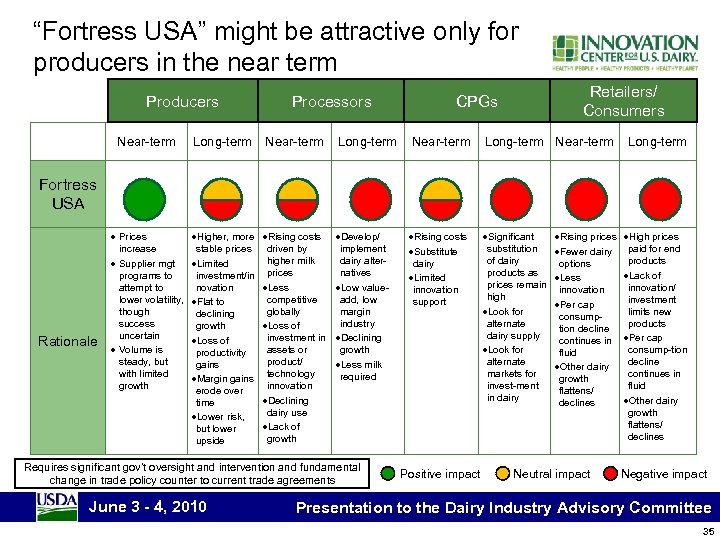

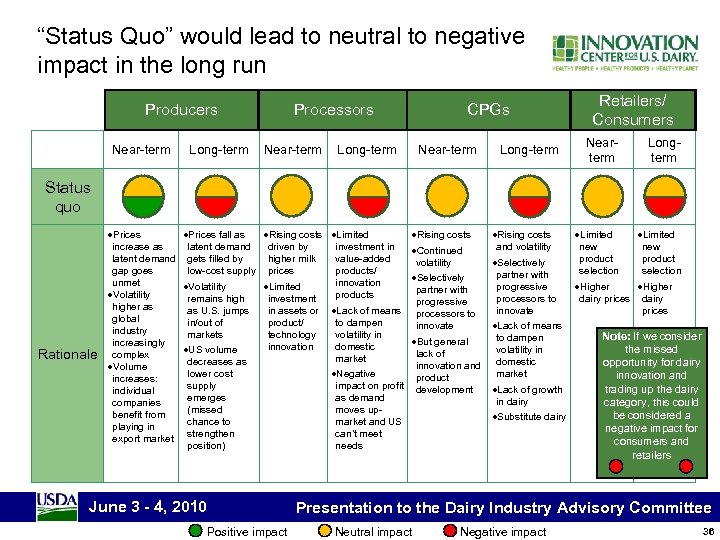

In summary, each option affects player in the value chain in different ways Producers Near-term Longterm Processors Nearterm Longterm CPGs Nearterm Longterm Retailers/ Consumers Nearterm Longterm Fortress USA Status quo Consistent explorer Global dairy player Depends on US ability to move upmarket to value-added products June 3 - 4, 2010 Positive impact Neutral impact Negative impact Presentation to the Dairy Industry Advisory Committee 26

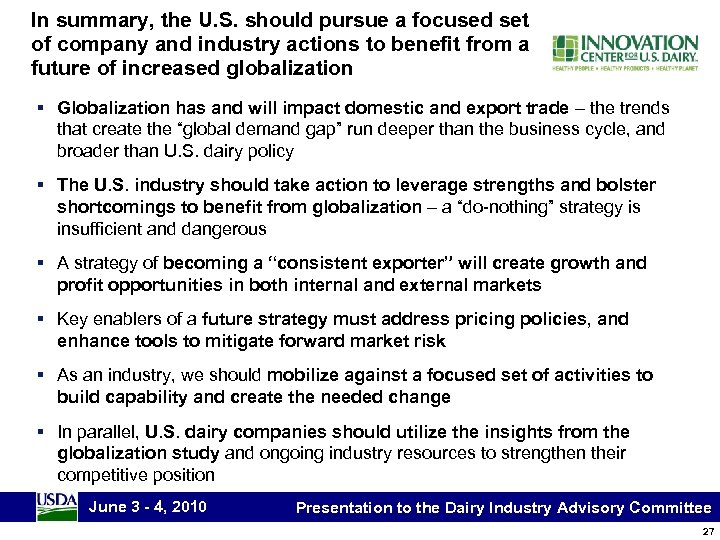

In summary, the U. S. should pursue a focused set of company and industry actions to benefit from a future of increased globalization § Globalization has and will impact domestic and export trade – the trends that create the “global demand gap” run deeper than the business cycle, and broader than U. S. dairy policy § The U. S. industry should take action to leverage strengths and bolster shortcomings to benefit from globalization – a “do-nothing” strategy is insufficient and dangerous § A strategy of becoming a “consistent exporter” will create growth and profit opportunities in both internal and external markets § Key enablers of a future strategy must address pricing policies, and enhance tools to mitigate forward market risk § As an industry, we should mobilize against a focused set of activities to build capability and create the needed change § In parallel, U. S. dairy companies should utilize the insights from the globalization study and ongoing industry resources to strengthen their competitive position June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 27

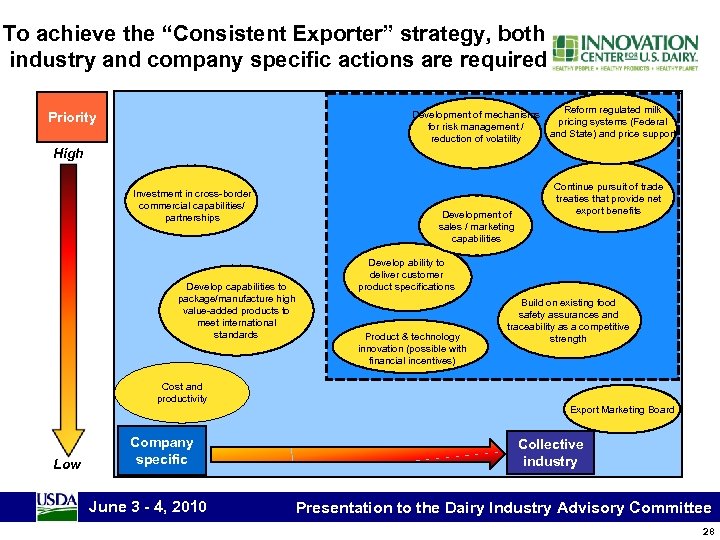

To achieve the “Consistent Exporter” strategy, both industry and company specific actions are required Reform regulated milk Development of mechanisms pricing systems (Federal for risk management / and State) and price support reduction of volatility Priority High Investment in cross-border commercial capabilities/ partnerships Develop capabilities to package/manufacture high value-added products to meet international standards Cost and productivity Low Company specific June 3 - 4, 2010 Development of sales / marketing capabilities Continue pursuit of trade treaties that provide net export benefits Develop ability to deliver customer product specifications Product & technology innovation (possible with financial incentives) Build on existing food safety assurances and traceability as a competitive strength Export Marketing Board Collective industry Presentation to the Dairy Industry Advisory Committee 28

THANK YOU QUESTIONS OR COMMENTS? Tom Suber, U. S. Dairy Export Council tsuber@usdec. org June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 29

APPENDIX June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 30

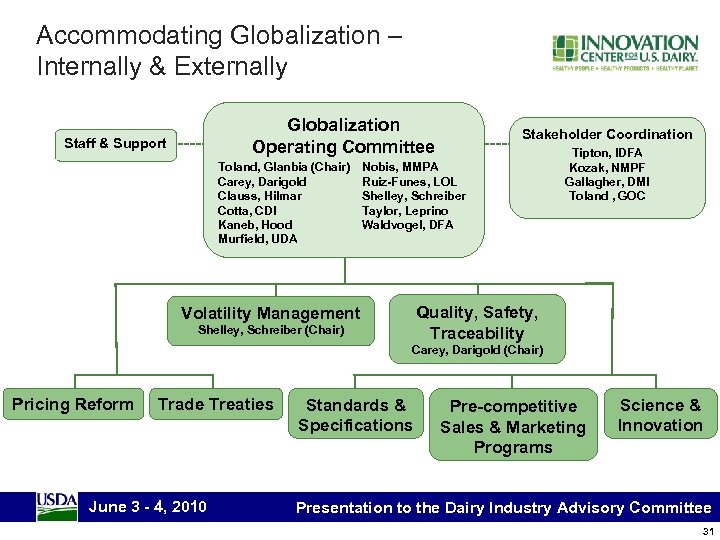

Accommodating Globalization – Internally & Externally Globalization Operating Committee Staff & Support Toland, Glanbia (Chair) Carey, Darigold Clauss, Hilmar Cotta, CDI Kaneb, Hood Murfield, UDA Stakeholder Coordination Nobis, MMPA Ruiz-Funes, LOL Shelley, Schreiber Taylor, Leprino Waldvogel, DFA Tipton, IDFA Kozak, NMPF Gallagher, DMI Toland , GOC Quality, Safety, Traceability Volatility Management Shelley, Schreiber (Chair) Carey, Darigold (Chair) Pricing Reform Trade Treaties June 3 - 4, 2010 Standards & Specifications Pre-competitive Sales & Marketing Programs Science & Innovation Presentation to the Dairy Industry Advisory Committee 31

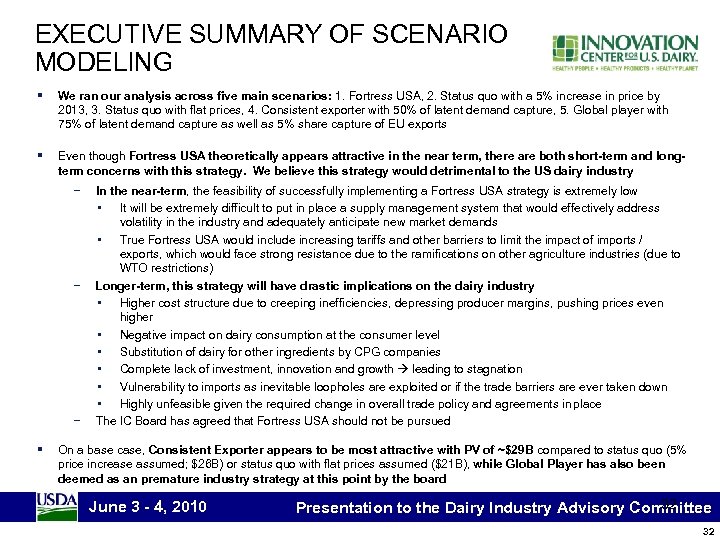

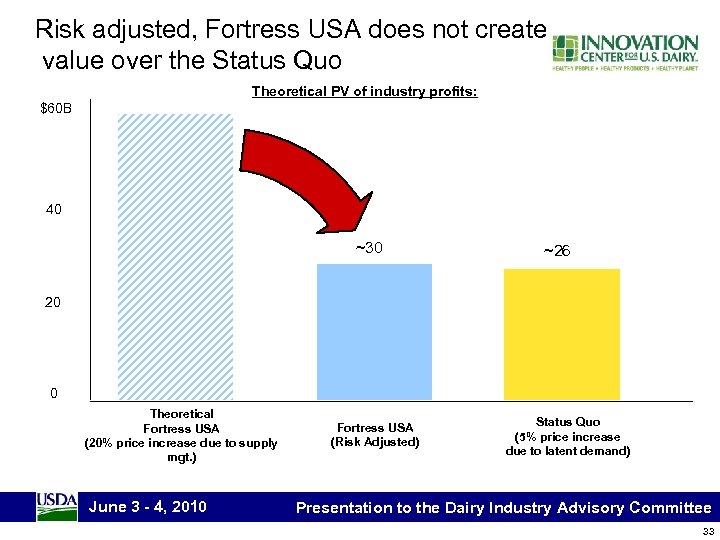

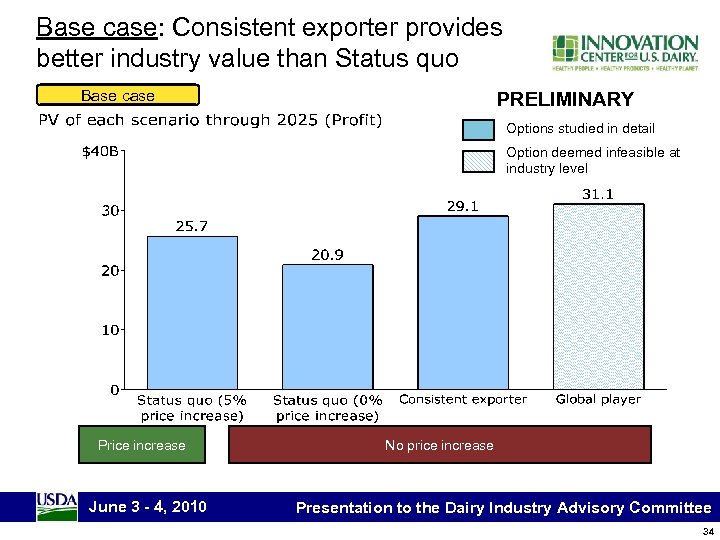

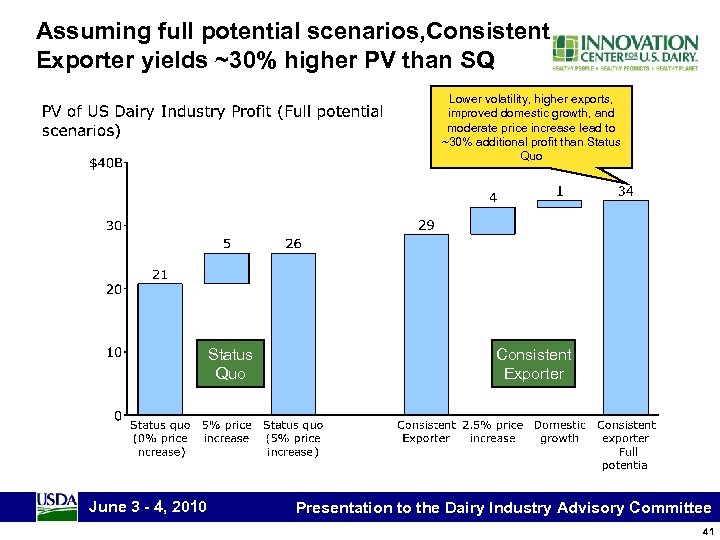

EXECUTIVE SUMMARY OF SCENARIO MODELING § We ran our analysis across five main scenarios: 1. Fortress USA, 2. Status quo with a 5% increase in price by 2013, 3. Status quo with flat prices, 4. Consistent exporter with 50% of latent demand capture, 5. Global player with 75% of latent demand capture as well as 5% share capture of EU exports § Even though Fortress USA theoretically appears attractive in the near term, there are both short-term and longterm concerns with this strategy. We believe this strategy would detrimental to the US dairy industry − − − § In the near-term, the feasibility of successfully implementing a Fortress USA strategy is extremely low • It will be extremely difficult to put in place a supply management system that would effectively address volatility in the industry and adequately anticipate new market demands • True Fortress USA would include increasing tariffs and other barriers to limit the impact of imports / exports, which would face strong resistance due to the ramifications on other agriculture industries (due to WTO restrictions) Longer-term, this strategy will have drastic implications on the dairy industry • Higher cost structure due to creeping inefficiencies, depressing producer margins, pushing prices even higher • Negative impact on dairy consumption at the consumer level • Substitution of dairy for other ingredients by CPG companies • Complete lack of investment, innovation and growth leading to stagnation • Vulnerability to imports as inevitable loopholes are exploited or if the trade barriers are ever taken down • Highly unfeasible given the required change in overall trade policy and agreements in place The IC Board has agreed that Fortress USA should not be pursued On a base case, Consistent Exporter appears to be most attractive with PV of ~$29 B compared to status quo (5% price increase assumed; $26 B) or status quo with flat prices assumed ($21 B), while Global Player has also been deemed as an premature industry strategy at this point by the board June 3 - 4, 2010 32 Presentation to the Dairy Industry Advisory Committee 32

Risk adjusted, Fortress USA does not create value over the Status Quo Theoretical PV of industry profits: $60 B 40 ~30 ~26 20 0 Theoretical Fortress USA (20% price increase due to supply mgt. ) June 3 - 4, 2010 Fortress USA (Risk Adjusted) Status Quo (5% price increase due to latent demand) Presentation to the Dairy Industry Advisory Committee 33

Base case: Consistent exporter provides better industry value than Status quo Base case PRELIMINARY Options studied in detail Option deemed infeasible at industry level Price increase June 3 - 4, 2010 No price increase Presentation to the Dairy Industry Advisory Committee 34

“Fortress USA” might be attractive only for producers in the near term Producers Processors Near-term Long-term Near-term • Prices increase • Supplier mgt programs to attempt to lower volatility, though success uncertain • Volume is steady, but with limited growth • Higher, more stable prices • Limited investment/in novation • Flat to declining growth • Loss of productivity gains • Margin gains erode over time • Lower risk, but lower upside • Rising costs driven by higher milk prices • Less competitive globally • Loss of investment in assets or product/ technology innovation • Declining dairy use • Lack of growth Long-term Retailers/ Consumers CPGs Near-term Long-term Fortress USA Rationale • Develop/ implement dairy alternatives • Low valueadd, low margin industry • Declining growth • Less milk required Requires significant gov’t oversight and intervention and fundamental change in trade policy counter to current trade agreements June 3 - 4, 2010 • Rising costs • Substitute dairy • Limited innovation support Positive impact • Significant substitution of dairy products as prices remain high • Look for alternate dairy supply • Look for alternate markets for invest-ment in dairy • Rising prices • Fewer dairy options • Less innovation • Per cap consumption decline continues in fluid • Other dairy growth flattens/ declines Neutral impact • High prices paid for end products • Lack of innovation/ investment limits new products • Per cap consump-tion decline continues in fluid • Other dairy growth flattens/ declines Negative impact Presentation to the Dairy Industry Advisory Committee 35

“Status Quo” would lead to neutral to negative impact in the long run Producers Near-term Long-term Processors Near-term CPGs Long-term Near-term Long-term Retailers/ Consumers Nearterm Longterm Status quo Rationale • Prices fall as • Rising costs • Limited increase as latent demand driven by investment in latent demand gets filled by higher milk value-added gap goes low-cost supply prices products/ unmet innovation • Volatility • Limited • Volatility products remains high investment higher as as U. S. jumps in assets or • Lack of means global in/out of product/ to dampen industry markets technology volatility in increasingly innovation domestic • US volume complex market decreases as • Volume lower cost • Negative increases: supply impact on profit individual emerges as demand companies (missed moves upbenefit from chance to market and US playing in strengthen can’t meet export market position) needs June 3 - 4, 2010 Positive impact • Rising costs • Continued volatility • Selectively partner with progressive processors to innovate • But general lack of innovation and product development • Rising costs • Limited and volatility new product • Selectively selection partner with progressive • Higher processors to dairy prices dairy innovate prices • Lack of means Note: If we consider to dampen the missed volatility in domestic opportunity for dairy market innovation and trading up the dairy • Lack of growth in dairy category, this could be considered a • Substitute dairy negative impact for consumers and retailers Presentation to the Dairy Industry Advisory Committee Neutral impact Negative impact 36

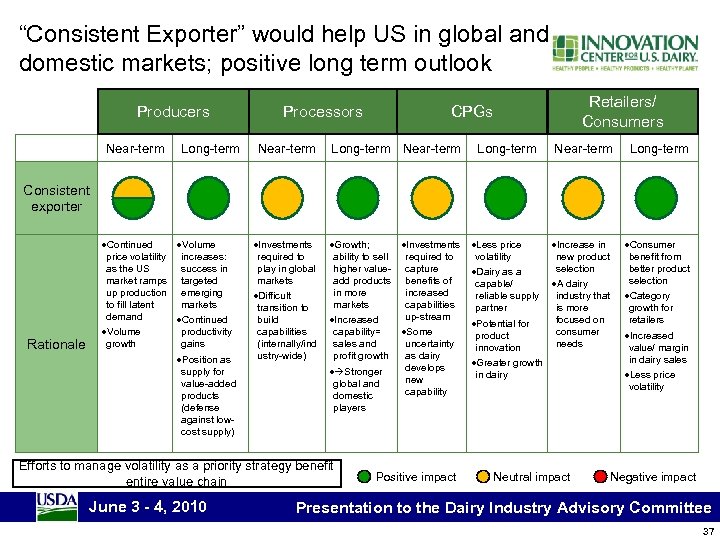

“Consistent Exporter” would help US in global and domestic markets; positive long term outlook Producers Near-term Long-term Processors Retailers/ Consumers CPGs Near-term Long-term Near-term • Investments required to play in global markets • Difficult transition to build capabilities (internally/ind ustry-wide) • Growth; • Investments ability to sell required to higher value- capture add products benefits of in more increased markets capabilities up-stream • Increased capability= • Some sales and uncertainty profit growth as dairy develops • Stronger new global and capability domestic players Long-term Near-term Long-term • Less price • Increase in volatility new product selection • Dairy as a capable/ • A dairy reliable supply industry that partner is more focused on • Potential for consumer product needs innovation • Greater growth in dairy • Consumer benefit from better product selection • Category growth for retailers • Increased value/ margin in dairy sales • Less price volatility Consistent exporter Rationale • Continued • Volume price volatility increases: as the US success in market ramps targeted up production emerging to fill latent markets demand • Continued • Volume productivity growth gains • Position as supply for value-added products (defense against lowcost supply) Efforts to manage volatility as a priority strategy benefit entire value chain June 3 - 4, 2010 Positive impact Neutral impact Negative impact Presentation to the Dairy Industry Advisory Committee 37

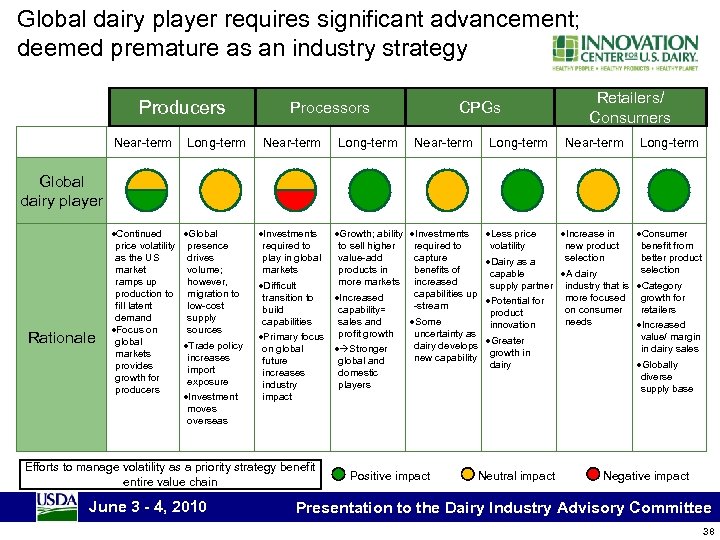

Global dairy player requires significant advancement; deemed premature as an industry strategy Producers Near-term Long-term Processors Near-term Long-term CPGs Near-term Long-term Retailers/ Consumers Near-term Long-term Global dairy player Rationale • Continued • Global price volatility presence as the US drives market volume; ramps up however, production to migration to fill latent low-cost demand supply • Focus on sources global • Trade policy markets increases provides import growth for exposure producers • Investment moves overseas • Investments • Growth; ability • Investments required to to sell higher required to play in global value-add capture markets products in benefits of more markets increased • Difficult capabilities up transition to • Increased -stream build capability= capabilities sales and • Some profit growth uncertainty as • Primary focus dairy develops • Stronger on global new capability future global and increases domestic industry players impact Efforts to manage volatility as a priority strategy benefit entire value chain June 3 - 4, 2010 Positive impact • Less price • Increase in volatility new product selection • Dairy as a capable • A dairy supply partner industry that is more focused • Potential for on consumer product needs innovation • Greater growth in dairy Neutral impact • Consumer benefit from better product selection • Category growth for retailers • Increased value/ margin in dairy sales • Globally diverse supply base Negative impact Presentation to the Dairy Industry Advisory Committee 38

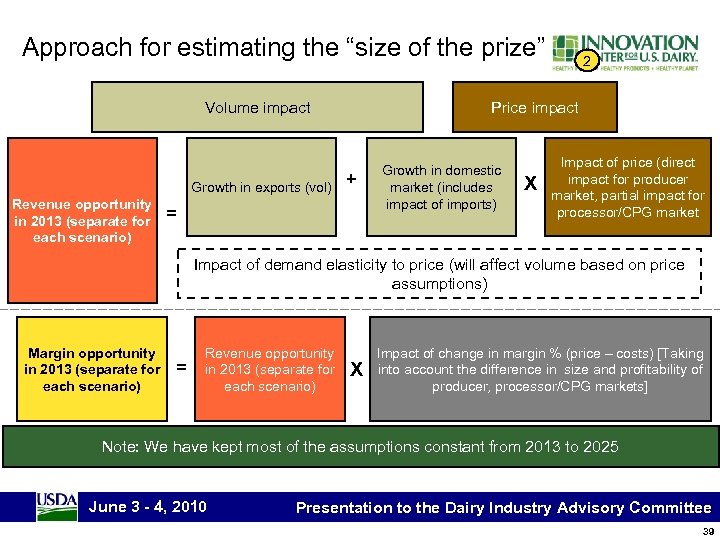

Approach for estimating the “size of the prize” Volume impact Growth in exports (vol) Revenue opportunity in 2013 (separate for each scenario) 2 Price impact + = Growth in domestic market (includes impact of imports) X Impact of price (direct impact for producer market, partial impact for processor/CPG market Impact of demand elasticity to price (will affect volume based on price assumptions) Margin opportunity in 2013 (separate for each scenario) = Revenue opportunity in 2013 (separate for each scenario) X Impact of change in margin % (price – costs) [Taking into account the difference in size and profitability of producer, processor/CPG markets] Note: We have kept most of the assumptions constant from 2013 to 2025 June 3 - 4, 2010 Presentation to the Dairy Industry Advisory Committee 39

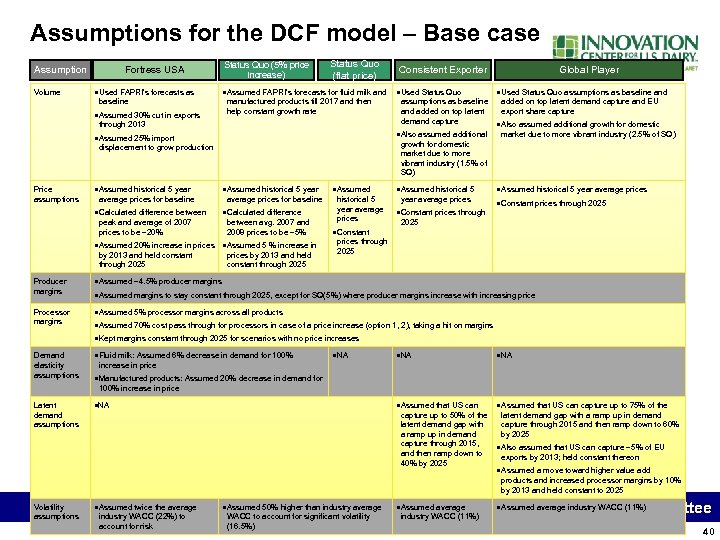

Assumptions for the DCF model – Base case Assumption Volume Fortress USA • Used FAPRI’s forecasts as baseline • Assumed 30% cut in exports Status Quo (5% price increase) Status Quo (flat price) • Assumed FAPRI’s forecasts for fluid milk and manufactured products till 2017 and then help constant growth rate through 2013 average prices for baseline • Calculated difference between peak and average of 2007 prices to be ~20% • Assumed historical 5 year average prices for baseline • Calculated difference between avg. 2007 and 2008 prices to be ~5% • Assumed 20% increase in prices • Assumed 5 % increase in by 2013 and held constant through 2025 assumptions as baseline and added on top latent demand capture Global Player • Used Status Quo assumptions as baseline and added on top latent demand capture and EU export share capture • Also assumed additional growth for domestic market due to more vibrant industry (2. 5% of SQ) growth for domestic market due to more vibrant industry (1. 5% of SQ) displacement to grow production • Assumed historical 5 year • Used Status Quo • Also assumed additional • Assumed 25% import Price assumptions Consistent Exporter prices by 2013 and held constant through 2025 Producer margins historical 5 year average prices • Constant • Assumed historical 5 year average prices • Constant prices through • Assumed historical 5 year average prices • Constant prices through 2025 • Assumed ~4. 5% producer margins Processor margins • Assumed 5% processor margins across all products • Assumed margins to stay constant through 2025, except for SQ(5%) where producer margins increase with increasing price • Assumed 70% cost pass through for processors in case of a price increase (option 1, 2), taking a hit on margins • Kept margins constant through 2025 for scenarios with no price increases Demand elasticity assumptions • Fluid milk: Assumed 6% decrease in demand for 100% • NA • Assumed that US can capture up to 75% of the increase in price • Manufactured products: Assumed 20% decrease in demand for 100% increase in price Latent demand assumptions • NA capture up to 50% of the latent demand gap with a ramp up in demand capture through 2015, and then ramp down to 40% by 2025 latent demand gap with a ramp up in demand capture through 2015 and then ramp down to 60% by 2025 • Also assumed that US can capture ~5% of EU exports by 2013; held constant thereon • Assumed a move toward higher value add products and increased processor margins by 10% by 2013 and held constant to 2025 Volatility assumptions • Assumed 3 - the 2010 twice June WACC 4, average industry (22%) to account for risk average Presentation • Assumed. WACC (11%) Industry Advisory(11%) to the Dairy • Assumed average industry WACC Committee industry • Assumed 50% higher than industry average WACC to account for significant volatility (16. 5%) 40

Assuming full potential scenarios, Consistent Exporter yields ~30% higher PV than SQ Lower volatility, higher exports, improved domestic growth, and moderate price increase lead to ~30% additional profit than Status Quo June 3 - 4, 2010 Consistent Exporter Presentation to the Dairy Industry Advisory Committee 41

edacef868162593a95e2147ba4684ef9.ppt