4369f81512c1c960fca10567fce11c08.ppt

- Количество слайдов: 15

The Homebuyer’s Guide Chapter 1 Owning a Home

Just a few questions…. • What kind of a home does my family need? • What kind of a home does my family want? • Should I rent or would I be better off buying? • What kinds of space do I need for family activities? • How much money is available for me to pay for housing? • Is this the best time for me to buy? p. 3 The Homebuyer’s Guide

Advantages of Homeownership • Your Home as an Investment • Tax Advantages • Equity • Control over your environment • Stability • Locking in Housing Costs Equity = What You OWN

Disadvantages of Homeownership • Homeowners need to understand terms of their ‘deal’ to determine if changes need to be made across the life of the loan. • No guarantees of increased net worth • Maintenance and repairs • Decreased mobility • Risk of Foreclosure

Steps in the Homebuying Process • • • Prepare for home ownership Determine how much you can afford to spend Get your loan preapproved Decide what kind of home you want and need Shop for a home

Steps in the Home-buying Process • • • Make an offer Get a professional home inspection Apply for a mortgage loan Get insurance and have additional inspections Close the loan

Your Home-buying Team • • • Real Estate Agent Lender Attorney Escrow Officer Title Insurance Officer • • • Housing Inspector Appraiser Surveyor Insurance Agent Housing Counselor

What Does a House Payment Include? • Principal • Interest • Taxes • Insurance • And, possibly, Private Mortage Insurance, or “PMI”

Prequalification Calculations using housing affordability ratios: • How much money the lender will loan you • What price home you can afford • How much down payment you need • How much your monthly payments will be A confirmed prequalification is not A guarantee that you will obtain a loan.

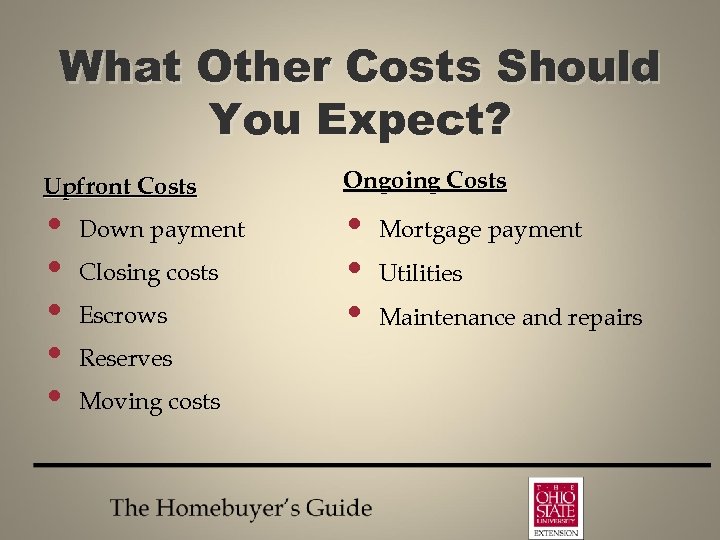

What Other Costs Should You Expect? Upfront Costs Ongoing Costs • • Down payment Closing costs Escrows Reserves Moving costs Mortgage payment Utilities Maintenance and repairs

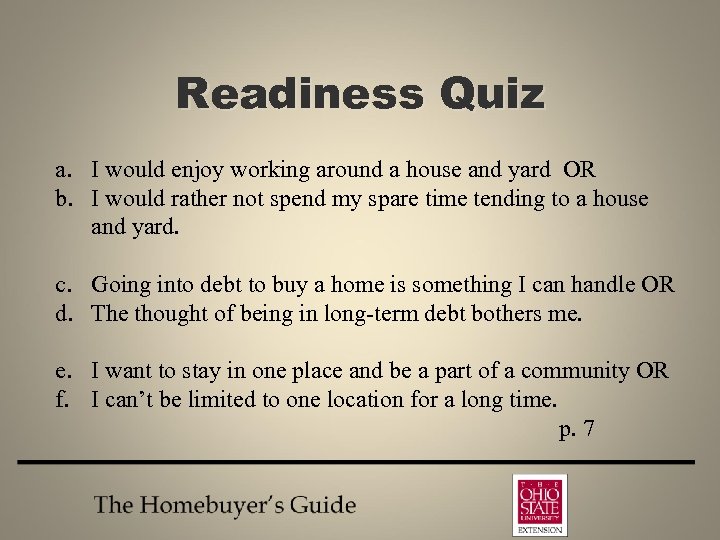

Readiness Quiz a. I would enjoy working around a house and yard OR b. I would rather not spend my spare time tending to a house and yard. c. Going into debt to buy a home is something I can handle OR d. The thought of being in long-term debt bothers me. e. I want to stay in one place and be a part of a community OR f. I can’t be limited to one location for a long time. p. 7

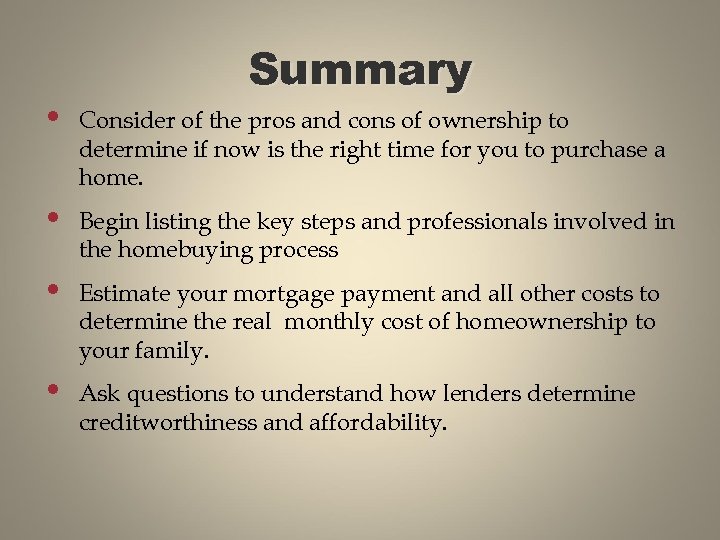

Summary • Consider of the pros and cons of ownership to determine if now is the right time for you to purchase a home. • Begin listing the key steps and professionals involved in the homebuying process • Estimate your mortgage payment and all other costs to determine the real monthly cost of homeownership to your family. • Ask questions to understand how lenders determine creditworthiness and affordability.

Where to from here? • Order copies of your credit report • Chart income and expenses for your household for three to six months to begin building a budget with new housing expenses…. . mortgage, insurance, taxes.

4369f81512c1c960fca10567fce11c08.ppt