3bd9f67be58053d9b7f999cd92161d83.ppt

- Количество слайдов: 25

The History of the 2006 - ? Economic Crisis Three Parts: 1) Government Intervention; 2) Federal Reserve Policies; and 3) Corruption

The History of the 2006 - ? Economic Crisis Three Parts: 1) Government Intervention; 2) Federal Reserve Policies; and 3) Corruption

Time Line • • 1938 Fannie Mae as government agency 1967: LBJ spins the Fannie off as GSE 1970: Freddie Mac created 1977: CRA enacted – 1992: Congress pushes FF to provide low income loans 1995: CRA strengthened 1996: HUD required that 12% of all mortgages purchased by FF be special affordable loans -- income less than 60% of the median in the area – then 20% in 2000, 22% in 2005 and 28% in 2008. HUD also gives FF target for affordable loans of over 50%.

Time Line • • 1938 Fannie Mae as government agency 1967: LBJ spins the Fannie off as GSE 1970: Freddie Mac created 1977: CRA enacted – 1992: Congress pushes FF to provide low income loans 1995: CRA strengthened 1996: HUD required that 12% of all mortgages purchased by FF be special affordable loans -- income less than 60% of the median in the area – then 20% in 2000, 22% in 2005 and 28% in 2008. HUD also gives FF target for affordable loans of over 50%.

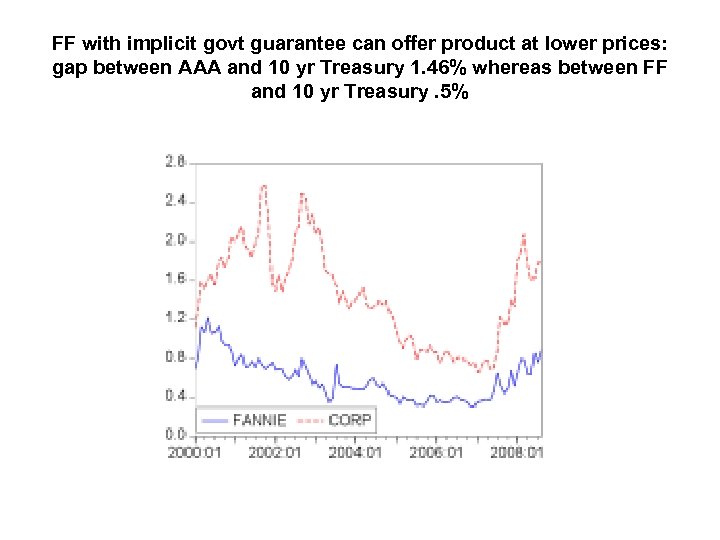

FF with implicit govt guarantee can offer product at lower prices: gap between AAA and 10 yr Treasury 1. 46% whereas between FF and 10 yr Treasury. 5%

FF with implicit govt guarantee can offer product at lower prices: gap between AAA and 10 yr Treasury 1. 46% whereas between FF and 10 yr Treasury. 5%

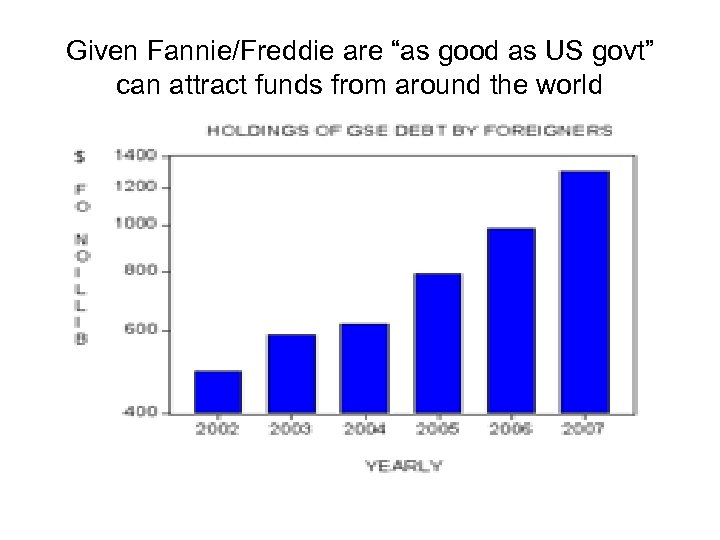

Given Fannie/Freddie are “as good as US govt” can attract funds from around the world

Given Fannie/Freddie are “as good as US govt” can attract funds from around the world

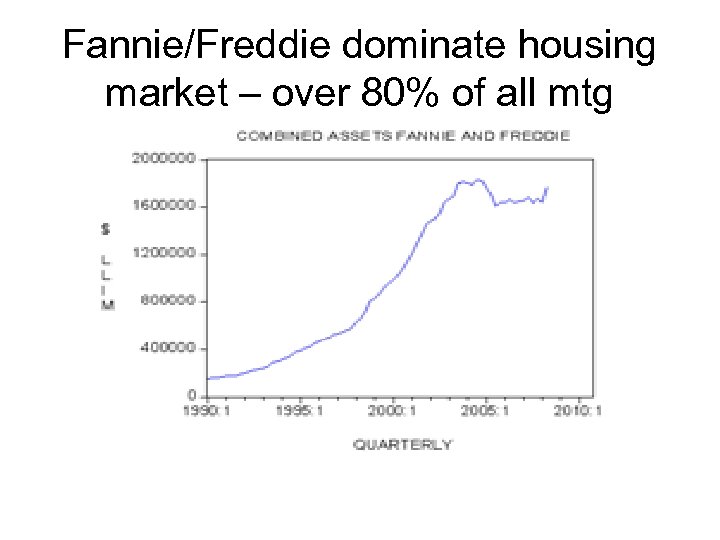

Fannie/Freddie dominate housing market – over 80% of all mtg

Fannie/Freddie dominate housing market – over 80% of all mtg

Looser Standards • In the 1980 s, groups such as the activists at ACORN began pushing charges of "redlining" - claims that banks discriminated against minorities in mortgage lending. • In 1989, Congress amended the Home Mortgage Disclosure Act to force banks to collect racial data on mortgage applicants;

Looser Standards • In the 1980 s, groups such as the activists at ACORN began pushing charges of "redlining" - claims that banks discriminated against minorities in mortgage lending. • In 1989, Congress amended the Home Mortgage Disclosure Act to force banks to collect racial data on mortgage applicants;

Looser Standards Larger percentage of NINJA loans included in securities • A 1995 strengthening of the Community Reinvestment Act required banks to find ways to provide mortgages to their poorer communities • the Boston Fed ruled that participation in a credit-counseling program should be taken as evidence of an applicant's ability to manage debt. •

Looser Standards Larger percentage of NINJA loans included in securities • A 1995 strengthening of the Community Reinvestment Act required banks to find ways to provide mortgages to their poorer communities • the Boston Fed ruled that participation in a credit-counseling program should be taken as evidence of an applicant's ability to manage debt. •

Securitization • 1. A borrower – sometimes working with a broker, gets a loan from a lender.

Securitization • 1. A borrower – sometimes working with a broker, gets a loan from a lender.

Securitization • 2. The lender bundles a number of home loans and sells bundle to an investment Security A bank

Securitization • 2. The lender bundles a number of home loans and sells bundle to an investment Security A bank

Securitization • 3. The investment bank takes pools of home loans worth billions of dollars and places them in a trust. The trust issues bonds secured by the mortgages.

Securitization • 3. The investment bank takes pools of home loans worth billions of dollars and places them in a trust. The trust issues bonds secured by the mortgages.

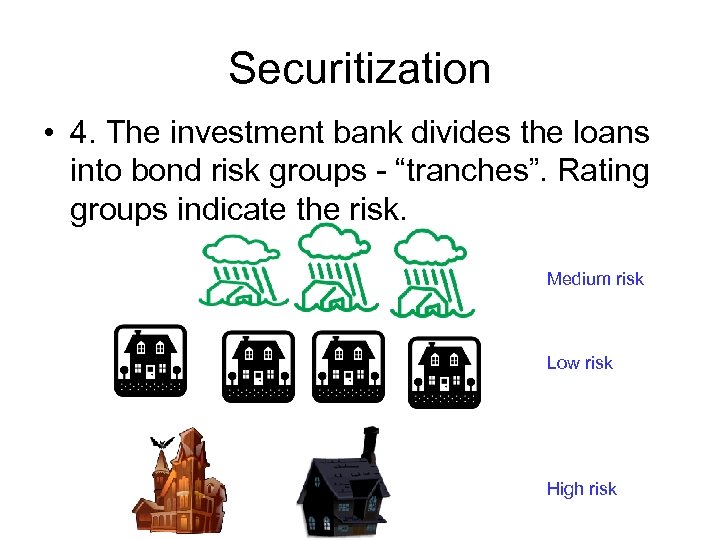

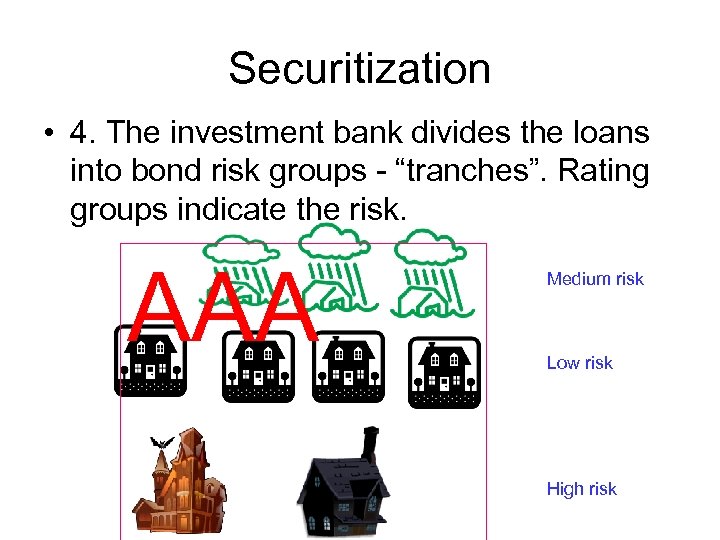

Securitization • 4. The investment bank divides the loans into bond risk groups - “tranches”. Rating groups indicate the risk. Medium risk Low risk High risk

Securitization • 4. The investment bank divides the loans into bond risk groups - “tranches”. Rating groups indicate the risk. Medium risk Low risk High risk

Securitization • 5. Bonds are sold to bigger investors • 6. Potential risk of default is solved by credit default swap

Securitization • 5. Bonds are sold to bigger investors • 6. Potential risk of default is solved by credit default swap

Part 2: Fed Policies

Part 2: Fed Policies

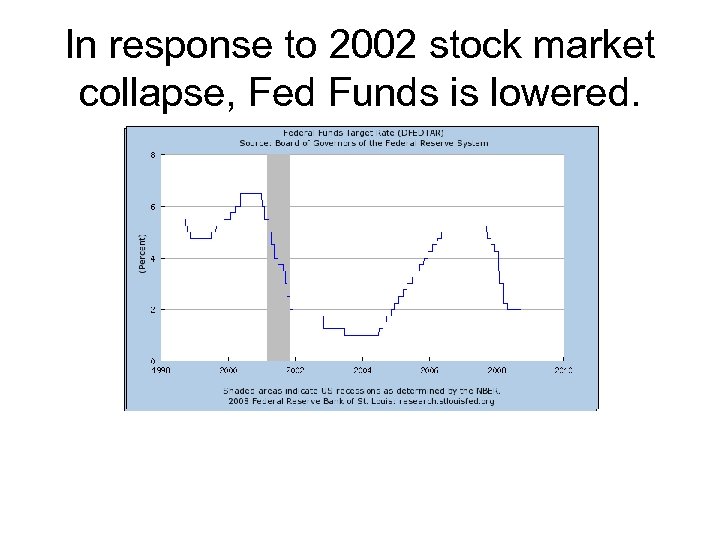

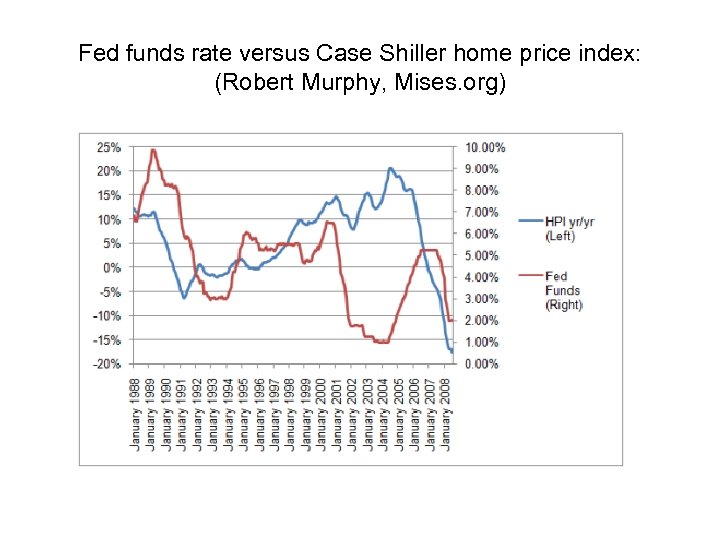

In response to 2002 stock market collapse, Fed Funds is lowered.

In response to 2002 stock market collapse, Fed Funds is lowered.

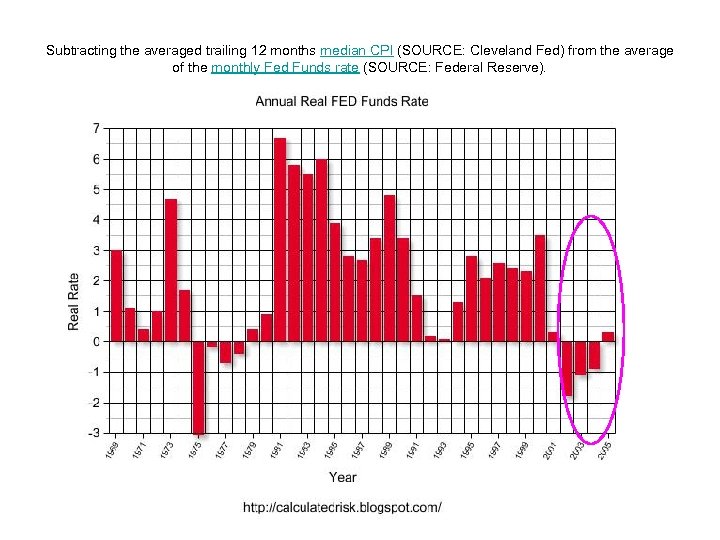

Subtracting the averaged trailing 12 months median CPI (SOURCE: Cleveland Fed) from the average of the monthly Fed Funds rate (SOURCE: Federal Reserve).

Subtracting the averaged trailing 12 months median CPI (SOURCE: Cleveland Fed) from the average of the monthly Fed Funds rate (SOURCE: Federal Reserve).

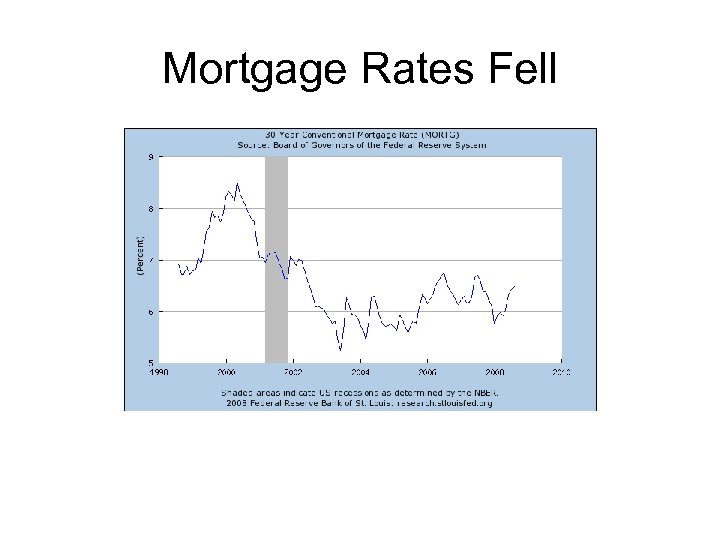

Mortgage Rates Fell

Mortgage Rates Fell

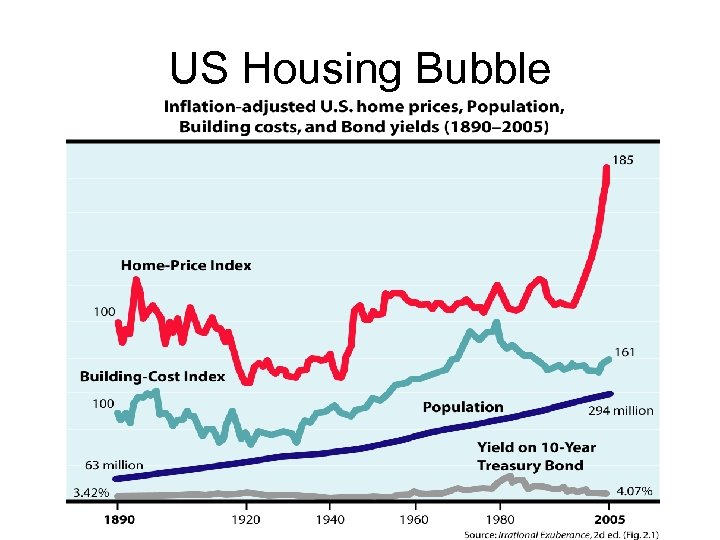

US Housing Bubble

US Housing Bubble

Fed funds rate versus Case Shiller home price index: (Robert Murphy, Mises. org)

Fed funds rate versus Case Shiller home price index: (Robert Murphy, Mises. org)

Root Cause • The bubble is a combination of “affordable housing” and the Fed's boom-bust policies. • The NINJA loans meant that the investors looking for homes to buy and resell got no down, interest only, ARMS also. It was not just poor people.

Root Cause • The bubble is a combination of “affordable housing” and the Fed's boom-bust policies. • The NINJA loans meant that the investors looking for homes to buy and resell got no down, interest only, ARMS also. It was not just poor people.

Is it due to lax regulation? Were regulators sleeping? • NO regulators relaxed lending standards - at the behest of community groups and "progressive" political forces.

Is it due to lax regulation? Were regulators sleeping? • NO regulators relaxed lending standards - at the behest of community groups and "progressive" political forces.

Securitization • 4. The investment bank divides the loans into bond risk groups - “tranches”. Rating groups indicate the risk. AAA Medium risk Low risk High risk

Securitization • 4. The investment bank divides the loans into bond risk groups - “tranches”. Rating groups indicate the risk. AAA Medium risk Low risk High risk

The Crunch • Federal funds rate was kept at 2 percent or lower from November 2001 right through to the end of 2004. • Greenspan used the housing market to prop up the economy after the 9/11 attacks. • In 2002 he called mortgage markets a "powerful stabilizing force" because they allowed people to extract equity from their homes. • In 2004 he said that homeowners should consider using adjustable-rate mortgages to save on interest and prepayment costs. • In 2005 Fed Funds rate increased tremendously– from less than 2% to more than 5%

The Crunch • Federal funds rate was kept at 2 percent or lower from November 2001 right through to the end of 2004. • Greenspan used the housing market to prop up the economy after the 9/11 attacks. • In 2002 he called mortgage markets a "powerful stabilizing force" because they allowed people to extract equity from their homes. • In 2004 he said that homeowners should consider using adjustable-rate mortgages to save on interest and prepayment costs. • In 2005 Fed Funds rate increased tremendously– from less than 2% to more than 5%

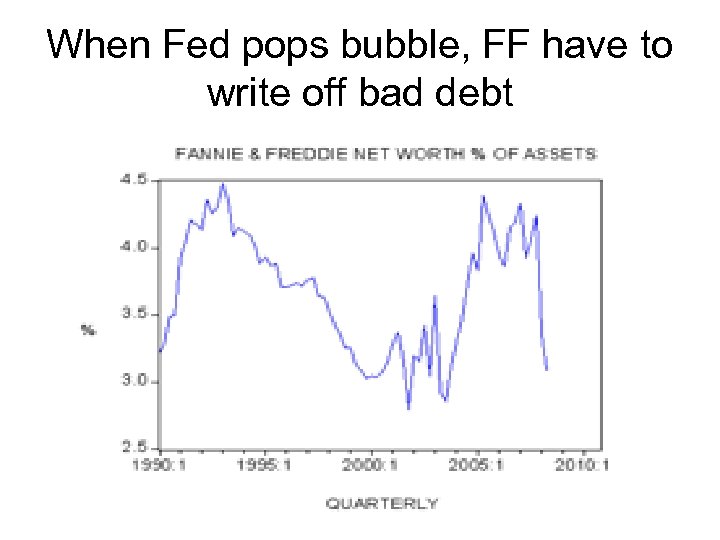

When Fed pops bubble, FF have to write off bad debt

When Fed pops bubble, FF have to write off bad debt

Much of the Bad Debt had been securitized

Much of the Bad Debt had been securitized

Ohhhh Nooooo – Credit Crunch

Ohhhh Nooooo – Credit Crunch