b470b99b1b47bef6273b1692b6a45353.ppt

- Количество слайдов: 48

The History of Money October 2011 1

Why do we have money? Convenience Ø It is often easier to use money than barter / trade Ø Would you prefer to receive fish or eggs instead of cash for the services you provide to your employer ? 2

What is money? 3

Features of Money Ø A medium of exchange Ø A unit of account Ø A store of value 4

Medium of Exchange Ø Liquidity Easily tradable, with a low spread between the prices to buy and sell Ø Transportable Having a high value to weight ratio 5

A Unit of Account Divisible Can be divided into small units without destroying its value (which is why leather and live animals are not suitable) Fungible One unit or piece must be equivalent to another (which is why diamonds, works of art or real estate are not suitable) Precisely Measurable Of a specific weight, or measure, or size to be verifiably countable. You must be able to weigh, 6 measure, and count your unit of account!

A Store of Value Ø Durable It should be long lasting and not perishable or subject to decay (which is why food items, expensive spices, or even fine silks or oriental rugs are not generally suitable as money) Ø Stable value Ø Scarce Can’t be easily manufactured Ø Difficult to counterfeit It must be difficult to make fakes, and the real 7 thing must be easily recognizable.

Features of Money Ø A medium of exchange Ø A unit of account Ø A store of value 8

Best Forms of Money Historically, gold & silver coins and bars 9

Warning on Love of Money The love of money is a root of all kinds of evil. . . -1 Tim. 6: 10 NIV [Note: money is not evil, just the love of it. ] 10

Currency Debasement Ø The practice of lowering the value of currency. Ø Results in financial gain for the sovereign at the expense of citizens Ø Lowers the value of the coinage, causing inflation - Wikipedia 11

Currency Debasement in Rome Ø The Roman Denarius 12

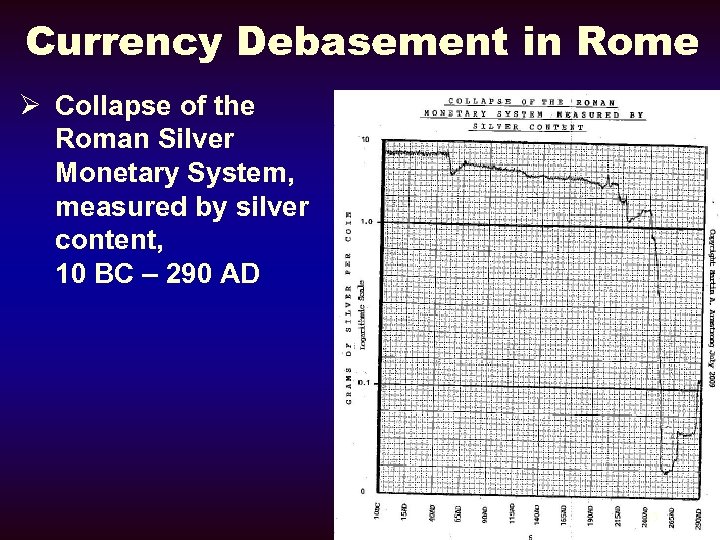

Currency Debasement in Rome Ø Collapse of the Roman Silver Monetary System, measured by silver content, 10 BC – 290 AD 13

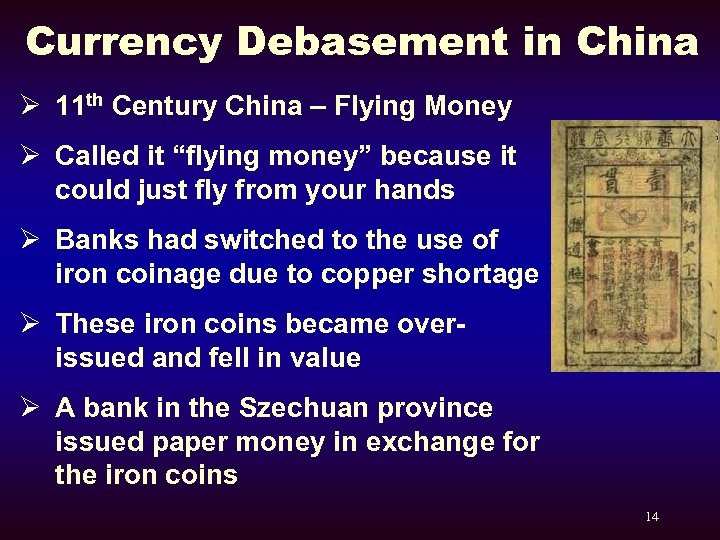

Currency Debasement in China Ø 11 th Century China – Flying Money Ø Called it “flying money” because it could just fly from your hands Ø Banks had switched to the use of iron coinage due to copper shortage Ø These iron coins became overissued and fell in value Ø A bank in the Szechuan province issued paper money in exchange for the iron coins 14

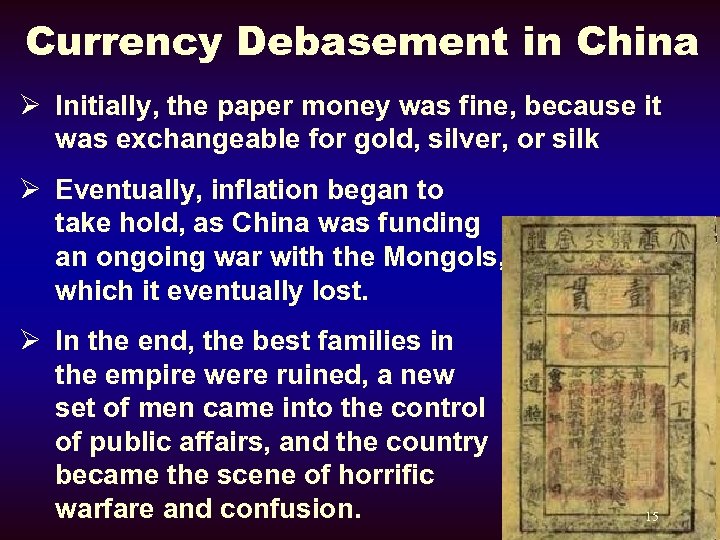

Currency Debasement in China Ø Initially, the paper money was fine, because it was exchangeable for gold, silver, or silk Ø Eventually, inflation began to take hold, as China was funding an ongoing war with the Mongols, which it eventually lost. Ø In the end, the best families in the empire were ruined, a new set of men came into the control of public affairs, and the country became the scene of horrific warfare and confusion. 15

Currency Debasement in France Ø John Law was the first man to introduce paper money to France in the early 18 th Century Ø Louis XIV died and left 3 billion livres of debt to his son, Louis XV Ø Louis XV required that all taxes be paid in paper money, which was initially backed by coinage Ø After high inflation, people demanded coinage, and the currency collapsed. Ø John Law became the most hated man in France and was forced to flee to Italy. 16

Currency Debasement in France Ø In the latter part of the 18 th century, the French government tried paper money again. Ø By 1795, inflation of assignats was running at approximately 13, 000%. Ø Then Napoleon returned the country to gold coinage, a stable currency. Ø French gave it another go in the 1930 s, this time with the paper franc. It took only 12 years for them to inflate their currency until it lost 99% of its value. 17

Currency Debasement in Weimar Germany Ø Post-World War I Weimar Germany was one of the greatest periods of hyperinflation that ever existed. Ø The only way the Germans could pay the war reparations required by the Treaty of Versailles was by running the printing press. Ø Thousands of people lost their life savings Ø Many starved to death Ø 1 billion mark, 1923 18

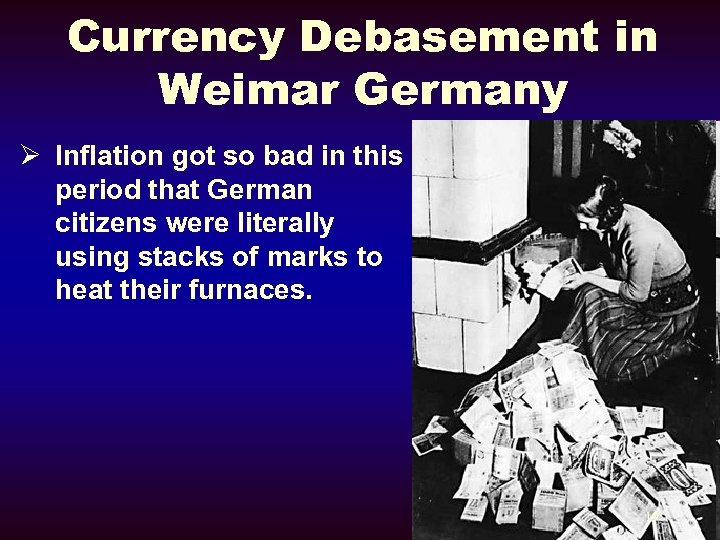

Currency Debasement in Weimar Germany Ø Inflation got so bad in this period that German citizens were literally using stacks of marks to heat their furnaces. 19

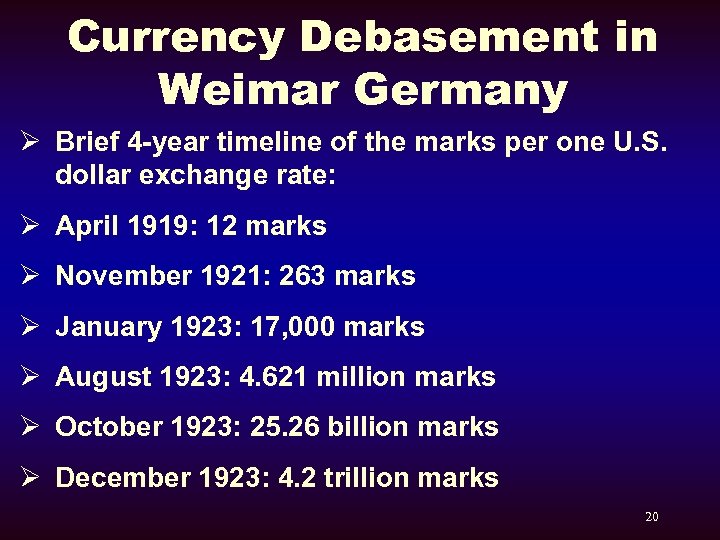

Currency Debasement in Weimar Germany Ø Brief 4 -year timeline of the marks per one U. S. dollar exchange rate: Ø April 1919: 12 marks Ø November 1921: 263 marks Ø January 1923: 17, 000 marks Ø August 1923: 4. 621 million marks Ø October 1923: 25. 26 billion marks Ø December 1923: 4. 2 trillion marks 20

Modern Currency Debasement Ø Hungary – 10 million pengo, 1945 21

Modern Currency Debasement Ø Nicaragua – 10 million córdobas, 1990 22

Modern Currency Debasement Ø Yugoslavia – 10 billion dinar, 1993 23

Modern Currency Debasement Ø Bosnia – 100 million dinar, 1993 24

Modern Currency Debasement Ø Turkey – 5 million lira, 1997 25

Modern Currency Debasement Ø Zimbabwe – 100 trillion dollars, 2006 26

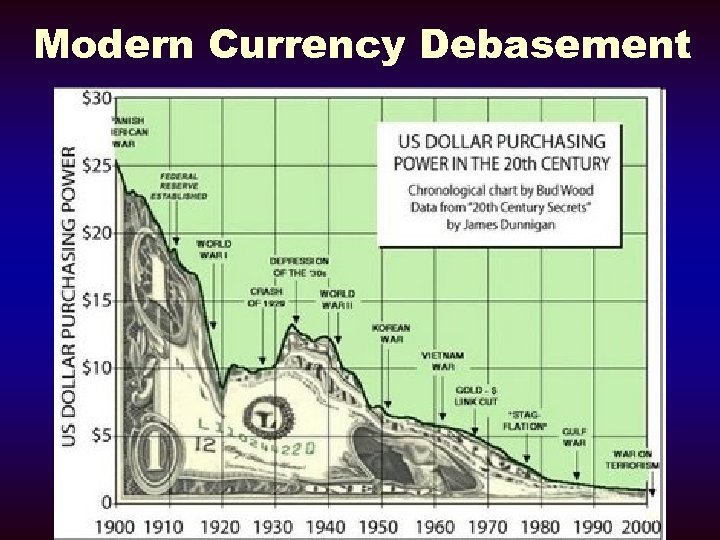

Modern Currency Debasement 27

Currency Debasement 28

Gold Certificate 29

Silver Certificate 30

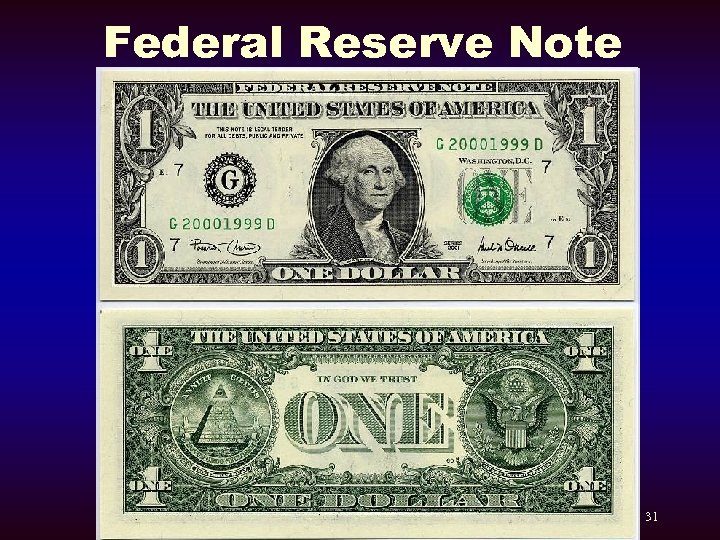

Federal Reserve Note 31

Fiat Currency Ø Currency that has value only because of government regulation or law Ø Has no value other than what government declares Ø Not backed by gold or silver Ø The term derives from the Latin fiat, meaning "let it be done“ Ø Originated in 11 th century China, and its use became widespread during the Yuan and Ming dynasties. 32

Fiat Currency Ø Spread to Europe gradually Ø Outlawed in the USA until 1933 Ø The Nixon Shock of 1971 ended the direct convertibility of the United States dollar to gold Ø Broken promise to pay Ø Since 1971, all reserve currencies have been fiat currencies Ø Competitive devaluation 33

Dishonest Measure of Value The Lord hates dishonest scales (including fiat currency), but accurate weights (like gold and silver) are his delight. – Proverbs 11: 1 NIV 34

Evolution of Fiat Money 1. Goldsmiths store gold and become banks 2. Banks lend gold that’s theirs 3. Banks lend others’ gold 4. Banks lend with no gold backing (fractional reserve concept) 5. Money is debt; no gold backing 35

Gunpowder 36

Change in Warfare 37

Clever Bankers “Permit me to issue and control the money of a nation, and I care not who makes its laws. - Mayer Amshel Rothchild, Banker, 1744 -1812 38

Currency Wars Geithner Says U. S. Will Never Weaken Dollar to Gain an Advantage in Trade - April 26, 2011, Bloomberg 39

Debt Slavery The borrower is slave to the lender. - Proverbs 22: 7 NIV 40

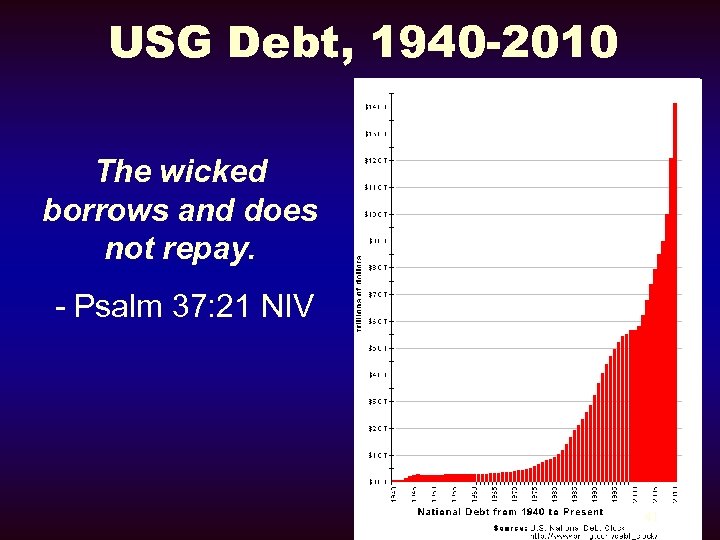

USG Debt, 1940 -2010 The wicked borrows and does not repay. - Psalm 37: 21 NIV 41

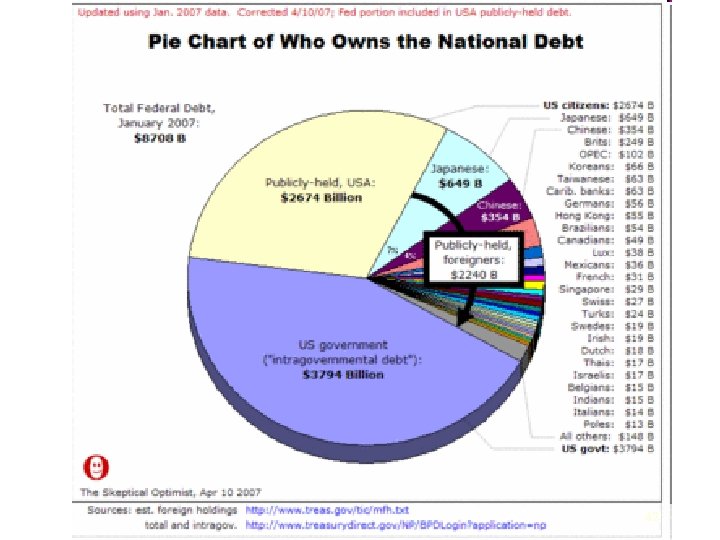

Who Owns USG Debt 42

Stewardship of Money Today Inflation is like a tax, but it’s worse than a tax, because it is on your hard earned savings, not just your income – UNLESS you hold your savings in appreciating assets like gold and silver. 43

Gold Up 17% Per Year on Average 44

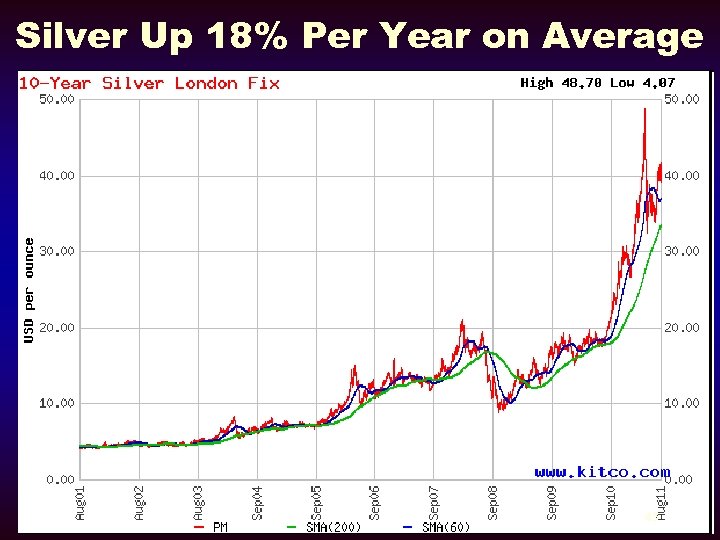

Silver Up 18% Per Year on Average 45

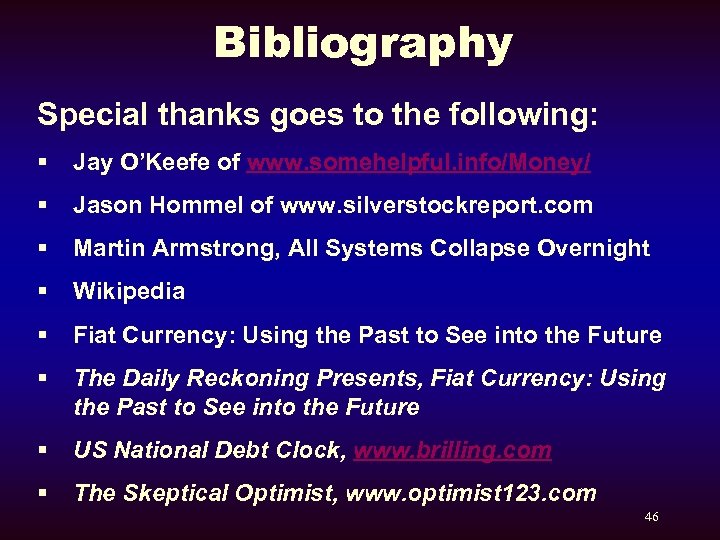

Bibliography Special thanks goes to the following: § Jay O’Keefe of www. somehelpful. info/Money/ § Jason Hommel of www. silverstockreport. com § Martin Armstrong, All Systems Collapse Overnight § Wikipedia § Fiat Currency: Using the Past to See into the Future § The Daily Reckoning Presents, Fiat Currency: Using the Past to See into the Future § US National Debt Clock, www. brilling. com § The Skeptical Optimist, www. optimist 123. com 46

More information: www. somehelpful. info 47

Thank you! 48

b470b99b1b47bef6273b1692b6a45353.ppt