5bf08d39e831a6357a1641ec6c0168cd.ppt

- Количество слайдов: 26

The Heckscher-Ohlin Model J. Peter Neary Oxford University and CEPR

The Heckscher-Ohlin Model J. Peter Neary Oxford University and CEPR

Preview: Simple General Equilibrium Models The Heckscher-Ohlin Model: • Factor-price equalisation • The Stolper-Samuelson Theorem • The Rybczynski Theorem • The Heckscher-Ohlin Theorem The Specific-Factors Model: • Comparative statics • Short-run to long-run interpretation

Preview: Simple General Equilibrium Models The Heckscher-Ohlin Model: • Factor-price equalisation • The Stolper-Samuelson Theorem • The Rybczynski Theorem • The Heckscher-Ohlin Theorem The Specific-Factors Model: • Comparative statics • Short-run to long-run interpretation

![The Heckscher-Ohlin Model [A special case of the general competitive model] Assumptions: • • The Heckscher-Ohlin Model [A special case of the general competitive model] Assumptions: • •](https://present5.com/presentation/5bf08d39e831a6357a1641ec6c0168cd/image-3.jpg) The Heckscher-Ohlin Model [A special case of the general competitive model] Assumptions: • • • Perfect competition, constant returns to scale 2 countries: Home and Foreign (*) 2 factors: Capital K and Labour L 2 sectors: y 1 and y 2 [Sometimes, to fix ideas: Manufacturing M and Food F] Complete intersectoral factor mobility Key Concepts: 1. Factor Abundance (of countries): • Home more labour-abundant: k < k*. 2. Factor Intensity (of industries/sectors): • Facing the same factor prices, sector 1 [M] is more capital-intensive: K 1/L 1 > K 2/L 2 or k 1 > k 2 • Assume: No "factor-intensity reversals": One sector always more capitalintensive 3

The Heckscher-Ohlin Model [A special case of the general competitive model] Assumptions: • • • Perfect competition, constant returns to scale 2 countries: Home and Foreign (*) 2 factors: Capital K and Labour L 2 sectors: y 1 and y 2 [Sometimes, to fix ideas: Manufacturing M and Food F] Complete intersectoral factor mobility Key Concepts: 1. Factor Abundance (of countries): • Home more labour-abundant: k < k*. 2. Factor Intensity (of industries/sectors): • Facing the same factor prices, sector 1 [M] is more capital-intensive: K 1/L 1 > K 2/L 2 or k 1 > k 2 • Assume: No "factor-intensity reversals": One sector always more capitalintensive 3

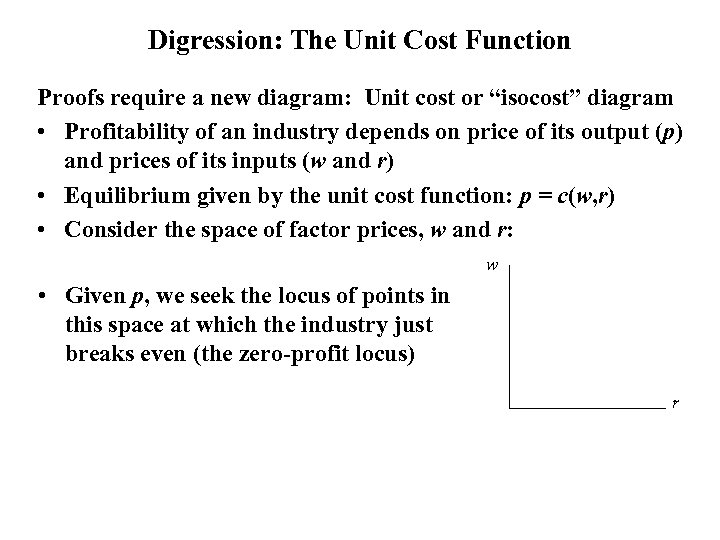

Digression: The Unit Cost Function Proofs require a new diagram: Unit cost or “isocost” diagram • Profitability of an industry depends on price of its output (p) and prices of its inputs (w and r) • Equilibrium given by the unit cost function: p = c(w, r) • Consider the space of factor prices, w and r: w • Given p, we seek the locus of points in this space at which the industry just breaks even (the zero-profit locus) r

Digression: The Unit Cost Function Proofs require a new diagram: Unit cost or “isocost” diagram • Profitability of an industry depends on price of its output (p) and prices of its inputs (w and r) • Equilibrium given by the unit cost function: p = c(w, r) • Consider the space of factor prices, w and r: w • Given p, we seek the locus of points in this space at which the industry just breaks even (the zero-profit locus) r

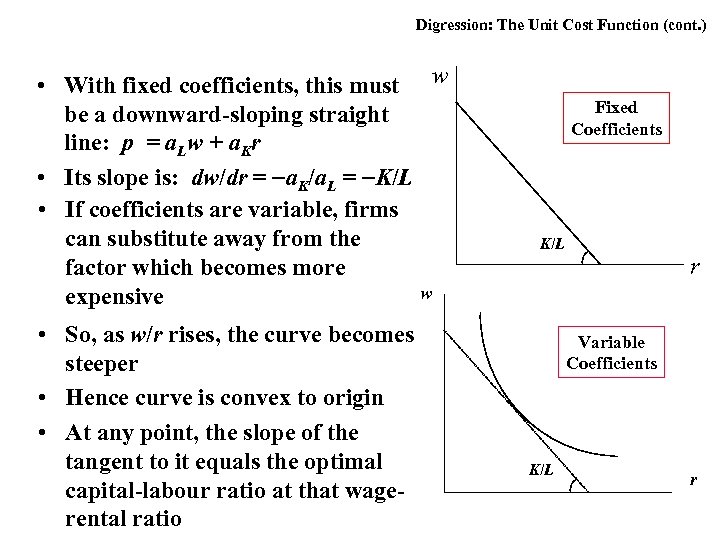

Digression: The Unit Cost Function (cont. ) • With fixed coefficients, this must w be a downward-sloping straight line: p = a. Lw + a. Kr • Its slope is: dw/dr = a. K/a. L = K/L • If coefficients are variable, firms can substitute away from the factor which becomes more w expensive • So, as w/r rises, the curve becomes steeper • Hence curve is convex to origin • At any point, the slope of the tangent to it equals the optimal capital-labour ratio at that wagerental ratio Fixed Coefficients K/L r Variable Coefficients K/L r

Digression: The Unit Cost Function (cont. ) • With fixed coefficients, this must w be a downward-sloping straight line: p = a. Lw + a. Kr • Its slope is: dw/dr = a. K/a. L = K/L • If coefficients are variable, firms can substitute away from the factor which becomes more w expensive • So, as w/r rises, the curve becomes steeper • Hence curve is convex to origin • At any point, the slope of the tangent to it equals the optimal capital-labour ratio at that wagerental ratio Fixed Coefficients K/L r Variable Coefficients K/L r

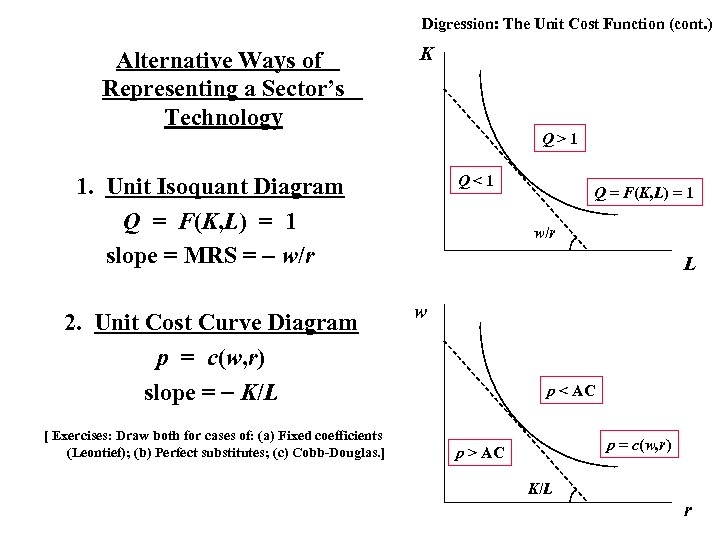

Digression: The Unit Cost Function (cont. ) Alternative Ways of Representing a Sector’s Technology K Q>1 Q<1 1. Unit Isoquant Diagram Q = F(K, L) = 1 slope = MRS = w/r 2. Unit Cost Curve Diagram p = c(w, r) slope = K/L [ Exercises: Draw both for cases of: (a) Fixed coefficients (Leontief); (b) Perfect substitutes; (c) Cobb-Douglas. ] Q = F(K, L) = 1 w/r L w p < AC p = c(w, r) p > AC K/L r

Digression: The Unit Cost Function (cont. ) Alternative Ways of Representing a Sector’s Technology K Q>1 Q<1 1. Unit Isoquant Diagram Q = F(K, L) = 1 slope = MRS = w/r 2. Unit Cost Curve Diagram p = c(w, r) slope = K/L [ Exercises: Draw both for cases of: (a) Fixed coefficients (Leontief); (b) Perfect substitutes; (c) Cobb-Douglas. ] Q = F(K, L) = 1 w/r L w p < AC p = c(w, r) p > AC K/L r

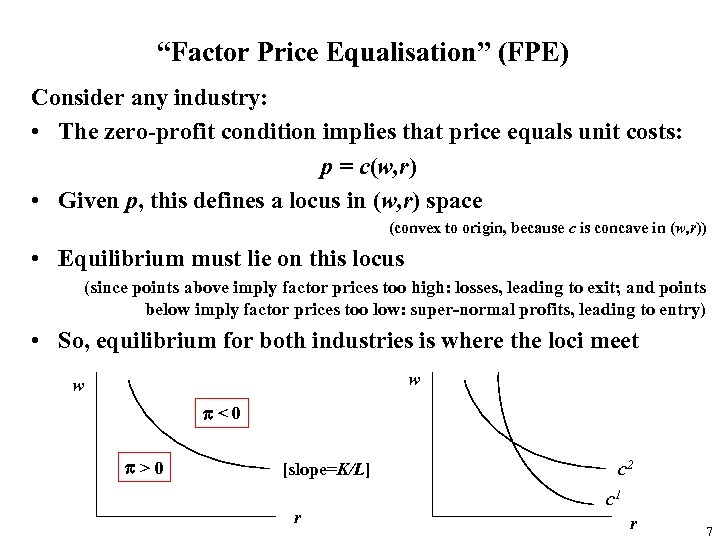

“Factor Price Equalisation” (FPE) Consider any industry: • The zero-profit condition implies that price equals unit costs: p = c(w, r) • Given p, this defines a locus in (w, r) space (convex to origin, because c is concave in (w, r)) • Equilibrium must lie on this locus (since points above imply factor prices too high: losses, leading to exit; and points below imply factor prices too low: super-normal profits, leading to entry) • So, equilibrium for both industries is where the loci meet w w p<0 p>0 [slope=K/L] r c 2 c 1 r 7

“Factor Price Equalisation” (FPE) Consider any industry: • The zero-profit condition implies that price equals unit costs: p = c(w, r) • Given p, this defines a locus in (w, r) space (convex to origin, because c is concave in (w, r)) • Equilibrium must lie on this locus (since points above imply factor prices too high: losses, leading to exit; and points below imply factor prices too low: super-normal profits, leading to entry) • So, equilibrium for both industries is where the loci meet w w p<0 p>0 [slope=K/L] r c 2 c 1 r 7

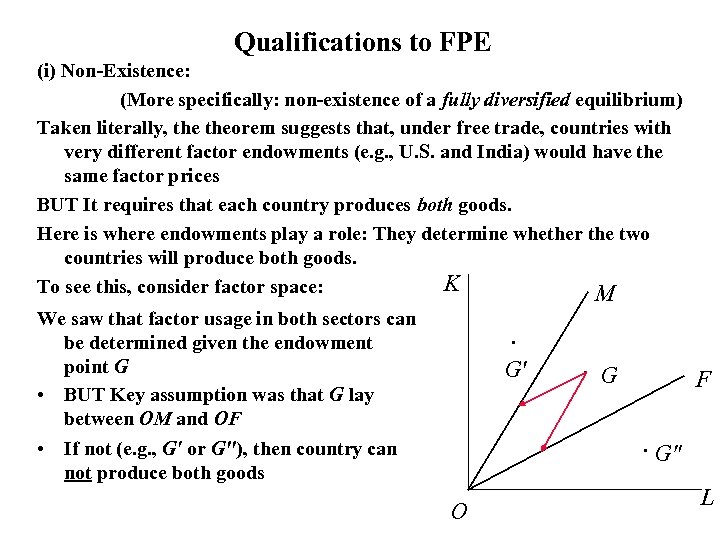

Qualifications to FPE (i) Non-Existence: (More specifically: non-existence of a fully diversified equilibrium) Taken literally, theorem suggests that, under free trade, countries with very different factor endowments (e. g. , U. S. and India) would have the same factor prices BUT It requires that each country produces both goods. Here is where endowments play a role: They determine whether the two countries will produce both goods. K To see this, consider factor space: M We saw that factor usage in both sectors can be determined given the endowment point G • BUT Key assumption was that G lay between OM and OF . G' . G F . G" • If not (e. g. , G' or G"), then country can not produce both goods O L

Qualifications to FPE (i) Non-Existence: (More specifically: non-existence of a fully diversified equilibrium) Taken literally, theorem suggests that, under free trade, countries with very different factor endowments (e. g. , U. S. and India) would have the same factor prices BUT It requires that each country produces both goods. Here is where endowments play a role: They determine whether the two countries will produce both goods. K To see this, consider factor space: M We saw that factor usage in both sectors can be determined given the endowment point G • BUT Key assumption was that G lay between OM and OF . G' . G F . G" • If not (e. g. , G' or G"), then country can not produce both goods O L

Qualifications to FPE (cont. ) (ii) Non-Uniqueness: Factor intensity reversals are possible If: Elasticities of substitution differ enough between sectors (iii) Same number of goods and factors required: • More goods: each country may produce a different mix of goods, more suited to its own factor endowments. • More factors: Specific-factors model a simple example of a model with m > n, which rules out FPE. 9

Qualifications to FPE (cont. ) (ii) Non-Uniqueness: Factor intensity reversals are possible If: Elasticities of substitution differ enough between sectors (iii) Same number of goods and factors required: • More goods: each country may produce a different mix of goods, more suited to its own factor endowments. • More factors: Specific-factors model a simple example of a model with m > n, which rules out FPE. 9

The Stolper-Samuelson Theorem: An increase in the relative price of the capitalintensive good will increase the rental and reduce the wage, relative to the prices of both goods • Note: It refers to “real” wages and rentals • This implies that wage-earners are unambiguously worse off and capital-owners unambiguously better off

The Stolper-Samuelson Theorem: An increase in the relative price of the capitalintensive good will increase the rental and reduce the wage, relative to the prices of both goods • Note: It refers to “real” wages and rentals • This implies that wage-earners are unambiguously worse off and capital-owners unambiguously better off

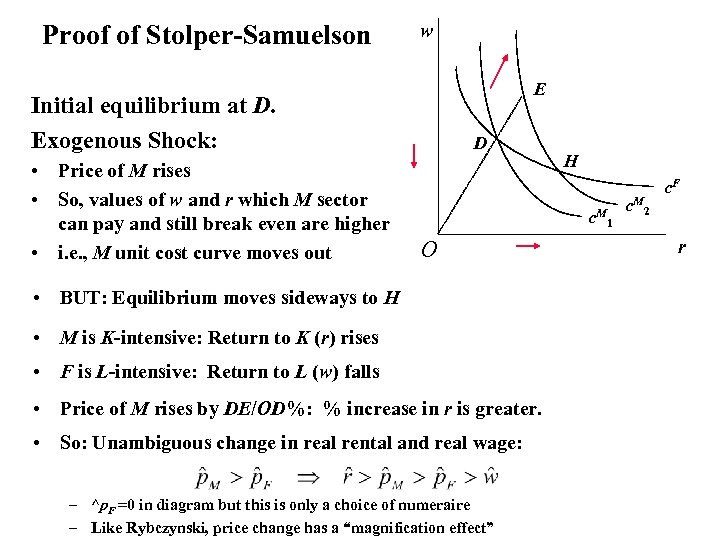

Proof of Stolper-Samuelson w E Initial equilibrium at D. Exogenous Shock: • Price of M rises • So, values of w and r which M sector can pay and still break even are higher • i. e. , M unit cost curve moves out D H c. M O • BUT: Equilibrium moves sideways to H • M is K-intensive: Return to K (r) rises • F is L-intensive: Return to L (w) falls • Price of M rises by DE/OD%: % increase in r is greater. • So: Unambiguous change in real rental and real wage: – ^p. F =0 in diagram but this is only a choice of numeraire – Like Rybczynski, price change has a “magnification effect” 1 c. M 2 c. F r

Proof of Stolper-Samuelson w E Initial equilibrium at D. Exogenous Shock: • Price of M rises • So, values of w and r which M sector can pay and still break even are higher • i. e. , M unit cost curve moves out D H c. M O • BUT: Equilibrium moves sideways to H • M is K-intensive: Return to K (r) rises • F is L-intensive: Return to L (w) falls • Price of M rises by DE/OD%: % increase in r is greater. • So: Unambiguous change in real rental and real wage: – ^p. F =0 in diagram but this is only a choice of numeraire – Like Rybczynski, price change has a “magnification effect” 1 c. M 2 c. F r

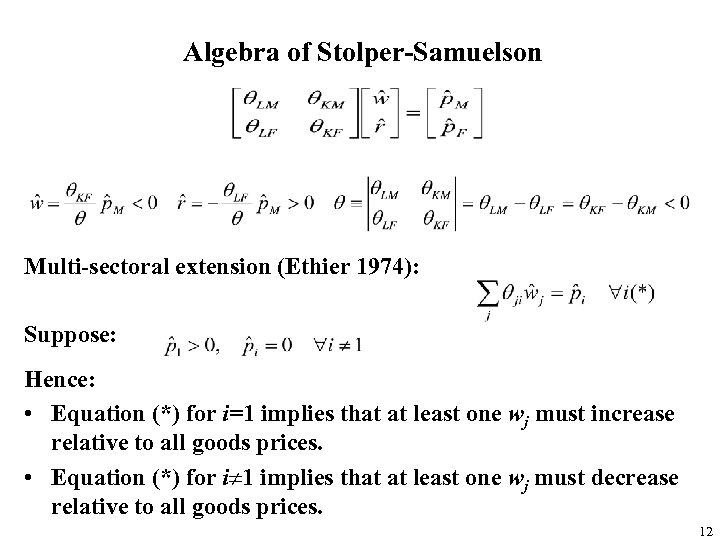

Algebra of Stolper-Samuelson Multi-sectoral extension (Ethier 1974): Suppose: Hence: • Equation (*) for i=1 implies that at least one wj must increase relative to all goods prices. • Equation (*) for i¹ 1 implies that at least one wj must decrease relative to all goods prices. 12

Algebra of Stolper-Samuelson Multi-sectoral extension (Ethier 1974): Suppose: Hence: • Equation (*) for i=1 implies that at least one wj must increase relative to all goods prices. • Equation (*) for i¹ 1 implies that at least one wj must decrease relative to all goods prices. 12

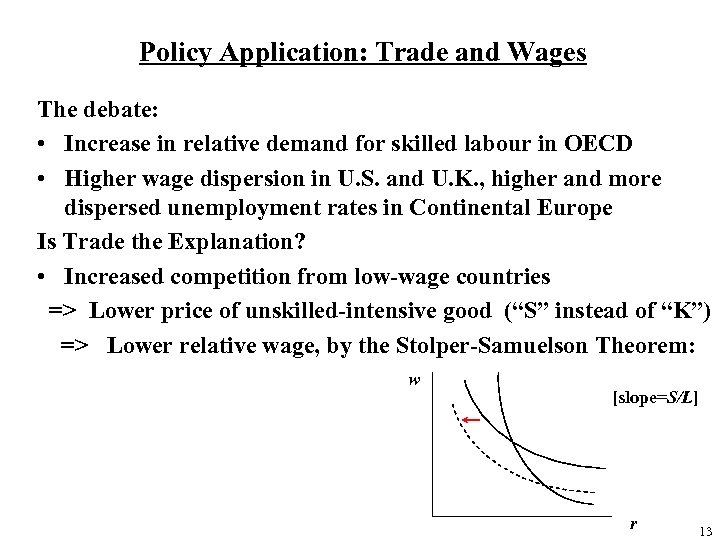

Policy Application: Trade and Wages The debate: • Increase in relative demand for skilled labour in OECD • Higher wage dispersion in U. S. and U. K. , higher and more dispersed unemployment rates in Continental Europe Is Trade the Explanation? • Increased competition from low-wage countries => Lower price of unskilled-intensive good (“S” instead of “K”) => Lower relative wage, by the Stolper-Samuelson Theorem: w [slope=S/L] r 13

Policy Application: Trade and Wages The debate: • Increase in relative demand for skilled labour in OECD • Higher wage dispersion in U. S. and U. K. , higher and more dispersed unemployment rates in Continental Europe Is Trade the Explanation? • Increased competition from low-wage countries => Lower price of unskilled-intensive good (“S” instead of “K”) => Lower relative wage, by the Stolper-Samuelson Theorem: w [slope=S/L] r 13

Policy Application: Trade and Wages (cont. ) Problems with the Trade Explanation: • Predicts a fall in S/L in both sectors • Predicts a rise in w/r in exporting countries (LDC’s) • Observed changes in price and import volume are not sufficient to explain the changes • More plausible explanations: • Labour-saving technical progress • Outsourcing BUT: Existing explanations assume perfect competition: • Cannot explain changes in profits or mark-ups • Lower import prices the only form of “increased competition” • Empirical evidence that market structure affects trade impact on unskilled wages [Oliveira-Martins (1994), Borjas and Ramey (1995), Neary (RIE 2002)] 14

Policy Application: Trade and Wages (cont. ) Problems with the Trade Explanation: • Predicts a fall in S/L in both sectors • Predicts a rise in w/r in exporting countries (LDC’s) • Observed changes in price and import volume are not sufficient to explain the changes • More plausible explanations: • Labour-saving technical progress • Outsourcing BUT: Existing explanations assume perfect competition: • Cannot explain changes in profits or mark-ups • Lower import prices the only form of “increased competition” • Empirical evidence that market structure affects trade impact on unskilled wages [Oliveira-Martins (1994), Borjas and Ramey (1995), Neary (RIE 2002)] 14

The Rybczynski Theorem At constant prices, an increase in one factor endowment will increase the output of the good intensive in that factor by a greater proportion and reduce the output of the other good

The Rybczynski Theorem At constant prices, an increase in one factor endowment will increase the output of the good intensive in that factor by a greater proportion and reduce the output of the other good

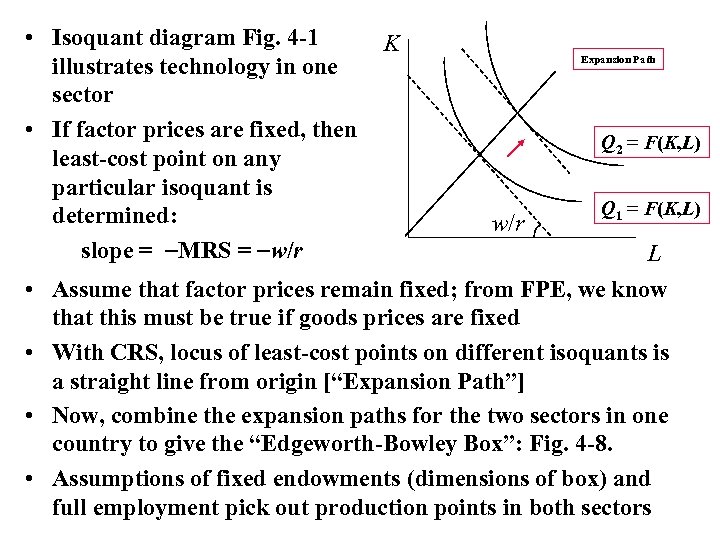

• Isoquant diagram Fig. 4 -1 illustrates technology in one sector • If factor prices are fixed, then least-cost point on any particular isoquant is determined: slope = MRS = w/r • • K Expansion Path Q 2 = F(K, L) w/r Q 1 = F(K, L) L Assume that factor prices remain fixed; from FPE, we know that this must be true if goods prices are fixed With CRS, locus of least-cost points on different isoquants is a straight line from origin [“Expansion Path”] Now, combine the expansion paths for the two sectors in one country to give the “Edgeworth-Bowley Box”: Fig. 4 -8. Assumptions of fixed endowments (dimensions of box) and full employment pick out production points in both sectors

• Isoquant diagram Fig. 4 -1 illustrates technology in one sector • If factor prices are fixed, then least-cost point on any particular isoquant is determined: slope = MRS = w/r • • K Expansion Path Q 2 = F(K, L) w/r Q 1 = F(K, L) L Assume that factor prices remain fixed; from FPE, we know that this must be true if goods prices are fixed With CRS, locus of least-cost points on different isoquants is a straight line from origin [“Expansion Path”] Now, combine the expansion paths for the two sectors in one country to give the “Edgeworth-Bowley Box”: Fig. 4 -8. Assumptions of fixed endowments (dimensions of box) and full employment pick out production points in both sectors

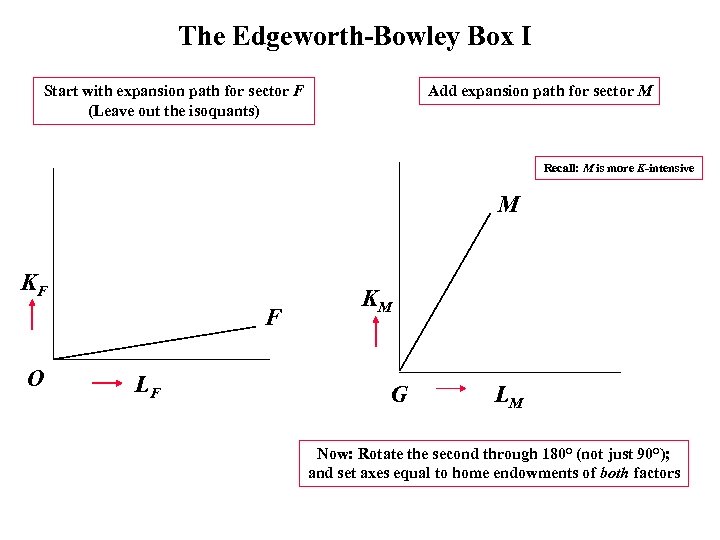

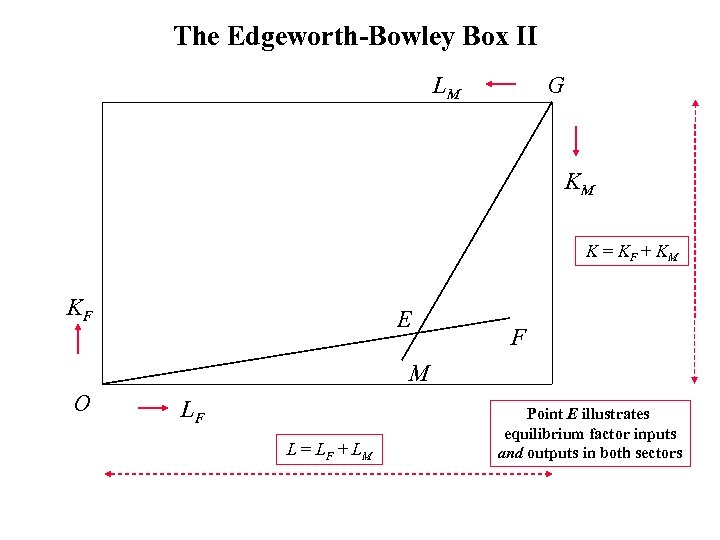

The Edgeworth-Bowley Box I Start with expansion path for sector F (Leave out the isoquants) Add expansion path for sector M Recall: M is more K-intensive M KF F O LF KM G LM Now: Rotate the second through 180° (not just 90°); and set axes equal to home endowments of both factors

The Edgeworth-Bowley Box I Start with expansion path for sector F (Leave out the isoquants) Add expansion path for sector M Recall: M is more K-intensive M KF F O LF KM G LM Now: Rotate the second through 180° (not just 90°); and set axes equal to home endowments of both factors

The Edgeworth-Bowley Box II LM G KM K = KF + KM KF E F M O LF L = LF + LM Point E illustrates equilibrium factor inputs and outputs in both sectors

The Edgeworth-Bowley Box II LM G KM K = KF + KM KF E F M O LF L = LF + LM Point E illustrates equilibrium factor inputs and outputs in both sectors

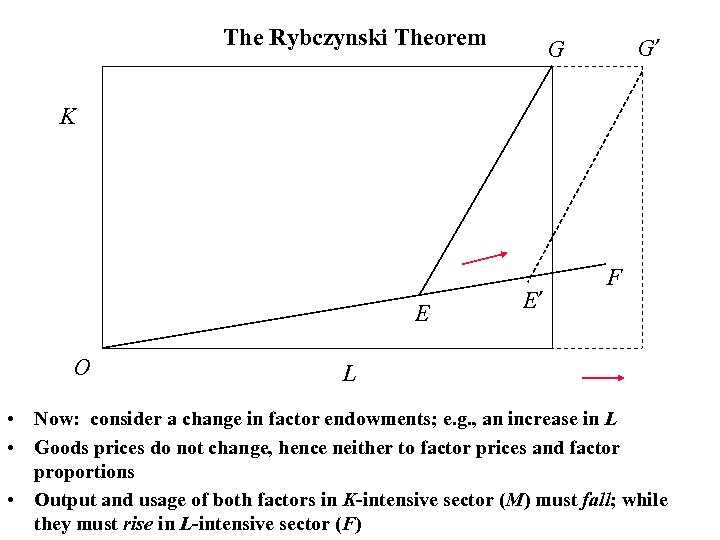

The Rybczynski Theorem G’ G K E O E’ F L • Now: consider a change in factor endowments; e. g. , an increase in L • Goods prices do not change, hence neither to factor prices and factor proportions • Output and usage of both factors in K-intensive sector (M) must fall; while they must rise in L-intensive sector (F)

The Rybczynski Theorem G’ G K E O E’ F L • Now: consider a change in factor endowments; e. g. , an increase in L • Goods prices do not change, hence neither to factor prices and factor proportions • Output and usage of both factors in K-intensive sector (M) must fall; while they must rise in L-intensive sector (F)

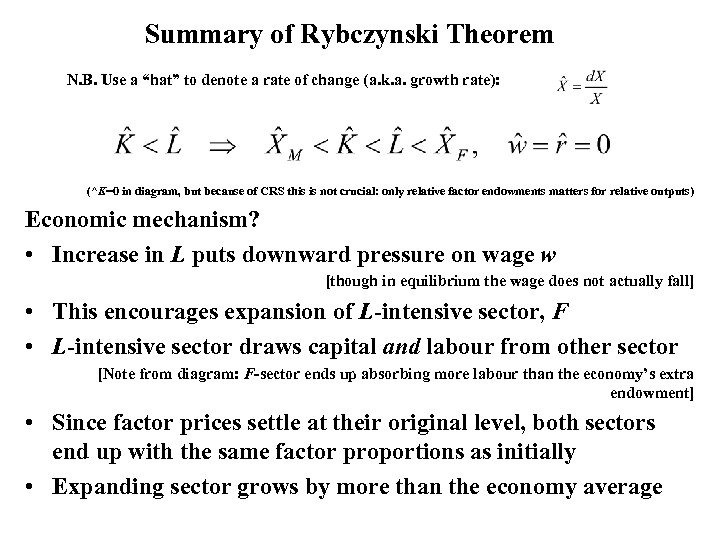

Summary of Rybczynski Theorem N. B. Use a “hat” to denote a rate of change (a. k. a. growth rate): (^K=0 in diagram, but because of CRS this is not crucial: only relative factor endowments matters for relative outputs) Economic mechanism? • Increase in L puts downward pressure on wage w [though in equilibrium the wage does not actually fall] • This encourages expansion of L-intensive sector, F • L-intensive sector draws capital and labour from other sector [Note from diagram: F-sector ends up absorbing more labour than the economy’s extra endowment] • Since factor prices settle at their original level, both sectors end up with the same factor proportions as initially • Expanding sector grows by more than the economy average

Summary of Rybczynski Theorem N. B. Use a “hat” to denote a rate of change (a. k. a. growth rate): (^K=0 in diagram, but because of CRS this is not crucial: only relative factor endowments matters for relative outputs) Economic mechanism? • Increase in L puts downward pressure on wage w [though in equilibrium the wage does not actually fall] • This encourages expansion of L-intensive sector, F • L-intensive sector draws capital and labour from other sector [Note from diagram: F-sector ends up absorbing more labour than the economy’s extra endowment] • Since factor prices settle at their original level, both sectors end up with the same factor proportions as initially • Expanding sector grows by more than the economy average

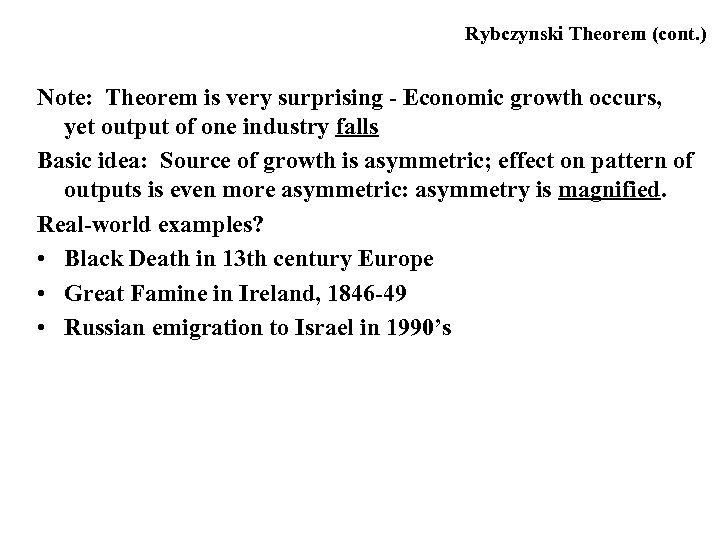

Rybczynski Theorem (cont. ) Note: Theorem is very surprising - Economic growth occurs, yet output of one industry falls Basic idea: Source of growth is asymmetric; effect on pattern of outputs is even more asymmetric: asymmetry is magnified. Real-world examples? • Black Death in 13 th century Europe • Great Famine in Ireland, 1846 -49 • Russian emigration to Israel in 1990’s

Rybczynski Theorem (cont. ) Note: Theorem is very surprising - Economic growth occurs, yet output of one industry falls Basic idea: Source of growth is asymmetric; effect on pattern of outputs is even more asymmetric: asymmetry is magnified. Real-world examples? • Black Death in 13 th century Europe • Great Famine in Ireland, 1846 -49 • Russian emigration to Israel in 1990’s

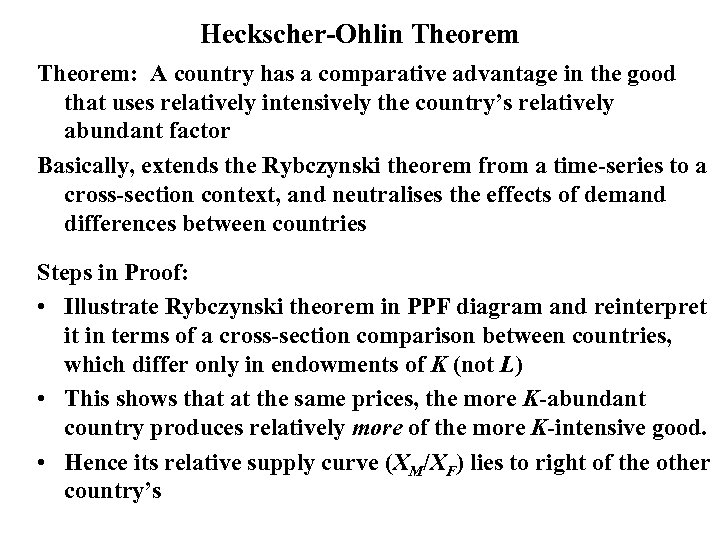

Heckscher-Ohlin Theorem: A country has a comparative advantage in the good that uses relatively intensively the country’s relatively abundant factor Basically, extends the Rybczynski theorem from a time-series to a cross-section context, and neutralises the effects of demand differences between countries Steps in Proof: • Illustrate Rybczynski theorem in PPF diagram and reinterpret it in terms of a cross-section comparison between countries, which differ only in endowments of K (not L) • This shows that at the same prices, the more K-abundant country produces relatively more of the more K-intensive good. • Hence its relative supply curve (XM/XF) lies to right of the other country’s

Heckscher-Ohlin Theorem: A country has a comparative advantage in the good that uses relatively intensively the country’s relatively abundant factor Basically, extends the Rybczynski theorem from a time-series to a cross-section context, and neutralises the effects of demand differences between countries Steps in Proof: • Illustrate Rybczynski theorem in PPF diagram and reinterpret it in terms of a cross-section comparison between countries, which differ only in endowments of K (not L) • This shows that at the same prices, the more K-abundant country produces relatively more of the more K-intensive good. • Hence its relative supply curve (XM/XF) lies to right of the other country’s

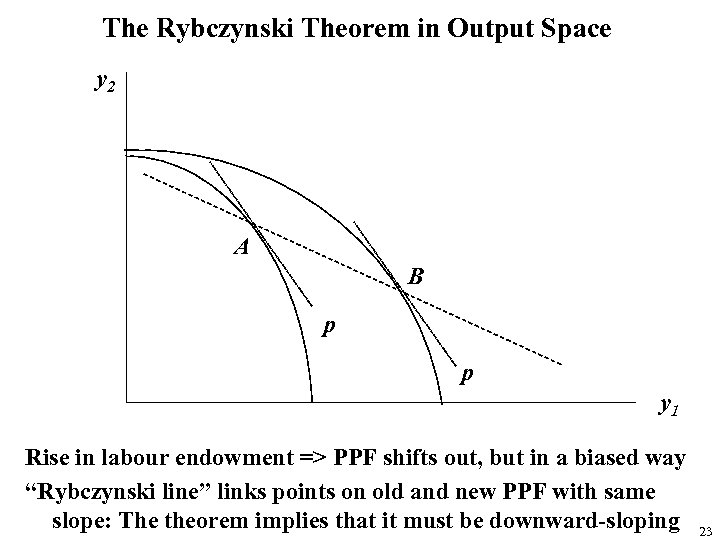

The Rybczynski Theorem in Output Space y 2 A B p p y 1 Rise in labour endowment => PPF shifts out, but in a biased way “Rybczynski line” links points on old and new PPF with same slope: The theorem implies that it must be downward-sloping 23

The Rybczynski Theorem in Output Space y 2 A B p p y 1 Rise in labour endowment => PPF shifts out, but in a biased way “Rybczynski line” links points on old and new PPF with same slope: The theorem implies that it must be downward-sloping 23

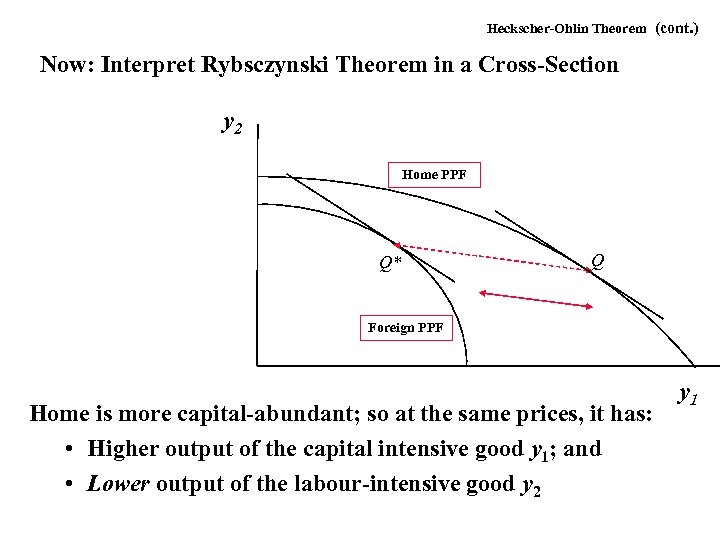

Heckscher-Ohlin Theorem (cont. ) Now: Interpret Rybsczynski Theorem in a Cross-Section y 2 Home PPF Q* Q Foreign PPF Home is more capital-abundant; so at the same prices, it has: • Higher output of the capital intensive good y 1; and • Lower output of the labour-intensive good y 2 y 1

Heckscher-Ohlin Theorem (cont. ) Now: Interpret Rybsczynski Theorem in a Cross-Section y 2 Home PPF Q* Q Foreign PPF Home is more capital-abundant; so at the same prices, it has: • Higher output of the capital intensive good y 1; and • Lower output of the labour-intensive good y 2 y 1

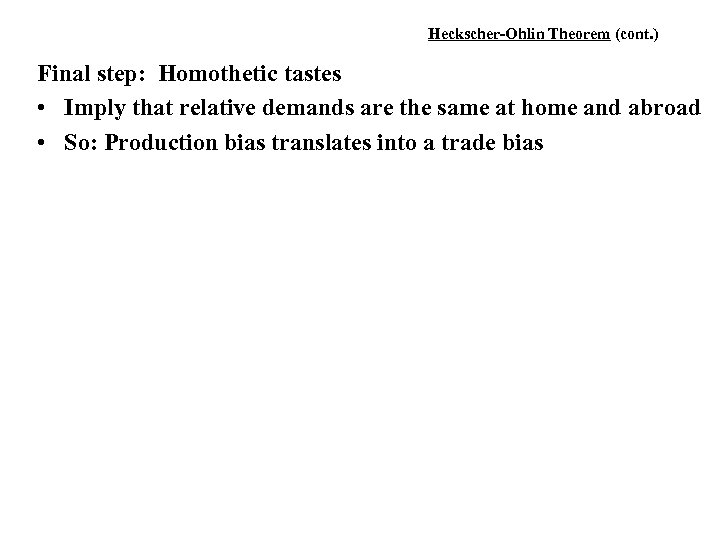

Heckscher-Ohlin Theorem (cont. ) Final step: Homothetic tastes • Imply that relative demands are the same at home and abroad • So: Production bias translates into a trade bias

Heckscher-Ohlin Theorem (cont. ) Final step: Homothetic tastes • Imply that relative demands are the same at home and abroad • So: Production bias translates into a trade bias

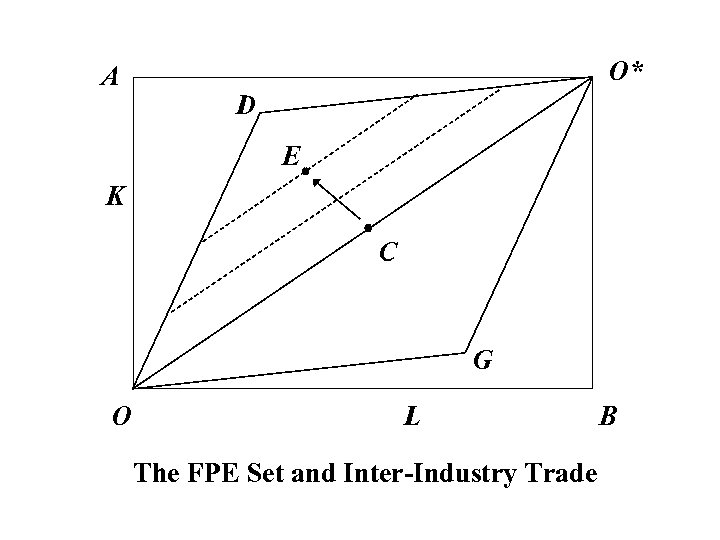

A O* D E K C G O L The FPE Set and Inter-Industry Trade B

A O* D E K C G O L The FPE Set and Inter-Industry Trade B