bab641c1bac013ff664f101c03b91c28.ppt

- Количество слайдов: 15

The Greek Letters Chapter 17 1

The Greek Letters Chapter 17 1

Example A bank has sold for $300, 000 a European call option on 100, 000 shares of a nondividend paying stock S 0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks, m = 13% The Black-Scholes value of the option is $240, 000 How does the bank hedge its risk to lock in a $60, 000 profit? 2

Example A bank has sold for $300, 000 a European call option on 100, 000 shares of a nondividend paying stock S 0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks, m = 13% The Black-Scholes value of the option is $240, 000 How does the bank hedge its risk to lock in a $60, 000 profit? 2

Naked & Covered Positions Naked position: Take no action If S<50(K) => the potion is not exercised=> work well If S=60 => option costs=(60 -50)*100, 000=1, 000 >300, 000 (charge for the option) Covered position: Buy 100, 000 shares today If S=40, stock losses (49 -40)*100, 000=900, 000> 300, 000 (charge for the option) Both strategies leave the bank exposed to significant risk 3

Naked & Covered Positions Naked position: Take no action If S<50(K) => the potion is not exercised=> work well If S=60 => option costs=(60 -50)*100, 000=1, 000 >300, 000 (charge for the option) Covered position: Buy 100, 000 shares today If S=40, stock losses (49 -40)*100, 000=900, 000> 300, 000 (charge for the option) Both strategies leave the bank exposed to significant risk 3

Stop-Loss Strategy This involves: Buying 100, 000 shares as soon as price reaches $50 (K) Selling 100, 000 shares as soon as price falls below $50 (K) This deceptively simple hedging strategy does not work well (fail to discount, fail to purchase and sale at exactly the same price K) 4

Stop-Loss Strategy This involves: Buying 100, 000 shares as soon as price reaches $50 (K) Selling 100, 000 shares as soon as price falls below $50 (K) This deceptively simple hedging strategy does not work well (fail to discount, fail to purchase and sale at exactly the same price K) 4

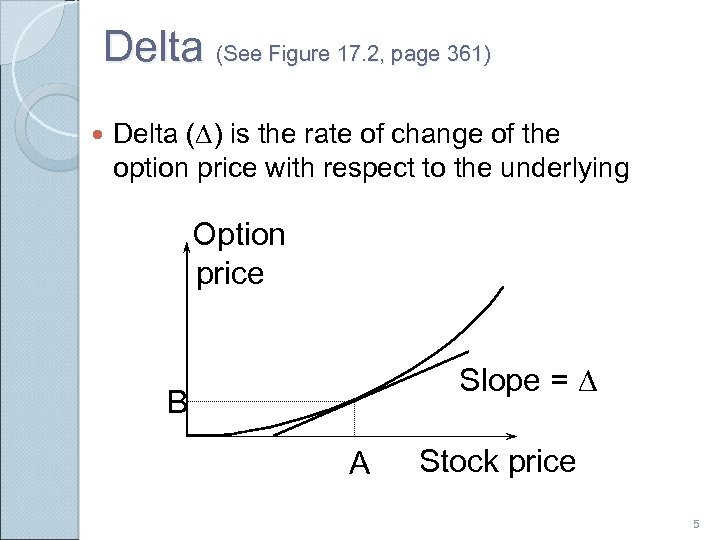

Delta (See Figure 17. 2, page 361) Delta (D) is the rate of change of the option price with respect to the underlying Option price Slope = D B A Stock price 5

Delta (See Figure 17. 2, page 361) Delta (D) is the rate of change of the option price with respect to the underlying Option price Slope = D B A Stock price 5

Delta Hedging This involves maintaining a delta neutral portfolio The delta of a European call on a nondividend paying stock is N (d 1) The delta of a European put on the stock is N (d 1) – 1 6

Delta Hedging This involves maintaining a delta neutral portfolio The delta of a European call on a nondividend paying stock is N (d 1) The delta of a European put on the stock is N (d 1) – 1 6

Delta Hedging continued The hedge position must be frequently rebalanced Delta hedging a written option involves a “buy high, sell low” trading rule See Tables 17. 2 (page 364) and 17. 3 (page 365) for examples of delta hedging 7

Delta Hedging continued The hedge position must be frequently rebalanced Delta hedging a written option involves a “buy high, sell low” trading rule See Tables 17. 2 (page 364) and 17. 3 (page 365) for examples of delta hedging 7

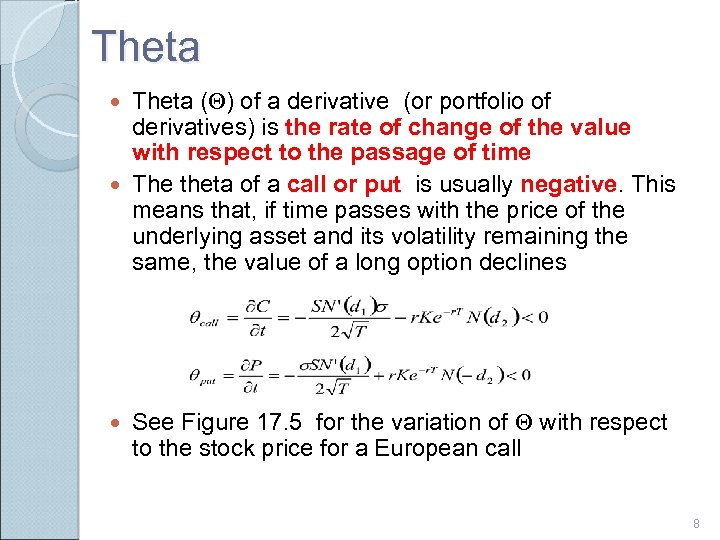

Theta (Q) of a derivative (or portfolio of derivatives) is the rate of change of the value with respect to the passage of time The theta of a call or put is usually negative. This means that, if time passes with the price of the underlying asset and its volatility remaining the same, the value of a long option declines See Figure 17. 5 for the variation of Q with respect to the stock price for a European call 8

Theta (Q) of a derivative (or portfolio of derivatives) is the rate of change of the value with respect to the passage of time The theta of a call or put is usually negative. This means that, if time passes with the price of the underlying asset and its volatility remaining the same, the value of a long option declines See Figure 17. 5 for the variation of Q with respect to the stock price for a European call 8

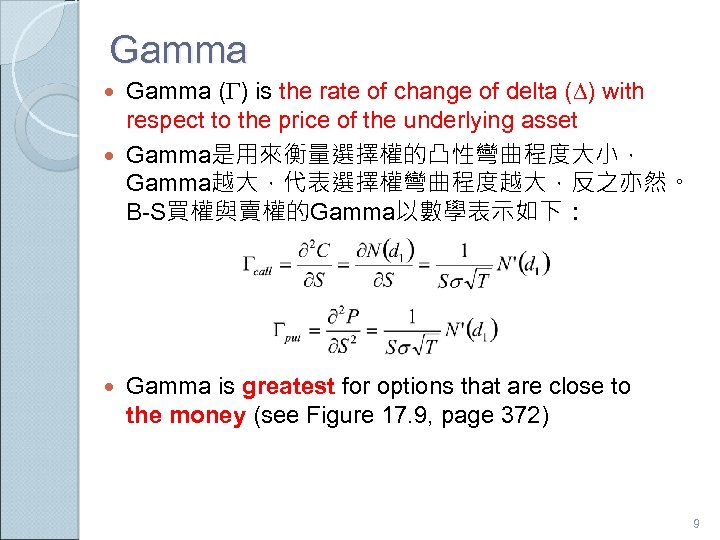

Gamma (G) is the rate of change of delta (D) with respect to the price of the underlying asset Gamma是用來衡量選擇權的凸性彎曲程度大小, Gamma越大,代表選擇權彎曲程度越大,反之亦然。 B-S買權與賣權的Gamma以數學表示如下: Gamma is greatest for options that are close to the money (see Figure 17. 9, page 372) 9

Gamma (G) is the rate of change of delta (D) with respect to the price of the underlying asset Gamma是用來衡量選擇權的凸性彎曲程度大小, Gamma越大,代表選擇權彎曲程度越大,反之亦然。 B-S買權與賣權的Gamma以數學表示如下: Gamma is greatest for options that are close to the money (see Figure 17. 9, page 372) 9

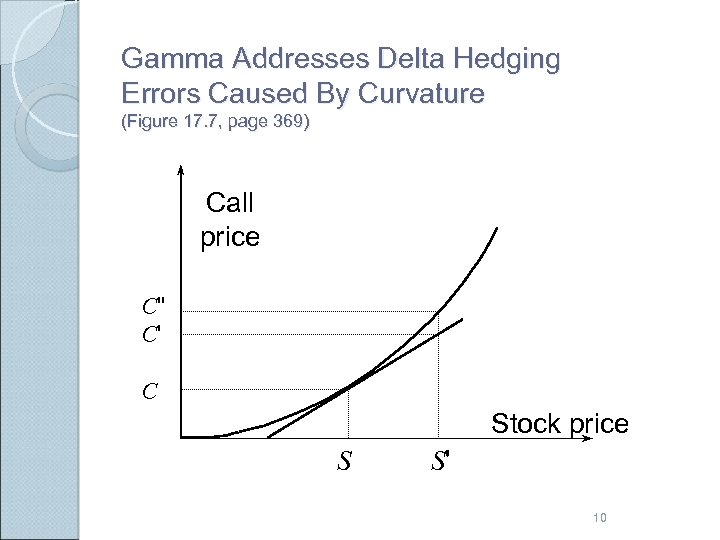

Gamma Addresses Delta Hedging Errors Caused By Curvature (Figure 17. 7, page 369) Call price C'' C' C Stock price S S' 10

Gamma Addresses Delta Hedging Errors Caused By Curvature (Figure 17. 7, page 369) Call price C'' C' C Stock price S S' 10

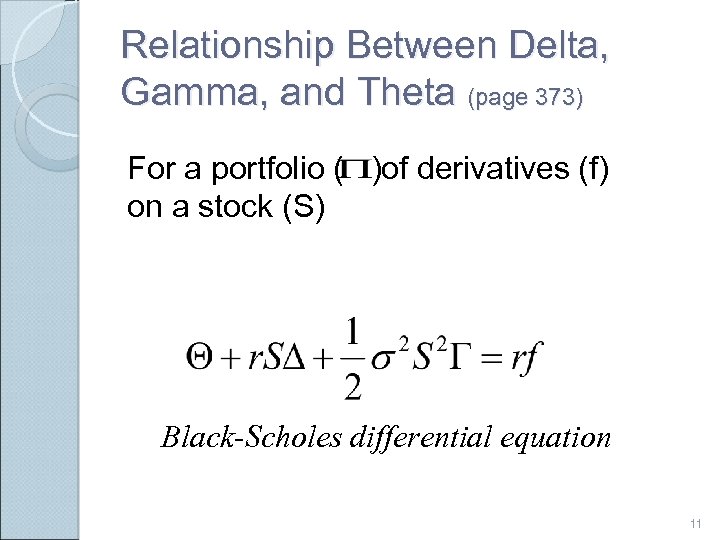

Relationship Between Delta, Gamma, and Theta (page 373) For a portfolio ( )of derivatives (f) on a stock (S) Black-Scholes differential equation 11

Relationship Between Delta, Gamma, and Theta (page 373) For a portfolio ( )of derivatives (f) on a stock (S) Black-Scholes differential equation 11

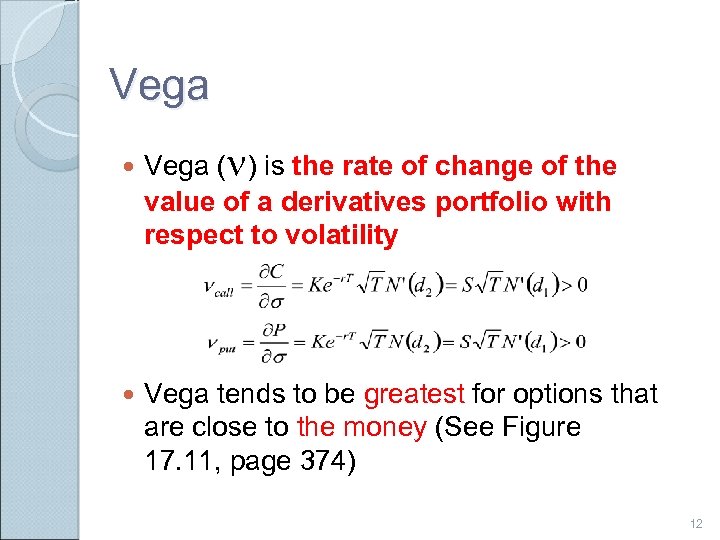

Vega (n) is the rate of change of the value of a derivatives portfolio with respect to volatility Vega tends to be greatest for options that are close to the money (See Figure 17. 11, page 374) 12

Vega (n) is the rate of change of the value of a derivatives portfolio with respect to volatility Vega tends to be greatest for options that are close to the money (See Figure 17. 11, page 374) 12

Managing Delta, Gamma, & Vega D can be changed by taking a position in the underlying To adjust G & n (G & n =0), it is necessary to take a position in an option or other derivative · 13

Managing Delta, Gamma, & Vega D can be changed by taking a position in the underlying To adjust G & n (G & n =0), it is necessary to take a position in an option or other derivative · 13

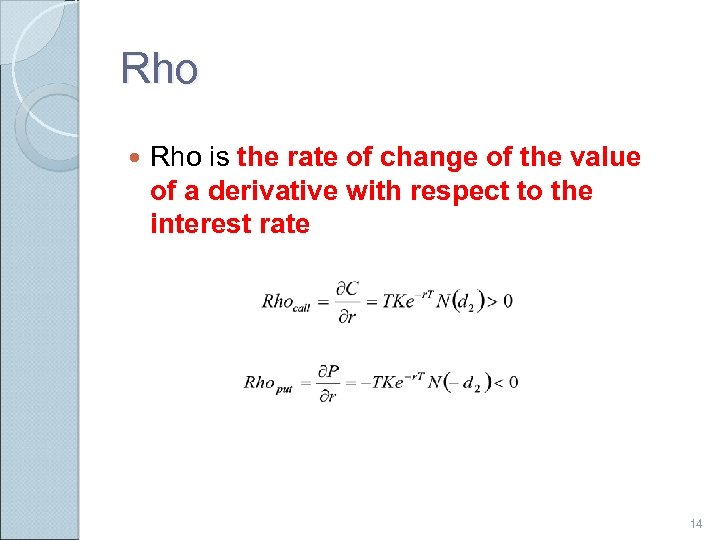

Rho is the rate of change of the value of a derivative with respect to the interest rate 14

Rho is the rate of change of the value of a derivative with respect to the interest rate 14

Hedging in Practice Traders usually ensure that their portfolios are delta-neutral at least once a day Whenever the opportunity arises, they improve gamma and vega As portfolio becomes larger, hedging becomes less expensive 15

Hedging in Practice Traders usually ensure that their portfolios are delta-neutral at least once a day Whenever the opportunity arises, they improve gamma and vega As portfolio becomes larger, hedging becomes less expensive 15