“The Greater China Co. Prosperity Sphere and How to Join it – Mate” Or, How to reduce your exposure to the US dollar by investing in Australia

“The Greater China Co. Prosperity Sphere and How to Join it – Mate” Or, How to reduce your exposure to the US dollar by investing in Australia

Agenda • • • Who am I? You’re not alone. . . Have yourself a Get-Out-of-Jail-Free Card Sell Bonds, Buy Energy 3 “Thin Air” Stocks for 2009/2010

Agenda • • • Who am I? You’re not alone. . . Have yourself a Get-Out-of-Jail-Free Card Sell Bonds, Buy Energy 3 “Thin Air” Stocks for 2009/2010

It Isn’t Just the US Government That’s Gone Spending Crazy! • Australia’s Stimulating Record – Cheques to dead people – ‘Free’ money to buy houses – Insulate your home for free – Build. . . Stuff • Hospitals, Schools, Bridges, Roads, Sheds, etc. . . – Something (Anything) must be done

It Isn’t Just the US Government That’s Gone Spending Crazy! • Australia’s Stimulating Record – Cheques to dead people – ‘Free’ money to buy houses – Insulate your home for free – Build. . . Stuff • Hospitals, Schools, Bridges, Roads, Sheds, etc. . . – Something (Anything) must be done

Still a Lucky Country – Just

Still a Lucky Country – Just

Greater China Co-Prosperity Sphere

Greater China Co-Prosperity Sphere

Orwell’s Vision for 1984 25 years later, has Australia joined ‘Eastasia’?

Orwell’s Vision for 1984 25 years later, has Australia joined ‘Eastasia’?

Why is Chinese Government Spending Good, but Australian and US Government Spending Bad? It Isn’t – but it’s good for Australia’s resources companies!

Why is Chinese Government Spending Good, but Australian and US Government Spending Bad? It Isn’t – but it’s good for Australia’s resources companies!

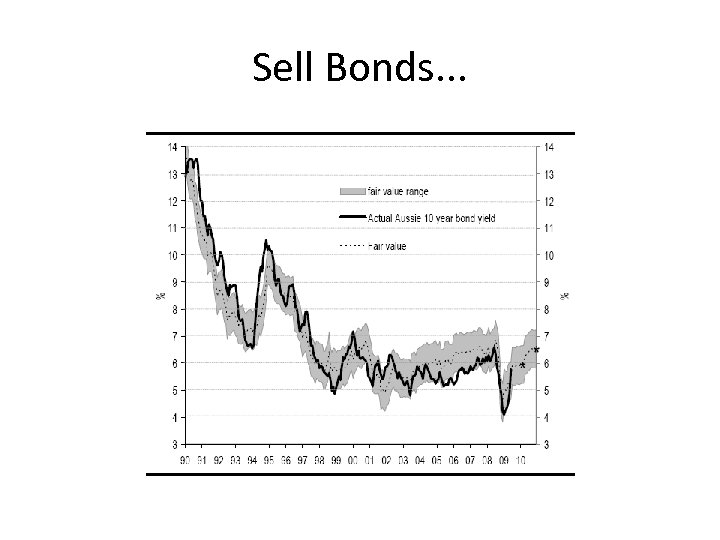

Sell Bonds. . .

Sell Bonds. . .

Buy Energy. . . or

Buy Energy. . . or

Sell USD, Buy AUD

Sell USD, Buy AUD

Which Australian Investments? • For you. . . – Resources – Small Caps • Natural Gas (CSG, LNG) – 3 “Thin Air” Stocks » LNG Terminal Operator » Gas Explorer » LNG Terminal Operator & Gas Explorer More Details in this afternoon’s workshop at 3: 20 pm in Cortes Room (Discovery Level)

Which Australian Investments? • For you. . . – Resources – Small Caps • Natural Gas (CSG, LNG) – 3 “Thin Air” Stocks » LNG Terminal Operator » Gas Explorer » LNG Terminal Operator & Gas Explorer More Details in this afternoon’s workshop at 3: 20 pm in Cortes Room (Discovery Level)

Who Should Buy Australian? • If you want to buy into some of the most exciting small energy plays on the market • If you want to reduce your US dollar exposure • If you want to increase your exposure to the Chinese economy • If you want to benefit from a non-US led global economic recovery • If you want to benefit from a US led global economic recovery

Who Should Buy Australian? • If you want to buy into some of the most exciting small energy plays on the market • If you want to reduce your US dollar exposure • If you want to increase your exposure to the Chinese economy • If you want to benefit from a non-US led global economic recovery • If you want to benefit from a US led global economic recovery

• www. moneymorning. com. au

• www. moneymorning. com. au