f056acc247efe9d577a7c38322473c54.ppt

- Количество слайдов: 93

The Great Depression 1929 -1941

The Great Depression 1929 -1941

1 st CAUSE OF THE GREAT DEPRESSION • An old decaying industrial base • Outmoded equipment made some industries less competitive

1 st CAUSE OF THE GREAT DEPRESSION • An old decaying industrial base • Outmoded equipment made some industries less competitive

Industry in Trouble The miner says, “Uh Oh…” • Textiles • Steel • Railroads • Mining and Lumbering • Automobiles • Construction

Industry in Trouble The miner says, “Uh Oh…” • Textiles • Steel • Railroads • Mining and Lumbering • Automobiles • Construction

2 nd CAUSE OF THE GREAT DEPRESSION • A crisis in the farm sector • Farmers produced more than they were able to sell, especially with the demand of WWI and the disappearance of markets that the war had opened to them

2 nd CAUSE OF THE GREAT DEPRESSION • A crisis in the farm sector • Farmers produced more than they were able to sell, especially with the demand of WWI and the disappearance of markets that the war had opened to them

Farmers in Trouble • During WWI • International demand for food crops soared • Prices Rose • Farmers took out loans to buy more land equipment

Farmers in Trouble • During WWI • International demand for food crops soared • Prices Rose • Farmers took out loans to buy more land equipment

Farmers in Trouble • Post WWI • Prices and demand fell • To compensate for lower prices farmers boosted production • Too much infiltrated the market • PRICES FELL $

Farmers in Trouble • Post WWI • Prices and demand fell • To compensate for lower prices farmers boosted production • Too much infiltrated the market • PRICES FELL $

Mc. Nary-Haugen Bill 1. The government would buy from farmers surplus crops at guaranteed prices that were higher than the market rate

Mc. Nary-Haugen Bill 1. The government would buy from farmers surplus crops at guaranteed prices that were higher than the market rate

Mc. Nary-Haugen Bill 2. The government would then sell these crops on the world market for the lower prevailing prices

Mc. Nary-Haugen Bill 2. The government would then sell these crops on the world market for the lower prevailing prices

Mc. Nary-Haugen Bill 3. To make up for losses caused by buying high and selling low, the government would place a tax on domestic food sales, thus passing the cost of the farm program along to consumers

Mc. Nary-Haugen Bill 3. To make up for losses caused by buying high and selling low, the government would place a tax on domestic food sales, thus passing the cost of the farm program along to consumers

Mc. Nary-Haugen Bill • Congress passed 2 x • Coolidge vetoed the bill 2 x • “Farmers have never made money. I don’t believe we can do much about it. ”

Mc. Nary-Haugen Bill • Congress passed 2 x • Coolidge vetoed the bill 2 x • “Farmers have never made money. I don’t believe we can do much about it. ”

3 rd CAUSE OF THE GREAT DEPRESSION • The availability of easy credit • Many people went into debt buying goods on the installment plan

3 rd CAUSE OF THE GREAT DEPRESSION • The availability of easy credit • Many people went into debt buying goods on the installment plan

Living on Credit • Americans buying beyond their means • Purchased goods on CREDIT • An arrangement in which consumers agreed to buy now and pay later for purchases • Credit easily available • BUT Hard to pay off debts

Living on Credit • Americans buying beyond their means • Purchased goods on CREDIT • An arrangement in which consumers agreed to buy now and pay later for purchases • Credit easily available • BUT Hard to pay off debts

4 th CAUSE OF THE GREAT DEPRESSION • An unequal distribution of income • There was too little money in the hands of working people who were the vast majority of consumers

4 th CAUSE OF THE GREAT DEPRESSION • An unequal distribution of income • There was too little money in the hands of working people who were the vast majority of consumers

Less Money to Spend • Everyone’s income fell • Americans buying less • Rising Prices • Stagnant Wages UNBALANCED DISTRIBUTION OF INCOME

Less Money to Spend • Everyone’s income fell • Americans buying less • Rising Prices • Stagnant Wages UNBALANCED DISTRIBUTION OF INCOME

UNBALANCED DISTRIBUTION OF INCOME • ½ the nation’s families earned less than $1500/year • 1920 -1929 • Income of the wealthiest 1% rose 75% • Poorest 40% of the population earned just over 1/10 of the national income

UNBALANCED DISTRIBUTION OF INCOME • ½ the nation’s families earned less than $1500/year • 1920 -1929 • Income of the wealthiest 1% rose 75% • Poorest 40% of the population earned just over 1/10 of the national income

And the Stock Market Came Tumbling Down Speculation: The engagement in risky business transactions (buying or selling stocks) on the chance of quick or considerable profit

And the Stock Market Came Tumbling Down Speculation: The engagement in risky business transactions (buying or selling stocks) on the chance of quick or considerable profit

And the Stock Market Came Tumbling Down Buying on Margin: Paying a small percentage of a stock’s price as a down payment and borrowing the rest

And the Stock Market Came Tumbling Down Buying on Margin: Paying a small percentage of a stock’s price as a down payment and borrowing the rest

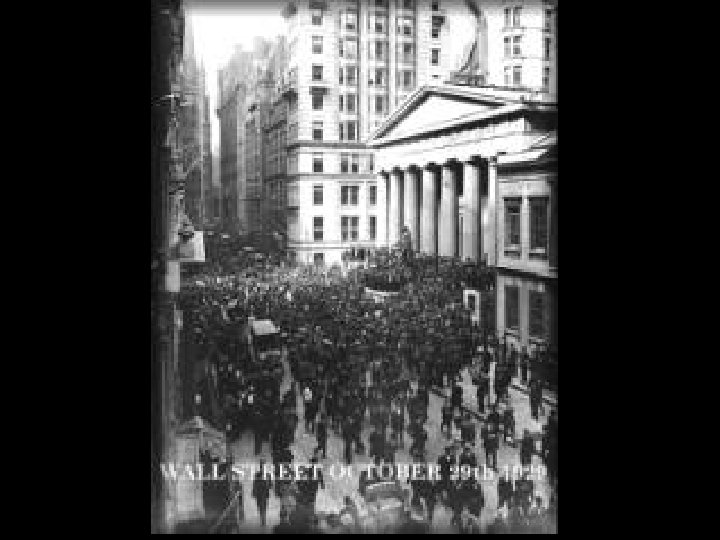

Going, going…gone… October 24, 1929 Stock market took a bad fall Panicked investors unloaded their shares

Going, going…gone… October 24, 1929 Stock market took a bad fall Panicked investors unloaded their shares

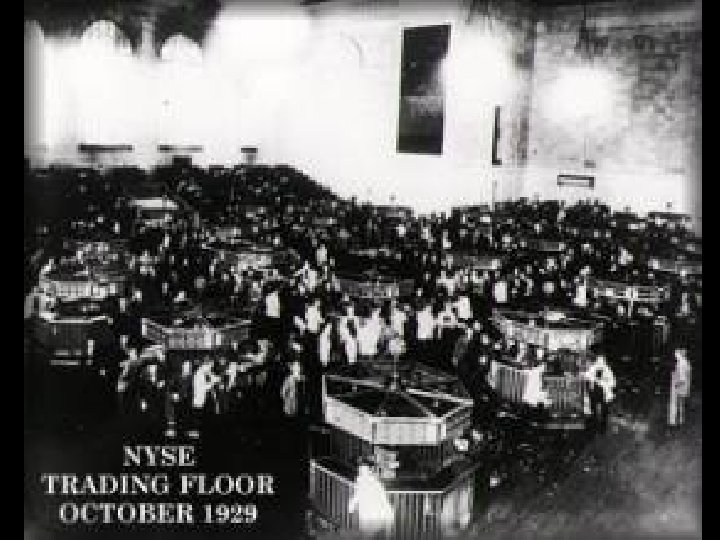

October 29, 1929 People and corporations frantically tried to sell their stocks before prices plunged even lower Those who had purchased stocks on credit acquired huge debts when stock prices plunged

October 29, 1929 People and corporations frantically tried to sell their stocks before prices plunged even lower Those who had purchased stocks on credit acquired huge debts when stock prices plunged

BLACK TUESDAY October 29, 1929 Many who had invested entire savings in the market lost everything 16 million shares dumped

BLACK TUESDAY October 29, 1929 Many who had invested entire savings in the market lost everything 16 million shares dumped

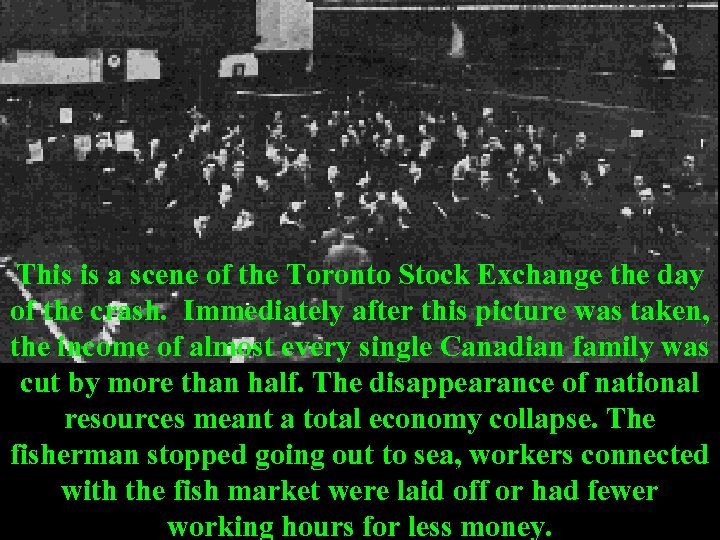

This is a scene of the Toronto Stock Exchange the day of the crash. Immediately after this picture was taken, the income of almost every single Canadian family was cut by more than half. The disappearance of national resources meant a total economy collapse. The fisherman stopped going out to sea, workers connected with the fish market were laid off or had fewer working hours for less money.

This is a scene of the Toronto Stock Exchange the day of the crash. Immediately after this picture was taken, the income of almost every single Canadian family was cut by more than half. The disappearance of national resources meant a total economy collapse. The fisherman stopped going out to sea, workers connected with the fish market were laid off or had fewer working hours for less money.

Dow Jones Industrial Average • Barometer of the Stock Market’s health • Measure based on stock prices of 30 representative large trading firms trading on the NYSE

Dow Jones Industrial Average • Barometer of the Stock Market’s health • Measure based on stock prices of 30 representative large trading firms trading on the NYSE

Alcoa 3 M Altria (Philip Morris) American Express Boeing Caterpillar Citi Group Coca Cola E. I. Du. Pont de Nemours Exxon Mobil General Electric General Motors Hewlett-Packard Home Depot Honeywell International Business Machines JP Morgan Chase Johnson & Johnson Mc. Donalds Merck Microsoft Proctor and Gamble SBC Communications United Technologies Wal-Mart Stores Walt Disney

Alcoa 3 M Altria (Philip Morris) American Express Boeing Caterpillar Citi Group Coca Cola E. I. Du. Pont de Nemours Exxon Mobil General Electric General Motors Hewlett-Packard Home Depot Honeywell International Business Machines JP Morgan Chase Johnson & Johnson Mc. Donalds Merck Microsoft Proctor and Gamble SBC Communications United Technologies Wal-Mart Stores Walt Disney

Financial Collapse • Many Americans panicked (wouldn’t you? !!) and tried to withdraw all of their money from banks • Banks forced to close because they could not cover their customers’ withdrawals • Banks lost money in the crash, too

Financial Collapse • Many Americans panicked (wouldn’t you? !!) and tried to withdraw all of their money from banks • Banks forced to close because they could not cover their customers’ withdrawals • Banks lost money in the crash, too

Financial Collapse • Economy went into a tailspin • Unemployment rose dramatically • 1929 • 3% of workforce unemployed • 1933 • 25% of workforce unemployed

Financial Collapse • Economy went into a tailspin • Unemployment rose dramatically • 1929 • 3% of workforce unemployed • 1933 • 25% of workforce unemployed

Some Folks Did Ok… • Joe Kennedy made all of his money during the weeks just before the Crash • Some held onto their jobs • Endured pay cuts • Endured fewer work hours $$$$$$$$$$$$

Some Folks Did Ok… • Joe Kennedy made all of his money during the weeks just before the Crash • Some held onto their jobs • Endured pay cuts • Endured fewer work hours $$$$$$$$$$$$

Shockwaves Throughout the World • Europe still recovering from WWI • USA limited Europeans from exporting their goods • THEREFORE, IT BECAME MORE DIFFICULT TO SELL US GOODS ABROAD

Shockwaves Throughout the World • Europe still recovering from WWI • USA limited Europeans from exporting their goods • THEREFORE, IT BECAME MORE DIFFICULT TO SELL US GOODS ABROAD

Hawley-Smoot Tariff The most ridiculous sounding name for a tariff ever • Highest protective tariff in history • Designed to help US farmers and manufacturers by protecting their products from foreign competition

Hawley-Smoot Tariff The most ridiculous sounding name for a tariff ever • Highest protective tariff in history • Designed to help US farmers and manufacturers by protecting their products from foreign competition

Hawley-Smoot Tariff BACKFIRED: • Reduced number of European goods into USA • Prevented other countries from earning US currency to purchase American exports • Countries reacted by raising their own tariffs • Reduced overall economic activity

Hawley-Smoot Tariff BACKFIRED: • Reduced number of European goods into USA • Prevented other countries from earning US currency to purchase American exports • Countries reacted by raising their own tariffs • Reduced overall economic activity

Gold Standard • Britain and other European countries went off the Gold standard • Paper money could no longer be exchanged for gold • Gold dropped in value • Europeans began to purchase US goods and repaying loans in cheaper currency

Gold Standard • Britain and other European countries went off the Gold standard • Paper money could no longer be exchanged for gold • Gold dropped in value • Europeans began to purchase US goods and repaying loans in cheaper currency

Gold Standard Today, money is based on “full faith and credit” We accept dollars because: 1. They are legal tender 2. They are backed by the world’s confidence in the US government

Gold Standard Today, money is based on “full faith and credit” We accept dollars because: 1. They are legal tender 2. They are backed by the world’s confidence in the US government

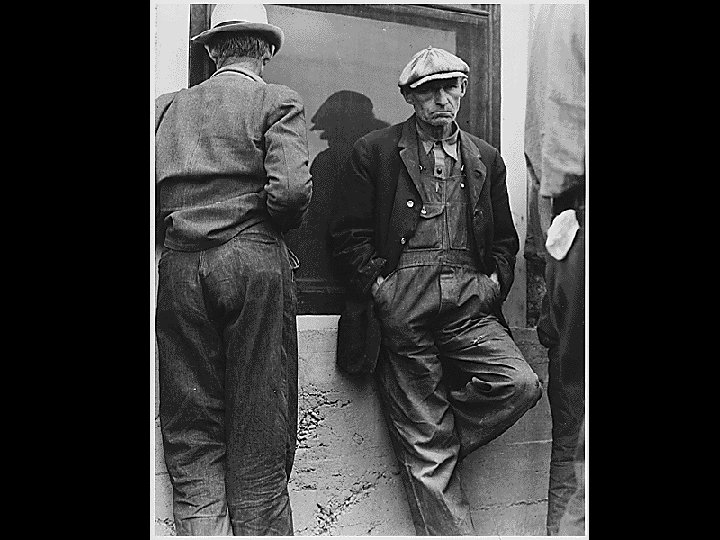

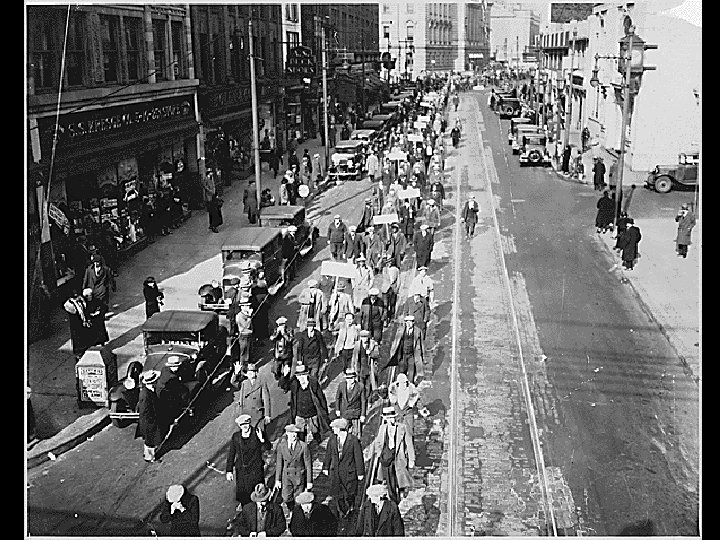

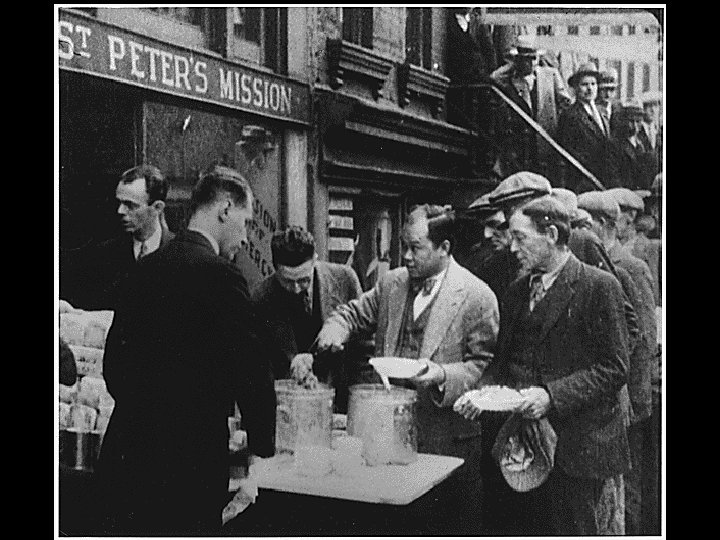

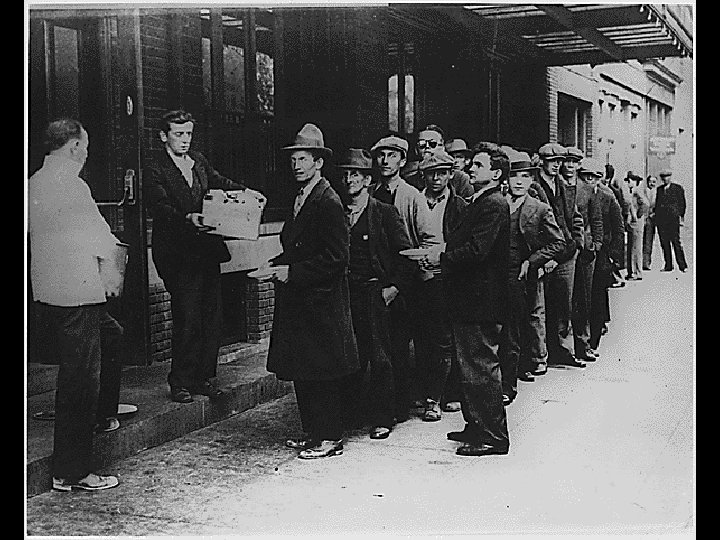

Unemployment

Unemployment

Towns

Towns

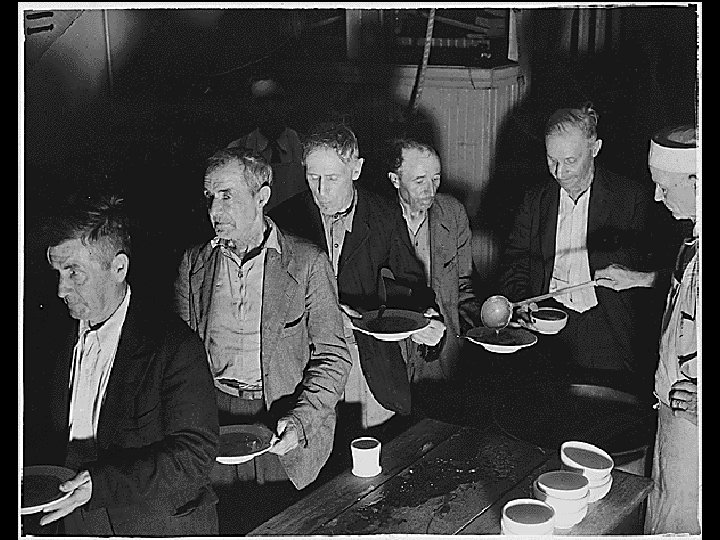

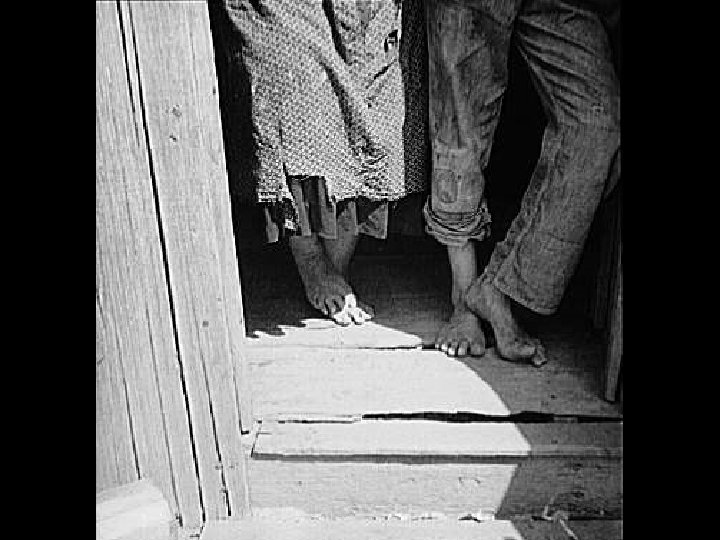

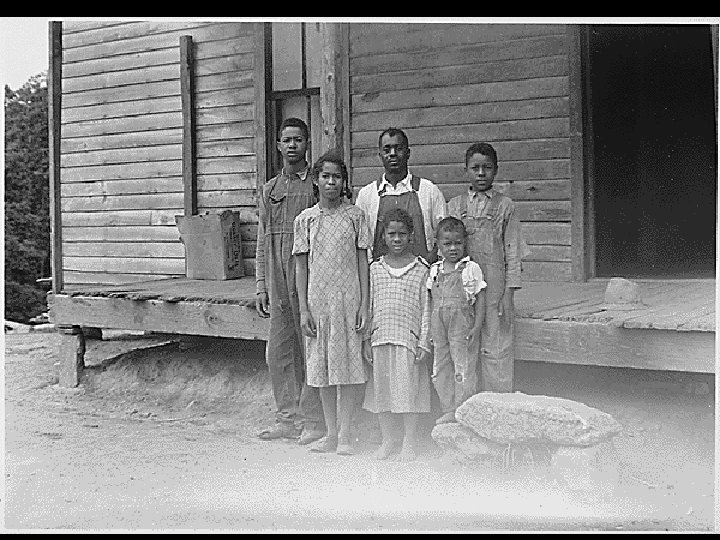

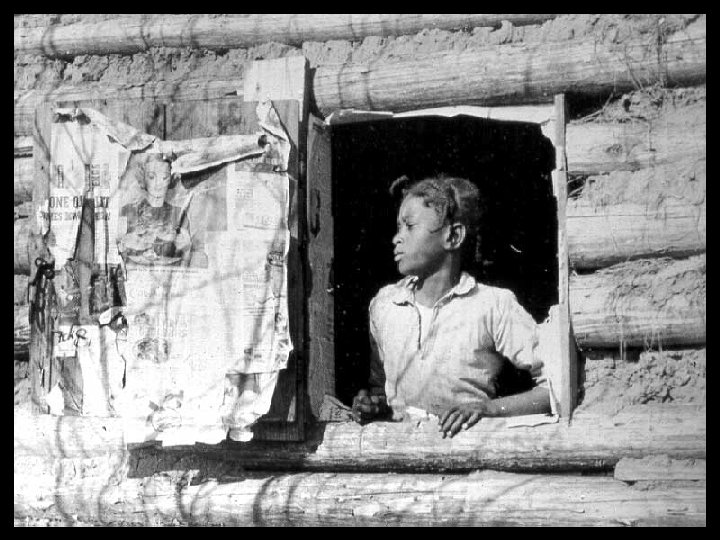

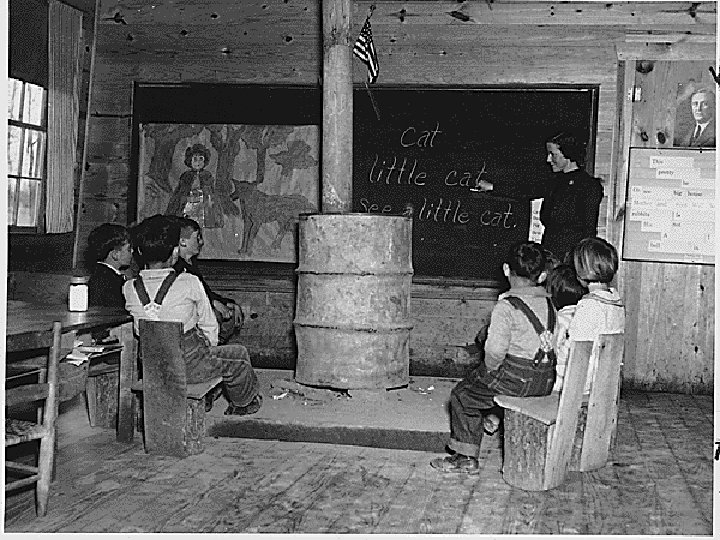

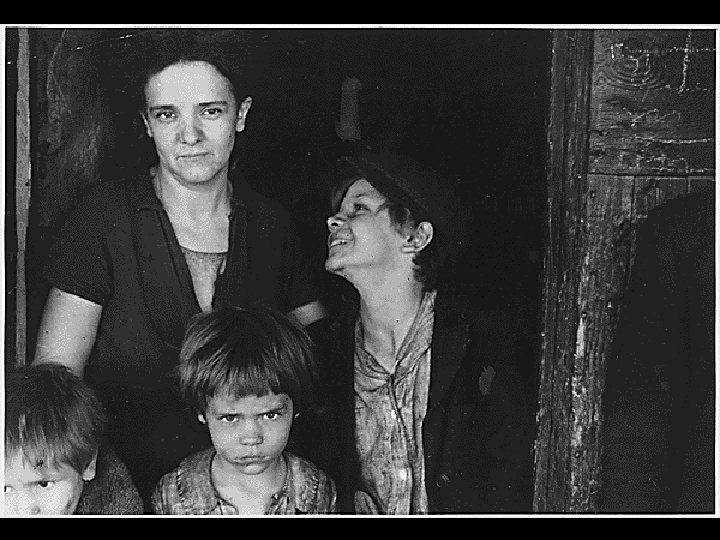

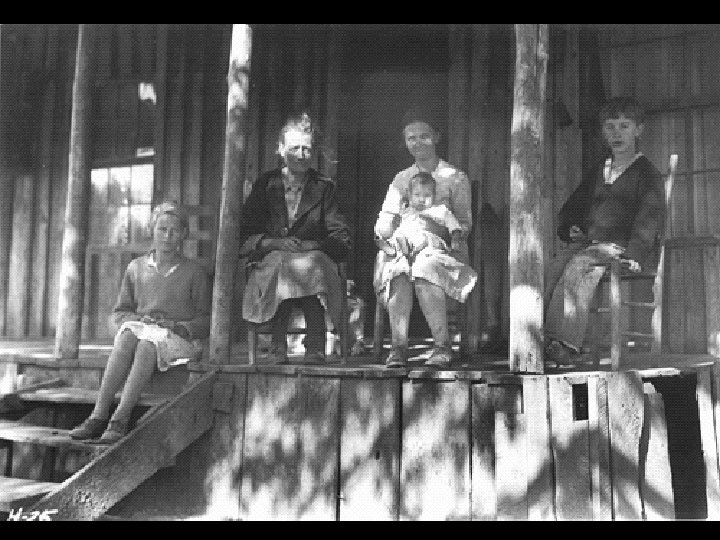

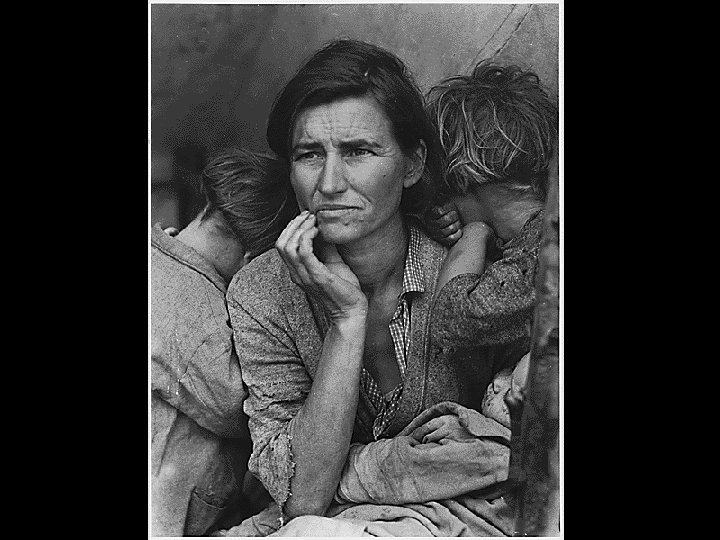

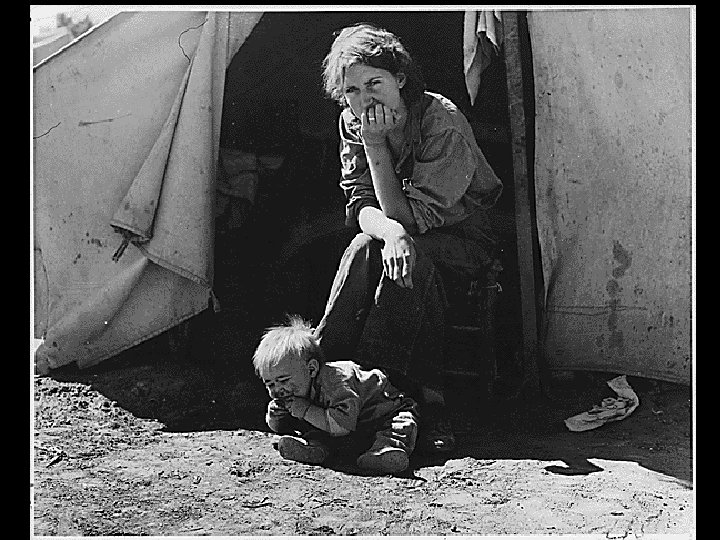

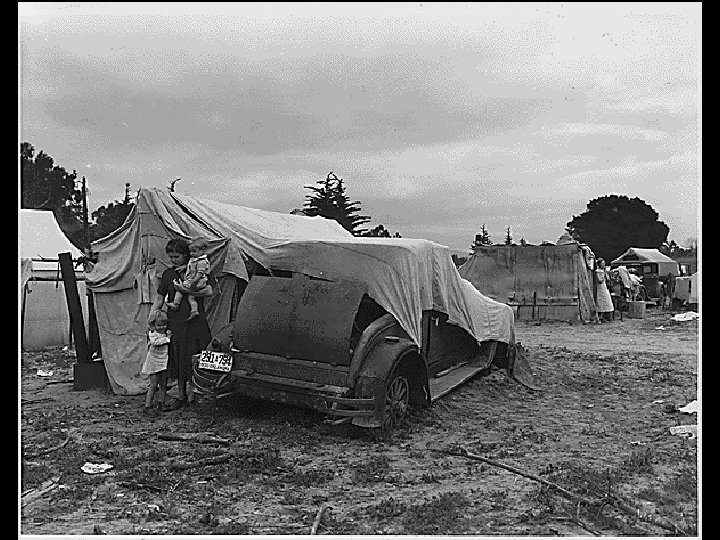

Poverty and Families

Poverty and Families

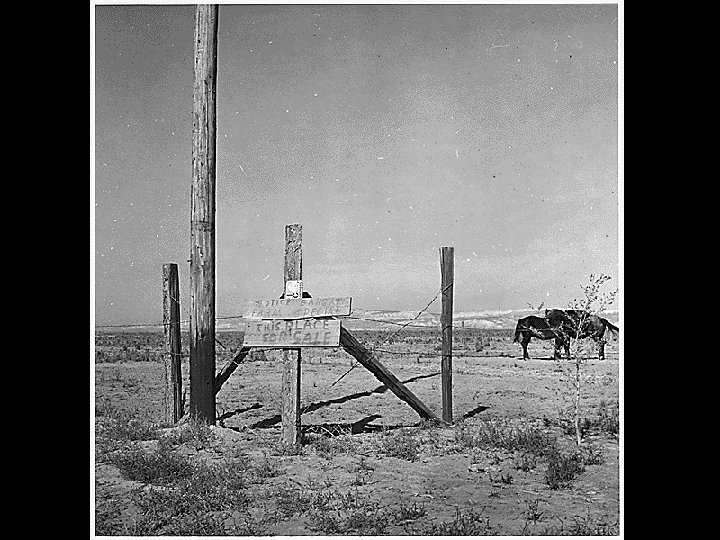

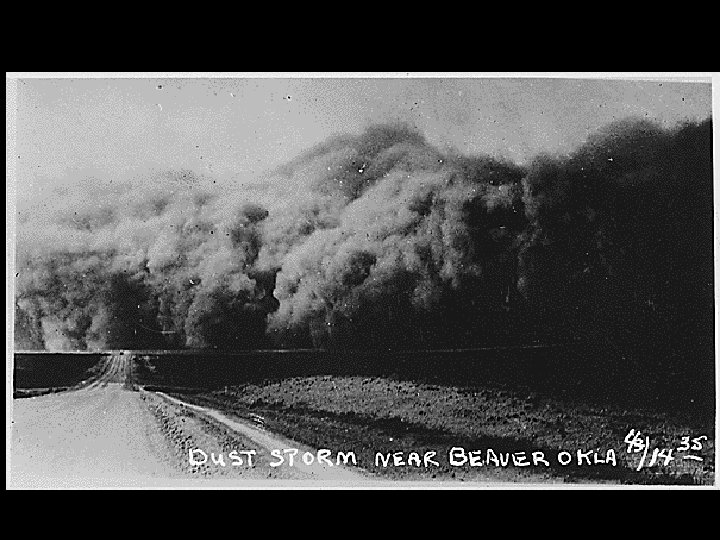

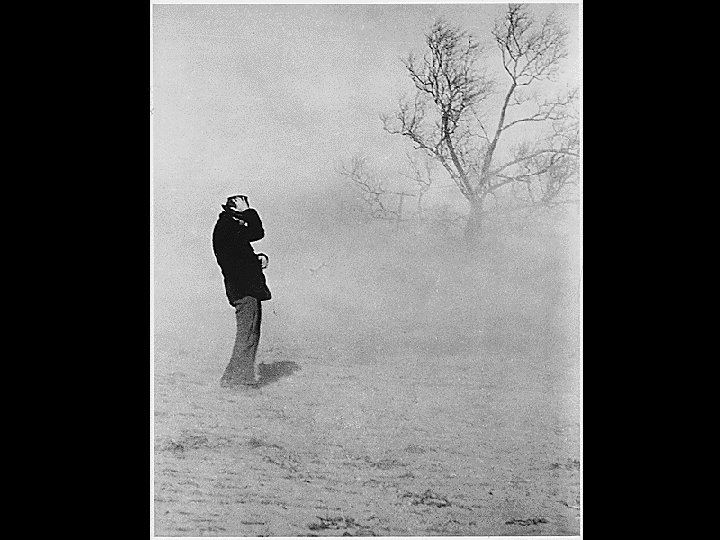

Dust Bowl

Dust Bowl

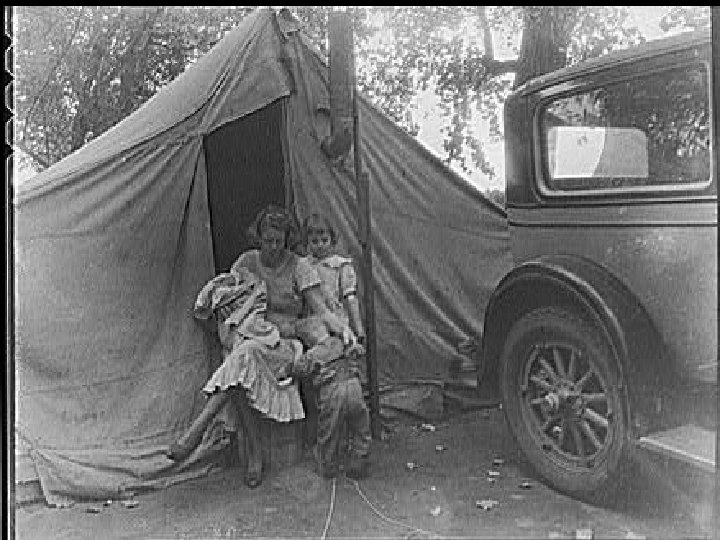

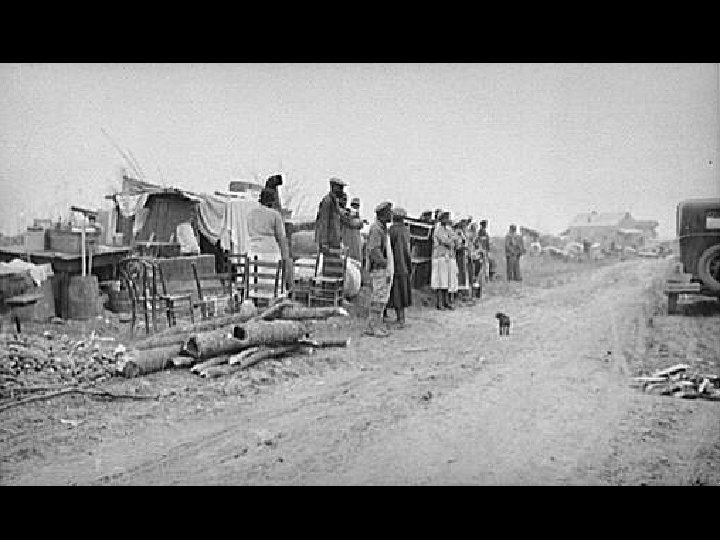

Migrants

Migrants

Shantytowns

Shantytowns

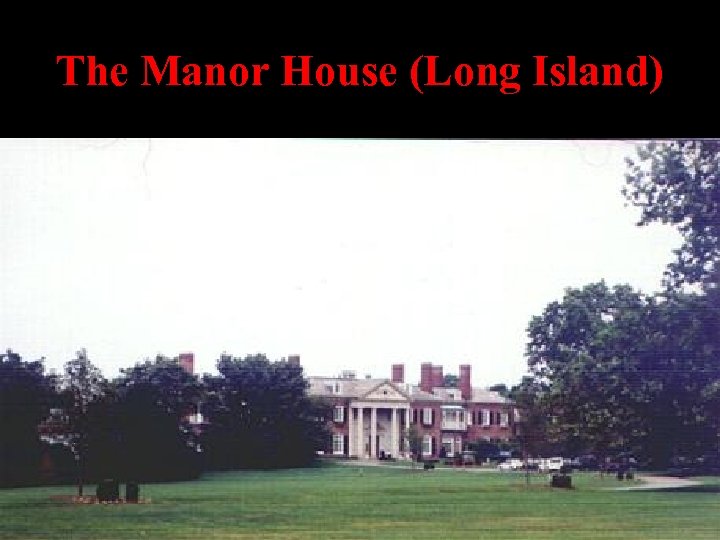

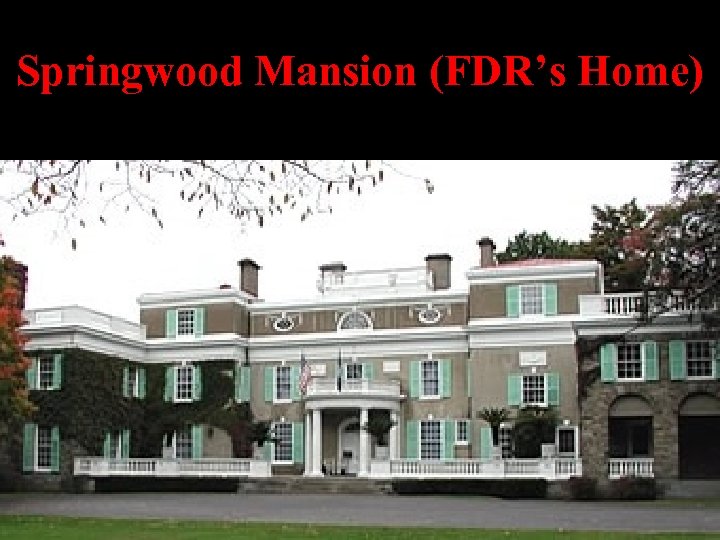

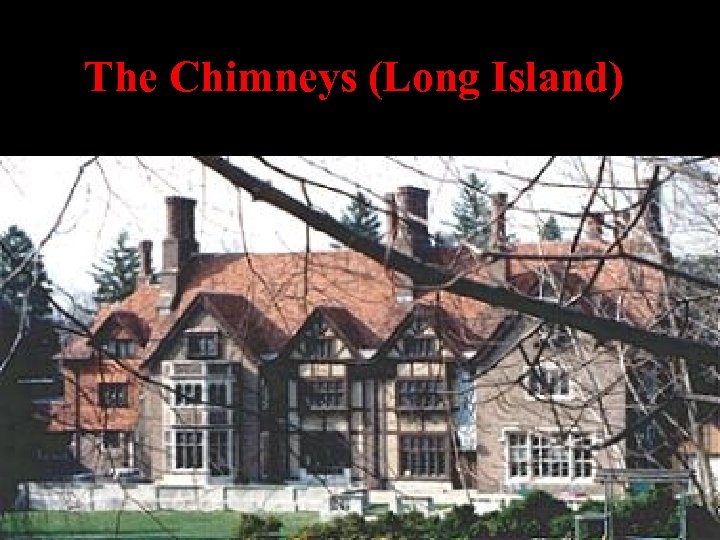

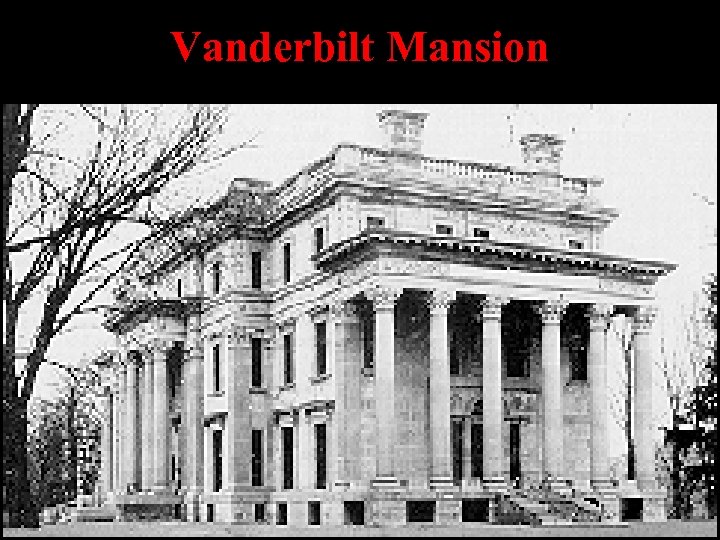

How the Other Half Lived…

How the Other Half Lived…

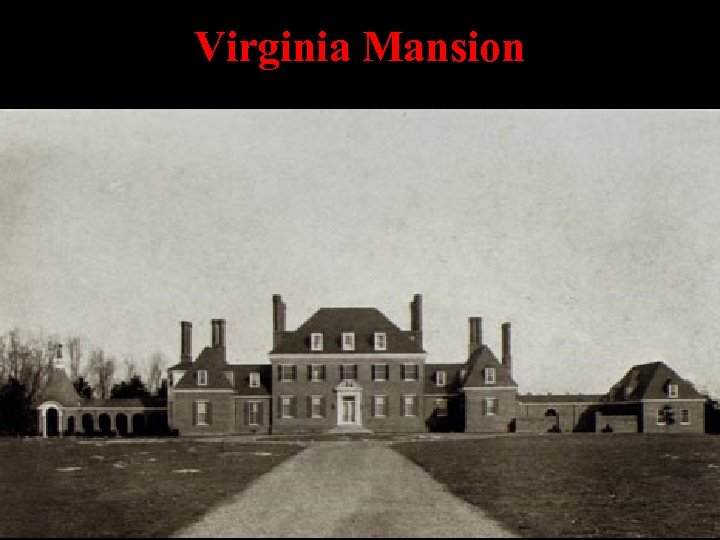

Virginia Mansion

Virginia Mansion

The Manor House (Long Island)

The Manor House (Long Island)

Springwood Mansion (FDR’s Home)

Springwood Mansion (FDR’s Home)

The Chimneys (Long Island)

The Chimneys (Long Island)

Vanderbilt Mansion

Vanderbilt Mansion