1f3ba505c5493c073ce170b18a8792eb.ppt

- Количество слайдов: 30

The Goods Market, Money, and Foreign Exchange The Linkages

The Goods Market, Money, and Foreign Exchange The Linkages

Macroeconomic Measures • The national income analysis is generally done in terms of real goods and services. • Most economic aggregate measures are more conceptual than real: • • • The real market value of the economy’s output The overall price index Labor force and employment measures The interest rate as the price of capital Money stock Demand for money • Often we use proxy indicators to measure macroeconomic aggregates

Macroeconomic Measures • The national income analysis is generally done in terms of real goods and services. • Most economic aggregate measures are more conceptual than real: • • • The real market value of the economy’s output The overall price index Labor force and employment measures The interest rate as the price of capital Money stock Demand for money • Often we use proxy indicators to measure macroeconomic aggregates

The Two Dimensions of Macroeconomics: The “Real” Economy and the Monetary Economy • The Real Economy and The Goods Market • The Monetary Economy and the Money Market • The linkages between the two markets: The overall price and wage levels The Interest rate The foreign exchange rate (through its impact on BOP)

The Two Dimensions of Macroeconomics: The “Real” Economy and the Monetary Economy • The Real Economy and The Goods Market • The Monetary Economy and the Money Market • The linkages between the two markets: The overall price and wage levels The Interest rate The foreign exchange rate (through its impact on BOP)

The Central Role of the Interest Rate • It plays a central role in the goods market as the price (a determinant) of capital • It is the price of money in the money market • It is an important factor in determining the exchange rate, especially in the short run

The Central Role of the Interest Rate • It plays a central role in the goods market as the price (a determinant) of capital • It is the price of money in the money market • It is an important factor in determining the exchange rate, especially in the short run

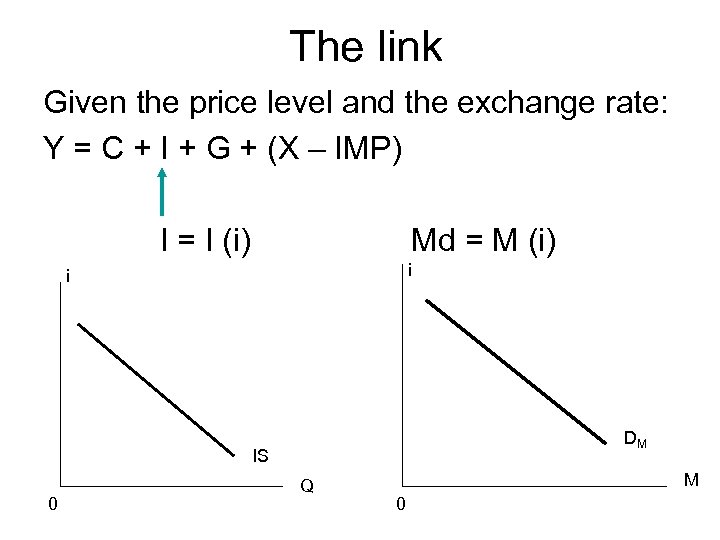

The link Given the price level and the exchange rate: Y = C + I + G + (X – IMP) I = I (i) Md = M (i) i i DM IS 0 Q M 0

The link Given the price level and the exchange rate: Y = C + I + G + (X – IMP) I = I (i) Md = M (i) i i DM IS 0 Q M 0

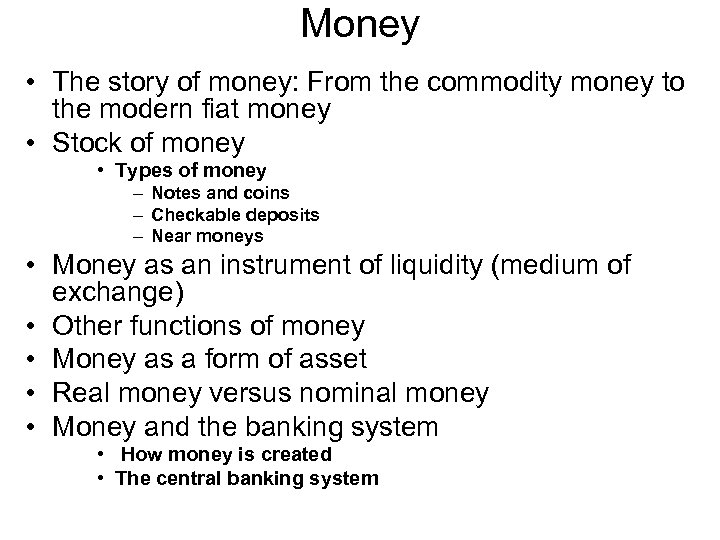

Money • The story of money: From the commodity money to the modern fiat money • Stock of money • Types of money – Notes and coins – Checkable deposits – Near moneys • Money as an instrument of liquidity (medium of exchange) • Other functions of money • Money as a form of asset • Real money versus nominal money • Money and the banking system • How money is created • The central banking system

Money • The story of money: From the commodity money to the modern fiat money • Stock of money • Types of money – Notes and coins – Checkable deposits – Near moneys • Money as an instrument of liquidity (medium of exchange) • Other functions of money • Money as a form of asset • Real money versus nominal money • Money and the banking system • How money is created • The central banking system

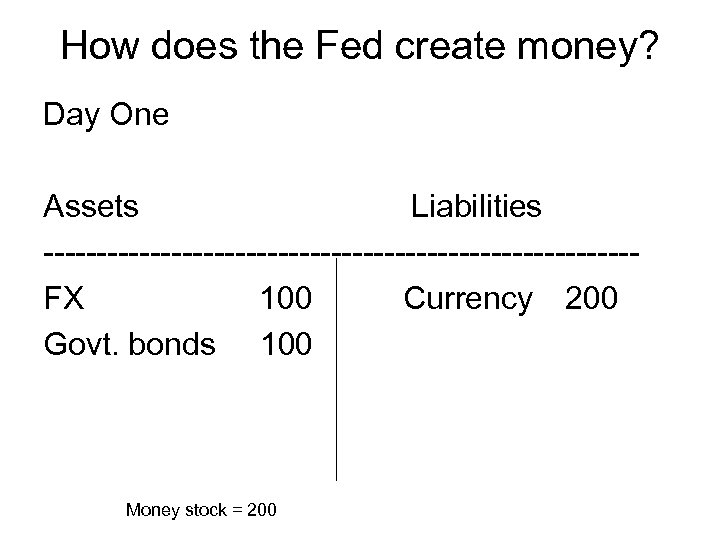

How does the Fed create money? Day One Assets Liabilities ----------------------------FX 100 Currency 200 Govt. bonds 100 Money stock = 200

How does the Fed create money? Day One Assets Liabilities ----------------------------FX 100 Currency 200 Govt. bonds 100 Money stock = 200

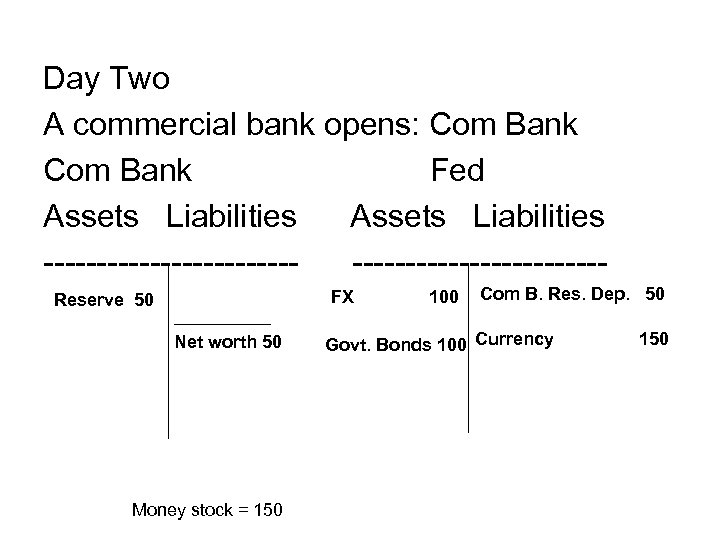

Day Two A commercial bank opens: Com Bank Fed Assets Liabilities -----------------------FX Reserve 50 Net worth 50 Money stock = 150 100 Com B. Res. Dep. 50 Govt. Bonds 100 Currency 150

Day Two A commercial bank opens: Com Bank Fed Assets Liabilities -----------------------FX Reserve 50 Net worth 50 Money stock = 150 100 Com B. Res. Dep. 50 Govt. Bonds 100 Currency 150

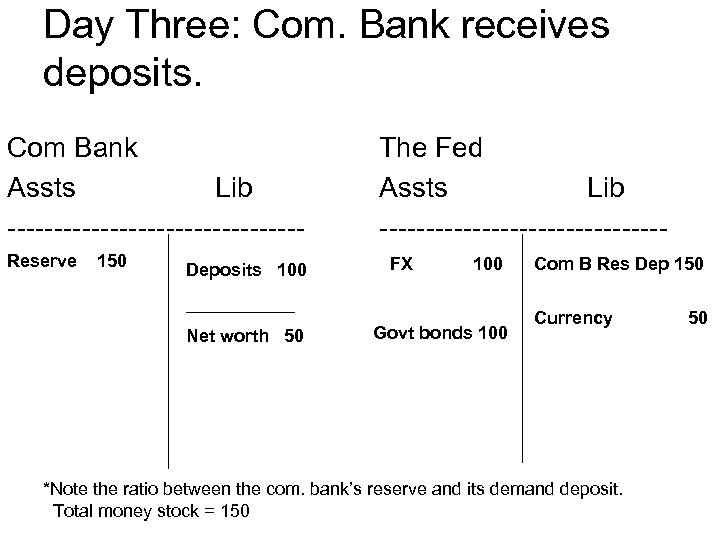

Day Three: Com. Bank receives deposits. Com Bank Assts Lib ----------------Reserve 150 Deposits 100 Net worth 50 The Fed Assts Lib ---------------FX 100 Govt bonds 100 Com B Res Dep 150 Currency *Note the ratio between the com. bank’s reserve and its demand deposit. Total money stock = 150 50

Day Three: Com. Bank receives deposits. Com Bank Assts Lib ----------------Reserve 150 Deposits 100 Net worth 50 The Fed Assts Lib ---------------FX 100 Govt bonds 100 Com B Res Dep 150 Currency *Note the ratio between the com. bank’s reserve and its demand deposit. Total money stock = 150 50

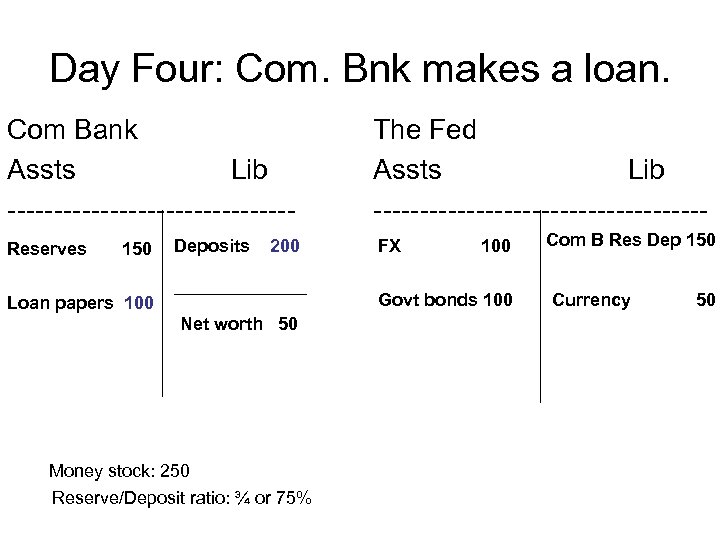

Day Four: Com. Bnk makes a loan. Com Bank Assts Lib ---------------Reserves 150 Deposits 200 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Loan papers 100 Net worth 50 Money stock: 250 Reserve/Deposit ratio: ¾ or 75% Com B Res Dep 150 Currency 50

Day Four: Com. Bnk makes a loan. Com Bank Assts Lib ---------------Reserves 150 Deposits 200 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Loan papers 100 Net worth 50 Money stock: 250 Reserve/Deposit ratio: ¾ or 75% Com B Res Dep 150 Currency 50

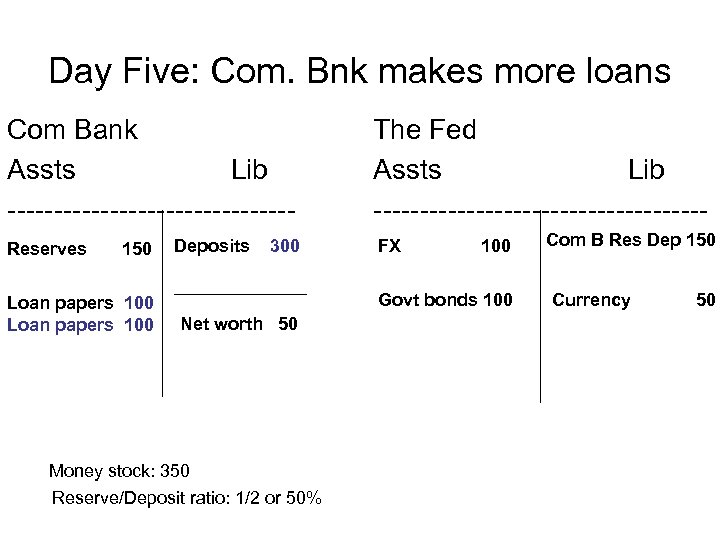

Day Five: Com. Bnk makes more loans Com Bank Assts Lib ---------------Reserves 150 Loan papers 100 Deposits 300 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Net worth 50 Money stock: 350 Reserve/Deposit ratio: 1/2 or 50% Com B Res Dep 150 Currency 50

Day Five: Com. Bnk makes more loans Com Bank Assts Lib ---------------Reserves 150 Loan papers 100 Deposits 300 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Net worth 50 Money stock: 350 Reserve/Deposit ratio: 1/2 or 50% Com B Res Dep 150 Currency 50

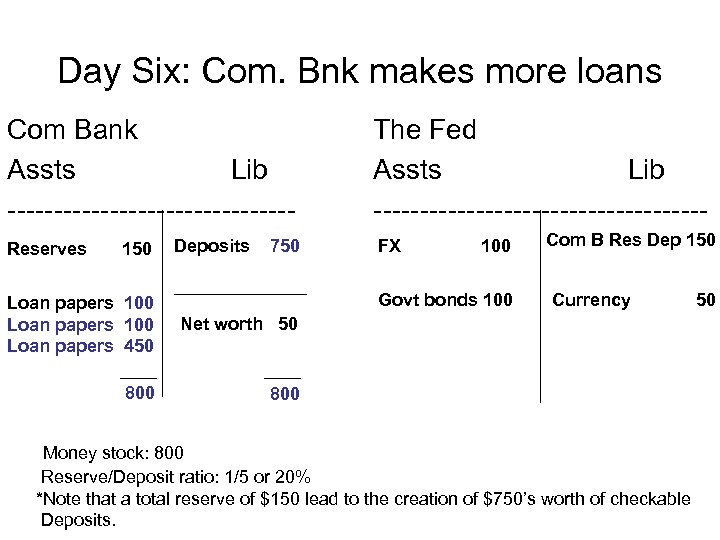

Day Six: Com. Bnk makes more loans Com Bank Assts Lib ---------------Reserves 150 Deposits 750 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Loan papers 450 Currency Net worth 50 800 Com B Res Dep 150 800 Money stock: 800 Reserve/Deposit ratio: 1/5 or 20% *Note that a total reserve of $150 lead to the creation of $750’s worth of checkable Deposits. 50

Day Six: Com. Bnk makes more loans Com Bank Assts Lib ---------------Reserves 150 Deposits 750 The Fed Assts Lib ------------------FX 100 Govt bonds 100 Loan papers 450 Currency Net worth 50 800 Com B Res Dep 150 800 Money stock: 800 Reserve/Deposit ratio: 1/5 or 20% *Note that a total reserve of $150 lead to the creation of $750’s worth of checkable Deposits. 50

Reserve Requirements and Money Multiplier • The reserve requirement ratio: The required ratio between the deposits held by a commercial bank and the sum of its cash reserve and its reserve deposit with the Fed. • Money multiplier mm= 1/rrr M = mm(Bank Reserves) + Currency in cir. The potential increase in the money stock (checkable deposits) resulting from one dollar increase in the com. banks’ reserves.

Reserve Requirements and Money Multiplier • The reserve requirement ratio: The required ratio between the deposits held by a commercial bank and the sum of its cash reserve and its reserve deposit with the Fed. • Money multiplier mm= 1/rrr M = mm(Bank Reserves) + Currency in cir. The potential increase in the money stock (checkable deposits) resulting from one dollar increase in the com. banks’ reserves.

How does the Fed change the money stock? • Open Market Operation • Buying or selling bonds • FX Market Intervention • Buying or selling FX • Other methods Given the currency in circulation, Δ M = mm (Δ GB + Δ FXR)

How does the Fed change the money stock? • Open Market Operation • Buying or selling bonds • FX Market Intervention • Buying or selling FX • Other methods Given the currency in circulation, Δ M = mm (Δ GB + Δ FXR)

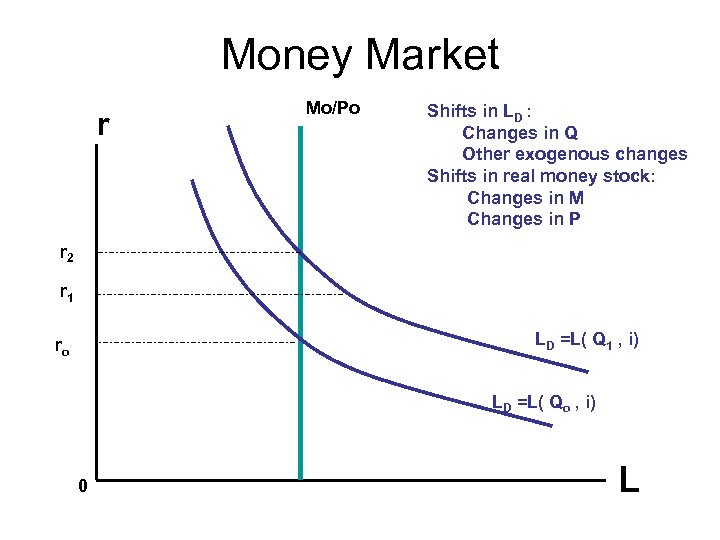

The Money Market • Real money versus nominal money Real Money = L = M/P • Demand for real money • Transaction demand • Asset demand LD = L ( Q, i) • Money stock (supply) The stock money is (exogenously) determined by monetary authorities.

The Money Market • Real money versus nominal money Real Money = L = M/P • Demand for real money • Transaction demand • Asset demand LD = L ( Q, i) • Money stock (supply) The stock money is (exogenously) determined by monetary authorities.

Money Market Equilibrium For any given level of output, Q, the money market is in equilibrium if the interest rate is at a level at which the quantity of real money, L, people want to hold is equal to the stock of real money provided by the monetary authorities (the Fed).

Money Market Equilibrium For any given level of output, Q, the money market is in equilibrium if the interest rate is at a level at which the quantity of real money, L, people want to hold is equal to the stock of real money provided by the monetary authorities (the Fed).

Money Market r Mo/Po Shifts in LD : Changes in Q Other exogenous changes Shifts in real money stock: Changes in M Changes in P r 2 r 1 LD =L( Q 1 , i) ro LD =L( Qo , i) 0 L

Money Market r Mo/Po Shifts in LD : Changes in Q Other exogenous changes Shifts in real money stock: Changes in M Changes in P r 2 r 1 LD =L( Q 1 , i) ro LD =L( Qo , i) 0 L

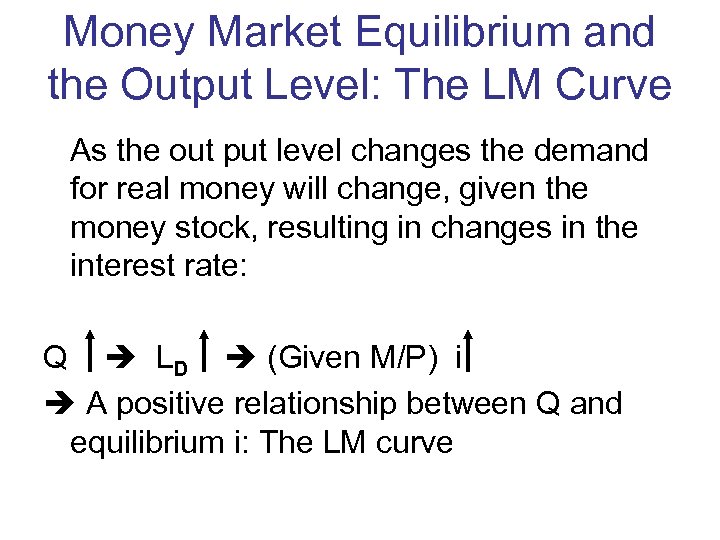

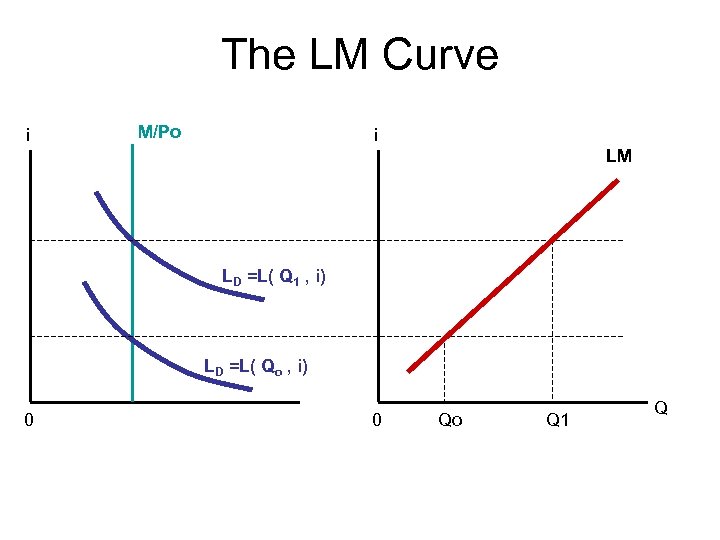

Money Market Equilibrium and the Output Level: The LM Curve As the out put level changes the demand for real money will change, given the money stock, resulting in changes in the interest rate: Q LD (Given M/P) i A positive relationship between Q and equilibrium i: The LM curve

Money Market Equilibrium and the Output Level: The LM Curve As the out put level changes the demand for real money will change, given the money stock, resulting in changes in the interest rate: Q LD (Given M/P) i A positive relationship between Q and equilibrium i: The LM curve

The LM Curve i M/Po i LM LD =L( Q 1 , i) LD =L( Qo , i) 0 0 Qo Q 1 Q

The LM Curve i M/Po i LM LD =L( Q 1 , i) LD =L( Qo , i) 0 0 Qo Q 1 Q

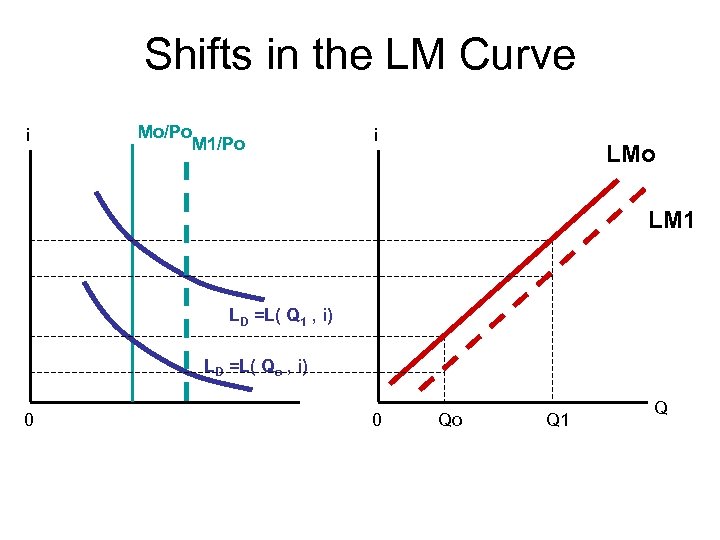

Shifts in the LM Curve i Mo/Po M 1/Po i LMo LM 1 LD =L( Q 1 , i) LD =L( Qo , i) 0 0 Qo Q 1 Q

Shifts in the LM Curve i Mo/Po M 1/Po i LMo LM 1 LD =L( Q 1 , i) LD =L( Qo , i) 0 0 Qo Q 1 Q

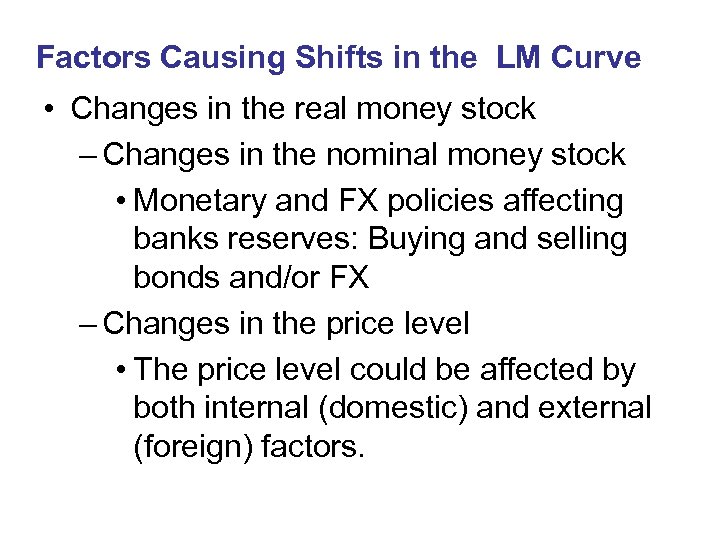

Factors Causing Shifts in the LM Curve • Changes in the real money stock – Changes in the nominal money stock • Monetary and FX policies affecting banks reserves: Buying and selling bonds and/or FX – Changes in the price level • The price level could be affected by both internal (domestic) and external (foreign) factors.

Factors Causing Shifts in the LM Curve • Changes in the real money stock – Changes in the nominal money stock • Monetary and FX policies affecting banks reserves: Buying and selling bonds and/or FX – Changes in the price level • The price level could be affected by both internal (domestic) and external (foreign) factors.

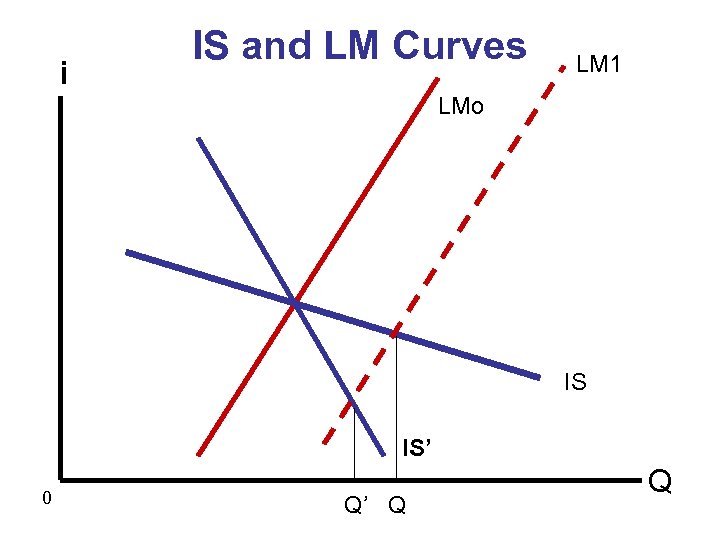

i IS and LM Curves LM 1 LMo IS IS’ 0 Q’ Q Q

i IS and LM Curves LM 1 LMo IS IS’ 0 Q’ Q Q

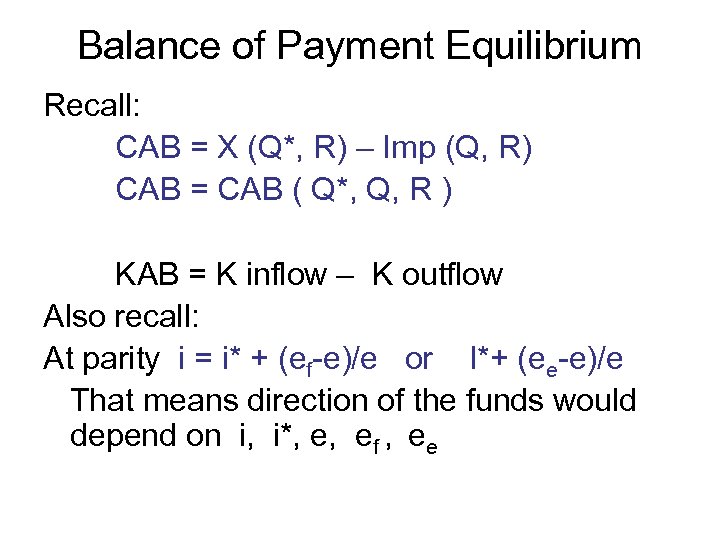

Balance of Payment Equilibrium Recall: CAB = X (Q*, R) – Imp (Q, R) CAB = CAB ( Q*, Q, R ) KAB = K inflow – K outflow Also recall: At parity i = i* + (ef-e)/e or I*+ (ee-e)/e That means direction of the funds would depend on i, i*, e, ef , ee

Balance of Payment Equilibrium Recall: CAB = X (Q*, R) – Imp (Q, R) CAB = CAB ( Q*, Q, R ) KAB = K inflow – K outflow Also recall: At parity i = i* + (ef-e)/e or I*+ (ee-e)/e That means direction of the funds would depend on i, i*, e, ef , ee

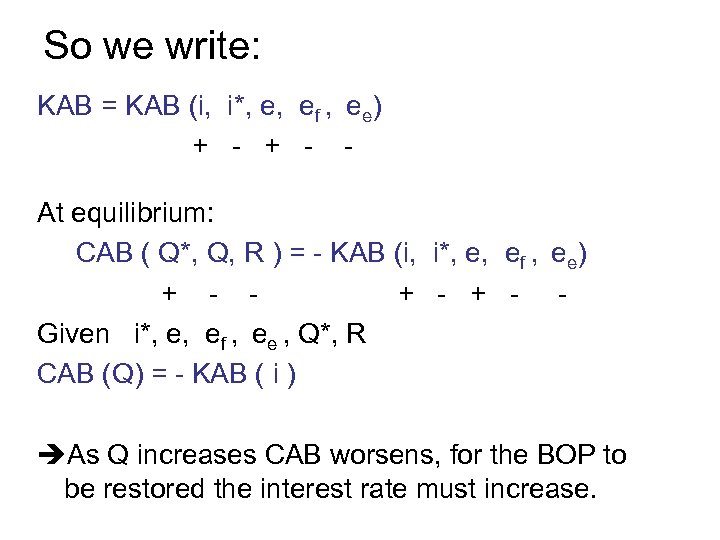

So we write: KAB = KAB (i, i*, e, ef , ee) + - At equilibrium: CAB ( Q*, Q, R ) = - KAB (i, i*, e, ef , ee) + - + - Given i*, e, ef , ee , Q*, R CAB (Q) = - KAB ( i ) As Q increases CAB worsens, for the BOP to be restored the interest rate must increase.

So we write: KAB = KAB (i, i*, e, ef , ee) + - At equilibrium: CAB ( Q*, Q, R ) = - KAB (i, i*, e, ef , ee) + - + - Given i*, e, ef , ee , Q*, R CAB (Q) = - KAB ( i ) As Q increases CAB worsens, for the BOP to be restored the interest rate must increase.

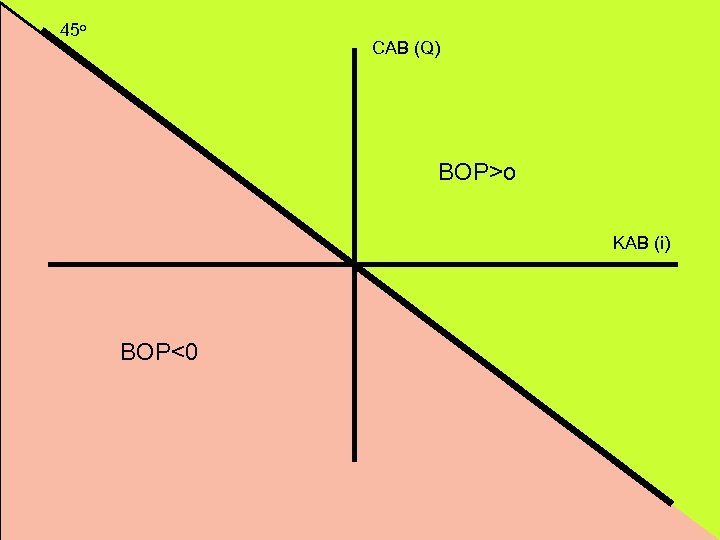

45 o BOP Equilibrium CAB (Q) BOP>o KAB (i) BOP<0

45 o BOP Equilibrium CAB (Q) BOP>o KAB (i) BOP<0

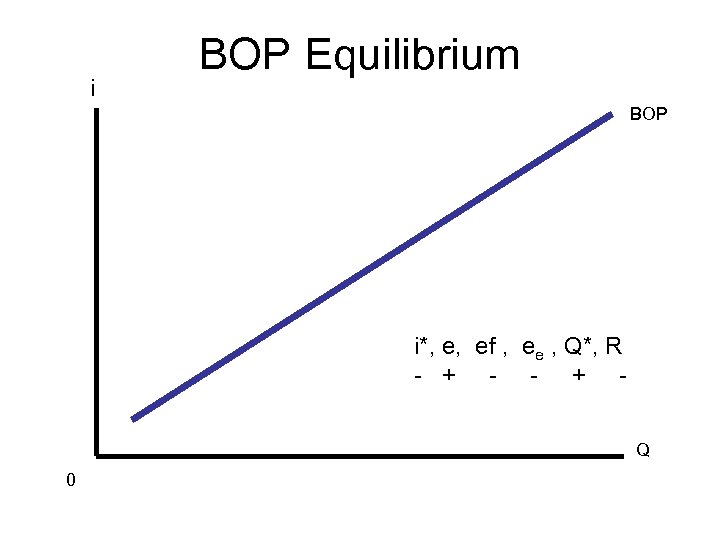

i BOP Equilibrium BOP i*, e, ef , ee , Q*, R - + - - + Q 0

i BOP Equilibrium BOP i*, e, ef , ee , Q*, R - + - - + Q 0

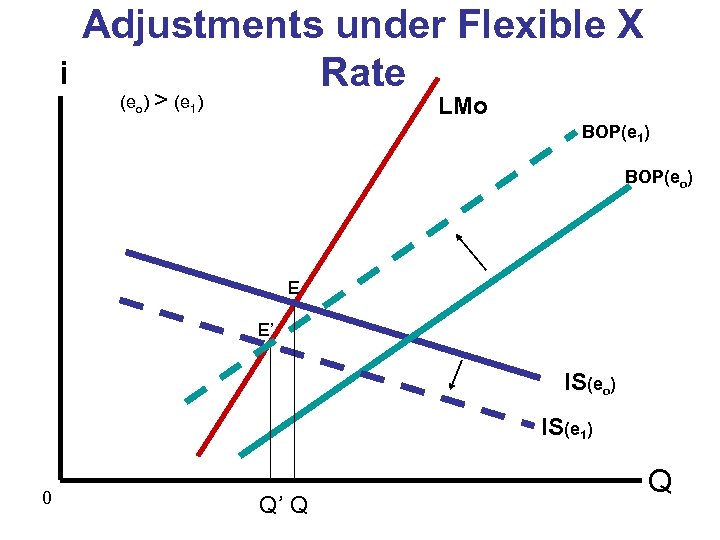

i Adjustments under Flexible X Rate (eo) > (e 1) LMo BOP(e 1) BOP(eo) E E’ IS(eo) IS(e 1) 0 Q’ Q Q

i Adjustments under Flexible X Rate (eo) > (e 1) LMo BOP(e 1) BOP(eo) E E’ IS(eo) IS(e 1) 0 Q’ Q Q

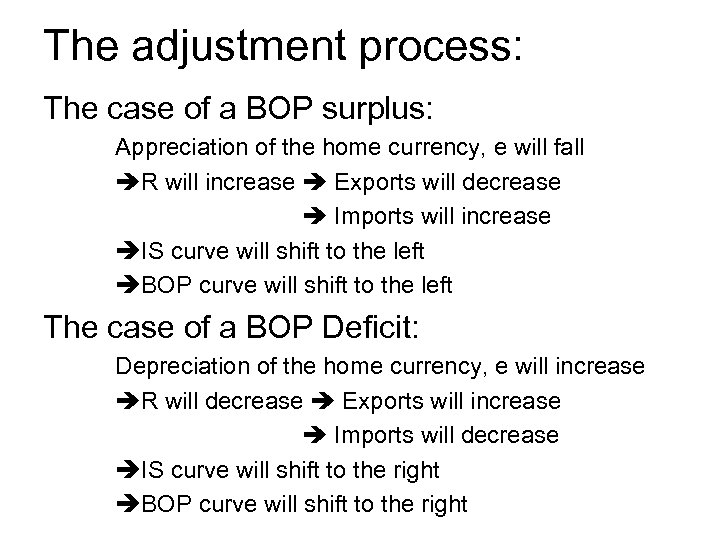

The adjustment process: The case of a BOP surplus: Appreciation of the home currency, e will fall R will increase Exports will decrease Imports will increase IS curve will shift to the left BOP curve will shift to the left The case of a BOP Deficit: Depreciation of the home currency, e will increase R will decrease Exports will increase Imports will decrease IS curve will shift to the right BOP curve will shift to the right

The adjustment process: The case of a BOP surplus: Appreciation of the home currency, e will fall R will increase Exports will decrease Imports will increase IS curve will shift to the left BOP curve will shift to the left The case of a BOP Deficit: Depreciation of the home currency, e will increase R will decrease Exports will increase Imports will decrease IS curve will shift to the right BOP curve will shift to the right

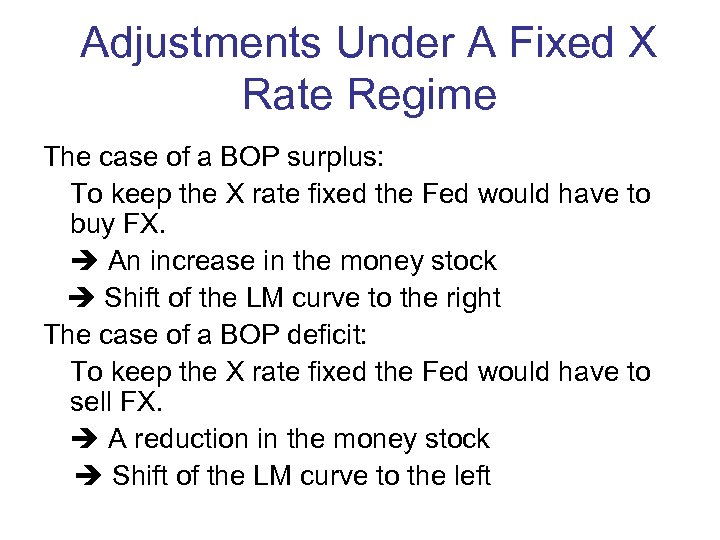

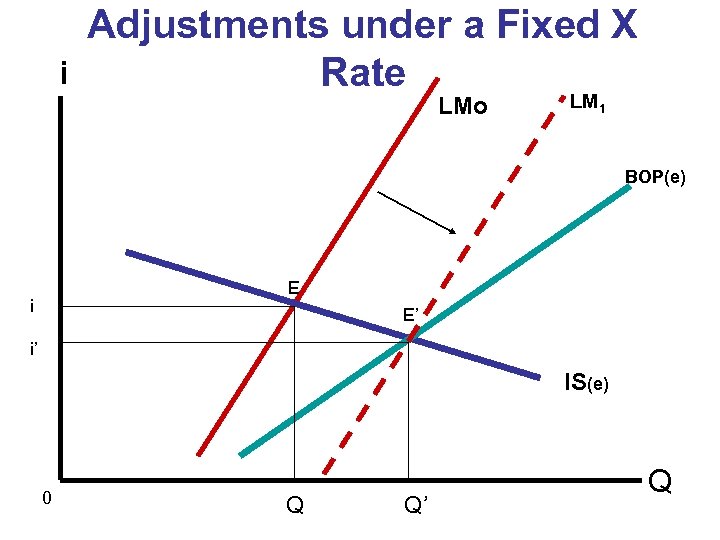

Adjustments Under A Fixed X Rate Regime The case of a BOP surplus: To keep the X rate fixed the Fed would have to buy FX. An increase in the money stock Shift of the LM curve to the right The case of a BOP deficit: To keep the X rate fixed the Fed would have to sell FX. A reduction in the money stock Shift of the LM curve to the left

Adjustments Under A Fixed X Rate Regime The case of a BOP surplus: To keep the X rate fixed the Fed would have to buy FX. An increase in the money stock Shift of the LM curve to the right The case of a BOP deficit: To keep the X rate fixed the Fed would have to sell FX. A reduction in the money stock Shift of the LM curve to the left

i Adjustments under a Fixed X Rate LMo LM 1 BOP(e) E i E’ i’ IS(e) 0 Q Q’ Q

i Adjustments under a Fixed X Rate LMo LM 1 BOP(e) E i E’ i’ IS(e) 0 Q Q’ Q