8f04716f84ccb5e02fba9bb834aaf1cd.ppt

- Количество слайдов: 22

The Global Capital Market Chapter 11 © Mc. Graw Hill Companies, Inc. , 2000

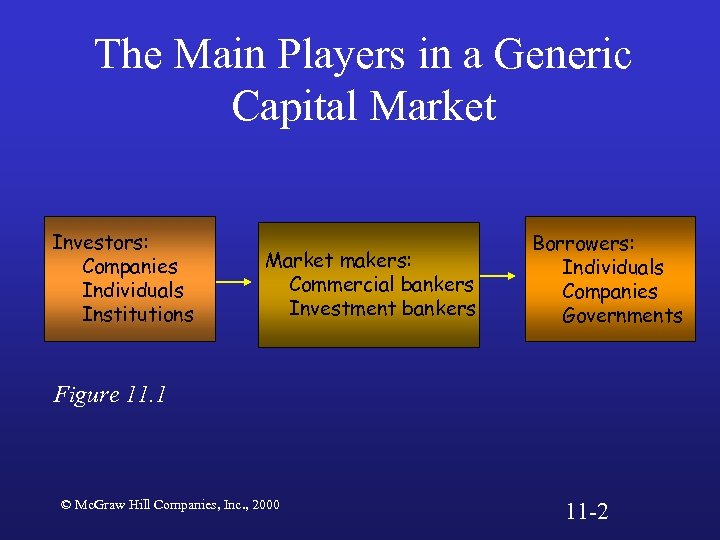

Functions of a Generic Capital Market ¥Brings together: ¤Those who want to invest: • corporations, individuals, nonbank financial institutions. ¤Those who want to borrow: • individuals, companies, governments. ¥Market makers: ¤Commercial and investment banks that connect investors with borrowers. © Mc. Graw Hill Companies, Inc. , 2000 11 -1

The Main Players in a Generic Capital Market Investors: Companies Individuals Institutions Market makers: Commercial bankers Investment bankers Borrowers: Individuals Companies Governments Figure 11. 1 © Mc. Graw Hill Companies, Inc. , 2000 11 -2

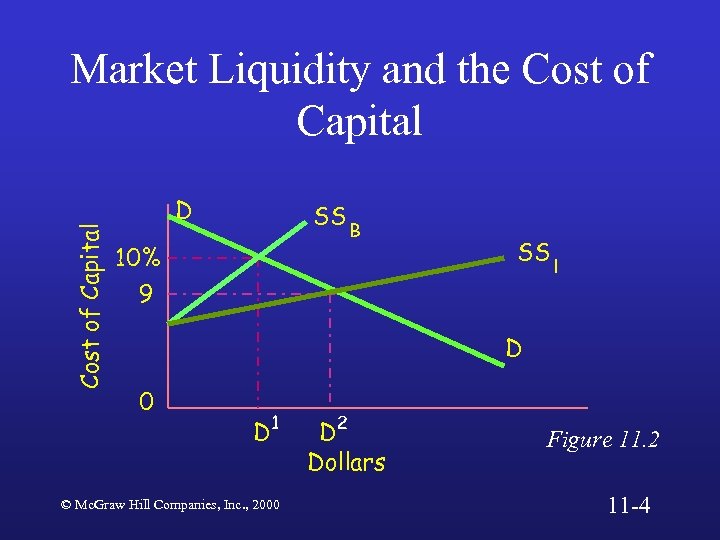

Attraction of the Global Capital Market? ¥Increases the supply of funds available for borrowing. ¥Borrower’s perspective ¤Lowers the cost of capital. ¥Investor’s perspective ¤Provides a wider range of investment opportunities. © Mc. Graw Hill Companies, Inc. , 2000 11 -3

Cost of Capital Market Liquidity and the Cost of Capital D SS 10% B SS 9 l D 0 D 1 © Mc. Graw Hill Companies, Inc. , 2000 D 2 Dollars Figure 11. 2 11 -4

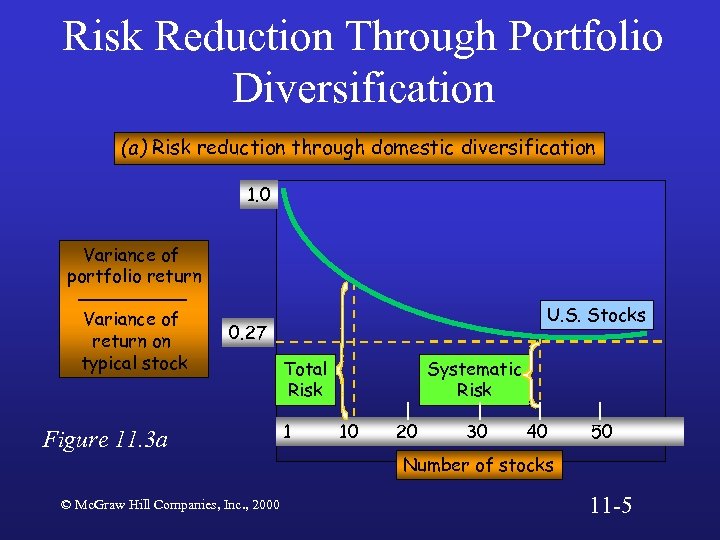

Risk Reduction Through Portfolio Diversification (a) Risk reduction through domestic diversification 1. 0 Variance of portfolio return Variance of return on typical stock U. S. Stocks 0. 27 Figure 11. 3 a © Mc. Graw Hill Companies, Inc. , 2000 Total Risk 1 Systematic Risk 10 20 30 40 50 Number of stocks 11 -5

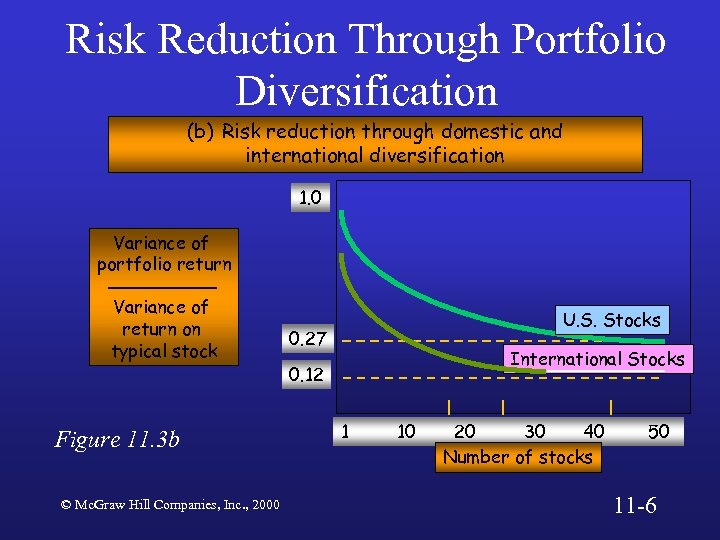

Risk Reduction Through Portfolio Diversification (b) Risk reduction through domestic and international diversification 1. 0 Variance of portfolio return Variance of return on typical stock Figure 11. 3 b © Mc. Graw Hill Companies, Inc. , 2000 U. S. Stocks 0. 27 International Stocks 0. 12 1 10 20 30 40 Number of stocks 50 11 -6

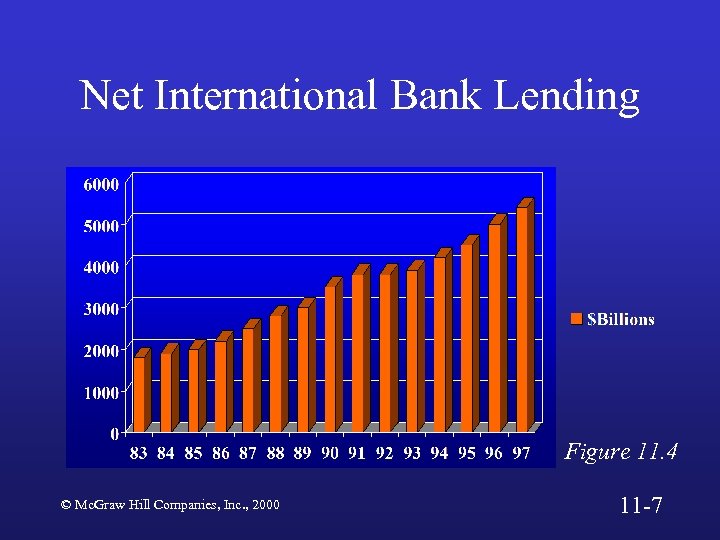

Net International Bank Lending Figure 11. 4 © Mc. Graw Hill Companies, Inc. , 2000 11 -7

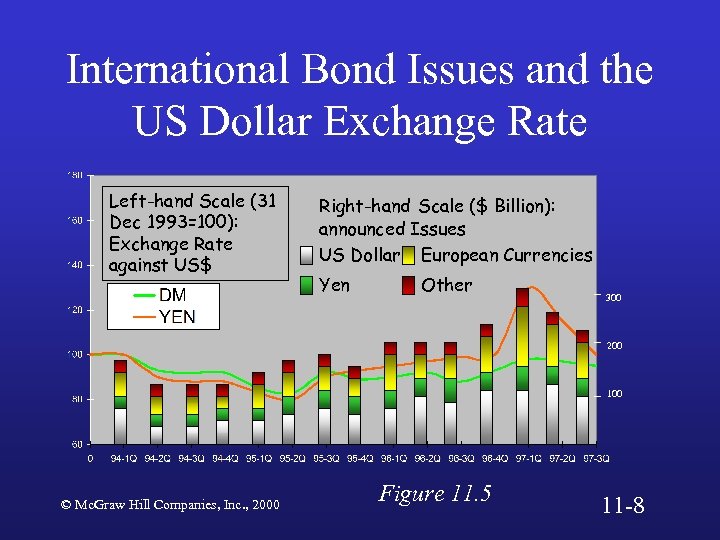

International Bond Issues and the US Dollar Exchange Rate Left-hand Scale (31 Dec 1993=100): Exchange Rate against US$ Right-hand Scale ($ Billion): announced Issues US Dollar European Currencies Yen Other 300 200 100 © Mc. Graw Hill Companies, Inc. , 2000 Figure 11. 5 11 -8

International Equity Offerings and Equity Price Developments 80 Left-Hand Scale (US$) M. S. C. I. World Index 60 Right-hand Scale ($ Billions) US$ Yen 40 20 © Mc. Graw Hill Companies, Inc. , 2000 Figure 11. 6 11 -9

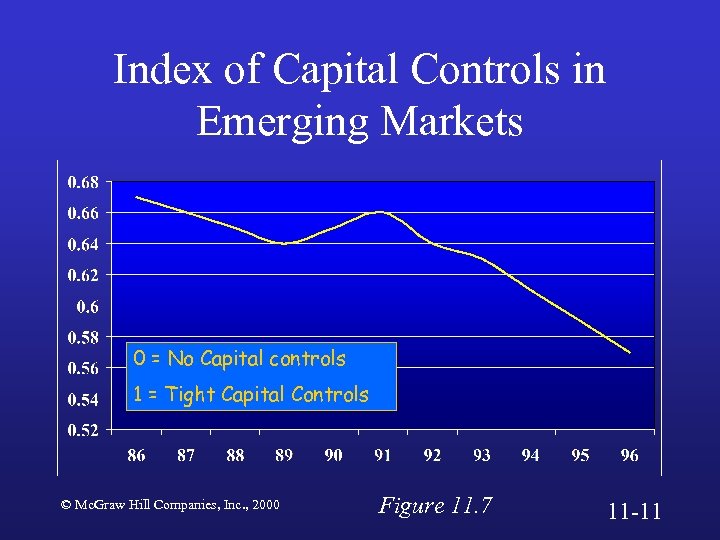

Why The Growth? ¥TECHNOLOGY. ¥Deregulation by governments of capital flows and financial services. ¥Risk: Nations may be more vulnerable to speculative capital flows. ¤Short term investing. © Mc. Graw Hill Companies, Inc. , 2000 11 -10

Index of Capital Controls in Emerging Markets 0 = No Capital controls 1 = Tight Capital Controls © Mc. Graw Hill Companies, Inc. , 2000 Figure 11. 7 11 -11

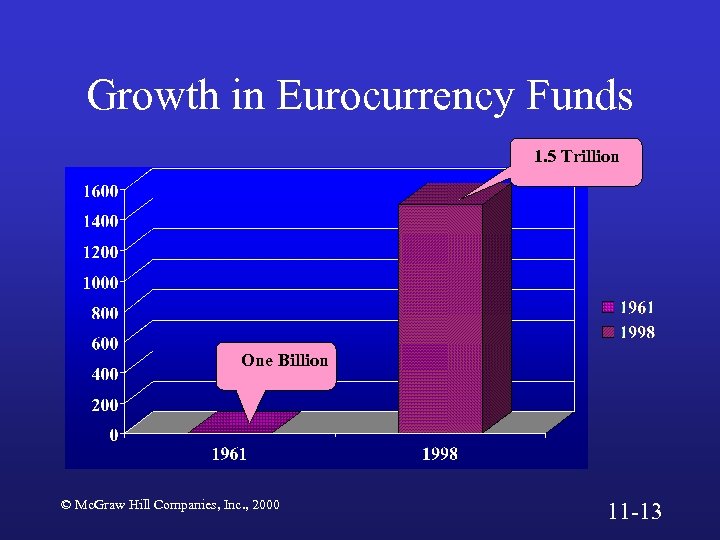

Eurocurrency ¥It’s not the Euro! ¥It is any currency banked outside its country of origin. ¥ 1950 s. Eastern Europeans afraid US would seize deposits to reimburse claims for business losses as a result of Communist takeover of Eastern Europe. © Mc. Graw Hill Companies, Inc. , 2000 11 -12

Growth in Eurocurrency Funds 1. 5 Trillion One Billion © Mc. Graw Hill Companies, Inc. , 2000 11 -13

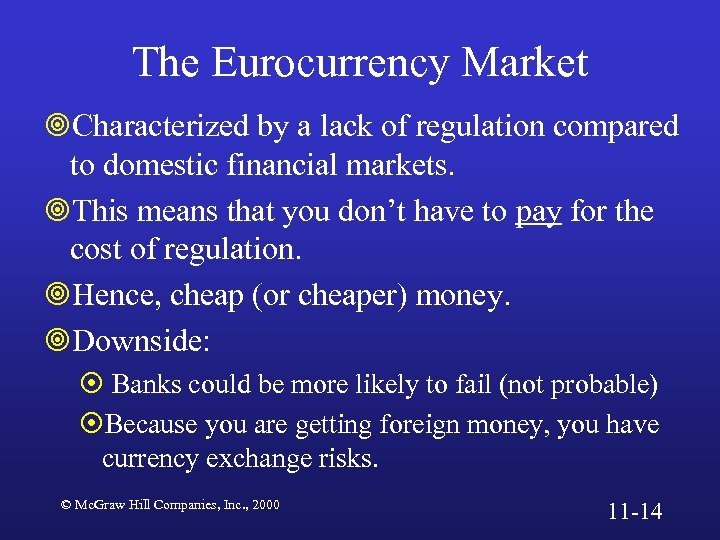

The Eurocurrency Market ¥Characterized by a lack of regulation compared to domestic financial markets. ¥This means that you don’t have to pay for the cost of regulation. ¥Hence, cheap (or cheaper) money. ¥Downside: ¤ Banks could be more likely to fail (not probable) ¤Because you are getting foreign money, you have currency exchange risks. © Mc. Graw Hill Companies, Inc. , 2000 11 -14

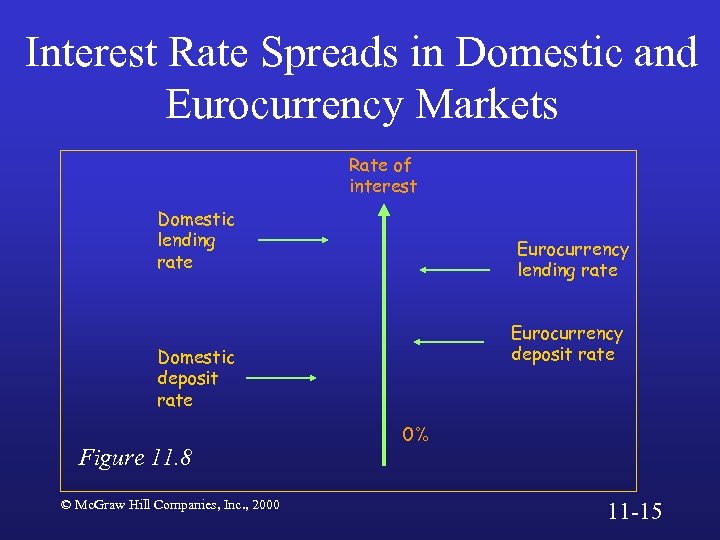

Interest Rate Spreads in Domestic and Eurocurrency Markets Rate of interest Domestic lending rate Eurocurrency deposit rate Domestic deposit rate Figure 11. 8 © Mc. Graw Hill Companies, Inc. , 2000 0% 11 -15

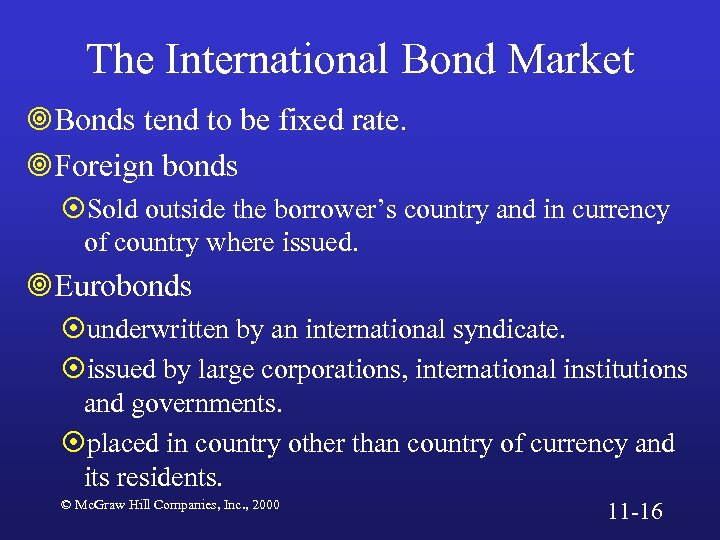

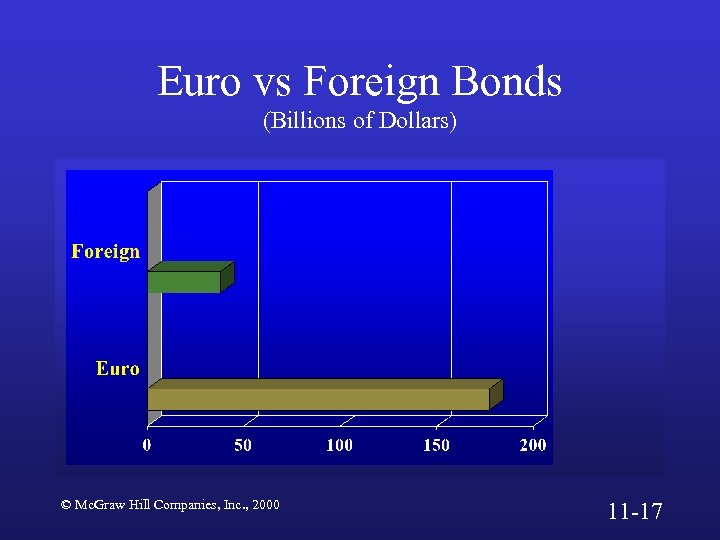

The International Bond Market ¥Bonds tend to be fixed rate. ¥Foreign bonds ¤Sold outside the borrower’s country and in currency of country where issued. ¥Eurobonds ¤underwritten by an international syndicate. ¤issued by large corporations, international institutions and governments. ¤placed in country other than country of currency and its residents. © Mc. Graw Hill Companies, Inc. , 2000 11 -16

Euro vs Foreign Bonds (Billions of Dollars) © Mc. Graw Hill Companies, Inc. , 2000 11 -17

Attraction of the Eurobond Market? ¥No government interference. ¥Few disclosure requirements. ¥Favorable tax status. © Mc. Graw Hill Companies, Inc. , 2000 11 -18

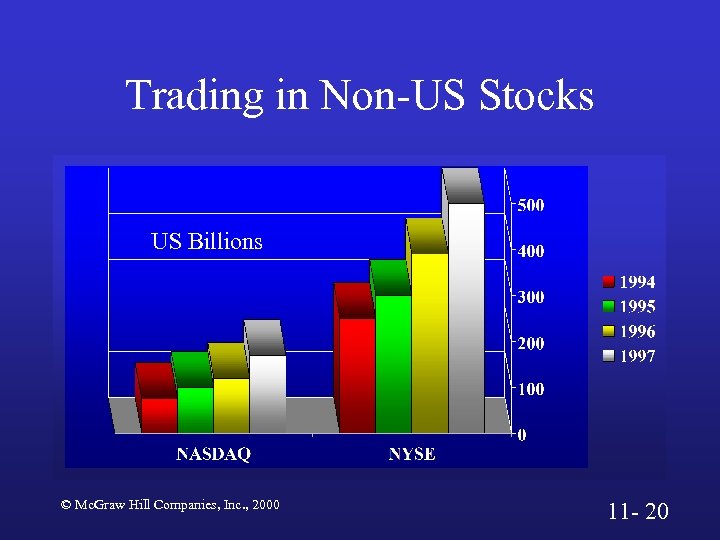

Global Equity Markets ¥Where investors can buy/sell stocks. ¥Made up of many stock exchanges around the world. © Mc. Graw Hill Companies, Inc. , 2000 11 -19

Trading in Non-US Stocks US Billions © Mc. Graw Hill Companies, Inc. , 2000 11 - 20

Who Uses These Markets? ¥Investors seeking to diversify their portfolios. ¥Companies seeking to ¤issue stock in the country ¤use stock and options as a form of employee incentives ¤satisfy local ownership requirements ¤create funding for future acquisitions ¤increase the visibility of the company. © Mc. Graw Hill Companies, Inc. , 2000 11 -21

8f04716f84ccb5e02fba9bb834aaf1cd.ppt