282c73188e851f26a852757fa3d08972.ppt

- Количество слайдов: 47

The German Power Market – Recent Developments Lorena Vinueza Stefan Trück Department of Statistics and Econometrics University of Karlsruhe, Germany stefan@lsoe. uni-karlsruhe. de lorena. vinueza@lsoe. uni-karlsruhe. de

The German Power Market – Recent Developments Lorena Vinueza Stefan Trück Department of Statistics and Econometrics University of Karlsruhe, Germany stefan@lsoe. uni-karlsruhe. de lorena. vinueza@lsoe. uni-karlsruhe. de

Contents n n n Historical overview Ownership and Market structure Power Trading in Germany The Leipzig Power Exchange – a case study Outlook

Contents n n n Historical overview Ownership and Market structure Power Trading in Germany The Leipzig Power Exchange – a case study Outlook

Dereglation Process in Germany – Historical Overview

Dereglation Process in Germany – Historical Overview

Historical Overview (I) 1935 “Energiewirtschaftgesetz” State monopoly 1996 The EU-directive guidelines Liberalization of the power markets in Europe 1998 The German Energy Sector law: opened the German power market to competition

Historical Overview (I) 1935 “Energiewirtschaftgesetz” State monopoly 1996 The EU-directive guidelines Liberalization of the power markets in Europe 1998 The German Energy Sector law: opened the German power market to competition

Historical overview (II) 1998 Verbändevereinbarung I (VV 1) Agreement regarding access to and use of the power network 1999 Verbändevereinbarung II (VV 2) New competitors CEPI Index

Historical overview (II) 1998 Verbändevereinbarung I (VV 1) Agreement regarding access to and use of the power network 1999 Verbändevereinbarung II (VV 2) New competitors CEPI Index

Historical Overview 2000 Gridcode 2000 Distribution. Code 2000 LPX Leipzig, 06/200 EEX Frankfurt, 08/2000 2001 Guidelines for information exchange regarding trading of physical power in Germany

Historical Overview 2000 Gridcode 2000 Distribution. Code 2000 LPX Leipzig, 06/200 EEX Frankfurt, 08/2000 2001 Guidelines for information exchange regarding trading of physical power in Germany

Lack of competition – Open Access for everyone? Theory: since 1998 open access for all network users in former Western Germany Practice: many obstacles remain for many network users on low network levels like: Øfew players with a lot of market power, Ørather high prices for consumers remain, Ølack of real competition, Øopen access

Lack of competition – Open Access for everyone? Theory: since 1998 open access for all network users in former Western Germany Practice: many obstacles remain for many network users on low network levels like: Øfew players with a lot of market power, Ørather high prices for consumers remain, Ølack of real competition, Øopen access

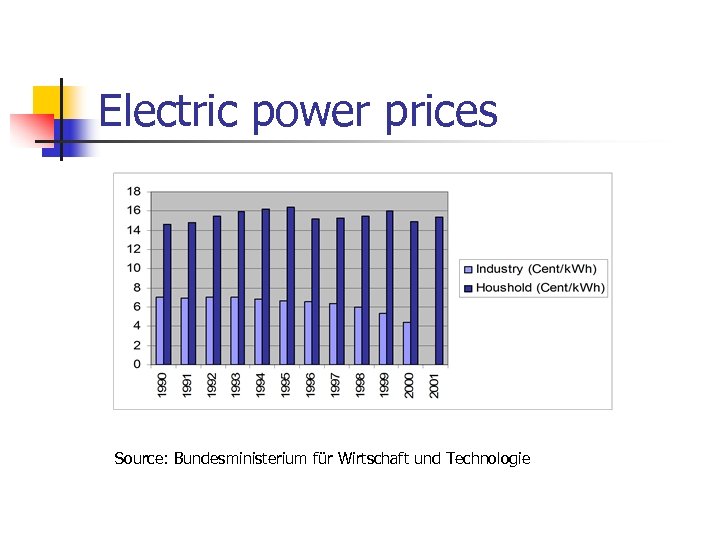

Electric power prices Source: Bundesministerium für Wirtschaft und Technologie

Electric power prices Source: Bundesministerium für Wirtschaft und Technologie

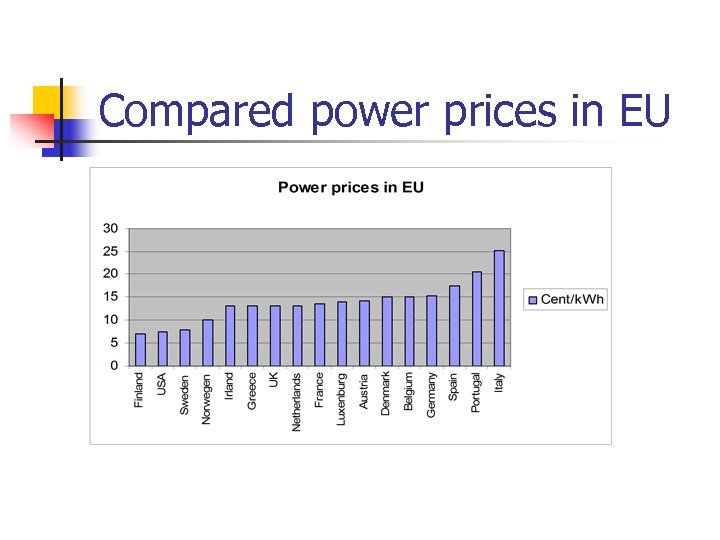

Compared power prices in EU

Compared power prices in EU

Market Structure in Germany

Market Structure in Germany

Market Structure and Market Shares Six “super-regional” companies large power plants and regional high voltage grid ~ 50 regional distributors regional distribution grids and smaller power plants ~ 600 municipal utilities regional distribution grids and smaller power plants ~30% ~40% End user sales

Market Structure and Market Shares Six “super-regional” companies large power plants and regional high voltage grid ~ 50 regional distributors regional distribution grids and smaller power plants ~ 600 municipal utilities regional distribution grids and smaller power plants ~30% ~40% End user sales

Markets – Ownership Structure n n Internationalisation of market Mergers and Acquisitions – some of them n PE + Bayernwerk E. ON n RWE + VEW RWE n VEAG HEW Vattenfall n Local/regional units “super-regional”/global units

Markets – Ownership Structure n n Internationalisation of market Mergers and Acquisitions – some of them n PE + Bayernwerk E. ON n RWE + VEW RWE n VEAG HEW Vattenfall n Local/regional units “super-regional”/global units

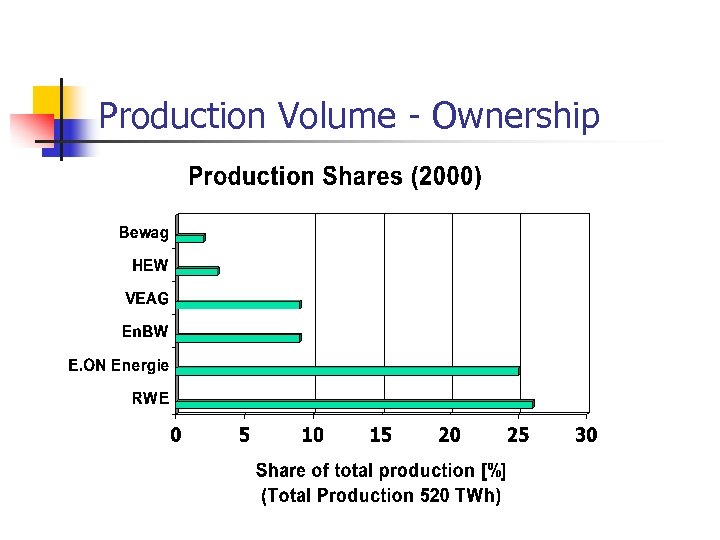

Production Volume - Ownership

Production Volume - Ownership

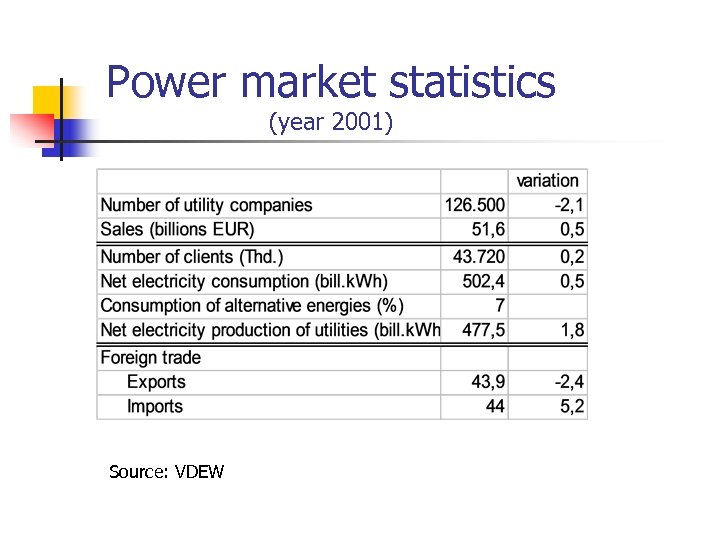

Power market statistics (year 2001) Source: VDEW

Power market statistics (year 2001) Source: VDEW

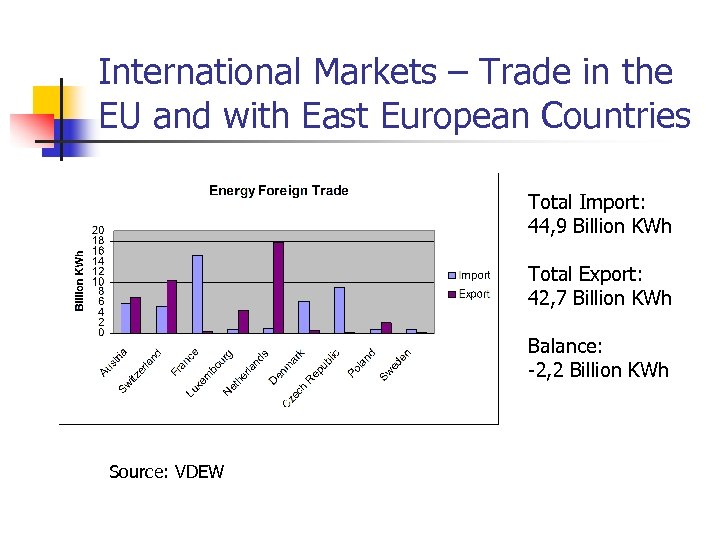

International Markets – Trade in the EU and with East European Countries Total Import: 44, 9 Billion KWh Total Export: 42, 7 Billion KWh Balance: -2, 2 Billion KWh Source: VDEW

International Markets – Trade in the EU and with East European Countries Total Import: 44, 9 Billion KWh Total Export: 42, 7 Billion KWh Balance: -2, 2 Billion KWh Source: VDEW

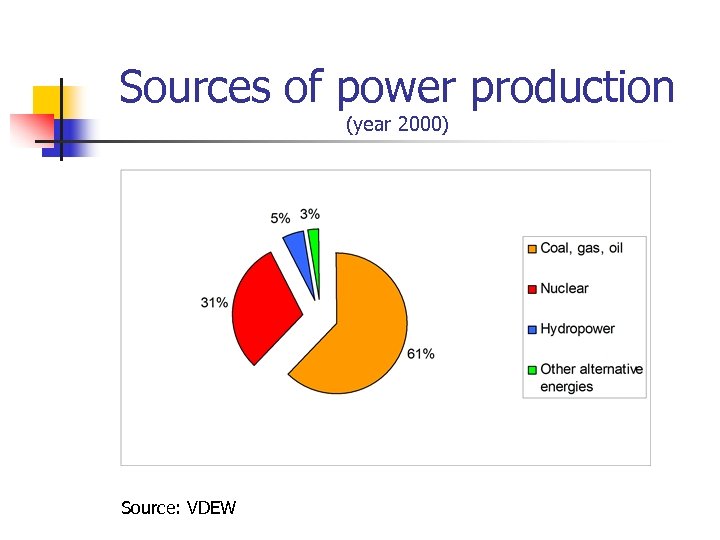

Sources of power production (year 2000) Source: VDEW

Sources of power production (year 2000) Source: VDEW

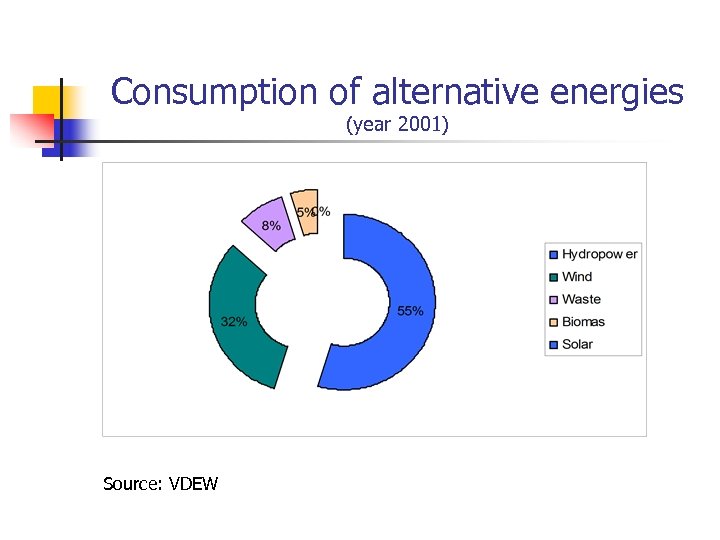

Consumption of alternative energies (year 2001) Source: VDEW

Consumption of alternative energies (year 2001) Source: VDEW

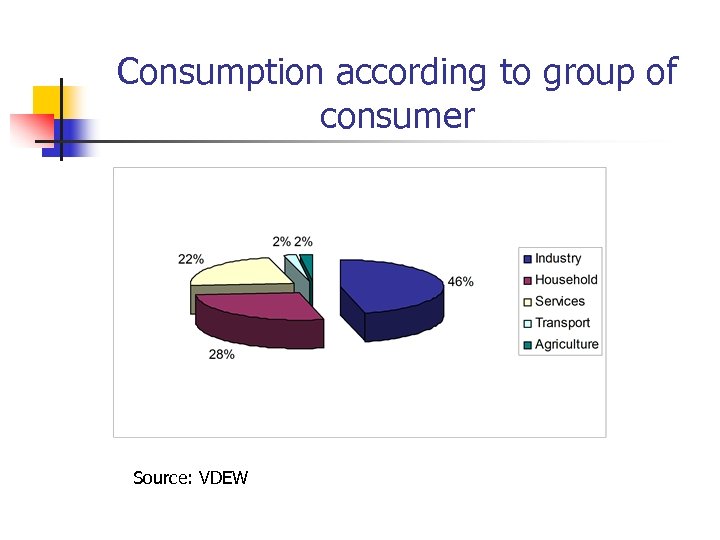

Consumption according to group of consumer Source: VDEW

Consumption according to group of consumer Source: VDEW

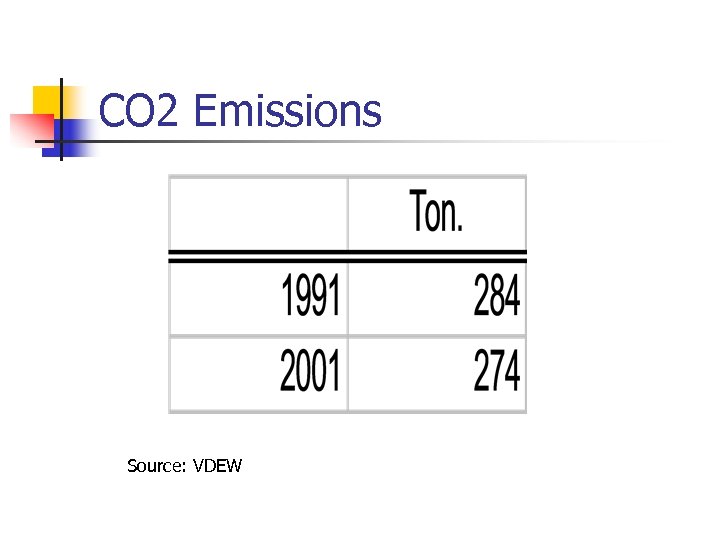

CO 2 Emissions Source: VDEW

CO 2 Emissions Source: VDEW

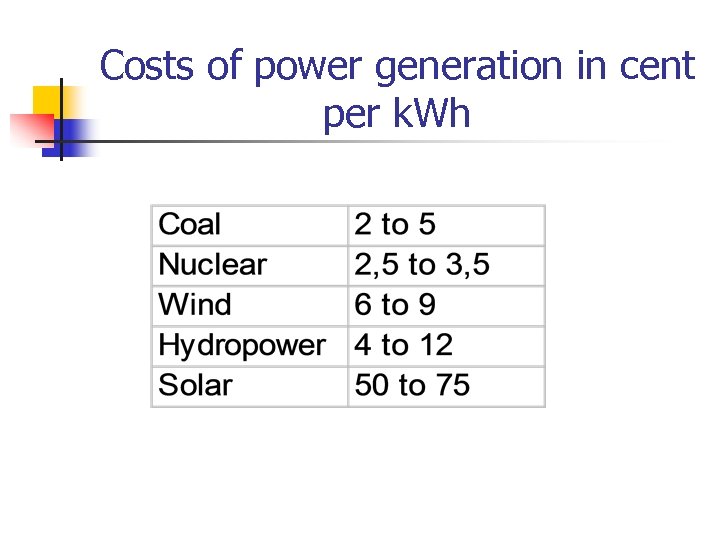

Costs of power generation in cent per k. Wh

Costs of power generation in cent per k. Wh

Energy Trading Institutions in Germany

Energy Trading Institutions in Germany

Energy Trading Institutions in Germany • OTC – Market • Internet Market Places • Power Exchanges (EEX and LPX)

Energy Trading Institutions in Germany • OTC – Market • Internet Market Places • Power Exchanges (EEX and LPX)

Energy Trading – OTC Markets (I) Ø More than 300 parties registered in German market, about 20 -30 active traders Ø Turnover estimated 50 -70 TWh/month Ø Mainly Bilateral Trades Ø Also cross-border auctions and active trading with e. g. Denmark, Netherlands, Czech Rep etc.

Energy Trading – OTC Markets (I) Ø More than 300 parties registered in German market, about 20 -30 active traders Ø Turnover estimated 50 -70 TWh/month Ø Mainly Bilateral Trades Ø Also cross-border auctions and active trading with e. g. Denmark, Netherlands, Czech Rep etc.

Energy Trading – OTC Markets (II) Ø Intermediate Brokers often act between Market Participants (~ 10 -15 brokers active) Ø Different sorts of contracts are traded - spot and future products Ø Transparency is not guaranteed Ø No real „Trading“ of Energy

Energy Trading – OTC Markets (II) Ø Intermediate Brokers often act between Market Participants (~ 10 -15 brokers active) Ø Different sorts of contracts are traded - spot and future products Ø Transparency is not guaranteed Ø No real „Trading“ of Energy

Energy Trading – Internet Platforms Ø Alternative Platform to common OTCTelephone trades Ø Several Market Places (e. g. Enron. Online, netstrom. de, HEW click&trade) Ø Only very small proportion is traded via Internet Market Places so far Ø Poor Liquidity of Internet Markets

Energy Trading – Internet Platforms Ø Alternative Platform to common OTCTelephone trades Ø Several Market Places (e. g. Enron. Online, netstrom. de, HEW click&trade) Ø Only very small proportion is traded via Internet Market Places so far Ø Poor Liquidity of Internet Markets

Energy Trading – Power Exchanges Ø Offering Standardised Products (Spot and Future Market) Ø more Transparency in markets than in OTC Ø many Market Participants Ø More „real“ Trading Ø (Especially Futures) Market is rapidly growing

Energy Trading – Power Exchanges Ø Offering Standardised Products (Spot and Future Market) Ø more Transparency in markets than in OTC Ø many Market Participants Ø More „real“ Trading Ø (Especially Futures) Market is rapidly growing

Power Exchanges in Germany I Leipzig Power Exchange (LPX) in Eastern Germany - first German Exchange for Energy Ø Main partner: Nord Pool ASA Ø Spot market Started 16 th of June 2000 60 parties have signed trading agreement Ø Future market Started in July 2001

Power Exchanges in Germany I Leipzig Power Exchange (LPX) in Eastern Germany - first German Exchange for Energy Ø Main partner: Nord Pool ASA Ø Spot market Started 16 th of June 2000 60 parties have signed trading agreement Ø Future market Started in July 2001

Power Exchanges in Germany II European Energy Exchange (EEX) in Frankfurt Ø Main partner: German Stock Exchange Ø Spot market Started 8 th of August 2000 30 parties have signed trading agreement Ø Concentration on Future market Started 1 st of March 2001 24 parties have signed trading agreement Turnover in May-01: 0. 6 TWh

Power Exchanges in Germany II European Energy Exchange (EEX) in Frankfurt Ø Main partner: German Stock Exchange Ø Spot market Started 8 th of August 2000 30 parties have signed trading agreement Ø Concentration on Future market Started 1 st of March 2001 24 parties have signed trading agreement Turnover in May-01: 0. 6 TWh

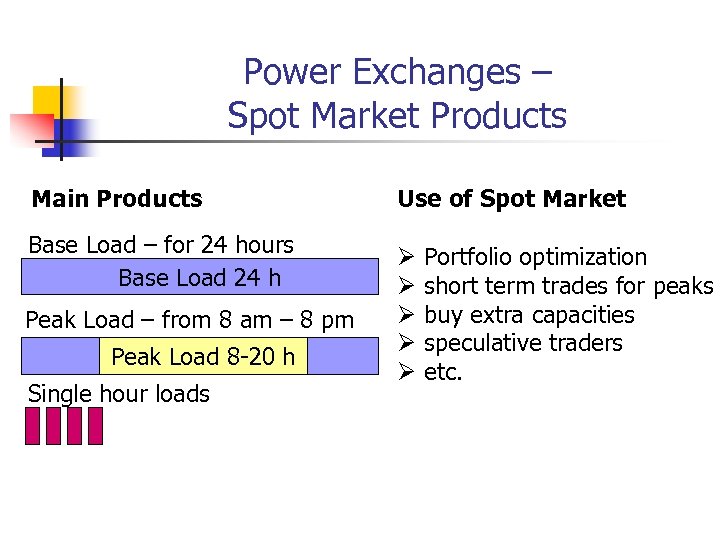

Power Exchanges – Spot Market Products Main Products Base Load – for 24 hours Base Load 24 h Peak Load – from 8 am – 8 pm Peak Load 8 -20 h Single hour loads Use of Spot Market Ø Ø Ø Portfolio optimization short term trades for peaks buy extra capacities speculative traders etc.

Power Exchanges – Spot Market Products Main Products Base Load – for 24 hours Base Load 24 h Peak Load – from 8 am – 8 pm Peak Load 8 -20 h Single hour loads Use of Spot Market Ø Ø Ø Portfolio optimization short term trades for peaks buy extra capacities speculative traders etc.

Power Exchanges – Future Market Products Ø Futures Ø Options (planned) Ø Swaps (planned) ØEtc. Traded are mainly long-term futures like monthly, quarterly and yearly products

Power Exchanges – Future Market Products Ø Futures Ø Options (planned) Ø Swaps (planned) ØEtc. Traded are mainly long-term futures like monthly, quarterly and yearly products

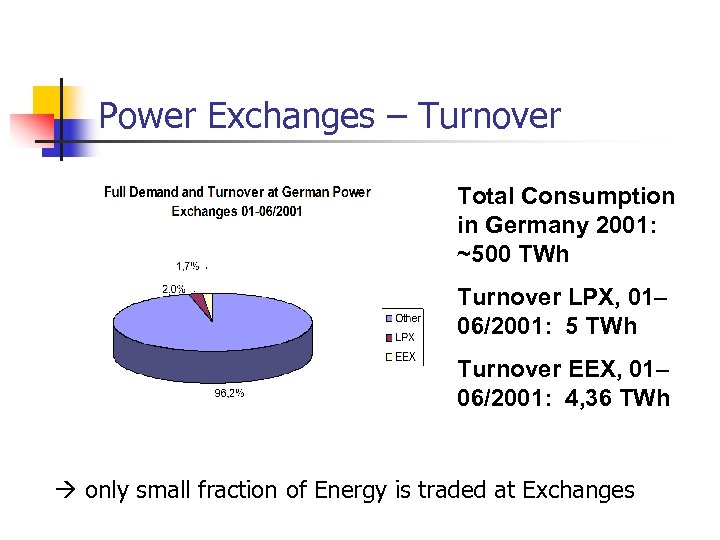

Power Exchanges – Turnover Total Consumption in Germany 2001: ~500 TWh Turnover LPX, 01– 06/2001: 5 TWh Turnover EEX, 01– 06/2001: 4, 36 TWh only small fraction of Energy is traded at Exchanges

Power Exchanges – Turnover Total Consumption in Germany 2001: ~500 TWh Turnover LPX, 01– 06/2001: 5 TWh Turnover EEX, 01– 06/2001: 4, 36 TWh only small fraction of Energy is traded at Exchanges

Trading / Strategies of Market Participants Combination of long-term OTC contracts with fixed prices and short-term trades at Power Exchanges as popular strategy Rapidly Growing Futures Market due to more transparency for complex products at exchanges compared to OTC trades

Trading / Strategies of Market Participants Combination of long-term OTC contracts with fixed prices and short-term trades at Power Exchanges as popular strategy Rapidly Growing Futures Market due to more transparency for complex products at exchanges compared to OTC trades

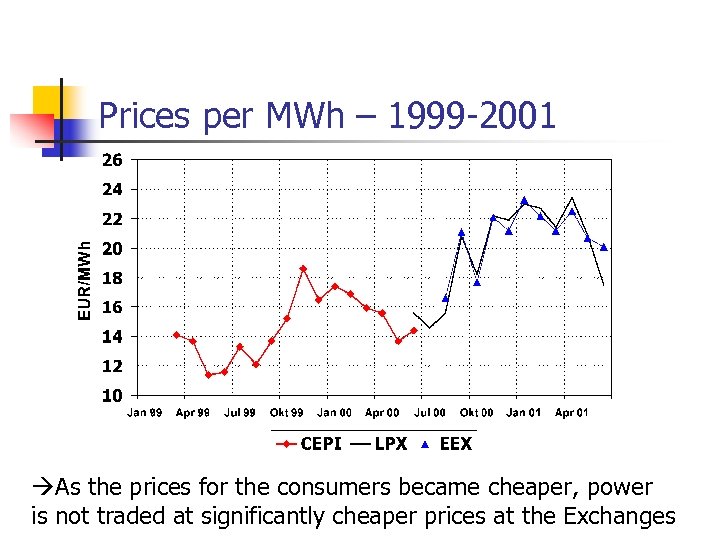

Prices per MWh – 1999 -2001 As the prices for the consumers became cheaper, power is not traded at significantly cheaper prices at the Exchanges

Prices per MWh – 1999 -2001 As the prices for the consumers became cheaper, power is not traded at significantly cheaper prices at the Exchanges

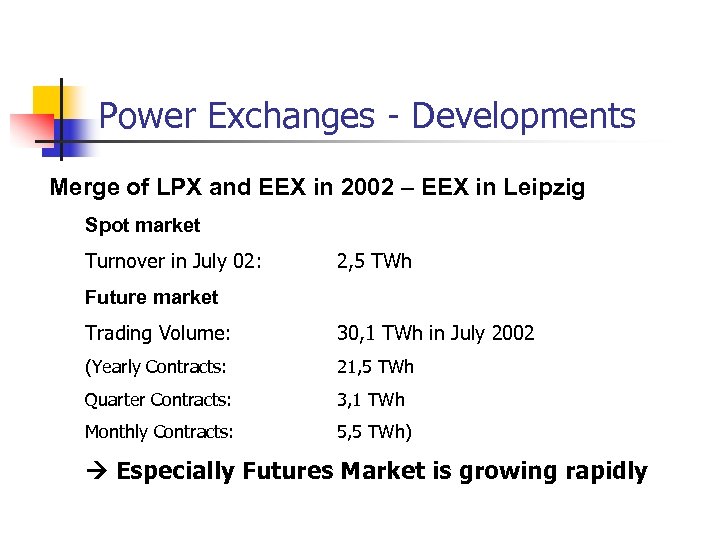

Power Exchanges - Developments Merge of LPX and EEX in 2002 – EEX in Leipzig Spot market Turnover in July 02: 2, 5 TWh Future market Trading Volume: 30, 1 TWh in July 2002 (Yearly Contracts: 21, 5 TWh Quarter Contracts: 3, 1 TWh Monthly Contracts: 5, 5 TWh) Especially Futures Market is growing rapidly

Power Exchanges - Developments Merge of LPX and EEX in 2002 – EEX in Leipzig Spot market Turnover in July 02: 2, 5 TWh Future market Trading Volume: 30, 1 TWh in July 2002 (Yearly Contracts: 21, 5 TWh Quarter Contracts: 3, 1 TWh Monthly Contracts: 5, 5 TWh) Especially Futures Market is growing rapidly

Case Study: The Leipzig Power Exchange (LPX)

Case Study: The Leipzig Power Exchange (LPX)

The Leipzig Power Exchange – Organisation of the Exchange Ø Public law structure Ø Ø Ø Exchange as an institution under public law LPX acts through organs under public law Supporter Ø Ø Ø LPX Leipzig Power Exchange Gmb. H Private law institutions Shareholders

The Leipzig Power Exchange – Organisation of the Exchange Ø Public law structure Ø Ø Ø Exchange as an institution under public law LPX acts through organs under public law Supporter Ø Ø Ø LPX Leipzig Power Exchange Gmb. H Private law institutions Shareholders

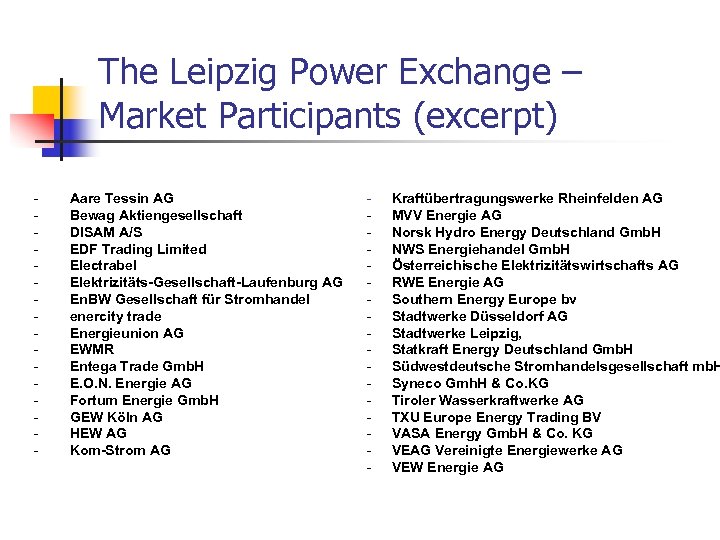

The Leipzig Power Exchange – Market Participants (excerpt) - Aare Tessin AG Bewag Aktiengesellschaft DISAM A/S EDF Trading Limited Electrabel Elektrizitäts-Gesellschaft-Laufenburg AG En. BW Gesellschaft für Stromhandel enercity trade Energieunion AG EWMR Entega Trade Gmb. H E. O. N. Energie AG Fortum Energie Gmb. H GEW Köln AG HEW AG Kom-Strom AG - Kraftübertragungswerke Rheinfelden AG MVV Energie AG Norsk Hydro Energy Deutschland Gmb. H NWS Energiehandel Gmb. H Österreichische Elektrizitätswirtschafts AG RWE Energie AG Southern Energy Europe bv Stadtwerke Düsseldorf AG Stadtwerke Leipzig, Statkraft Energy Deutschland Gmb. H Südwestdeutsche Stromhandelsgesellschaft mb. H Syneco Gmh. H & Co. KG Tiroler Wasserkraftwerke AG TXU Europe Energy Trading BV VASA Energy Gmb. H & Co. KG VEAG Vereinigte Energiewerke AG VEW Energie AG

The Leipzig Power Exchange – Market Participants (excerpt) - Aare Tessin AG Bewag Aktiengesellschaft DISAM A/S EDF Trading Limited Electrabel Elektrizitäts-Gesellschaft-Laufenburg AG En. BW Gesellschaft für Stromhandel enercity trade Energieunion AG EWMR Entega Trade Gmb. H E. O. N. Energie AG Fortum Energie Gmb. H GEW Köln AG HEW AG Kom-Strom AG - Kraftübertragungswerke Rheinfelden AG MVV Energie AG Norsk Hydro Energy Deutschland Gmb. H NWS Energiehandel Gmb. H Österreichische Elektrizitätswirtschafts AG RWE Energie AG Southern Energy Europe bv Stadtwerke Düsseldorf AG Stadtwerke Leipzig, Statkraft Energy Deutschland Gmb. H Südwestdeutsche Stromhandelsgesellschaft mb. H Syneco Gmh. H & Co. KG Tiroler Wasserkraftwerke AG TXU Europe Energy Trading BV VASA Energy Gmb. H & Co. KG VEAG Vereinigte Energiewerke AG VEW Energie AG

The Leipzig Power Exchange – Trading and Entrance Fees Ø Overview l Trading fees (mutual, i. e. to be paid by both the purchaser and the seller) 0. 04 Euro/MWh l Annual fee 12500 Euro l Entrance fee (one-off) 7000 Euro

The Leipzig Power Exchange – Trading and Entrance Fees Ø Overview l Trading fees (mutual, i. e. to be paid by both the purchaser and the seller) 0. 04 Euro/MWh l Annual fee 12500 Euro l Entrance fee (one-off) 7000 Euro

The Leipzig Power Exchange – Auction Bidding Ø LPX supposes „Auction Bidding“ as best solution Ø Bundling up of demand supply Ø Minimizes Strategic Influences and Market Power Ø Economical and Simple Solution

The Leipzig Power Exchange – Auction Bidding Ø LPX supposes „Auction Bidding“ as best solution Ø Bundling up of demand supply Ø Minimizes Strategic Influences and Market Power Ø Economical and Simple Solution

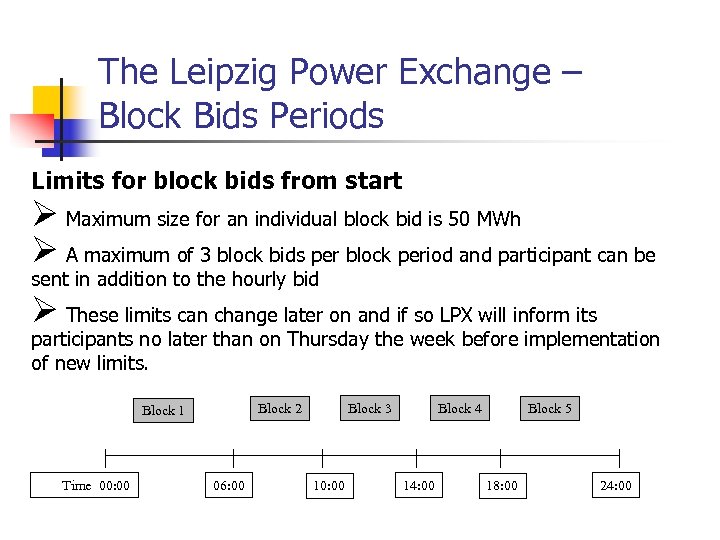

The Leipzig Power Exchange – Block Bids Periods Limits for block bids from start Ø Maximum size for an individual block bid is 50 MWh Ø A maximum of 3 block bids per block period and participant can be sent in addition to the hourly bid Ø These limits can change later on and if so LPX will inform its participants no later than on Thursday the week before implementation of new limits. Time 00: 00 Block 3 Block 2 Block 1 06: 00 10: 00 Block 4 14: 00 Block 5 18: 00 24: 00

The Leipzig Power Exchange – Block Bids Periods Limits for block bids from start Ø Maximum size for an individual block bid is 50 MWh Ø A maximum of 3 block bids per block period and participant can be sent in addition to the hourly bid Ø These limits can change later on and if so LPX will inform its participants no later than on Thursday the week before implementation of new limits. Time 00: 00 Block 3 Block 2 Block 1 06: 00 10: 00 Block 4 14: 00 Block 5 18: 00 24: 00

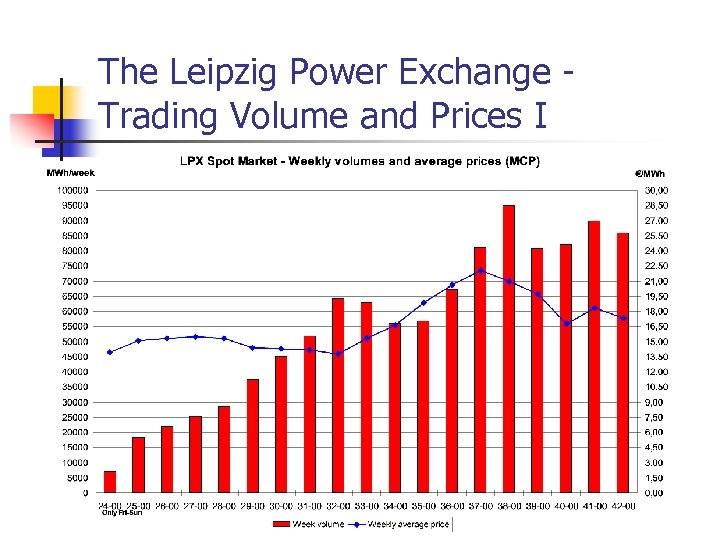

The Leipzig Power Exchange Trading Volume and Prices I

The Leipzig Power Exchange Trading Volume and Prices I

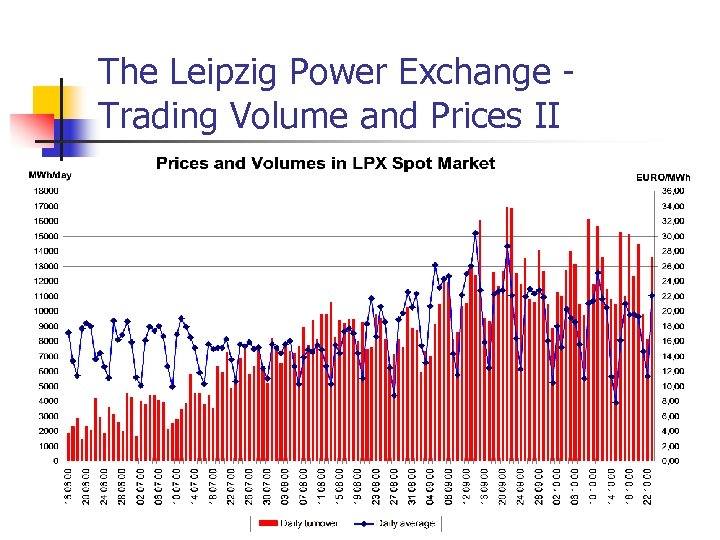

The Leipzig Power Exchange Trading Volume and Prices II

The Leipzig Power Exchange Trading Volume and Prices II

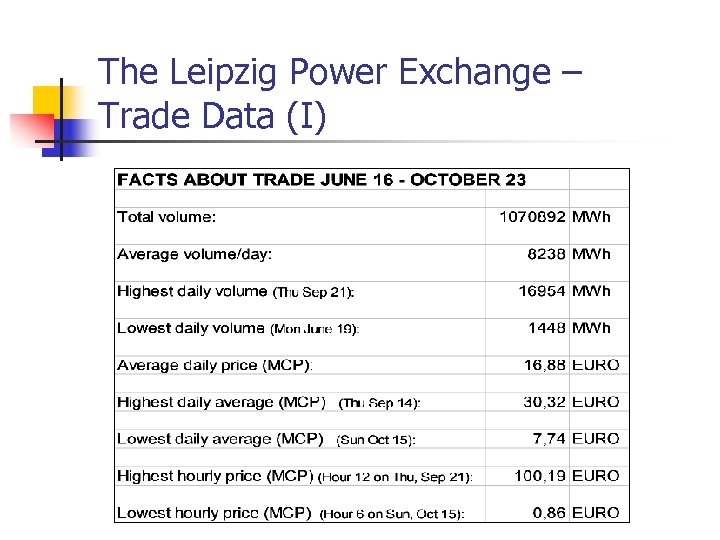

The Leipzig Power Exchange – Trade Data (I)

The Leipzig Power Exchange – Trade Data (I)

The Leipzig Power Exchange – Trade Data (II) – Anomalies Ø in December 2001 the „market-clearing-price“ reached a peak with 1000 Euro/MWh Ø the average weekly price moved to 50 Euro/MWh Ø ‚prices are economically not logical nor explainable‘ (MVV) Ø problem: data about production, network problems not available to all traders

The Leipzig Power Exchange – Trade Data (II) – Anomalies Ø in December 2001 the „market-clearing-price“ reached a peak with 1000 Euro/MWh Ø the average weekly price moved to 50 Euro/MWh Ø ‚prices are economically not logical nor explainable‘ (MVV) Ø problem: data about production, network problems not available to all traders

Conclusions considering Prices (I) Ø Behaviour of prices suggests challenges associated with modelling these prices, e. g. • Volatility seen in Power Prices is exremely high and unprecedented in other Commodity Markets • Prices vary substantially by time of day, week or year • Positive and Negative price „spikes“ can be observed • Frequency, Magnitude and complexity of Fluctuations also unique in commodity markets

Conclusions considering Prices (I) Ø Behaviour of prices suggests challenges associated with modelling these prices, e. g. • Volatility seen in Power Prices is exremely high and unprecedented in other Commodity Markets • Prices vary substantially by time of day, week or year • Positive and Negative price „spikes“ can be observed • Frequency, Magnitude and complexity of Fluctuations also unique in commodity markets

Conclusions considering Prices (II) Ø However. . . • Prices follow similar daily, weekly and annual patterns • Even the price volatility follows certain patterns, price volatility is strongly correlated with price levels • Basic relationships between power prices at different geographic locations show e. g. similar volatility Ø. . . the challenge is to build models that capture this complex behaviour of prices

Conclusions considering Prices (II) Ø However. . . • Prices follow similar daily, weekly and annual patterns • Even the price volatility follows certain patterns, price volatility is strongly correlated with price levels • Basic relationships between power prices at different geographic locations show e. g. similar volatility Ø. . . the challenge is to build models that capture this complex behaviour of prices

Links in the Internet • • www. strom. de www. eex. de www. lpx. de www. bmwi. de www. finance. wiwi. uni-karlsruhe. de www. energy-more. de www. bundeskartellamt. de www. eu-kommission. de

Links in the Internet • • www. strom. de www. eex. de www. lpx. de www. bmwi. de www. finance. wiwi. uni-karlsruhe. de www. energy-more. de www. bundeskartellamt. de www. eu-kommission. de