8d2732b6416b07166be968357540ec46.ppt

- Количество слайдов: 28

The Foreign Exchange Market Chapter 6

The Foreign Exchange Market Chapter 6

The Foreign Exchange Markets I. INTRODUCTION A. The Market: the anyplace where money denominated in one currency is bought and sold with money denominated in another currency. 2

The Foreign Exchange Markets I. INTRODUCTION A. The Market: the anyplace where money denominated in one currency is bought and sold with money denominated in another currency. 2

INTRODUCTION B. International Trade and Capital Transactions: facilitated with the ability to transfer purchasing power between countries 3

INTRODUCTION B. International Trade and Capital Transactions: facilitated with the ability to transfer purchasing power between countries 3

INTRODUCTION C. Location 1. 2. OTC-type: no specific location Most trades by phone or SWIFT* *SWIFT: Society for Worldwide Interbank Financial Telecommunications 4

INTRODUCTION C. Location 1. 2. OTC-type: no specific location Most trades by phone or SWIFT* *SWIFT: Society for Worldwide Interbank Financial Telecommunications 4

PART II. ORGANIZATION OF THE FOREIGN EXCHANGE MARKET I. PARTICIPANTS IN THE FOREIGN EXCHANGE MARKET A. Participants at 2 Levels 1. Wholesale Level (95%) - major commercial banks 2. Retail Level - banks dealing for business customers. 5

PART II. ORGANIZATION OF THE FOREIGN EXCHANGE MARKET I. PARTICIPANTS IN THE FOREIGN EXCHANGE MARKET A. Participants at 2 Levels 1. Wholesale Level (95%) - major commercial banks 2. Retail Level - banks dealing for business customers. 5

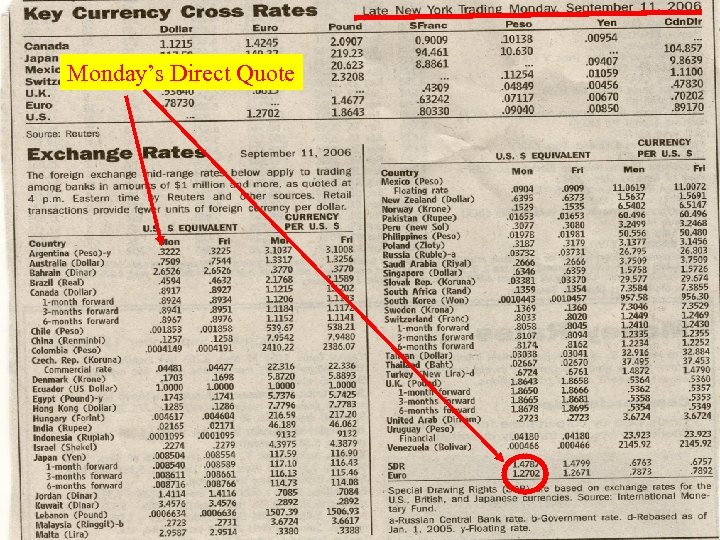

Monday’s Direct Quote 6

Monday’s Direct Quote 6

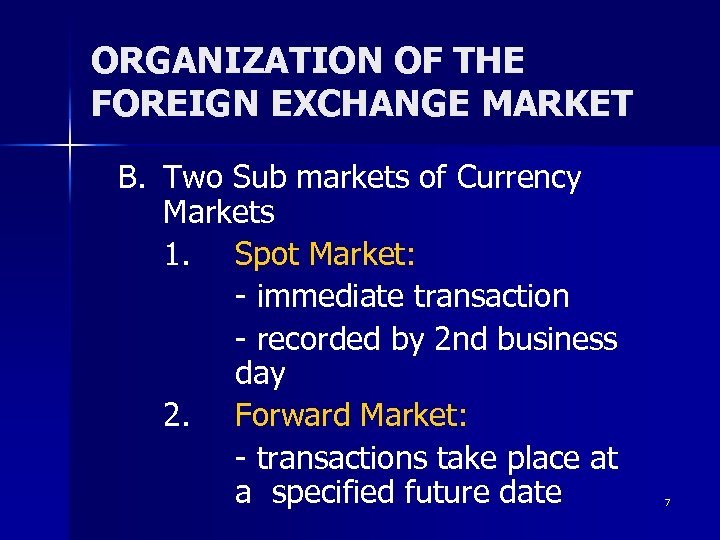

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET B. Two Sub markets of Currency Markets 1. Spot Market: - immediate transaction - recorded by 2 nd business day 2. Forward Market: - transactions take place at a specified future date 7

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET B. Two Sub markets of Currency Markets 1. Spot Market: - immediate transaction - recorded by 2 nd business day 2. Forward Market: - transactions take place at a specified future date 7

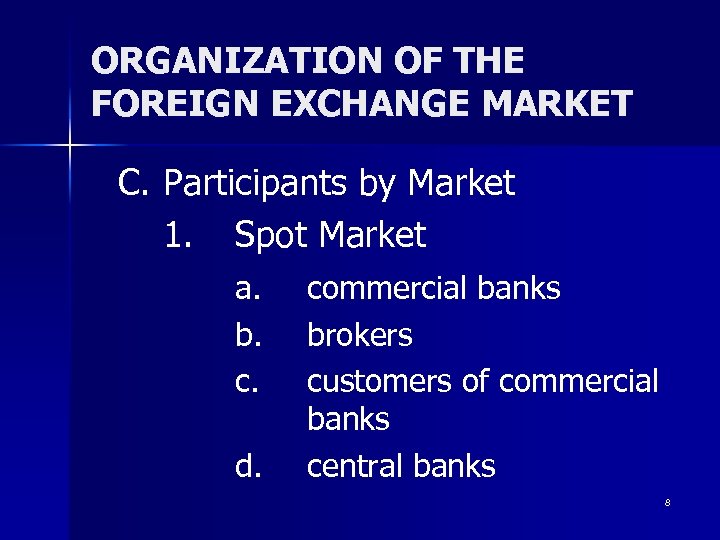

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET C. Participants by Market 1. Spot Market a. b. c. d. commercial banks brokers customers of commercial banks central banks 8

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET C. Participants by Market 1. Spot Market a. b. c. d. commercial banks brokers customers of commercial banks central banks 8

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET 2. Forward Market a. arbitrageurs (hold currency) b. speculators c. hedgers 9

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET 2. Forward Market a. arbitrageurs (hold currency) b. speculators c. hedgers 9

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET II. SIZE OF THE CURRENCY MARKET A. Largest in the world 2005: $1. 9 trillion daily B. Market Centers (1998): London = $637 billion daily New York= $351 billion daily Tokyo = $149 billion daily C. Benchmark: 1999 USGDP = $9. 1 trillion 10

ORGANIZATION OF THE FOREIGN EXCHANGE MARKET II. SIZE OF THE CURRENCY MARKET A. Largest in the world 2005: $1. 9 trillion daily B. Market Centers (1998): London = $637 billion daily New York= $351 billion daily Tokyo = $149 billion daily C. Benchmark: 1999 USGDP = $9. 1 trillion 10

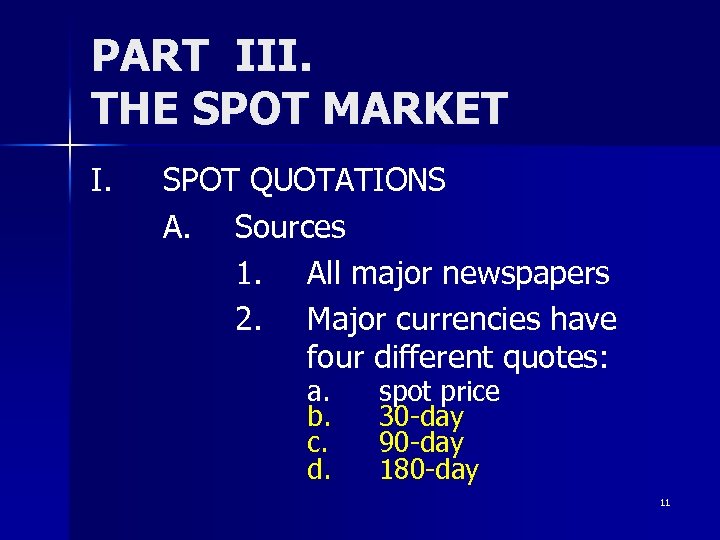

PART III. THE SPOT MARKET I. SPOT QUOTATIONS A. Sources 1. All major newspapers 2. Major currencies have four different quotes: a. b. c. d. spot price 30 -day 90 -day 180 -day 11

PART III. THE SPOT MARKET I. SPOT QUOTATIONS A. Sources 1. All major newspapers 2. Major currencies have four different quotes: a. b. c. d. spot price 30 -day 90 -day 180 -day 11

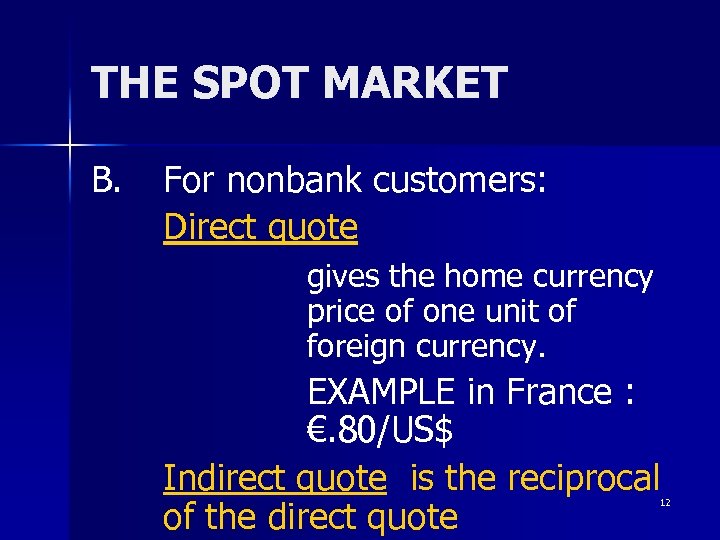

THE SPOT MARKET B. For nonbank customers: Direct quote gives the home currency price of one unit of foreign currency. EXAMPLE in France : €. 80/US$ Indirect quote is the reciprocal of the direct quote 12

THE SPOT MARKET B. For nonbank customers: Direct quote gives the home currency price of one unit of foreign currency. EXAMPLE in France : €. 80/US$ Indirect quote is the reciprocal of the direct quote 12

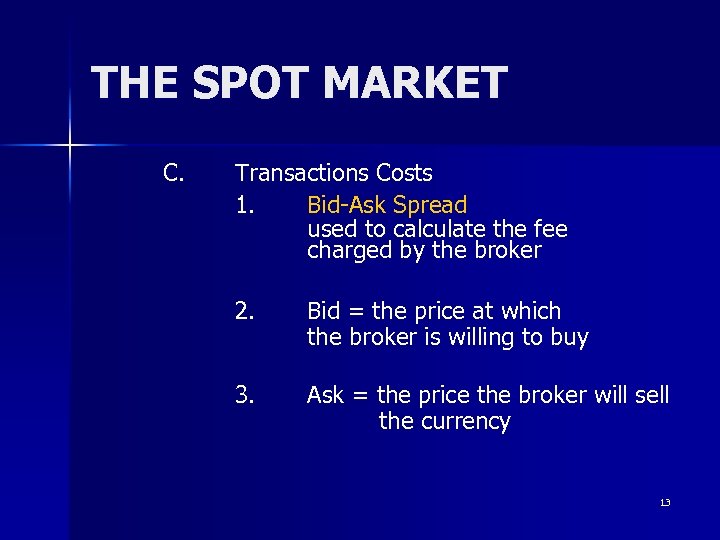

THE SPOT MARKET C. Transactions Costs 1. Bid-Ask Spread used to calculate the fee charged by the broker 2. Bid = the price at which the broker is willing to buy 3. Ask = the price the broker will sell the currency 13

THE SPOT MARKET C. Transactions Costs 1. Bid-Ask Spread used to calculate the fee charged by the broker 2. Bid = the price at which the broker is willing to buy 3. Ask = the price the broker will sell the currency 13

THE SPOT MARKET Sample bid-ask quote: €. 7353 -75/$ or €. 7375/$ If you are selling dollars for euros, this is the rate at which the broker will buy them from you If you want to buy dollars wit euros, this is the rate at which the broker will sell them to you 14

THE SPOT MARKET Sample bid-ask quote: €. 7353 -75/$ or €. 7375/$ If you are selling dollars for euros, this is the rate at which the broker will buy them from you If you want to buy dollars wit euros, this is the rate at which the broker will sell them to you 14

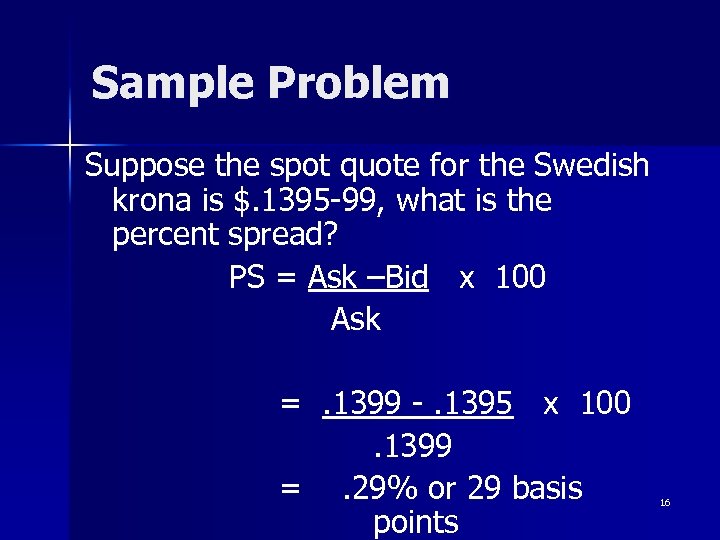

THE SPOT MARKET 4. Percent Spread Formula: Percent Spread = {(Ask-Bid)/Ask} x 100 15

THE SPOT MARKET 4. Percent Spread Formula: Percent Spread = {(Ask-Bid)/Ask} x 100 15

Sample Problem Suppose the spot quote for the Swedish krona is $. 1395 -99, what is the percent spread? PS = Ask –Bid x 100 Ask =. 1399 -. 1395 x 100. 1399 =. 29% or 29 basis points 16

Sample Problem Suppose the spot quote for the Swedish krona is $. 1395 -99, what is the percent spread? PS = Ask –Bid x 100 Ask =. 1399 -. 1395 x 100. 1399 =. 29% or 29 basis points 16

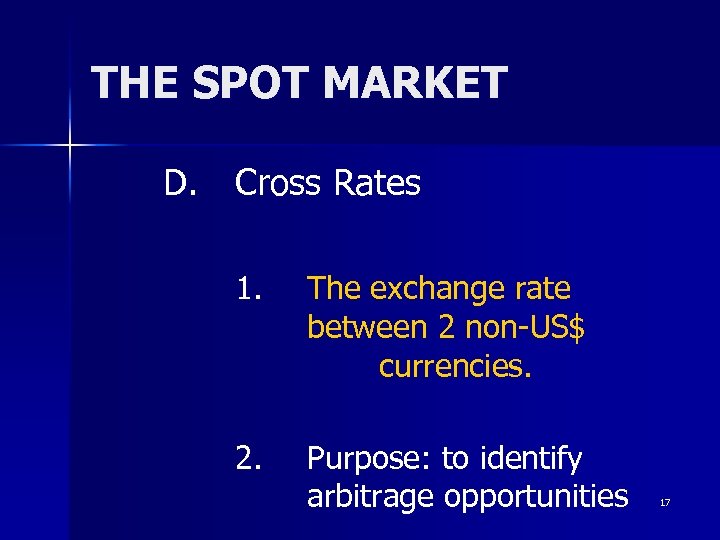

THE SPOT MARKET D. Cross Rates 1. The exchange rate between 2 non-US$ currencies. 2. Purpose: to identify arbitrage opportunities 17

THE SPOT MARKET D. Cross Rates 1. The exchange rate between 2 non-US$ currencies. 2. Purpose: to identify arbitrage opportunities 17

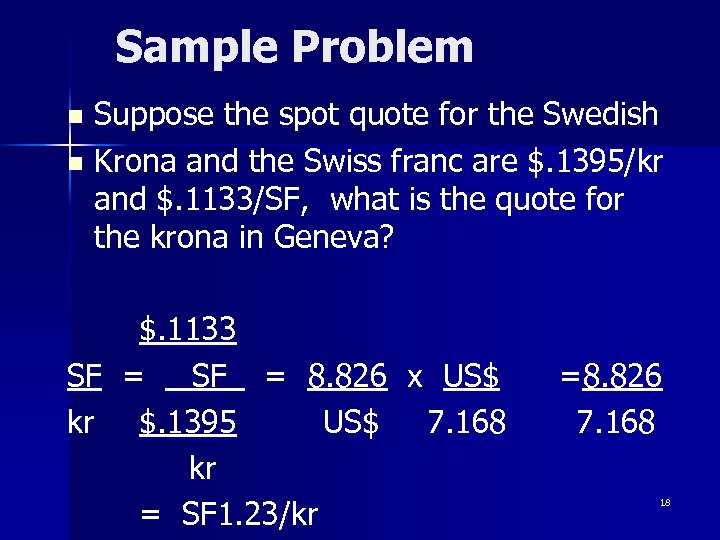

Sample Problem Suppose the spot quote for the Swedish n Krona and the Swiss franc are $. 1395/kr and $. 1133/SF, what is the quote for the krona in Geneva? n $. 1133 SF = _SF_ = 8. 826 x US$ kr $. 1395 US$ 7. 168 kr = SF 1. 23/kr =8. 826 7. 168 18

Sample Problem Suppose the spot quote for the Swedish n Krona and the Swiss franc are $. 1395/kr and $. 1133/SF, what is the quote for the krona in Geneva? n $. 1133 SF = _SF_ = 8. 826 x US$ kr $. 1395 US$ 7. 168 kr = SF 1. 23/kr =8. 826 7. 168 18

The Impact of Arbitrage 19

The Impact of Arbitrage 19

THE SPOT MARKET E. Currency Arbitrage 1. When cross rates differ from one financial center to another, arbitrage profit opportunities exist. 2. Strategy: Buy cheap in one int’l market, Sell at a higher price in another 20

THE SPOT MARKET E. Currency Arbitrage 1. When cross rates differ from one financial center to another, arbitrage profit opportunities exist. 2. Strategy: Buy cheap in one int’l market, Sell at a higher price in another 20

CURRENCY ARBITRAGE What is The Critical Role of Arbitrage in the Global Financial Markets? 21

CURRENCY ARBITRAGE What is The Critical Role of Arbitrage in the Global Financial Markets? 21

PART III. THE FORWARD MARKET I. INTRODUCTION A. Definition of a Forward Contract an agreement between a bank and a customer to buy or sell 1. a specified amount of currency against another currency 2. at a specified future date and 3. at a fixed exchange rate. 22

PART III. THE FORWARD MARKET I. INTRODUCTION A. Definition of a Forward Contract an agreement between a bank and a customer to buy or sell 1. a specified amount of currency against another currency 2. at a specified future date and 3. at a fixed exchange rate. 22

THE FORWARD MARKET 2. Purpose of a Forward: Hedging the process of reducing or mitigating exchange rate risk. 23

THE FORWARD MARKET 2. Purpose of a Forward: Hedging the process of reducing or mitigating exchange rate risk. 23

Hedging Tools Type Contract Features Forward 1. Future 2. Option 3. Fixed currency amount Fixed exchange rate Fixed expiration date 24

Hedging Tools Type Contract Features Forward 1. Future 2. Option 3. Fixed currency amount Fixed exchange rate Fixed expiration date 24

THE FORWARD MARKET C. Forward Contracts Require performance by both parties 1. Contract Terms may be 2. a. 30 -day b. 90 -day c. 180 -day d. 360 -day Longer-term Contracts possible 25

THE FORWARD MARKET C. Forward Contracts Require performance by both parties 1. Contract Terms may be 2. a. 30 -day b. 90 -day c. 180 -day d. 360 -day Longer-term Contracts possible 25

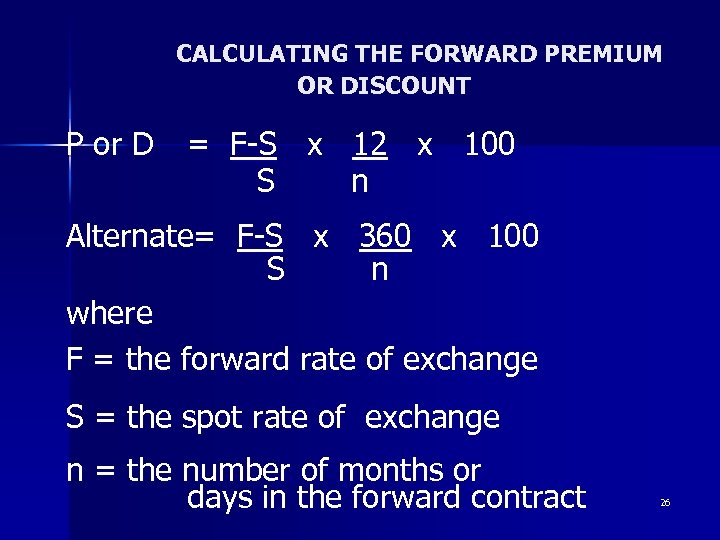

CALCULATING THE FORWARD PREMIUM OR DISCOUNT P or D = F-S x 12 x 100 S n Alternate= F-S x 360 x 100 S n where F = the forward rate of exchange S = the spot rate of exchange n = the number of months or days in the forward contract 26

CALCULATING THE FORWARD PREMIUM OR DISCOUNT P or D = F-S x 12 x 100 S n Alternate= F-S x 360 x 100 S n where F = the forward rate of exchange S = the spot rate of exchange n = the number of months or days in the forward contract 26

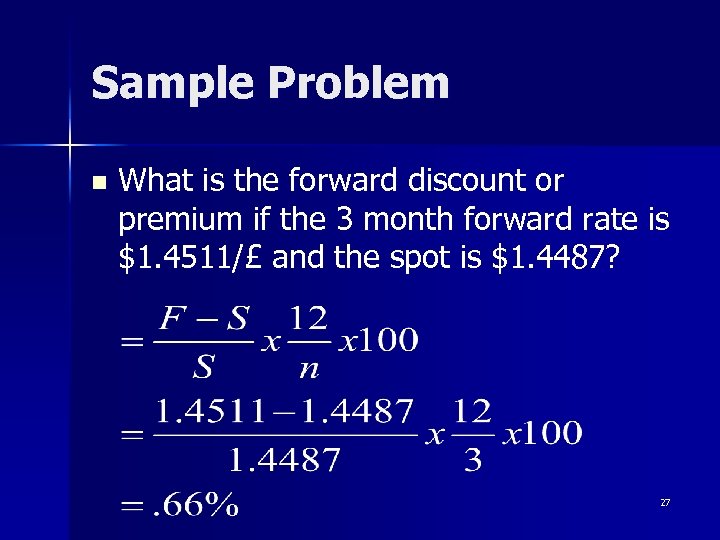

Sample Problem n What is the forward discount or premium if the 3 month forward rate is $1. 4511/£ and the spot is $1. 4487? 27

Sample Problem n What is the forward discount or premium if the 3 month forward rate is $1. 4511/£ and the spot is $1. 4487? 27

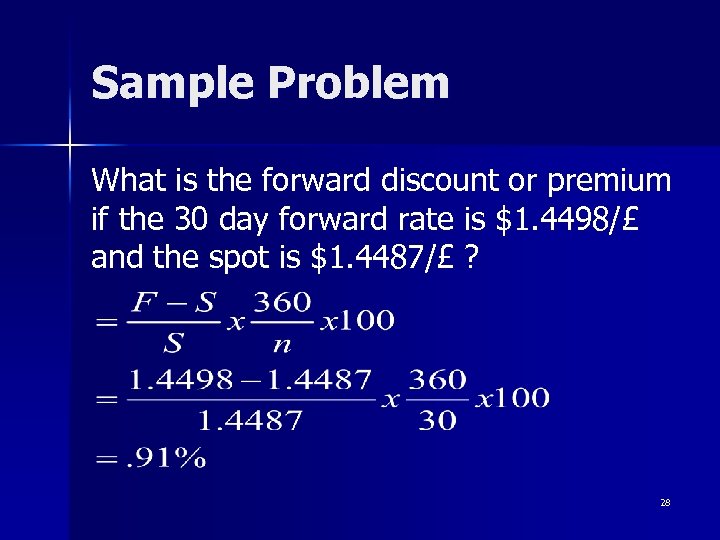

Sample Problem What is the forward discount or premium if the 30 day forward rate is $1. 4498/£ and the spot is $1. 4487/£ ? 28

Sample Problem What is the forward discount or premium if the 30 day forward rate is $1. 4498/£ and the spot is $1. 4487/£ ? 28